- HubSpot has done well as a small, specialized enterprise software company. In spite of the giants nearby.

- But enterprise software is going to be transformed with the rise of intelligent capabilities. CRM within businesses is changing. And so are the SaaS companies that service them.

- HubSpot may be sub-scale and under-resourced for this new fight.

***

In Part 1 and Part 2, I went through the HubSpot business model. Which I think is really impressive. It’s a:

- Digital bundle with recurring revenue

- Offering freemium tiers

- With big switching costs.

- That gets you:

- Gross Margin of 84%

- 103-115% net revenue retention over the past three years

- Big negative working capital

There are lots of good digital lessons in the HubSpot business model. Particularly its increasing customer data and knowledge and its sales and marketing flywheel.

However…

- It is still a relatively small business competing with enterprise software giants. It may be subscale.

- Generative AI is going to disrupt CRM software. HubSpot may lack the resources (capital, expertise, etc.0 to compete against the giants and/or the aggressive new entrants in this expensive “free for all”.

That said. I have 3 questions for HubSpot going forward.

Question 1: Who is the Cheetah in GenAI-Powered CRM?

“Who is the Cheetah?” is one of my standard checklist questions.

In the savannah, cheetahs are super-specialized for acceleration. Their collarbones don’t connect with their rib cages and spines (so they can hyper-extend while running). Their claws function like cleats. They are small and thin, so they are faster.

The net result of this super-specialization is they can catch the springboks and other fast prey that other big cats (lions, jaguars, tigers) cannot. But they have given up a lot of the strengths of big cats to do achieve this.

I like businesses that are super-specialized in one specific dimension (like cheetahs). For example, Costco is super-specialized in being low cost. Every aspect of their business model and operations are about getting costs down and then passing those on to consumers. And it’s not just about focusing on this as the top priority. It’s also about giving up lots of other capabilities to do this. For example:

- Costco stores are located outside of town. That makes them cheaper but also means they have far less visibility and local traffic that other retailers.

- They limit the number of items they sell in each product type. Usually to 2-3. That gives them more negotiating power with suppliers and therefore lower prices. But it also means offering consumers less selection (which they don’t like).

- Costco makes their money on membership fees. They are not as focused on sales margins as other retailers.

So, what is the key activity in CRM software that really matters? Who is the cheetah in this business?

I think the key activity is actually sales and marketing.

That is the key activity that really matters. And is where you want to super-specialize.

It’s not in creating lots of software. Or doing lots of groundbreaking R&D. CRM software is not particularly unique. And it doesn’t advance that fast. Having good software services is of course important.

But the key activity is marketing, sales and getting that software installed in (and locked into) businesses.

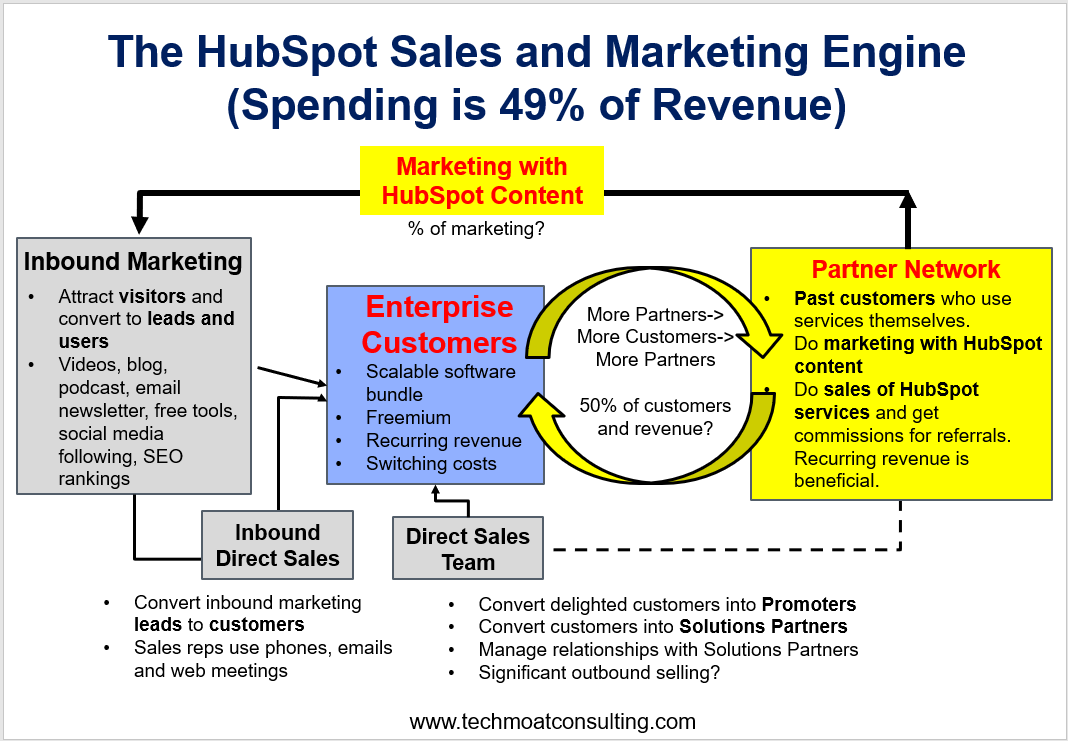

And HubSpot is actually quite specialized in this activity. It has a business model that is specialized to do this for small and medium businesses, which are far more difficult to sell to. That’s the flywheel and inbound marketing activities I described in Part 2.

You can see their specialization in their business model and operations. And in their big spending on Sales and Marketing, which was 49% of revenue in 2023. Note: They are not spending 49% of revenue on R&D.

Going through HubSpot, I immediately started to think “cheetah”.

However…

That is for CRM software. But generative AI is different than traditional software. It has different capabilities. It has a different tech stack. And it may completely change how businesses operate.

That’s my big question. Who is the cheetah in GenAI-Powered CRM?

I think we are moving from a business where it was mostly about selling and getting adoption of standard software products to a period of creating entirely new enterprise software services and capabilities. And ultimately about changing how businesses do sales, marketing and customer CRM.

On one of “All In Podcasts”, there was an interesting comment that the SaaS business model may end up being a short-term solution. That might end up being a half-step between traditional business (think 1980-2000) and businesses with intelligent capabilities (+2030).

This worries me for HubSpot. I think product design and R&D in intelligence tech may be emerging as the key activity to super-specialize in. Not sales and marketing. Keep in mind, all of this business strategy stuff is secondary to having a winning product that customers want.

Question 2: Is HubSpot Subscale and Under Resourced to Fight the Enterprise Giants?

I did a series of articles on how to survive and maybe thrive as a smaller specialty player against the ecommerce giants. Think Etsy vs. Amazon.

And I came up with the following 5 questions (thus far) for assessing the viability of a specialty enterprise company against much larger rivals.

- Is the company sufficiently differentiated in the user experience?

- Can the company compete and/or differentiate in sales, marketing or R&D without ongoing spending?

- Does the company have a strong competitive advantage in a circumscribed market?

- Is there a clear path to significant operational cash flow?

- Has the company avoided markets and situations that are attractive or strategic for the major enterprise companies?

- Addendum: Don’t overestimate first mover, virality or growth hacks.

Here’s how I think about this as a strategy question.

Specialty enterprise software is different than specialty ecommerce, but the situation is pretty similar.

For HubSpot, Questions 1 and 3 are pretty solid. They have a differentiated product and strong competitive advantages. But Questions 2 and 5 worry me.

Question 2: Can the company compete and/or differentiate in sales, marketing or R&D without ongoing spending?

As a smaller player, you don’t want to be stuck in a long-term spending war with the bigger players. For HubSpot, the answer to this before was yes. They spend a lot in Sales and Marketing, but not a huge amount in R&D or other infrastructure (like logistics).

But with a major tech change happening, the answer is now no. They are going to have to spend big (or partner) to build entirely new tech capabilities. And this is going to go on for a long time.

That’s bad.

Question 5: Has HubSpot avoided markets and situations that are attractive or strategic for the major enterprise software companies?

Sort of. CRM is a high priority for all these companies. Customer interactions are ground zero for value add to businesses. And customer information and knowledge is also a key system of record.

But HubSpot has focused on CRM for small and medium companies, which have not been a priority for Salesforce, Microsoft and the other giants. Thus far. That’s good.

But this could change at any time. That worries me.

HubSpot Has Serious Competitive Threats on the Horizon

That’s really the issue.

When you are a smaller specialty player, you always have to watch what the giants are doing. They may not be after your space today, but they could easily step in. That’s why I like smaller digital businesses to be in strange, small niches. Something completely off the strategy path of the big boys like Microsoft, Oracle, and SAP.

There are also lots of point solutions in other enterprise specialties, such as Zendesk.

Plus, there open-source and in-house solutions that businesses can adopt.

Any of these could impact HubSpot’s market share. But even if they can’t steal clients, they can create lots of price pressure. They can force HubSpot to keep prices low. They can shorten the typical subscription length.

Basically, having serious competitors at your gate can keep you in a defensive posture. Where you must always keep its prices low, and your sales and marketing spend high. Raising prices or decreasing sales spending can draw a competitive attack.

This is something I wrote about with Didi in China. They have a powerful competitive position in ridesharing in China. But there are other digital giants very close by (Meituan, Alibaba). And they have made attempts to enter their space. This has kept Didi in a defensive posture where it is difficult to raise prices or decrease marketing spend (especially drive subsidies) without risk. This (and other things) have made it difficult for Didi to get to profitability, despite having dominant market share.

I worry about this more for HubSpot, because of Question 5 above.

Customer interactions and intelligence are an area of strategic importance to the big enterprise companies. These giants may not try to capture really small businesses (10 employees), but they could target 500-2000 person companies. And that could shift the customer mix of HubSpot easily.

This is one of my standing questions for HubSpot.

- What is their customer mix (micro, small vs. medium clients)?

- What is the difference in the profitability of these segments?

- Has the mix been changing over time?

Overall, HubSpot may be subscale and under-resourced in the fight for GenAI-powered CRM.

It’s hard to live between the feet of giants. HubSpot might be too small of an animal for the coming fight. The big players have more revenues, more clients, and more resources. It’s easy to attack in enterprise software when interoperations are so important.

HubSpot may not have the capital, staff and tech capabilities to go head-to-head with Salesforce and others in a big new technology investment fight.

Question 3: Does HubSpot Control Its Destiny?

This is one of my favorite checklist questions. It’s from value investor Thomas Russo.

This question distills all these competitive factors.

- Are you charting your own course as a business?

- Or are you mostly having to respond to moves by competitors and customers?

For example, Starbucks doesn’t worry at all about GenAI, tech and competitors. It just does its own thing. It really does control its destiny. So does Amazon. So does Coca-Cola.

Here are some of my questions here:

- Do this business have to keep adding new products to stay competitive? For example, supermarkets have to offer almost everything. They have a huge list of services and products.

- Is the business highly dependent on external factors like the weather? Like agriculture.

- Is this business subject to external factors like government regulations? Does it need government support? Contracts? Subsidies?

- Is this business subject to changing customer preferences and behavior? Like in fashions.

- Is the business dependent on R&D investment and constant product advances?

- Does the business have to make bet-the-company decisions? When Boeing planes launches a new plane, it basically has to be the entire business on its success.

- Does company have to spend like crazy just to stay in place? Note: Warren Buffett hates these types of businesses.

Reading those questions, I think HubSpot has had a degree of control over its destiny as a CRM software / SaaS business. But I think the tech changes happening are going to take this away.

Conclusions

- HubSpot has done well as a small, specialized enterprise software company. In spite of the giants nearby.

- Its main weapon has been specializing in Sales and Marketing to small and medium businesses.

- But enterprise software is going to be transformed with the rise of intelligent capabilities. CRM within businesses is changing. And so are the SaaS companies that service them.

- HubSpot may be sub-scale and under-resourced for this new fight. It may be specialized in the wrong activity. And it is probably losing a lot of the control of its destiny.

That’s it.

Thanks for reading, Jeff

- I Love the HubStop Business Model. But Not the One They Describe. (1 of 3) (Tech Strategy)

- HubSpot’s Big Weapon Is its Solutions Partners and “Sales and Marketing Flywheel” (2 of 3) (Tech Strategy)

———

Related articles:

- A Digital Strategy Breakdown of Salesforce. Spoiler: It’s Awesome (1 of 3) (Tech Strategy – Daily Article)

- Is GenAI Disrupting Salesforce? The Rise of Intelligent CRM? (Tech Strategy – Podcast 215)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- SaaS

- Enterprise B2B: CRM

- Enterprise B2B: Specialty

- Cheetah

From the Company Library, companies for this article are:

- HubSpot

Photo by Pavan Kumar on Unsplash

Graphic by AI

——-–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.