This week’s podcast is about how to profit from political involvement in China tech. But really it is about how to think systematically about the role of the State. And about how to benefit from the State as the mother-of-all catalysts.

You can listen to this podcast here or at iTunes, Google Podcasts and Himalaya.

You can sign-up for my webinar next week on retail tech at:

Here is the marketing material for OShares OGIGX.

Here is the Standard Digital Playbook:

- Target a 10x or 100x market opportunity.

- Grow users and revenue.

- Capture and grow cash gross margin. Not the %. The cash.

- Flood cash into new revenue streams and innovation to improve the user experience.

That playbook is all about building a digital business on the demand side. It is about identifying a big opportunity and then systematically improving the consumer experience and going after related consumer problems.

However, this also usually results in negative operating profits until sufficient scale is reached. The gross profits are positive but the operating profits are negative. Often for a long time. However, with increasing scale the operating leverage eventually kicks in and the big profits are revealed.

Here is a list for the Digital Basics:

- Growth and Scale

- Digital Core

- Ecosystem, Connectedness and Coordination-Based Business Models

- Leadership and Management

- People, Culture and Talent

- Operating Cash Flow. The Cash Engine.

——-

Related articles:

- Lessons from Cheah Cheng Hye on China Stocks and Uncertain Terrains (Asia Tech Strategy – Daily Lesson / Update)

- Can Foodpanda / Delivery Hero Get to Profitable Scale in On-Demand Food? (Asia Tech Strategy – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Digital Basics

- Digital Playbook (Standard)

From the Company Library, companies for this article are:

- Delivery Hero / Foodpanda

——–Transcription Below

:

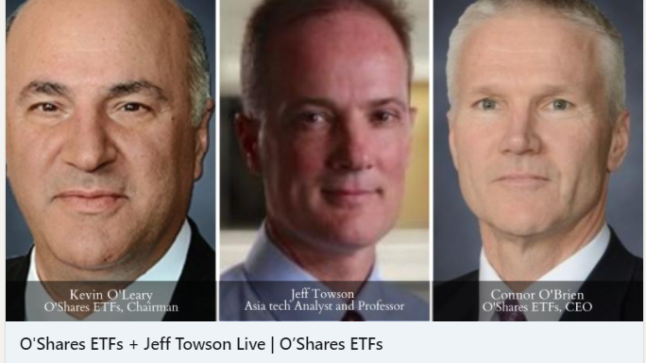

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy. And the topic for today, my conversation with Kevin O’Leary of Shark Tank fame, Mr. Wonderful. Plus a little bit about Food Panda and Digital Basics versus the standard digital playbook. So a little bit of a grab bag today, but I think this is actually gonna be. maybe a bit more sort of directly useful than some of the things I tend to go into sometimes. I do kind of split my time on this between talking about specific companies which is pretty actionable real and then maybe a bit of theory. And that bit can kind of go down the rabbit hole sometimes not always directly useful. I think it’s interesting but I know for some people that’s not maybe their thing. Although I do hear from other people that’s their favorite part so who knows. Okay, but what these things have in common for today is when you look at a company from a growth perspective, a digital company, and your primary metric you’re thinking about is growth, right? It’s a growth investment. What do you look for? How do you do it? And I’m going to basically give you three different takes on that. One is the Kevin O’Leary conversation because that’s what they’re focused on. Number two, which I call the standard digital playbook. And then number three will be, which is what I think Food Panda is doing, hence that company. And then number three, just sort of what I call digital basics, which every company is pretty much doing that’s doing digital. It’s not necessarily a growth thing. I think it’s helpful to sort of distinguish between those three. So that will be the point for today. Now, for those of you who are subscribers, I sent you kind of some investor-focused stuff over the last week, a bit about Mario Gabelli. which was sort of following up. I mean, I’ve sort of been cycling through several of them over the last couple weeks. So this was Mario Gabelli, a Gamco billionaire, but really when I think about him, I think about catalysts. I sent you some stuff on Philip Fisher and Ben Graham, Mr. Chia Changhai about identifying China bargains, and then also Warren Buffett about compounding and things like that. So we’ve really gone through four. major investors over the last couple weeks sort of highlighting things that I think are helpful. And then talked a little bit about Ctrip and some specialty e-commerce players. That’s kind of what I’m thinking a lot about is how to identify the winning specialty e-commerce players like Ding Dong is one we talked about. Food Panda would be another in that category. Food Panda is delivery hero but in Thailand it’s under Food Panda. Anyways, so there’ll be more probably within the specialty e-commerce space coming. I think that’s where I’m going to stay focused. For those of you who aren’t subscribers, you can feel free to go over to jefftausen.com, sign up there for a free 30-day trial, see what you think. Let’s see, a little bit of promotion for an upcoming thing. I’m doing a webinar on Wednesday. Today’s Monday. So two days from now, there’ll be a webinar on Eventbrite. You can look at the show notes. The link will be there. We’ll be doing sort of retail tech takeaways. I’m gonna start doing more of these webinars. This is kind of a new thing. So this is the first one. Come over, check it out, I’d appreciate it. We’ll see how it goes. Okay, and last bit, standard qualifier disclaimer. Nothing in this podcast or in my writing or on the website is investment advice. The numbers and information from me and any guests may be incorrect. The views and opinions expressed may be incorrect or no longer relevant or accurate. Overall, investing is risky. This is not investment advice. Do your own research. And with that, let’s get into the topic. Okay, so last week I did this video sort of conversation interview with O’Shares. For those of you who aren’t familiar, O’Shares is, you know, this is Kevin O’Leary. For those of you in the US, you probably know who he is in the business world. Maybe not so much overseas. But he’s kind of, you know, he’s a TV, he’s one of these few business people that have become sort of media personalities. you know, there’s Jim Cramer, you could say Scott Galloway, and I mean, Kevin O’Leary’s one of them. It’s kind of an unusual position to be, and they’re all serious, well, I mean, they’re all real business people in the sense that they’ve built businesses, and they have a track record, but they also have sort of these outsized personalities, which maybe are real and maybe are created. Apparently, Scott Galloway, who’s, you know, he’s pretty out there. Apparently that’s exactly what he’s like in real life. The others, like Jim Cramer, I always got the sense it’s a bit of an invented personality, outsized. Who knows? Anyway, so Kevin O’Leary, you know, successful business person, goes on Shark Tank, becomes sort of pretty famous based on that show, and he’s got multiple businesses all over the place. He’s on social media all the time. And one of his major companies, I think he’s got quite a few, but one of the bigger ones is O’Shares. which is an ETF, so you know, an index ETF, but it’s what he would call, or what they would say, is rules-based ETFs, where it’s not, you know, you can sort of have specific rules based on the companies within whatever theme you’re doing that would fit certain investors’ profiles, things they’d be looking to do. So you’re kind of matching, you’re sort of taking ETFs and to some degree customizing them. to certain types of investor interests. And one of the ones he has, that’s a bad explanation for what they do, but I think that’s basically directionally correct. One of the ones they do is called the Global Internet Giants Index, GIGI. I don’t think people say GIGI, I always say GIGI. And I noticed this one several years ago, it kind of got my attention because I thought it was clever. And I’ll sort of go through what it is and I’ll put a basic description of it. their own sort of marketing material in the show notes. But I thought it was an interesting idea worth talking about, but just to be clear, I don’t have any financial interest in any of this. Not with this company, nothing Kevin and Larry does. I don’t know, they just called me up a week ago and said, hey, would you talk about this because we do this global internet giants index. China’s all over the news with the tech world, so that was how. But yeah, I actually noticed this index years before and I thought it was interesting. which is not the same thing as good, it just means interesting. Like interesting thinking behind it. Anyway, so that was kind of the thing. So we had this call and it was fun. You know, he’s a busy guy. He just sort of popped, I think they were filming Shark Tank. I was sort of waiting online and they said he’s doing something with Shark Tank in Los Angeles, he’ll be here in a minute. He literally just popped on and we went. Like, he’s very like, okay. But he had some interesting points. He’s clearly not a China expert, which you wouldn’t expect him to be. But his thinking was relatively, I thought, on point. I would disagree with some of it here and there, but directionally, I thought, no, that’s probably where I am as well. If you’re going for longer term growth, which is what they’re going for, obviously with the ETF, a lot of what’s going on in the. political realm right now is not really changing that story. Now it is in some cases. If you go sector by sector like education, maybe some of the dominance of certain e-commerce players, definitely credit, financial services. Yeah, in that case, you know, the economic value of these companies is being changed over ten years, five years. But if you’re taking a broader approach on growth, which It wasn’t that much of a change, really. So that was kind of his point. I thought that was interesting. And I basically agreed with that. But I’m going to give you some information on the Oshare’s Global Internet Giants Index. And this is from the document, the marketing document, summary document that they sent me. I’ll put a… I’ll try and put it in the show notes if I can. It should be there. But here’s how they describe it. from their document, is a rules-based index intended to give investors a means of tracking global stocks that exhibit above average growth potential in the internet sector. Okay, includes two main business segments, internet technology and internet commerce. So internet technology they define as businesses where the principal business is to provide the technologies that support internet commerce and then The other one, Internet Commons, obviously is to sell products and service via the internet. Okay, that makes sense. Constituents must pass quality focus screens for profitability and balance sheet sustainability. Stock allocation and weighting method is designed to provide greater investment and stronger revenue growth. So what’s my takeaway from that? Number one, two, and three is they’re going for growth based on digital. That’s the goal. I mean, this is a growth index focused on the fact that software and digital in general are very good at growth. They’ve segmented it, that’s fine, into tech and commerce, fine. But the third bullet point I just read, that’s the other one got my attention. The constituents must pass quality focus screens for profitability and balance sheet sustainability. So it’s kind of like they’ve got these. two buckets of metrics. One is like growth by virtue of being a digital company. That’s generally a pretty good idea. The second is it’s gotta have some financial stability, reliability, strength, liquidity. And Kevin basically said this on the call that the thing he looks at is growth and then the balance sheet. That’s not a bad approach. because I mean when you start looking at these companies, everyone’s looking at growth and then you try and look at cash flow and by the nature of the way they develop, you often don’t see cash flow for years. You can get growth but then you’ve got this negative operating profit. We see that all the time. You know, their approach seems to be okay, look at the growth and then look at the balance sheet. That’s what you go with. And in theory, the cash flow will show up in time. I’m pretty much on board with that. And I’m going to talk about the standard digital playbook, which really captures that as well. So I thought his sort of points on that were quite good. Here are some more details on that same thing. So they break the constituent companies into sub-industries. Fine. Software, internet, movies, apps, home entertainment. Fine, fine, fine. Constituents must acquire more than 50% of their revenues from internet technology and or internet commerce. So again, I mean, that should get you higher than normal growth. The thing we, one of the things we like about digital is it can grow much easier and much cheaper. So they want companies where literally 50% of the revenue is coming from that engine. Fine, they exclude some things here and there. They get to the financial thing, which is, constituents must be able to sustain their cash flow burn for at least 12 months and have a positive gross margin. Now that’s really interesting. Okay, you look at the balance sheet. If you’re losing money, you’ve got to have enough cash on the balance sheet to sustain your cash rate burn for at least 12 months. Fine. That would be sort of the balance sheet measure. But when you look, when you start looking at growth, you can look at users, you can look at revenue. One of the numbers people look a lot at is gross margin. You often hear the phrase cash gross margin, not percentage gross margin, You know, because you can have a massive platform with tons of business with a small gross margin as a percentage, but it actually adds up to a significant amount. So you hear people talk about that, you hear about net gross margin, they’re saying positive gross margin. Positive gross margin. So that’s an interesting way to take that apart. And when I talk about sort of the standard digital playbook, you’ll see that… even though you may be operating profit negative because maybe you’re spending on R&D, maybe you’re flooding money into marketing, even when you’re seeing that picture, you wanna be seeing a positive gross margin. So they kind of identified what we hear in a lot of other scenarios. I thought that was pretty interesting. The historical performance I won’t go through, but it basically shows a lot of growth. Then you look at their top 10 constituents. They’re mostly looking at larger cap companies. They’re not going too down into the mediums and small caps. which is not surprising because they’re global so it’s not a u.s. story it’s china it’s asia it’s latin america but you know the big top of their index amazon alphabet tencent alibaba microsoft maytwan facebook pin dodo zoom and roku so you know that’s basically a u.s. asia story which uh… made me feel pretty good about myself because that’s exactly what i focus on They’re big three sectors, application software, interactive media, and internet and direct marketing retail. Again, I like when people think what I think because that’s basically what I look. Apps, media, entertainment, e-commerce, right? Those are the things that tend to show the fastest growth. And that’s where a lot of the action is. I would put retail in there as well, but okay. Anyway, so just sort of take that as an approach. I think it’s a… very logical approach to capturing global growth by virtue of digital. You take an ETF approach, that’s pretty good, that’s a long-term portfolio play. You focus on the top line growth, gross margin in particular, also revenue. You focus on those companies that have 50 plus percent of their revenue coming from digital activities and then you pair that with some degree of financial heft on the balance sheet, cash flow as well. I mean cash balance that could sustain losses for at least 12 months. I think that’s a real logical approach. I think that’s some good clear thinking. It doesn’t mean it will always work out. But I like things that are sort of that clear and logical. Okay, so let me switch over to Food Panda and what I call the standard digital playbook. Now, Food Panda, one of you recommended that I take a look at this company. That was very helpful. Thank you for that. Really interesting company. Delivery Hero is the listed company, Berlin based, but they operate all over the world and basically they do food delivery. So it’s a marketplace platform for services, which we’ve talked about many times. Who are the two user groups? Local consumers and local restaurants. That’s a nice fragmented user base on both sides. Restaurants tend to be very differentiated. That’s great. We like all of those things. If it has a weakness, the weakness is that this is overwhelmingly a local marketplace and therefore local network effects. You’re gonna buy food from people in your neighborhood. You know, having a bunch of restaurants in Beijing doesn’t help you if you’re living in Shanghai and it certainly doesn’t help you if you’re living in Bangkok. So, okay, you know, that’s not awesome, but you don’t get everything in life. But generally speaking. it tends to be a a nice fragmented robust marketplace platform at the local level certainly better than say mobility ride sharing scooters because that’s local which is not great but it’s a commodity service and when we talked about well when i talked about network effects you always ask how you know when i look at network effects it’s always like okay if i had a marginal user or marginal usage, how much does that marginal user increase the value or utility to the other users? and restaurants tend to be good because every new type of restaurant adds value. We have a sushi restaurant, now we have a Thai restaurant, now we have a Mexican restaurant. It’s more and more value. When you’re in a commodity service like Uber, if there’s already a bunch of drivers on your street, every new driver on your street doesn’t add any value to you because it’s a commodity. That marginal value flatlines very quickly. So that was kind of my standard question for network effects. The other question I tend to ask on network effects is What is the threshold for minimum viability? And at what level does it sort of maximize and flatline? So, how many restaurants would you need to have on your platform in a local area to become a viable competitor? Is five enough? No. Is 100 enough? Probably. So, it’s a little bit like ride sharing. It’s actually kind of, because it’s local. it’s relatively easy to jump into this business as opposed to say like, what’s the minimum viability for accommodations on Ctrip or Airbnb? Well, it’s actually very, very high because you need basically regional or global footprint of hotels before you’re reasonable as a company to look at. That’s kind of a global network effect tends to be more powerful in that regard. ride sharing, local services in general, whether it’s restaurants or whatever, it tends to be pretty easy to jump into that game. Okay, so the minimum threshold for viability is quite low. And then the other question is, okay, at what point do you have so many users on there, on either side, that it flatlines and there’s no more value? Restaurants, it keeps going up. I mean, having more and more restaurants in your neighborhood is generally a good thing. So it doesn’t flatline very quickly and then on top of restaurants what they can add is grocery stores, convenience stores, cloud kitchens are the next one sort of coming online. You could put all of those in that same user group. And from the consumer perspective that’s all good because you’re tapping on that app because you want something to eat. That’s how you consumers view this. It’s on-demand food. So restaurants, convenience stores, supermarkets, probably cloud kitchens may take off. Anyways, generally speaking, it’s a pretty nice local platform business model. The big problem is it’s local. Therefore, it ain’t gonna be Netflix, it ain’t gonna be Google, it ain’t gonna be Alibaba across a whole country. I mean, you can do that, but most of the power is local. So what do you do in a scenario like that? Well, you can do what Meituan is, and you expand from food delivery to lots and lots of services. They do a whole suite of services. Gojek has done the same thing in Indonesia, basically copying. made to one. You can try and own a niche. Ctrip does their niche in tourism. DD does its niche in mobility. You could say therefore that food panda is a niche in food, on demand food. Not totally sure I buy that. I don’t generally buy that argument if it’s purely a digital creature like Ctrip because it’s… I don’t think there’s any reason to stay within just one industry definition like tourism. In food, I think it’s a bit different because there’s a significant operational component of all those riders around town. So if there’s an operational component, I’m more amenable to the argument we’re going to stay in a niche. If it’s just purely digital like hotels or whatever, I don’t really buy those definitions of industry barriers like I used to. Okay. So why is Delivery Hero interesting? because, you know, Meituan, they were China, Uber Eats, Mexico, US, what Delivery Hero did is they basically went multinational from day one. They didn’t go after these major markets. They went after lots and lots of little markets and tried to get there first. So they’re in the UAE, they’re in Saudi Arabia, they’re in Poland, they’re in Germany, they’re in Brazil. I mean, they’re in 50 plus countries around the world. So that’s kind of an interesting combination of this idea that Yes, this is mostly a local marketplace. Most of the costs are local. But the IT, we can standardize that across 50 countries and maybe get some scale on the IT side. So that’s an interesting combination of almost like a McDonald’s model. We’ll do certain things by local franchisee and then we’ll do certain things up at the headquarters. And also I think a lot of the reason they’ve been growing quickly is just because they’re going after these markets first. Everyone’s going after the big markets. They’re going to the little markets people aren’t paying as much attention to and just trying to get there first and get up to scale before the major tech companies come after those markets, which they may never do. And this was what I sent out in the update the other day. It may be that the best thing they’re doing is they’re just avoiding the stuff that the big tech companies want. Amazon doesn’t care about Bahrain. They don’t. it’s too small for them to move the needle in any way. You know, Alibaba, do they really care about, I don’t know, Myanmar? I mean, Lazada does, but you know, maybe that’s the best strategy for a specialty e-commerce players. Just go after the stuff the big players just don’t want that much. And then get there first, build up some local network effects. That may be enough. Or may not. Okay, so, what was the point of that? If you look at their numbers, what you’re gonna see is you’re gonna see a company with high growth, lots of users, lots of revenue. It’s not a huge company, but it is growing fast. You’re gonna see a positive gross margin of about 20% after you take out the delivery fees and all that, and then you’re gonna see a strongly negative operating profit. And that’s the scenario we see all the time, and I’m calling that the standard digital playbook. Oh, there’s two… concepts for today that will be in the show notes. They’re in the concept library. These are both new. I haven’t really listed these before. The standard digital playbook and then what I’m calling digital basics and then this will also go under food panda. So I’m calling this sort of the standard digital playbook which has four steps and I’ll list these in the notes. But we see software companies whether they are platform business models, which this is or not. We really see this pattern all the time. I’m not sure how I copied this from. I got this from someone. This is not my thinking, but I’m not totally sure where I got it from. You target a really, really big opportunity. Not a pretty big one, a huge opportunity because digital has an ability to grow faster and cheaper than most any other business we’ve ever seen. Okay, so you target a 10X or a 100X market opportunity. And generally when you’re targeting these things, Oftentimes people underestimate how big of the target it is. Like people have been underestimating Amazon for a decade consistently. They’re like, yeah, it’s a good company, but it’s already overvalued. And then you realize they were going after a much bigger opportunity than you thought. And it keeps happening. So one, you go for growth, growth, growth, huge opportunity. And often that means creating something new. Against that opportunity, you’re all about growing users and revenue. That’s… what the company’s about, that’s what it’s doing, and it keeps just plugging after that 10x, 100x market opportunity for years, if not decades, which I think you could say Amazon and Google and Facebook have been doing. I mean, hasn’t everyone just underestimated how big they were gonna be year after year? Okay, so this is a growth story against a massive opportunity. Number three, you capture and as much as possible grow the cash gross margin. So yes, you’ve got growth. And yeah, you’re losing money. However, the gross, at the end of the day, there is a business model here that works. This thing is throwing off cash. It’s not just, hey, we’ve got a bunch of traffic on our business model, like YouTube, but we don’t know how we’re gonna make money. No, it’s not that. And it’s not, hey, we’ve got a business, like let’s say Uber. We don’t know if we’ll ever make money. No, you’ve got some. degree of reliability, look, this thing does produce cash. Now it doesn’t have to be a huge percentage of gross margin because one of the benefits of digital is you can capture lots of little activity and aggregate. You don’t need to sell big contracts. You can sell millions of tiny little transactions and you can have a small percentage of those but they can add up. So you don’t wanna look at percentage of gross margin, you wanna look at, look, what’s the absolute dollar amount? Okay, so you look at the percent. I’m sorry, the cash gross margin. And then you kind of keep an eye on the fact that that should improve over time. You know, 15% three to four years later it’s 18%. Because software gets better and better. It’s one of the nice things they call this sort of you know, increasing returns to scale. Not operating leverage but just you know, returns to scale. So you want to see growth and you want to see a decent cash gross margin that hopefully is increasing. That’s kind of the key goal of management within the standard digital playbook. Point number four. From there, you flood cash into two things. New revenue streams and innovation that improves the user experience. So yeah, you’ve got some traction in food delivery. Yeah, you’ve got some traction in e-commerce and it’s growing and you’re showing a… cash gross margin, you’re still operating negative, but you’re flooding money into new types of activities and revenue streams you can add to that. So within a couple years, you’re not just Amazon selling books. Now you’re Amazon selling books and appliances. Now you’re Amazon selling books, appliances, and groceries. Now you’re selling Amazon Web Services. Now you’re selling video. You keep flooding money into building those revenue streams as much as you can. and then you also flood money into continually improving the user experience. Now how do I characterize all of this? To me this whole thing looks like we are going for a mostly digital business with tremendous scale on the demand side, which is the exact opposite of how businesses were built for fifty years. Well let’s build the railroad, let’s build the stores, let’s build the warehouses and we’ll have so much power on the supply side. local consumers in this town will have nowhere else to go but our stores. Now this is all about the demand side of the equation. It’s digital first, it’s gross, I’m sorry, it’s revenue, it’s cash gross margin, and it’s flooding money into new revenue streams and innovation to improve the user experience. And you just whittle away at the big opportunity year after year. And at some point, the operating profit should go from negative to positive. But it may take five years before you see that. And that’s kind of the goal here is like, generally when the company starts turning operating profit negative and positive, it’s usually too late. So you kind of want to spot these companies before that happens. Now that picture I just told you, that looked a lot like Shopee in 2016, 2017. That was exactly what they looked like. It was the standard digital playbook, in that case a marketplace. You could say that delivery hero looks like that today. Now, it doesn’t mean they’re necessarily gonna get to operating profit positive. Uber never, and people said this about Uber, oh, Uber’s gonna turn positive for years because it had the same picture and it never got there. Didi still isn’t there even though they’ve had a virtual monopoly in China for four years. So it doesn’t mean it’s necessarily gonna get there, but this is what the picture looks like. Now one of the reasons I liked Shopee so much back then, I didn’t get in there in 2000, I should have, I didn’t, was because it had this picture and we knew the business model because it was e-commerce, so we knew how it was gonna look. As opposed to Uber, where was a business model, we didn’t know. Anyways, that’s kinda how I think about it. So I’ll put those in, but ideally as the scale gets more and more, the operating leverage should kick in. large operating profits should suddenly be revealed. And, yeah, you just keep doing that, and it can be amazing. Now, the flip side is, if it turns out the company really does have fundamental problems, which I think Uber does, not Uber Eats, I actually like Uber Eats much more. People, this picture can hide the real problems, because you look at it and be like, well, they’ve got growth, but they’re operating profit negative. Yeah, but they’re probably okay, it just hasn’t kicked in yet. Well, no. Turns out it wasn’t gonna happen, but you can keep raising money based on that story for a long time before people start to lose faith. WeWork tried to tell this story for a long time. I never understood WeWork. I really didn’t. I just chalked it up to the fact that I don’t know real estate very well, but I’m like, this makes no sense to me. But maybe I don’t know real estate. And then I talked to some real estate people and they’re like, yeah, it doesn’t make sense to us either. I’m like, okay, maybe it’s not just me. Anyways, that’s kind of concept number one for today. The standard digital playbook. It’s really useful to get good at identifying it and knowing when to invest. And I think people miss, there’s probably two spaces to target. One is when it’s still operating profit negative and people are unsure, but you are. The other one is, okay, it is operating profit positive now, but everyone is still underestimating the size of the ultimate opportunity. Yes, it’s big, but it’s bigger than everyone thinks it’s going to be. Which is how people made a lot of money investing in Amazon and Facebook over the last five years because everyone underestimated it. Well, not everyone, a lot of people. Okay, so that’s kind of concept number one for today, standard digital playbook. Okay, second and last concept for today is digital basics. The distinction is there’s a list of things that most companies are doing with regards to digital. And it’s kind of standard, it’s the standard operating that everyone has to do, it’s basically table stakes to be a business that has any degree of digital within your business or on the way. And I think people tend to overvalue these things and see them as terribly special. Oh, this company’s really special because it’s doing A, B, and C. And it’s like, nah, that’s just the basics. And maybe they’re doing it first before the rest in their industry, so people think it’s special. But I think, nah, it’s just management basics that everyone is gonna be doing. Maybe they’re just got there a little earlier than others. But I don’t think it’s special. I don’t think it’s an advantage. I don’t think it’s an indication that they’re gonna outperform. And a lot of what companies like Amazon are doing, I think people put into that category. It’s like, oh my God, they’re personalizing. They’re using their data to customize what you can see when you go shopping. That’s a data network effect, which I don’t think it is. I don’t think that’s special. I think that’s just going to be standard in every business going forward. And it just so happens that Amazon kind of did it before others, but it’s not going to be a source of advantage. It’s not going to be a source of greatness. Now I think the digital, the standard digital playbook is a pathway to a powerful business model and growth and wealth and all of those things. This list is more like, yeah, don’t overvalue this stuff. This is just kind of standard. management operating behavior in a digital age and everyone’s gonna get there sooner or later. So here’s my list for that. This is not my thinking, by the way. This is a fairly famous consultant named Ram Charan. I’m probably saying his name wrong. His last name is C-H-A-R-A-N. He’s an advisor consultant, and he’s been talking about competition and operations for decades. He’s a bit older guy. And… you know he talks about this stuff he looked at amazon a lot he’s got like nine or ten books or something like this a lot of them are about how board should behave i think it is a lot of board advising but within all of that he talks about sort of digital behavior digital management why amazon is so successful and he he lays out five or six things uh… within there there’s probably four or five of them i i agree with so this is kind of more his thinking than mine Every digital company is doing this. Anytime you start engaging with digital economics, bits and bytes, growth becomes, you know, it should be the primary thing on your list, because you can do it better than others. If you open, you know, a hundred Walmarts, it takes forty years. But you can scale an e-commerce company across, you know, six countries in Southeast Asia in a couple years. It’s just easier to grow. Netflix is friggin’ everywhere, globally. Disney Plus is rolling out like it’s everywhere. So you wanna tap into the scale and growth, digital companies, it’s one of their biggest advantages versus any traditional physical-ish company. So if you’re managing a company with a digital component, you wanna pull that growth and scale level as hard as you can. Okay, now I don’t think that’s special, I think everyone’s doing it. It’s important, it’s in the digital playbook, the digital basics. but I don’t think it makes you special. I think they’re all doing it. Okay, number two, this is a RAM term. He calls it the digital core. I don’t really use that term. I think he calls it digital platform. This is the idea that look, all businesses, the core operations are increasingly about data, data technology, software. So when companies say, oh, our company’s data-driven, you know, we get real-time feedback. We get real-time feedback on what customers are doing in the store, what they’re buying, how much inventory. Yes, that’s true. Digital operations at the core, which means you’re data-driven, which means you’re making very smart decisions, which means your management is increasingly smart, that you have more transparency in what you’re doing. I think that’s table stakes for pretty much every business going forward. All management is gonna be data-driven. Data analytics are in everything. The core operations of most companies are going to shift to digital prediction, AI, ongoing experimentation, learning, all of that. That’s usually the first step when a company starts to do a digital transformation. If you’re selling consulting engagements to traditional companies, that’s like I think what you sell on day one, will help you begin digital transformation by starting to gather data across your company. Build out a dashboard. and give you much better visibility into what’s happening and you can start to make real-time data different data-driven decisions okay that’s digital core everybody’s doing that so that’s kinda my personalization analogy example like like yes they’re doing personalization but everyone’s gonna do personalization in everything so again important not special number three uh… ecosystems and connectedness One of the nice things about software is as a business becomes more and more data-driven or digital, you can connect to other things outside of your company much easier than previous company. I mean, if you had an old factory in the day, you had a couple relationships, you had customer relationships, you had a couple suppliers, you had roads you sent your trucks on, but you weren’t deeply connected to other parts of the business or other parts of your city or other parts of society. Software is really good at connecting to other software. So you can reach out from the boundaries of an organization, a firm, and connect with other things much greater. Amazon’s great at this. I mean, you can just count the number of APIs a company has to sort of assess their connectedness. And there’s a lot of benefits to that. The most obvious one is it just gets you a lot of data. The more connected you are, the more data inflows you have that makes you smarter. But it also allows you to… coordinate activities where suddenly the product you’re making is not just something you’re making, it’s you and other and five other companies kind of coordinating on a more complete customer solution. We’ll do the e-commerce page, we’ll have Shopify doing the logistics, but we’ll tie into TikTok to do video. And on the customer perspective, all they’ll see is an e-commerce app that’s got lots of things they can buy, good video, good entertainment, fast delivery. You can kind of put all those pieces together as a digital company. So you can jointly deliver customer experiences, you can provide a complete solution, you can be smarter based on data, you can coordinate on things like product development, you can coordinate on innovation and R&D. And companies start to look more like, I wouldn’t call them ecosystems, but they start to look more like connected entities than they look like. standalone companies of the past. I’ve been calling these sort of coordination-based business models. I did this, I did a podcast on this, it must have been a year ago, where I basically said, stop thinking about ecosystems, think about business models that are inherently about coordination. They’re really interesting. Okay, so that’s number three. Again, I think everyone’s going that direction. Number four, this is the area of expertise which is leadership and management. How do you run companies like this? Now there are consultants all over the place. What kind of CEOs are good at this? What kind are not? Anyways, I don’t know that much about that one to tell you the truth. People and culture, as soon as you start doing consulting to companies that are going digital, the number one topic usually ends up being people. That all sounds good. None of my people can do that stuff. We don’t have software engineers. We don’t. have people that work in agile teams. Our company is six layers deep organizationally. Amazon and these companies are three layers deep. Google, their common approach to everything as far as I can tell is let’s build lots of teams. And we’ll give them authority and we’ll let them run and we’ll support them. It’s all team-based, team-based, team-based. How do you hire them? How do you keep them? How do you compensate them? You know, this is a big deal when we start talking about these companies like, why do I think Alibaba is going to do great in logistics? Why do I think Jingdong Logistics is going to be successful? Because if logistics moves from people in buildings and people driving trucks to robots and software and AI, I don’t think a lot of the AI talent of China works at express delivery companies. I don’t think they have that talent pool. It’s kind of like when Steve Jobs, um, took down Disney Animation. He was very good at this. He had teams of engineers who did hardware and software. That’s what Apple did. And they would target industries like Disney Animation, where you had a bunch of people drawing with pens. And it was clear that animation was going to go computer, graphic design. And they didn’t have enough people. And he did. So he starts doing computer-generated graphics. And Disney ends up having to buy Pixar. You can see he did the same thing to the music industry when music started to be about iPods and software and iTunes. Your typical record label, they don’t have software people. So that whole people and culture and talent bucket is pretty important. And then the last one, one, two, three, four, five, this will be number six. I’m putting the list in the show notes. Operating cash flow. This is similar to what I just talked about. All of that’s good. but you are never gonna succeed as a digital entity, a digital first entity focused on growth if you’re not generating cash flow to support that growth. You need to keep flooding money into new revenue streams, into new products, and into improving the user experience day after day. So you’ve gotta have some cash engine within the company. And I don’t think relying on external funding works. So I’ve said this about a lot of these companies, like when I’m looking at these asia digital companies where’s the cash machine is there a cash machine uh… by do has one but it’s not as big as ten cents ten-cent in alibaba have huge cash machines by dance built one very very quickly but you there’s got to be an internal cash machine uh… may twan to my credit went from a company that went public without a big cash machine to having one kinda surprised me anyways those are my six well they’re not really my six digital core, ecosystem and connections, coordination based business models, leadership and management, people culture talent, operating cash flow, cash engine. Anyways, those are my six. And you can kind of put those into two buckets so when people start telling you, oh this company’s really gonna do awesome, you can put that against the digital basics and say, nah, they’re just doing the basics. I don’t think this is a source of superior strength to their competitors. or you can put it against the standard digital playbook and it says alright looks like I know how to take apart the scenario and you can even look at the Kevin O’Leary O-Shares. I mean they’re a growth focused ETF based on digital economics more or less. And you can kind of see those three examples I just gave you. They all kind of have the same components. Balance sheet, cash flow, growth, operating margin, gross margin. It’s all kind of the same but you kind of got to look at them differently. Anyways, that was kind of what I wanted to present to you today. I find that’s not a, it’s a pretty helpful little cheat sheet to have in your pocket. But yeah, that’s it for today in terms of content. The two main concepts, digital basics, standard digital playbook. As for me, I’m sitting here in quarantine in Bangkok and it’s been, today is officially my seventh day. which means I guess at midnight tonight, I am halfway done, which is heading toward the exit. I’m on the down slope. And it’s really awful. Like, I’m surprised at how awful it is. I knew it was gonna be kind of boring. I didn’t know it was gonna be this unpleasant. Like, it’s three times worse than I thought it was gonna be. It was really kind of interesting. I got here about 11 p.m. on Monday night, checked in and they do all the check and stuff like that. Within the first day, within the first two days, it’s like, oh my God, I can’t leave this room for half a month. I can’t even go into the hallway. I can’t go to the gym and the hotel. I literally can’t relieve this 20 by 10 space for half a month. I mean, it’s kind of like prison. Like, it’s really, it’s easy to get depressed, to tell you the truth. You know, I got everything I need here. I got internet. I ordered a bunch of weights that got delivered, I get coffee delivered, all of that. But dude, like 3 p.m. every day, you start to, at least I start to feel depressed. Like it’s really, I literally stand at the window and I watch people on the street and I’ll stand there for an hour and watch people go by. Like if you go by the Holiday Inn on Sookumvit 11, you’ve probably seen me just stand, it’s kind of sad. No, what tends to work a lot is, exercise like exercise is my go-to solution and in a in kind of a screw up I ordered a bunch of weights and I didn’t really know what to order so it’s like a package like how many do you want seven kilogram ten kilogram feet I don’t know so I just picked one and apparently I kind of picked a big bag of weights and I’ve got literally a pop put a picture in the in the show notes I’ve got a pile of weights here They couldn’t carry it to my room. The poor girl at the front desk had to put it on a trolley and bring it to my door and then they couldn’t lift it. They had to roll it in. I kind of significantly over purchased weights. I don’t know what I’m gonna do with all these. But yeah, that’s my thing. I’m like the king of pushups this week. I’m getting real good at them. But yeah, it’s surprisingly bad. I knew it was going to be unpleasant. I had no idea it was going to be like this. So, anyway, my takeaway on this is, I’m in the home stretch, well, I’m not in the home stretch, but I’ve passed the midpoint as of today. So I’m heading down and I am never going to do this again, like under any circumstance. I don’t care what it’s about. I don’t care why. I’m never doing it again. They say, oh, you can’t get home to Bangkok unless you go to quarantine. Well, then I’m going to go live in Spain for a year. but I will never do it. Yes, I’m kind of surprisingly bad. And it comes and goes. Yesterday was not happy, but then some days it’s fine. So anyways, I don’t know. We’re gonna chalk this up to an interesting experience and me significantly underestimating the situation. But anyways, apart from that, it’s hanging out, watched The Black Widow this morning, which was surprisingly not good. not terrible but for a marvel movie that’s surprising house of cards watching that i watched a show on i’m watching a lot of netflix by the way uh… i watched a show called uh… cocaine cowboys on netflix which is a the craziest story true story i’d never even heard of before it’s about two cocaine dudes in florida you go watch the first episode and you’ll think oh it’s an interesting story it goes on for decades how these two dudes in florida the DEA and everything, it went on for decades. Like it just keeps going on. I’m like, how did I not hear about this story ever? It’s crazy. So anyways, that’s what I’m learning. I’m discovering all sorts of things in Netflix. But I guess that’s it for me. I’m doing a lot of content, so that part is good. But yeah, seven more days, seven more days. If you go by the Holiday Inn, look for the guy doing pushups or lifting weights on the seventh floor. You can’t miss me. Anyways, that’s it. I hope everyone is doing well. If you’re in Thailand, I hope you’re staying safe. And I will talk to you next week. Bye-bye.