This week’s podcast is about Nike in China. But it really about how you win as a participant in large platform businesses in ecommerce and social media.

You can listen to this podcast here or at iTunes and Google Podcasts.

Here is my new book:

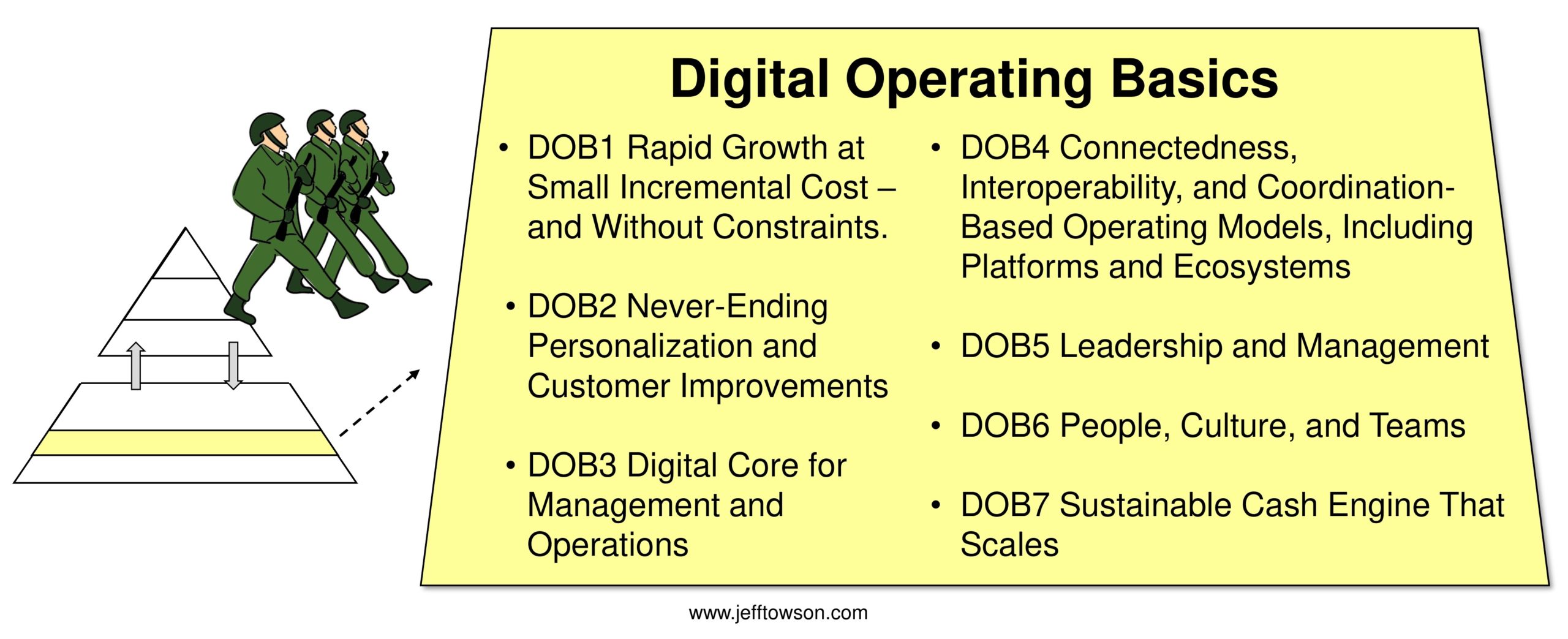

Here is the Digital Operating Basics 4:

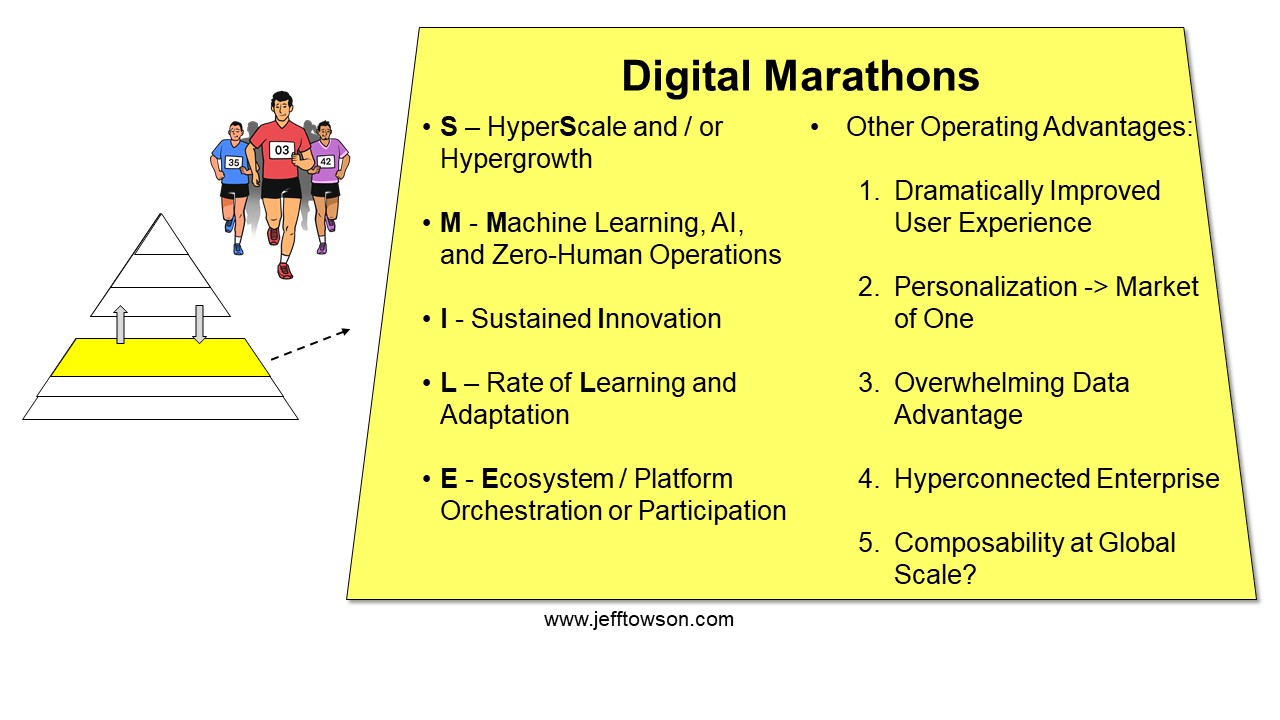

Here are the SMILE Digital Marathons

——–

From the Concept Library, concepts for this article are:

- Digital Complments

- SMILE Marathon: Ecosystem Orchestration or Participation

- DOB4

From the Company Library, companies for this article are:

- Nike

Photo by K X I T H V I S U A L S on Unsplash

———–Transcription Below

:

Welcome, welcome everybody. My name is Jeff Towson and this is Asia Tech Strategy. And the topic for today, Alibaba WeChat and how Nike won as a platform participant. So yet another entry in my ongoing series of podcasts with really wordy titles. But there’s sort of a question here I’m getting at, which is, and I think it’s actually really important. which is how do you win as a platform participant? I mean, you’re gonna deal with big platforms, big social media platforms, big e-commerce platforms. How do you win? And this is sort of cuts across a lot of the thinking I’ve been doing and writing, and it’s in my six levels of competition. I thought I would sort of tease out that question a little more directly, and then at least point to one or two companies that are doing quite well. of how do you win in this system where you are mostly dealing with a large platform and you are not the platform, which is most companies. That’s a really common question for merchants and brands in particular, but it’s also a question for investors. How is this company going to do going forward? Are they going to do really well in a world or a sector dominated by a Taobao, Mercado Libre, Shopee, Amazon? Or are they going to be sort of perpetually under the gun? And some are gonna do very, very well. And a lot are gonna sort of just tread water. So that’ll be the question. Okay, a little housekeeping stuff. First of all, I’m sorry for being late this week. I’ve been flying all over the world and it’s just been back to back here in Sao Paulo. So I’m about three to four days late here. Sorry about that. Actually, I was thinking about that. I realized I haven’t missed, I don’t think I’ve missed a podcast in two years in terms of the weekly schedule. So this is maybe the first one I’ve been significantly late, but anyway, sorry about that. The books are out, part one and part two of Motes and Marathons. Link is in the show notes. Doing pretty well. For those of you who are subscribers, I’ve been sending you out some stuff on Web 3.0. I think I’ve kind of taken that as far as I’m probably going to go for now, but let me know if you have any companies worth looking at. The one that’s on my radar is Brave as a browser. company. That’s really interesting, but I can’t really get very much information on it, so I’m not sure about that. But other than that, I’m kind of working on Mercado Libre and more Asian companies here, but you know the Brazil thing has been really interesting. Well, Latin American Brazil. And let’s see, standard disclaimer, nothing in this podcast or my writing or website is investment advice. The numbers and information for me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment advice. Do your own research. And with that, let’s get into the topic. Now, one of the reasons I like this topic is it kind of cuts across three important concepts that I’ve talked about, but I’ve never really stitched them together. So the three concepts for this talk are platform participation, digital complements, and digital operating basics number four. For those of you who don’t remember that, which is this is kind of a wordy one. On my digital operating basics, it’s connectedness, interoperability, and coordination-based operating models. So yeah, too wordy. The slides in the show notes, if you want to look that up. But there’s really three related ideas here, which is, the digital operating basics, I’ve argued these are kind of what most companies that are becoming software-infused have to do. It’s six to seven things you have to do. You have to. Build the digital core, digitize your operations. You have to do never-ending improvements for the customer-facing side. And I’ve talked about those. Number four on that is, and I’ll read it again, connectedness, interoperability, and coordination-based operating models. And it’s this idea that once you digitize the operations of a business, it becomes far easier to connect with other businesses, with customers as well. with content creators, with suppliers, with sometimes your competitors. This idea that when things become more digital, and really the world is becoming much more connected. So as there’s more connectedness, you start to get interoperability, where you can offer things to customers that are no longer just what you’re offering, it’s you and the three companies you’re connected to. You can offer… broader solutions, more complete solutions, things that you could never do as a standalone company. Typically most companies, traditional companies, they have partners, they have strategic partners, suppliers, but you’re probably talking about 10 or 20 companies at most, they’re usually not deeply connected on an operating level on a minute by minute basis with 30, 40, 100, 200 companies. You can’t do that unless you’re digital. But once you are, you can start to do that. So you see greater interoperability, and you see business models offering really interesting solutions based on their ability to coordinate with each other. Now it could be in terms of operating a more complete solution. We’ll offer the logistics, that company will offer the manufactured good, the other company will offer the service. We’ll put it all together, it’s one coordinated operating model that gives us a customer something. But we could also see coordination and the manufacturing level, which is something definitely higher is doing this in China. They’ve digitized all their factories and then they connected them all and they all work together now. You could see research and development being coordinated. Definitely a lot of this connectedness and interoperability is about data sharing. because very few companies have enough data internally to do everything they need to do. They’re pulling data from a lot of external sources. And then within all this idea of digital operating basics is the fact that most companies, not most, lots of companies are engaging with the platform business models. You’re dealing with Facebook. You’re dealing with Amazon. That could be a sales channel for you. It could be distribution. It could be an area for marketing. It could just be for acquiring data. There’s a lot of interoperability with these major platform business models that most everyone’s dealing with in some form. If you have a web page, you’re doing search engine optimization to get on Google. So you’re connecting there. So I’ve kind of argued, look, this is the basics. Most companies have to do this. That’s why I called it Digital Operating Basics Number 4. So that’s kind of one idea. OK, fine. But. in the marathons, hence my book, Motes and Marathons, where can you build real advantage over competitors? And number five on that list, SMILE, S-M-I-L-E, the E stands for ecosystem orchestration and participation. And I’ve always talked about ecosystem orchestration. That’s Shopee. They are orchestrating an ecosystem. That is primarily what they do. They help companies interact. and customers engage, I mean, they’re in the interactions business. They’re an orchestrator of a larger ecosystem than themselves. I’ve never really talked much about the second part of that phrase, which is ecosystem orchestration and or participation. And that’s most companies, right? As I just kind of said, most companies are dealing with platform business models, ecosystem orchestrators, really the same thing, but they are not the orchestrator themselves. Okay. How do you win as a digital marathon? in that dimension? How do you get so good at being a participant on a platform or ecosystem that you really pull ahead of your competitors? Can you build a competitive advantage? Well, not a competitive advantage, an operating advantage there. So that’s kind of the second idea is when does this become a real unique strength? And we can look at companies who have done that at least in the short term. I would argue that Shein. which is doing very, very well around the world, they have a couple skills that they sort of launched with. One would be, hey, they’re pretty good at pretty quick manufacturing and turnaround, and they’re good at cross-border, D to C, direct to consumer type business. They’re also really, really good at digital marketing. From almost the day they were founded, about nine years ago, they have been active on the major platforms like… TikTok and Instagram and all of that. You know, they’ve been a major player on those for every single one. They are very effective at that digital marketing, which you could argue is platform ecosystem participation. And I think that’s been a big part of their success. And we could look at say Perfect Diary, not diary, yeah, Perfect Diary. I always say Perfect Dairy, which is Perfect Diary, the makeup company out of China. Yat-sen is the name it’s listed under. You know, they really rose incredibly quickly to become the number one or number two makeup brand on let’s say T-Mall, sometimes displacing L’Oreal in a couple years because they were so effective at organizing influencers, KOL’s private traffic on WeChat. And that’s really what they did. They were an incredibly effective participant on WeChat and on Taobao and the e-commerce platforms. So they were able to play both, the social media platforms and the e-commerce platforms did very, very well. The model use was very effective. Now they’re having trouble now because it turns out a lot of people can copy what they’re doing. And it turns out the platforms eventually said, hey, you’re making all this money off us, why don’t we just change the rules and keep some of that money ourself? That’s the problem with being too dependent on platforms. But we can see at a certain point this digital operating basic can become a real competitive operating strength, at least for some period of time, and maybe longer term. So that’s kind of the second idea for today, is the ecosystem participation, ecosystem orchestration and participation. The third idea for today is digital compliments. Compliments, you know, it’s an old, old idea. It’s been around forever. It just became a lot more powerful when software and digital came along, and now everyone’s talking about it. And it became so important that Michael Porter added it as his sixth force instead of five forces. Now it’s six forces. He added compliments. Why does that matter? Compliments, you know, okay, hot dogs buns are compliments to hot dogs, so is mustard. All three of those things form a complete solution. All three of those things add value to the other thing. You know, so… if the price of hot dogs falls, if they cut the prices, put them on sale, you will sell more hot dogs, but you’ll also sell more buns. So you can call that the primary product versus the compliment, but it kinda depends where you’re sitting. I mean, the hot dog buns probably consider the hot dogs compliments to their product. The hot dogs consider the hot dog buns to their compliments to them. And generally speaking, when this went digital, it became possible to add tons and tons of compliments because they don’t cost you anything. So you could kind of consider the iPhone as a hardware product with hundreds of thousands of free digital compliments, which is all the apps. You could think about it that way. You can look at these other ways, but compliments is one way to think about it. And platform business models. you could, I mean I’ve laid these out one way, but another way to lay them out is like a platform business model. You could say all the merchants on Taobao are complements to the Taobao service. Although I think that’s not an awesome way to look at it, but some people do view it that way. Anyways, the point of this is, we are all part of a greater solution. And one of the interesting things that happens is, everyone tries to make their complements cheaper. Like everyone always wants to commoditize their complements. Because if you can make your complements cheaper, you will sell more as a product. So, you know, famously Facebook commoditized its complements, which was news, right? Facebook, lots of information, the major newspapers, Wall Street Journal, well not them, but let’s say Washington Post. Bay Area Examiner, whatever, that was kind of their compliments because those would be posted in the news feed. But they commoditized them so much that news basically became almost free. Now that was awesome for Facebook because the cost of the compliments dropped. It was terrible for those companies because your typical newspaper suddenly was just another post in between a cat video and what your mom posted. So Facebook famously commoditized. tons of news organizations in particular and really devastated them, but it was great for Facebook. So there’s always a question of who’s commoditizing who in terms of a compliment. Generally speaking, the platform business models have been trying to drop the costs of all their merchants and suppliers and standardize them. And that’s been pretty brutal for them. The counter strategy to that… Often is if you are a small player again And usually when you’re talking about the compliment thing one party is generally more powerful than the other and you kind of know who it is Hot dogs are more powerful than hot dog buns. Everyone knows that so if you’re the smaller player in the relationship There’s a couple strategies and I think Nike is definitely smaller than T-Mall and yet they’ve won They’ve done very very well. So that’s kind of an example of how to be that Anyway, so we can kind of look at this in three different ways with three different frameworks. Digital operating basics around connectedness, smile marathon, ecosystem participation, and then this just idea of digital compliments, which kind of cuts across everything. Okay, so those are sort of the three concepts for today. I think they’re good to keep in mind, and I’ll put them in the show notes, and they’re definitely in the concept library. But… Okay, so that brings us to the topic of let’s say Alibaba and WeChat and Nike in China. Because here we have two powerful platform business models, ecosystem orchestrators, Tmall and WeChat, and we have an ecosystem participant, Nike. And yet Nike is operating through those platforms very, very effectively and is doing quite well. digital story. I probably won’t go through all of it now, but they’ve done really cool stuff with their running clubs and their community building and their offline community and their stores where the runners can hang out and everyone’s sharing photos and older runners are training younger runners. I mean, they have a really vibrant community, both online, which is mostly located in WeChat, and offline, which is these running clubs. Really interesting, but they are deeply connected to the two major platforms. In this case, Tmall’s were there, and WeChat. All right, so one of the questions I like to ask companies, merchants and brands in particular, how do you measure the success of a merchant or brand on Singles Day? Lots of companies participate, but how do you measure success? It used to be mostly about sales. That’s what Singles Day was. You do a lot of promotions, all the consumers show up, everybody competes and you move a lot of merchandise. Let’s look at the GMV. Sales opportunity. Okay, that’s not really what it is for the most part. Yes, you’re gonna make some sales, but it’s much more of a brand building day now. You know, they can sell throughout the whole year and they’re doing so many discounts, they’re probably not making that much money on sales. So this is more of an opportunity to build your brand. How can we reach an entire country for one day? Let’s say we’re just entering China. Allbirds shoes did this. Milkana, cheese company out of Germany did this. They use Singles Day as a way to really save some time and get a lot of awareness that they’re entering the market using this. Or you could say it’s an opportunity to product launch. You’ve got a new thing. You want to get a lot of attention for it. Okay, let’s say you have an existing brand. Could you significantly elevate it? Because we know we’re gonna get a lot of attention that day. People are paying attention. So definitely brand building is a big part of it. Customer identification, customer acquisition. You’ve got your customers. How do we pull in a whole new wave of customers quickly? Okay, maybe we do that. And then definitely it’s about acquiring a lot of data. let’s put out a lot of products, let’s test our marketing strategies, let’s test our product mix, and we’re gonna get a ton of feedback in one day that probably will inform our strategy for a large part of the year. So it’s a lot about the data. So you can kind of measure it in different ways. And that’s very, very cool. So there’s a lot of value in this connection, even if it’s just one big day. Now, the flip side to that, is every year Alibaba in particular creates new tools for merchants. Here’s new data, services we offer, uni marketing. Here’s product development services we offer, that’s Tmall Innovation Center. Here’s data, here’s marketing services, here’s pop-up shops. They keep rolling out more and more tools, digital tools for the merchants to use on that day and in general. Okay, that’s cool because it gives them more capabilities. And there’s a lot to be gained from that. The problem is it’s kind of like an arms race. You are competing against other brands and every year Alibaba keeps handing out new weapons. And if you don’t adopt the new weapons and your competitor does, you’re going to get slaughtered. So, it’s kind of like an arms race where you have to keep competing year after year and these new tools, you have to keep adopting them. or you can get beat pretty easily. And that’s kind of what Alibaba does, is they have just this long list of merchant tools they keep building. Credit, supplier credit, consumer credit, digitized manufacturing, uni-marketing, which is kind of a data-rich dashboard for merchants to see the behavior of their current potential customers. Data intelligence, data operations on AliCloud, Tsai Niao, fast delivery, Tmall Innovation Center. You can go pretty much down the P&L of any merchant on Taobao T-Mall and you can see all the services that Alibaba offers and they keep adding more and more. They grow it every year. Now they would say this is a big benefit to you. We’re giving you greater capabilities. We’re letting you be more productive. You’re going to save some money, whether it’s financing. R&D expenses, IT expenses, branding and marketing, distribution cost, cost of logistics, whatever. That’s true. These are awesome tools to provide to them, but at the same time, it’s this arms race. If you’re not adopting their new stuff, your competitors are. So it’s a really strange kind of relationship. I’ve talked before in a previous podcast about JD and all the AI tools they’re giving to merchants. The ability to generate new photos of models. You take 10 pictures of a model in the studio, you say, thank you very much, she goes home, it’s almost likely a she, and then you can just start mixing and matching colors and sweats and just put it on the model and make picture after picture after. You make thousands of them every day automatically with the AI. Bad news for models, really good for small merchants who can do this stuff. You can generate new designs. have the AI create the text for the picture you just did to describe the sweater. So it makes it very easy to load up hundreds of new products every day onto your website. That kind of tool is awesome. And if you are a brand or a merchant, even a big one like Nike, most aren’t obviously that big. Even if you are like them and you say, look, we wanna use these tools that these companies are offering the Alibaba’s, the JD’s. But we also want to kind of do it ourselves. You are never gonna be able to spend enough money to match the AI capabilities of Alibaba and JD and Mercado Libre or Shopee or whatever. They are gonna outspend everybody by orders of magnitude. So you’re gonna end up using those tools whether you like to or not. And that’s really the interesting dynamic in this sort of arms race of tools that… Yes, we are wary of working with these platforms because we are a participant, and we are a complement to them. But we also know they have tools we could never do ourselves. So we have to work with them. It’s a very interesting question. And I think it raises the next question is, OK, if I’m a merchant or a brand, I am a ecosystem participant, I am doing the digital operating basics of connecting with others. How much of my core operations is going to end up shifting to these data-rich platform companies with increasing tools? And is that a problem? And yes it is. How much should I shift? How much should I keep myself? It’s a big question. And we know what the small companies are gonna do. The small companies are gonna look at the money and say, I can’t do any of that. Okay, I guess I am an ecosystem participant on the Taobao platform. and everything that they do, I won’t do that in-house. We know the small companies are gonna do that. Medium to big companies have to grapple with this question of, all right, how much do I do in-house? How much do I rely on them? I have to do it because my competitors are working with them. Now, that’s kind of the scenario, and those are the three concepts I wanted to tee up. So let’s just jump to the so what. What is, how do you win, as far as I can tell, as a ecosystem participant, like a Nike China? And I’ll give you what I think, and then I’ll explain a little Nike China. Basically, you have to go direct to consumers if you’re in the B2C business. You have to go direct. What does that mean? It means you have to have your own mobile app, or more likely you have to have a mini app. If you’re in China, The first thing you’re going to do is open a mini app within WeChat. And then if that does well, then maybe you’ll open a mobile app. And then if that does well, you might consider doing a web page, but you’re probably not going to do it because who cares? No one uses those anyways. You’ve got to go direct to consumer. That means your own mobile app. If possible, you want to open your own physical stores. That is arguably your best direct connection for so much of the consumer experience. And that’s exactly what Nike has done. They have their physical stores and they have their mobile app there, which is fantastic, by the way. So that’s number one, you gotta go direct. Number two, you’ve got to pull the data internally, which means, yes, we are gonna get some data from these big platforms, but they are never gonna give us everything. They’re never gonna give us most. We need… 360 degree behavioral data on our customers because our whole ability to innovate and serve them is data dependent. So yes, Alibaba and them are always gonna have more data than we could ever have. So we will work with them and we will use their data rich dashboard services. But we are gonna gather data directly on the app and in the physical stores if we have them. Number three, we gotta go personalization. that’s our biggest lever. If we have an ability to personalize, some companies can’t do that, backpack companies can’t really do that, it’s a backpack, it’s a backpack. They are gonna be more dependent, but if you’re something that’s more differentiated, like fashion, if it’s something that has aspects to it that’s not just the product, like if it’s entertainment, if it’s an activity, like running, if it’s a community, the more we get away from just having a standard product. the more we can build out personalization and the user experience. Now some businesses can do that. Nike, Nike can’t really, this is what’s kind of interesting, Nike can’t really personalize and differentiate on the product level very much. It’s still a sneaker. They have been very good at personalizing and enriching the user experience in terms of activities, entertainment, sports stars. running clubs around town. Pretty much a lot of Chinese cities have running clubs that Nike’s involved with. So they’ve actually found an interesting set of activities that complement their product. The product itself is not, there’s not that much to do. If you actually go into the Nike store in China, okay, it’s not that special. It’s got some shoes on a shelf and you put them on and maybe you have a little special membership card and you meet with someone and they tell you, there’s not that much as opposed to luxury. Gucci, Prada, fashion. Then when you go in the stores, there’s a whole lot more to the user experience that’s sort of being digitized and enriched. But Nike really sort of shifted out into activities and community, as opposed to, let’s say, entertainment and user experience in a store, which is kind of really interesting, I think. So let me give you a little bit of the history of Nike in China. It’s a pretty awesome story. Obviously they’ve been there forever, but their first big move, let’s call it, was 2012 when they opened up on T-Mall. So not Taobao, but T-Mall, right? Nice store, you can customize a major brand there much more than you can on Taobao. For those of you who aren’t familiar, Taobao is like your local marketplace in the square. T-Mall is more like your high-end shopping center, right? Bigger brands, nicer location, things like that. Okay, fine, so they do that and they start doing sales. Website store, 2014. They launched the Sneakers app, 2017. So that’s their direct channel, right? The other two, they’re going through partners. Well, I mean, you could say the website store is direct, but Chinese consumers don’t really use websites. Okay, that’s all fine. But really things start to get interesting in 2018. That’s when they opened their WeChat store. Now what’s the point of the WeChat store? This is about getting traffic. This is you working on the WeChat platform. You know, the Tmall app, I’ll say the Tmall store, that’s you getting onto the Alibaba platform. The WeChat store, that’s you getting on the WeChat platform. And they start to do a lot there, and then 2019 they create their Nike app. Now… What’s the direct channel? I said number one, if you’re gonna be an ecosystem participant, you gotta go direct to your consumers. Okay, this is the online channel. This is the app. And what’s their app? They’ve actually got five or six of them now. They’ve got a couple apps that are just for selling. You know, you buy shoes, they’re commerce. But they launched lifestyle apps, the Nike Running Club, the Nike Training Club, which are… You go on and there’s training sessions and there’s videos and there’s content and most of it’s professionally created content and you can do some subscriptions there, a lot of it’s free. And they’re great. I mean these are sort of activity based services. And then they have some sort of service app like Connecting and customer service and things like that. All of that would be under the term Nike app. That’s their direct channel. So why are they dealing with Team All and WeChat? That’s where they’re getting traffic, that’s where they’re getting data, that’s where they’re tapping into these merchant tools that are probably beyond what they can build. And then they’re shifting that over to their direct channel. And I’ll give you some examples of what they’re doing in a minute. The other channel, which is their direct, is their physical stores. So 2018, they also, in China, Shanghai, I believe, they opened their first sort of digital store called Nike 001. And this was sort of their flagship digital driven sports retail innovation. That’s kind of their term for this. With design and personalized services and you know, quoting, you know, it’s the cornerstone of their new retail and digital strategy in China. That’s cool. But as I said, like, Their ability to sort of digitize the physical store is actually fairly limited. There’s not that much they can do. You go in and you can do mobile checkout, fine. You can do sort of in-store bookings to talk to experts about personalized products and there’s exclusive products for some. You can get some customized and private services. You can make online reservations. You know, you can get lots of information through WeChat or in the store about, ooh, here’s this shoe, let me learn about what the… Okay, that’s all fine, that’s basic digitization of a physical space. There’s not really that much going on. It doesn’t knock you over, it’s fine. But within those two channels, their percentage of direct to consumer sales has started to increase. So, let’s say 2015, total… revenue of Nike in China about 32 billion remmb. So divide that by seven, that gets you US dollars. And it goes up, you know, 32, 2016, 38, 2017, 42, 2019, 51, I’m sorry, 2019 was 62. So good growth, but what’s interesting is the percentage of those sales that are coming through the direct to consumer channel, which is their own apps. and the physical stores not through T-Mall, WeChat, many programs. And 2015, it was about 25% was direct to consumer revenue. Goes up to 30%, 35%, 37%, 2019, 40 plus percent. So they are shifting their revenue to their direct channels. And that’s really what you want. One, you want to sell there because you don’t want to be too dependent on these other companies, these platforms. But also… The more activity you have in your direct channel, your data knowledge explodes, because you’re getting so much information about what your consumers are doing, and that’s what’s fueling your next iteration of innovation for customer-facing improvements. That’s what you want. I mean, you honestly want the data, if not more than the revenue. Okay, so that’s kind of cool. But again, I think if that was the entire story, this would not be considered such a success. They’re doing fine, they’re driving it, it’s fine. Their apps are pretty cool. Their lifestyle apps, the running club, all pretty cool. But what they really did is they got into the community building business. They started to think about… You know, how can we engage our customers, get users engagement and get user retention? Building a community, that’s about the most powerful retention mechanism you can have. Everyone wants to get customers. What’s your customer acquisition cost? That number keeps going up. That’s a really bad business. Not bad, it’s a very difficult business. You don’t want to have to keep getting customers. You want a retention strategy where everyone we get, we keep. So then we don’t have much churn. Probably the biggest lever you can get for retention is to build a community Where people feel that this is their place they spend time there they share there they create content They do activities together and maybe it becomes a bit of their identity. I’m a member of this club I’m an alumni of Columbia Business School, you know that Really holds people in Okay, so how did Nike do it well 2015 They started focusing on the running culture of China. They connected with the running clubs around town. Each running club, which are already there, runners are very into running, right? They care a lot, which is what you want. They started working with the running clubs, giving them their own WeChat groups, sort of supporting them, enabling them, giving them tools you couldn’t, they could never have. And people start chatting on these things You know, you don’t want to be Nike giving them information. That’s part of it. But what you really want is the members to be giving each other information. Because that’s what a community’s about. You want them to share content. You want them to create content and share it with each other. So on runs, you know, they share their favorite runs. They share advice. They share the shoes they’re wearing. The older runners talk to the novices. Here’s what I would do. Oh, here’s a cool run we should do. So you start to get this real online community going located within WeChat. Outside of that, January 2020, Nike opens a physical location in Shanghai for the runners called Run High Lane. It’s free to use if you’re a member. You get free services, there’s professional courses, you can have contests, you can try out new products. There are photographers. you can share events, and they all just start, you know, doing all these events. There’s running clubs, there’s runs all over the place, there’s competitions, they have a Just Do It Sunday where people do events, and they’re just giving tools and activities and experiences to these communities to sort of support them. and then the community members, they all share with each other, they’re members, they love it, it’s community owned, by the way they buy a lot of Nike stuff along the way. Now compare that, that story I just told you, direct channels, two of them, physical and mobile app, very active presence on WeChat and other places online where there’s a community but they push people to their direct channels, and then a very vibrant offline community of runners. who are doing lots of activities, and Nike’s giving them all sorts of support, tools, information, videos, let’s have an event this Sunday, we’re all running in the park, come on over. Compare that scenario of a company dealing with an Alibaba or a WeChat to virtually any other company that would be an ecosystem participant on those platforms. I mean, they’re really in good shape. I mean, they’re using these platforms, they’re getting the tools they need, they’re using them for traffic, but they’re not very dependent on them. And they’ve got all these capabilities outside that really give them some strength. So that to me is a little bit of the gold standard for how to engage with these very powerful ecosystem orchestrators, platform business models. I’m looking for other models. for how to win. I mean, that was the topic for today. I’ll finish up here in a minute. That was the topic for today. How do you win as an ecosystem participant? And I’m still looking for examples. The company Bata, which is a shoe company in China, which was bought by Hill House. They’re sort of doing a similar play. Definitely Nike China’s on the list. I think you can point to Xi-Yin and Perfect Diary as short-term successes. I’m not sure they’re going to win long term, but they definitely rose rapidly with this type of ecosystem participation strategy, at least for several years. Whether it lasts is another question. The Nike China story? Yeah, I’m a total believer. I think it’s outstanding. Anyway, so I’m kind of hunting around this question because I want to be able to predict what merchants are really going to do well and what brands are going to do well in this sort of unusual environment. And I think it’s only going to get more. I think we’re going to see more and more connectivity. I think we’re going to see business become more and more about the connections between things and being able to work with other parties in a way that’s to your advantage. Anyways, that’s where I kind of am on all this. I think that’s probably enough for today. I’m trying to do these a bit shorter and also I feel guilty for being a couple of days late so I wanted to get one out right away. But anyways, the three concepts for today which are in the show notes. Digital operating basics for, platform participation as a digital marathon, and then compliments. All pretty important things. As for me, I’ve been having kind of a crazy week. I got down here about, I don’t know, 10 days ago into Sao Paulo, which is always fun, Sao Paulo, it’s great fun. And I’m working with a client here on sort of retail, sort of strategy, digital thinking, things like that, working with their management team. Really interesting, I’ll probably talk about that at some point. Obviously I don’t mention client names ever, but yeah, it’s really, there’s a lot going on here. And then my two and a half week trip into Brazil kind of got blown up where we started getting so many sort of invites and you want to come over that the whole thing got extended to seven weeks. Like really two and a half weeks in Brazil down to seven weeks, I shifted everything around. four to five to six talks per week at various companies around. I mean, it’s just crazy. There’s just a lot of interesting stuff going on here in terms of digital, especially as it relates to China, Asia. Because, I mean, we’re seeing the major players from that part of the world here now. Definitely Xi-Yin, Shopee, Alibaba and Tencent are bouncing around here doing some acquisitions and stuff. Didi is here. SoftBank is flooding money into Latin America. They did their first… I think it was $3 billion fund which they deployed, something like that, and now they’re announcing another $5 billion. So somewhere along the way, the Asia digital giants have set their sights on Latin America as their target. Not target, let’s say next opportunity. They went after Southeast Asia five years ago, and maybe because of the stuff with India with the launch of Chinese apps getting banned. US is a different market, maybe this is just the priority. So yeah, there’s a ton going on. And I’m getting calls from companies sort of all over Brazil who are, you know, they’re rightfully sort of trying to understand these companies coming in. And some of them they know, but a lot of them, you know, you talk about Grab and Go-Jek, or you go down to the second or third tier, people are generally not familiar with those yet here. So there’s sort of a learning curve happening, and I just seem to, I guess, a little bit be in the right place at the right time. So having an absolute ball, lots of talking and heading out to Rio in a couple of days, which is always awesome. It’s like my favorite place in this part of the world. But they did officially, I believe, cancel Carnival because of COVID. It was supposed to be next week. They did officially cancel it. I don’t think that’s gonna stop the block parties. I don’t think that’s gonna stop people getting out on the street and… getting drunk and having fun. My standard joke now is like, if having fun were an industry, like Brazil would be the world leader. If it was an Olympic event having fun, they’d win the gold every year, because it’s really entrepreneurial and super fun. So I suspect Rio’s gonna be a blast. I’ve been to Carnival before and it’s… You can go to the parade and you sit and you watch all the floats and that was pretty good. But it’s the street parties where like entire blocks are just filled with people. And they’re all over the place. And it’s just great fun, which is obviously a COVID concern, I guess. So we’ll see if everyone ignores it or what’s up. Anyways, that’s it for me. Kind of a crazy week. And that’s why I’m sorry, I’m a little bit late. But anyways, I hope everyone’s doing well. If you’re in Brazil, I’m definitely, you know, you want to talk. tech stuff, digital stuff, I’m definitely floating around for at least another four to five weeks. So yeah, I’m here. I’m going to be Sao Paulo, Rio, Brasilia, Porto Alegre, probably Florianopolis. Anyways, I’m around. Send me a note. I’m easy to reach here on LinkedIn. Okay, that’s it for me. Everybody take care and I will talk to you next week. Bye bye.

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.