In Part 1, I laid out how to think about physical networks. For logistics, that means lots of warehouses and trucks doing various routes between them.

In Part 2, I talked about one of the big competitive advantages of logistics networks, which is network effects. Note: These are significantly different than the network effects we see in digital.

And that leads me to economies of scale.

That is the other big competitive advantage in logistics. And there are actually three types of economies of scale playing out in these physical networks. Network effects plus 3 types of economies of scale is a great way to take apart logistics companies.

This leads in nicely to my 6 Levels of Competition (from Moats and Marathons).

If we break-out Competitive Advantages, we get this list. Note the highlighted CA11, CA12, and CA13.

I typically break economies of scale into 5 distinct competitive advantages:

- CA11: Fixed Operating and Capital Costs

- CA12: Purchasing Economies and Bargaining Power with Suppliers

- CA13: Geographic and Distribution Density

- CA14: Geometry Effect

- CA15: Learning Scale

An Introduction to Supply-Side Economies of Scale (and Scope)

This is pretty big topic. It’s worth thinking about how cost advantages can show up in a business. We usually see the following situations:

- Variable cost advantages. In this situation, a company has a lower cost per unit, regardless of the volume manufactured or produced.

- Restricted or scarce supply advantages. This is a catch-all bucket where a required supply or resource is simply not available at a reasonable or normal cost to a competitor. Sometimes, it cannot be accessed at any price. Either way, it shows up as a real or potential cost for a competitor. And, therefore, a cost advantage for the other party.

- Scale and scope advantages in capital costs and operating costs. In this case, a company has a lower cost per unit based on superior scale or volume. That’s most of what we’re talking about in logistics networks.

- Cumulative and historical cost advantages. In this situation, a company is benefiting from past spending, such as in IT, marketing and R&D. These cost advantages are based on spending in previous years and often multiple business cycles. For example, Microsoft doesn’t have to spend as much on its operating system every year because it benefits from previous years’ spending.

In all of these, we are looking for decreased capital costs (including working capital), fixed costs or variable costs versus a competitor. And it is a situation that is sustainable.

Ok. That said, supply-side economies of scale are mostly about #3 and #4. We are looking for cost advantages based on superior scale and output versus a specific competitor or group of competitors.

For example:

- Lower per unit costs based on a higher volume of production or throughput being spread out over fixed capital and fixed operating costs.

- Capital costs can be in tangible assets like PP&E, in intangible assets like software, or in working capital.

- These scale and scope advantages can happen at the asset level and at the enterprise level. A bigger factory may have lower costs than a smaller factory. A business with ten facilities may have lower costs than a business with five facilities.

We are looking for a chart like this for long run average costs (LRAC) per unit. Look at the light green light and sweet spot.

We can also make an analogy between economies of scale and network effects. We have good frameworks for network effects, which are sometimes called demand-side economies of scale. The same questions can be useful for both.

For example, minimum viable scale and the scale differential are important in assessing both network effects and economies of scale. See my previous articles on these if you are curious. However, there are also important differences in supply-side economies of scale.

- You want a circumscribed market. This means there is less available room in the market for competitors to get to minimum viable scale or to reduce the scale differential.

- Growth can be a mixed blessing. It can create value but it can also decrease competitive tension and enable other companies to grow and close the scale differential.

- Switching and other types of customer capture are very important. They prevent a slow chipping away of customers and a deceasing of the scale advantage.

- Bureaucracy, complexity, increasing internal coordination costs and other disadvantages of scale usually overcome the advantages of scale eventually. We rarely see winner-take-all markets based on economies of scale. We usually see a giants and dwarves scenario.

You can see the differences in demand-side economies of scale (i.e., network effects) and supply side economies of scale in the below chart by Credit Suisse.

Note the difference between the supply-side and demand-side curves. I think the supply side curve is good. The demand-side curve is a bit too simplified. It ignores the fact that perceived value and/or utility usually flatlines beyond a certain volume. It can even decrease if there is congestion or diseconomies of scale. But it’s a pretty good graphic to keep in mind.

***

As mentioned, I break supply-side scale advantages into 5 categories. However, this is not my list. This topic has been discussed and written about for decades. I learned most of the following from Professor Bruce Greenwald at Columbia Business School, Charlie Munger and others.

The three types of economies of scale that are relevant for logistics are CA11, CA12 and CA13.

CA11: Fixed Operating and Capital Costs

Fixed costs are the most commonly discussed category. Larger competitors have lower unit costs in the major fixed costs because of their higher volume. You can find these costs on the income statement. But you also want to think about maintenance capex and other fixed capital costs. This is where most of the operating leverage shows up.

What are the fixed operating and capital costs for a nationwide logistics network?

- Does ANE have to keep all the warehouses staffed and running, regardless of volume?

- Do they have to keep all the truck routes running, regardless of how full the trucks are?

They can scale up and down with volume somewhat. There are variable costs. But most of them are pretty fixed. Offering national coverage in a timely fashion is a key part of their value proposition.

A nationwide logistics company is mostly a big fixed operating cost with lots of ongoing maintenance capex. A company with a larger volume will have a lower per unit cost than a similar network.

CA12: Purchasing Economies and Bargaining Power with Suppliers

Bigger players get cheaper prices and/or better terms from suppliers than their smaller competitors. This is about bargaining power for important and/or sizeable inputs.

Walmart, Costco and the traditional retail powerhouses have built their businesses based on purchasing economies. As do health insurance companies that negotiate rates with doctors and hospitals. Clever online plays like Pinduoduo and community group buying have also used this effectively.

This is not insignificant for logistics networks. They do buy lots of trucks and have to spend on fuel, insurance and maintenance. But it’s less important than the other two.

CA13: Geographic and Distribution Density

This is really the important point for today.

As the density of customers and orders within a geographic area increases, the transportation costs (both pick-up and delivery) can decrease as more economical routes are used. More nodes can be created. More direct routes can be used. Utilization at the truck level can increase. And the overall logistics costs (warehouses, transportation) can also decrease.

Recall the graphics I showed in Part 2 for adding nodes and routes to a logistics network.

When you add nodes and routes, you increase the coverage of the service and you decrease the time to deliver. That’s important. But you also significantly decrease the costs.

- The more direct of the route between two points, the less fuel and truck time you use.

- The more customers you have within an area, the more you can fill the truck and optimize the delivery route for all those packages.

What matters is the geographic density of the nodes and routes. And the volume of customers and shipments.

This is one of the ways Meituan got to profitability in food delivery in China. As they got greater and greater geographic density in parts of town, they used software to better and better optimize the routing and sorting of their delivery people. This dropped their per unit costs. Geographic density plus improving AI has turned out to be a real strength for both Meituan nd Didi. Geographic density really works in trucks and scooter delivery. It doesn’t work as well in trains and freight trucks because you can’t alter the routes as much.

ANE Logistics Details All Three Effects Directly

Ok. Back to ANE.

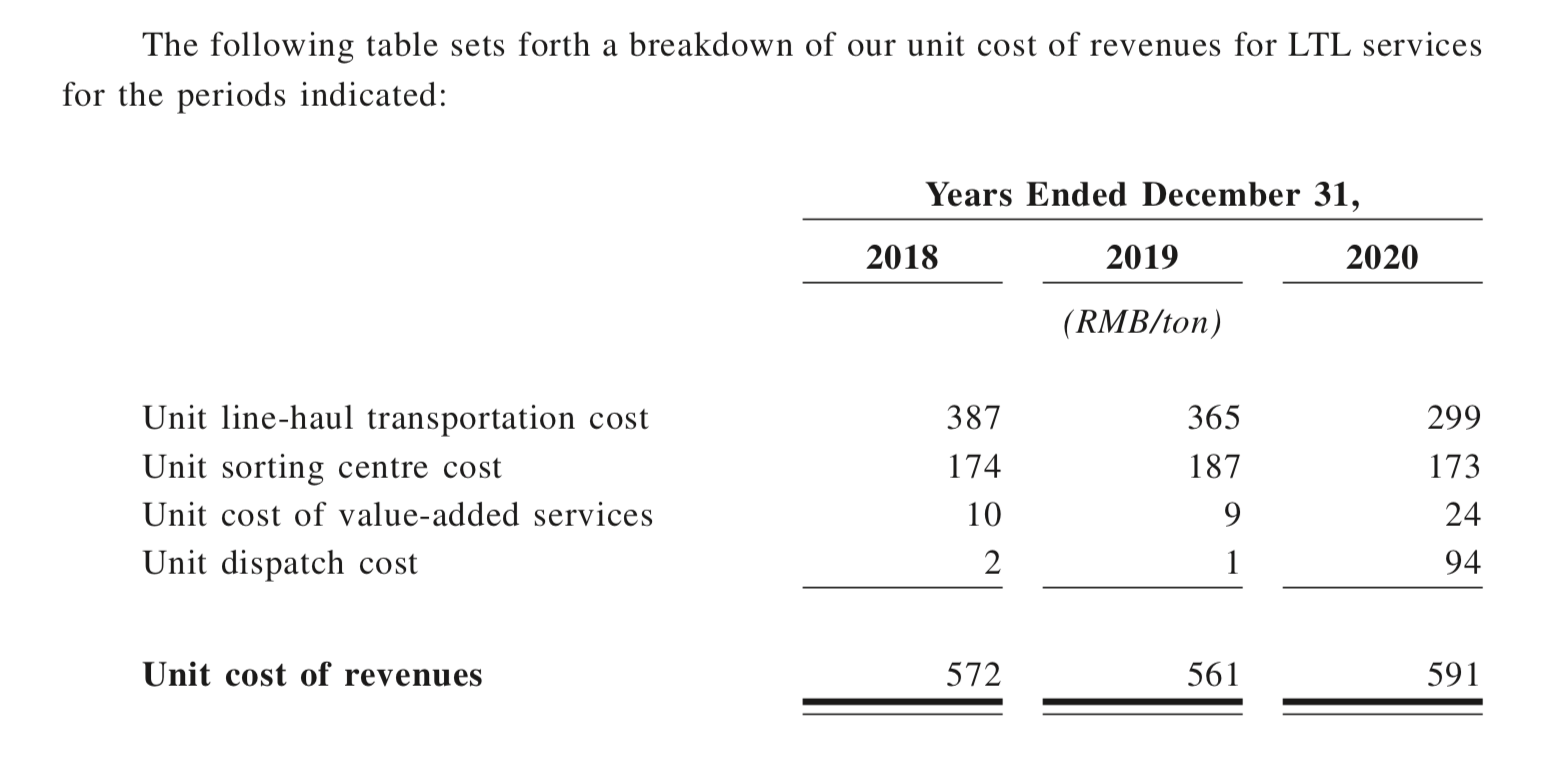

ANE says its biggest strengths are network effects and economies of scale. And it breaks out the per unit costs for both the line-haul transportation and sorting centers by ton. From the 10-K:

And they even mention the three types of economies of scale in their explanation of costs. Read these sections from their 10-K.

They explain their decreasing line-haul transportation costs as:

- Economies of scale by increased freight volume. That’s CA11: Fixed Costs.

- “Enhanced direct connectivity and routing due to our optimized line-haul management”. That’s CA13: Geographic Density.

- Increased deployment of self-operated high-capacity trucks. That more CA11.

- Increased centralized procurement of truck auto parts and fuel. That’s CA12: Purchasing Economies.

They also detail their sorting center costs.

That’s CA11: Fixed Costs plus some spending on technology to increase productivity (not a competitive advantage).

Overall, ANE Logistics is a pretty great example of the competitive advantages of physical logistics networks.

- Network effects

- 3 types of economies of scale

Last Question: Is Digital Changing the Barriers to Entry?

If you look at my 6 Levels, I also have Level 3: Barriers to Entry.

I’m not going to go through this today. But Barriers to Entry are mostly about how hard is it for a new entrant to get to viable scale within this business?

Traditionally, this has been very difficult in logistics. Especially express delivery and railroads. Entering the business means replicating the existing physical network. That is expensive and takes a long time. So historically, logistics networks like FedEx have had great barriers to entry at the national and international level. It took them decades to build these networks in-house.

I’m wondering if that is changing.

As mentioned in Part 1, ANE is using a franchised model where partners and agents do the selling and them plug into the core network of ANE. But ANE is also digitizing the logistics network. They are creating software and digital tools that can, in theory, be plugged into any warehouse to expand the network. JD Logistics is doing the same thing and calls these cloud warehouses. They run 900 warehouses themselves and have +1,200 cloud warehouses they don’t own.

I’m wondering if the digitization of logistics networks is significantly lowering the barrier to entry. Doesn’t all this make it much easier to build a network if you have the software and digital tools?

***

That’s pretty much for ANE Logistics. I think it’s a pretty useful company to study. Lots of good digital concepts.

Cheers, jeff

—–—

Get my new book Moats and Marathons (Part 1): How to Build and Measure Competitive Advantage in Digital Businesses

Related articles:

- An Intro to ANE Logistics and Franchised Physical Networks (1 of 3) (Asia Tech Strategy – Daily Lesson / Update)

- ANE Logistics and Network Effects in Physical Networks (2 of 3)(Asia Tech Strategy – Daily Lesson / Update)

- Podcast 26: Is Baidu the New AT&T? The Basics of Physical vs. Virtual Networks.

From the Concept Library, concepts for this article are:

- Economies of scale: Fixed costs

- Economies of scale: Purchasing power

- Economies of scale: Geographic density

- Physical Networks

- Logistics

From the Company Library, companies for this article are:

- ANE Logistics

Photo by Zetong Li on Unsplash

———-