There is a lot of political uncertainty around China tech stocks these days. But this is not anything new. China and other rapidly developing economies always have greater uncertainties. And I think avoiding such uncertainties is not a great strategy. It’s better to learn to navigate them.

The person that comes to mind for this is Cheah Cheng Hye, co-founder of Hong Kong-based Value Partners. He did very well investing in small cap companies in the Chinese mainland for decades. He has been called the “Warren Buffett of the East”. I think there are good lessons here for how to navigate uncertain terrains.

An Introduction to Value Partners

First, the basics of his company.

Hong Kong-based Value Partners is one of Asia’s largest asset management firms – with assets under management of US$13 billion as of 2020. It was founded in 1993 and was one of the first stand-alone investment groups focused on the Greater China region. In November 2007, it became the first asset management firm listed on the Hong Kong Stock Exchange. In 2007 and 2008, it was rated as the second largest hedge fund manager in Asia by Alpha Magazine.

Today, the company has tons of funds and products. It manages absolute return long-biased funds, long-short hedge funds, exchange-traded funds, quantitative funds, as well as fixed income and credit funds. But its roots and early years were focused on small cap China stocks. It was an expert at hunting small unknown, unfollowed and unloved companies in the Mainland.

Cheah Cheng Hye co-founded the company in 1993 and was named one of the 25 most influential persons in Asian hedge funds by Asian Investor in 2010. In 2007, Finance Asia recognized him as “Capital Markets Person of the Year”. In 2003, he was voted the “Most Astute Investor” in The Asset Benchmark Survey.

I have been teaching his investment strategy for a long time. And I invited him to speak to one of my classes at Peking University. More on that below.

But first, a few comments on why Western investors struggle so much with the uncertainties of developing economies.

Of Course, Developing Economies Have More Uncertainties

Investors like to see a track record. They like to see a predictable future. But a typical company in China usually looks like this.

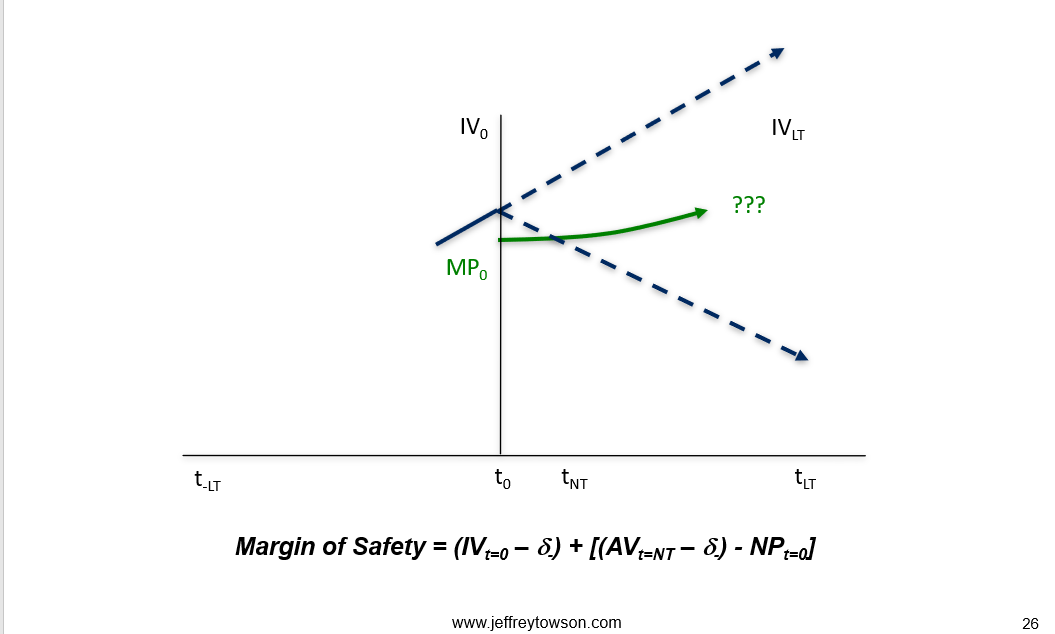

The Y axis is intrinsic (or economic) value per share. The X axis is time, with t=0 being now. And you can see, there is only a short track record. And going forward, there is a wide spectrum of potential paths. Lots of uncertainty.

And this is logical. Because rapidly developing and State-involved economies have far greater uncertainties.

- The economy itself is changing rapidly.

- Consumers and competitors are changing and developing.

- Technology changes or disruptions are common.

- Financial innovation can create disruptions.

- Management can behave badly and not in shareholders’ interests.

- There can be limited, inaccurate or fraudulent information about companies, industries or markets.

- Contracts are often not enforceable. There are lots of governance and legal problems.

- Government is actively regulating the market and its businesses.

- Government is actively involved – as a competitor and financier.

- There can be financial or economic downturns or crisis. And major adverse events.

The terrain is just changing faster. And so are its participants.

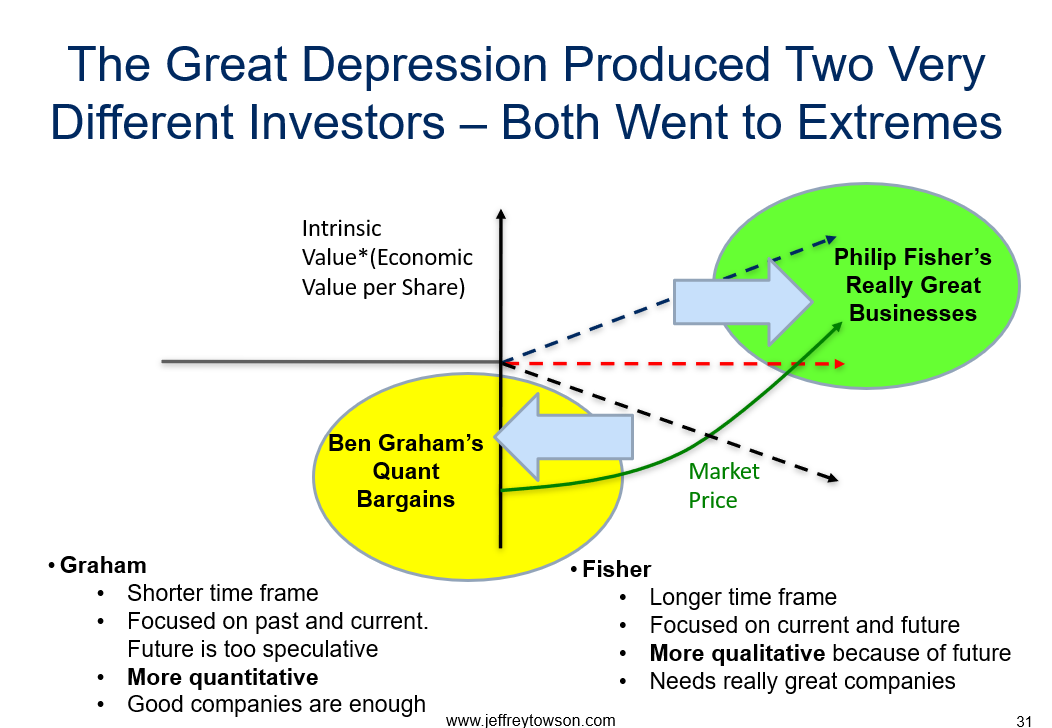

We can look to the US in the 1930’s as a similar situation. And we can look to Philip Fisher and Ben Graham as investors who were experts at that investing under high uncertainty.

Graham focused on capturing a margin of safety at the time of purchase. Fisher focused on longer term growth.

Both of these are good strategies for high uncertainty environments.

I think there are five basic approaches to high uncertainty terrains.

Ben Graham basically did 2 and 3. Philip Fisher did 4. Ben Graham bought based on highly reliable tangible assets and got in and out fast. Fisher bought the best of the best and held for decades. Basically, you can fly above the storm clouds. Or you can dart in and out quickly.

Which brings me back to Cheah Cheng Hye.

He co-founded Value Partners to focus on China small and mid caps in the 1990’s. And he explicitly copied Ben Graham for his investment strategy. He was an avid reader and had Ben Graham’s book in his office.

Some Background on Cheah Cheng Hye

Cheah was raised in Penang on the West coast of Malaysia. His father died when he was 12 and he and his two brothers supported their mother. “We were the poorest of the poor,” said Hye.

He attended Penang Free School for a while and sold pineapples by the roadside. But he quit school after 0-level because he could not afford to continue his education, not unlike many of his peers.

“I never felt deprived. People around us were no doubt very poor. Many were food hawkers, and there were gangsters about who would seek protection money…The richest person around was a guy who had a motorcycle and went around selling Milo chocolate.” – Cheah Cheng Hye

At age 16, he began work as a reporter at The Star newspaper in Penang – folding newspapers from 10pm to 5am. He was later promoted to reporter. Becoming a reporter was his first step towards becoming a self-taught investor.

“In fact, I was very driven. I was and am a very organized person. Self-teaching means that I schematically work out what I need to know and to learn, and then I just obtain whatever knowledge and skill are required.” – Cheah Cheng Hye

“I was an inhabitant of those libraries. I would stay there rather than go home. While my body may have been in Penang, my mind was always someplace else.” – Cheah Cheng Hye

He began as an investigative reporter in Malaysia and eventually made his way to Hong Kong and Singapore. He worked at the now defunct Singapore Monitor. Then at the Far Eastern Economic Review and then at the Asian Wall Street Journal in Hong Kong.

His standout moments as a reporter included:

- Breaking the news in 1983 that Hong Kong was planning to peg its currency to the U.S. dollar.

- Covering the fall of Philippines President Ferdinand Marcos in 1986.

“I left Penang in 1974. I was 20 years old, and I had never left Malaysia before. Within Malaysia, I had only travelled to Kuala Lumpur twice. It was considered brave, and maybe foolhardy to do it.” – Cheah Cheng Hye

“I would attribute it (my success) to a “nothing-to-lose mentality”. Since my dad passed away…I had felt that I had nothing to lose taking on anything at all.” – Cheah Cheng Hye

From Journalist to Investor

In 1989, he was introduced to Mr. Hsieh Fu Hua, then head of Asian investment bank Morgan Grenfell, and then CEO of the Singapore Exchange. Hye joined Morgan Grenfell in 1989 as head of research in the Hong Kong/China Equities Research Department, focusing on mid and small caps.

“As a former journalist, I had an advantage over people who were purely financial people. I learnt to put events in a historical, political and social context. Many people with CFAs or MBAs are narrow in that they tend to interpret reality through quantitative and statistical analysis.” – Cheah Cheng Hye

Cheah had also acted as a consultant to the family business of Yeh V-Nee. Together, they founded Value Partners in 1993 with US$3 million from savings and contributions from friends and former clients.

For several years, Value Partners was a small player. They worked from a small Hong Kong office staffed with one secretary and $5 million in funds. They did make some profitable investments, such as in North Korean and Vietnamese bank debt.

Over the next +20 years, Value Partners would deliver a 16% per annum compounded gain to its clients.

Value Partners Applies Ben Graham to China

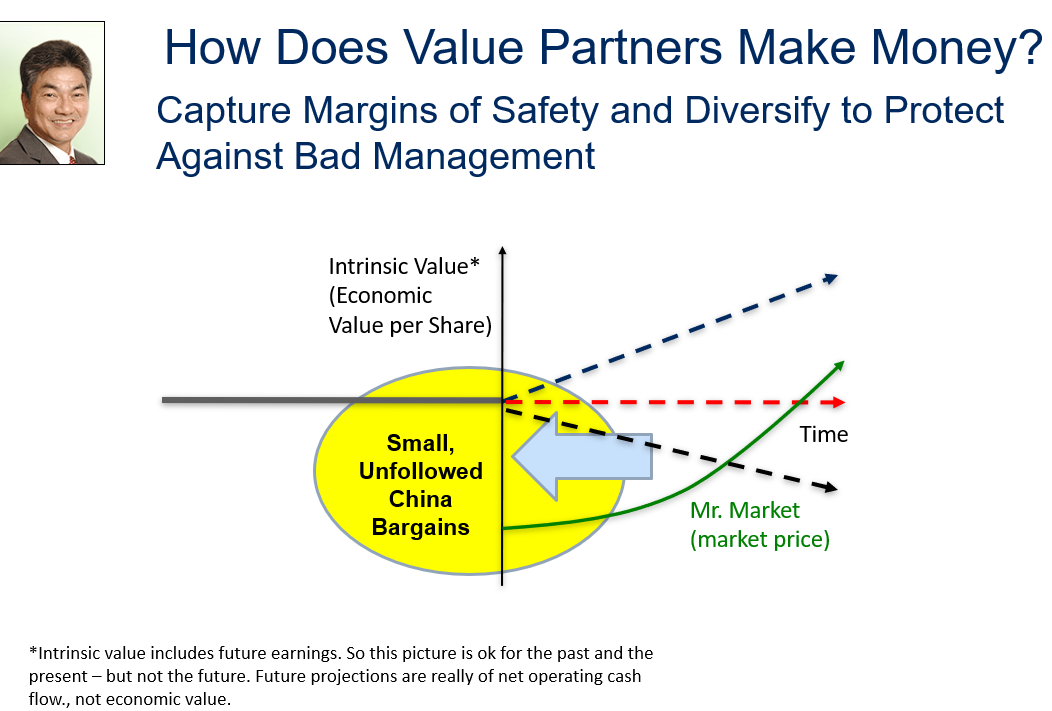

Value Partners focused on small Chinese companies. Specifically, they bought the unloved and obscure. The two founders sought out stocks that weren’t covered by analysts and weren’t widely held by institutions – or included in major stock indexes.

And the process was focused on local research. Cheah, a trained reporter, did a lot of legwork to uncover good stocks.

“In the last couple of years, we have done about 2,000 company visits a year – excluding phone calls. We have done this in good and bad times. We have 18 full-time professionals, whose average age is in the early 30s. As far as I know, we do more company visits than any China team in the world.” – Cheah Cheng Hye

Value Partners seeks “stocks with low price-earnings ratios” and “high dividend yields of at least 5%”.

- They also looked for solid companies with viable long-term prospects, high dividends, low debt, good cash flow, high return on equity and assets and low price-to-earnings and price-to-book ratios.

- “We don’t try be smart; we just protect our downside,” – Cheah Cheng Hye

“We don’t limit our stock picks to any industry. Our job is to buy the 3Rs – the right business run by the right people and selling at the right price. At the moment, we are finding the 3Rs in a broad spectrum of businesses across China.” – Cheah Cheng Hye

That’s some complicated language. But it’s basically Ben Graham. And Cheah keeps a copy of Benjamin Graham and David Dodd’s classic 1934 text, Security Analysis, in his office bookcase.

“To me, the great minds in value investing are people like Prof Benjamin Graham, Warren Buffett and John Templeton, to name just a few. Their ideas and their books were easily accessible. Simply having the interest and the passion, I was able to access what they know easily, literally for a few dollars.” – Cheah Cheng Hye

They basically went after highly uncertain terrain of 1990’s China with the Ben Graham approach.

Cheah’s process starts with price relative to value (i.e., margin of safety). He says he divides stocks into three categories by price.

- Category 1 stocks are undervalued. The job is to identify Category 1 stocks and do research on them.

- Category 2 is fair value. He says a lot of sell-side brokers tend to recommend Category 2 stocks.

- Category 3 is overpriced. He says if you sit in a taxi and the taxi driver tells you about stocks, it is probably Category 3.

- His objective is to buy 1 and sell at Category 2.5.

He says the most fertile area to find these stocks are companies that are unpopular or that nobody cares about. So definitely not an index stock. And perhaps something bad has happened.

He says in China-related stock markets, there are actually quite a lot of Category 1 stocks because it is a very emotional market, very momentum driven. Stocks fall in and they fall out of favor fairly quickly, and in a rather predictable way.

“When I first started in the 1990s, there were very few companies with superior business characteristics in China. What you were really buying were pretty lousy companies trading at very cheap prices, and that, in fact, it was quite difficult to be a long-term investor because some of these companies got chopped up, or competitors came in and they are gone.” – Cheah Cheng Hye

“So, we were pretty much a traditional classic value investors trying to get the last free puff of the cigarette.” – Cheah Cheng Hye

He checks for:

- The average dividend yield is 5%

- The average P/E ratio is 8

- The average price-to-book multiple is 1.2

“The secret to our investing success is kind of boring,” says Cheah. “We make sure that our average dividend yield is 5% and potential capital gain is 10%, so that every year we can deliver 15% to our investors. As it happens, I often get more than 15%.”

Cheah Is Slowly Going from Graham to Buffett in China

Ben Graham taught Warren Buffett and Buffett followed his approach for the first ten years. Buy and sell mediocre companies at a discount. But then he met Charlie Munger, who convinced him the bigger money was in holding great companies long term.

It sounds like Cheah is shifting in this direction as well.

“But in more recent years, the trend has been much more encouraging. You are finding more companies that may fit the description of a good franchise. I.e. a sustainable, competitive advantage, durable advantage we call it, and to do that it is very difficult to quantify in numbers.” – Cheah Cheng Hye

“We have been moving away from quantitative analysis to qualitative analysis.” – Cheah Cheng Hye

“You need to be familiar with the political and social context of the investment, not just the financials. We have problems sometimes with Asian people who came out of US Universities with an MBA or whatever, because we find that they are too focused on numbers alone” – Cheah Cheng Hye

“There is a growing number of such superior businesses, but it is still much less than in America. You make money by taking money from stupid people who shouldn’t be in the market; that is the truth about it – it’s changing but it’s still there.” – Cheah Cheng Hye

His Biggest Challenge is Management

“I believed in having a very concentrated portfolio. I used to go around telling everybody “you won’t see more than 40 companies in my fund, these are my high conviction ideas,” – Cheah Cheng Hye

“…and then as the years went by, I began to realize that our market was really very different from the US, because there are just a lot of crooks out there with very bad corporate governance, and some of these guys are very convincing.” – Cheng Cheah Hye

“We are talking about a generation of people who are in their 40s and 50s now and are captains of industry…These are people who don’t necessarily want to play by the book.” – Cheah Cheng Hye

“As they get richer and have more at stake – in terms of reputation and wealth – they would be less and less naughty. They want to be more and more respectable, which means our stock investing risks go down.” – Cheah Cheng Hye

“Those who want to invest directly in equities should go for large-cap stocks because these are more liquid than small caps. There is also far less likelihood of big companies being led by crooked management.” – Cheah Cheng Hye

“For emerging markets such as China, it is better to have a very diversified portfolio. Don’t put more than say 1 to 2% of your fund in any particular idea, because you can then go to sleep much better and you can withstand all these nasty accidents that seem to happen every now and then, no matter how hard you work at it.” – Cheng Cheah Hye

“So, now we have a portfolio with typically over 80 to 110 companies inside.” – Cheah Cheng Hye

Final Thoughts on How to Invest in Uncertain Markets

“We are the pioneers of small-cap research and also China B-share research. The lack of published research is a huge advantage. You don’t really want someone else competing with you and researching the company. You want to be the first ambulance on the scene, you know, so I estimate that in my universe there are approximately 1000 to 1300 companies with market capitalization below US$1 billion.” – Cheah Cheng Hye

That’s it for today. Cheers from Rio, jeff

–—

Related articles:

- My 9 Investment Questions: Part 1 (Asia Tech Strategy – Daily Update)

- Lessons from Philip Fisher on Tencent, Motorola and Rate of Learning (Asia Tech Strategy – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Margin of Safety

From the Company Library, companies for this article are:

- Cheah Cheng Hye / Value Partners

- Ben Graham

- Philip Fisher

Photo by Robert Gourley on Unsplash

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.