This week’s podcast is Fiverr and their classic approach to building a marketplace platform (for freelance services). I don’t go into it too much but I thought it was a good example of a common playbook for venture capital-backed early stage companies.

You can listen to this podcast here or at iTunes, Google Podcasts and Himalaya.

Andreesen Horowitz listed 4 types of competitive advantages:

- Network effects

- Economies of scale

- Direct brand power

- Differentiated technology

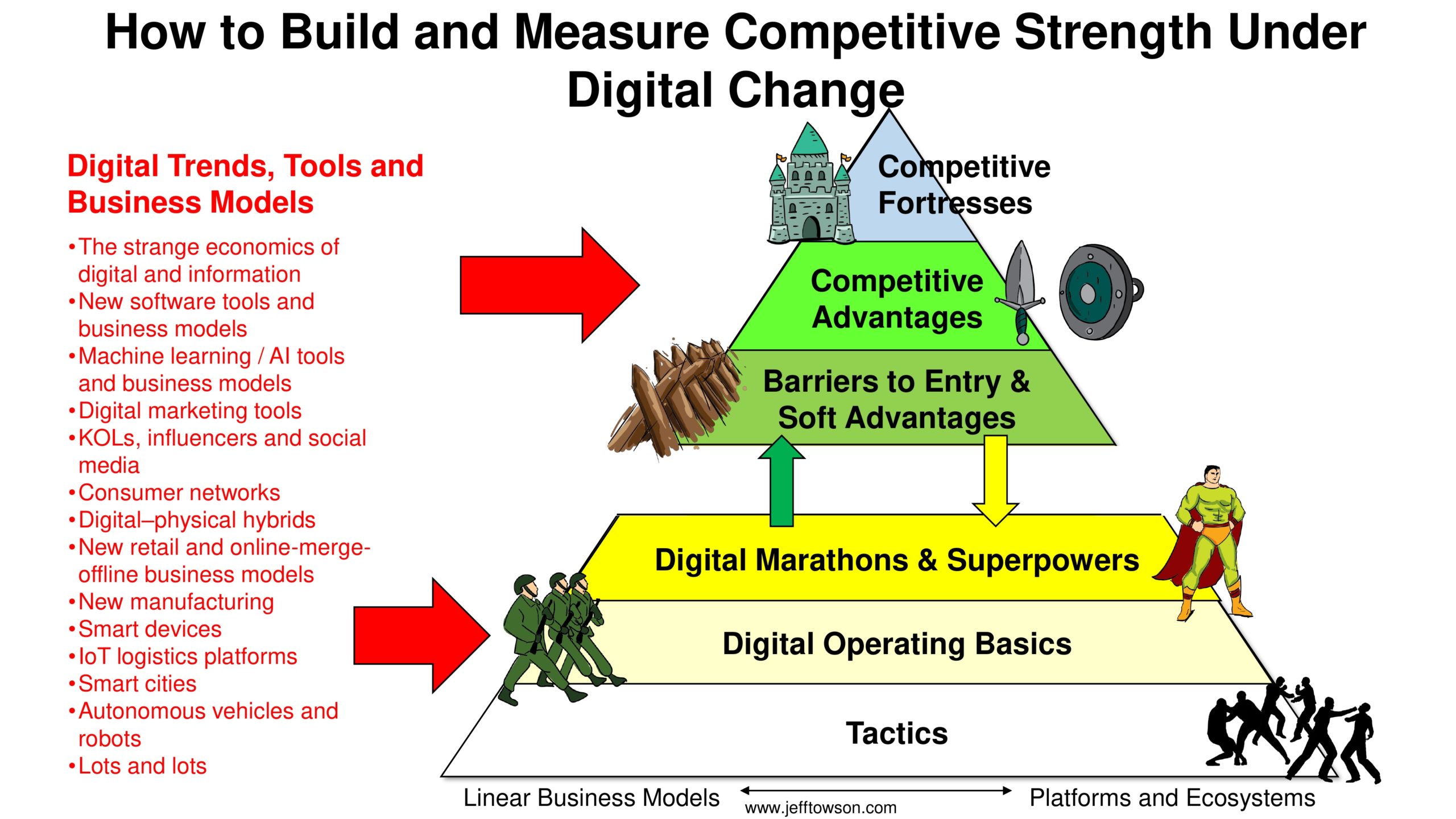

My competitive defensibility pyramid:

- N/A

From the Concept Library, concepts for this article are:

- Platforms: Marketplace

- Network Effects

- Competitive Advantage: Differentiated Technology?

From the Company Library, companies for this article are:

- Fiverr

Photo by Brooke Cagle on Unsplash

———-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

—–transcription below

:

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy. And the topic for today, Fiverr and the Marketplace Platform Playbook. Now this company is a bit out of the normal Asia Tech geography, but I thought it was sort of an interesting company to talk about just in terms of Marketplace strategy, because it is such a prototypical, almost ideal. marketplace strategy that a venture capitalist, as far as I can tell, would be attracted to. So I thought it was worth sort of talking about those aspects of it. And also because we had a fairly fun meeting today here in Bangkok with the team presented five or we had about 40, 45 people there today. It was great. A lot of fun. couple hours of talking about this company which is really quite interesting and then I just hang out for a while which is always fun on a Sunday afternoon in Bangkok. So I thought this would be kind of a good company to just use as a bit of an example to talk about some ideas. Now for those of you who are subscribers I sent you I don’t know, kind of a bit this week I think. Two companies I haven’t really covered very much which are Baozun which I’ve described as sort of the dark horse of China e-commerce. I think that’s a really interesting company to think about. And then the second is iQiyi. Again sort of a compelling company that sort of was on the radar, but now people don’t talk about as much. I think those are both really interesting companies to think about from a strategy and maybe investment perspective. So I sent you a bunch on that and we’ll be sending you a couple more this week. I’m trying to sort of introduce new companies into the mix as opposed to talking about, you know, Alibaba forever. Although that is. pretty fun as far as I’m concerned but yeah we’re gonna keep adding companies as we go so both of those in the last week were sort of introductory more than anything else but some good strategy stuff there. For those of you who aren’t subscribers you feel free to join in we’re over at jefftowson.com you can sign up there with a free 30-day trial and see what you think. Okay let’s get into the topic. Now first let me put a qualifier on this, which is, you know, I am not by any stretch of the imagination a fiver expert. This is not a company I look at a huge amount. I just thought it was interesting and went through it, but there’s certainly people who will be rolling their eyes and gritting their teeth with my simplistic summary. So I apologize for that. This is a bit outside of my sort of strike zone. The two ideas I just did want to point out and kind of use Fiverr as an example is one, obviously marketplace platforms. If you go to the concept library, and you’ll see in there, you know, various types of platforms, I’ve listed five types. One of those is marketplace platforms, which is really, you know, I think it’s one of the most, if not the most compelling. And this is a great example of that. And the other concept, which I’m not really gonna put in the library because I think this is really just something VCs talk about, which is this idea of growth plus sales. It’s kind of a growth hack, I’ll go through it. But it doesn’t apply that much outside of the sort of early stage zero to one phase. So I’m not probably gonna put it in the library, but I do wanna talk about it a little bit. And so those are sort of the two ideas for today. Now Fiverr, for those of you who are not familiar, is, I mean, it’s a marketplace platform. But unlike most of the ones people talk about, it’s not B2C, it’s not merchant to consumer in products or sales, it’s B2B. It’s businesses buying basically freelance services, although they’re expanding beyond that. I mean, that’s really where they started with low cost, simple. freelance services that were really digital in nature. So web design, video editing, logo design, stuff like that, that could be done at a distance and were sort of fairly simple and standardizable. And that’s where they started. And Fiverr, I believe, came from the idea that their initial services were all $5. And the term that’s always thrown around is gig. You know, this is the gig economy and every service they offered is a gig and they have sort of like lots of SKUs, but each service sort of has a defined scope, duration and price and therefore if you need something you can just go and sort of buy them as you see fit and it’s pretty standardizable, which is different than their main competitor Upwork at this point, although there’s other competitors floating around. where it was more of a bidding scenario where you say, hey, I’d like to hire someone to work on my web page or do a logo or something like that. And you maybe put out an offer, here’s how much, and then there’s some back and forth. Fiverr was different. It was very standardized, which I guess you could make a little bit of an analogy to the early days of eBay when it was an auction and it was a more complicated type of interaction. And then they eventually moved to sort of spot prices where it was set. and a little more standardized. Now the reason you wanna standardize when you’re building a platform is because you’re going for network effects. You’re going for, hey, we’re gonna scale this thing up as fast as possible in terms of the number of users and the number of interactions because that’s how we’ll get a network effect. Well, if you have a very simple standardized interaction, it scales better than if you’re doing something more complicated or customized or one-offs, things like that. So that’s part of it. But I mean, this was clearly a platform strategy from the get-go. It was clearly a network effects playbook from the get-go. I mean, this is just, I’m not a venture capitalist, so I don’t want to come off like I am at all. This early stage stuff, I have a very limited understanding of, but parts of what I do, which is more on the strategy and competitive advantage side, does show up in those early stages when you start talking about network effects. However, a lot of the stuff they really do focus on is getting initial traction, getting up to scale, going after sort of a blue ocean strategy. That’s not stuff I really know very much about. I’m usually looking at companies that already have sort of an established business. So anyways, so marketplace platform for freelance services. And the first thing that jumps out is you’re talking about a global. Platform, you know if uber is mostly local. Hey, I live here. I need a ride here and in my own town I don’t care if there’s drivers in another city, let alone another country. I mean this is by definition a global Platform and therefore in theory a global market or a global network effect, which is really quite spectacular If you can pull it off, that’s what Airbnb has that’s what Expedia has that’s what Ctrip is trying to get to You know, global network effects are pretty awesome because the activity is fundamentally global. It makes it very difficult to replicate. I mean, it ain’t that hard to replicate Uber in one part of town by hiring 50 drivers and putting them on the street, but to replicate a global network is really difficult. So anyways, global scale, global network effect. which basically is a competitive advantage, but it also gives you sort of a barrier to entry. Anyways, founded 2010, this is actually an Israeli company, serial entrepreneurs 2010, basically they went after the marketplace from day one, two sided platform, digital services to begin with. You know, so you’re talking about writing, translation, graphic design, video editing, programming, stuff like that, but sort of $5 ish. And now they’ve expanded to, you know, 200 plus categories of different services, getting more and more complicated as you go. Not unlike how, you know, Jeff Bezos started out with simple products in e-commerce, like books, and then moved, you know, into more complicated stuff. And now they’re sort of in the most complicated stuff now, which is like fashion and groceries and more difficult things. Anyway, so they grew very big. Now you’ve got a couple players in the market at the global scale up work in Fiverr too that a lot of people talk about, but you get some specialized players in various industry verticals. And basically what I like about this company, I’ll just give them my short list. Obviously, global in scale and global network effect, that’s huge, that’s big barrier to entry. Something I don’t talk about that much but I really like is I just like cheap stuff. I like when a company does something that you already do in life and finds out a way to do it much, much cheaper because it just tends to take off so much easier. So, you know, the nice, why do people hire freelancers? Well, because it’s a heck of a lot cheaper than hiring someone full-time for sure. It’s also a lot cheaper than hiring an agency to do it for you or just trying to find someone in town. A global… supply of freelancers you can tap for five bucks. I mean, I like cheap. I think it’s a powerful lever to pull in business. I like that there’s no low-cost substitutes. I think this is one of Uber’s biggest problems. I think Buffett focuses on this much, although he doesn’t talk about it much. I think this is actually one of his major things is substitutes. Are there substitutes for your product, particularly low cost substitutes, because it really puts a ceiling on your ability to price. You know, yes, Uber’s nice and I can rent a car and get a ride, but ultimately I can take the metro and it’s a buck or two bucks. That’s a low cost substitute and that really does sort of bound what’s possible. Well, there’s no lower cost substitutes for what they’re doing. Well, at least not until the AI gets good enough or… maybe some software tools come along. But generally, I mean, they are the low-cost player. They are the low-cost substitute to hiring someone full-time. I like that they have direct relationships with their customers and their merchants, both sides of the platform. They’re not going through a search engine, for the most part. They’re not out there on Facebook trying to get traffic day after day. I mean, they have direct relationships. That’s great. I like that it’s something that you use forever. Amazon’s like that, you know, you buy things on Amazon, but you could buy things for decades on Amazon. So it’s a long-term relationship. You could use freelancers in your business forever. I like that. And then of course they were an early mover and that’s always a nice thing to have. So there’s just a lot of attractive stuff here. If you were to go through my sort of list of six digital superpowers, I mean you can see like one, two, three, four. at least for maybe five of the six they’re going for from day one, which is nice. Now obviously there’s some bad stuff too and there’s been some, not controversy, but there’s been some sort of complaints about this company here and there. You know, probably the list of stuff I’d be most concerned about. Number one would be multi-homing. You know, the idea that you can sort of as a supplier or a buyer… as a business buying a freelance service or as a freelancer providing the service, either as an individual, maybe a small company, maybe a design from whatever, it’s very easy to have a presence on both platforms or multiple platforms. And that really does impact your profitability over time, depending how platforms behave with each other. You know, DED doesn’t have a competitor in China for the most part. And so profitability is a lot easier than say Uber versus Lyft. Because if you’re a driver in a Lyft car, I mean, you can just switch from one app to the next, Uber Lyft or WeLift. And you can basically do the same thing if you’re a designer or design firm. You could have a profile on Upwork, one on five or one on other companies. So that sort of multi-homing effect is, it’s problematic for platforms. That’s definitely something to think about. It’s easy to move off platform, which is one of the problems with these services companies that, you know. You can hire someone to do your books or do your graphic design or do your webpage or whatever. And you do the transaction through the platform, but then you just sort of do it offline on email or whatever, or not offline, but off platform. It’s very easy to lose the subsequent transactions. I’m not sure how big of a deal that is for Fiverr. I know for the similar companies like this in China, that’s a major problem, that people just, they connect through the platform and then they move off platform and they continue their business. and a company like Fiverr is taking a 20 to 25% take rate. So that’s pretty significant. And then maybe the last issue would be regulations. Remote services where you’re in the UK and you’re buying graphic design services in Sri Lanka the Philippines Regulations not a problem, but obviously we’ve seen local services like transportation become a Government and political issue and this whole idea of gig workers in California should be classified as employees things like that So that’s probably the three things I’d worry about Okay, so what are the strategy lessons here when I look at this? I mean this looks to me like the marketplace playbook for venture capitalists, Silicon Valley, Israel, places like that. Now, obviously, as I said, I’m not a venture capitalist, so this is just my impression, but I think there’s a lot of the strategic aspects that I look at, I can see here. Number one would be, okay, what’s your primary problem of building any sort of platform business model is you’ve gotta attract, engage, and retain your users. Right, the whole thing’s based on activity. I’ve said digital platforms are made of four intangible assets, users, activity, data, and then money, although money I guess is kind of tangible. You know, you’ve gotta get people coming to the platform, you’ve gotta attract them when they’re there, they’ve gotta engage, they’ve gotta participate, and then you’ve gotta retain them, they can’t leave. And if you get that, the platform starts to move and you start to get the network effects, but if they start to go away, you know. it goes away. Your whole purpose as a platform business model is to facilitate interactions. And if they’re not interacting, then well, you got nothing. So how do you do that? Especially in the early days, obviously, that’s a VC type topic, which is not my thing. But you’ll hear VCs talk all the time about sort of customer acquisition costs, the CAC, and then the long term value and how much should you spend to acquire customers? and it should only be a third of your long-term value, otherwise it’s a waste. I tend to focus much more on retention. I think just in general, attracting people to whatever business you’re doing, it can be a platform where, you know, engagement is critical, or it could just be a regular business where you just gotta get customers. I think getting… attracting customers is just getting harder and harder. There is just too many things in the world now. There’s too many books, there’s too many videos, there’s too many platforms, there’s too many apps, and it just keeps increasing, increasing. You know, I think a lot more about, okay, just retain the ones you have, because if you do that, you’re most of the way home. So everyone talks about attraction strategy, but you know, retention strategy, I think is, at least for me, I think it’s a lot more important. especially if you’re not doing early stage stuff and you probably already have a customer base, it’s about retention. When I look at Fiverr, what jumps out at me? Okay, if I’ve got two sides to this platform, I’ve got my businesses, which could be smaller, they could be large, could be solo entrepreneurs, buying freelance activity, that’s the buyers and then I look at sellers, which could also be businesses, it could be individuals, could be anywhere. You know, how are you going to attract? them. Each individual group you have to sort of make each group happy and if you make each group happy then they show up which is actually kind of tricky a lot of times. You know what I love about that on the buyer side is cheap. I mean it’s cheap. Free would be better but you know this isn’t YouTube so you can’t offer it for free but it’s just dramatically cheaper. I mean it’s it’s you know a 10x product. It’s 10 times better. than a previous product because one, it’s a lot easier to find a freelancer on an app, especially for rare skills where you wouldn’t even know where to look. And then in addition to being a better product, it’s also much, much cheaper. That’s a great scenario, better and cheaper than something that already exists that customers already use. If you’re going to digitize something that already exists in the world, that’s a lot easier than trying to get people to use something that never existed before. So Facebook digitized social interactions, but they already existed. Twitter was, I think, had a much harder play, which is that we’re going to create a new type of interaction that doesn’t exist anywhere else, really. I mean, Twitter was kind of a new thing. Well, this is companies hiring freelancers. They already do that. So you’ve got an existing activity. You’re just making it a lot cheaper and better. That’s a great way to attract users. I think WhatsApp was an awesome example of this because sending text messages used to be such a pain. You had to use your mobile carrier. They charged you for every text. It was ridiculous. And then WhatsApp comes along and it was better. Oh, and it was free, right? That’s a great thing. So I thought they have a great sort of pitch to the buyer. Cheap, convenient, easy to use. And because it’s global. Not only are you hiring freelancers, but if you’re in the UK, you’re hiring freelancers in the developing world like Sri Lanka, the Philippines, or India. So dramatically cheaper than say hiring in London. That’s great. On the seller side, I like free. I think free is awesome. But usually when I talk about free, I’m talking about a free consumer product like you can watch YouTube for free. You can use Google for free. Google search is free. There’s a seller version of this which I call free money. You know, if you can go to a business where they’re already operating, they’ve already got people staffed up, and you offer them a way just to make free money with their existing cost structure, that’s awesome. So that’s like, hey, you’ve got a restaurant, you’ve already staffed up, you’ve got your cook waiting in the back, but you’re only operating at 50% capacity because people aren’t walking down the street as much right now. Why don’t you sell some dishes online through this app and we’ll deliver it for you to their homes. Well, for the restaurant, at least in the initial stages, that’s just free money. It’s like, okay, I’ll take it, just give me the orders, I’ll fill them. We already got the people sitting here. My fixed costs are pretty much the same anyways. You got an empty hotel, you give those rooms right. So I like, you know, sort of free on the consumer side and free money on the seller side. And, you know, this company’s basically offering both. That’s great. Now it plays out over time, but at least as these companies become more and more dependent on platforms for their business, that can change. But in the early days, that’s part of it. Okay, so move on to let’s say question or challenge number two. What’s your total addressable market? What’s the TAM? How big of a space are you going after? How fast is it growing? And this is one where I think Soda Fiverr has… this great story because it can talk at two levels. It can talk at a simple level like, look, this already exists in the world. We’re just gonna move it online, it’s gonna be cheaper and it’s gonna be better. That’s a good pitch for something that exists. But it also opens up this idea of like, look, we’re actually doing something transformative here. And the total addressable market could be dramatically larger than this existing market we’re used to in the real world. Okay, we know what the freelancer economy is worth. It’s not huge. Let’s say 300, 500 billion, something like that. It’s big, but you know, but if we start to transform the nature of work itself, this could be, you know, we could have lots of dimensions of growth. You know, e-commerce is dramatically bigger than what people thought it was gonna be. Oh, it’s a bookstore. No, it’s bigger than a bookstore. You know, it… It grew, it created new activities, it expanded into other product categories, we added experiences, we added content, we added social media. I mean, e-commerce has gone dramatically bigger than, hey, we’re gonna take bookstores and put them online. This is the same. And what I think is kind of cool about this idea is, what could this freelancer marketplace become? I don’t really have any great thoughts on this because it’s a little too speculative for me, The idea I keep thinking about is this idea of unbundling work. That you know there’s the old saying that there’s only two strategies in business. First to either bundle or unbundle or unbundle and then bundle. Like it’s always back and forth, back and forth, back and forth. CDs were a bundle. You used to buy a CD, you got ten songs together, that was a bundle. Steve Jobs unbundled it. Hey you can just buy the one song you want on iTunes. Spotify came along and re-bundled it. Well, now you can buy all the songs that ever existed for one monthly price. So they sort of unbundled it from one place, physical disks, and then they sold it and then re-bundled it in a digital format somewhere else. It’s almost like you can see the same thing in work. Like, if I’m gonna hire someone and I want you to be my in-house graphic designer, okay. Or I could just unbundle that and say, look, when I need a graphic designer, I will just hire a gig and I’ll hire one person to do the gig for me. So I’ve sort of unbundled it. I’ll just do it as I need it, like one song instead of the CD. Okay, but then a company like Fiverr is starting to offer subscriptions where you can pay a set fee and get unlimited access. Well, that’s kind of me bundling it back up where now I’m not hiring just. one person to do graphic design, I’m hiring maybe five people or maybe I’m hiring the same one person but 10 times. So I’m kind of rebundling it. And isn’t a job kind of a bundle anyways? I mean if I’m hiring someone in-house to do this job for me every day and that’s all they do, isn’t that like basically a subscription of gigs that I’ve bundled together and I’m calling that employment? So is it kind of the same story? We’re unbundling what it means to have a job. employment to its fractional fundamental units, which is gigs, activities, and now we’re starting to rebundle in different ways. And then that’s just the work aspect. Most jobs also, they offer health insurance. They might offer a pension. They might offer a location you work at. They might offer a car. They might give you an assistant. Well, isn’t that kind of a bundle too? Like, what if I offer someone, hey, I wanna hire you for 50 gigs to do graphic design and I’ll bundle that together with a co-working space so you’ll have a location and I’ll bundle that in with insurance and whatever. I mean, so it’s sort of like I’m recreating work. So this whole idea of unbundling, bundling at the employment level I think is really interesting to think about. So anyways, the point of that is, okay, so question number two, like how big is the total addressable market? Well, I mean, that kind of depends on how much do you think this is going to develop? Is this just going to remain a freelancer marketplace or is this going to expand into something that’s much more transformative in the way people work and make money and the way businesses hire people and build their businesses and maybe businesses will use entirely new business models based on this sort of evolving work structure? I don’t know. I think there’s a lot there, that’s kind of cool. And question number three, competitive advantages. Now this is the one I really wanted to talk about. Because this is sort of, those first two are not really in my strike zone that much, although retention strategy is. But number three is, okay now we’re in competitive advantages. And what I thought was interesting here and I wanted to go through was, this is Andreessen Horowitz. I’ve been looking some of their stuff. There’s a gentleman named Martin Casado who writes pretty good stuff on, he’s a partner at Andreessen Horowitz, Silicon Valley. He writes, I mean, I’ve sort of noticed his stuff over the last year, he’s very, very thoughtful. So I saw an article by him about sort of, you know, what competitive advantages do they look for? And I thought that was really interesting because, you know, this is my area, digital meets competitive strategy. So what do venture capitalists look for in competitive advantage? and is it different than what I look for? And yeah, it’s basically different. I thought what they included that I didn’t was interesting, but also basically they have a much smaller subset than what I look at. You know, I find venture capitalists are not, they’re kind of not awesome at competitive strategy because they’re generally, competitive strategy tends to play out over the longer term. in the zero to one, it’s mostly about growth and getting there first and avoiding the competition and disrupting and doing new stuff. And then if you do manage to succeed, you get this massive growth surge. Most of the competitive fighting stuff doesn’t play out until the market is more mature and the growth is slower and then everyone turns their guns on each other and we discover who’s really got the competitive strength and who doesn’t. So it’s just not as big a factor for them. in those early phases as it is when you’re looking at sort of Hey, is this a good company to invest in over three to four years? Well over three to four years the competitive thing is is going to be one of if not the major factor in my opinion So anyways, they basically Martin they listed one two three four basically four types of competitive advantages And the first two I’m on board with The first two they mentioned are network effects and economies of scale. Fine, I’m totally on board with that. Software people love network effects. You know, if you’re in the software business and you don’t have a network effect or you don’t have like say switching costs or something, it can be a really brutal business. So, yeah, venture capitalists love network effects and because they love marketplaces which have lots of other types of strengths like chicken and the egg, they scale easily. I mean, they’re a very powerful type of business model. So that’s part of it. They love marketplaces and they love network effects. Kind of goes, you know, this idea that a product or service will become more and more valuable and useful the more people use it. One, that gives you a competitive advantage, which I’ve talked about many times, but it also gives you sort of a growth effect. It can really accelerate your growth in the early years. And you see these S-curves take off because as more people go to WhatsApp, it’s more valuable to everyone. So because it’s more valuable, it attracts more people. You can get accelerated growth by virtue of a network effect early on. I don’t usually focus on that very much. I’m… more concerned with the competitive barrier effect, but it has multiple effects you can get. So you see that companies like Uber and Fiverr, they sort of use network effects, one, to drive growth, two, to get sort of increasing value, to get to scale, and then on top of that, they often try and build in switching costs, usually on the merchant side. That the two metrics they mentioned in this article, for network effects. How do you tell if a company has network effects? And Andreessen Horowitz has long articles about the 11 or 15 metrics they look at to measure network effects. It’s really well thought out. But generally you’re looking for two types of metrics. You’re looking for one that’s an activity metric, how many people are using this, and then you’re looking for another metric that’s about monetization. How much money is it creating? You want to see both of those trends moving in the right direction. So for activity, the question would be like, does the engagement improve with the number of users? So as you get more and more users on your platform, you should be seeing greater engagement per user, which would mean the service is getting better and better. So you should see like the monthly active users, the daily active users, that number should be going up as the platform gets bigger. For the monetization, you’re basically looking at, are we seeing growth in the wallet share of buyers and sellers. This is what Alibaba talks a lot about. They always talk about what is the percentage of wallet we’re getting from our consumers, what is the percentage of the income statement we’re capturing from our merchants. And the idea is as the platform gets better and better, you should have an increasing percentage of your users’ wallet. Now when you look at Fiverr, does Fiverr have that? Yeah, you can, I mean, clearly from day one, they’ve been going for global network effects for freelancer services. Some of those services are commodities, a lot of them, some are differentiated, but they’ve got a suite of 200 plus different services that are all over the world in 160 different countries of both buyer, most of their buyers are coming out of the West right now, but you know. the suppliers are everywhere. So clearly they’re going for the network effect, all their numbers, they don’t publish a huge amount of them, but if you read their annual report, all of the numbers look pretty good. The take rate is increasing. The activity levels are going up. The revenue level’s going up. The number of views, I mean, all the, they don’t give you a lot of numbers, but all the numbers they do give you basically support all of that. So that’s sort of, okay, competitive advantage number one, network effects. Number two, economies of scale, which I have talked about forever. Generally, this is about your fixed cost, but not always. That’s the most common one. If you’re bigger than your competitor and your fixed costs are 20% and the competitor’s 20%, your 20% is going to be bigger in general, but it’s also going to be lower on a per unit basis, so it’s a cost advantage. that depends on your relative side versus a competitor. It’s not an absolute advantage. It’s only relative to a competitor that is smaller than you in terms of activity or money. You know, the Andreessen argument on this is, look, economies of scale are actually pretty rare in the early stages. They’re pretty rare for startups. They’re pretty rare for sort of early stage growth competition. Those are things we sort of see later when you, i.e. get to scale, right? Like it’s economies of scale. Well, they don’t, you know, they don’t have major scale at that point. We also don’t see it in high growth businesses. The sort of caveat on economies of scale is I need to be bigger than my competitor to have this advantage. So I need a market that is somewhat circumscribed where there’s no room for them to get as big as me. or a market that’s not growing really fast so that there’s not room. I want a fixed stable market where I’m 70% of the market and my competitors three and there’s no room for them to get bigger unless they take it from me. But if the market is not terribly circumscribed or it’s growing, there might be enough room for them to grow and get to my size without taking from me and once they get to my size, I lose my advantage. So anyways. You don’t really see it so much in high growth businesses, early stage startups, economies of scale happens later. What would you see? Well, this is from them. Are the per unit costs improving, but not degrading the overall unit economics? You can be spending a lot on advertising and marketing and saying, hey, look, 20% of our revenue is advertising and our competitors spending 20% on advertising, which might be like Coca-Cola versus you know, a smaller beverage, and we’re bigger, so we have an advantage. Well, yes, in theory, that’s true if you’re talking about Coca-Cola. They have economies of scale and marketing and advertising. But it’s not if you’re a platform and you’re spending that money, not as a hammer, you’re pummeling and smashing your competitor with, but you’re using that advertising spend to keep people coming to your platform if you’re buying traffic. then that would be a case of, okay, you’ve got this sort of scale thing in fixed cost, but your overall unit economics are not great. In fact, they’re getting worse. Now, if you’re talking about soda, yeah, that’s true. If you’re talking about Apple, with their gazillion dollars they spend marketing the iPhone every year, that is a big club they are hitting their competitors with. That’s true. That sort of. I’ve gone through economies of scale quite a bit. The two they talk about are the unit cost, which is about your fixed cost, and then they talk about purchasing economies, which is like the Walmart effect. When you get bigger and bigger, you can go to your suppliers and say, give me a discount. So purchasing economies. Now I’ve mentioned several others about logistics and some other things, rate of learning. There’s other types of scale economies, but those are the two they talk about. Some funny purchasing economy ones. One of the great ones was actually Yahoo. That back when Yahoo started as a portal, back in the 1990s, they had to sort of curate manually content and put it up there in a sort of a home page for the web. Here’s the top articles from news, sports, politics, whatever for today. And they did it very manually. But to get the content, they had to pay the companies, can we put your stuff up there? And it was a cost. And then at a certain point is they got bigger and bigger and bigger. Not only did they get sort of purchasing power, it flipped. The content people ended up paying them, I think, to to list their stuff on the Yahoo page because they got so much traffic and they got so many clicks. So not only did the scale sort of get them purchasing economies, I think at a certain point, they literally flipped and it’s like, no, no, no. This year, I’m not paying you. You pay me. I think ESPN had a similar story where ESPN became so popular that people started to pay to have it on their networks and their cable channels. Anyways, I’m not 100% I think that’s true. I’m 90% sure it’s true but I may have a mistake there. Okay, now there’s other types but those are the two they talk about. When you look at Fiverr, they are mostly about the network effects. Clearly, that’s their number one strategy. But they in and if you look at their income statement now, you don’t see any real there’s no purchasing economies, there’s no logistics and geographic density, anything like that. The only thing you could say is okay, they’ve got some significant R&D, they’ve got some significant marketing spend. Now their marketing spend is 60 plus percent of their revenue because they’re doing a blitz scaling thing. So don’t pay attention to that. That’s not it. But in the long term, you would expect them one day to have sort of R&D and innovation related fixed costs that are larger than their competitors. Which kind of Airbnb has today. Okay, I’d expect to see that one day, don’t really see it today. And then they’ll probably have some marketing advantages one day if they choose to do that when things are more stable though, I don’t think today. So that’s the two. The other two competitive advantages they mention are direct brand power and meaningful differentiated technology. And I’m putting all four of these in the show notes just so you can sort of see what they listed as a famous venture capital firm. Direct brand power, I’ve kind of talked about this. Everyone seems to have a different name for this. This is a demand side, revenue side advantage. I use share of the consumer mind. I’ve actually detailed this pretty good if you wanna go through the concept library. I mean, I think there’s a lot of types in here. I think there’s habit formation. I think there’s chemical addiction. I think there’s share of the consumer mind. I think there’s aspirational behavior. I think there’s entertainment behavior. I think for businesses, there’s the risk of a critical process versus a necessary process. Hamilton Helmer. the seven powers guy he talks about he calls it branding and feeling good which is more of the emotional impact uh… they talk about direct brand power that’s their phrase i mean brand power in theory gets you word of mouth that this becomes a must have product that everyone mentions in the office maybe you get a occult following Maybe you want to get direct traffic to your app or website that’s not going through somewhere like Google which is going to charge you. All of those things could be an indication of direct brand power. I think there’s a heck of a lot more going on here, but this is not really their world so much. They’re going for sort of like, what would a brand power be for something totally new in the world? Cult following. We don’t see cult followings in detergent. these established products. That’s more of a VC thing. But the metrics they point to in that increasing direct and organic traffic. What percentage of your traffic is coming direct and is it increasing? As opposed to what percent of your traffic is coming from a search engine or social media, which tends to be the other big locations. And then are you seeing decreasing In theory, those should be going down over time because your brand is becoming more and more powerful. Again, I think those are acquisition metrics, but as I kind of said, when I look at brand power, I’m looking more at retention than I am at acquisition. I’d love to see lower churn. If you get lower churn, you’re losing fewer people. That helps you all over the place. It’s a very early stage, fine. And the last one, and this is the one where I hadn’t really, I don’t really talk about this very much. They talk about meaningful differentiated technology. Okay, now you have a technology with lots of features, lots of integrations, lots of connections, lots of things that you can do that others can’t. Elon Musk’s cars can drive down the street. Most other companies can’t do anything like that. Does that constitute a competitive advantage? My take is most of the time the answer is no. I think most IT gets replicated very, very quickly. But I think you could put that on your list of competitive advantages as a rare exception. Now, if you have a patent, that’s one thing. But most things do get copied very, very quickly. It’s very hard to keep a trade secret. So if you have that, if it’s dramatically better, let’s say not better, but differentiated, you have technology that’s doing something different than others. And maybe it’s not that they can’t copy it, it’s that they’re doing a business that is different than yours. So they wouldn’t wanna create some specialized, differentiated technology to do that because maybe what you’re doing is a little bit strange. There’s an e-commerce company, well, I mean, e-commerce company in Omaha, which Warren Buffett is an investor in, called Oriental Trading. And it’s a very interesting company that’s been around for 60, 70 years. And it started out as a company that made like watches for, you know, when trains would come, people had to have watches. So they sold watches and it sort of evolved over time. And now they do e-commerce and they have their own warehouses and they have their own webpage. But what they sell are a little simple items that costs like 50 cents or 20 party. So if you wanted to throw a party for your staff, you might need something like I need 500 little plastic ducks that have the boss’s name on them. I want confetti. I want lots of little balloons. I want 145 stuffed animals that are small, teddy bears. They have the weirdest assortment of stuff you’ve ever seen. And they have thousands and thousands of these tiny little weirdo things. But if you are a company and you’re throwing a corporate event on a Friday and you need all these little things, where else would you go to get those? You can go to Amazon and hunt for them, but no, you go to this site, they have everything. And the technology of their warehouses is customized to handle these weirdo packages they send. So that would be a type of meaningfully. differentiated technology, where they have built something so different in terms of a warehouse, which has a lot of IT in it, to handle these weird order types, and their warehouses look very different than an Amazon warehouse. Now, Amazon could do that, but why would they? They haven’t gone down this specialized, weird path in business. So that’s kinda how I’d think about it. Anyways, the metrics they point to. You should be able to see premium pricing. Maybe you have less marketing spend because you’re so different that people sort of know about you and word of mouth. Maybe there’s some switching costs. Anyways, I think those are not awesome. Probably the one I would just look at, I didn’t buy most of this, the one I would look at is I would just talk to customers. And if they all say, oh, this company does something that no other company can do, if you’re like five or 10 customers say that, yeah, yeah, yeah, I use that e-commerce company because they can do it and nobody else can do that. You can’t order these crazy ducks and the ducks are like their number one selling thing. And no other company can do that. If you hear that from five or 10 customers, and their service offering is based on technology, it’s like, okay, maybe they’ve really differentiated here in a meaningful way. So I’m open to it, but I think it’s a lesser thing. Okay, and that’s pretty much it. So competitive advantages according to Andreessen Horowitz, network effects, economies of scale, direct brand power, meaningful differentiated technology. It’s a very VC playbook, but I think there’s some interesting lessons here. Now, just to wrap up Fiverr, you know, going through my sort of digital competition pyramid, I’m trying to think of a new name for my pyramid. Maybe the word pyramid doesn’t add much. I’ve sort of started to say like a digital defensibility playbook, digital defensibility ranking. I’m not sure the word pyramid helps at all. But basically there’s three levels. There’s competitive advantage, actually four levels. Competitive advantage, various entry and soft advantages, smile marathon and tactics. Bottom of the pyramid is tactics. I’ll put the picture in the show notes. Then you go up to operational marathon, then you go up to soft advantages, varied entry, then you go up to competitive advantage. And the higher you up on the pyramid, the greater your defensibility, the greater your competitive strength. Now when I look at Fiverr starting at the bottom of the pyramid. The first thing I see is they’re in a money war. They’re spending a ton of money They’re losing money and they’re doing that as a strategy to acquire market share in the short term You know, they’re doing blitz scaling Okay, so that’s a tactic. It’s short term. They’re not gonna do this for ten years But they’ve decided to do it now because they’re going for scale as a platform fine. They’re clearly doing that That’s a tactic Move up the next level, smile marathon. The smile marathon is like, you have to do things fast. Your speed of execution, your operational speed is incredibly important, but you can’t do everything fast. You can’t just all walk around the office faster. You gotta choose what dimension we’re gonna run our marathon in, and I’ve given you five, SMILE. I think they’re doing the E. I think they’re in the ecosystem orchestration business. That is their primary operating metric. So they’re running as fast as they can in ecosystem orchestration because they’re building a platform. Fine. Up to the next level, barriers to entry and soft advantages. I think they’re a platform business model, obviously. So that gets you some ability to do chicken and the egg. It’s hard to break in to get going as a platform. It also gives you the ability to subsidize price from one side of the platform to the other. I think those are in both soft advantages. I think they increasingly are gonna start to bundle. I think bundling is a good soft advantage. And we go up to the higher level, which is then competitive advantage. And obviously the two they’re going for, the number one one they’re going for is global network effects. And then after that, I think they’re probably going for economies of scale and marketing and R&D, but not this year, maybe in a couple of years. And then can they get to the top of the pyramid? Can they become dominant, an ecosystem? Maybe one day. I don’t see it today. But anyways, that’s sort of my competitive assessment of them overall if they pull it off Very very strong like Airbnb strong Okay, and I think that’s enough for today. I’m not gonna I guess get to Growth plus sales. That’s that’s sort of a growth hack tactic your venture capitalists talk about a lot I may cover that at another point. I guess so It’s not terribly important. I don’t keep it on my concept list. The concepts, I guess, for today, marketplace platforms, obviously, network effects. And then I think differentiated technology as a competitive advantage is worth thinking about. I keep it under my list of competitive advantages, but I kind of put it as a rare exception. I don’t think it really works or lasts that long, generally speaking, but I’m willing to be convinced. You know, I could see something, okay. you know, the Oriental Trading, that’s actually kind of a quirky company. I went there with, when I took some students out to me with Warren Buffett and he had us do a tour of that. And when we went to the factory, they actually gave us Warren and Charlie rubber ducks. So I have a couple of them somewhere in a box, but yeah, it’s just a weird, strange company, but it’s, you know, it’s actually got some fairly powerful. Well, fairly strong competitive positioning, which is, you know, if Berkshire buys it, that’s generally an indication that it’s got a great position. And it’s funny, the CEO who was involved in the sale to Berkshire, he told us the story and he basically said, you know, he just sent an email to Warren. We didn’t really know at that point on like a Friday. And he basically got an email back in two to three days saying, uh, yeah, I want to buy it. and then they did the deal in a week or something. Like, it was done really quick, and that’s just how he works. Now people say, oh, that’s because he’s so smart. Well, yeah, he obviously is. But I also suspect if that was an Omaha-based company, he’s probably been aware of it for a very long time. So he’s probably been following it or had his eye on it for a long time. I don’t think it was the first time he was looking at the numbers, but that’s just a guess. Anyways, that’s it for content for today. As for me, I’m doing pretty well. I did go to Phuket for the week. I didn’t see any cobras, which, you think I’m joking about that, which I kinda am, but I did look under the bed three or four times during the week. I don’t like when you go to a hotel and the bed isn’t flush with the floor where it’s like a stand. Instead, it’s elevated. and I look under, because that’s where they go. Anyways, fortunately I didn’t see any, but I did look in the news while I was there, and there’s reports all the time. I’m not totally crazy. Let’s say I’m 20% crazy. I’m not totally crazy. There are news reports all the time. So, anyways, no cobras. And I didn’t do anything stupid with apartments either. I did look around at a couple condos. More as just something to do. It would be a really not smart purchase. It would be up there with buying a boat, right? Like most people, if they buy a boat, they regret it later. It’d be something like that. But I did do it. It’s something to do. It’s still pretty shut down in Phuket. I was in the south and the very southern tip, which is Rewai, which I think is really just a beautiful part of town. And it tends to be not so touristy in the bad way. There’s a little skeevy stuff that goes on, particularly in Patong. But that’s actually quite nice. It’s kind of like a retirement community, if anything else. I mean, there’s just a bunch of folks from a lot of people from Russia, Europe, who have retired there. And now that there’s not really any tourists outside of international tourists, that’s pretty much what you see. You see Thai families on vacation and then you see a bunch of sort of foreign retirees. who are just staying there during COVID because that’s their home. So it’s kind of a strange place. But for those of you who are familiar with why, I mean, it’s Nihon Beach is beautiful. Just fantastic. And there’s a little bakery I always go to in Rewai Beach, which is really kind of nice. Anyways, it was a good trip. And it’s back to Bangkok. And I started watching Falcon and the Winter Soldier on Disney Plus, which just started a couple of days ago. And it’s great. I’m having… I love all this Disney and Avengers stuff. I mean, I just, I really enjoy this stuff and they just keep making more and more. Oh, the trick for those of you in Thailand, because you can’t get Disney Plus in Thailand directly, it’s not available, so VPN it. If you work in China, you get really good at VPN. I have like a master’s degree in VPN. The one that I use is ExpressVPN, which you have to know one that Disney doesn’t block. because these companies generally don’t like VPNs. Like Netflix starts to block VPNs. So you have to kind of check which VPN is good at getting around their blocks. And ExpressVPN is the one I’m using. It works pretty good right now. So anyways, that’s it. Back in Bangkok, some more Avenger stuff doing well. Okay, anyways, I hope this was helpful. I hope everyone is doing well and I will talk to you next week. Bye bye.