This week’s podcast is Part 1 of an introductory explanation for the Digital Operating Basics. This is a very useful framework for thinking about digital transformation.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Here is the link to the China Tech Tour.

Here is my summary of digital operating basics (Dr. Ram’s book combined with some of my own thinking):

- Rapid Growth at Small Incremental Cost. And Without Constraints.

- Never-Ending Personalization and Customer Improvements.

- Digital Core for Management and Operations.

- Connectedness, Interoperability and Coordination-Based Operating Models (Including Platforms and Ecosystems).

- Leadership and Management.

- People, Culture and Teams.

- Sustainable Cash Engine that Scales

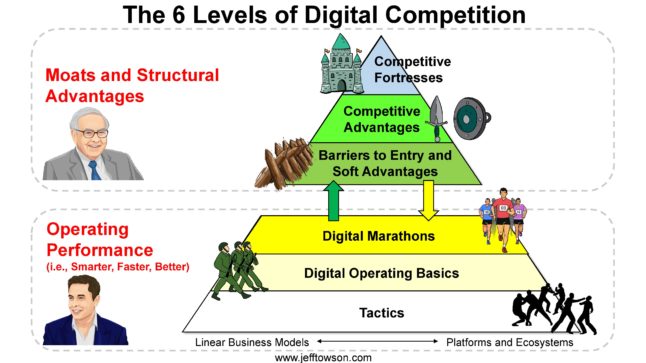

Here is my standard framework for digital competition

——–

Related articles:

- Lessons in Digital Operating Basics from Ram Charan. Part 1 of 2 on “Rethinking Competitive Advantage”. (Asia Tech Strategy – Podcast 98)

- Meituan vs. Ctrip vs. Alibaba: Who Will Win in China Services? (Jeff’s Asia Tech Class – Podcast 22)

From the Concept Library, concepts for this article are:

- Digital Operating Basics

From the Company Library, companies for this article are:

- n/a

——–Transcription below

Welcome welcome everybody my name is Jeff Towson and this is the tech strategy podcast from TechMoat Consulting. End the topic for today an intro to digital operating basics. So today is going to be a digital strategy lesson as mentioned in the last podcast review I’m gonna do these podcast shorter. And we’re either gonna do sort of a deep dive on a company or we’re just gonna do a digital strategy lesson. Today’s gonna be kind of a big one. I guess in terms of digital strategy lessons the digital operating basics. I Mean if you understand this you’re in pretty good shape in terms of what digital businesses are doing and more importantly probably What companies that are going digital are really focusing on it’s a pretty standard playbook This is not really my thinking. This is you know, people have been talking about this for a while, but I find it super useful So that’ll be the topic for today the digital operating basics and this will be, you know, basically an introduction to that, an outline of what it is. And obviously you can go deeper from there. So that will be the topic for today. And let’s see any issues. We have a China tech tour coming up, really a Beijing tech tour coming up in January. It’s gonna be a shorter one, just a couple days of visiting companies and then a couple days of sightseeing if you… like that sort of stuff, which is pretty awesome in Beijing, actually. This is something we’ve designed which is basically a shorter and much cheaper version of sort of the full tour we do, which is usually twice a year. So if you’re interested in that, that’ll be middle of January around 18th or 19th. If you’re interested in that, give me a note over on LinkedIn or info at tausendgroup.com and I’ll get you the details. But that’s going to be pretty great. So let me know. And I think that’s it for housekeeping for today. Other stuff, standard disclaimer, nothing in this podcast or in my writing website is investment advice. The numbers and information from me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advice. Do your own research. And with that, let’s get into the topic. Now, as always, let’s start with sort of three minutes on sort of… significant tech events that have happened in my opinion. Number one JD has done its quarterly earnings this week. Pretty interesting because this was kind of one of the first real looks we’ve gotten at whether their new low price strategy is working. Now recall Richard Leo came back more hands-on at the end of 2022. Has really sort of refocused JD on a low cost low price strategy, which is for a couple reasons. Number one, growth is slowed in China, competition is getting more aggressive in many ways, especially coming from sort of lower cost players like Pinduoduo. And then you’ve also got some serious disruption coming from the video and social media players like TikTok, Douyin, but also Xiaohongshu as well. So there’s a lot going on in e-commerce in China. The response to that from JD has been go back to basics. They call it the low cost strategy. Really what they’re doing is they’re going back to the basics that they were doing 10 years ago, where they were a very aggressive competitor in terms of pricing. They used to launch price wars against companies like Suning and such back in 2012 or so. So they’re doing more of that. And so far it looks pretty good. The two numbers I’m keeping an eye on are market share stability. Is this working? Is it protecting and maybe increasing market share? And how many merchants are they onboarding? The key to their low price strategy is to bring on a whole new class of merchants, entrepreneurs, a lot of small players that can offer lower prices. Kind of makes it look more like Taobao. And those numbers have really jumped. in the last six months. So, so far looks pretty good. That’s sort of event number one, but we’ll see these early days. Event number two, there’ll be two for today. Alibaba in the last day has also released its quarterly earnings. Now, normally I don’t follow quarterly earnings too much. This was important because it was the first one that now Chairman Joe Tsai spoke at and it was also pretty much the first one by Eddie Wu, the new CEO since Daniel Jang has stepped down. So both of them put out statements and talked in the last day and a half. Joe Tsai didn’t say too much that was terribly interesting, basically talking about the need for capital allocation, which means not doing some IPOs that thought they were going to happen like the cloud business apparently is not going to IPO in the near future. We’ll see what they’re doing. That has a lot to do. The reason they cited was basically political. The moves related to high-end semiconductors coming out of the US by the US government has created significant uncertainty for that business. That’s what they cited. I think it’s just overall uncertainty is they’re gonna kind of hold on that. But apart from that, you know, the big message in terms of cloud was the surge of generative AI. basically has created a surge in cloud and a surge in semiconductors, because to do AI, you need a ton of computing power. So everybody is scaling up their computing power. The number one way companies do that is by cloud services that are, especially those that are AI rich, which is what Alibaba Cloud is going for. So that’s kind of what I took away from that. The other thing that’s probably worth your attention is that their international business, you know, which is basically AliExpress, Lazada, big growth, really interesting growth quarter for this quarter year over year, 70 plus percent, depending what metric you wanna look at. That was pretty interesting. Apart from that, we’ll see, I’m gonna start paying more attention to these numbers in the next month or so. Anyways, that’s kind of the two events that caught my attention, and I think I kept that to about three minutes. Okay. Let’s get into the subject. Obviously the concept for today is digital operating basics. So you can go to the concept library and take a look at that. There’s a lot written there about this. Again, this is not my thinking. This is a bunch of consultants, a bunch of digital heads. This playbook is very common. My language is a little bit different, but it’s pretty similar to what you’ll see out of a McKinsey or BCG, some of that. And the basic idea is as a going digital business, a retailer, a media company, a bank, increasingly manufacturing, slowly, agriculture and healthcare, which are kind of the laggards, you are basically becoming first data-driven in your operations, and then increasingly your workflows become digital by nature. So the first thing to do is you put sensors, you gather all the data, that makes your decision-making better. makes management smarter, the whole thing just gets smarter. Because in most businesses, you know actually very little about what’s going on. Data is like, if you digitize in that sense, it’s like turning on the lights in a dark room. Instead of walking around with a flashlight, pointing at various things in this dark room, which would be what management does when it asks for certain reports. Instead of just searching around this dark room with your flashlight, it’s like the lights get turned on and you can see everything. So when you go digital, the first thing you tend to get is a lot of transparency, a lot of data, and then you increasingly have data-driven and data-operated operations. So the company I always point to in this topic is Snowflake, which is basically offering a service that lets you, you know, digitize your operations and go after the data first, which is what. Snowflake does. They’re kind of a data ecosystem service. That’s what they’ve done. Okay. So as you go digital, or if you’re a digital native and you were kind of born digital, like a lot of companies, Food Panda, Lazada, a lot of companies are sort of digital. I look at all of this as, there’s two types of ways to think about strategy. You can think about it structurally. We are building a motorcycle. and not a bicycle. We are building an airplane and not a motorcycle. That is structure. That, you know, your business model, things like that. And then there’s sort of operating performance. So structure versus operating performance. Operating performance is more like, look, how fast are you? How good are you at operations? The analogy I tend to use there is like, you know, running a marathon or something like that. The one Warren Buffett uses is talking about the horse versus the jockey. Some horses are just faster than another one. That’s structure. But the jockey also matters. Some jockeys are better than another. That’s operating performance. So you put a amazing jockey on a mediocre horse, it’s probably not gonna make a difference. If you have a really fast horse, you can probably get away with mediocre operating performance, i.e. jockey. Now ideally what you want is both. You want a super fast horse and you want an amazing jockey. That means… great business model with structural advantages and outstanding operating performance, which includes management obviously, but it’s a lot more than that. Okay, so if you break it into those two buckets and I’ll put in a slide, my standard six levels of digital strategy. I’ll put the slide in the show notes there. It’s always on the webpage under these podcasts. Within operating performance, I break it into three levels. which are tactics, digital operating basics, and digital marathons. Okay, now we’re gonna talk about digital operating basics, which are the difference between tactics and digital operating basics are important. Tactics are just doing random stuff every day. Put this on sale, drop a promotion here, let’s refurbish this store. You know, lots of little things you’re doing back and forth that are kind of tactical moves. I call tactics basically do whatever works. Whatever’s working, just do it. Digital operating basics are when you take the things that work and you standardize them and you build more regimented and systematic operations around certain activities. Those are what I call the operating basics. We may do promotions here and there, but running good convenience stores, that would be part of your operating basics because you know that’s a core activity. Okay, so operating basics, these are the six or seven ones I consider pretty fundamental for businesses that are digital first. So whatever operating basics you used to have as a retailer, inventory management, supply chain management, purchasing, store management, opening stores, those would be your standard operating activities. On top of those, you need these six to seven digital operating basics as well. and the same is pretty standard across all of them. If it’s a bank, a retailer, a manufacturing, you’re still looking for businesses that are doing these six or seven things well in a regimented pattern, and you can measure how well they’re doing. When you start talking about doing digital transformation at a company, you’re usually talking about these six to seven things. Okay. Now. What are the six, what was it, six or seven? I always get it confused. Now, if you look at other frameworks companies have for digital performance, digital transformation, there’s a lot of these frameworks out there. McKinsey has a bunch, BCG has a bunch, Bain has a bunch, specialists have a bunch, people who do like, you know, digital transformation as executives within companies, they have their own frameworks. My experience is if you look at all of them, you’re gonna kinda see these six to seven things across all of them. There’s other stuff, but these are kinda the big ones that I think are significant. All right, so with that, let me just get into the digital operating basics. And there are basically, hang on, it was seven, sorry, not six, although the seventh is kind of, it is really a six, the last one’s basically about cash flow. So there’s six operating activities. And the seventh is you gotta have a lot of cashflow being thrown out. Okay, so number one, digital operating basics one. There’s a management consultant called Dr. Ram Charan. He wrote a book pretty similar to this, about 50 to 60% of this list is from him and the rest is from me and other people. He talks about this in terms of competitive advantage. I don’t think any of these are competitive advantages. I think this is just. the operating performance you have to achieve to be competitive. But competitive advantages for me are a structural barrier or a marathon for those of you who’ve read my books. But okay, seven components of digital operating basics. Number one, which DOB digital operating basics. One, rapid growth at small incremental cost without constraints. Now my language here is a little bit wordy, I’m sorry about it. I’ll put the list of these there. But when you start to go from a traditional business, which is probably physical in nature, factories, warehouses, power plants, as you start to incorporate digital aspects into your business, in whatever way, one of the things digital can do is you can grow much faster. It’s just the nature. I mean, things made of bits and bytes and ones and zeros on a screen don’t have physical form and they have very strange economics and one of the big benefits is you know you can ten people can read your digital book or a million people can read your digital book it’s all the same when it’s digital it ain’t the same when it’s a physical book you gotta have warehouses and trucks and stores and staff and all of that so as you go digital you really want to lean into anywhere you can start to access rapid growth because that’s the…not going for growth when you’re doing something digital is just missing the whole point. I mean that is one of the greatest things about it. You got to go for that. So one you can go for growth. Two you can go for growth at a small incremental cost. Now if it’s a book the incremental cost is basically zero. You know, doesn’t cost anything to make two copies of a digital book, Control C, Control V, you got two. That’s digital content, but as you move into sort of non-content, like physical products and services, physical stores, e-commerce, okay, it’s not going to be zero for incremental cost, but it’s usually very small. So you can grow and do so pretty cheaply. And the third aspect of this is you can usually grow without constraints. If you make a factory, that’s awesome, but eventually that factory is gonna max out in what it can produce, and you’re gonna have to build another factory. There’s a constraint on volume. If you build hotels, you’re gonna rent out of rooms to rent constraint. Most digital activities, they can grow quickly. It usually doesn’t cost much, and there’s no natural constraint. YouTube can keep being watched everywhere in the world. That’s why so many of these digital businesses become global, which is really stunning. So that’s kind of number one. Now within that, if that’s your benefit, digital operating basic one, where’s your growth? That’s kind of a standard question I would ask a CEO. You’re going digital, where’s your biggest engine of growth going to be? Now based on that, you want to be targeting a 10x or 100x opportunity. If you can access this type of growth, go for something big. Now, venture capital has loved that. Most businesses don’t have a hundred X market opportunity. Not really. So, yes, you should be looking for those big massive opportunities. If you don’t have one, don’t worry about it. Most people don’t. But within that, you still want to be focused on growth and maybe your core product can’t grow. Let’s say you’re selling sneakers. Okay. Selling more sneakers does not going to. It doesn’t access digital. type of growth, you still have to make the shoes and sell it. But what you can do at Nike did, you can do like a training app or a runners club app. Well, that aspect of your business can grow digitally and you can get user engagement at a growth rate you could never get from just selling shoes. So if it’s not your core business, you want an ancillary service or product that lets you get that kind of growth. Okay, that’s DOB1. My bad language here is rapid growth at small incremental cost and without constraints. Lean into that as much as possible. DOB2, Digital Operating Basics 2, Never-Ending Personalization and Customer Improvements. Now one of the other things when you go digital, you start to get data. As mentioned, most businesses don’t have that much data. It’s… You know, occasional reports, maybe weekly. It’s relying a lot on the judgment of senior management who have been around for a while. That’s how decisions are made. But once you go data and the lights get turned on, you can see everything. Okay, fine. What do you do with that? You can do a lot of stuff with that. You could become more efficient. Let’s do productivity gains. You can do that. You can make the supply chain more flexible. You can do that. There’s a lot of things you can do with this, you know, vast transparency in your business and off in your market. The number one thing you want to do, you want to start to improve the customer experience. That’s number one. You take that data and you immediately start to improve the experience of your customers because that at the end of the day in business, that’s where rubber hits the road. So if your product or service is getting better and better rapidly, cause you’re constantly feeding off this data and making small improvements, small experimentation. There’s, you know, basically a flywheel that everyone talks about. As you get data, you start to make rapid improvements to the customer experience. In theory, that gets you more users and more engagement. You get more data, you keep going. Okay, now within this idea that we are gonna rapidly make improvements, lots of experimentation, lots of A-B testing, lots of new products, all of that. Personalization is the biggest lever. When you start to personalize your products, here’s the videos that Jeff likes to watch as opposed to all of standard popular videos, that’s YouTube, people love that. The more you can personalize content, the more you can personalize messaging, communication, marketing. If you can personalize physical products like shoes and apparel is a good one, it’s a huge win. I mean, customers absolutely love it. The most extreme version of this, they call the market of one, where you are basically every one of your customers is their own independent market. So number two on the list, you start to gather data, you look for customer facing innovation and improvement, and the faster you can go, the better. And within that personalization, that’s usually your best lever. It makes a huge difference. Customers absolutely love it. And that’s DOB2, which is never ending personalization and customer improvements. All right, we’re at about 20 minutes here. So there’s no way I’m getting through all seven today. So we’re gonna now call this intro to the digital operating basics part one. And we will do part two next week. All right, let’s do the last one for today then. Digital Operating Basics number three, Digital Core for Management and Operations. Now I’ve kind of already touched on this one, which is all businesses, you gotta be fast, you gotta be data-driven and you gotta be smart. If you are not data-driven, very fast and very smart in your decision-making, you’re just gonna be obsolete because the companies are digital. They have so much information that they didn’t have 10 years ago that they can make decisions and do moves almost every day. So, you know, it’s just kind of required. Well, what does that mean? Well, that means you have to do a lot of data consolidation, a lot of data gathering. You have to sort of do the transparency we talked about. But just gathering and consolidating the data, which is usually a fairly big effort, it’s not enough. You start with the data lake, maybe you do the data warehouse, now they have what they call the data lake house. You build out the databases, all of that. Now, the most common way people do this is they do something with Google Cloud or AWS or a company like Snowflake. Okay, that’s kind of the first part of that is you gotta gather the data and you start feeding it to management. But then what you start to do is you start to do the analytics on top of the data. You know, you can build models and you can start to hunt in the data for various things. And so this sort of retroactive, backward looking analytics is very common. That’s usually where people start. And then they usually do one of two things, usually both. Once you have the data coming in and you’re doing pretty good analytics and you keep advancing your analytic abilities, what models you’re running on this, and it’s usually a lot of small models, you start to become much more experimental as a company. You start running tests, you start launching things all the time and then seeing the feedback in real time. I mean, in many ways, the whole strategy business, which is what I do a lot of, obviously, It’s all based on this sort of top-down decision-making that you do once or twice a year. More and more business decisions are not happening that way. More and more, it’s bottom-up experimentation. Forget planning, let’s just do 100 things every month, and whatever works, we’ll just do more of that. So what you’re seeing in businesses is a shift from traditional top-down strategy to a combination of top-down strategy. and sort of bottom up data driven organic experimentation. And so you start to gather the data, you do a lot of analytics and the teams on the ground, usually the ones that are closest to the customers, they start to experiment on their own. And if something works, they implement it. So, you know, the analogy I use is top down strategy is sort of like being the general and deciding the army is gonna go left or the army is gonna go right. This bottom up, it’s more like an amoeba that just sort of constantly adapts and tries and does things almost on its own. That’s kind of what strategy’s looking like. And if you’ve read my books, I basically argue the two decisions that have to be made top down are what’s your moat and what’s your marathon. Outside of that, you wanna push as much decision-making and sort of strategic moves. down into the organization to operate in this amoeba like fashion that you can. That’s usually it, but you know, that’s kind of my opinion on how this works. Okay, so you see that and then kind of the third thing you start to see is you start to move from retroactive data analytics to more forward looking prediction. And that’s basically AI. You know, AI is anticipating or predicting what will happen. What is the best move from here, well, that’s different than retroactive data. And what tends to happen within this, and this is something Huawei’s been talking a lot about, is we see a big trend from going from some data to a huge amount of data, because you cannot do predictive analytics, you cannot do generative AI without massive amounts of data. The other type of data analytics you can do with small amounts of data. But real AI takes a huge amount of data, so you’ve got to start getting a lot more. You also need a ton of computing power. And you also have to switch from lots of small models, which are sort of data analytic models, to really big models. You have to stop, you have to go from, we’ve got lots of models that are looking at our data. We have one looking at customer satisfaction, we have one looking at efficiency of our supply chain. All those small models that have been built against the data backwards, you have to start looking at big models going forward like foundation models, GPT. GPT models that are customized to your specific industry, let’s say agriculture. In scenario specific foundation models that are specific to something like customer complaints, supply chain management. So… As you go from backward data analytics to forward, you gotta have a lot more data and you gotta go from small models to big models. And so companies that are making this transition now, that’s what you hear a lot about. That’s kind of like 60% of the conversation on the ground, at least I’ve heard. Anyways, so that is kind of number three here, which is this idea that you have to build the digital core for management operations. And it doesn’t really stop. There’s a feeling in this that, oh, we have to do digital transformation. We have to build our digital core, which our management and operations are going to run on. It doesn’t ever really stop. It’s continually being built and rebuilt and rebuilt. That’s why I put it in the digital operating basics. It’s not a one-time thing, this digital transformation. No, no, you keep transforming kind of forever. Hence, it’s one of the digital operating basics. and you want to be improving your core faster than your competitors. Okay, I think that puts me right on time. 28-29 minutes, perfect. Anyways, so we’ll call that point part one of the digital operating basics sort of introduction. In the next one we’ll do the other three to four. Hopefully that is helpful. This stuff’s really important. When I talk with companies, I’d say half the time, there’s a lot of advanced strategies you can talk about. structural advantages, switching costs, network effects, all this cool stuff. Probably half the conversation is these six to seven things, implementing them in wherever the company is in its own sort of development right now. Do you have the people to do all of this? What is doable today? It’s sort of integrating those. And most people, most companies I’ve dealt with are sort of halfway in the process of implementing their digital operating basics, which is fine. I mean, it’s just a process. Anyways, that is it for the content for today. So the key concept, digital operating basics, and we’re right on time, perfect. Anyways, that is it for me. I’m sorry I was on vacation this week with my family, so I didn’t do a podcast and I got a couple articles on the way that have, I’m about a week behind, but I’ll catch up in the next couple of days. That was pretty fun. I took my parents around Southeast Asia a bit, which was great. But I’m only good for that sort of stuff for about a week. Then I get kind of antsy to get back to work. So I was actually, it was fantastic, glad to see everyone. And then I was kind of okay, eager to get back to work. So yeah, that’s been the last day or so. Anyways, that’s it for me. I hope this is helpful and I will talk to you next week. Bye bye.

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.