This is my first business model breakdown of Facebook / Meta. But I’ve actually been looking at the business in depth since 2018.

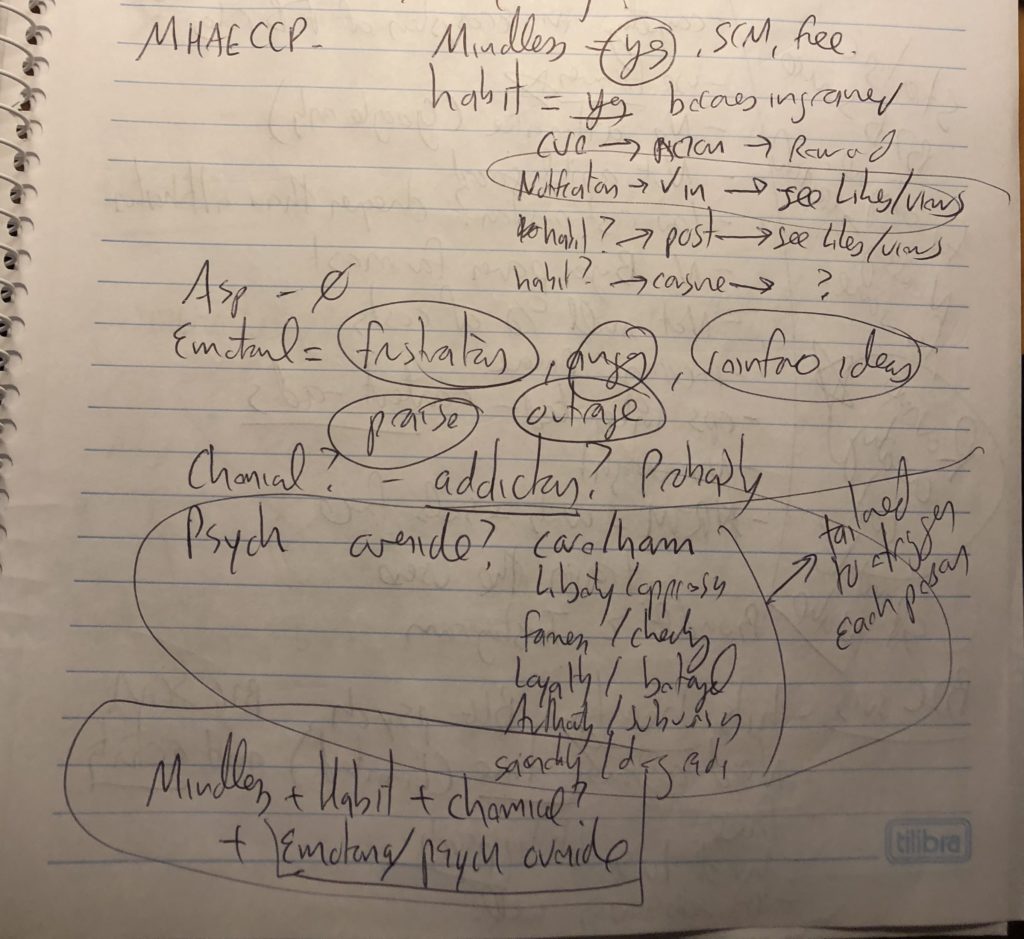

So, just for fun, I pulled my notes from 2018. Which were written at a Starbucks in Leblon, Rio.

My basic assessment (at the top) hasn’t really changed. It’s still a powerful but simple business that is 100% a digital creature. And it has crazy cash flow.

In my notes, you can see three user groups: users/consumers, merchants / advertisers, and developers. Although developers are not that big a deal.

For users / consumers, you can see the services and features offered to them:

- Connect

- Produce and share

- Discovery and consumption

- Communication

These also haven’t really changed.

Finally on the right, you can see my notes on its network effects and platform business models. Only about 50% of that was correct. More on that later.

I’ll go through the basics of the business model in this article. It’s not a complicated business. And then in Part 2, I’ll get to the 5 factors that I am following for the company.

Here’s the quick version of the business model.

Facebook Has Remarkably Powerful Core Products

My #1 question for every business is always about the demand-side. The nature of the products / services. How are they used? How powerful or weak they are? How predictable is demand long-term? After that, I start looking at competition and business model.

And for question #1, Facebook is a once in a decade company. It’s like Coca Cola and Marlboro cigarettes.

It has two really powerful consumer products (the original Facebook newsfeed and later Instagram). For Facebook, the early uptake was super-fast. People use it every day, if not every hour. And it had global demand that has never decreased. The early core product, the Facebook newsfeed, was a monumental consumer product. The closest thing close to it in recent times has been TikTok’s short video product.

I went through Meta’s third quarter 10Q for 2023. And the numbers for usage are still just amazing. In their Family of Apps (i.e., not counting their Reality Labs business), its:

- 14B users are active daily.

- 96B users are active monthly.

- Growth of DAU and MAU are about 7% year over year.

- DAU / MAU is over 75%. Most all of their users are on the app every day.

Those number include all their various apps (Facebook, FB Messenger, Instagram, IG Messenger, WhatsApp, Messenger). So, you need to break these numbers down by product. And by geography. And by age cohort. But the numbers for users and engagement overall are huge. And steadily growing.

So are the ad impressions and revenue. Note: that the engagement that is responsible for most of the revenue is Instagram and Facebook.

So, why is this such a powerful product with consumers / users?

I answer that by breaking this into different businesses.

- There are (at least) 4 communications networks. That’s WhatsApp, FB Messenger, IG Messenger, and Messenger. I consider these types of networks to be intangible assets. And they are the kind of intangible assets you can build platform business models with. But I don’t consider any of these products to be platforms.

- There are (at least) 2 audience builder platforms. That’s Instagram and the Facebook Newsfeed.

This is a simplification, but I think it captures most of it. I’ll diagram these later. And within these, you can see how they offer consumers their described services:

- Communication networks for connection and

- Platforms for sharing and discovery.

Two important things explain the power of these products.

- These are frequently used, utility services. Especially the connection and communication services. This is not unlike AT&T and the first telephone networks. Communication is the most frequent activity consumers do on a daily basis. So, capturing that high frequency activity put FB at the front of the engagement and the attention cue.

- They are free. That’s a big deal.

It’s a good product focus. Offering free, high frequency utility services is pretty much all Google does (Gmail, search, mapping).

But there is a lot more happening than this

Facebook Is a Leader in the Software Hacking of the Human Brain

There is a lot of power coming from the psychology hacks of social networks. It turns out public (not private) communication, posting, and sharing can have a lot of strange effects on human psychology.

Here’s my list for FB:

There is a lot of status seeking behavior in public posting and communication.

You may be your authentic self in private communication, but public communication (something we almost never do in real life) is very different. It makes people brag and show-off. Or at least show the best parts of their life. It can make other people feel envious. Public sharing just has tons of status-seeking behavior. Think about that next time FB reminds you to post about your birthday to increase your engagement.

The newsfeed is a never-ending bowl for consumption.

There are good psych studies showing people in a restaurant will keep drinking soup for a remarkably long time if the bowl automatically keeps re-filling. That’s the newsfeed. And Netflix auto-play. These products enable endless consumption, automatically. Think about that when you are sitting scrolling.

There is a lot of variable rewards behavior built into liking and sharing.

Think about how you feel when you check to see who has liked and commented on your post. Did you get a lot of likes? Variable rewards (no likes this time. Lots of likes last time) has a powerful effect on people. It makes them keep playing. This is the same psychology exploited by slot machines and in gambling.

There is habit formation.

When you do something daily, it gets hardwired into your habits and brain. You will start doing it without thinking about it. People check email all day long for no reason. Cigarette smokers go through +20 cigarettes per day. Facebook wants you to check in all day. This is also why they want notifications on. High frequency makes it easier to create habits. It’s also important to be able to use the product immediately when you have an impulse. That is why they put cigarette vending machines around.

Strangely, Facebook also appears to be chemically addictive.

You get dopamine hits the same way coffee gives you caffeine hits and cigarettes gives you nicotine hits.

And of course, these products can make give you customized emotional rewards.

Your newsfeed can make you laugh with comedy content. It can make you angry and outraged (the business model of most news programs). It can make you feel good with praise. Most entertainment are emotional products. You don’t need them. You get emotional rewards. Whether this is making you happy, angry, or scared (i.e., horror films).

However, the FB algorithm actually chooses what content to show you. And therefore, how to make you feel. It can manipulate you emotionally in real-time. This last one is important. It turns out it is a very short step from mass surveillance (you need lots of data to shape the product) to mass manipulation (emotional manipulation, creating outrage, shifting elections, fake news, etc.). A topic I have ranted about many times (which I won’t do here).

When I first tried to explain the consumer side of Facebook, I made the following list below. I said it was a combination of:

- High-frequency, free utility services.

- A growing list of psychology hacks that are both more powerful and surgical when used by data-driven software that commands your attention.

- Habit formation by daily usage.

- Chemical addiction via dopamine.

- Lots of emotional rewards (both good and bad) and increasing manipulation.

- Mindless behavior.

We see #1 in Google. We see #2 in casinos and gambling. We see #3-4 we see in cigarettes. #5 is pretty much everything on tv (but this is more powerful).

Ok. That’s a simplistic but solid first past at question #1.

Let’s look at the business model (question #2), which is much more my area.

The Business Model is 4 Networks and 2 Platforms

Warren Buffett once looked at acquiring a cigarette company. He said it was the most powerful business model he had ever seen. Cigarettes as a product have a lot in common with Facebook.

But cigarettes are physical products that cost money to make and sell. Imagine you could give them away for free? What if they were digital products and you could monetize by advertising? Free cigarettes would have been far more powerful.

That’s pretty much how I see Facebook.

- I like the communications networks. But I view Instagram and the FB newsfeed as unhealthy but admittedly powerful products.

- This has been paired with a powerful digital business model.

Note: Warren Buffett passed on the cigarette company because he said he wouldn’t feel good about owning a cigarette business.

As mentioned, the Meta / FB business model is a:

- 4 communications networks. That’s WhatsApp, FB Messenger, IG Messenger, and Messenger. They all have direct network effects with global scale. These were separate but have been merging over time. They are mostly not monetized.

- 2 audience-builder platforms. That’s the FB newsfeed and Instagram. These both have indirect network effects. The enable interactions between users / consumers and content creators (both amateur and professional). And they monetize by advertising and most of their cash comes from these businesses. This is somewhat similar to YouTube and TikTok, but the content types are different (text, photos, and now short video). These are complementary platforms which is my favorite type of business models.

- Economies of scale in IT, R&D and arguably political lobbying.

Here’s how I view it. You start with a people network.

Then build services and platforms on it.

You can see the connections and communications network at the bottom. That was early Facebook Messenger and then the Messenger app. This basically created a big pool of connected users. This has a direct network effect, similar to the phone networks.

Above this, you can see an Audience Builder platform that enables interactions between users / consumers and content creators. This has a indirect network effect. However, it’s important to note that the line between being a content consumer and a content creator can be blurry. If it’s professional produced videos, it’s clear. But if it’s writing blogs and such, it can be blurry.

And you have merchants / advertisers as a third user group that provides monetization.

From this powerful position of demand-side scale, they built out some supply side scale. Particularly, they have economies of scale in tech / web services, R&D and lobbying.

Over time, they added platforms and networks. This is how I see FB / Meta today.

As mentioned, the Meta financials are fantastic. Here are the 9 month numbers for 2023 Q3.

It’s almost $100B in revenue for 9 months. And with 12% y-o-y growth.

And nobody thinks this is not a pretty bloated company. That has also been flooding money into dubious ventures like metaverse and augmented reality. If you assume more reasonable R&D, Marketing and G&A spend, the operating margin is probably over 50%. It’s a global cash machine.

But there are some problems. More on that in Part 2.

***

Ok. That’s it for Part 1. In Part 2, I’ll go into the 6 digital concepts I pay attention to for this company.

Cheers, Jeff

———–

Related articles:

- A Breakdown of the Verisign Business Model (2 of 2) (Tech Strategy – Daily Article)

- 3 Factors Will Determine the Future of Verisign Inc. (Tech Strategy – Podcast 191)

- A Strategy Breakdown of Arm Holdings (1 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Audience Builder Platform

- People Networks: Communications

From the Company Library, companies for this article are:

- Facebook / Meta

Photo by Brett Jordan on Unsplash

AI generated image of people network

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.