I break competitive advantages into those on the demand-side and those on the cost / supply-side. Plus government-granted advantages. It results in a list of 15 types.

On the demand-side, everyone dreams of network effects. Especially for digital businesses. But these are actually quite rare.

On the cost and supply-side, companies talk a lot about economies of scale. These are common but are also uni-directional and exclusive. It is something a company can have over smaller rivals. So it is actually not available to all companies in an industry. Just those with scale over others.

But my favorite for digital businesses has long been switching costs.

- They are common.

- They are something that software is particularly good at.

- And they are non-exclusive. They are available to every company. Every company can try to lock-in their customers.

My standard example for switching costs is when your accountant tells you prices will be increasing 10% this year. You immediately weigh that 10% increase in price versus the “costs” of switching to another accountant.

- It would take time and effort to do the switch.

- A new accountant wouldn’t know your business and would have a learning curve.

- The new accountant may not be as good. That’s an uncertainty.

- The new accountant may make a mistake which could cost you significantly later. That’s a risk.

Switching can have a:

- Financial cost

- Time cost

- Hassle factor

- Uncertainty

- Real or perceived risks.

You weigh all that against a 10% price increase and say “ok” to the new price. The “cost”, both real and perceived, of switching is greater than 10%. Hence, it is a form of customer captivity and a competitive advantage.

Service businesses have long loved switching costs. And they take advantage of them in reasonable and sometimes unreasonable ways.

- Storage facilities offer low initial rates to get customers to move their stuff in. Then they raise the rates after 3 months because it is physically difficult to move stuff out. It’s a pain. People don’t like to do it and they stay at the higher prices.

- Health insurance companies like raise to annual renewal rates gradually but consistently, often 10-15% per year. Customers don’t like the hassle of finding a new plan and going through another medical screening. It’s amazing how consistently the “cost of medical care” in their studies increases by 10-15% per year.

- Accounting and software companies offer customized solutions, which make them harder to find and replace.

- Airlines and coffee shops offer miles and points, which means switching costs when you switch and lose accrued benefits. There are lots of switching costs in gamification.

Switching costs can be particularly effective in software. And in digital platforms like marketplaces and audience builders, where you can build them on both sides of the platform. Merchants and content creators invest time, activity, and capital as participants in these platforms. They often become dependent on the platforms for their customers, operations and data. They get locked in. Everyone talks about the addictive nature of social media on consumers, but often the most powerful demand-side competitive advantages are switching costs on the producer side of digital platforms.

***

Overall, switching costs and customer / user lock-in are a much simpler idea than share of the consumer mind or network effects. Although they have similarities to share of the consumer mind as a demand-side competitive advantage.

- Both are types of customer capture.

- Both can be achieved with different user groups on a platform, not just with customers.

- Both are non-exclusive competitive advantages. Competitors can both have share of the consumer mind. Competitors can also both have switching costs, although usually not with the same customer.

- Both require additional purchases or activity by users. There is no value to share of the consumer mind or switching costs if the customer is not doing repeat purchases or activity.

- Time is an important factor for creating both share of the consumer mind and switching costs. For switching costs, you have to think in terms of multiple rounds of competition, activity, and purchasing. For share of the consumer mind, this usually takes years to build.

That last point is important.

Ok, so why am I saying the future of switching costs is B2B?

Digital Consumers Don’t Like Switching Costs

One of my rules for digital has long been “give consumers exactly what they want.” If you don’t, somebody else will. And data technology is really good at identifying every little friction point and solving it. New companies are really good at finding any unmet consumer desire and offering that service. In an age of abundance, with limitless options for everything, you have to give consumers exactly what they want.

And that runs counter to the whole idea of switching costs.

By their definition, switching costs are contrary to the best interests of the consumers. If consumers can’t switch easily, they get annoyed. And they don’t like companies that make it hard to switch. Consumers want endless options and the ability to endless shop around. This is why when we look at digital companies, we only see soft, gentle switching costs on the consumer side, if at all. Netflix is a good example of this. Netflix is a subscription service. But the company makes it super-easy to pause your subscription at any time for any reason, with no cost. They could very easily have created switching costs.

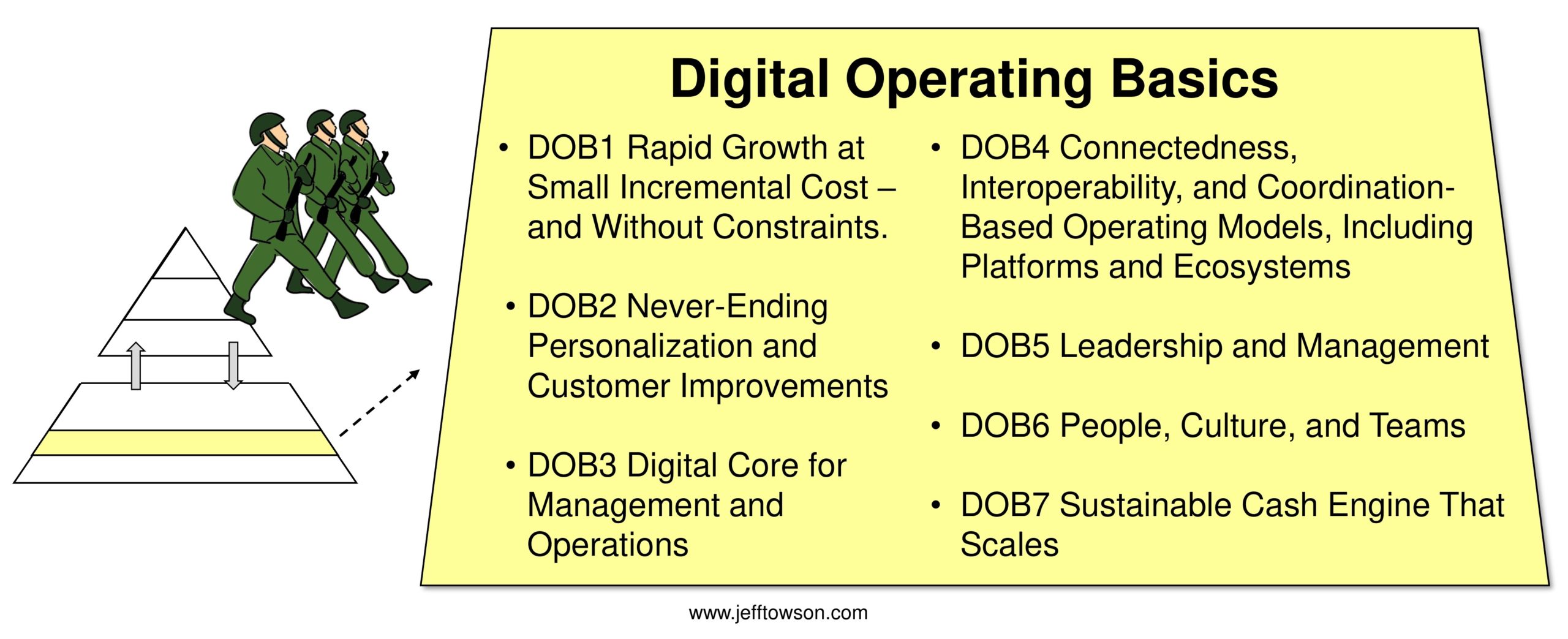

Think about the digital operating basics. One of the key operating ideas (DOB2) is never-ending, continuous innovation to improve the customer experience.

Think about Amazon. They always talk about how relentlessly they serve the customer.

Think about Coupang in South Korea. They talk about how they are in the business of creating “wow experiences” for their customers.

All the trend lines point in the same direction.

- Increased convenience.

- Improved service.

- Increased options.

All of those run counter to the idea of switching costs for consumers.

However…

B2B Customers and Other User Groups Accept Switching Costs

Auto and industrial companies have long had close partnerships with key suppliers. Enterprise clients have long used ERP systems with very high switching costs. Merchants are increasingly integrated with both platforms and partners.

Instead of the constant switching and shopping around we see by consumers, business customers are actually becoming more operationally and technologically integrated with their supply chains and partners. The digital operations of businesses are becoming increasingly connected. This increasing operational and technological integration naturally creates switching costs.

And when we look at digital platforms, we see lots of switching costs for non-consumer user groups.

- Merchants are locked into marketplaces like Alibaba because their customers, marketing and data are there.

- Content creators on YouTube are locked in because their audiences are there.

- Drivers on Didi are locked in because Didi finances their loans for their cars (and other stuff).

- Developers are locked-in to building on certain platforms like RedHat and Android.

As things continue to go digital, switching costs are increasing in B2B and on the non-consumer side of digital platforms. And consumers are becoming ever more fickle and resistant to any type of inconvenience (such as switching costs).

***

Ok. That is my main point for today.

I thought I would include a checklist for switching costs. The below checklist is mostly from Hamilton Helmer, author of the book 7 Powers. Plus some of my own stuff.

A Good Checklist for Switching Costs (mostly from Hamilton Helmer)

CA2: Financial Switching Costs

You can often calculate the direct financial costs of switching. Do you buy a new ERP system or pay the renewal fee? What is the upfront cost for buying a new copier for the office?

Direct financial costs can apply to both the core product and purchased complements. They can include:

- Contractual commitments. Are there compensatory damages? For example, breaking a lease for an apartment rental.

- Durable purchases. Switching can mean buying another piece of durable equipment, such as a big copier. However, the cost of replacing IT equipment tends to decline as the equipment ages.

- Specialized suppliers. The cost of a new supplier may rise over time if capabilities are hard to find or maintain.

CA2: Procedural Switching Costs

These are indirect costs, such as being unfamiliar with a new product or service. These can be retraining costs and the costs of changing routines and workflows within an organization. There is also the difficulty of removing and replacing existing operational and technological integration. The high interoperability of digital tools can make this especially significant.

- Brand specific training. The costs of learning a new system can include direct costs and lost productivity. These tend to rise over time.

- Information and databases. The cost of converting data to a new format tends to rise over time as the collection accumulates.

- Operational and digital integration. This includes customization.

- Loyalty programs and accumulated value. This is any lost accumulated benefits from current suppliers. Plus, the need to rebuild cumulative use.

CA2: Relational Switching Costs

B2B businesses can be a lot about personal relationships. You work with the same suppliers over time. You are all in the same industry. Your career paths keep intersecting. These types of professional relationships can be long-standing and important in your career. This a significant part of the reason McKinsey & Co gets repeat business from the same clients year after year. This is part of the reason people stay with their physicians for decades. The relationships matter.

Whether B2B or B2C, people are only rational cost-benefit calculators up to a point. Breaking relationships can be difficult. There is a familiarity, ease of communication and mutual positive feelings.

Customers can also have affection for products and services. People really like their iPhones. People love their Teslas. A product can become part of one’s identity and it can create a community of users. Think about the communities around certain video games. Switching a product can mean losing an identity and a community. The holy grail for a retention strategy in digital is the creation of a community.

CA2: Real and Perceived Risk or Uncertainty

As mentioned, switching to another unproven product can sometimes create larger risks for a company or individual. There can be larger problems. The risks of buying cheaper brakes for a truck is far larger than just the cost of the brakes. It’s just not worth it to switch, even if the risk and uncertainty are only perceived by the buyer. Don’t underestimate how aggressive some companies are in creating the perception of switching risks.

***

That’s it for today. Cheers, Jeff

——-

Related articles:

- How to Think About Web 3.0 Business Models (1 of 2) (Asia Tech Strategy – Daily Article)

- Platform-Protocol Hybrids and Why DeFi is the Center of Web 3.0 (2 of 2) (Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- CA2: Switching Costs

- Competitive Advantages

From the Company Library, companies for this article are:

- n/a

——-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.