In Part 1, I argued that Mark Zuckerberg’s memo on “privacy-focused messaging and social networking” is actually an aggressive and potentially stunning growth path for the company. I called it the ultimate gangster move.

Their move to consolidate their messaging services creates a big global tool. And it looks a lot like the foundation of a WeChat-type operating system.

How WeChat Went From Private Messaging to Payments (and Financial Services)

WeChat’s messaging and social network is a one-sided platform with a direct network effect. There is a lot of power in this and it tends to grow organically in a winner-take-all manner. And it gets you demand-side scale, which is really what you want in a digital age.

From this messaging platform, WeChat built out a complementary payment platform. Payment platforms are typically two-sided networks between users and merchants (and banks, sort of). But in WeChat’s case, their payment platform also functions as a one-sided network for user-to-user payments. Having one network effect is great. Having two is awesome. Once they added payments, WeChat had three.

How WeChat Pay (i.e., their digital wallet) got launched is an interesting story. Because they were not the first mover in digital payments in China. Alipay had long dominated this space, based on their e-commerce business. They built AliPay on top of Taobao/Tmall the same way PayPal was built on top of eBay (although Elon Musk and Peter Thiel did it without asking eBay, another gangster move).

WeChat Pay’s big moment (and Jack Ma’s big surprise) came in 2014 when they launched virtual red envelopes during Chinese New Year. Chinese netizens could suddenly send their yearly cash gifts to friends and families (individually and in groups) through WeChat. It rocketed WeChat Pay upwards and Jack Ma now refers to it as a “pearl harbor moment”.

Today, the mobile payment market in China is about 50/50 Alibaba and WeChat. Mobile payment is super convenient and accepted everywhere. From McDonalds, to weddings, to street food vendors to beggars (they put QR codes on their signs). I rarely carry cash in China anymore.

And as Chinese tourists increasingly go global, so is WeChat Pay (at least on the merchant side). Walk down any street in Bangkok and every store will have a sign saying they accept WeChat and Alipay. In 2018, Charlie Munger cited WeChat as one of the main global competitors for Visa and Mastercard.

And payments are just the beginning. Because what WeChat has really built is a complementary financial services platform (connecting consumers, merchants and financial institutions). Payments were the starting point but they are expanding into consumer credit, money market funds and wealth management products. And they now have a private banking license. This is the reason Ant Financial (which also started with payments) is now valued at +$150B.

Back to Facebook.

Imagine what happens if Facebook goes from messaging to payments.

- How big of a global payment network could they build for +2B people?

- How big of a financial services platform could you build that into?

People argue that setting up such a payment platform globally would be too difficult. And certainly cross-border payments are more complicated. But this is definitely doable in lots of geographies. And acquisitions can make it happen much faster than you think. This is why Ant Financial has been on global buying spree for the past two years. They have been snapping up banks and financial institutions everywhere from Thailand to Brazil. This is also why they attempted to buy MoneyGram in 2017 (which was blocked by the US).

Does Facebook really need to launch coin to do this? Or can they just buy stakes in a bunch of banks? FYI: They are not really that expensive in most developing economies.

How to Go From Payments to E-Commerce and Local Services

If you have the consumers and they can all now pay with their phones, e-commerce services happen very quickly. And not just online. WeChat’s hundreds of millions of consumers are walking around China and buying things with a scan of their phones. This is why services like bike-sharing took off so fast in China (and not elsewhere). This is why there are new types of vending machines popping up all over the place. Note the airport karaoke booth and the claw game (with live lobsters) below.

And from this point, it was an easy step for WeChat to start to bringing e-commerce services into the app itself.

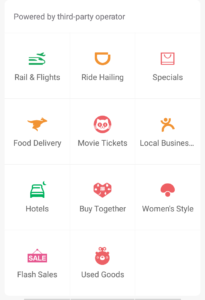

Below are some screenshots of the Wechat Wallet and mini-programs on my China phone.

If WeChat Pay lets you stop carrying cash, WeChat’s e-commerce services and mini-programs let you stop carrying your wallet at all. It is Allen Zhang’s ultimate tool – an app that does all your communications. payments and e-commerce and services. With my phone, I can rent a bike, hail a taxi, order food, have a latte delivered, pay my utilities, buy merchandise, send a friend some money, book a hotel, plane or train, buy movie tickets, get special daily flash sales, buy used goods, etc. Basically everything.

If WeChat Pay lets you stop carrying cash, WeChat’s e-commerce services and mini-programs let you stop carrying your wallet at all. It is Allen Zhang’s ultimate tool – an app that does all your communications. payments and e-commerce and services. With my phone, I can rent a bike, hail a taxi, order food, have a latte delivered, pay my utilities, buy merchandise, send a friend some money, book a hotel, plane or train, buy movie tickets, get special daily flash sales, buy used goods, etc. Basically everything.

When You Are the Operating System for People’s Lives, Are the Avenues for Growth Endless?

Allen Zhang has really completed what he set out to do. He created one of history’s most useful and efficient tools. WeChat is not a time waster. It is not something for passive consumption. It is the awesome tool you use every 3-4 minutes to live and do business in China.

And think of all the revenue streams this tool can create. I’ve already mentioned communications, financial services, e-commerce and local services. What about healthcare? Education? Government services? Mobility? Forget unicorns. Each of those is a business in the tens of billions (if not hundreds of billions) of dollars.

Now imagine Facebook follows WeChat’s path and becomes the operating system for some of their +2B users? How big of a company could that be? How many revenue streams will they have? How many avenues for growth? Their current advertising business starts to feel small in comparison.

So you have to hand it to Facebook. If they can pull this off, it will be one of the biggest moves in business history.

***

Anyways. That’s my take.

A lot of this is conjecture about Facebook’s intentions. I’m inferring from the memo. But none of this is actually speculation in terms of the business model. This is a proven path and Facebook is in a very good position to go after it. We’ll see.

Thanks for reading – jeff

—-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.