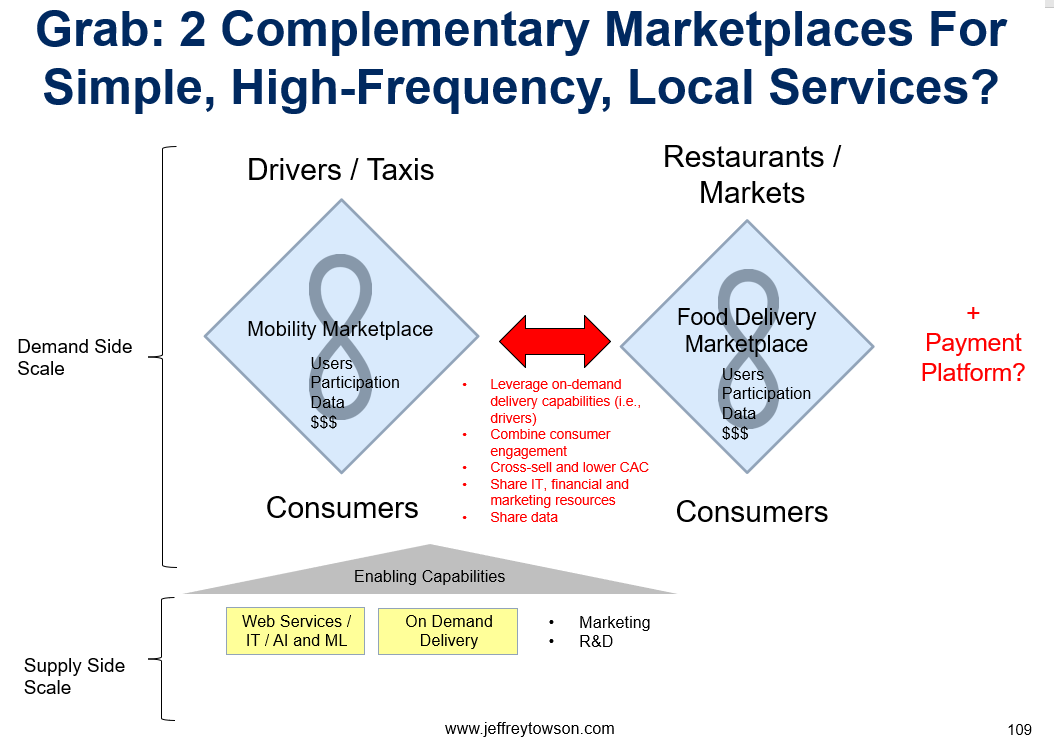

In Part 1, I went through the basics of newly public Grab. It’s one of the first tech unicorns of Southeast and it’s an interesting combination of a mobility and a food delivery platform. At first pass, we could represent it this way.

You can see a marketplace platform for mobility services, which is where Grab gets most of its engagement and revenue today. It connects drivers / taxis and consumers for on-demand, undifferentiated transportation services.

You can also see a marketplace for food delivery services, which connects consumers with an increasing list of food providers (restaurants, convenience stores, supermarkets, etc.). This is also on-demand. The transactions happen in real-time, which means higher liquidity requirements and therefore higher barriers to entry.

But, unlike mobility, this marketplace is for differentiated (i.e., not commodity) services, which makes it more powerful. It’s not just a fast and affordable ride to the airport. The food types, restaurants and menu items matter. I generally like marketplaces for differentiated services, such as food delivery, much more than commodity marketplaces (such as mobility).

In the previous graphic, you can see (in red) the benefits of Grab’s two complementary marketplace platforms. They share consumers and data. They can cross-sell and lower the CAC. You can see the 3-4 assets within each platform (users, participation, data). Complementary platforms can combine these to some degree.

And supporting all this is 2-3 capabilities (shown in yellow): Web Services / IT and On-Demand Delivery. So, lots of servers and dudes on scooters.

This is where I disagree with how Grab presents itself. In its filings, it calls itself a “delivery ecosystem”. I think its delivery people are really just a supporting capability. You can get some supply-side economies of scale but this is not a platform or ecosystem. You can also lever drivers (a user group) into being also being food delivery drivers sometimes. Useful, but not an ecosystem. It’s also really easy to replicate, which a marketplace platform is not.

Finally, there is the question of whether Grab’s payment business will become a third platform, which I’m sure was the original plan. I’ve listed it off to the right. Payment platforms are being transformed and probably disrupted by blockchain and decentralized finance. It’s not clear to me how this will play out.

So that is a pretty standard explanation for two complementary platforms. However, that is not actually how I would represent Grab, which is spread across +8 markets in Southeast Asia. I actually think about Grab like this:

The defining characteristic is that these are marketplaces for local services. The platforms are overwhelmingly local. Outside of travel, consumers are mostly buying food from their own neighborhoods (about 7 km). Mobility is overwhelmingly at the city level.

You really want to think about Grab as into 8 pairs of national platforms. You can see that in the graphic. And note (in red) how this is mostly about local demand-side scale, supported by regional supply-side scale in IT.

All this dramatically lowers the barriers to entry. It dramatically lowers the power of the marketplaces. For example, Siam Commercial Bank jumped into food delivery in Thailand in 2020, despite Grab being in the market leader for years. The story goes that SCB CEO Arthid Nanthawithaya conceived of the idea in April 2020. And the service launched in September. If you can jump in as an unrelated business in 6 months, that is a low barrier to entry. As I am writing this, AirAsia is also jumping into food delivery.

The threat of new entrants also seriously limits Grab’s ability to raise prices or decrease its payments to drivers. It is risky to increasing its take-rate or to reduce its ongoing promotions and incentives to consumers and drivers. So, the company appears stuck with the current economics and is trying to grind its way to profitability by getting to big scale.

So, while I have put both Ecosystem Orchestrator and Complementary Platforms at the highest level in my 6 levels, you really have to take these companies apart individually. The competitive strength and defensibility is not always so simple. Neither are the unit economics or growth.

Which brings me to Digital Operating Basics #7.

DOB 7 Is a “Sustainable Cash Engine that Scales”

Recall my list of digital operating basics. These are the standard operating activities in a digital business. And a reasonable playbook for the digital transformation of a traditional business, which seems to be most businesses these days. These are often described as competitive advantages or unique skills. But they are increasingly just standard operating behavior.

Within this list, I’ve usually talked about DOB1-4. Those are about digitizing and connecting the core operations. DOB5-6 are about people and culture, which is a whole subject. But I’ve sort of glossed over DOB7, which is making sure there is a sustainable cash engine.

The goal of the digital operating basics is to make sure a company is taking advantage of the unique capabilities of software and digital. This starts with scalability, which is DOB1. If you are doing anything in digital, you should be trying to take advantage of its low-cost scalability and potential for great reach. You want to be constantly improving the end user experience (DOB2). You want to build out data and digitized operations (DOB3), which makes management smarter and faster. And you want to connect with other entities extensively (DOB4). Those are all great. But those, plus training and recruiting, cost a lot of money.

A digital transformation playbook needs to show up in the financials. Otherwise, you can’t afford to keep doing it year after year. It doesn’t have to be crazy profitable with increasing gross margins and operating leverage. But something has to pay for continually improving and scaling digital operations.

So, you need a sustainable cash engine that scales with the enterprise. This is also why I always put “$$$” next to the key intangible assets (users, engagement, data) in each platform business models graphic (see above).

However…

In Podcast 121 (Will Southeast Asian Grab Become Meituan or Didi?), I also went through the idea of engagement products vs. margin products. You can get the cash flow from some products and user engagement from others. And that is increasingly how digital businesses are behaving. The low cost of digital goods and services means you can offer them cheaply as complements to products that generate margins. So DOB7 can be from a suite of products and services. Some for products and some more for engagement. Or by complementary platforms.

Recall Grab’s Cash Flow Problem (from Part 1)

Grab doesn’t have DOB7 (yet). It has lost money basically every year. That is ok if you are going for dominance in a big market, which Grab is. But there has to be operating cash flow at some point. Grab has to dial back the marketing and user incentives at some point.

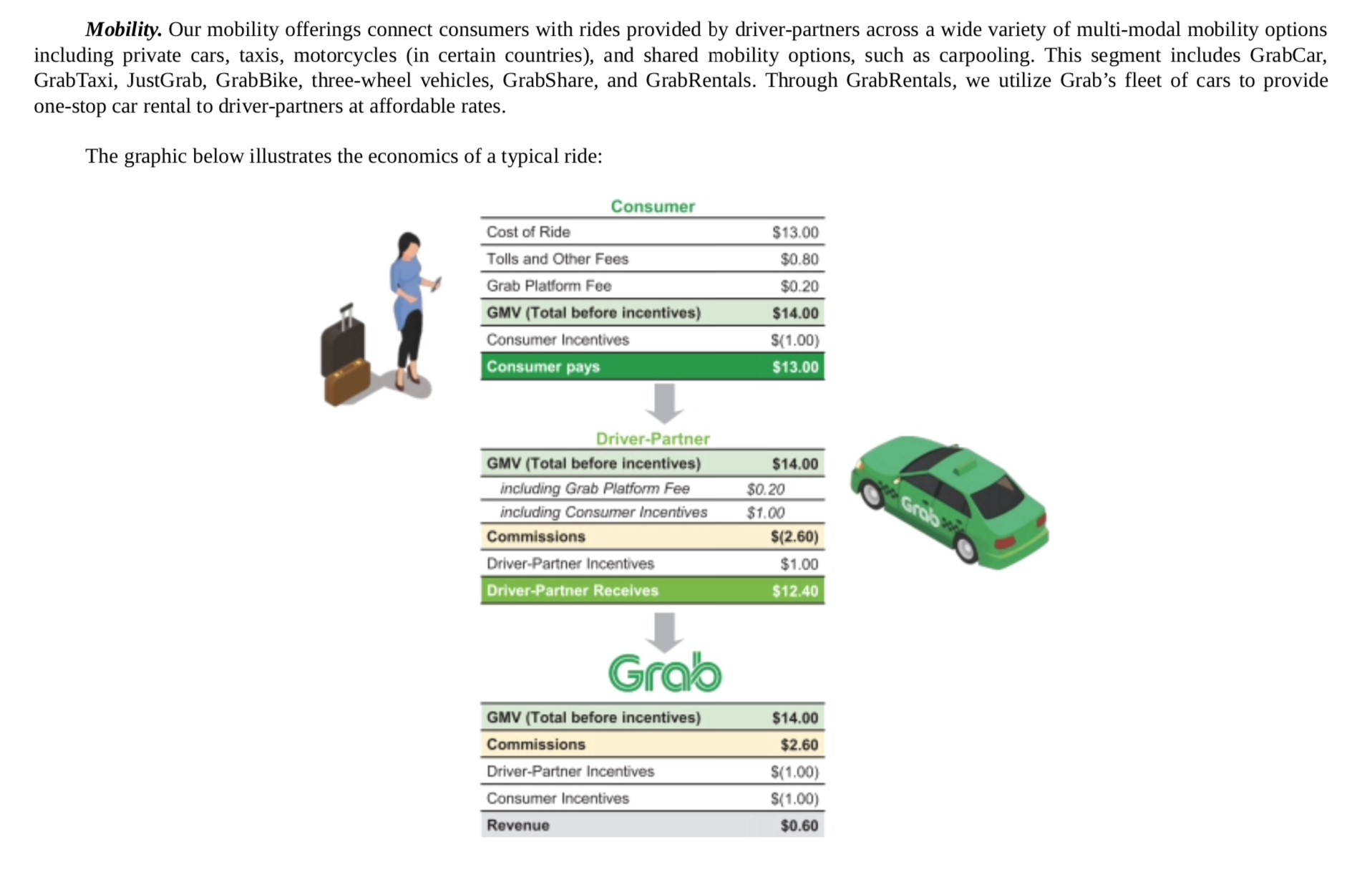

Take a look at the unit economics of Grab’s mobility and food delivery business. It’s a little confusing. Just look at the last line within each box.

You can see a very small take-rate for each order. Here is how Grab describes the unit economics situation. This is a bit long, but worth reading.

I think it’s easier to understand all this with Porter’s Five (6) Forces:

- Supplier power is mostly about the cost and bargaining power of drivers. This is an important factor.

- Drivers have multiple options, including not working in the gig economy. And they have a minimum cost and are price sensitive. Digital strategy people typically say the problem is “multihoming”, the ease for drivers to switch from Lyft to Uber. But this is not the major issue. Most company have at least one competitor.

- Supplier power also includes the cost insurance and fuel.

- Buyer power is pretty good for Grab. They are one of 1-3 players in each market.

- Substitutes is a problem on the consumer side.

- There are too many other options in both food and mobility. And (worst of all), they are lower cost substitutes, something I always hate.

- For food, consumers can just buy offline. At the market. And they can cook at home.

- For mobility, there is public transportation. Which is usually cheap. This is really a problem in China, which is great at infrastructure. Plus, there are taxis and owned cars.

- There are too many other options in both food and mobility. And (worst of all), they are lower cost substitutes, something I always hate.

- Competitive rivalry is ok but not great.

- In each market, we see just a few players. The platform business model results in local oligopolies.

- New entrants are a big problem.

- The local nature of these services and their fairly weak network effects makes it too easy for other companies to jump in. And we see this all the time.

- We see Foodpanda jumping in country after country in food delivery.

- We see Deliveroo in Singapore.

- We see Robinhood and others in Thailand.

- This threat really limits what Grab can do with pricing and paying drivers.

- The local nature of these services and their fairly weak network effects makes it too easy for other companies to jump in. And we see this all the time.

I think the difficult unit economics are mostly about Supplier Power, Substitutes and New Entrants

Compare that list with Taobao or Shopee, which have strong network effects, big barriers to entry and no low-cost substitutes.

Final Point: Grab’s Plan for Operating Profit is Incremental Growth. Not Awesome.

Grab’s plan to reach operating profits is pretty like what we hear from Didi management. Basically:

- Grow the revenue line.

- Add to monthly transacting users (MTUs), services and per user spending. Become a bigger business. Maybe increase the take-rate if possible?

- However, this likely requires ongoing incentives and customer acquisition. And new customers are likely more expensive than current ones.

- Increase gross profits, if possible.

- Increase operating leverage with increasing scale. This is more about going for scale.

- Reduce the incentives.

- This may or may not be doable depending on competitors and new entrants. And even if they can reduce incentives, it will likely decrease user and revenue growth, which is the #1 plan for growth. So, #1 and #4 are in conflict.

Grab’s other stuff is standard for digital companies.

- Invest in R&D, tech and infrastructure. This will result in a better user experience and improve operating efficiency.

- Drive efficiencies and increase monetization.

- Expand the products and services in high growth areas.

- Do targeted M&A.

Will it work?

As discussed in Podcast 121, this hasn’t worked that well in mobility for Didi, Uber or Lyft. However, it has worked in food delivery – as Meituan has shown. As mentioned, Meituan expanded to a suite of services (both engagement products and margin products) and took advantage of economies of scale in geographic density.

***

And that brings me to the coolest tech strategy question in Southeast Asia: How will Grab compete with GoJek? GoJek is dominant in Indonesia as a services marketplace. And it has now merged with Tokopedia, an ecommerce products marketplace. That’s an interesting combination. And that will be Part 3.

Cheers, Jeff

——-

Related articles:

- Will Southeast Asian Grab Become Meituan or Didi? (Tech Strategy – Podcast 121)

- Grab’s Big Strategy and Cash Flow Question (1 of 4) (Tech Strategy – Daily Article)

- Lessons from Grab in Geographic Density and Other Tech Enabled Cost Efficiencies (3 of 4)(Tech Strategy – Daily Article)

- Grab Has 5 Compelling Growth Initiatives (4 of 4) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- DOB7: Sustainable Cash Engine that Scales

- Marketplace Platform for Services

- SE Asia

From the Company Library, companies for this article are:

- Grab Holdings

Photo by Grab Media Resources

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.