I’m pretty obsessed with JD Logistics, Cainiao and Amazon logistics. I think we are seeing something entirely new emerging.

Logistics networks are evolving rapidly, transitioning from physical infrastructure to digitized, intelligent systems that move objects around the world. I’ve called this smart, automated IoT networks at scale. Which is not a great name.

I thought I would do a bit of history on physical networks. To point out how big of a transformation is currently happening. And because physical networks have long enabled some of the most powerful business models. There is reason why Warren Buffett has invested big in BNSF railroad, UPS and even US airlines.

The Rise of Physical Networks: How Infrastructure Enabled Early Commerce

Historically, logistics businesses revolved around purely physical networks such as railroads, roads, and waterways. These networks took decades to build and facilitated the movement of goods and people, enabling trade and economic growth.

Roads are important but not that interesting in terms of business. They enable the distribution of goods via trucks and other vehicles. And the efficiency of road networks depend on factors such as the density of nodes and routes, as well as the volume of customers and shipments.

But one business couldn’t really own or control these networks. There are tons of companies using them.

Railroads are where things got interesting. Privately owned rail networks in different regions were stitched together to create unique physical networks, often owned by 2-3 companies. People and businesses couldn’t just use them. You had to buy services from railroad companies for shipment and transportation.

Plus, they enabled transportation services that were much cheaper per ton.

And the standardization of rail gauges and systems enabled the connection of previously disparate local networks. This standardization led to a network effect. Companies could now all build standardized trains, services and machinery for all the rail networks. That made things cheaper.

Railroad networks are basically impossible to replicate. When Warren Buffett bought BNSF, he captured the only rail network in the Western United States. Something almost impossible to replicate now that the West is settled and developed.

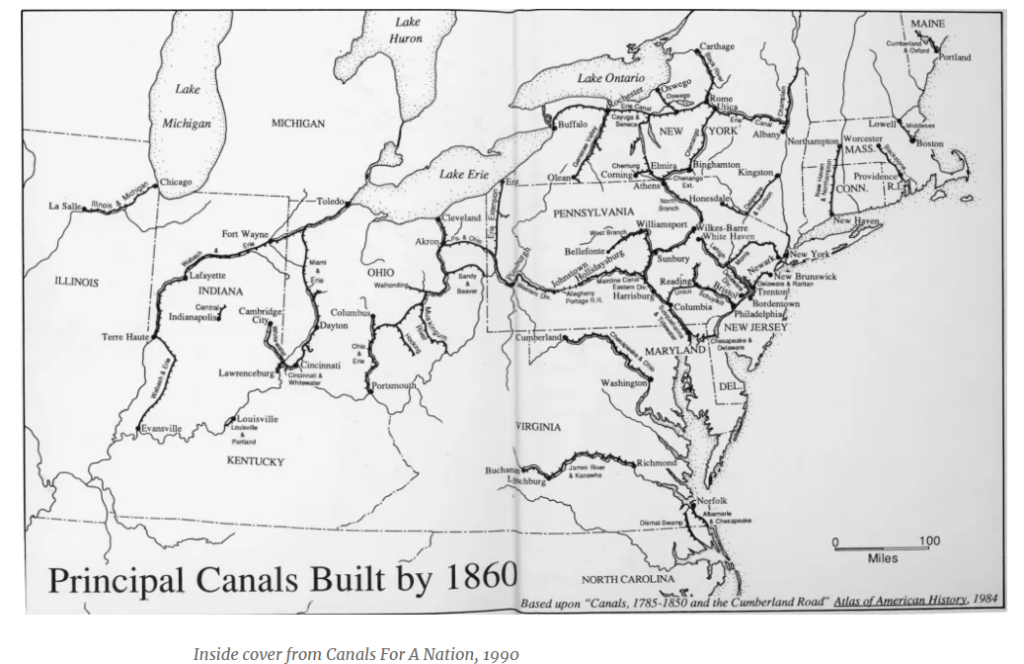

Canal networks are underappreciated historically. The US, rich in waterways, was very aggressive at building canals and creating internal shipping lanes within the country during the industrial revolution. They made it very cheap to move things around the country.

And as manufacturing was centralized to a few places during the Industrial Revolution, you needed such cheap distribution to take goods from specific location out to disparate markets. Canals and waterways were really the first solution for this (leading to a big stock market boom). But the same industrial revolution also gave us the steam engine and railroads rose quickly to replace the canal network.

***

There is a really interesting history of physical networks. Pipelines, oceanic shipping, airline routes, and many others. And all these physical networks enabled physical services (i.e., moving stuff). Many of these turned out to be very powerful business models.

However, most of these physical networks are based on hub and spoke systems. Goods are transported from various locations to a central hub, where they are sorted, re-packaged and then distributed onward. Except for roads, networks rely mostly on hub and spoke systems to optimize transportation costs vs. delivery times. As a result, we don’t really see network effects. But we do see big supply side cost advantages based on geographic network density. You win by having more hubs and spokes.

Which brings me to Express Delivery services, something I have written a lot about. It’s the physical network business Warren Buffett has been investing in the longest. You can find his investments in UPS going back decades.

From FedEx to DHL: The Rise of International Express Delivery Networks

Staring with FedEx, express delivery is arguably the best service built upon a physical network. It’s more capital lite than a railroad. And is a service based on having faster delivery, which requires a specific type of physical network. We see dominant national railroads but we see dominant international express delivery networks.

Over decades, businesses like FedEx and DHL built extensive networks of warehouses, trucks, and planes to facilitate the rapid movement of packages. These networks benefited from economies of scale, where having numerous warehouses globally made it difficult for competitors to replicate their cost versus service.

Photo by Nick Morales on Unsplash

The success of these physical networks depends on a couple factors:

- Coverage: The more extensive the network, the more valuable it becomes to shippers. Increased coverage means goods can be shipped to more places, enhancing the network’s utility.

- Cost: Lower transportation costs are a significant advantage. Denser networks with more direct routes reduce expenses.

- Timeliness: Faster delivery times are the main selling point. Efficient networks ensure goods reach their destinations quickly.

These early networks faced challenges such as fragmentation and inefficiency. However, the increasing demand for faster and more reliable delivery services drove consolidation and innovation. Now we see a couple of major players in each region and globally.

I’ve written a lot about how growing volume enables adding more warehouses (nodes), which means more routes. And more routes means lower costs and faster delivery. And so on.

The Rise of Digital Services: Enabled by Protocol Networks.

The advent of protocol networks, such as telephone lines and connected computers, revolutionized communication and commerce. These networks enabled the creation of digital services that transformed various industries.

- Telephone lines are a really interesting case study. Laying cables and telephone poles over entire countries enabled instant voice communication, arguably the first mass market digital service. And the CEO of AT&T famously first described the direct network effects of such a business. With the value of a telephone service increasing as more users joined. You could argue that the first phones were a physical network but it’s really just a landline version of ICP and such.

- The internet came next, which changed everything of course. From phone lines to broadband and mobile networks. You could argue that these are protocol networks or people / company networks (for example, ecommerce platforms connect buyers and sellers). Mark Zuckerburg basically created a virtual telephone network plus phone book, capturing the direct networks previously held by AT&T.

If physical networks enabled physical services and business models, virtual networks (whether protocol or people based) enabled the emergence of digital services.

E-commerce platforms such as Alibaba and JD.com have naturally merged into logistics, driving the need for more efficient and scalable delivery solutions. It didn’t transform logistics directly (still mostly people and trucks and warehouses). But it opened up a new avenue for growth.

The relationship between physical and virtual networks is interesting. Many of the companies that built physical networks, such as AT&T, ended up becoming mere “pipes” as the value shifted to virtual networks and digital services. But railroads and express delivery have done quite well.

Intelligent Logistics: The Next Phase of Physical Network Evolution

Which brings me to today.

Alibaba and JD are aggressively upgrading physical networks with technology. They are pioneering new integrated hardware and software to digitize the express delivery, logistics and supply chains described in Phase 1.

- Lots of new IoT devices (cameras, sensors, and RFID tags) are tracking everything in every warehouse, railroad, and highway.

- Tons of data is now coming in from IoT devices. Which enables better visibility, management and real-time control of operations.

- Vehicles and warehouses are becoming automated.

- The whole network is becoming intelligent.

The near-term benefits are:

- Enhanced visibility: Real-time tracking and tracing provide transparency throughout the physical network.

- Improved efficiency: Automation and robotics reduce manual labor and streamline operations.

- Optimized routes: Data analytics and AI algorithms determine the most efficient delivery routes for every single package.

- Better demand prediction: Forecasting tools help anticipate future demand and optimize inventory management.

We can already see this being built.

- JD Logistics now operates a vast logistics network with warehouses, transportation, and delivery services. They employ advanced technologies such as warehouse management systems (WMS), transportation management systems (TMS), and order management systems (OMS) to optimize operations. They are taking this international as a service with their Ochama business but are mostly focused on their China network.

- Cainiao, Alibaba’s logistics arm, focuses on building a smart logistics network through partnerships and technology. They aim to create a digital nervous system that connects all aspects of the logistics process. This is moving fast in China and internationally. They are aiming to build a global network.

Here are some articles / podcasts on this:

- 3 Ecommerce Lessons from My Visits to China’s Digital Leaders (Tech Strategy – Podcast 230)

- JD’s Smart Logistics Is Getting Traction in FMCG and International (2 of 2) (Tech Strategy – Daily Article)

We are completely changing how physical goods move around the world.

That raises an interesting question:

What kinds of services will this new digitized and intelligent physical network enable?

We can already see a few interesting services emerging:

- Cloud warehouses: JD Logistics is extending its WMS to third-party warehouses, integrating them into its network. You can basically take any physical building and plug in the hardware and software. And it is now part of the physical network.

- End-to-end fulfillment: Companies can offer integrated solutions that manage the entire logistics process from order placement to delivery. From shipper to receiver. From supply chain to the factory. From the factory to the warehouse and to the client. JD logistics has interesting services here focused on bulky item shipping and cold chain.

- Customized delivery with additional services: Logistics networks can tailor services to meet specific customer needs, such as temperature-controlled delivery for perishable goods. You can offer customized packaging. You can pair delivery with installation and other services.

That raises another interesting question:

What kinds of business models will this new digitized and intelligent physical network enable?

We can definitely see:

- Production ecosystems: Digitizing the entire supply chain improves data connectivity and overall efficiency. And it naturally integrates into production and manufacturing.

- Consumption ecosystems: Connecting logistics services with complementary services creates integrated solutions for customers. And enables C2M.

- Innovation platforms: Opening up these new logistics networks to developers can enable the creation of new applications and services that run on this digitized physical network. That makes this system look a lot like an operating system.

The Future of Commerce: Intelligent, Automated, and Interconnected Networks

Looking ahead, logistics networks can be expected to become even more intelligent, more automated, and more interconnected.

When I think about this, I imagine a network that covers the world and moves huge amounts of physical items around at will. And has increasing services layered on top. These networks will be able to handle complexity far beyond what humans can manage, predict demand, and move goods around the world with greater efficiency.

Is it really even logistics anymore? Don’t we just call this commerce?

Think about how the current tech trends are going to shape physical networks:

- Artificial intelligence: AI will play a greater role in optimizing logistics operations, from route planning to warehouse management. AI algorithms can analyze vast amounts of data to identify patterns and make predictions, enabling more efficient decision-making.

- Robotics and automation: Robots will perform more tasks in warehouses and delivery, reducing labor costs and improving efficiency. Autonomous vehicles and drones may also become more prevalent for last-mile delivery.

- Internet of Things: IoT devices will continue to generate data that provides insights into the location, condition, and status of goods. This data will enable better tracking, monitoring, and optimization of logistics operations.

- Blockchain technology: Blockchain can enhance transparency and security in logistics networks. It provides a decentralized and immutable record of transactions, reducing the risk of fraud and improving trust among participants.

- Sustainability: As environmental concerns grow, logistics companies will focus on reducing their carbon footprint. This includes using alternative fuels, optimizing routes to minimize emissions, and consolidating shipments to reduce the number of vehicles on the road.

***

That’s how I’m thinking about this. I’m hoping to head back to JD Logistics and Cainiao next month. I try to visit 1-2x per year to stay on top of what they are building.

Cheers, Jeff

———

Related articles:

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

- Why Netflix and Amazon Prime Don’t Have Long-Term Power. (2 of 2) (US-Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Logistics

- Physical Networks vs. Protocol Networks

From the Company Library, companies for this article are:

- Cainiao

- JD logistics

- FedEx

——-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.