This week’s podcast is about machine learning and prediction as a capability.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is podcast on the intangible asset framework.

Here is the link to the TechMoat Consulting.

Here is the link to the China Tech Tour.

——

Related articles:

- An Intro to Discount Rates and Cost of Capital for Digital Valuation (Tech Strategy – Daily Lesson / Update)

- Why DCF Sucks for Digital Valuation. (Tech Strategy – Podcast 101)

- An Intro to Digital Valuation (Tech Strategy – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Capabilities, Resources and Assets (CRAs)

- Machine learning / AI

- SMILE Marathon: Machine Learning

From the Company Library, companies for this article are:

- n/a

Photo by mostafa meraji on Unsplash

——–Transcription Below

Episode 157 – AI.1.transcribe

Sat, May 06, 2023 7:43AM • 43:52

SUMMARY KEYWORDS

ai, business, data, prediction, activities, digital, companies, operating, competitive advantage, machine learning, capabilities, put, crs, running, marathon, working, china, stores, controlled, build

SPEAKERS

Jeffrey Towson

Jeffrey Towson 00:00

Welcome, welcome, everybody. My name is Jeff Towson, and this is the tech strategy podcast where we analyze the best digital businesses of the US, China and Asia. And the topic for today, why prediction and machine learning are not competitive advantages yet. And I’ve been struggling with this for a while, I’ll kind of explain why it’s such a powerful thing. It’s such a huge capability. But is it gonna be something that creates tremendous value for a company or is most of that value is going to be passed on to customers, and it’ll just be business as usual in companies, which is usually what happens. Usually, when a new technology comes along, everybody adopts it, all the value gets passed on to the consumers, and then our customers, and then, you know, the business looks pretty much the same. It’s in the rare cases where it creates something new and powerful for the business. So that’ll be the question for today. And my working answer is obviously, no, it doesn’t create a competitive advantage yet, but it does do some important things. And I’ll detail what those are. So that’ll be the topic for today. For those of you who are subscribers, I sent you an email about this. Yesterday, it was kind of theoretical. I’m still trying to get my brain around it. And I’m basically here’s I mean, here’s the reason I’m doing it. I’m looking for companies that are building this technology, aggressively, where I think it’s really going to play out in the future, but people don’t see it yet. So I’m kind of trying to get ahead of the curve on this one. So I sent you a kind of a theoretical argument about that one, which is really me thinking out loud, actually. So I’ll probably won’t, I’ll do one more on rate of learning, which will be similar but machine and rate of learning, I put both of those in this same bucket. Let’s see other stuff to talk to the China tech tour coming up in three months in China, Beijing, Han Jo Shanghai, a lot of digital content, lots of strategy stuff, visiting some cool companies. As of last night, China tourist visas are back online. We pretty much knew this was going to happen in theory, but it did get announced so in a couple of March 15 ish. That’s all regular again and if you had a visa before, which you know I did, those have been halted, but now they’re active again. So if you had an old one that’s not expired, that works. So anyways, the doors open, everything looks good. That’s going to be in June. If you’re interested, send me a quick email at info at Towson. group.com. Go to the website techno consulting, you’ll see it there. That’s going to be awesome. Okay, what else? I think that’s it. That’s standard disclaimer, nothing in this podcast or my writing or website is investment advice and numbers information for me in any guests may be incorrect, the views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky, this is not investment advice, do your own research. And with that, let’s get into the content.

Jeffrey Towson 03:16

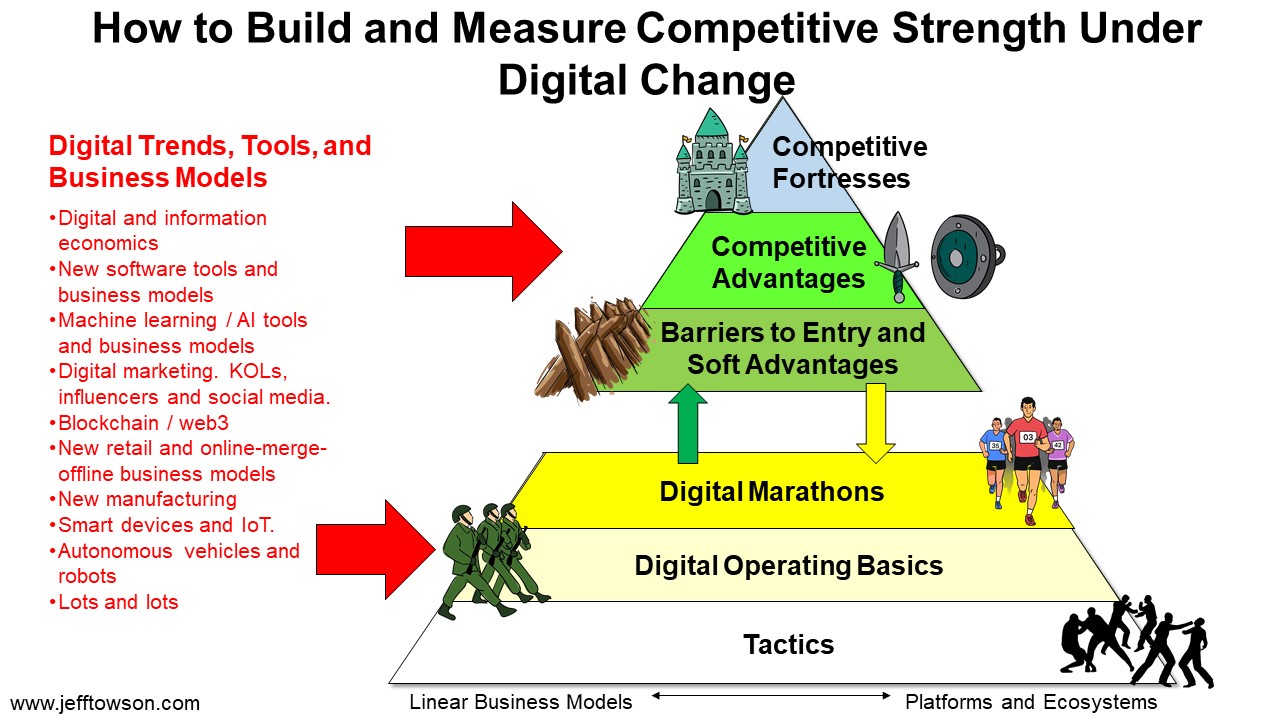

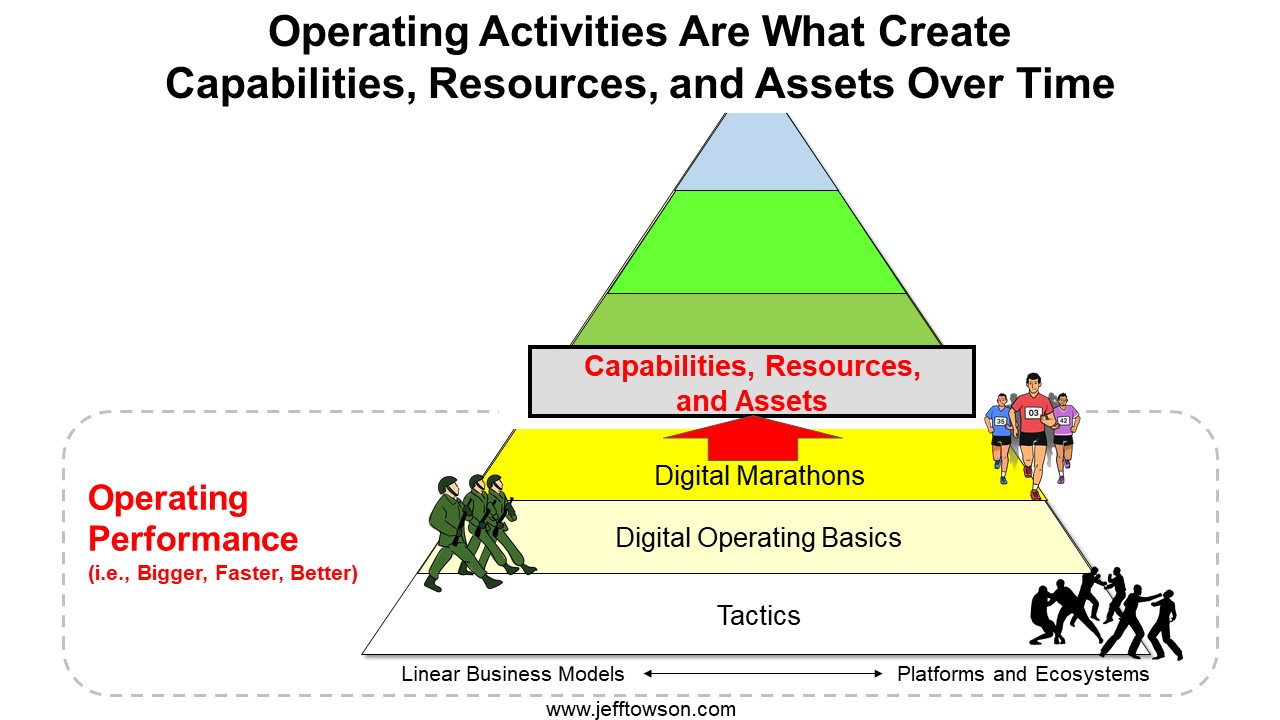

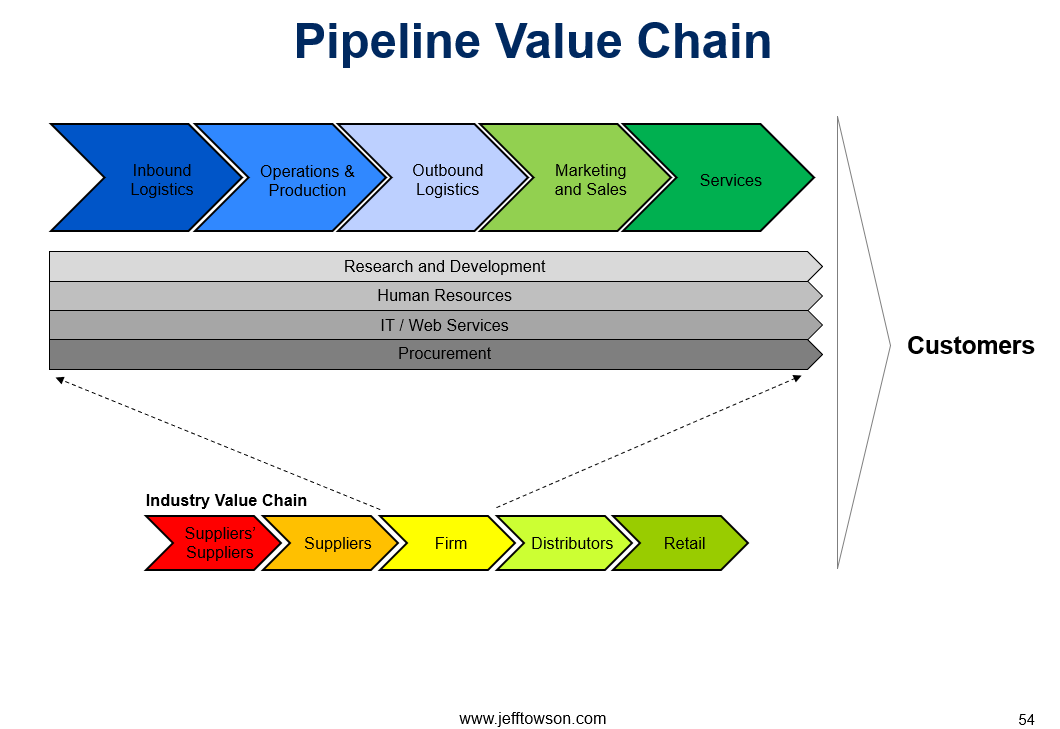

Now, as always, we start with the sort of the key concepts that are always in the concept library on the webpage, Jeff thousand.com. And we’ve got a new one today, which I haven’t talked about before, but it’s actually becoming a significant part of the next moats and marathons book, which is going to be a short speed read for executives. And that’s what I’m calling C RAs, which stands for capabilities, resources and assets. And it’s this idea of in between operating activities, hey, we’re opening stores, hey, we’re managing stores, hey, we’re doing customer relationship management. And let’s say competitive advantages. You’re basically building assets. And you’re building capabilities and you’re building resources. A couple weeks ago, I talked about intangible assets as kind of this key thing in the digital world. That’s really the link between those if you’re in the business of building stores, your Walmart, that’s your primary activity, building managing stores along the way, as you go, you will start to build assets in this case, tangible assets, stores, operational footprint retail supply chain. And then the next phase is that starts to become, in some cases a competitive advantage usually, and people talk about competitive advantage. The flip side of that coin is the picture of resources. And this is often called a Resource Based competition. But in the digital world, we don’t talk about that as much because we’re not talking about tangible assets. We’re talking about intangibles, and we’re talking about capabilities and we’re talking about resource Since like I have data, that would be kind of a resource. So the linkage between sort of operating activities as you do operating activities, they create CRH. Over time, and I’m trying to develop more clear pictures of those for digital businesses. The same way, if we were looking at a Walmart, we’d be really focused on their warehouses and stores as their tangible assets. So there’s kind of that linkage in between there. And that’s kind of the idea for today’s CRA s. Now, I’m going to put a, I’ll put a slide of that in the show notes, which is on the webpage, it doesn’t show up in iTunes. Oh, and by the way, this podcast is on Spotify. Now, I gave in and put it up there, because everyone kept asking for it. You know, I put my sort of six levels, my standard pyramid chart. And you know, we talk a lot about operating activities now for talking about traditional businesses, pretty straightforward. We all I mean, we would, we would talk about a Michael Porter value chain, and I’ll put that slide in the notes too, which is sort of a value chain from left to right, on the left. It’s like supply chain management. And then it’s, you know, production, and then it’s inventory management. And then it’s distribution, and then it’s retail, and then it’s marketing. And then it’s customer services. It’s like this left to right chain of activities. And that’s how most businesses are you have five to six key operating activities. And then out of those operating activities, you start to create capabilities, resources and assets, suddenly, you got five factories, suddenly, you’ve got trucks everywhere, suddenly, you’re really good at marketing, because you have a whole team that would be more of a capability as opposed to an asset. So out of these operating activities, just start to build CRH over time. And traditionally, business has been a bit a game of scale, whoever had the biggest scale usually won the bigger factories beat the small factories, the big retailers beat the small retailers, the big bank beats the small banks. Well, when we’re talking about big, yeah, we’re talking about customers and volume of activity, but we’re talking about CRH. You know, we have we’re a major bank, we have hundreds of branches. This is a regional bank, it’s got five. Okay, so Operating Activities sort of naturally build, you see RAS. And then the next level up is, and this is sort of my thinking, which is sometimes those CRA sometimes those operating activities can become marathons, right? That’s on my my six levels, sometimes, yes, it’s an operating activity, you’re opening stores, but you’re so good at it. And you’ve been doing it so consistently, and it’s so cumulative, that you build an operating advantage versus your competitor. And that’s what I’ve been describing as digital marathons. And I think that’s a serious advantage you can have. So sometimes your Operating Activities get you a marathon type advantage, which is an operating advantage. It’s not a structural advantage. And also sometimes as you accumulate CRA s, you start to get a structural advantage, that’s a moat. That’s a competitive advantage. That’s a barrier to entry. And if you look at my chart, which is in the notes, you’ll see that sort of operating activities then can be increased marathon’s, then you see CRS, which I’m putting in there, and then you see barriers to entry, and then you see competitive advantage. That’s how you kind of move up the chain. And that all makes good sense when you’re talking about Walmart stores. Right? Okay, but when you start to go into digital, one, it gets a little more complicated because suddenly it’s harder to see the capabilities, it’s harder to see the resources and assets. Most of the key assets are intangibles. You have a social network, that’s an intangible asset you have a lot of data can sometimes be a resource. You have good engagement with your customers, those things can all be sort of intangible assets. And I gave you a framework for classifying those types of intangible assets. I’ll put the link in the show notes. But they’re harder to see the CRS. Okay, so the question I’ve been struggling with now that I’m finally getting to the point is prediction. Really, there’s two activities, operating activities, which I’m trying to sort of put into this framework like just the same way inventory management is an activity. Production is an activity supply chain management is an activity. Prediction is an activity. It’s an operating activity. We could put it very easily in the Michael Porter value chain prediction. The other one we can put in there is rate of learning that some come Penny’s like fashion companies, she and T mu, they’re so fast at learning about what people want and what the market that’s an activity. Right? So those are operating activities, but they’re different than any operating activities we’ve seen before, because they’re sort of new technologies are letting this happen. So I’m sort of putting those activities into the operating chain, which is straightforward. But then the question is, at what point? Did those become competitive? Can they become competitive advantages? The same way having all those operating stores can become a competitive edge? So Can these two new operating activities? What CRS do they create? And then can they become barriers to entry and competitive edge, that’s what I’m looking for. Because if I can see someone who’s real good at this, I’m going to know in a year or two, they’re going to have a competitive advantage. Others don’t have. It’s kind of what I’m looking for. Anyways, that’s a bit of theory, but CRA s are kind of the the linkage between operating activities and structural advantages. That’s how I think about them. And you can look at the chart, I think it makes pretty good sense in that chart. Okay, so that’s kind of the where I’m starting with this. And I’ll give you my working answer, and then I’ll talk through how I got there. But I could be wrong. I think I’m right, but it could be wrong. When I look at prediction, which is machine learning, you know, it’s it’s really important, obviously. And we’ve talked about prediction, machine learning basically is cheap and fast prediction. And you could argue now that machine learning is also cheap and fast content creation, which is generative AI, but it’s all basically predicting what people are going to want predicting the right answer, predicting what word comes next, predicting it’s all prediction prediction prediction. My working answer is machine learning and prediction is a core operating activity. So it’s in my digital operating basics. It’s all throughout that. And in some cases, it can rise to become a digital marathon. I think tick tock has it, I think tick tock is so good at prediction that they can keep rolling out new types of content, short video news, headlines, videos, games, and they’re so good at predicting matching of what you want to see that there like the marathon runner who’s a mile down the road. So I think in that case, we’ve seen examples of this becoming an operating advantage.

Jeffrey Towson 12:37

I think it is absolutely creating new types of CRS, I think this is a new type of capability to be incredibly good at prediction. Because that requires a couple things, not just algorithms, it requires data. And it requires talent, which is actually the hard part. So we’re seeing new CRS. I think in some rare cases, it can create a barrier to entry, it’s a hard to replicate capability, especially getting the people, most small retailers can’t get a lot of AI people. However, I think that is a barrier to entry is going to get wiped out pretty fast. I think the snowflake and AWS and Google, they’re going to offer that to everybody very cheap. So I suspect the barrier to entry which exists today is going to get wiped out. And I don’t see the competitive advantage yet, but I’m looking for it. That’s kind of where my working solution, my working sort of conclusion is right now. So let me give you sort of how I got there. All right. So there’s two things I think we don’t know about prediction, AI centered businesses where this is the core activity of what they do. I mean, Walmart’s core activity is opening and managing stores. That’s it. There’s certain businesses like tick tock like, not really she and Clive show is definitely doing this. Where their core activity is AI sense time make V. That is what they do a lot of these generative AI companies, chat GPT that is all they do is prediction. It’s not just one of their 10 activities. It’s the main one. So we look for businesses like that. I think there’s two things we don’t know about them yet. We don’t know what their ultimate economics is going to look like. And I’ll give you my standard analogy for this, which I’ve sent out to those of you who are subscribers in the last day, which I always considered hospitals versus shopping malls. I’ll explain that in a minute. And we don’t know at what point prediction as a CRA key capability and resource becomes a structural advantage. So far, I don’t see it, but I’m looking for. Okay, so my standard analysis DJI is the difference between a software business and a AI business. The difference between Adobe, which is traditional software, and let’s say make V since time GPT. It’s the difference between like a hospital, I’m sorry, a shopping mall and a hospital. Ai businesses are much messier. Software businesses, you write the code video game, you write all the code, you tell it exactly what’s going to happen in every event. Well, not multiplayer, but simple standard, like Atari old games. You know, if you do this, this is what happens, you write all the rules, right? AI is a lot more messy, because we’ve got to ingest a bunch of data that’s coming in in real time, the data is messy, it has to be cleaned, it has to be tagged, then the AI makes predictions, and you generally need a lot of people to do that. So you know, traditional software economics is pretty beautiful. You know, windows, Adobe, these companies, Microsoft, AI businesses, the economics are a lot closer to software plus a lot of services, because you got to do all this human labor to make it keep functioning. So the economics don’t look as good. But the analogy I use is, you know, if you run a hospital, which I used to do for a year or so, I was a sort of turnaround CEO of a hospital, which was, like really not a fun job. I didn’t enjoy it. I liked the turnaround bit because when you turn around the hospital, it was basically broke. People were quitting, the suppliers had cut us off from everything from consumables to sutures. And so I’m you know, I’m running around town in a car at 2am. Delivering labs, because the laboratory we’re using is cut us off because they think we’re at cash risk. I like the turnaround bit, because it’s like being a trauma surgeon, you know, you have to jump in and that nothing works. And you got to sort of save the patient, which is really fun. But then once you fix it running the business was pretty boring. It was just operational day to day you’re doing the same stuff. And what I didn’t like about it was you had almost no control. Like, how much am I going to spend this month to run the hospital? I have no idea. Literally, you have no idea. Because you don’t as CEO spend the money. The doctors spend the money, the surgeon spend the money, the pharmacy spends the money, how many sutures did they use? What kind of surgical drapes did they use? How many doctors do I have on staff? Well, you have to have them on staff all the time. And they have to be there at 2am. Because if someone walks into the ER with a gunshot wound, you have to be able to handle that. And if a pregnant woman walks in, who we’ve never seen before, and start to give birth in the clinic, which happens, we’ve got to have people for that. Oh, and by the way, if she has high blood pressure and cardiac problems, we have to have a cardiac surgeon or cardiologist on staff. You are basically responsible for anything that the external world throws at you and shows up if there’s a pandemic in town and everyone starts getting viruses, they all come to the hospital, you got to have ventilators, you got to have a storage of ventilators somewhere across town that you can access which smart hospitals had during the pandemic. You have to have certain parts of it you really control nothing like being the CEO of a hospital is like driving a car with no steering wheel. I can’t cut the costs. I can’t remove staff, I can’t decrease staff. I can’t close departments. You got to have it all running because we are facing the external messy real world of how people get sick, what happens in society, violence, all of it. And so you’re really on the receiving end. Now that is very different. And that’s that’s a lot. My point is that’s a lot like being an AI business. That if you’ve got what Elon Musk calls a real world AI, where you’re sending a car down the street, it can encounter anything. It can encounter a dog running across the street, it can accounter I don’t know. Some lumber falls off a building or falls off a car in front of you and bounces across the street. It can encounter potholes, it can encounter gang warfare, who knows. But the AI basically has to be able to respond to everything in the real world. And he kind of said this at an interview about six months ago, which was really interesting. They asked him How did you how did you get your cars to run? And he said it basically required us to solve the problem of real world AI. We couldn’t just develop AI that could drive a car because the Cars are out in the world, and they can encounter anything. And therefore, the AI had to effectively be trained to encounter everything in the real world, which he called the real world. And that’s why he can then take his AI from his cars and put them into trucks or put them into robots or put them into anything. Because they’ve all been trained to sort of navigate your house, the street, whatever, that’s a lot like a hospital, you are really on the receiving end of data coming in, and you just have to respond. And that’s a very different business model. And the economics are very different, and they’re usually less attractive. Okay, so that’s kind of like how AI businesses are like running sort of a hospital. The counter analogy is software businesses like Adobe, Microsoft Word, a lot of old video games. That’s like running a shopping mall, which I also did, I was sort of overseeing general manager of a high end shopping mall, we had Gucci stores and Saks Fifth Avenue and Marks and Spencer and coach and a food court. There was a Saks, there was a Four Seasons Hotel upstairs, which was awesome. By the way, I got to stay there a lot. Now, this is a world that we created. This is not the real world. This is a world created by business people, we controlled everything. We designed the layout, well I didn’t do was done by the time I get there. But I decided the staffing, how many security guards what kind of lights we’re going to use, who’s going to be in the food court who’s not going to be in the food court, I determined what hours we opened, what hours we closed, you know, 2am, we’re not open, I don’t have to worry about random patients coming into the ER at 2am. Therefore I have to be staffed up and ready to do and we closed nine at nine at 9pm. We’re close. That’s it. See you tomorrow at 10am. We controlled the entire environment. So we could decide what business off services we wanted to offer and what ones we didn’t and what problems we wanted to solve and what ones we didn’t.

Jeffrey Towson 22:06

You know, it was a business world as opposed to the real world much cleaner. And the economics we could choose. We don’t really want to be in the food court business Food Court doesn’t make that much money. So we would, you know, we contract for that bit. But you want to open the anchor stores, the Marks and Spencer, the Saks Fifth Avenue, that’s where you make a lot of money. So we want to own those. But we would contract out the other stuff. The Four Seasons made a lot of money to man that a lot of money wasn’t actually that profitable overall. So, you know, it’s kind of like that, that’s a lot more like doing engineering and doing basic software. The other is a lot more like doing science where you’re studying the real world. And you can see that sort of play out in the analytics and in the economics and things like that. So that’s kind of how I do it. Now in between there, there’s a bit of a middle ground. Tick tock is an AI based company, but tick tock is not doing too much real world AI. You load up the videos, when you load up the videos, you tag them for tic tock so a lot of the problem is sort of taken care of. And then they control the app where you know, one person watches and one person loads of it. So a lot of that is kind of like the shopping mall, they really do control it. It’s not a car going out driving around Bangkok, right, and who knows what it’s going to encounter. So it’s much more control. Now, understanding the content of a video is actually fairly difficult because it can be anything it could be people dancing, it can be. So there is a bit of real world embedded in the content of the videos, but it’s sort of half controlled half not. If you have Robo taxis or robotic trains working within a business park. Okay. I mean, it’s out in the real world, but you designed the business park. So you controlled the roads, you controlled what’s there, you put up signs that are easy for the AI to recognize. And this is what China’s doing. They’re building entire cities. There’s a huge one to the south of Beijing, where they’re making all the infrastructure, the roads, the signs, all of that to be sort of easy for AI to navigate. Not the you know, most cities have evolved over hundreds of years. So they’re very, very messy. You know, your typical London cities nightmare. The roads are curvy, and they evolved. You know, they evolved over 100 years because that’s where the cows used to walk and you know, but if you design a city from scratch, you can make it much more like the business park or the shopping mall. And it’s easier for the AI to recognize and operate so there’s a bit of a middle ground out there you can think about. Okay, so that’s kind of how I take all this apart. In terms of, you know, those are sort of my knowledge. Now let me sort of go through the steps of how I decide whether this is a competitive advantage. So I’ll put a slide in the notes, which is basically I mean, it’s kind of my key slide, which is there six levels that I look at, for digital strategy and for competition. And then on the left of this slide, there’s all these new technologies I’ve put in red. And that’s really the question like, how do these new technologies which keep working, we got so much keep emerging new business models, new tools, new tech? How do they impact each of those levels? And that’s sort of my process. So I look at something like machine learning. And then I try and figure out, how does it impact each of those six levels, and I find this sort of granular approach that really works. I find it really gives me some often some real visibility into what’s going to happen here and what isn’t? Not always but I find it pretty. I find it works most of the time. Okay, so let’s say the new digital tool track trend business model is machine learning and prediction, how does that sort of impact, you know, each level and I broken each one of those levels into its sub components, like if you look at competitive advantages, I’ve listed 16. If you look at digital marathons, I’ve listed five, if you look at digital operating basics, there’s seven sub parts, and you can kind of just sort of this is literally all I do to try and predict what’s going to happen. So tactics and digital operating basics, the bottom two levels. Yeah, I think machine learning is all throughout there. All throughout there, like, you know, you meet with a retailer, you meet with a media company, they need to be putting AI into everything, all of their levels. And some are going to be more important than others. If you ask Alibaba, what are you using AI for which we’ve asked? They’ll say everything. Okay, not true? Well, yes, it is true, but no, not really. I mean, then you push them on the question, which we did. And they will say, Okay, it’s mostly about logistics, and inventory, and demand projection. That’s what they’re doing. They’re predicting actively what people are going to buy later today, tomorrow in every city, every consumer, every sort of district. And that’s giving them very detailed demand projection estimates. And then based on that, they’re shifting their inventory around in real time and making sure they have certain things in certain warehouses, so that they can, you know, rapidly meet that demand. That’s what, that’s the sort of big gun in this. Now outside of that they’re putting in everything, and you can kind of go through businesses and decide when it matters. Now, if you’re a digital business from the get go, like Tic Toc, or quite show, okay, your core activity is prediction. And other you can kind of go through there and see where it matters. Fine. I don’t generally consider any of that to be a source of competitive strength. I just think it’s a operating requirement. it’s table stakes. You’ve all got to have it. Just like everyone’s got a you know, if your E commerce site or retailer, you’ve got to be doing digital marketing, you just have to doesn’t necessarily you can be better at it than others. But yeah, it’s generally not a source of long term strength do you might do well for a couple of years. Because, you know, a company like she and her company like perfect diary was better than L’Oreal at digital marketing. But then L’Oreal caught up. And this was in China. Right and, okay, fine. We moved to the next level, which is digital marathons. This is where I think, absolutely, we’re starting to see certain machine learning companies establish serious operating advantages, and it’s one of my five sort of digital marathons smi le. The M stands for machine learning zero human operations. This was absolutely what ant financial is going for. They are trying to run a digital marathon in machine learning. So that theory digital only bank, that was their playbook, which they’re still doing. Tick tock is definitely moving that direction. We can see certain companies that are so far ahead in terms of their operating activities there, that unless they really screw it up. It’s unclear that other companies will ever catch them meant that the other companies will advance they will just you know, that’s why I use the marathon analogy. This is the marathon runner who’s over the horizon. Now he could fall down. Okay, then you might catch them. But assuming they don’t mess up, they’re gonna have a persistent operating advantage. So I think We can definitely see it there absolutely true. We move up to the next level, which is C RAs, which sits sort of between capabilities, resources and assets. Do we see companies that are doing so well in their operating activities in machine learning that they’re starting to build sizable assets, resources capabilities in this area? Well, what are the CRA? Is that matter? Well, there’s three. There’s algorithms, there’s data, and there’s people, those are the resources, you need to do prediction. Okay, are you gonna have a real advantage in algorithms? Probably not. Most of the algorithms most of the people are using are pretty standard. What’s really making them better or worse is the data, who’s got more data, who’s got better data, who’s got data that’s hard to access? If you are in medical care, you know, data is much, you can’t just go to public beta databases of people’s chest X rays, right? I mean, that stuff is controlled, especially in the US. If you have a walled garden, like Tencent, or Facebook, they’re not going to let others just take all their data and feed it into algorithms on a daily basis to provide a service. They might, they might create some API’s, but that data is held there. That could be pretty powerful. We could see certain companies getting walled gardens of data, or data that’s rare. And that’s something I’m keeping an eye on. I’m not super optimistic, that’s going to happen, I think, keeping data’s too easy to move around. I think there might be some rare exceptions where data can be sort of walled and you have a resource that others don’t have CRA.

Jeffrey Towson 31:59

I think most of its going to end up being sort of ubiquitous. I think these companies like Google, cloud, AWS, Azure snowflake, I mean, one of the things they’re doing, which I talked about a year ago, is yes, they’re providing data and digital services. The other thing they’re doing is creating data marketplaces. So they actually have multiple platform business models. And one of the things snowflake is doing is creating a data marketplace. So if you have data, you can sell it to others and make money and you can buy data from others. So I think that’s going to be a hard one to do. But we could see some rare companies where they’ve got some real advantages as data. And then the one that is, clearly the bottleneck right now is human talent, to do algorithms and to do machine learning and to do AI to build real capabilities. Because these businesses mean these capabilities do not run on their own like software, where you build it and deploy it and it runs, you’re almost always having people tweaking the algorithm, cleaning the data, checking the data, it’s kind of mentioned, you need people involved. And there’s very few people that understand this stuff. And most of them, they go where they want in life, they want to work at Google, they want to work at Alibaba, if you’re a specialty supermarket in Mexico, it is very hard and almost impossible for you to get machine learning people you’re going to deal with contractors. So this is the great limiting resource right now. So if I was going to start, okay, that’s the CRA picture. We go to the next level, which is barriers to entry, which is structural advantage. And then above that is competitive advantage. That’s where I like that’s where I like companies delivers competitive advantage. You could argue that there is a barrier to entry right now for most companies to build significant prediction capabilities. Because you can’t get the people. I think that’s true. So I would say yes, we’ve got a digital marathon. Yes, we’ve got a barrier to entry right now. But I think the barrier to entry is going away. I think there’s a lot of companies like snowflake that are in the business of solving that problem for businesses. And so I don’t think that’s going to be a long term barrier. And then we get to competitive advantage which I’ve listed 16 Customer capture economies of scale. I don’t see it yet. I don’t see this playing out yet. So that’s kind of where I am. I think it’s a digital marathon for some companies. I think it’s an operating requirement for most all of them. I think it’s a short term barrier to entry, but it’s going to go away. That’s kind of where I am. Now, one last point that I’ll finish up. Within all of this, you hear a couple ideas floating around around frequently, which are the idea of a data network effect. And you hear the idea of a data competitive advantage. They say, Hey, if you have data, you get a competitive advantage. If you have more users, they provide you more data, you then use that data to create a better service. Therefore your services always better data network effect. I don’t really buy it. I think that’s just standard personalization. And one, and then they Well, okay, let’s say that’s nonsense, which I think most people think it’s nonsense. Three years ago, everyone talked about that, I think that it is pretty much gone. The other one is, okay, it’s not a data network effect. But you have a data advantage, it’s a competitive advantage based on having data scale, lower cost. I don’t really buy that one either. I don’t buy it. Because I don’t think anyone knows what the word data means. I think it’s a it’s an idea based on a fuzzy definition. It’s like, when, five years ago, 10 years ago, everyone talked about the sharing economy, or the sharing economy, it was an idea. And we were, then they would take that idea further and build business models. And they’re even professors you meet who are like the professor of sharing economy, it’s so unique. But you actually ask people to sharing economy was kind of a half baked concept. doesn’t really make sense. When you think platforms, that’s the way to think about, I think data is the same idea. I don’t buy it as a concept. I don’t know what it means. How do you build a business model and a framework based on a fuzzy definition? What isn’t data in this world? Everything in a spreadsheet? Okay. That’s what people usually think about. What about photos? What about videos? What about cameras on the street watching stuff? Isn’t everything data handy? So when they talk about data, I don’t know what it means. So I generally don’t pay attention to it. I’m open to it. But I think it’s a definition that’s going to, say half baked idea that’s going to fade away. Anyway, so that’s kind of where I am on this right now. So prediction is one the other sort of new operating activity that I talked about is rate of learning and adaptation. I think that’s an entirely new capability, operating activity as well. And I’m, I’m sort of, you can see that in my marathons. That’s there as well. I’m sort of struggling with the same question there. Because I think that’s I think both of these are going to be huge activities over the next five to 10 years. The same way we would say, you know, opening and running stores was a huge idea in the past, but I’m still sort of playing them out. So that’s the other one I’m sort of struggling with right now. Anyways, that’s where I am on this one. Hopefully, that’s helpful. Take a look at the charts I put in there and look at cra s. CRA is when when you when you do all this strategy stuff. Here’s the here’s the competitive advantage we’re trying to build. Here’s the marathon we’re trying to run that’s a top down CEO level decision. Okay, fine. Once you’ve made that decision, the roadmap for executing that decision for building that the roadmap is your CRS that actually tells you, here’s the assets we need to build over the next three years. So if if your big strategy call is choosing a moat and choosing a marathon, hence, moats and marathons, the roadmap that falls out of that decision, is your CRA picture. The same way to say like, you know, if we had an idea that we’re going to be a big box retailer, that’s your strategic decision, the roadmap would that would fall out of that would be and here’s the stores, we’re going to open over the next two years. Same idea. So you want to detail the CRS, and that basically gives you the roadmap. Okay, I think that is it for two day for content. As for me, I’m pretty amped up if you can tell. I’m getting on a plane tonight. I’m going to sit on the beach for a couple of days, which is, you know, that’s always fun to sort of amps me up, and also the China Asia stuff. Everything’s just moving. I got four trips into China planned. I mean, one, I used to live in Beijing and Shanghai for a long time. And then I tried to move my home south to Thailand, just for quality of life. But the idea was, I would always just fly back and forth every week because it’s a nothing little flight. But then that kind of got shut down with COVID. So now it’s ramping back up. So yeah, it’s flights all over the place for the next month, which is really exciting. The next one I’m doing is end of this month, there’s a big walkway annual event. Every year they released their their six month and their year end financials and they have a big event. So I’m flying into that in a couple weeks. I think the 28th 29th I’m going to be in Shenzhen. Dongguan, which is fantastic. The whole Greater Bay Area of China, which is that southern region, Zhu Hai, Guangzhou, Shenzhen, Jongwan don’t want fantastic. I mean, it is just this awesome economy that’s being built there. So going into their headquarters, which is, you know, this is the fun part of my I’m going to go to the event and it’s kind of a big event because you know, they have this funny what kind of interesting management structure where they have rotating chairman, Chair people now, where usually it’s been three to four people that rotate chairman, it was Leon was there, if you look up, you’ll always see the same names long Ha, Eric Xu, Ken who, and then it was penguin Oh, but he stepped down and the new person is some brain among Mung Wan Jo, which, if you’ve been following the news in the last couple of years of this is the daughter of the founder Ren Zhang Fei, who was under some sort of arrest, house detention something in Canada for two years. While she’s back, she’s now one of the rotating Chairwoman. And she’s also CFO. So I think she’s going to be doing all the presentation. So it’s kind of a big deal in terms of that. I don’t usually follow the political stuff, if you can’t tell. But the financials are really interesting when they talk about them. It’s a really fascinating company. I’ve been following them for almost 12 years. Before it all became political, right. And it’s funny that like, the telco equipment business, which is where they were founded and built, you know, building various quick manufacturing, manufacturing, selling it to carriers around the world, British Telecom Safari calm in the Middle East, all

Jeffrey Towson 41:49

you know, Africa, all this stuff. That was their business. And it was never a great business. And even the founder, you know, Ren Zhang, Fei, he even jokes about like, if we knew what a bad business and hard businesses one, I wouldn’t have chosen this. But because it’s such a difficult business, they built in response, a tremendously effective culture. I mean, they have an absolutely dominant corporate culture, staffing culture. I mean, you do not want to compete with a team from Huawei, you just don’t want to do it. And it’s funny that these things go hand in hand, like if you choose a business, bad business, you got to become unbelievably good at execution to survive. As opposed to if you build a really good business, like Facebook, you tend to get really weak ineffective management, because life is so easy, it’s kind of a fun trade off. Anyways, that’s where they were. And then it turns out telecommunications equipment became dramatically more important because it basically became, hey, we’ll set up your phone systems, to the digital infrastructure for everything. So it became highly political, became incredibly important. Its cloud is connectivity, its edge computing, all of that, you know, that is the foundation of the next 20 to 30 years is digital infrastructure. And that’s where they’ve ended up you know, so it’s, it’s really interesting company, but apart from all the political stuff that they’ve been sort of sucked into. Fascinating company, like, I would have invested five to 10 years ago if it was possible. But, you know, now who knows? And it was so that’s gonna be the plan, and I’ll do some writing and podcasting and maybe some videos from then. Yeah, it’s gonna be great. So excited, and then a couple more trips around China, Asia. Anyways, that is it for me. I hope everyone is doing well. I hope this is helpful and I will talk to you next week. Bye bye.

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.