JD has been making some interesting strategy moves. Particularly in its low-price strategy and its internationalization of logistics. And these are part of its 20-year vision plan, which was outlined in 2023. In Part 1, I summarized this plan, which is called the “35711 Vision”.

Honestly, that’s kind of hard to remember. But here’s what 35711 stands for:

- The 3 is JD’s goal of establishing 3 businesses with over 1T RMB in revenue (and 70B RMB in net profits).

- The 5 is JD’s goal of having 5 businesses on the Fortune Global 500 list.

- The 7 is JD’s goal of having 7 publicly listed businesses that started from zero and achieved a market value of 100B RMB.

- The 11 stands for goals in taxes and jobs.

So, the 35711 vision is about long-term growth. These are financial metrics for size. JD is focused on getting a lot bigger.

I re-wrote their 20-year vision as “215”. And the key terms for their strategy going forward are “core engine”, “revenue adjacency”, and “explore and exploit”.

- Grow and adapt their 2 core engines to 1T RMB in revenue each.

- They need both growth and adaptation of their core businesses. Both are important.

- We already know that one of the core engines of JD is domestic ecommerce. The other likely candidate is international logistics. Think JD’s version of DHL.

- Capture 1 revenue adjacency and create a third core engine – also with 1T RMB in revenue.

- JD is going to have to build another core business that drives the company. And that likely means capturing a large revenue opportunity adjacent to their current businesses. That could be cloud. Or AI services, likely starting with merchant services.

- Explore and exploit opportunities to create 5 medium sized businesses.

- To get 5 new businesses that are on the Fortune 500 list, they are going to have to make lots of bets. It’s going to take systematic experimentation.

- First, they have to make lots of small investments (i.e., explore) and see which get product market fit and growth. This can be done internally or by M&A.

- Then they fuel the winners’ growth and cull (i.e., close) the losers. That is the exploit phase.

- This needs to be done systematically. That’s the key. It’s like running an investment firm.

That’s my interpretation of their new strategy longer-term.

But what does it mean in the short term?

At the 20-year celebratory event in 2023, Sandy Xu, now CEO of JD.com, said they are focusing on three things:

- The development of lower-tier markets for domestic ecommerce.

- Advancements in technology and services.

- The expansion of their international business. Which is logistics.

I wrote about JD’s lower-tier markets / low-price strategy in Part 2. I want to go into that some more. And in Part 3, I’ll go through their international logistics business.

JD’s Low-Price Strategy Depends Both on their Marketplace and Technology

Their low-price strategy is really the biggest thing JD is doing right now. They have 588M active users (in China). And 35M of them are JD Plus members (very important). But:

- To grow bigger domestically, they have to go to lower tier markets. That means offering lower priced goods. Think 4th and 5th tier cities.

- It’s a competitive requirement. Competitors with lower priced goods are their biggest competitive threats. Think Pinduoduo. Think Taobao moving down market.

JD’s domestic ecommerce business is great. Like Amazon, its retail plus a marketplace. They refer to this as their first party (1P) and third party (3P) businesses.

Here’s how JD describes it:

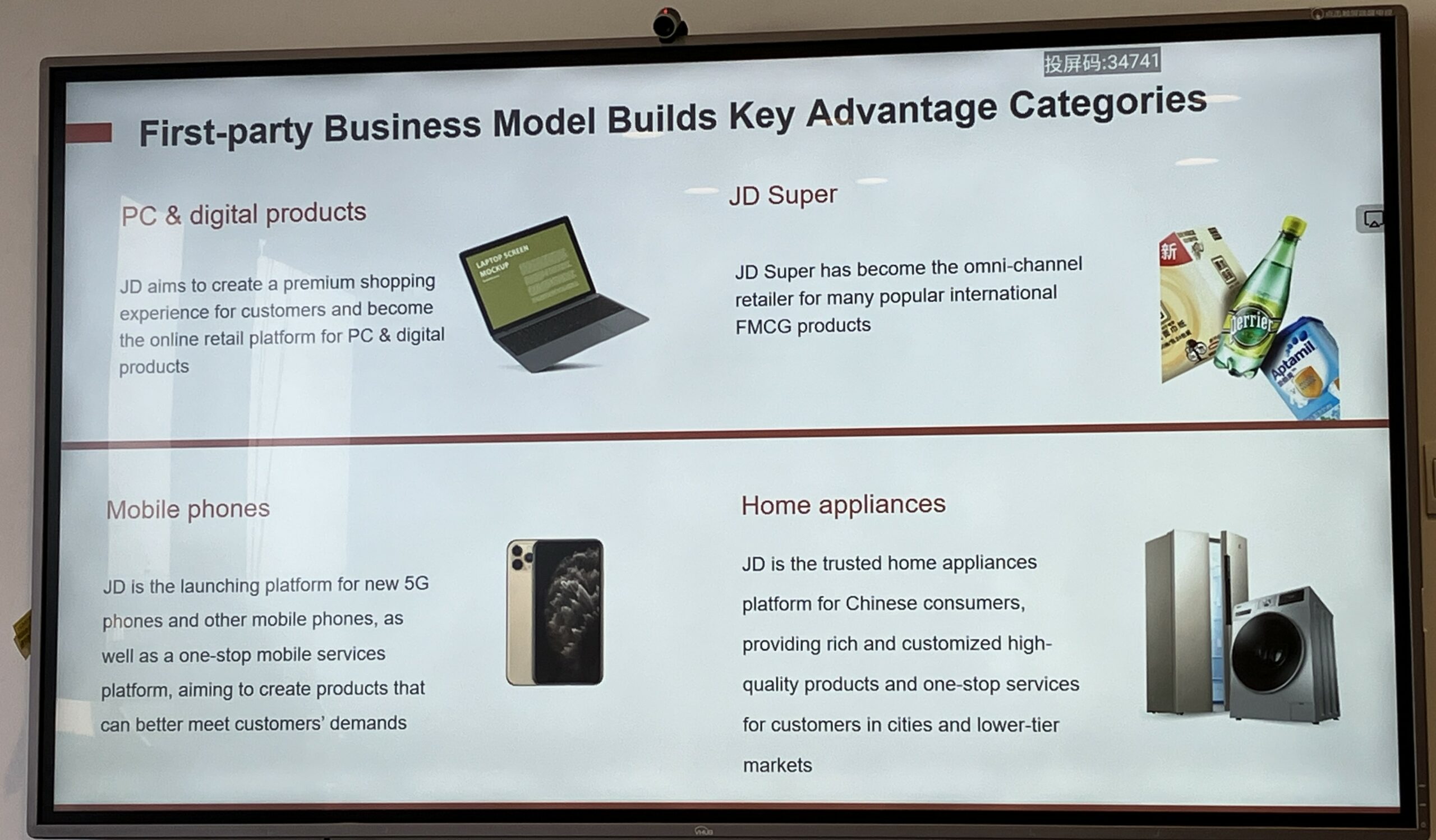

These are pretty good summaries. Their 1P business shows their traditional strengths, which are quality products, good service (especially in delivery) and good prices. And the 1P has historically centered on smartphones, consumer electronics, and appliances.

They added a marketplace (3P) business to expand their product selection. And to offer a greater range of merchant services. Everything from beauty products to home furnishings.

So, it’s not surprising that they are using their marketplace to expand into lower-priced goods. That is the big lever they are pulling to enter the lower tier markets. They are dramatically increasing their product offerings and offering lower priced (i.e., affordable) goods.

To do this, they are adding more and different types of merchants to their marketplace. They are bringing an entirely new class of merchants on the platform. And JD has launched at least two initiatives specifically to encourage small merchants, college students, entrepreneurs, and lots of others to start selling on the platform.

That was pretty much my explanation in Part 2. But I really missed some things.

For the Chinese middle class (their core customers), it’s still about offering better and better products and services. That is their traditional strategy. To keep increasing the quality of the products and services. As mentioned, this is mostly done through their 1st person retail business.

At the same time, they need to appeal to more price-sensitive consumers. As mentioned, they are relying more on their 3p business for this. And this requires:

- Increasing the product selection. Using new merchants. As mentioned.

- Adjusting the search recommendations. They want a new customer base to see the lower-priced goods. But they don’t want their core customers to necessarily have their goods recommended to them.

- And they don’t want anyone to get recommended low-quality goods. Offering quality goods is still the core of the business. Keep in mind, there are only 300k merchants on JD (roughly).

- At the same time, they want to educate these customers about quality goods. And about big price ticket goods. Such as home appliances. They want to move them upmarket over time.

All this requires lots of big data and AI matching. The search recommendations are crucial to their low-price strategy. JD needs to use AI and big data to effectively capture the high and low markets with one brand. They are changing both the IT and merchant mix.

That’s how I view their current big strategy move.

However…

This Is Not Really New. JD Has Always Focused on Low Prices.

This is not as big a strategy shift as it seems. JD has always focused on:

- Product

- Service

- Price

That has been their key equation. And it has always come from Richard Liu at the top.

- The product focus has been about quality and trust.

- The service aspect has been about rapid delivery and user experience.

- And JD has always used low price as a big competitive weapon.

That last point is important. JD has been waging price wars for +20 years. Keep in mind, JD was not a leading ecommerce player for much of its existence. It was in a large pack of online and physical retailers, including giants like Suning. JD fought its way to the top over time. And part of how they did that was by waging price wars. These were particularly brutal in the appliance space about ten years ago.

Richard is now back in charge at JD. And he has been stating that JD has to “go back to basics”. That the company has lost focus. And this has hit them in market share.

So yes there is a new price strategy. But you also expect to see more of the traditional JD strategy. They are going to offer low prices every day. That others can’t beat. But with a somewhat bigger selection. In practice, this means the following:

- Offering the absolute lowest price on key items. Nobody is going to beat them on price on items like the iPhone.

- Offering relative low prices on select items. This means better prices than competitors on lots and lots of items.

- Doing their regular subsidy programs. This can include things like flash sales.

Updates on JD’s Low-Price Strategy

A couple of other updates:

- The 1p and 3p used to be different teams at JD. But the GMV ROI for each product category is now combined. So, the teams are working together.

- The 3P merchants can have different competitive strategies. This really broadens both the products and services offered. For example, different merchants selling iPhones may have different price and service offerings. Some merchants might offer customers a free case with their iPhone. Others may offer different gifts. And both may pair that with slower delivery. There are clever variations from merchants. This is an interesting contrast to 1P, which has more standard offers with same day/next day delivery.

- JD has shut down Jingxi, which was their app for lower tier cities. JD says Jingxi was largely to introduce and train these lower tier customers on ecommerce functions. This has largely been accomplished.

- In logistics, the low-price strategy does not require use of JD’s delivery. Customers can use other services. Note: PDD customers don’t expect 1 day delivery in their low-priced goods.

- In customer service, the low-price strategy depends on the rating system for merchants. Weeding out low quality and problem products is key as you move down market. So is avoiding counterfeit products (a long-standing problem at Taobao).

***

That’s it for Part 3. In Part 4, I’ll go through the international business.

Cheers, Jeff

————-

From the Concept Library, concepts for this article are:

- ecommerce

From the Company Library, companies for this article are:

- JD

———-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.