There has been a lot of soul-searching by entrepreneurs, venture capitalists and Internet companies about what has gone wrong in Chinese digital health. Thousands of digital health companies have been launched and funded in recent years but there have been few, if any, big successes.

However, if the past few years were overly optimistic, I think the current view is overly pessimistic. There have been, in fact, some successes and there is now a clear way forward in Chinese digital health. And that path is to go direct-to-consumer – and especially to their smartphones. Bypass the core hospital system and its problematic finances and incentives. The smartphones of Chinese consumers have become the epicenter of Chinese digital health.

The problem is supply, not demand

The big problem in Chinese digital health has been the lack of adoption and predictable revenue on the supply side. Healthcare delivery and supply in China is still mostly State-run hospitals, distributors and insurance. These three groups have limited IT infrastructure and few big incentives for digital initiatives. Most business models that depend on adoption, revenue and / or data from these entities have either languished or advanced very slowly. So, despite the predictions of 2014-2015, we’re not seeing things like online consultations, operational advancement or big data / AI initiatives on the clinical side.

However, in direct-to-consumer services, such as in communications, information searches, some e-commerce and making appointments and payments via mobile, adoption has been impressive and the revenue models are more viable. This is increasingly true as you move from core clinical services like State-run hospitals to more ancillary services like private dental clinics.

Chinese consumers are continuing to rise in their wealth and expectations. They want better healthcare and they are willing to pay for it. So we are seeing an increasing gap between rising demand and somewhat stagnant supply. This gap is especially visible in areas like cancer treatments, insurance products, inpatient care and so on. And this situation is not just showing up in digital health. It is happening across the system. You can literally see this supply-demand gap every day in the lines that stretch out the doors of many Chinese hospitals.

Note: This is a very different digital health situation than we see in the West, where new digital tools have mostly focused on hospitals / providers and insurers. And on the supply chain. These companies have very sophisticated IT systems to build upon and this is where the data is. So you see lots of digital initiatives focused on capturing new efficiencies in hospital operations, in streamlining supply chains, in extending providers with new data and decision-making tools, and in upgrading and empowering insurers with big data and analytics capabilities. That is very different from the picture I am describing for China, where most of the action is happening on the consumer side.

A framework for direct-to-consumer activity in Chinese digital health

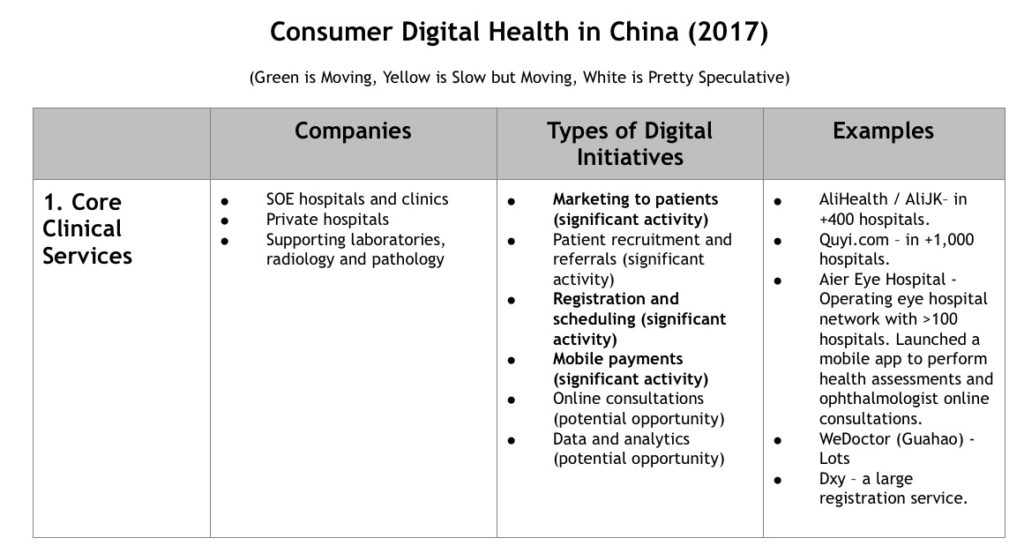

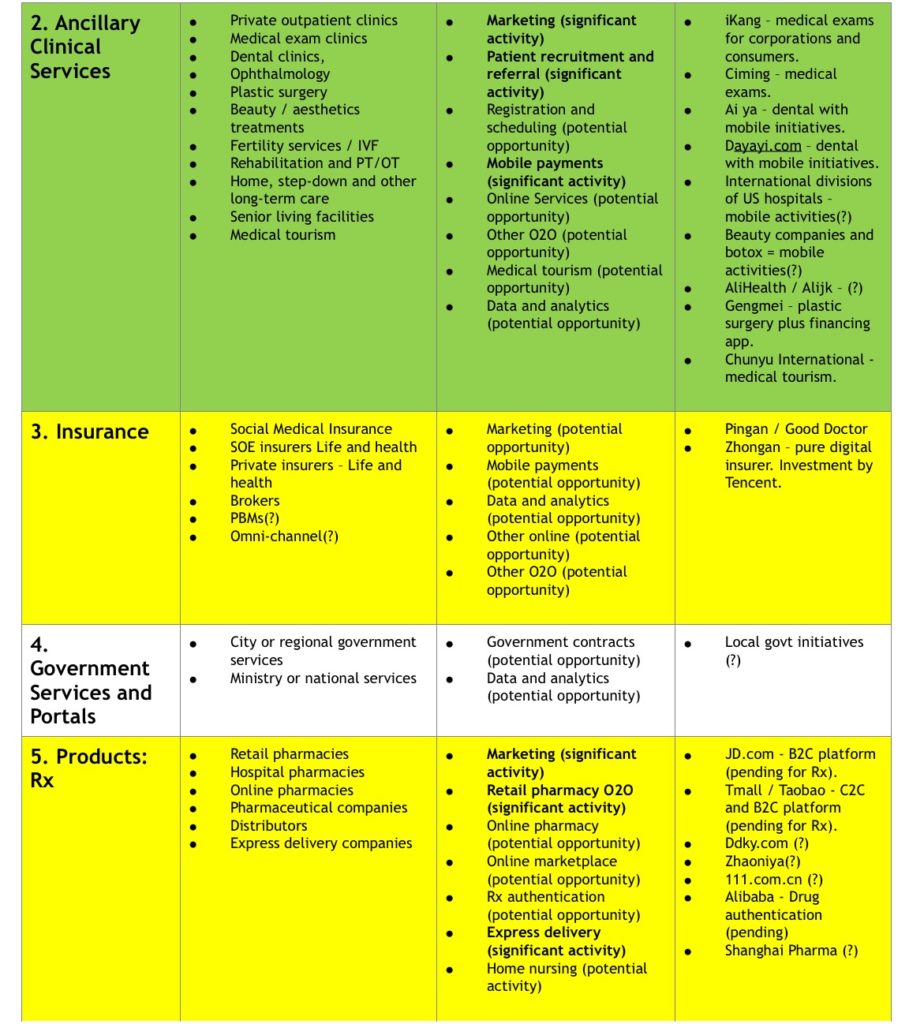

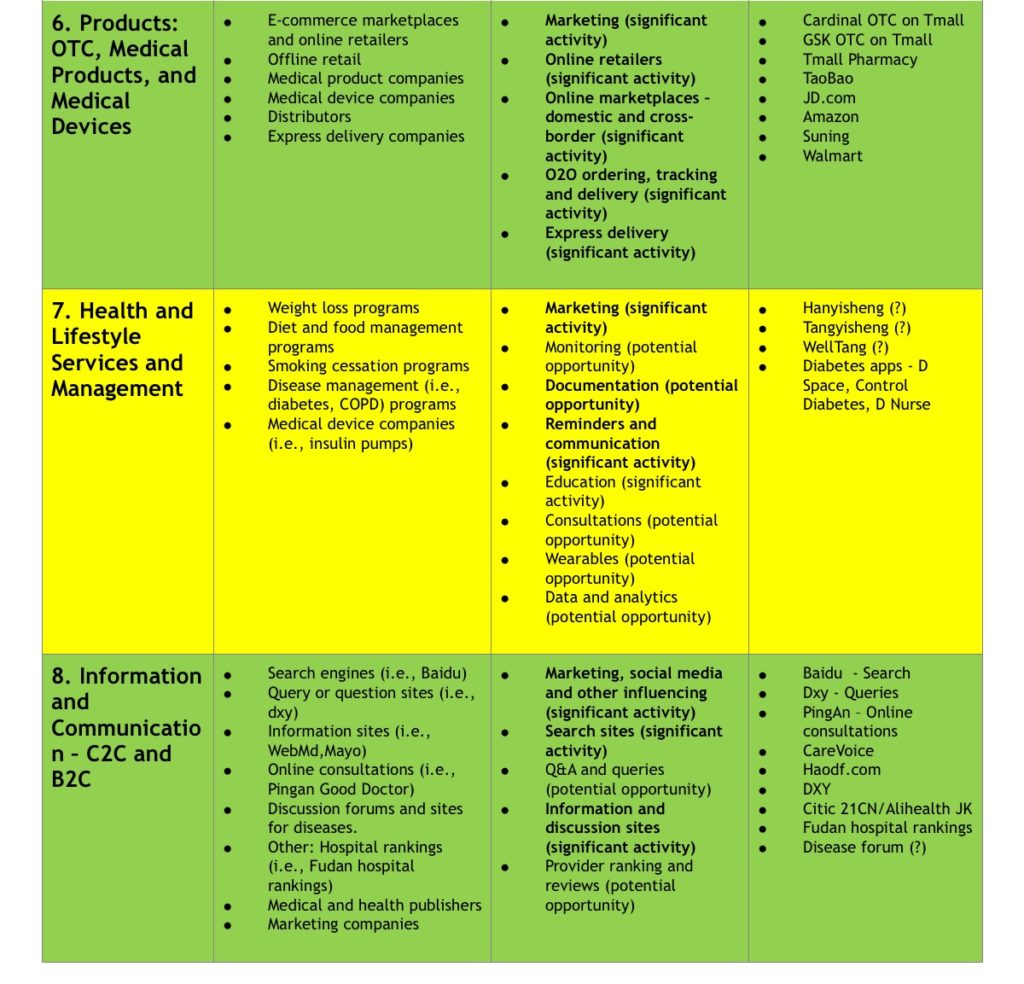

Look at consumer-facing digital health initiatives in China, we can see 8 major buckets of activity:

- Core clinical services

- Ancillary clinical services

- Insurance

- Government services and portals

- Prescription products

- OTC products, medical products and medical devices

- Health and lifestyle management and services

- Information and communication services

Below is a summary of where we are today. I think the China digital health world is currently about creating initial connections with consumers. That is the common theme so far for what has been happening. It is a lot about enabling communications and very basic transactions, such as making appointments and purchasing non-prescription products.

Based on the above chart, I think the most common activities today are now:

· Marketing to consumers (who are very reachable on their smartphones)

· Searching for health information

· Making appointments and mobile payments

· OTC e-commerce.

As that was a bit of theory, I have put four examples below of various initiatives from this space. I think they show some of the successes and struggles going on.

Example of a limited success in Core Clinical Services (#1)

The Wuhan Asian Heart Hospital has an Asian Heart mobile app, an Asian Heart Hospital official WeChat, and an Asian Heart Hospital official website for making online appointments. Through their apps, patients can make appointments up to 7 days in advance, select departments, select experts, and pay through Alipay or bank card registration fee. According to Dean Ye Hong, “At present, 20% of patients registered by the Asian Heart official website registration, 3000 people through the official WeChat booking appointment.”

I think this is a good example of enabling initial connections with patients in core clinical services. This sort of success is happening hospital by hospital, which is slow. These functions are also still pretty limited.

Examples of two compelling but still unrealized strategies in Insurance (#3)

I think health insurance is the mother of all potential opportunities in Chinese healthcare today. It is just a huge opportunity on the horizon. And PingAn’s Good Doctor app is arguably the most ambitious and sweeping of the mobile health initiatives. It is positioned as a complete one-stop O2O solution. They basically want to connect all the players and then offer insurance on top of this (probably a PBM to start). So Good Doctor wants to offer consumers (and corporates) family doctor consultations (both online and offline), access to offline specialists, registration services, online product purchases, health community forums and, in theory, tailored private insurance. It is basically a complete O2O platform between smartphones, healthcare delivery and healthcare financing. It hasn’t happened yet but if it does it will be amazing.

A compelling contrast to this is Zhong An. Launched in 2013 by Ping An, Tencent and Alibaba, Zhong An is China’s first purely digital insurer. It sells all its products and handles its claims online. In contrast to Ping An’s sweeping O2O platform, Zhong An sells small price insurance products that target specific pain points or consumer needs.

For example, in its first year of operations, Zhong An reportedly underwrote over 630 million insurance policies and serviced 150 million clients. And the products offered included consumer products such as flight cancellation insurance as well as health-related products such as Down’s Syndrome and dysaudia insurance. In the latter, over 30,000 mothers-to-be purchased this insurance in the first three months. It was sold purely through online channels, such as Tmall, and was marketed as something an expectant father would give as a gift.

Both of these plays in the insurance space are really compelling. But still not yet realized in a big way.

Example of a big potential win in Prescription E-commerce (#5)

Prescription e-commerce is one of the areas that is really poised to expand in the near future, depending on government regulations. The big Internet companies are very active in this space and basically waiting for approval. When that happens, I think this sector will happen fast.

AliHealth’s prescription mobile application, called Alijk, is a good example of the potential. The app enables bidding by local retail pharmacies for the fulfillment of prescriptions. Customers upload a photo of their prescription and then receive price bids from nearby pharmacies. Once the customer chooses which retailer they would like to use, they make the payment through Alibaba’s mobile payment system, AliPay. The medication is then delivered to their door. This service has been piloted in Hebei Province in cooperation with local governments. The prescription mobile application has reportedly resulted in prescription drugs sales 20% below average market prices. However, this seems still at the pilot stage.

Example of a big success in OTC e-commerce (#6)

This is a particularly active area, with companies like Alibaba and JD.com moving aggressively in e-commerce for over-the-counter products. And distributors and pharmaceutical companies are following them. For example, in January 2016, GSK launched an online pharmacy in Tmall, becoming the first multinational pharmaceutical company to operate a self-owned online pharmacy in China. The products available for sale in online pharmacies include OTC products and health supplements products. Similarly, Cardinal China launched an online pharmacy in Tmall. Both companies are basically creating direct-to-consumer channels and OTC products are a viable option for this today.

***

My take is that direct-to-consumer digital initiatives are succeeding in China because consumers want better care and are willing to pay. And smartphones make them reachable in this. So digital initiatives that are built on activity, revenue and data from consumers – and that can bypass the core clinical care system – are moving forward much more rapidly.

Of the above 8 sectors for consumer-facing digital activity in China, it is really Ancillary Clinical Services, OTC e-commerce and information / communication that are the most active today. But looking forward, I think it is Rx e-commerce that could really emerge quickly and in spectacular fashion. And insurance is perhaps the largest potential opportunity long-term. Both of these last two will depend heavily on long-awaited regulatory changes.

Thanks for reading, jeff

—-

I write and speak about “how rising Chinese consumers are disrupting global markets – with a special focus on digital China”.