I recently did a podcast on Horizon Robotics, which is a pretty cool (and public) autonomous driving solutions provider in China. It sits at the intersection of Chinese manufacturing scale and China’s rapidly advancing AI capabilities. That’s kind of a big deal in the world.

I’m struggling to figure out:

- How you win in autonomous vehicles (AV)? Really, in AI plus Robotics? What competitive advantages can you capture here?

- How does open-source change this? Open-source AI is a big disruptor.

This article has my thinking so far. I think the concepts that matter are:

- Manufacturing Scale

- R&D Scale

- Brainpower behemoth

- Ecosystem building with developers. And how this can create operating systems and innovation platforms. Think Huawei HarmonyOS and DeepSeek.

- Open Source. Think DeepSeek and Qwen. Not Baidu Ernie.

But first, let’s go through Horizon. I view it as a combination of hardware and AI. Plus, open source.

An Introduction to Horizon Robotics

Horizon Robotics is in the smart driving solutions business. They are selling hardware plus software solutions to the makers of passenger vehicles (and their Tier 1 suppliers). I view them as the selling the brains that make cars autonomous. And their core product (launched in 2016) is actually named the Brain Processing Unit (BPU).

This Beijing-based company was founded in 2015 by Yu Kai and some other former Baidu employees. Yu Kai previously led Baidu’s self-driving car division.

And the Horizon HQ is in the northwestern Haidian region of Beijing. Basically 10 minutes away from the Baidu headquarters.

Horizon went public in Hong Kong in late 2024 and is listed as an AI and semiconductor business. Its chips can be also used in smartphones and surveillance cameras but it is really in the auto business.

In October 2022, Volkswagen Group invested $2.3 billion to establish a joint venture with Horizon named Carizon. This created an in-house capability for vehicle software for Volkswagen. That’s a big part of the current situation at Horizon.

What’s compelling about Horizon’s solutions is they are doing the full tech stack. They do the algorithms, the processing, and the semiconductors as well. They offer fully integrated solutions for both driver assistance (ADAS) and autonomous driving (AD).

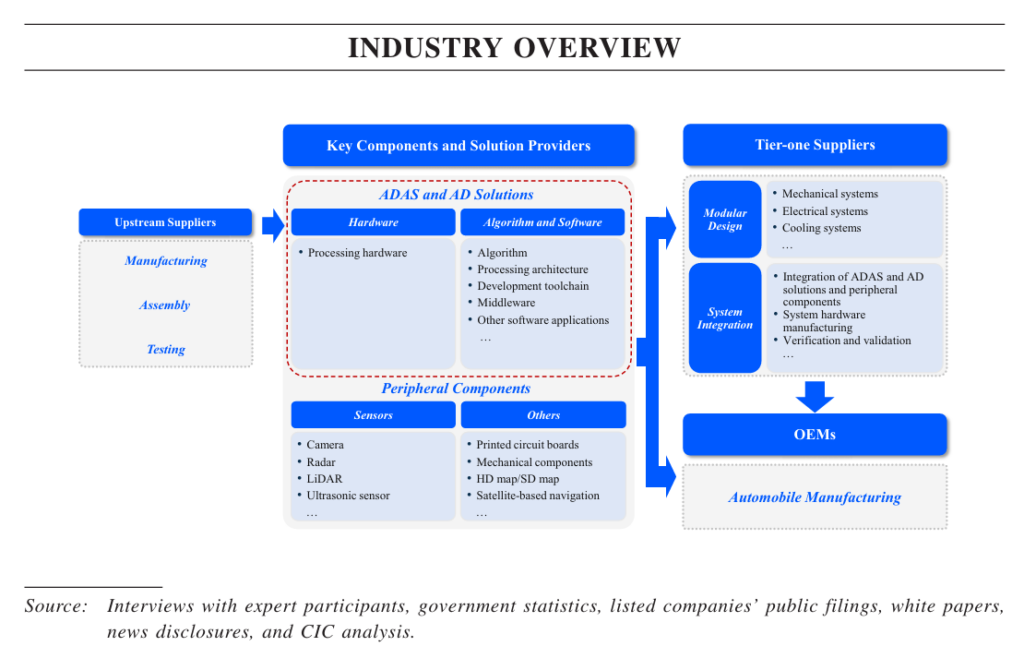

From their annual report, here is their position in the industry.

They offer 3 main solutions:

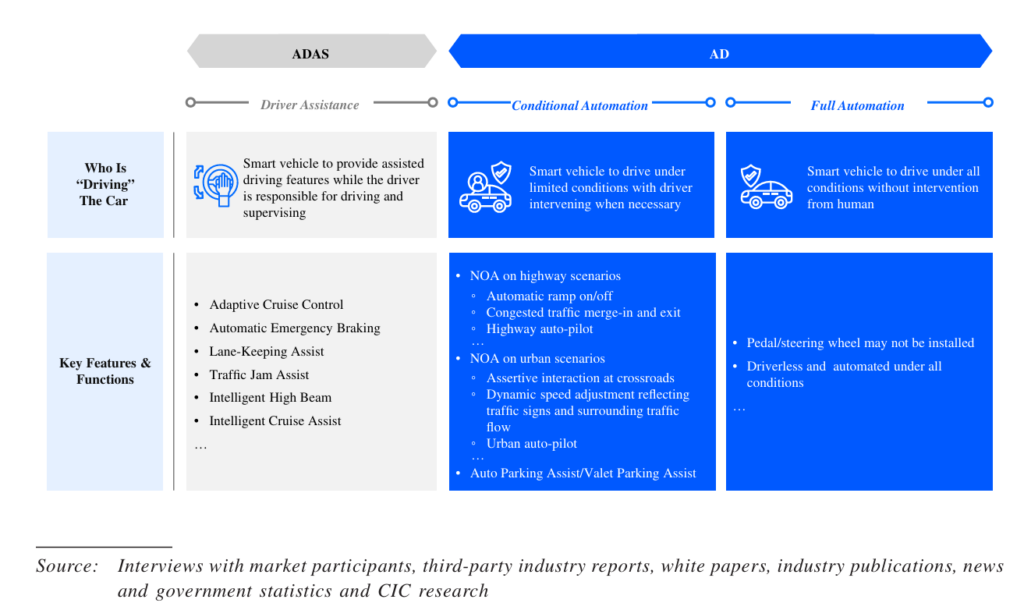

Horizon Mono is their ADAS solution, which is mostly about adding safety features that help drivers. This was launched in 2019 and went into mass production in 2021. You can see the main features of Mono in the grey column below. It includes Adaptive Cruise Control, Automatic Emergency Braking, Lane-Keeping Assist, etc. In terms of tech, Mono uses their Journey 2 and Journey 3 processing and hardware.

Horizon Pilot is their highway autopilot solution. Plus, it has some parking features.

Horizon Pilot has automotive on/off ramp, autonomous merge in and exit, automated lane change, highway autopilot and advanced parking (auto parking assist). It uses their Journey 3 and Journey 5 hardware. It was launched in 2021 and went into mass production in 2022.

Finally, they have Horizon SuperDrive, which is their cutting-edge AD. This includes autonomous driving for urban, highway and parking. And it uses Journey 2026. It is expected in 2026.

Here’s how their 3 solutions line up with their AI Tech Stack.

Note the semiconductors, BPU (processing architecture), and algorithms. That’s expected. But also pay attention to:

- Horizon OpenExplorer. That’s their algorithm development toolkit. And their ready-to-use modules and reference algorithms.

- Horizon TogetheROS. That’s middleware.

- Horizon AIDI. That’s their software development platform. For automatic iterative model improvement.

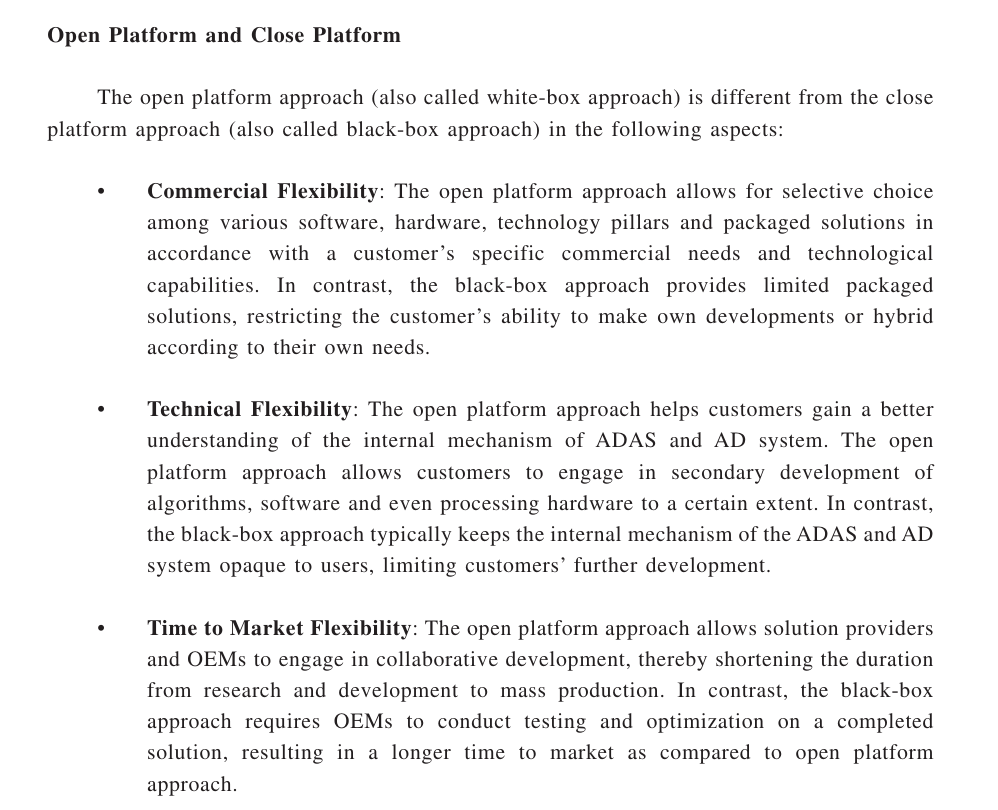

You can see they are trying to create an entire ecosystem around their hardware and software. And they are leaning into a more open platform for their OEM and Tier 1 clients. They’re giving them tools and libraries to build upon and customize. That is a very different approach than Tesla.

Adoption in China is Horizon’s Big Selling Point

Adoption is Horizon’s strongest story. They are getting adoption at automakers across China and claim to be the market leader. Here is how they present it. Note how they offer flexible and scalable solutions.

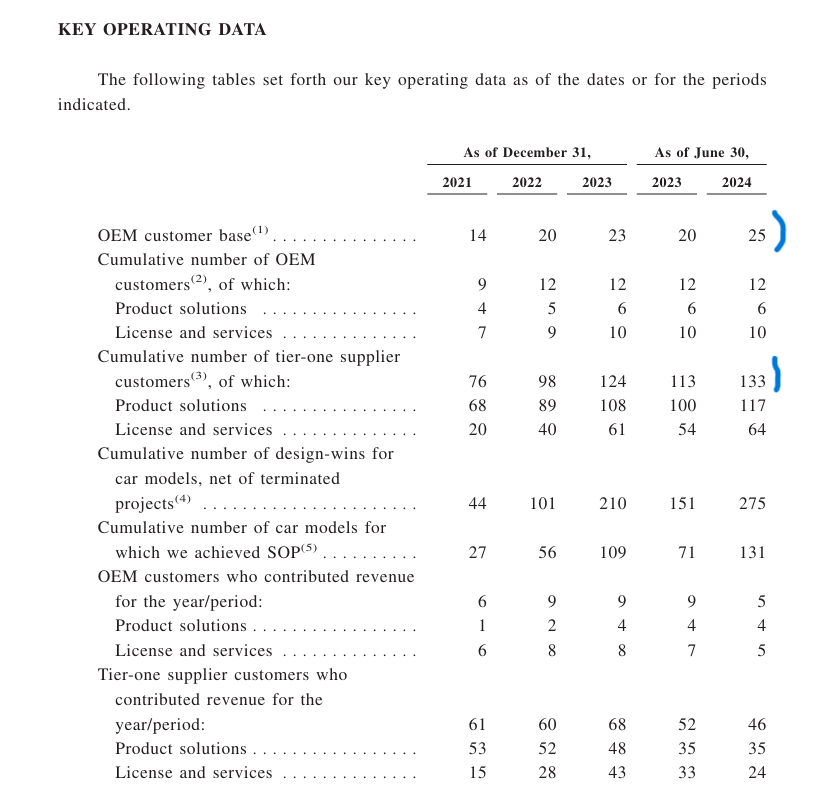

Here are the adoption numbers.

The key numbers are the 24 OEM customers. And the 133 tier one supplier customers. If you’re trying to become the standard and build an ecosystem, this is important.

However, this is not the same thing as big revenue.

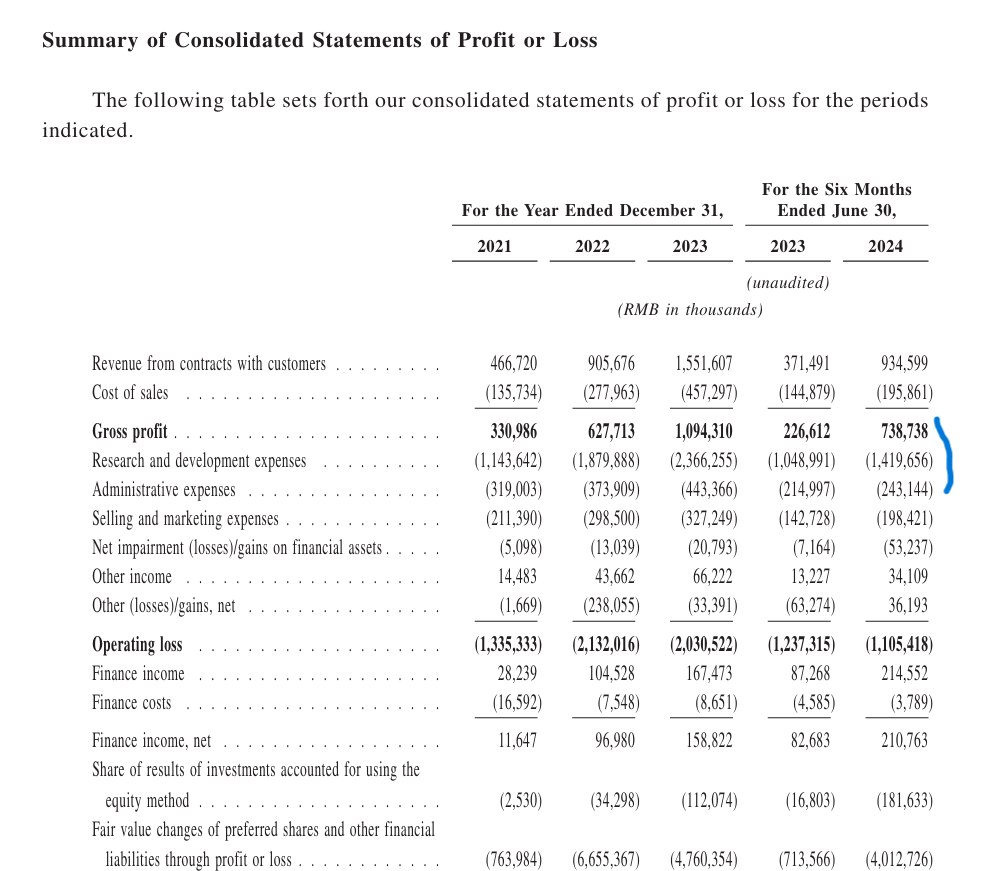

Horizon’s Financials Are Not Good Today. But This Is Expected.

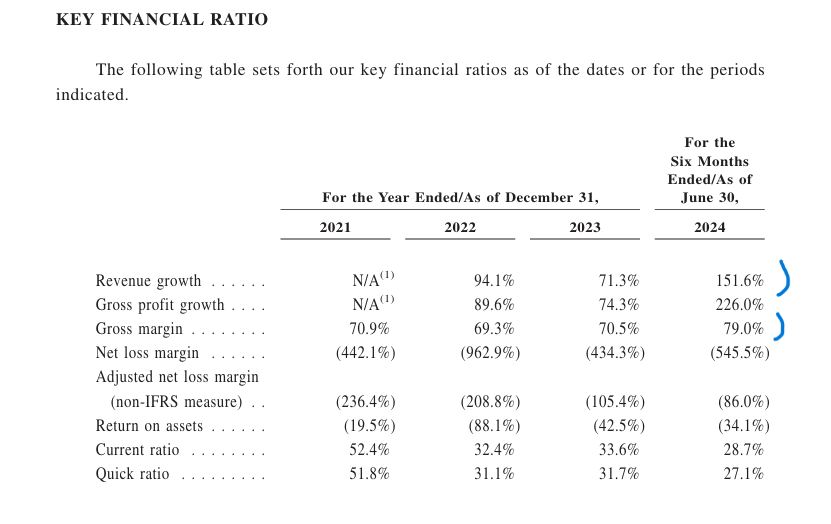

Yes, the revenue growth and gross profit look good. And it’s what you would hope to see in a semiconductor company. Revenue is growing at +100% and Gross Profits are 70-80%.

But 77% of their revenue is from 5 customers. For all the talk about adoption and market leadership, this is still a very small client base. And 1 customer is 37% of their revenue.

And the R&D and other spending dwarf the revenue today. R&D is almost 50% more than total revenue.

This is not a surprise for an emerging technology. But it means a lot of investing today for returns (maybe) in the future.

Ok. That’s the basics of Horizon.

Let’s get into the business thinking here.

Horizon is Well Positioned in a Highly Differentiated AI Space

I like Horizon’s industry position. AD and ADAS are specialized niches in AI solutions. And I business that build dominance in highly specialized use cases.

Think about how different AI for autonomous driving is.

First, driving is just a strange activity. It’s high-speed navigation in a rapidly changing environment. It’s nothing like text or image generation, which is more generalized AI.

Second, driving is edge computing. There is no time for cloud connectivity. It requires edge computing with very low latency. And with high processing capacity. There is a ton of data coming into the car from visual and other sensors.

Third, driving solutions need to be appropriate for mass production. OEMs need to be able to install these solutions in the design phase and then ramp them up to large scale production. That means these solutions need low energy consumption and to be affordable at large scale.

Fourth, it has Warren Buffett type B2B criticality. I have previously written about Buffett’s investments in businesses like Wabco, which makes braking systems for large trucks. They are critical for safety and that makes Wabco a critical supplier for large truck OEMs. That’s an attractive position to be in. And Buffett has frequently invested in such companies.

You want to be the B2B supplier that has the critical component. That supplies the brakes in trucks. Or the airframes to aircraft manufacturers. Or the sealants to factories.

You want to provide a component that can impact the entire product. And ideally, where it is a small percent of the overall cost. In these situations, it is never worth it for the buyer to go a cheaper alternative. It’s too much risk for no real cost savings. I did a podcast on these types of businesses here:

Horizon is somewhat in this situation. If an OEM is comfortable using Horizon’s AD solutions, why would they take the risk and switch to another supplier? What if the cars start crashing?

Finally, AD and ADAS require high-performance AI. This is not like GenAI for creating articles and logos, where it’s ok if half of them suck. AI for high-speed navigation can’t make mistakes. It needs to be high performance. All the time.

Based on these factors, I really like where Horizon is positioned as a business.

What Are Horizon’s Competitive Advantages?

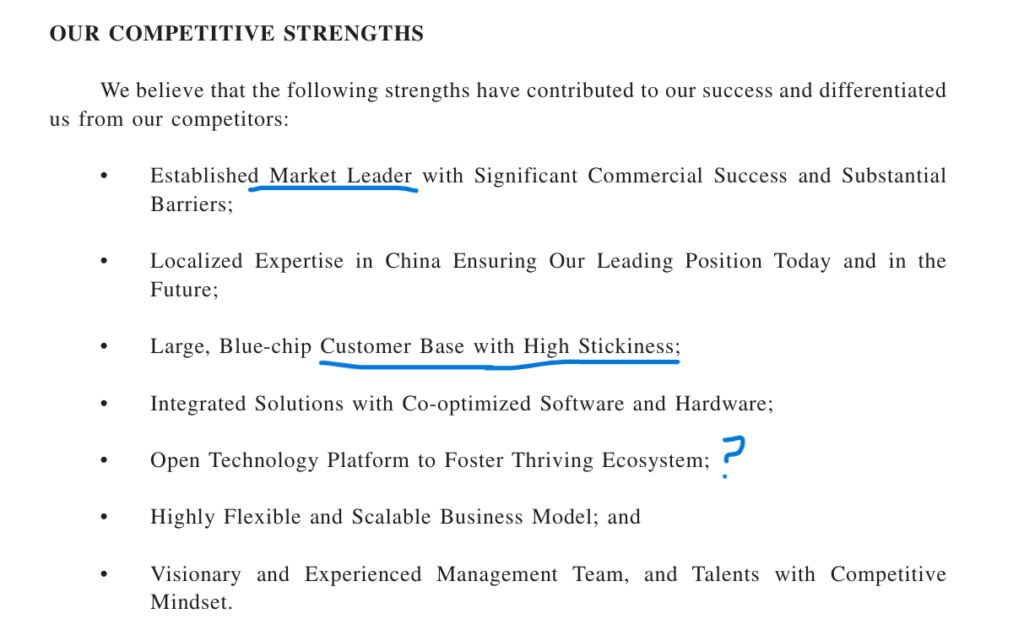

Here is how Horizon describes its competitive strengths.

Those are all good. But I don’t consider most competitive advantages. They are mostly operating activities. I’ve marked the ones I like.

- They are the market leader. This matters if you are getting integrated into the design and production phase of automakers.

- They have a growing customer base with ‘high stickiness’.

Here’s how I describe their competitive advantages:

- Economies of scale in a specialized technology. This is great. I like to see companies like Adobe and Apple that are dramatically outspending their rivals in R&D in a specialized activity. The more specialized the better. WABCO spends more on braking systems than any other company. And have been doing so for over a hundred years. You want to dominate a specialty. And then outspend rivals in something unique.

- Switching costs. Horizon is building in switching costs with its B2B buyers based on technological integration, operational integration AND perceived risk. The tech integration happens all throughout the vehicles as the brain controls the car. The operational integration happens as Horizon works closely with buyers in the design and production of vehicles. The risk part is the fear of switching to another supplier and having a major problem (criticality).

- A machine learning flywheel? As the Horizon systems get more usage on the roads, there is a feedback mechanism that will make the machine learning for driving better. This type of operating flywheel is the strategy that Baidu is banking on. However, that is not the same thing as a competitive advantage. It’s mostly an operating advantage. But it may end up being a competitive advantage in time. We’ll see.

- A developer ecosystem? Horizon is providing toolkits to OEMs, developers and AI model builders. This ecosystem approach could create a standardization network effect. We could see this happen with developers or at lower levels of Horizon’s AI tech stack. Unclear. We’ll see.

Overall, it’s attractive. We can see 2 clear competitive advantages being built. And maybe 1-2 more.

Horizon’s Growth Plan Is Solid

Horizon is focused on growth, not profits. And they have a pretty clear plan for this.

- Invest big in technology. Very important.

- Get more client production contracts. Add clients and get more of their cars on the roads learning.

- Expand their portfolio of products.

- Ride the AD industry secular trend.

- Build an ecosystem as much as possible.

- Maybe go international?

That’s a solid plan.

Final Question: How Does Open Source vs. Closed Source Impact This?

This is the question I have been struggling with.

Across the GenAI businesses (DeepSeek, Baidu, Alibaba, OpenAI, Google, Microsoft), we see a debate about open vs. closed source. Open source definitely gets you faster development. But closed source gets you profits (somewhat).

It’s unclear how this is going to play out (to me) in GenAI. And in AI plus robotics (i.e., Avs).

I’ve been going through the history of this question. Here my working list.

- Open and closed source have a long history in enterprise operating systems. Businesses have been using both RedHat and Microsoft for decades. They have co-existed quite well. Both have been profitable. In this space:

- Microsoft has an innovation platform with big two-sided network effects and profits.

- RedHat has been dominant for +30 years with mostly standardization network effects.

- Open and closed source exist in mobile operating systems, but within a single company. Android and Google Play have co-existed but within Google.

- Android is open source but not profitable. It has standardization network effects.

- Google Play is closed and very profitable. Another innovation platform with indirect network effects.

- Web3 was supposed to give ownership and profits to developers in an open-source world. Web3 was finally going to solve the financing problem of open source (no more donations). In theory, this could be a powerful form of network effects. But it hasn’t happened.

- Open source appears to be dominating in GenAI foundation models (mostly). DeepSeek, Qwen, Huawei, Llama and others are growing fast. This has given closed source models like OpenAI and Microsoft pause.

- Developers and companies really like the open-source foundation models. And Chinese AI firms are definitely pushing in this direction.

- OpenAI and Microsoft are going closed source plus open source. And maximizing profits.

- The big question is does the feedback loop in algorithm learning become a sustainable advantage? Or will these foundation models just become free commodities?

Which brings me back to Horizon.

I think AVs are probably going to be more closed source. The integration of hardware and software make it more likely.

Plus, I think there are real competitive advantages we will see in Avs that we won’t see in most robotics (personal home robots, cleaning robots, etc.).

Here is how Horizon describes it:

We’ll see. I think it’s an important question. I don’t have a solid answer yet.

Cheers, Jeff

——-

Related articles:

- BYD Is Going for Global EV Leadership (1 of 2) (Tech Strategy – Daily Article)

- A Breakdown of the Verisign Business Model (2 of 2) (Tech Strategy – Daily Article)

- 3 Factors Will Determine the Future of Verisign Inc. (Tech Strategy – Podcast 191)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Ecosystems of Developers vs. Open Source

- Real-world AI

- Autonomous Vehicles

- Robotics

From the Company Library, companies for this article are:

- Horizon Robotics

——

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.