I like search engines. But they are very strange animals. They remind me of giraffes and ant eaters. Unique animals that you can’t really compare to anything else. But their competitive strength is really impressive. For example:

- Google Search is dominant globally, with +85% of the market.

- Bing and Yahoo are 2nd and 3rd globally, with only around 3% and 2% respectively.

- All the rest are under 1%.

And we can see the same picture at the country level:

- Baidu is dominant in China, with +75% of the market.

- Naver is dominant in South Korea, with +70% of the market.

- Yandex is dominant in Russia, with +60% of the market.

Note: The above numbers are not 100% accurate. It depends on desktop vs. mobile. It doesn’t count product search, which happens on ecommerce sites.

But overall, we see a fantastic competitive picture AND attractive unit economics. Search engines are just great businesses.

In the next couple of articles, I am going into Baidu’s current strategy. They just did a secondary listing in Hong Kong. But first, I wanted to lay out my frameworks for search engines and learning platforms. As mentioned, these are strange animals.

My Definition for Learning Platforms

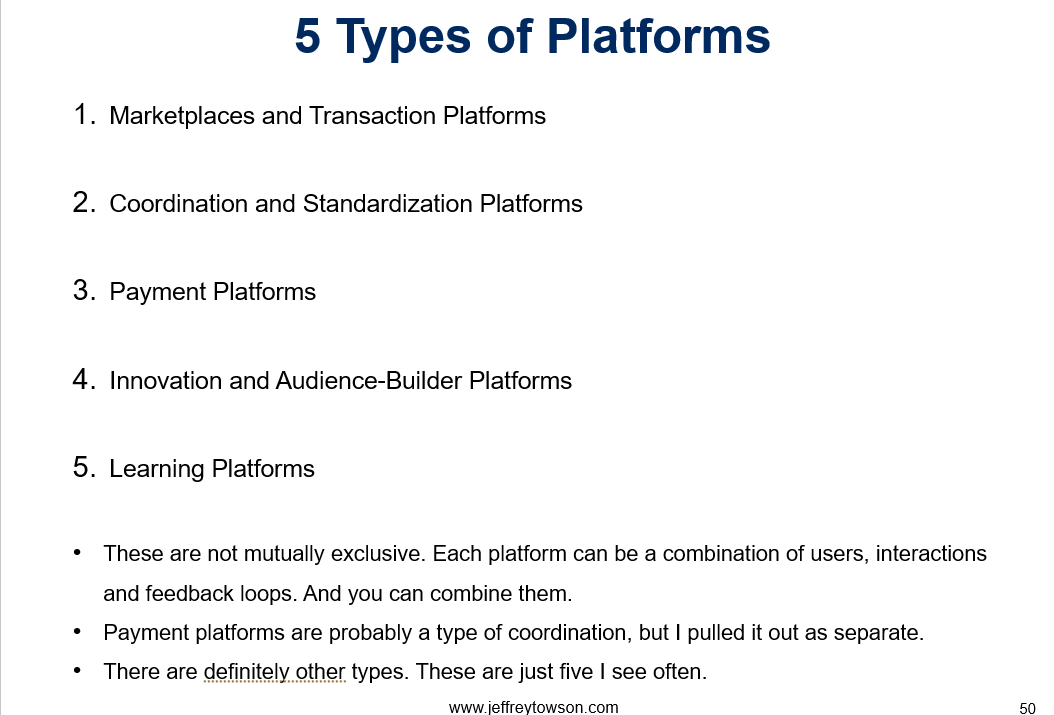

Recall, my five platform types:

In my article on Megvii, I laid out an introduction for “learning platforms”.

“…my basic definition for learning platforms is they are business models where the more users and/or interactions, the smarter and therefore better the product / service. It is the platform’s rate of learning that fundamentally makes it a better service.”

And you’ll probably notice that I have already put “learning” as both an operating dimension (the L in SMILE is for rate of learning) and a competitive advantage. Well, learning can also be a platform.

My definition for learning platforms has 4 key points:

- The primary purpose is to enable interactions between user groups within a greater ecosystem. It is, first and foremost, a platform business model. It is in the business of lowering Coasean coordination costs between user groups. And this is pretty obvious for search engines, which are about decreasing the searching costs for finding information.

- The interactions on the platform improve in their accuracy and quality with more users and / or activity. The “learning” of the service is directly dependent on the interactions between user groups.

- The learning can happen in the aggregate and / or at the individual level. More overall activity can make the service better for everyone. Or an individual’s own usage can make it better for that one person. For example, YouTube customizes to you specifically. But search engines learn from everyone’s activities.

- Users can be human and/or digital agents (cameras, IoT sensors, web pages, etc.). This is kind of the big point.

That last point is important.

Think back over all my talks about how platforms are “network-based business models that enable interactions between 2 or more user groups”. But I never said user groups were people. It was certainly implied because most platforms are about enabling interactions between people or companies (made of people). For examples, marketplaces help buyers and sellers transact. Audience builders help content creators and viewers interact.

But in an age of AI, software and robotics, we are increasingly seeing non-human agents making both predictions and decisions. We are seeing digital agents move packages, drive cars, send emails, buy goods, answer phone calls and so on. So can’t user groups be digital agents? Can’t platforms also enable digital agents interact with each other? Or with human agents?

Imagine the following scenario:

- Retailers are already using AI to do demand projection and inventory management.

- The AI for the retailer then goes ones step further and starts placing orders for goods in its supply chain.

- AI at supply chain companies accept these orders and fulfil them automatically. That would be one-to-one digital agent transactions.

- But then a new marketplace platform is created only for digital agents as users. It is for lots of AI buyers and sellers to connect and do transactions. And there is no mobile app or webpage. In fact, there is no human interface at all.

I think this sort of interconnected business is on the way. Food for thought.

Two last points on learning platforms:

- I don’t think “data” really works as a concept in business strategy. You will often hear about “data network effects”, “data competitive advantages, and “data advantages”. But I find them too fuzzy to be useful. Try to actually define “data”. Numbers in a spreadsheet? Images? Maps? Movements of cars on a street? Faces? What in life and business isn’t data?

- Personalization and customization aren’t learning platforms. People say Amazon and Netflix have “data network effects”. Because the more you watch Netflix, the better the video recommendations become. The more you use Amazon, the more the store becomes customized to you. I don’t consider these network effects. Or a learning platform business model. Or a structural advantage that really separates a company. I think this type of personalization and customization is just a standard feature in a data-rich world. And Amazon and Netflix got there early.

Ok. On to Baidu Search.

My Explanation for Baidu Search in 3 Slides

Baidu was founded by Robin Li in 2000, around the same time as Google and Naver. The early version for a PC world looked like this:

Let me talk through this basic version. Because it’s going to get more complicated in Part 2.

First, you’ll notice on the left that this is about achieving demand-side scale first. That’s where the power is. Aggregating usage.

On the blue diamond, you can see three user groups:

- People doing searches. This was on web browsers on personal computers. And this was mostly about searching the text within webpages. Maybe some images.

- “Webpages”. I consider this user group a combination of digital and human agents. It is people. It is companies. It is software. The webpages are being formatted and structured to meet the Search Engine Optimization specifications of the leading search engines. Some of this happens by software. Some of it is done by people. But this is certainly not person-to-person interactions.

- Companies / advertisers bidding on search results. This is pay-for-performance (P4P) advertising, which is very different than the attention-based advertising of companies like Facebook, Tencent and ByteDance.

The platform reduces search costs and enables users to find the content they want. And it’s an interactions business that is free for users.

We see 2-3 network effects.

- The important network effect is the learning effect. The more users searching, the better the quality of the results. That’s a direct network effect on the searcher side. But we also see an indirect network effect. The more webpages listed, the better the search results will be. And the more searchers, the better it is for webpages being seen. You can see these as two infinity symbols on my chart.

- There is also a standardization and interconnection network effect. The more webpages that standardize according to Baidu SEO, the better it is for everyone. Everyone uses the same formatting. Everyone has the same metrics. Everyone uses the same tools and training. Standardization is a direct network effect. This is like when everyone writes documents with Word. Or uses PDF. The more people use a standard, the more it creates value for everyone. You can see this in my chart as an infinity symbol next to Webpages.

Finally, on the supply side, things are pretty simple. Just building scale in IT / Web Services. And Marketing. You can see this at the bottom in yellow. These are the key capabilities that support the platform. And you can achieve scale in some of them, which is another type of advantage.

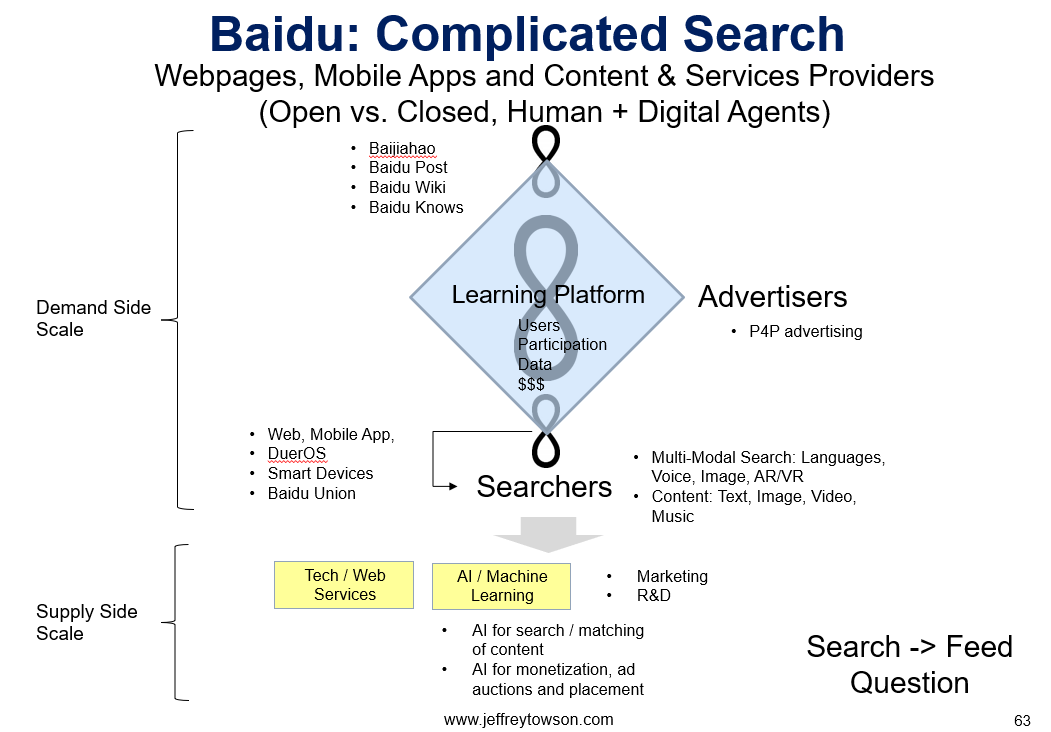

Ok, those first two charts are basic search. And this is how it worked for 2005-2010. But then search became more complicated.

- Searchers moved onto mobile devices. Smartphones were a big change to search. But we also see smart devices, AI speakers, etc.

- Content types expanded to videos, music, text, images, etc. Text was fairly easy to search. But searching the content of a video is more difficult.

- Some information began to move into walled gardens. Webpages could be searched by anyone. But information in companies like Tencent and ByteDance can only be searched by those companies.

- Search methods expanded to multiple languages.

- Multi-modal search began to emerge. Users are starting to search by voice. By camera. By AR/VR.

- Search began to happen in lots of locations. Searching from webpages and mobile apps expanded to embedded searches in webpages and mobile apps, from within operating systems, from within maps, from within smart devices and so on.

- Search engines evolved from being a place to search for information to a place to answer complicated questions.

You can see more complicated search below.

You can also see that AI became a major capability during this period. Baidu has been active in AI since at least 2010. And today, they consider this their core capability. They now call themselves an “AI company”.

Ok. Those are my basic pictures for Baidu Search. In Part 2, I’ll build on these charts to show you how their entertainment, web services, self-driving and AI businesses fit into all this. But search is their foundation.

A Final Qualifier

I am really sort of stretching my definitions for platform business models here. Learning platforms? Platforms with digital agents as users? Learning may end up being a new type of platform. Or this may end up being replaced by a better, more appropriate framework.

I think the 4 platform business models I have presented (marketplace, audience-builder, payment, coordination / standardization) are solid. Learning platforms is sort of an idea in process. We’ll see if it stands up over time.

That’s it for today. Cheers, jeff

———

Related podcasts and articles are:

- Introduction to Learning Platforms, Computer Vision and Megvii (Jeff’s Asia Tech Class – Daily Update)

- Baidu is Struggling in Content Creation, Push Feeds and the Attention Market (Pt 2 of 3) (Asia Tech Strategy – Daily Update)

From the Concept Library, concepts for this article are:

- Learning Platforms

- Standardization and Interconnection Network Effects

- Search Engines

From the Company Library, companies for this article are:

- Baidu (BIDU)

Photo by Jizhidexiaohailang on Unsplash

————

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.