As I’m writing this, Coinbase is at $190 per share. That’s up from $50 per share in 2022. Although still below its IPO price (2021) of around $250.

Coinbase’s fall in stock price was not surprising. 2022 was the year of crypto scandals. There was Luna, Celsius, Three Arrows Capital, Voyager and, of course, FTX.

But the recent rise is interesting. Investor sentiment is definitely changing. Although keep in mind investor sentiment for Coinbase is directly tied to the prices of Bitcoin and Ethereum. And Bitcoin has increased from $20,000 in 2022 back to +$60,000 today.

I thought it made sense to look at the business again. I wrote quite a bit about Coinbase and web3 previously. You can find those articles here.

- After the Fall of Crypto, Is Coinbase an Opportunity? (Tech Strategy)

- Coinbase and the Tech Uncertainties of Platform-Protocol Hybrids (3 of 3) (Tech Strategy)

- Platform-Protocol Hybrids and Why DeFi is the Center of Web3 (2 of 3) (Tech Strategy)

Here’s my assessment of what I think is happening at Coinbase:

1) Transactions and Transacting Users Have Fallen Dramatically. And May Continue to Fall. That’s Bad.

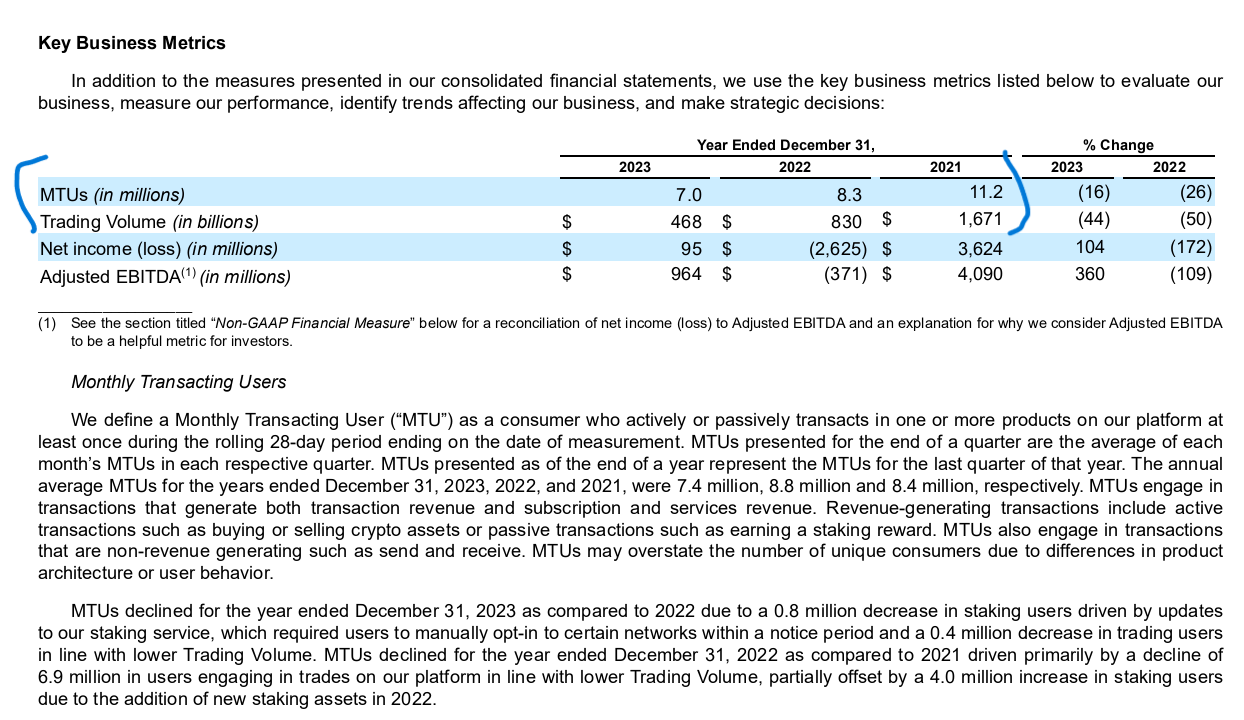

Take a look at the 2023 transaction activity for Coinbase.

Trading Volume fell dramatically from 2021 to 2023. It was $1.7T in 2021. And then fell to $830B in 2022. And then to $468B in 2023.

That’s bad. However, it does contain the falling price of Bitcoin and other coins during that time.

MTUs (monthly transacting users) are decreasing and also a problem. These are their active users. Their monthly active users dropped from 11M to 8M in 2022. And then again to 7M in 2023.

Also, bad.

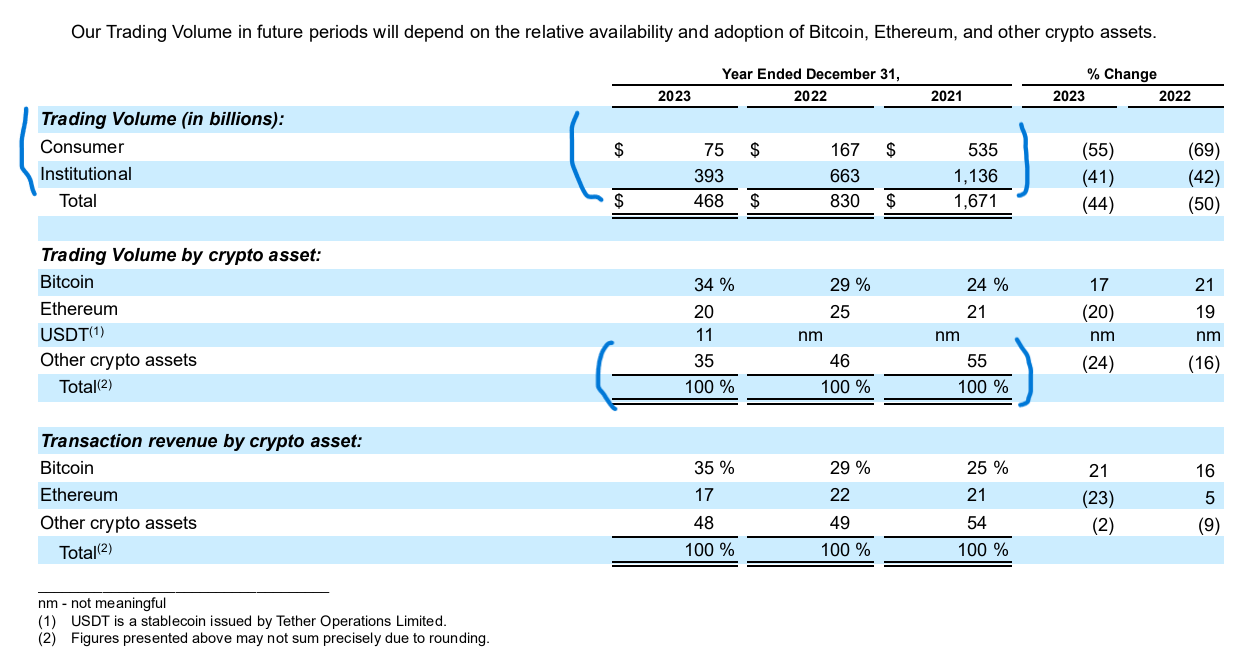

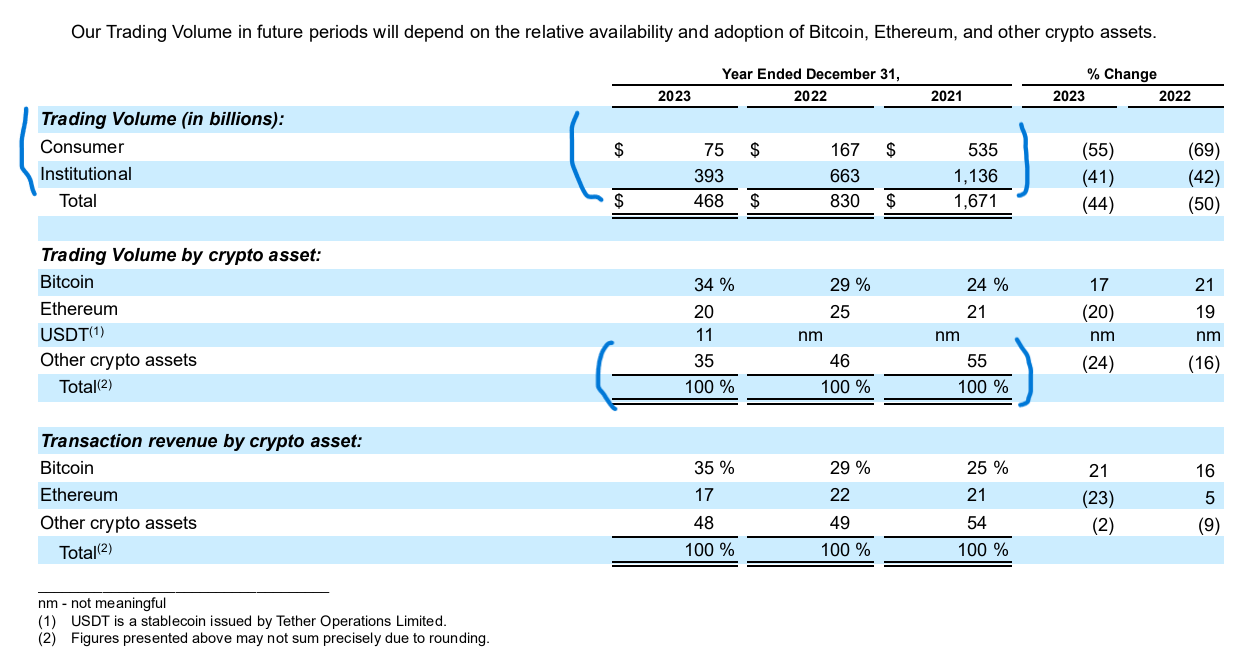

And this appears to be both happening both with consumers and institutional customers. Note the top two lines below. Consumers and institutions are both down by 75-85% in dollar trading volume between 2021 and 2023. But keep in mind Bitcoin dropped by +60% during that period.

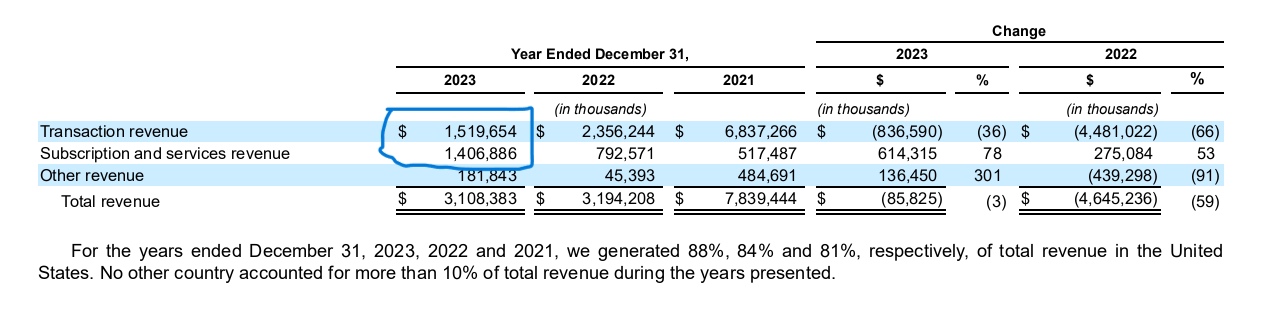

2) Transaction Revenue Has Really Fallen. And May Not Rebound. That’s Bad.

Decreasing transactions and transacting users really hits Coinbase in its traditional source of revenue. Which was mostly from transaction fees (mostly as a percentage of transaction value).

Note the below decreases in transaction revenue. That’s really bad. And I don’t think there is any reason to expect a rebound soon.

3) Coinbase Is Now Much More Focused on Bitcoin, Ethereum and Stablecoins. That’s a Service, Not a Marketplace.

Look at the middle section of the chart below.

In 2021, “Other crypto assets” was 55% of trading volume. And represented 54% of the transaction revenue. A large and expanding suite of different crypto assets was a big part of the Coinbase story. It was going to be a big marketplace for all types of crypto assets.

But in 2023, “other crypto assets” had fallen to 35%. And Bitcoin, Ethereum and USDT (the Tether stablecoin) were 65% of trading volume. Plus, there is their deal with the USDC stablecoin, another big part of Coinbase’s strategy.

So, Coinbase is looking much more like a service for 3-4 crypto products. It’s a service for Bitcoin, Ethereum and a few stablecoins. That is ok and a good service. But that is different than the robust and growing marketplace previously discussed.

4) Coinbase Has Launched Lots of New Ecosystem (i.e., Not Transaction) Products. That’s Great.

This is the most interesting part of what’s happening with Coinbase.

Coinbase now breaks its products into Trading Products and Ecosystem Products. Which include products done by themselves and by 3rd parties.

Trading products are their historical services. These products / services are all about trading coins and crypto assets. And result in transaction revenue. These are done on their three marketplaces.

- Coinbase exchange

- Coinbase international exchange

- Coinbase derivatives exchange

Within this, Coinbase offers both simple and advanced trading services. Retail consumers use the simple products. Institutional customers use the advanced services.

Fees for these products are based on volume and/or the spread.

There is also Coinbase Prime, which is a full-service brokerage platform for institutional customers.

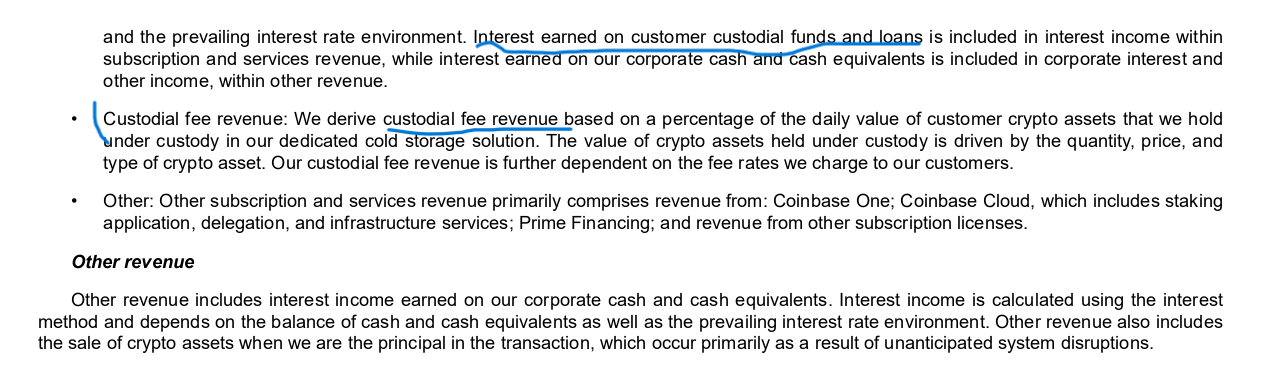

Ecosystem products are the interesting area where they have been adding products in the past 1-2 years. These generate subscription and service revenue. Which is not dependent on transactions happening (which is the whole point).

Take a look at the below description.

They describe this as fees for staking, custody, financing, and wallets (self-custody). And there is Coinbase One, a subscription product where you can trade without transaction fees.

But this is about fees based on assets under management.

- Stablecoin revenue is described as a “pro rate portion of income earned on USDC reserves”.

- Blockchain rewards are the fees customers get for depositing their crypto assets in certain protocols. It’s similar to interest on a savings account.

- Interest income is from cash or cash equivalents held.

That is all great.

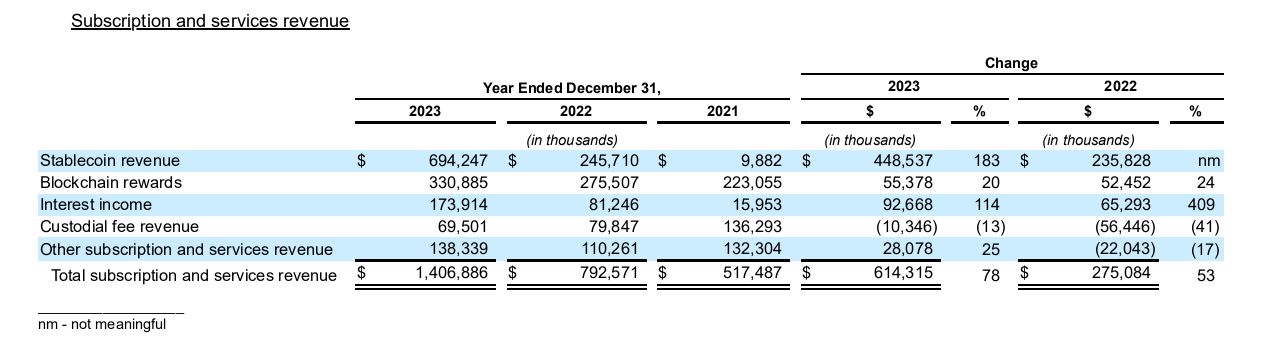

The number I am most interested in for Coinbase is their growth in revenue from subscriptions and services.

5) Their Revenue Mix and Business Model Have Shifted from Trading to Assets Under Management. That’s Smart.

Take a look at the revenue mix for 2021-2023.

In 2021, transaction revenue was 87% of revenue. By 2023, it was down to 48%.

And subscription and services revenue had risen to 45% of revenue. Here’s the breakdown.

That is a big shift from trading activity to fees from holding assets. That’s pretty great. That’s a big change in their business model. And a smart response to the fall in transactions in crypto, which is outside their control.

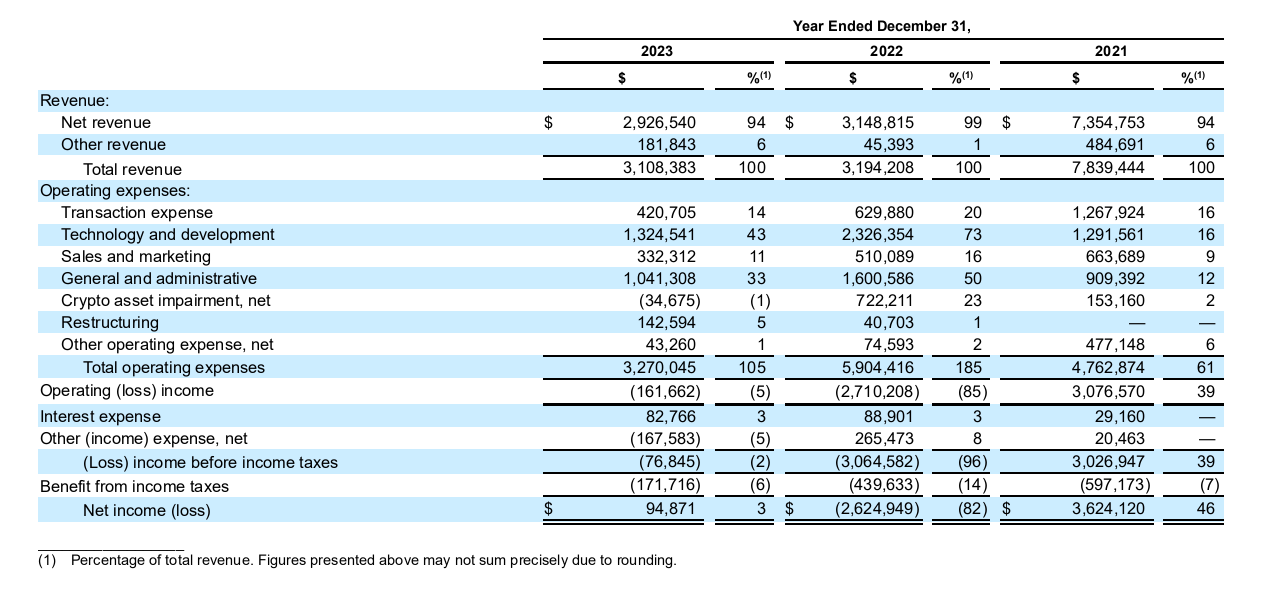

6) Coinbase Has Returned to Operating Profitability

Here is the income statement for 2021. Note the return to operating income after a rough 2022.

***

Overall, I think this is a solid management response to the big changes in crypto behavior.

- Coinbase has simplified its business model. It’s mostly a service now. And no longer a marketplace with lots of activity.

- Coinbase has re-focused on the 3-4 crypto assets that are mostly for storing value.

- Coinbase is firmly positioned as an easy and trusted “on ramp” to crypto. And serves as a customer’s primary account for holding crypto.

- Their product mix was shifted from being for trading to holding assets. That makes sense.

In Part 2, I’ll talk about my own personal lessons from the crypto rollercoaster.

Cheers, Jeff

———-

Related articles:

- How to Think About Web 3.0 Business Models (1 of 3) (Asia Tech Strategy – Daily Article)

- Coinbase and the Tech Uncertainties of Platform-Protocol Hybrids (3 of 3) (Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Protocol Networks

- Platform-Protocol Hybrids / Web 3.0

- Blockchain

From the Company Library, companies for this article are:

- Ethereum

- Bitcoin

- Coinbase

- Tether USDT

Photo by Kanchanara on Unsplash

———–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.