This week’s podcast is about how to assess specialty companies within enterprise software and services. And about Tuya, which an interesting example of a specialty B2B play.

You can listen to this podcast here or at iTunes and Google Podcasts.

Here is my new book (released December 1):

Here are my 5 questions (thus far) for assessing the viability of a specialty ecommerce company.

- Is the company sufficiently differentiated in the user experience? Or did they just get there first?

- Can the company compete and/or differentiate in logistics or infrastructure without ongoing spending?

- Does the company have a strong competitive advantage in a circumscribed market?

- Is there a clear path to significant operational cash flow?

- Has the company avoided markets and situations that are attractive or strategic for the major ecommerce companies?

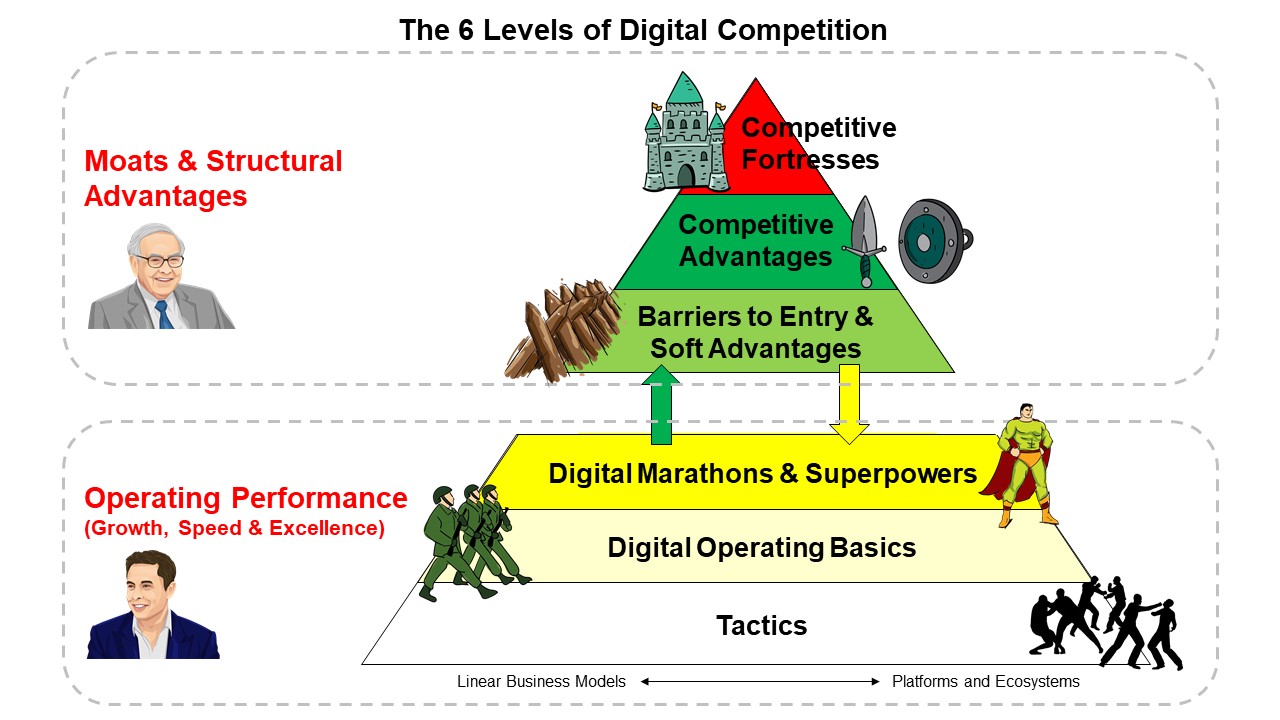

My 6 Levels of Digital Competition

Level 2: Digital Operating Basics

Here are my 5 questions (thus far) for assessing the viability of a specialty enterprise company.

- Is the company sufficiently differentiated in the user experience? Or did they just get there first?

- Can the company compete and/or differentiate in sales / marketing or R&D without ongoing spending?

- Does the company have a strong competitive advantage in a circumscribed market?

- Pay attention to DOB1 and DOB4 for operating performance

- Pay attention to switching costs and standardization network effects for structural advantages

- Is there a clear path to significant operational cash flow?

- Has the company avoided markets and situations that are attractive or strategic for the major enterprise companies?

- Pay attention to hierarchies of control.

——-

Related articles:

- Etsy and How to Predict the Winners in Specialty Ecommerce (Asia Tech Strategy – Daily Lesson / Update)

- An Introduction to Tuya and Its Play for an IoT Ecosystem (Pt 1 of 2)(Asia Tech Strategy – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Hierarchy of Control

- Enterprise Specialty

From the Company Library, companies for this article are:

- Tuya

Photo by Sebastian Scholz (Nuki) on Unsplash

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

——-Transcription Below

:

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy. And the topic for today, Tuya, Medalia and how to predict the winners in specialty enterprise. Now again, that’s a little bit of a convoluted title. I’ve got to get these a little shorter, but I want to basically talk about this idea of specialty enterprise. Now over the last month or two, well actually three to four months ago now. I went into the topic of specialty e-commerce. You know, everyone understands Shopee and Alibaba, but what about the specialty players that are always gonna be smaller? How do you tell which of those are gonna win? Well, the same question kind of comes up on the enterprise side when you start looking at the majors. You know, obviously AWS, Microsoft, companies like that, and maybe Snowflake. But second to that, there’s a lot of smaller players that are never gonna dominate. but they can be very successful as a specialty play. So that’s kind of the question for how to figure that out. I’ve got basically a list of five questions I’m working on. I did this for e-commerce. I’m gonna give you five questions for enterprise. It’s a work in progress, but I find it pretty helpful. So that’ll be the topic today, and we’ll talk about Tuya and Medalia. Some other stuff, it was Singles Day last week. Pretty uneventful. pretty muted, let’s say restrained. I made a prediction they would increase their GMV like 15 to 20 percent, basically something modest that wouldn’t rile up the government or anyone else. They came in at about 9 percent GMV. So yeah, pretty restrained. Now they have a significant ability to move that number. They can’t hit a hundred, but they can’t If they want to get to the teens, they can get to the teens. You just I mean, you do discounts and promotions and you basically pull forward sales to today. You know, you pull sales of what happened in six months back to today by discounting. They don’t seem to have done that. The growth they did talk about came pretty much where you’d expect it to come from. Fourth and fifth tier cities, some international, but I think that’s pretty overstated. I’m not a huge believer in that. So pretty much nothing terribly exciting. Low key would be, I think, the right description of the event. Other stuff, there’s going to be a discussion this weekend on Sunday afternoon Bangkok time. We’re going to have people talk about the company Roku. We’ve been doing these in Bangkok for a year or two. And I think we’re going to open it up to people. So if you’re interested in being part of that, send me an email and I’ll send you the Zoom link. Some of you have done this. We’ve got your names. I’ll send you out a link. But yeah, if you’re interested, let me know. I think, well, you know, the timing is not awesome. If you’re not in Asia, it’s middle of the afternoon. It’s going to be problematic time zone wise. But anyways, if you’re curious and it works out, send me a note and I’ll introduce you. We’ll probably roll those out more conveniently in the future. Okay, and what else? I got my book coming out on December 1st. It’s available up on Amazon now for pre-order. You can see the link in the show notes. It’s called Motes and Marathons. It’s actually going to be one of five to six books on this subject. So this is part one. Okay, and I think that’s it for stuff. Standard disclaimer, nothing in this podcast or in my writing or on the website is investment advice. The numbers and information for me and any guess. may be incorrect, the views and opinions may no longer be relevant or accurate. Overall, investing is risky. This is not investment advice. Do your own research. And with that, let’s get into the topic. Now the two concepts for today, there’s always concepts, is specialty enterprise, which will be in the concept library on the webpage. And the other idea is hierarchies of control, which I have talked about in emails to subscribers. I don’t think I’ve talked about it on the podcast. It’s a pretty important idea, especially when you move over to the enterprise side. So we’ll talk about that, but those are the two concepts for today, specialty enterprise and hierarchies of control. Now, you know, when the whole Alibaba, China tech crackdown thing was happening, one of the obvious conclusions was, look, the major e-commerce and really digital giants of China are gonna be on the radar a lot more in terms of the government than they have been in the past. They’re gonna be dialed back to some degree. and they’re not gonna be able to throw around their weight. That could hurt them, we’ll see how it plays out long term, but it’s definitely good news for the second tier of e-commerce, specialty players. And I did quite a lot on that. I looked at quite a few companies in that space. Delivery Hero, Secu, Farfetch, Ding Dong, Etsy. which is not a China company, but it’s interesting. Even looked at a company called Oriental Trading Company, which is a Warren Buffett e-commerce company based in Omaha, which does specialty e-commerce. It’s actually a very great example of how to win in specialty e-commerce. All of those were covered in mostly emails to subscribers. I don’t think I talked about most of those in podcasts. But out of that, I came up with sort of five working questions. for how to tell if a specialty e-commerce company is gonna do well, or if they’re just gonna constantly be in a game of struggling for survival against their much bigger rivals. You know, if you’re going head to head with Amazon in a space that Amazon cares about, I mean, at best you’re gonna survive, you know, but thriving and growing and throwing off cashflow to shareholders, probably unlikely. So you gotta really have that right strategy if you’re gonna try and sort of live between the elephants as we say. But out of that, I came up with five questions and I’ll read those to you and I’ll put them in the show notes. And here were my five, and I think this is reasonable. I’m still working on this, but so far, I’m feeling pretty good about it. But what are my five questions for assessing the viability of a specialty e-commerce company that might be a good investment? Number one, is the company sufficiently differentiated in the user experience? Now, the language is important. Differentiated, is it different? Is it more valuable? Usually when you talk about differentiation, almost for sure you are talking about a niche type of customer. It is very hard to differentiate to the mass market. You can, you can be luxury, you can be premium. You could argue that JD is differentiated to the mass market by moving more into quality products. Okay, I think that’s sort of true. That’s not really what I’m talking about when I talk about specialty. I’m talking about like, look, we have the greatest e-commerce site for new moms. We have content, we have new products, we have worries, we have forums, we have discussion groups, because new moms as a demographic has very unique needs and interests. Used goods, selling, reselling old stuff. Etsy, which I… wrote about quite a bit. You know, they do arts and crafts and stuff that people, most of the things sold on Etsy. If you wanna buy a model of, I don’t know, Captain America’s shield or something, or special jewelry that is vintage jewelry from the 1920s, that’s Etsy, and it’s mostly made or resold by people working out of their homes. It’s a very unique merchant group, a very unique consumer group. So when you talk about differentiation, you’re usually talking about a different demographic, almost always. It can sometimes be a different geography, usually it’s a demographic. But I don’t use the word customer, I say is the company sufficiently differentiated in the user experience? First of all, you gotta think beyond product. It’s not just the product, it’s the experience. If you’re selling to new moms in China, who by the way are an awesome demographic to go after. It’s the whole experience. It’s worries, it’s answering questions, it’s what to expect, it’s buying new stuff, like diapers, but it’s also a lot of reselling of old stuff. There’s a lot of reselling of things like, I don’t know, strollers, because people buy expensive strollers and then they sell them because you don’t use them beyond a couple years. So it’s not just products, you have to think about the whole experience and then you have to think about different users. Consumer would be one user group. But we could also look at the other side of the platform if this is a platform business model and we could talk about merchant experience. Etsy, I think is very interesting on the merchant side. And this is what I like about Etsy. For those of you who aren’t familiar, it’s a funny site. If you wanna buy coins from Japan in the 1920s, you can find them on Etsy. Like 70 to 80% of everything they sell on Etsy is unique. You can’t get it anywhere else. Vintage furniture vintage clothing vintage is just a fancy word for old paintings jewelry things like that That is really mostly about the merchant side. They have a completely different group of merchants than those people are not on Amazon at all These are the people if they weren’t on Etsy They would be at the local craft market on a Sunday on the Upper West Side of Manhattan Selling the jewelry they made themselves they’re a very different user group. So anyways, that’s question one. Is this company sufficiently differentiated in the user experience? And we could have multiple users. I think Etsy is a great example of that. Can the company compete, this is question number two. Can the company compete and or differentiate in logistics or infrastructure without ongoing spending? Now, when we map out an e-commerce platform, a marketplace platform, You know, we have two user groups or three user groups, but then we have enabling capabilities like logistics, payment, customer service. One of the problems these specialty e-commerce companies have like fashion companies, yes, they differentiate on the user experience because people buy fashion and luxury very differently than they buy socks and underwear. Well, I mean, depending on the socks and underwear, I guess. But one of the other questions is even when they’re differentiated by the user, they still get into this ongoing spending war in areas like logistics. You know, you still have to match the fact that Alibaba and Amazon are spending billions every year to offer next-day delivery because consumers expect that regardless of whether you’re a niche player or a big player, you don’t want to get stuck in one of those ongoing spending wars in logistics or infrastructure. So you need a product or service that doesn’t require you to do that. If you’re in a specialty player and you’re based on next day delivery, that’s a problem. Which is one of the problems for things like fresh groceries. You don’t wanna get into that ongoing spending war against Amazon over who can deliver in 12 hours. If you’re buying niche jewelry, you know, I bought on Etsy, I bought. a model of the SpaceX Starship. And it was made by a guy in Liverpool, I think. And it took weeks to get here, but because of the product, I didn’t care about the delivery time. You gotta get out of those arms races of infrastructure, logistics, and other types of sort of enabling spending, because you’re not gonna win. And then eventually they’ll offer a product like yours, and they’ll kill you on the logistics spend. So that’s number two, you gotta get out of that game. Number three, does the company have a strong competitive advantage within a circumscribed market? This is where you found a niche, good, very unique user experiences that you can differentiate on. You’re not in an arms race for logistics spending or infrastructure spending. And within your niche, you have a dominant competitive advantage. That could be branding. user experience, it could be R&D spending, it could be switching costs, it’s usually switching costs. Within a circumscribed market that doesn’t give that player because the market’s not growing and because the market has a hard barrier to other markets, the only way someone can get to your size is if they break in and take market share from you. There’s no room to grow without taking your customers. That’s what you want. and then you have to defend. So you need sort of some degree of a competitive advantage in a pretty well circumscribed market. Used goods are actually pretty good for this sense. Fashion and luxury are pretty good. The same company that sells you milk and bread cannot sell luxury. Those markets are separate. Used goods tends to be separate because of the requirements of testing things. So yeah, you got to have a small market, no arms race, and you’re dominant in your market. Number four, is there a clear path to significant operational cashflow? If you’re going to be a smaller player in a niche market that you dominate, it has got to throw off enough cash that you can actively defend. This is kind of one of the problems with Didi. I wouldn’t call them a specialty player, but… They are dominating a niche, but it’s not throwing off a lot of cash. If Alibaba chooses to go after them, it’s very hard for them to defend because they don’t have the money. So whatever your specialty is, it better be throwing off some cashflow that lets you reinvest, it lets you fortify, it lets you fight off your competitors. And some of these you see companies on a regular basis. I would put Ding Dong, for those of you who are familiar with Ding Dong, it’s a Chinese grocery specialty player. They basically do next day fresh groceries. So it’s a niche, they’re building some special logistics against it, but it doesn’t throw off cash. And that makes it very hard to defend. Okay, last question. Has the company avoided markets and situations that are attractive or strategic for the major e-commerce players? If you’re gonna be a small animal, on the Savannah, you got to be in an area that the lions don’t want, right? You got to just, if you’re in a space that Amazon views as strategic, that they have to have it, they’re going to keep coming after you. You don’t, or if you’re in a market that’s really high growth and big, that’s very attractive. the big players are gonna come after you. You’ve gotta be away from that stuff. You wanna be in a specialty niche area that’s defended. And look, at the end of the day, Amazon just doesn’t care that much about that space. So they don’t, they’re not gonna come after you. You gotta be out of their pathway. You know, the analogy I make is like, you don’t wanna be the lion, and you gotta stop thinking you’re the lion. You wanna be the hedgehog. You wanna be the small animal with spikes, and yeah, the lions could eat you, but there’s not enough meat. You’re spiky, it’s a pain, and they’re just like, ah, forget it, it’s not worth it. And that’s what the animals do. If you ever watch them go after hedgehogs, they try for a little bit, and then they just give up and… walk away and go do something else. You kind of want to be the hedgehog. You want to be the ant eater. You want to be the monkey way up in the trees that nobody can reach, but can do pretty well up there. You know, that’s what you want to think like. Anyways, those are my sort of five questions. I’ll put them in the show notes. And I want to tee these up because the enterprise ones are pretty similar. Anyways, I’ll put those in the show notes and you can see the previous articles if you want. But the companies that I think are pretty compelling within this, those five questions, Oriental Trading Company, which is a private company. Unfortunately, it’s a Berkshire Hathaway company. You can find my notes on there. I visited them a couple of times. Really cool e-commerce company, by the way. Etsy is pretty interesting, but I think the frequency of usage is very, very low, which worries me, but otherwise I think it’s compelling. I think luxury is very compelling in terms of e-commerce, except for the fact that the major companies like Alibaba really want to be in luxury. Delivery hero, which is Food Panda, is a bit of a question mark for me. I’m thinking about it. And Farfetch, which is a cross-border luxury player, I tend to think they’re going to get bought by an Alibaba at some point. I’ve written about that in the notes. that they might be an acquisition target. So for those of you who do catalyst based investing, that’s an idea. Okay, that’s kind of point number one. That’s sort of my working five questions for specialty e-commerce players. If you have any questions on that or suggestions, please let me know. I’m still working on that. I find that’s helping me think through it, but I’m still working on it. Okay, with that, let me move on to the enterprise side and same ideas. Now over the last really six weeks, I’ve been writing a lot about enterprise companies and cloud companies. I’m trying to focus on China-Asia, because I think this is the next big wave that’s coming, and I’m trying to get ahead of it. It’s also significantly behind the West. B2C in Asia-China, I think, is superior to what we see in the US and definitely Europe. B2B is pretty far behind the US, and it’s gonna be a big area. But it’s harder to get your brain around because it’s a lot more murky and the data is not as clear and a lot of it’s like Alibaba Cloud is a big, big deal. Huawei Cloud is a big deal. Tencent Cloud is a big deal. But there’s very little information coming out on those. So I’ve looked at a couple players around the edge. I looked at Kingsoft Cloud, which you can see on the webpage because it’s a standalone company. Basically it’s Lei Jun, it’s the guy who’s, before he founded Xiaomi, he ran Kingsoft and he’s still on the board. And Kingsoft Cloud basically provides cloud for Kingsoft and for Xiaomi. So I’ve looked at that, but I’ve also sort of dabbled. I’ve looked at Snowflake and companies in the West just to get around the question because it’s hard to find that in China right now. Okay, that’s the cloud question. which is separate than enterprise, although they’re often conflated because most of the enterprise players are offering cloud-based solutions. The cloud is a new architecture of technology, enterprise, SaaS, cloud-based, separate question, but they’re related. Okay, on the enterprise side, over the last couple of weeks, I’ve looked at Snowflake, looked at Tuya, looked at Medalia. those of you who are subscribers, I’ve sent you some pretty deep dives on these. I don’t think it’s my best thinking. I think you can tell that I’m still struggling to tease out the right frameworks for this. Most of these companies on the enterprise side are platform business models. They’re either B2B services or they’re platform business models. And if they’re platform business models, they’re almost always coordination and collaboration platforms. And that’s one of the five types of platforms I’ve talked about, right? I’ve talked about transaction marketplace platforms. I’ve talked about payment platforms. I’ve talked about innovation and audience builder platforms, learning platforms. And then one of them was collaboration and coordination platforms, which is where… The point of the platform is to help different user groups interact around a more complicated process. You’re helping different groups do something together. Like Microsoft Teams is about helping teams at companies collaborate on complicated projects online in a way that they would only be able to do in person. Now, one of the problems I’ve been having is when I talk about marketplace platforms, I have pretty detailed frameworks for different types. There’s ones for products, there’s ones for services, there’s ones for hotels, there’s ones for flights, there’s ones for mobility, there’s ones for logistics and products. I’ve already sort of delineated five or six different types of marketplace platforms on the B2C side. But when we move to collaboration platforms, which is on the B2B side, enterprise, I haven’t really detailed out five or six different subtypes yet, clearly. And I think that’s what I’m struggling to do right now, because I think there’s four or five major ones in there. And I think once those are clear, this will all become a lot easier. Microsoft Teams is clearly one type of collaboration platform. Zoom is another type of collaboration platform. They are probably very, very different. One is more a specialty play. One is more of an ecosystem orchestrator. Anyways, that’s kind of where I am in my thinking. I think you can see that in the notes that I’m still putting that together. Okay, but within collaboration platforms, coordination platforms, Tuya and Medalia are both trying to become specialty players. Okay, now Tuya is a China-based company. It’s public, Hanjo-based, and basically what they’re selling is… They call it an IoT ecosystem. Internet of things. They also, they really call it a platform as a service. They sell two products, software as a service, SaaS and platform as a service. I think people say pass, I usually say platform as a service for IoT. And really what they’re selling, I think this is much more of a B2B service than a platform and it’s definitely not an ecosystem, even though they say it’s an ecosystem. They’re basically going to two groups of corporate clients. They’re going to OEMs, original equipment manufacturers. These are people that make laptops and they make tables and they make air conditioners or whatever. And most of these companies, surprise, surprise, are in China, because it’s the world’s manufacturing base. And then they’re also going to brands of branded products like Schneider Electric. which makes air purifiers, air conditioners. Phillips, which also makes air conditioners, but they also make toothbrushes and hairdryers and things like that. Now they’re going to those companies and helping, and those companies, big surprise, they’re also manufacturing their stuff in China. So you’re really kind of dealing with either brands that are working with manufacturers or you’re dealing with the manufacturers directly. And they’re selling to both of these groups the same idea, which is… Look, you make air conditioners. You’re good at air conditioners. This is mostly about engineering. However, your problem is air conditioners are starting to become smart. They’re starting to become a combination of engineering. Hey, it’s a piece of hardware. It’s a product and a product plus software that is also connected to a greater system like I can control my air purifier from the app on my phone. and this air purifier, I can control it by the app on my phone, and it’s connected to all the other devices in my house. So it’s this idea of like your products are becoming smart and connected, and you as Philips or as a typical OEM have no ability to do that. You don’t have software people, you don’t know how to put sensors into things, you don’t know how to put semiconductors into things, you don’t know how to connect it. You don’t know how to offer it to your customers as a service that they can put the app on the phone when they buy the air conditioner. So they’re sort of filling in that other part of the equation for these companies, saying we will do that for you. So for their branded companies, like let’s say Philips, they will take a product like a toothbrush or a humidifier and they will help them turn it into a smart device. They will add the platform as a service such that it is a connected device. And then they make it seamless so it can integrate with Alexa, it can integrate with Google, it can integrate with Xiaomi, SmartMe, it can integrate with all the major players. Okay, so Tuya sort of describes itself as, hey, we are pioneering an IoT cloud platform. This is their quote. We are enabling everything to be smart, quote unquote. We are an IoT developer ecosystem. And they call themselves the IoT cloud. platform that helps you connect manufacturers and brands, make their devices smart, and then connect them to developers who write apps that run on these things. So they’re kind of saying, we’re a platform. Now, I don’t really think that’s true. I think it’s mostly just about making a typical device smart and connected. And then it can connect with AWS and Azure and Tencent Cloud and… You know, it’s a pretty good pitch because most of these manufacturers and branded companies, they don’t want a product that only connects in China or only connects in Thailand. When they sell their hairdryer or their air conditioner, they want to make sure it can connect in London and New York and China. So they need to be able to connect with all the major cloud systems of the world. AWS, Azure, Tencent, Alibaba, Alexa. Google, Alibaba, all of them. So that’s a pretty good pitch that they can offer this to manufacturers that our system will work everywhere. So I think it’s actually a fairly compelling B2B service. And I would, so I put it in the bucket of, okay, this is specialty enterprise. They are clearly not gonna be a Microsoft Teams. They are not gonna be a dominant e-commerce, I’m sorry, enterprise player that really is in control when they deal with a major client. They are always gonna be secondary or tertiary to the other enterprise software that Phillips and Schneider are running, which is probably from AWS or Alibaba or Microsoft. So you’re a specialty player by definition. I think it’s a pretty compelling value proposition. We can give you smart device capabilities. It will be globally scalable. If you go with us, it’ll work in China, it’ll work everywhere. It’ll work if you sell 10 devices, it’ll work if you sell 10 million. It will interoperate with all the major clouds and all the major protocols. By working with us, you have a dramatic decrease in the uncertainty and risk of trying to do this yourself. Because look, you’re gonna have to hire software people, it’s not gonna work. There’s much less risk and it’s just easier. I mean, it’s a very good B2B enterprise pitch, I think. Oh, and by the way, you’re gonna go faster to market than your competitors, because they’re trying to build it in-house, but we can get your device smart and connected. and in the marketplace in three to four weeks. So time to market for your new product matters. And finally, you’re gonna have an overall lower cost structure because this is software as a service. And that’s the biggest benefit of software as a service is look, don’t build this stuff in-house, just contract to us, it’ll be very cheap, which is true, until you start to get larger and larger and then actually the costs do add up. pretty significantly and a lot of these companies start to bring this stuff back in house when they get to scale because the costs are pretty significant. But in the early days, no, it’s a much cheaper product. That’s their core use case. I think it’s compelling. I think you can see why a lot of brands and OEMs who are already manufacturing out of China, why they would turn to the Hanjo based company to do this. Now the company itself, it’s still quite small. They claim a lot of usage. They claim about 5,000 clients. They say that their products, their software is now being used in about 250,000 different SKUs. So different types of products they claim it covers over a thousand product categories. But when they talk about their premium customers, and that’s really when you look at enterprise, everyone’s gonna claim big usage. But most of it’s pretty shallow. You wanna look at premium customers, which generally means, look, which customers generate more than $100,000 per year of revenue for you as a service? Tuya has about 180 of those customers. That’s pretty small. You know, what you’re really looking for is premium customers when you’re suddenly talking about thousands. And that’s one of the reasons everyone is sort of gaga over snowflake because when you look at their premium customer numbers, it is jumping. And that’s like, okay, this thing is this thing has got the right revenue line coming into play. But company like to yeah, they’re doing fine. But you it’s this looks a lot more to me like Etsy. This is never going to be. gigantic company but it could be a very compelling specialty company if they meet the right criteria of can you win as a specialty enterprise player and that that I think is why I put them into this category they’re kind of an early mover in this space they’re well positioned I think they’ve got a compelling product their revenue is growing pretty good they went from you know, let’s say 2019, they had about $105 million in revenue. 2020, they had about 180 million. So they’re still quite small, but that’s 80% growth, 90% growth. Their gross profits tend to be in about the 30% range. So they don’t have the kind of gross profits we like to see in enterprise of like 60 to 70%. So it’s not quite that. I mean, they’re more hands-on software. And then big surprise, They’ve got massive R&D and marketing money and they’re losing money on an operating level. So that brings me to the question, okay, if that’s the model, so could this become a very attractive specialty enterprise player? And I’ll just give you my five questions. And this is really, they’re pretty similar to the ones I use for e-commerce. And I’m still working on these, but there are some important differences. So here are my five questions and I’m putting these in the show notes. for specialty enterprise. Number one, same question. Is the company sufficiently differentiated in the user experience? Now, the user that matters, two user groups here that you could consider. The first is the brands and the OEMs, which I’ve talked about. And the second user group is developers who create smart devices and applications for smart devices. If you have a smart and connected hairdryer, Okay, you’re gonna have the basic functionality, like let’s turn it on with my phone and set whatever, but you want developers, the same way you want lots of people to write software for an operating system on your smartphone and your PC, you want developers to write software that can run on all the devices that use the Tuya system. So any device that has the Tuya system could run this program. I don’t think that’s a huge lever, but it could be interesting. I think most of the user group we’re talking about is obviously the brands and the OEMs. So can you sufficiently differentiate in the user experience? Um, my answer to that is mostly no. I think this is pretty standard what they’re doing. Um, I think they are extending software capabilities to branded and non-branded products, and I think there’s a, and they’re, they sort of got to IOT first. But if you listen to what Huawei is doing, Huawei is doing the exact same thing. They are talking about building, when they talk about Harmony OS, which is their operating system that they’re trying to get to be a real competitor to Android. Harmony OS did not start as an operating system for smartphones. Harmony OS, which they’ve been working on for years, was an operating system for IoT devices. It was for smart homes, smart factories, all of that stuff. That’s what Harmony, and it was built as an operating system that could run. on, you know, when you do IOT, it’s a very different architecture. You’re not talking about powerful semiconductors in phones. You’re talking about very limited semiconductors in cameras sitting outside a warehouse in the rain that watches the security. And they use much less power. They don’t use, you know, latency is not a big deal. It’s a very different type of. technology when you start moving into IoT devices. So they use a very different operating system. Harmony OS was built as an operating system for IoT devices. And then when they got shut out of Google Mobile Services, they adapted Harmony OS for smartphones, which is what they’re doing right now. But when they pitch Harmony OS, and I interviewed them about this about six months ago, one of their biggest pitches is if you adopt Harmony OS, It will work across smartphones, major ancillary devices like a car, and all the way down to every IoT device. It will be a seamlessly connected operating system for what they call 1 plus 8 plus n. That’s their slogan, 1 plus 8 plus n. One is the center of a digital life is your smartphone. Eight is the eight major devices that support the smartphone, which is smart TV. smart home, smart car, and a couple others. And then the N is IoT with sensors in everything. But their operating system will work across all of those. Okay, that’s pretty much what Tuya is trying to do. But they’ve only got the IoT piece, the N, not the one plus eight plus N, just the N. So no, do I think they are sufficiently differentiated? No, I don’t. I think their user group is different in that they’re going to this different group of manufacturers and OEMs who are based in Asia looking for manufacturers. I think that is compelling, that Microsoft is not on the ground doing that. So maybe the location is different and the user group is different and they got there first, which is good. Long-term, I don’t see what they’re offering as being totally differentiated. Okay, question number two. Is the company building a strong competitive advantage in a circumscribed market? Okay, same question. I want them to get there and dominate an area that’s not gonna have a lot of room for someone else to grow. Now, this is the question I think is very different for enterprise versus e-commerce, even though it’s pretty much the same question. Now, when I talk about a strong competitive advantage, On the enterprise side, if you look at my six levels of digital competition, which is that pyramid I use, which people are starting to call the thousands tower, which I’m not sure if that really works, but I just call it the six levels of digital competition. You have to outperform at the operating level. So operating performance, the Elon Musk level. I’ll put the graphic in the show notes. And then you have to move up from there to build structural advantages, the Warren Buffett level. So when we look at these companies for how they’re performing at the operating level, the operating performance level, I’ve broken that into three levels, basically. Tactics, digital operating basics, and digital marathons and superpowers. What matters here is digital operating basics, and specifically DOB1 and DOB4. I’ll put the… graphic in the show notes, but basically within digital operating basics, which is DOB, digital operating basics, number one on my list is rapid growth at small incremental cost. So I wanna see this company getting lots of adoption and getting into those clients with their enterprise services fast. I wanna see them dominating within their specialty as much as possible. I want 40% of all the OEMs in China using a company like Tuya. I wanna see them using them. So I wanna see real rapid growth on enterprise adoption, and that’s DOB1. The other one is DOB4, which is connectedness, interoperability, really connectedness and interoperability. When a company is adopting this specialty enterprise service, I wanna see them connecting it with all their other enterprise services. I wanna see them deeply embedding it in their operations such that it becomes very difficult to get it out. Those are the two metrics I’m looking at for digital operating basics to look at whether this specialty enterprise company is outperforming others on an operating level. Lots of adoption and lots and lots of integration with all the other enterprise services they use. Because we’re always gonna be secondary. We’re not gonna be the major platform. We’re not Microsoft Teams. But I wanna see this specialty integrated in Microsoft Teams. I wanna see it integrated in their ERP system. their salesforce.com, their recruit now, all of those. So adoption and deep integration. Those are kind of the two things I’m looking for at the operating level. Now, if they achieve that, we can move up to the Elon, I’m sorry, to the Warren Buffett level, the competitive advantage, the structural level. And that’s really where we start looking for switching costs and standardization network effects. And you can see how one of those would fall out of the previous operating activity. If I’m getting lots and lots of integration and adoption, I am gonna become the default standard for doing this in the industry. And then you get what’s called the standardization network effect. Or if I’m getting lots and lots of adoption and I’m deeply integrated in their business, I’m gonna have switching costs. So at the operating level, I’m looking for DOB1, DOB4. And then over time, I’m looking for that to create switching costs, standardization, network effects. One of those two. And that gets me the answer to question number two, which is like, look, I’ve got a strong competitive advantage in this market, I am entrenched. And that’s kinda how I think that plays out over time. So when I was looking at Tuya, that’s what I was looking for. I was looking for growth and adoption. and I was looking at for interoperability and integration. And I give it sort of a six out of 10 on those. It didn’t knock me over. Now Snowflake knocks me over. Snowflake is like a 10 out of 10 on both of those. Two is like a five or a six out of 10. Now, if there are five or six out of 10, and then you look at their competitors and their competitors are all two out of 10, Hey, we’re looking for relative performance here. So then that would be an indication, hey, they’re outperforming, I should expect them to maybe have switching costs in a couple years. That’s how I break that apart. So number two, is the company building a strong competitive advantage in a circumscribed market? You’ll notice the language I used is, are they building? Not do they have it today, but are they gonna get there in the near future? That’s how I take that one apart. Okay, the other three are shorter. That number two I think is the main one. Number three, is there a clear path to significant operational cashflow? Same as e-commerce. Yeah, I suspect Tuya will be fine. They do have a decent gross profit, 20s to 30s%. They’re spending like, the thing that’s gonna kill you on enterprise is your spending on sales and marketing. because most of this is not self-service type of sales. Most of this is having a sales force that goes out and directly sales, and it takes a long time. So that could be an issue. I have a question mark for Tuya on this one. Number four, which is a similar question, can the company compete and or differentiate in sales? or R&D without ongoing spending. You don’t wanna get into an arms race with Microsoft on overall sales spending over time. This is how Microsoft is sort of slowly crushing Slack. Slack was doing very, very well in getting adoption. It’s one of the ways they’re doing that. And they had sort of an organic level of adoption where companies were starting to use them. And then Microsoft started basically replicating their service and they would use their massive sales force. I mean, they’ve been selling to corporations around the world every day for 30 years. And they started to sell that as one of their products. And that is a devastating move because you can’t match their sales force. So it’s sort of like with specialty e-commerce, you don’t wanna get into an arms race for logistics spending as a specialty player. In enterprise, you don’t wanna get into an arms race for Salesforce or R&D spending with the major players long-term, because they’ll crush you. Now in this case, I actually think that Tuya is in pretty good shape. I think they’re on the ground. I don’t think this is a massive amount of money that you have to spend over and over and over. I actually think they’re in pretty good shape on this one. All right, number five, last question. Has the company avoided markets and situations that are attractive or strategic for the major enterprise players? And here I think we get a solid answer of yes. I don’t think. at the end of the day, I mean, Huawei wants to do a lot within enterprise, that’s true. I don’t think they view helping all these OEMs and brands create smart devices one after the next, after the next, after the next, as a major business for them. I think they wanna control the ecosystem long-term. They wanna be the platform that connects everything. But I don’t think as a B2B service that you charge for, I don’t think that’s what they want. It’s a pretty peripheral, small, and it’s not strategic. I think they’re probably quite happy to work with a company like Tuya that is out there working with Philips and all these companies every day for their latest round of air conditioners that are coming out next month. And then once those companies are digitized and smart and connected, they will then connect with Alexa. or connect with Harmony OS seamlessly. So I think that answer to that one is pretty good as well. Now, one last comment on this question. The other concept for today is hierarchies of control. And this is in the concept library. And I haven’t really talked about this on the B2C side, but it’s a big deal in B2B and enterprise. Hierarchies of control, I did send out an email to subscribers about this. It’s this idea of look, at the end of the day, if you’re an app, you are living in Android and you are living in iOS. You are living in their world. As if Apple wants to ban your app, there’s not much you can do about it. If Android wants to ban you or wants to say, you must pay us 30% of your revenue, what are you gonna say? We’re an app, if we are not on Android and iOS, we’re dead. You know, in the hierarchy of control, they are higher in the hierarchy than most all apps. And really the top in the smartphone world in B2C, the ultimate power is at the top, which is the company that puts the device in people’s pockets. You know, I have an iPhone in my pocket. At the end of the day, Apple’s in charge of everything on that device because they can get people to buy their phones and put them. in their pockets. Now, semiconductors also have quite a bit of power. As you move further down the tech stack, companies like Arm Holdings have quite a bit of power. But generally on the B2C side, we know where the hierarchy of control is. It’s the smartphone companies, it’s the operating systems. After that, it’s a handful of apps like Facebook and WhatsApp and WeChat that are particularly powerful. You can as… As Huawei found out, you cannot sell smartphones if you don’t offer Google and Facebook apps. People won’t buy them. But once you move below that, there’s a sea of apps that just do what they’re told. Okay, on the B2B side, because everything has to tightly interoperate, everything has to tightly integrate, your ERP system has to connect with your CRM system. with your sales force, with your digital marketing, with your internal project management, with your data core. All of that has to integrate very tightly and it all has to operate sort of in an integrated fashion. So the hierarchies of control are a lot more important. And within that, certain companies are really powerful. Microsoft and Oracle have absolutely dominated the ERP and the corporate enterprise for decades. Salesforce.com came in in a fairly powerful fashion because Salesforce is a big deal. Mark Benioff, you know, who came out of Oracle. The group that controlled the database. Oracle, the group that controlled the sales force, salesforce.com, the group that controlled your enterprise software, Microsoft, I mean very powerful historically, and they pretty much told everyone else what to do. So again, back to Snowflake. This is why Snowflake is really interesting because they would be a major player. If they control the data core of companies, that’s the center of everything. That’s really interesting. AWS, Azure, also very interesting. Okay, if you’re a specialty enterprise player, you are really in a weak position. So question number five, has the company avoided markets and situations that are attractive or strategic to the major enterprise companies? You need a strong yes on that question because if you are in an area that any of these companies views as strategically important, they can shut you down so easily. They just make your system not work well with their system. They don’t ban you. They just make sure that whatever you’re selling doesn’t integrate well with Microsoft. And that in companies do not like that. They don’t have to do it overtly. They just make it difficult. So they really can shut you down quite you don’t want to you don’t want to fight with them. You just don’t You know, this is not the hedgehog situation where you are too difficult to deal with This is more like I don’t have a great analogy for this But this is more like you are the lamb standing next to the lion It can kill you at any given moment if it so chooses So you got to make sure they don’t care about you at all Now is Tuya doing that? Yeah, I think Tuya’s in pretty good shape. I think they’ve stayed out of that pretty well. Anyway, so those are my five questions. answers for that. I think Tuya is a solid five or six out of ten on these questions. I think it’s a reasonable specialty play that avoids most of the problems. I think it could get commoditized fairly quickly. It doesn’t strike me as something that’s going to throw off a lot of cash, but it also doesn’t strike me as something that’s going to get destroyed pretty quickly. I basically had the exact same assessment of Zoom about a year ago when everyone was talking about, oh, Zoom is going to be spectacular. And I’m like, I think they’re in a communications niche. I think video conferencing very easily could become a free commodity that Microsoft just offers for nothing. And my advice on this one, which I don’t think they cared about. was they need to get adoption and integration as fast as possible such that they become the standard that maybe they get a network effect and that they get switching costs. I mean, it was basically the exact same DOB1 to DOB4 playbook. They need to integrate and become the de facto standard for video communication. But Microsoft Teams, I mean, look, Microsoft Teams came in there very quickly. and I do about half, about 30% of my calls on Microsoft Teams. They view communication as a strategic priority for them as a major enterprise player. So does Google. That’s a problem for Zoom. I’m not convinced Zoom is gonna do well as a specialty enterprise player long-term. Anyways, that’s where I fall on that one. Okay, I think that is enough for today. I was gonna go through Medalia, which is another specialty player. I think I’ve given you enough content for today. I will push that to next week. So sorry about that. But yeah, I think that’s a whole nother company. So we’d have to go through a lot of the basics. It’s an interesting company. They do experience management as a specialty enterprise service. So I’ll deal with them next week. Okay, and yeah, that’s pretty much where I fall on that one. Again, the key concepts for today. Hierarchies of control on the enterprise side versus on the B2C side, very important. And then specialty enterprise as an area. So those are the two ideas. As for me, it’s been a pretty good day. I’m heading down to the land office of Bangkok in about 15 minutes here to transfer over the title of the new condo, which has worked out surprisingly well. To do this stuff, it’s kind of old school. You have to do it in person and you have to do it. It’s all on paper. Like there’s literally a land title and they have to scratch out one person’s name and put the other person’s name on there and it’s on the file. There’s also computers, but they sort of keep things in paper, which is a pretty good way to protect a system actually. But getting people in Bangkok during quarantine and COVID has been a problem. So. It worked out well, but it’s been actually a little bit of a trick. So I’m going down there. I’ll get that done in a couple of hours. Um, yesterday here in Bangkok, we had, uh, the Huawei event for Thailand. So I went out there and spoke on a panel in the afternoon. And that was, I mean, Huawei is a really interesting company. It became very political two years ago. And anytime, you know, anytime this stuff becomes political, the quality of the thinking just drops like a stone. Um, It became very dumb for a couple of years. And now that stuff’s sort of over. So they’re back and they’re resetting the company and they’re sort of focused on Southeast Asia and they’re really focused on Thailand. 5G is going to be pretty big here in Thailand. It’s already, Bangkok I think is already in the top 10 for cities for 5G rollout. But Huawei, Huawei is amazing at this stuff. There’s Nokia and there’s Ericsson when you talk about telco. You know, Huawei is much more impressive as a company, in my opinion. And since they’ve been sort of shut out of the US and a lot of Europe, they’re focusing a lot more in Southeast Asia. So they’re big here. And they’re gonna focus on this market. They’re also focused on cloud. After that, I mean, their smartphone business basically got kind of decimated outside of China because they can’t get the high-end semiconductors and they can’t get Android and Google and things like that. So, you know, they’re focused on smartphones in China. but outside they’re focused on cloud. And they’re doing telco where they can, but they’re focused on cloud as a growth driver, and they’re also starting to focus a lot on power, charging stations, energy grid, stuff like that. So I mean, you know, they’re smart, and they’re sort of pivoting now that the dust is settled. I think they’re gonna do a lot here in Thailand and Southeast Asia. And anyways, I spoke on a little panel. And they had some pretty senior government people coming in the morning. It was pretty interesting. And it was also just kind of nice to see a conference. I mean, there were 500, 700 people in the morning. So it’s nice that this whole world is restarting. It was a lot of fun. It’s been a pretty good week. But I think that’s it. Kind of a lot of content for today. Hopefully this was helpful to you. I think it’s a really important question. I think the whole specialty enterprise question. is really important, especially in Asia. Because we’re a bit behind here, but it’s gonna be a big area. So this is sort of where my thinking is today. If you have any feedback on that, please let me know. I’m still trying to sort of break it apart and make it more usable. I think I’m about halfway there right now. So hopefully it’ll get better in the next couple months. Anyways, that’s it for me. I hope everyone is doing well. Hope everyone’s staying safe. And I’m off to the land title office. Anyways, take it easy and I’ll talk to you next week. Bye bye.