This week’s podcast is about Ram Charan’s new book “Rethinking Competition Advantage“. I think it has a lot of great insights about the basics of digital operations. But not much about competitive advantage.

You can listen to this podcast here or at iTunes and Google Podcasts.

Here is the link to the Q&A on Sept 7:

Here is my interpretation of the book’s digital operating basics (combined with my own):

- Scale and growth and small incremental cost.

- Personalization. A personalized consumer experience is key to continued growth. Continually innovating on the consumer experience enables cross-selling more and more products and services to a broad audience. A “market of one” is the ultimate personalization.

- A digital core for operations. Algorithms and data are essential weapons.

- Ecosystem and connectedness. Every major player needs at least 10 partners for sharing data, meeting a range of consumer preferences, growing faster than it otherwise could and continually refreshing with technology and innovation.

- People, culture and work design form a social engine that enables innovation and execution personalized for each customer. Decision-making is designed for innovation and speed.

- Operational cash flow. Companies need powerful moneymaking models. Target a big opportunity and increase cash gross margin by innovation and cost reductions over time. Fund multiple experiments against consumer experience. Add revenue streams on the same digital core.

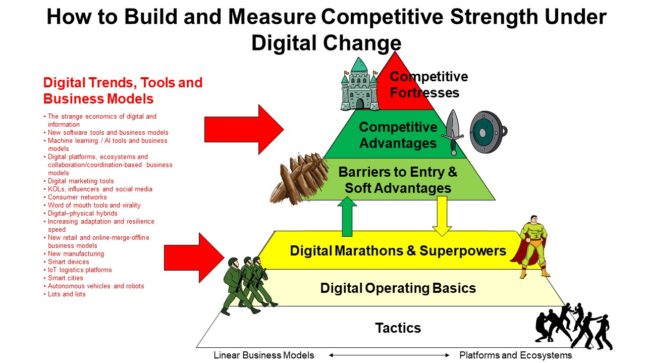

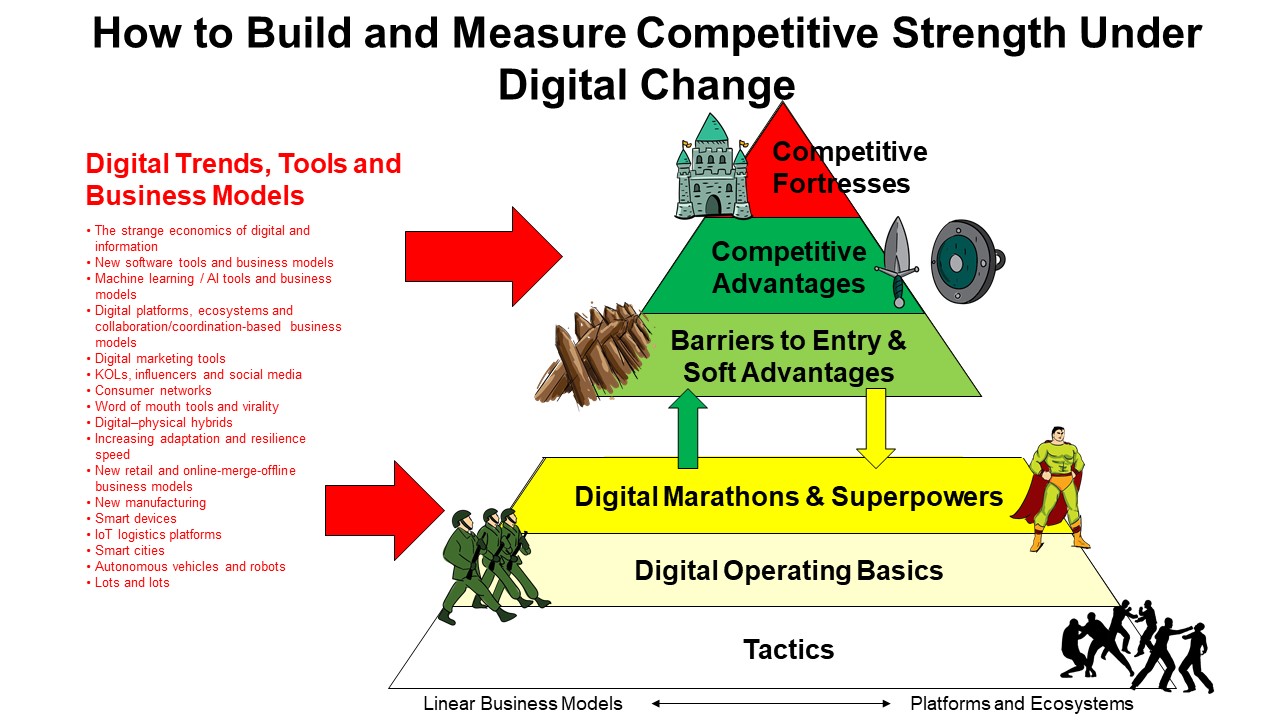

Here are my 6 Levels of Competition:

—–

Related articles:

- Can Foodpanda / Delivery Hero Get to Profitable Scale in On-Demand Food? (Asia Tech Strategy – Daily Lesson / Update)

- Meituan vs. Ctrip vs. Alibaba: Who Will Win in China Services? (Jeff’s Asia Tech Class – Podcast 22)

From the Concept Library, concepts for this article are:

- Digital Operating Basics

From the Company Library, companies for this article are:

- n/a

———-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

—–Transcription Below

:

Welcome, welcome everybody. My name is Jeff Towson and this is Asia Tech Strategy. And the topic for today, Lessons in Digital Operating Basics from Ram Charan. Now Ram Charan for those of you, I’m probably saying his name wrong, sorry about that. He’s a well-known strategy consultant. He’s been around for a long, long time. Very high profile, advises a lot of big, big Fortune 500 companies, talks to their boards, lots of books written about… how boards should behave, things like that. Anyways, he has a new book called Rethinking Competitive Advantage, which is basically looking at digital meets competitive advantage, which is kind of my area. And, you know, a lot of interesting stuff, and I’m gonna go through some of that, but I’ll kind of just say off the front, look, I don’t think this is about digital meets competitive advantage at all. I think it’s really about operating behavior, operating excellence in a software-driven world. I think that’s most what he talked about, not really competitive advantage, but I’ll kind of lay out, there’s a lot of good stuff in there. I’ll sort of lay out how I view it and what I think of the takeaways. I’ll probably do this in two podcasts because there’s kind of a lot there, but I’ll also put a link in the show notes to the book. I think it’s worth your time. I think there’s a lot of good insights in these from someone who has been sort of advising practitioners as opposed to theory for a long, long time. So this is probably one of the podcasts where you’re going to want to take notes. certain podcasts I’m always writing stuff down on my phone, others it’s like yeah that’s kind of interesting. This is probably one where you’re gonna take some notes if you do that sort of thing. Anyways that’ll be the topic it’ll probably do two podcasts to get through all of this there’s kind of a lot. Now for those of you who are subscribers I sent you kind of a lot this week. I wrote pretty long articles on Billy Billy and on Pin Duo Duo. Yeah I’m kind of a bit there a lot of strategy thinking there. Hopefully that wasn’t too much. But those are important companies. I think they’re on the frontier. I think they’re important to understand. I think we’re gonna see what they’re doing in other markets around the world, especially Latin America, Southeast Asia. I think they are often misunderstood from a strategy perspective. So anyways, kind of a lot there. Next on the list coming your way, probably Kingsoft and Global E are the next two on my list, so you’ll get some information. that. For those of you who aren’t subscribers you can go over to Jeff Towson dot com sign up there get a free 30-day trial see what you think join the group. What else? Oh this week we’re gonna do an online Q&A which is the first one of these we’ve done. I’m trying to shift away from me just pushing out content to more of you know questions back and forth because I think that’s actually valuable to people to sort of you know shift away just from what I think to what a lot of people think. So anyways, we’ll do the first one of those this week. You can go over in the show notes, there’s a link to sign up on Eventbrite, but I think it’s Wednesday-ish. Usually we’re doing these in the evenings, Asia time, so that people in Europe can participate, and then people in the morning in Latin American can participate. Anyways, that’ll be the Q&A. The link is in the show notes. See what you think. Last bit of housekeeping here, my standard disclaimer, nothing in this podcast or in my writing or on the website is investment advice. The numbers and information from me and any guess may be incorrect. The views and opinions may no longer be accurate, relevant. Overall, investing is risky. This is not investment advice. Do your own research. And with that, let’s get into the topic. Okay, the two concepts for today. We’ve actually got kind of a lot of new subscribers in the last couple of weeks. For those of you who are new, I mean, the way this works is focus equally on companies and concepts so that you can sort of build up a baseline of understanding both in the important ideas and the companies because you’ve got to kind of live in the details. So every podcast we try and cover a company or I try and cover a company and a couple of the key ideas. And then over time, the idea is you’ll get smarter and smarter because there’s not a million companies to study. There’s you know, there’s 100 or two. And there’s not a million ideas you have to understand when you start thinking about how digital software, data technology changes strategy and business models. There’s 30 or 40. And you can go to my website and there’s a tab called Concept Library and there’s a tab called Company Library. So I’m working my way through those, always sort of going a little bit deeper on them. But the two ideas for today, the two concepts are, well, really there’s just one for today, which. which we call digital operating basics. And I’m gonna kinda tee up what that means. And I think most of what Ram wrote about, I put under that category. I don’t think it has very much to do with moats, competitive advantage, structural advantages. I think we’re talking about the operating basics in an increasingly digitally infused world. So all of it’s gonna go under that concept. If you ever wanna know, just look at the bottom of any of the articles or podcasts and you’ll always see I’ve listed specifically what companies and what concepts are relevant for this article or podcast. Okay, the starting point for this is if you look at my, what we call competition pyramid, which is not a good term. Someone started to call it 1000’s Tower in the last couple weeks, which I thought was kind of funny. I think it’s easier to remember. I’m going to start probably calling it that. But in the show notes there’s a graphic, which is a pyramid. Let’s call it the tower now. If you go to my web page, on the first page you’ll see the pyramid. Under the concepts, at the very top of the concepts library, you’ll see the pyramid. It’s pretty detailed, but it does sort of encapsulate everything. And this is, you know, the title basically says what I’m doing, which is, this is how to measure competitive strength and defensibility under digital change. So here’s all the components within the tower of competitive strength. It could be a moat, it could be a network effect, it could be fixed costs, it could be purchasing economies, all of that. And then as new digital tools and trends and business models emerge, I’m always looking at how those things impact your competitive strength of a company at a granular component level. That’s how I take it apart. So every time someone says, oh, here’s a new digital tool, GPS, geolocation, AI, this, I always just sort of, okay, how does this impact the components of competitive strength? And they’re all sort of shown within the tower. That’s how I view the world. That’s how I try to predict what’s gonna happen next. Who’s gonna win, who’s gonna lose, what digital tools matter, what don’t. Okay, so if you look at the pyramid, the tower, you can see I’ve basically broken it into two pieces. The top of the tower, on the left side, you’ll see it says Moats. Structural advantages. This is Warren Buffetland. This is a company has a structural advantage that is very hard for a… new entrant or a rival to overcome. At the bottom of the pyramid I put operating speed and excellence. This is the game that every company has to play and you have to win on both levels. You have to win on look our company is just really good at operations. We’re really fast. We have excellence and then at the top of the tower is okay and do we have a structural advantage on top of that. You have to win on both levels. The top of the pyramid is about motes. The bottom of the pyramid is about speed and operating excellence. And you gotta assess a company at both levels. I’ve also sort of referred to this in the past as the horse versus the jockey. The top of the pyramid is the structural advantages. That’s look, who has a faster horse? Some people, some companies just, the horse is faster in this race. The bottom of the tower, the pyramid is, who’s got a better jockey? You know. So you could also say here’s the business model versus the management team. Here’s the horse versus the jockey. Here’s the moat versus operating speed and excellence. You got to you got to play on both levels. But generally speaking, if you have a better horse, a stronger business model, a stronger moat, you’re generally going to win even if you’re if you’re jockey, your management team kind of sucks mostly you want to move up the tower as much as possible as a company over time. Okay. Now most of what this book, Rethinking Competitive Advantage is talking about, it’s talking about how does operating speed and excellence change in a digital world. And here’s kind of what I think, and if you actually look at my pyramid, you know, you can see I’ve broken that level, operating speed and excellence, into two buckets. Marathons, and then the bottom of the pyramid, which I’ve listed, digital operating basics, tactics. digital competition. We talk about this stuff all the time in digital. Most of what people are talking about are what I would call tactics and digital operating basics. This is being first mover. This is counter positioning. This is virality. This is hyper scaling. This is blitz scaling. This is using money as a weapon. All of this stuff is tactics and digital operating basics. Everyone has to do it. But generally this isn’t a game where you can win. You just have to keep fighting. You have a good year, you have a bad year, but you’re not pulling out of the pack. As you start to pull out of the pack, that’s what I look for as a marathon. As you start to build moats and structural advantages, that’s the top of the pyramid. That’s kind of how I break the world down. Most of what I think this book is about is, it’s a good summary of digital operating basics. And you can see in the pyramid that I’ve listed some of the digital operating basics. Going for scale, going for growth at a cheap cost, building a digital core, becoming more connected as a business as opposed to a standalone company. Operational cash flow that you’re generating, your people, your culture, your management, your leadership. All of that stuff which is very important, which companies like McKinsey and BCG spend a lot of time selling consulting services. That’s really what they’re talking about. culture, things like that. I put all of that under operating excellence, but not structural advantages. And I think this book is really speaking to that quite well actually. So in this book, what he’s basically doing is he’s looking at the difference between large traditional companies like Walmart, like Disney, things like that versus large digital natives like Amazon. versus Netflix and people like to look at this comparison and why Netflix is different than Disney and why Amazon is different than Walmart and why a digital insurance company is different than a traditional insurance company because that’s obviously where his clients are. And then he’s looking at those differences. Now, what I think is incorrect is he’s ascribing those differences as competitive advantages. Hey, this company is operating more from a digital playbook. versus this company that is operating from a more traditional playbook. I don’t think that’s a competitive advantage. I think what we’re actually seeing is the digital companies got there first and started to operate in a way that has sort of what I call the digital operating basics. It’s not that it’s sustainable as a difference, it’s just that they’re doing it first. These other companies are all gonna start operating the same way. We’re all gonna start operating from a digital operating playbook. That’s not a competitive advantage. It’s just like they started doing it first so it looks very powerful, but it’s gonna be copied. Everyone’s gonna operate this way. So not a competitive advantage, but important aspect of operating speed and excellence going forward. Okay. Now here’s this argument. I’m summarizing this from the book. There’s a lot of good insights. You can tell this is a guy who spends a lot of time advising CEOs and… having to tell them things that are directly usable. It can’t just be theory. I think that’s what I really like about this book. It’s a good usable playbook for most CEOs. And his argument is, look, in the past, competitive strength was about controlling distribution channels, having tangible hard assets on a large scale. That’s like, hey, you’re Walmart, you got all those stores. Having an established brand, maybe having a patent. he kind of puts most competitive advantages under that category within usually industries that had very clear markations. This is tourism, this is retail. You know, we saw those industry barriers, we knew who our competitors were, and then we saw these sort of hard assets, distribution channels, established brands, patents as strengths within that world. I think that’s generally true. I think his approach to what constitutes a competitive advantage is very simple. I don’t think it’s the whole thing. I don’t even think it’s half of the thing. I think it’s like 20%. If you want to know what I think is the whole enchilada, look at the top of my tower. That’s where I think I’ve sort of laid it out very specifically what the components of competitive advantage really are. Okay. But in a world, here’s where I think he makes a good argument. The past used to be about mass markets and mass production of goods that evolved out of cottage industries in the 1800s. You started to see mass production. We started to see these sort of mass markets, mass production, mass distribution, doing mass marketing for very commonly used goods. That was largely the story of the last 100 years, 150 years. That is changing now. Within that picture we had different strategies. The Model T was one product that’s the same for everyone, commodity, low price. GM was making cars with lots of different types. That’s differentiation. So that’s sort of Michael Porter look. There’s two strategies. Mass market cheap or differentiation? Fine. His argument, which is I think correct, which is longer term over the next five, 10, 15, 20 years, that’s gonna fall away. and a data-driven world with algorithms is going to enable personalization of everything. The products are going to be designed per person. The delivery is going to be designed of every product and service per person. The customer journey is going to be customized at every single touch point. From how you look at a company, from how you look at the web page, from how they communicate with you, to how you do back and forth, to the product, to the service, it’s all going to be increasingly personalized in a data-driven world run by algorithms. That’s the future in contrast to this past of mass production. I think that is largely true for a significant portion of all products and services. We already see it in media. We already see it in e-commerce. We’re going to see it in insurance. We’re going to see it in financial services. Do I think selling socks and underwear is going to be that way? No, I think a good portion of the future is going to be mass market, mass production. But a good healthy percentage of it is going to be. data-driven personalization of the entire consumer experience. So I think he’s right in putting a stake into where the future is going. That’s his tee up to his argument. And here’s the main argument of the book. The main argument of the book is about competitive advantage. Now I think this is incorrect. I think the main argument of the book is what I call digital operating basics, which is the key idea for today. Here’s how he would describe this, and I’m pretty much on board with this. So digital operating basics are about winning consumer preferences repeatedly over and over through continuous innovation on behalf of the consumer. We have to understand the end to end consumer experience from when they open the app. to when they look at it, to when they walk in the store, to what they see, what they think, what they feel, to maybe how they buy things along the way, to how they feel about it afterwards, to communication. All of that end-to-end consumer experience, the way you win in the future is you have to continually innovate against that experience and make it better and better and better. And you have to continually data mine. that experience to look for new opportunities to create new things. That to me is the baseline digital strategy for operating speed and excellence, all of which I’ve put under the title of, this is the basics. If you’re gonna compete in anything, that’s the playbook. And that’s the bottom of the pyramid. It’s not the top of the pyramid. That’s table stakes in a digital world. Okay. What does that, and he basically lays out six points, five to six points within that general strategy. And I’ll take you through those in the next, this podcast and the next one. I’ll probably get through two of the key points, this one, two to three. But basically you have to think about growth. You have to think about cashflow. You have to think about operating as a system and ecosystem, not as a company. And he basically gives a lot of a. Examples, Amazon versus Walmart versus Best Buy versus Macy’s, credit cards versus PayPal versus Apple Pay, AWS versus Azure, Warner, Disney versus Netflix, Amazon Prime, lots of examples of these major companies. Okay, digital operating basics. Now he does sort of allude to the idea of core competence and core competence was kind of an idea put forward in the 1990s by Gary Hamill. CK, Prahalad, these are sort of digital strategy people. In the 90s, this idea of like, look, you can’t think about competitive advantage in the sense of Michael Porter anymore. You need to think about having a core competence. Semiconductors are building a core competence in chip manufacturing and design. And that’s really what you have to build over a long period of time. Elon Musk is building a core competence in rocket engineering. And that’s going to play out in a lot of ways. These are sort of longer term views of competition. And I think that’s quite good. If you look at my tower, you will see in the middle of the tower, there’s a break. Between the bottom, which is about operating speed and excellence and the top, which is about moats and structural advantages, there’s a little gray box, which is capabilities, resources, and assets. That to me is the bridge between those two worlds. As you do operating speed and excellence over time, what you’re really doing is building assets and capabilities and core competence. When you build store after store after store as a retailer, you start to build a baseline of assets. In this case, stores, warehouses, things like that. Those assets and core competence are really what give you your structural advantages. You know. You could say that structural advantages, moats are one half of the coin. The other flip side of the coin are the resources that let you do that. There’s a reason Walmart can sell you things cheaper because they have scale and they can get purchasing economies of scale. Well, how do they have that? Well, because they have a ton of stores. The resources are what become reflected in your structural advantages. So that to me is sort of the transition between these two playbooks. You have to be good at operating speed and excellent. In that process, you start to build capabilities, resources and assets. Those then get reflected in your competitive strength. That’s kind of how I put all that together in my head. Anyways, that is not really the point. Okay, so what are the digital basics? I’ve basically listed them. At the bottom of the pyramid, you can see digital operating basics. And these are pretty, these are about 70% in line with his playbook as well. I have some other thoughts, but we’re pretty much on the same page. So scale and growth at a small incremental cost is a big benefit of being digital. You build a digital core, which is IT algorithms and data. You start to think like an ecosystem and you start to think about connectedness. You think about leadership, management, people, culture, and then you have to think about operational cash flow that gets thrown out. Those are kind of, I’ll go through what he talks about, but they pretty much line up with that. So let me give you, I’m going to go through, let’s see, three of the sort of digital operating basics today. And I will list these in the show notes. All right, number one, this is from his book. This is his thinking, his words. Number one. personalized consumer experience is the key to exponential growth. This idea that, he basically says the ultimate goal is a market of one. That’s the ultimate personalization, which really Apple does quite well. If you’ve ever noticed your smartphone is completely personalized to you by virtue of you choose what apps you want on there and what you want. Another example he lists like Starbucks, when you walk into a Starbucks, they actually offer 170,000 different beverage options that you can choose from. Now as the world becomes more data-driven, lots more sensors, data coming from everywhere, lots more algorithms, within all of that, we are moving more and more towards a market of one. That’s the goal. Now he says this is the key to exponential growth. I don’t really believe that’s true. I don’t think we see exponential growth in anything. I think we can see… continual growth, that as you get more and more personalized, you can offer more and more things to the consumer that fit their world. It gives you the ability to cross-sell to each individual customer across a very, very large audience. So you look at what are the pain points of this specific customer? What are the touch points? How do we continually improve those? Now I think that’s basically true. Now within this, What are the big levers? The big levers, cost and convenience. That’s always the biggest levers. All these digital operating playbooks, all these companies like Amazon and Netflix and all of them, the biggest lever they’re always pulling is cheaper. If you can find a price gap, this is his words, quote, The price gap, the difference between the existing price to the consumer and what the price could be if digital technology was creatively applied.” That’s the big opportunity. Quote, industries get overturned when someone finds a way to exploit the gap for the benefit of the consumer. Unquote. Absolutely true. Spot on. This is where these companies, this is Jeff Bezos, your margin is my opportunity. Quote. Right? He is looking at the consumer experience in a very detailed data-driven way, and then he’s looking to apply digital tools to just whack the cost. And that is devastating against traditional competitors. So it’s about personalization, data-driven personalization. But within that, low cost is your big, big lever. And the other lever you could say is convenience. I think that’s usually their second biggest lever. Like it’s just easier to buy stuff on your phone than going down to the store. It’s easier just to have the next video tee itself up instead of me searching for the next video. Number one lever for me cost number two lever for me convenience. After that, then you have to start thinking about an improved experience. It’s better. And then sometimes if you have a significantly improved experience, you don’t have to be cheaper. This is JD versus Alibaba. JD lives, in look we’re not as cheap as Alibaba, but all of our goods are quality. You will never get a fake good if you buy a laptop on JD. If you buy on Taobao, it will be cheaper and very convenient, but you have to kind of think about, you know, you might get some fake stuff. So you can, you know, sometimes it’s all about cost. Sometimes it’s like, look, we’re not the cheapest, but we’re better in some important way. Usually it’s those three. Okay, I think that’s right. And then the long-term goal is market of one. And you can see in my pyramid, I’ve actually put market of one up at the top of the pyramid. I think if you can do one to one personalization, that is a structural advantage. That’s one of the ones I pull out of the basics and put up to the top. That one is actually quite powerful. Okay, second one. Basically, this is his language. Algorithms and data are essential weapons. Basically, everything in the previous point, this personalization, all of that requires data and algorithms. I mean, the quote is, quote, creates a superior end-to-end experience that is personalized for each individual and at scale. Unquote. So you’re not gonna be able to personalize to millions of people with people, I mean, with staff. You’re gonna have to use data. I mean, it’s one thing to personalize a small company, but they’re talking about doing this for millions, hundreds of millions of people. So he argues that you need a digital platform at the core. I don’t use the word platform because I think that’s a, I use that as a term for business model. What he’s really talking about, in my opinion, is what I would call the digital core. That the core operations of your company have to be based on software, data, AI, data technology. Everything else sits on top of the digital core. Now, in practice, it’s a mix of algorithms and data. That’s really what it is. And you can see one of the advantages companies like Amazon and Alibaba have is they were built around a digital core from day one. They weren’t traditional companies that are then shifting that direction. Although traditional companies have a lot of advantages. It’s just, they’re a little behind in building the digital core. So why is that valuable? Lots of reasons. Data can basically help you identify the new consumer experiences to build against. And you can do it with great accuracy because you’re seeing the data. This is what consumers are frustrated with. This is their pain points. This is products and services they might also want. So one, you can see it with far greater accuracy than companies that are doing market research studies. And two, when you start to innovate and create those new products, your risk of innovation is much, much less. because you see the numbers, your likelihood of failure is dramatically less. Third benefit, when you do roll out your new product or your new service, your cost of acquiring the new customers is very, very low because you already have them. Your customer acquisition cost is very, very low. So this is Alibaba going from, hey, we do e-commerce to, hey, we’re doing hotel services, which was fliggy, right? They saw it in the numbers. They… You know, they’re always data mining their traffic and their activity, they see it. They sort of did their product development, their innovation at a much lower risk. And then when they rolled it out, they had virtually no customer acquisition costs because they could just cross sell it to their current user base. So that’s just like bam, bam, bam. I mean, it’s really powerful. And they have this group called the Tmall Innovation Center within Alibaba and that’s all they do. They do it internally for themselves, but now they increasingly provide that as a service to merchants on their platform. So when Nestle rolls out, you know, special coffee that’s black coffee that you chug before you go to the gym, which they rolled out a couple years ago, it was a very weird idea but not for them because they saw it in the data ahead of time. They knew that certain people in China used to drink black coffee before working out. And then they sort of did the innovation and then they rolled it out to their customers with virtually no customer acquisition costs. Very powerful when you start doing that. And then what happens? Well, then you’re selling black coffee to mostly dudes who drink coffee before they work out. Well, that gets you even more data. So it feeds your digital core even more when you do that. So you start getting smarter. What else does it do? It starts to add a new revenue stream. on top of this. So you’re getting stronger in two dimensions. One, you’re getting more data. And two, you’re creating a next revenue stream that creates even more operational cash flow. What do you do with that cash flow? Well, you reinvest it in innovation against the consumer experience. So it’s like this virtuous cycle of continual innovation and adding value to your consumers with this model. And he lays this out the next point. will be about the operational, well, one of the next points is about operational cashflow that this creates and multiple revenue streams after revenue streams after revenue streams. So if you have a digital core, what you can basically do is you can use that to support and create multiple new and different money-making models, one after the next, after the next, after the next. And a good example of this is a company I’ve talked about, which is Adobe. Adobe is not a platform business model. It is a traditional old school software business model. They make Photoshop, they make PDFs, all of these stuff. But their revenue has just been going up and up, especially in the last five years, because they’re doing this playbook. They’re serving their customers, they’re studying their needs. It turns out people who use Photoshop, video editors and things, they have other needs and they keep rolling out product after product after product. to this group that gets them more data, it gets them more revenue, they use that to roll the next product out. Their revenue keeps booming. Anyways, I think that’s a great strategy for digital operating basics. He delineates that a little bit more. He says your digital core has really three layers. The basic one would just be your IT infrastructure. You got a bunch of servers, you got a bunch of people building IT infrastructure. Fine. Um, the other level would be sort of support systems that your staff use every day, like procurement, sales, communication, all of that. Okay. Those are both fine. Not too interesting. It’s the middle that is really your digital core. That’s when you have a common data repository that everyone uses. It’s all your data. It’s all your algorithms. Everyone else draws on this, all your teams. This is where they go. to do any new project they’re looking at. It gives you a 360 degree view of consumers. It basically gets created in standardized modules that any team can plug and play. If you wanna know about something, you just plug and play, here’s the AI algorithm for personalization. Here’s the AI algorithm for new products. Every team within your company can just plug and play into these modules. and then they all add more data back to the modules. Now it actually gets more interesting because you can open up your digital core not just to your teams, but to other companies in the ecosystem. And that’ll be the next point is operating like an ecosystem. Once you open up your digital core, which is basically what AWS has done, other companies can start to plug into that system. And what do they give you? they give you more data flows. So here’s a quote, securing flows of data into the core is key. The quality, reliability of timing are crucial to the speed and quality of the company’s decision. So the more you build the digital core, the more you can open up, not just to your own internal staff, which are all operating in teams at this point, you can open up to your partners. in your ecosystem, you can open it up more broadly to everyone. All of that will secure more data flowing into the core, which will make it smarter. Now I’ve described that as a marathon, but that’s just definitional. I think that’s a good way to think about it. Okay, so that’s Alibaba. That’s Netflix. They’ve been building the digital core from day one. But you could look at other companies, traditional companies, Walmart, Disney, Warner Brothers, typical bank. They’ve been building this but they actually have quite a few advantages in this world because they’re coming to the table with things that your digital natives don’t have. They have a lot more resources, they have people, they have an established brand, they have an existing customer base. You know they can sort of digitize their current customers which is what the smart companies do when you see these traditional retailers, The first move they make when they go digital is to digitize their current customers. So when you walk into Walgreens or Starbucks, the first thing they do is say, please sign up here. Please sign up here, scan us in, download our app. They’re digitizing their current customers. They also have some talent pools. They have a lot of existing data. Now they’ve been collecting, you know, let’s say for Thailand, when we look at, you know, the big retailers here, you know, you walk into any… C plus or any store the first thing they’re gonna ask you is are you a member they’ve been creating membership programs for decades so they have huge numbers of members already so that’s that all gives them some very powerful strengths versus the digital natives now they have to build their digital core but they actually are doing quite well so anyways and then you know what do they start doing well they start offering lower prices that’s usually the first lever again when you digitize when you have a digital core you try and improve the consumer experience the first thing you do is you know make it cheaper make it more convenient and so on now that I think that’s a lot of businesses and the examples he points to are like Netflix and media and retail because these are the companies that really have been turned on their heads by digital but there’s a lot of companies that don’t have this problem Starbucks doesn’t really have this problem. Your typical steel mill doesn’t have this problem. Car factories don’t have these problems. These companies are still mostly competing in capital intensive, tangible asset businesses. So I don’t think the digital playbook is as important when you move into that. And you can see it all in My Tower. My Tower sort of applies to digitized businesses like retail, media, entertainment, communications, but also traditional businesses like a factory. Anyways, that’s kind of how I take it apart. So that’s kind of point number two. Point number one, personalizing the consumer experience is the key to growth, personalization, which is data driven. Point number two is you got to have a digital core. Your algorithms and data are essential weapons within your digital operating basics. Okay, number three, and I think this will be the last one for today, because I know it’s kind of a lot of theory. But number three on the list, this is a quote, a company does not compete, its ecosystem does, unquote. So this idea that like, you know, you can’t just think of yourself as a company anymore. You have to think about your connections to other players in the ecosystem. which can be competitors, it can be other supporting companies, it could be an alliance, it could be a lot of things. Now he uses the word ecosystem. I don’t really think that’s what he’s talking about for most companies. Now certain companies are ecosystems. Alibaba is, Amazon is. A simpler version of an ecosystem, which I’ve talked about a lot, is a platform business model, which is by definition in the business of connecting consumers and merchants and whatever within an ecosystem. I think mostly what he is talking about is partnerships. That look, you’re gonna deal with 10 or 15 companies outside of your own company. And that is gonna be the extent of your connectedness. Now for those of you who’ve been listening for a long time, I talked about this a year ago, where I called this collaboration based business models. That you need to stop thinking about one company, here’s my factory, I’m a company. you need to think about collaborating with other businesses to some extent. And that’s your business model. I don’t call that ecosystems. I think very few companies rise to the level of ecosystem. Google is, Apple is, Epic Games is, Alibaba is, Tencent is. Second to that is platform business models. I think that’s a type of ecosystem. And then what he’s talking about is the vast majority of businesses, which is like, you’re gonna be in partnership or collaboration. with 10 to 20 businesses. And he even says this, here’s a quote, every major player will need at least 10 ecosystem partners to succeed. I think that’s true. Why? Because there’s a lot of benefits to that. The number one is you’re gonna start sharing data. If you are a digital core business, you are dependent on data coming in all the time that’s accurate, that’s reliable. that is coming in in a timely fashion so that we can make decisions as a business on it immediately. Okay, you’re gonna get some of that yourself. You’re gonna get a lot of data from other people. How do you get data from other people? You connect with them. That’s why having your digital core with standardized interfaces is so important so everyone can plug and play. Okay, so you get data. What does that get you? Well, that lets you meet a larger range of consumer preferences. You’re gonna get data, you’re gonna wanna meet various consumer preferences. You wanna personalize, you wanna identify new opportunities to exploit and build against in the consumer experience. Now some of those you can do by yourself, but a lot of them you’re gonna need other companies with other capabilities. You may be an automaker, but you’re gonna need to connect with the retailers because they have that capability which you don’t have. And you may wanna connect with DD. and ride sharing because they have capabilities you don’t have. But together you can offer something that none of you could offer on your own. A more full and complete solution for a customer. You might want to partner with content creators so that your retail experience is better. So one it gets you data by having a collaboration based business model. Two it offers you a greater ability to provide solutions. Other thing you can do, it’s gonna let you grow faster than you could otherwise. Suddenly it’s not just one company focusing on getting customers and growing, it’s four or five companies together. You’re gonna see greater growth. You’re gonna just be dependent on your own money to invest in innovation and new products. All 10 companies are gonna be accessing their capital. So you’re gonna get a lot more resources. And then the other thing is you’re going to get much greater innovation. I talked about this, Scott, it must have been a year and a half ago, about when do you need to stop thinking like a company and you need to start thinking like an ecosystem? One of the places ecosystems are much more effective is when we’re seeing a major technological dislocation. When we’re seeing something emerge that we’ve never seen before, and it really takes a lot of companies together to figure out what’s coming next. Like an ecosystem, let’s say in ride sharing or autonomous vehicles, it’s really about everyone operating together almost, cause you can’t predict what’s gonna happen. You don’t know what the solution is. So an ecosystem, like let’s say in the semiconductor business in the autonomous vehicles business, these major technological changes. An ecosystem is not like a company that does a strategic plan and then rolls it out to the market. An ecosystem is more like an amoeba that just sort of grows and evolves together because we don’t know what the solution is. And that’s really the big strength of an ecosystem model is innovating when we don’t know what the future is. Now, the downside of an ecosystem model is it’s much less efficient. You waste a lot of money, but that’s kind of what we’re seeing in things like When the PC first emerged in the 80s, it was an ecosystem approach between, you know, Microsoft and IBM and others, where none of them knew what the future was, but we were working together, we sort of operated like an amoeba that found the future. Steve Jobs did this. The mobile, you know, smartphones, when they emerged, it was the same thing. So. Definitely when you’re dealing with a major change, ecosystems are able to continually refresh and innovate much faster than any company ever could. So we get multiple benefits by operating this way. Now he’s talking about late. If we have 10 partners, we can share data, we can share capabilities, we can share equal resources, we can probably innovate much better, and we can grow faster and we can create better solutions that none of us could do individually. Fine, I mean the simplest example of this would be when airlines offer you joint sort of loyalty programs. If you sign up for United Airlines you get points. Oh and by those points they also work with Singapore Airlines and Qantas Airlines. That’s a collaboration based product that makes it more valuable for everyone. And you can kind of get network effects. The more partners you have, the more suppliers, the more customers, it’s more valuable for all the participants. You can kind of think, okay, I think that’s basically true. A company does not compete, its ecosystem does. And most companies probably should have 10 to 20 key partners at this point. Everyone should have that. That’s your digital operating basics for all the benefits I just mentioned. And then a certain number of companies move beyond that as a platform business model. And a rare few build entire ecosystems like the automakers did in the past. like the autonomous vehicles are doing now. Now the trick when you go to pure digital ecosystem is you gotta decide, are you the orchestrator or are you the participant? And everyone wants to be the orchestrator, but only one company gets to be the orchestrator, that’s Apple. And they have to sort of create the rules such that the participants decide it’s worth participating even though I’m not in charge. And famous examples of this are like Nokia, which started to, they tried to create a smartphone ecosystem in the late 2000s against Android and against Apple. But they couldn’t get the rules right such that all the other smartphone makers felt comfortable participating. And so it didn’t work. Android pulled it off. Apple pulled it off. Well, Apple didn’t really have an ecosystem. They did it themselves, but Android was a successful ecosystem strategy. Nokia and Blackberry failed because they couldn’t get the rules of participation right such that everyone felt comfortable So you got to balance all that stuff There’s a guy named Peter Williamson who was sort of an old colleague out of out of Cambridge He writes books called ecosystem edge about creating these sort of Massive plays and why they succeed and why they don’t fail another guy named Michael Jacobides I always say his name rhyme J-O-C-I-B-D-E-S He writes about ecosystem strategy, which most companies don’t have to deal with because there’s only a couple of them. Anyways, those are the three points for today. I think that’s enough theory. But yeah, I’ll put those in the show notes along with the other two to three, which I will talk about in the next podcast. But let me just sort of give you the summary. This is from his book. Quote, think of the customer experience and transform it with technology. that is customized and continually improved through data. That will generate cash as it gets delivered at increasingly low incremental costs across multiple geographies, unquote, continues later. Digital technology makes the incremental cost of delivery that end-to-end consumer experience to consumers closer to zero. The business becomes a cash machine and that cash can be used to further increase the market. So he’s sort of talking about his overall playbook is that kind of virtuous cycle. You focus on the customer, you transform it with data technology, you need a digital core to do that, you continually customize and you continually improve. By doing that successfully with you and your ecosystem partners, that generates cash. As you get more and more cash, more and more scale, you then reinvest that money. into the consumer experience and that’s the cycle. Which is pretty much what Amazon and Netflix do. And Alibaba. Okay, I think that is enough theory for today. Today is kind of theory day. So that all goes under the concept, digital operating basics. And I’ll put my pyramid in the show notes. I’ll put the book link. I’ll put the four to five digital basics that he lays out in my opinion. He uses different languages, but that’s what I think. In the show notes, you can do it from there. And that’ll be it for today. As for me, I had a pretty nice week. It’s, you know, things have opened up here in Bangkok and the last week the shopping malls are open again and the gyms are still not open, which is frustrating, but at least we can go down to the shopping mall and sit in restaurants and that’s kind of what you do. You know, every day it’s funny, like when Warren Buffett was asked, like, why do you live in Omaha? His answer was, because every day in Omaha is a good day. Which I always thought was a funny thing, because I’ve been to Omaha, it ain’t that exciting. I don’t know what he loves about it. But I kind of feel that way about certain places like Bangkok would be that way for me. Shanghai definitely that way for me. Every day you kind of walk outside and say, today’s a good day. You just feel pretty good about life, especially when you sort of buzz around on your scooter and such. Anyways, I’m doing pretty well. Moving things forward. setting up new apartment, things like that. I guess sort of next thing on my list is I try to spend, my new thing is to spend about every six months to spend one month somewhere else. Just for, I don’t know, just for enjoying life. So in July I spent all of that in Rio, which was awesome. I mean, I like six months because it gives me something to look forward to. Right, I’m always, it’s never, it’s not like a year away because that’s too far. It’s always like, oh, four to five months, I’m excited about something. So I’m trying to think up where I’m gonna go in January, because I gotta sort of, one, I gotta reset my visa for Thailand, which is a pain. I’ve been thinking about the Balkans, but I don’t really have an answer. If anyone has any suggestions, I’ve gotta be somewhere warm, it’s gonna be January. Asia is closed, you can’t get in anywhere in Asia right now. I mean, borders are closed. I mean, it’s basically Latin America or… Europe or Eastern Europe. So I was thinking somewhere on the Mediterranean. But if you have any suggestions, please let me know. I’m looking for something to be excited about. That’s kind of what the whole point is. I want to be excited about something. Like Rio I was really excited about, it was awesome. I’m looking for something like that. Anyways, that is it for me. Last thing, if you want to talk a bit, come to the Q&A later this week. The link is in the show notes. It’ll be fun to see everyone. And yeah, that’s it. I hope everyone is doing well and I will talk to you next week. Bye bye.