In Part 1, I laid out the basics of building a single platform business model. Or what BCG calls a “hyperscaler”. That is about getting the initial platform interactions going and going for growth, which is where the value is created.

However, once the basic demand and supply picture are in place, you start thinking about innovation and capturing ancillary opportunities. Which brings me to Phase 3.

Phase 3: Exploit Insights and Innovate Really Fast (The Elon Musk Strategy).

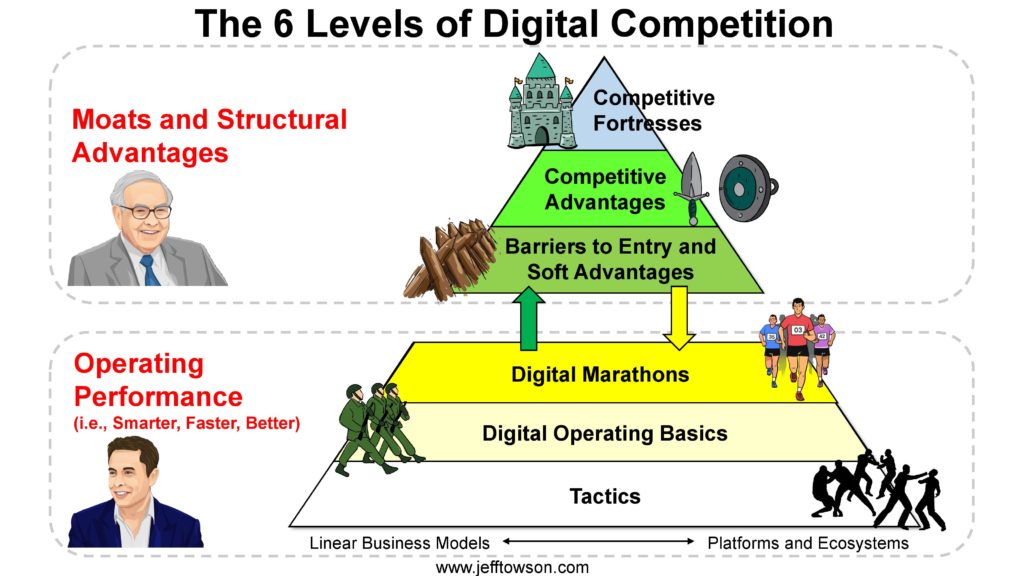

There is an ongoing discussion about going for competitive advantage vs. being a really fast innovator. Elon Musk (and others) argue that speed of innovation is the only advantage you can have now. Warren Buffett has argued his candy and soda companies are well-protected, even against Elon Musk.

My take is that you need both. And that speed of innovation can be greatly amplified by your structure and competitive advantages. Competing in a race with a car is better than on a bicycle. The below picture is how I view most competitive strategy.

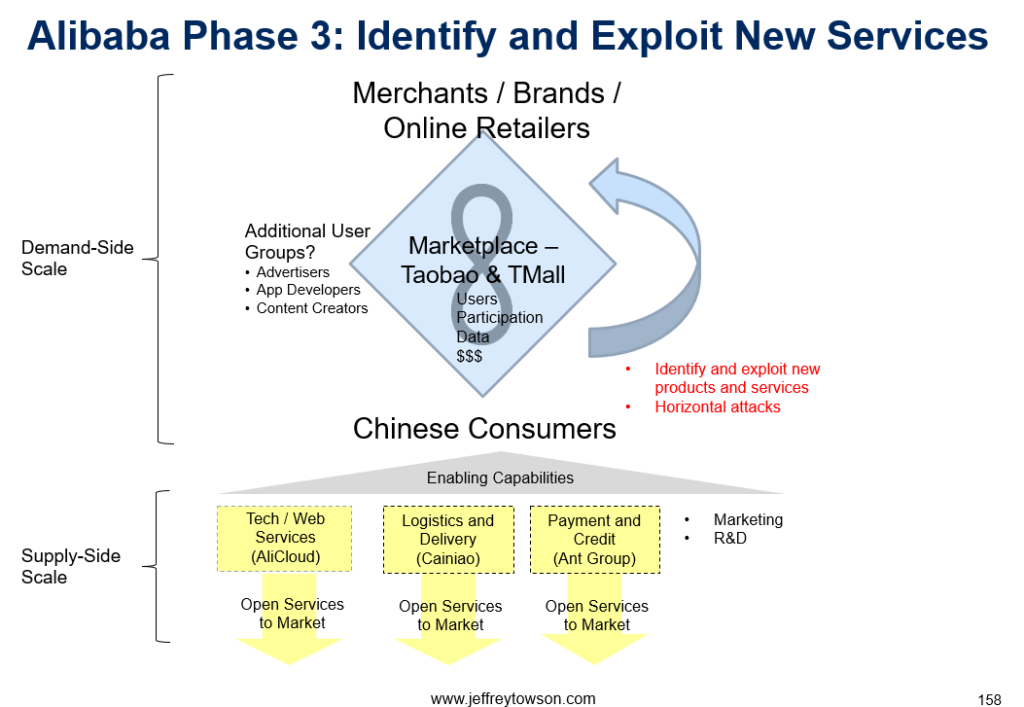

So Alibaba’s next phase of development was about taking the existing core structure (a robust platform plus supply side scale) and using that to exploit insights and innovate really fast.

Alibaba has a sea of users and data. It has many user groups that are very active. Consumers, merchants, brands, content creators, advertisers and others. The company can study all of this and identify new needs and opportunities. They can improve the user experiences. They can come up with new services, products and business models. And they can then implement them very rapidly, by rolling them out to their existing users.

And Alibaba is really good at this. Because their management is as good as you will find anywhere. And they view ongoing innovation as their strategic imperative. Over the years, they have made big moves in groceries and fashion. They entered hotels and entertainment. They, like most of the super-platforms of China, are also targeting finance. They are moving really fast in multiple areas. This is how you get from a basic e-commerce site to +20 businesses, most of which are named after animals in Alibaba. The joke is that Alibaba is building the world’s biggest petting zoo.

Now compare all of that to companies like Twitter (pre-Musk), Facebook, Instagram and WhatsApp. These companies are not nearly as innovative and aggressive.

The next graphic tries to show this with an arrow.

Phase 3 is about becoming a fast and relentless innovator. And using the existing business to have a powerful advantage in this.

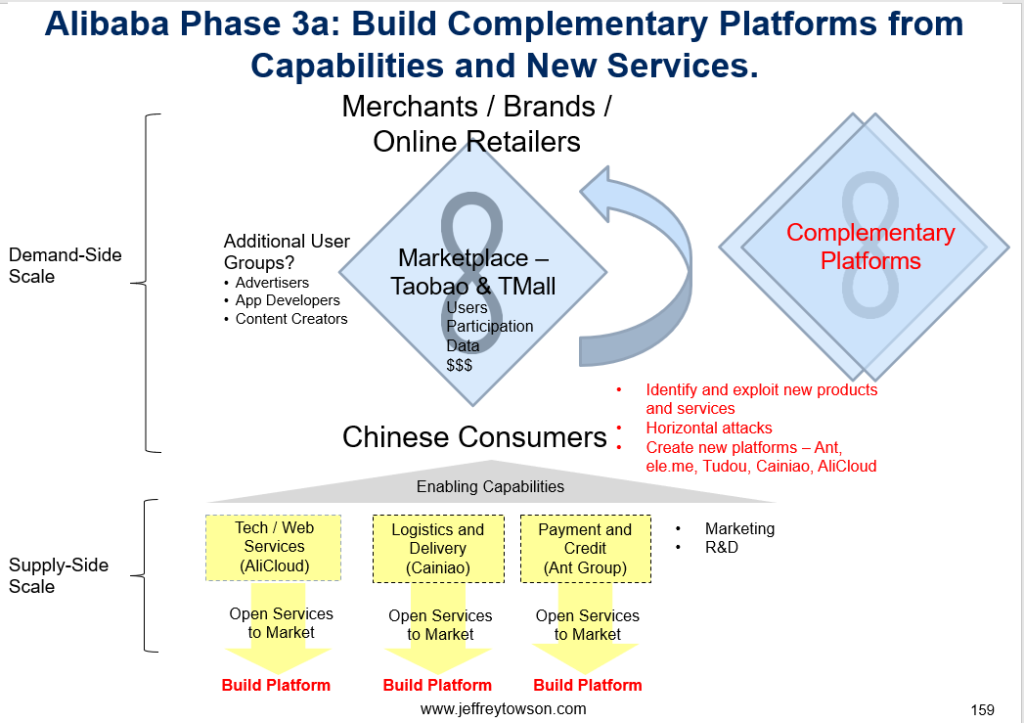

Phase 3a: Add Complementary Platforms and Linked Businesses

And with a little luck, some of these new services, products, use cases and business models can become platforms themselves. Which can complement and reinforce the current platform. Likely on the consumer side but it’s also possible on the enterprise-side. Or with advertisers. Maybe app developers. And these can also come out of the externalized capabilities.

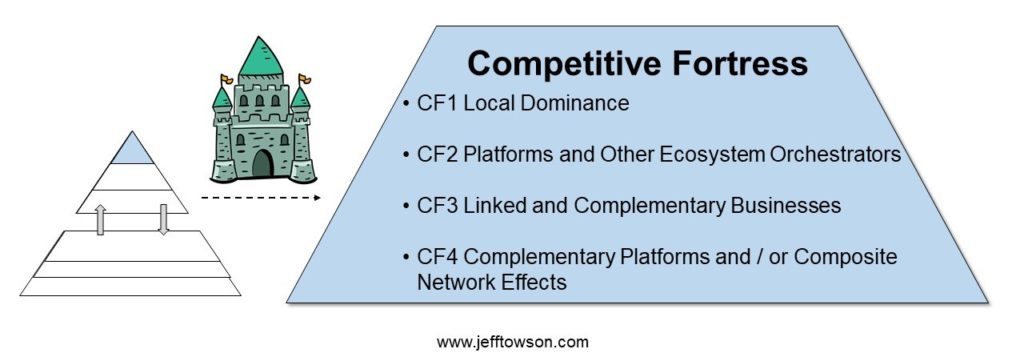

For Alibaba, the situation is pretty amazing now. They have multiple complementary platforms: Taobao, Tmall, Youku-Tudou, Alipay, and others. They reinforce each other. And create service offerings that are impossible for competitors to match. Recall, I have called complementary platforms and linked businesses competitive fortresses. They are the top level of my 6 levels.

And even if their new services don’t create complementary platforms, they can still be linked businesses. They can share customers (lowering acquisition costs), technology and capital. A good example of this is Baidu’s relationship with investee iQiyi. They have a master agreement that covers AI, web services, online advertising, internet traffic, data / content and smart devices. You can see the details in the iQiyi F-1.

Here is my graphic for how innovation can lead to complementary platforms and linked businesses.

***

And that is my basic explanation for what has been going on with Alibaba until about 2015. Which brings me to New Retail, which was a big change to the entire evolution I just outlined.

New Retail Supercharged Alibaba’s Platform Strategy

I have been arguing that new retail is much bigger than just the supermarkets, delivery guys and convenience stores everyone talks about. And it is not about all the cool new tools like magic mirrors, robot waiters, and payment by facial recognition. Although, those are pretty fun.

New retail is really about a quantum increase in users, participation, data and supply-side scale. That’s my main point.

The engine at the center of Alibaba is still 1-2 core interactions on marketplace platforms. These are their marketplaces Tmall and Taobao (plus the B2B ones) that connect online merchants and brands with Chinese consumers. That core interaction dropped the transaction costs (search, coordination, negotiation, and information asymmetry) between these groups such that small and medium enterprises were able to do transactions.

With these transactions, they brought users (consumers, online merchants), participation (buying, selling, writing reviews, etc.) and data onto the platform. And these are the main intangible assets that enable everything else. They are also what also get you demand-side scale, which is Alibaba’s main power.

From this position of strength, Alibaba was then able to build additional advantages, add more user groups (content creators, advertisers, etc.), build supply side scale (warehouses, server farms), innovate new use cases, and build out in multiple directions. I went through all this in detail in Part 1.

However… (you knew it was coming)

All of this evolution has been about core interactions that are happening online. Online consumers are interacting with online merchants and brands. On the supply-side, there are some tangible fixed assets (warehouses, delivery people, etc.). And these fixed assets can actually be a real source of competitive protection. But it’s mostly an online phenomenon.

New retail expands these interactions into the physical world – and is a quantum increase in users, data and participation.

What new retail is really doing is bringing a massive new user group onto the platform: literally millions of physical retailers in China.

This is stunning to think about. These are the millions of restaurants, mom-and-pop shops, convenience stores, department stores, hotels, pharmacies, grocery stores and other physical retailers across China (to begin with). This is a huge new group of users onto the platform. Which we can show as a new user group on the diamond.

And just think about how much data they are bringing with them.

- Sales information from physical retailers is being combined with online sales data. Note: Alipay already gives the sales amounts but this is item by item sales data.

- These merchants are also digitizing their operations. So their inventory management and purchasing data is also being added.

- It will also add a wealth of new types of data as stores continue to upgrade their operations with new digital tools. Retailers are adding computer vision, facial recognition, natural language processing and other digital tools. The store will know who came in the store, what they did, what they looked at, what items they picked up, how they made their choices and so on. Physical stores are going to be able to capture all sorts of fascinating data that you can’t get online. And this is coming into the platform.

New Retail is Also a Big Increase in Supply-Side Scale

Now other user groups have been added to Alibaba before. Content creators are a big group on Youku. Advertisers are important. We even have user groups like influencers through Bilibili and others. But none of these user groups brought real estate with them.

Physical retailers are bringing physical assets with them. Suddenly Alibaba can extend itself into local supermarkets. Suddenly they can offer on-demand delivery from local convenience stores. And so on. See the below graphic.

The tangible assets of new retail are a combination of retail space, logistics nodes and service centers. That is why Freshippo can sell you pasta (physical retail), cook your dinner (a local service) and deliver your packages and food (logistics / delivery) in 30 minutes from the same location.

It’s clear Alibaba wants a retail footprint that gets them close to people’s homes. The more inventory you can put closer to people the faster your delivery (which is hugely important in China). But it also gets you entirely new customer interactions. It gives you a new location to innovate on the customer experience. It gets you all types of new data.

However, it’s not clear to me how much of this real estate will be owned, operated, partnered or franchised. It is beginning to look like Alibaba will own a basic operational skeleton (RT-Mart plus Hema). And from this operational skeleton, I suspect they will franchise their business model and digital / data tools (like Cainiao). But I’m just guessing.

New Retail Also Creates New Network Effects and Competitive Advantages

So new retail adds a new user group, lots of participation and data, and lots of physical locations (serving as retail, logistics, and service centers). And all this creates lots of new advantages.

I’m not going to go through all the details about digital competition. But you can see in the graphic I’ve noted where you can create switching costs, a dramatically improved consumer experience, network effects and complements.

For example, you get even more economies of scale and barriers to entry on the supply side. If you are a new entrant to this business, you no longer have to just replicate an online marketplace (already very hard). You also have to replicate a national footprint of physical stores and warehouses. Good luck with that.

There are lots of switching costs for the physical merchants. Mom-and-pop stores are getting digital upgrades and getting lots of inventory and supply chain management tools. That’s awesome. But it’s also hard to swap out for another system. B2B software is famous for creating billionaires because of these switching costs (just try switching out Windows on your computer).

But the most interesting advantage is the dramatically improved consumer experience new retail is creating. If you are a traditional supermarket, how do you compete with Freshippo and the amazing services it is creating and constantly improving? How do you compete with its ability to take 60% of orders from phones outside the store? With its integration with the entire Taobao marketplace of products and services?

Finally, New Retail Enables an Explosion of Creativity, Use Cases and Business Models

This is my last point – and my favorite part of new retail.

I talked about how digital businesses often have a powerful ability to exploit their data and launch new services for their users. When you have the users, data and participation, you have an amazing ability to see opportunities, create new things and roll them out quickly. Alibaba is really great at this. It is how they are always jumping into new businesses like banking, hotels and entertainment.

Now imagine, you also have a massive new user group (like physical retailers), their participation and their data. And you have the physical retail, the logistics network and the growing local services capabilities as well. How many businesses can you create or re-imagine?

And that is what is happening right now. You can see Alibaba experimenting with lots of new use cases and business models. They are partnering with Starbucks on delivery. They have partnered with Intersport to re-imagine sports apparel. They are trying out new retail formats with Sun Art. And so on. There is so much creativity happening right now. It’s really amazing.

***

That’s it for the 10 slides. Thanks for reading. Especially if you got through all the graphics.

Cheers, jeff

———

Related articles:

- How Alibaba Freshippo and Dingdong Got to Profitability in Ecommerce Groceries (1 of 2) (Tech Strategy – Daily Article)

- Dingdong vs. Oriental Trading: How to Spot the Specialty Ecommerce Winners (1 of 2) (Asia Tech Strategy – Daily Lesson / Update)

- Can Dingdong Win in Groceries and Specialty Ecommerce? (Asia Tech Strategy – Podcast 90)

- How AB InBev and Zé Delivery Are Changing Ecommerce in Beverages (Tech Strategy – Podcast 139)

From the Concept Library, concepts for this article are:

- Ecommerce

- Marketplace Platform

From the Company Library, companies for this article are:

- Alibaba

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.