I like the saying that winning in digital B2C is like catching lightning in a bottle. But winning in digital B2B is more like mining. The former happens really fast but is difficult to predict. The latter is slower but pretty reliable when you’re in the right spot. You just keep digging away over time.

Slow mining is what comes to mind when I think about Baozun. They are an IT services company for larger brands in China. And they are specialized in ecommerce. Their business and financials look like a slow and steady growing IT services company (think IBM, not Shopify). And having been founded in 2006, they have been growing quietly behind the scenes of Chinese ecommerce since the beginning. They are the dark horse of China ecommerce.

Their financials have looked pretty much the same for the past 5 year. For 2020, they were:

- Revenue: 8B RMB

- Growing at 20-30%

- Gross Profit: 3.7B RMB (42% and increasing over past 3-4 years)

- Operating Profit: 0.56B RMB (6% and stable)

I’ll go into my take on their strategy. But first a basic introduction.

An Intro to Baozun Inc.

Here is the description from their webpage:

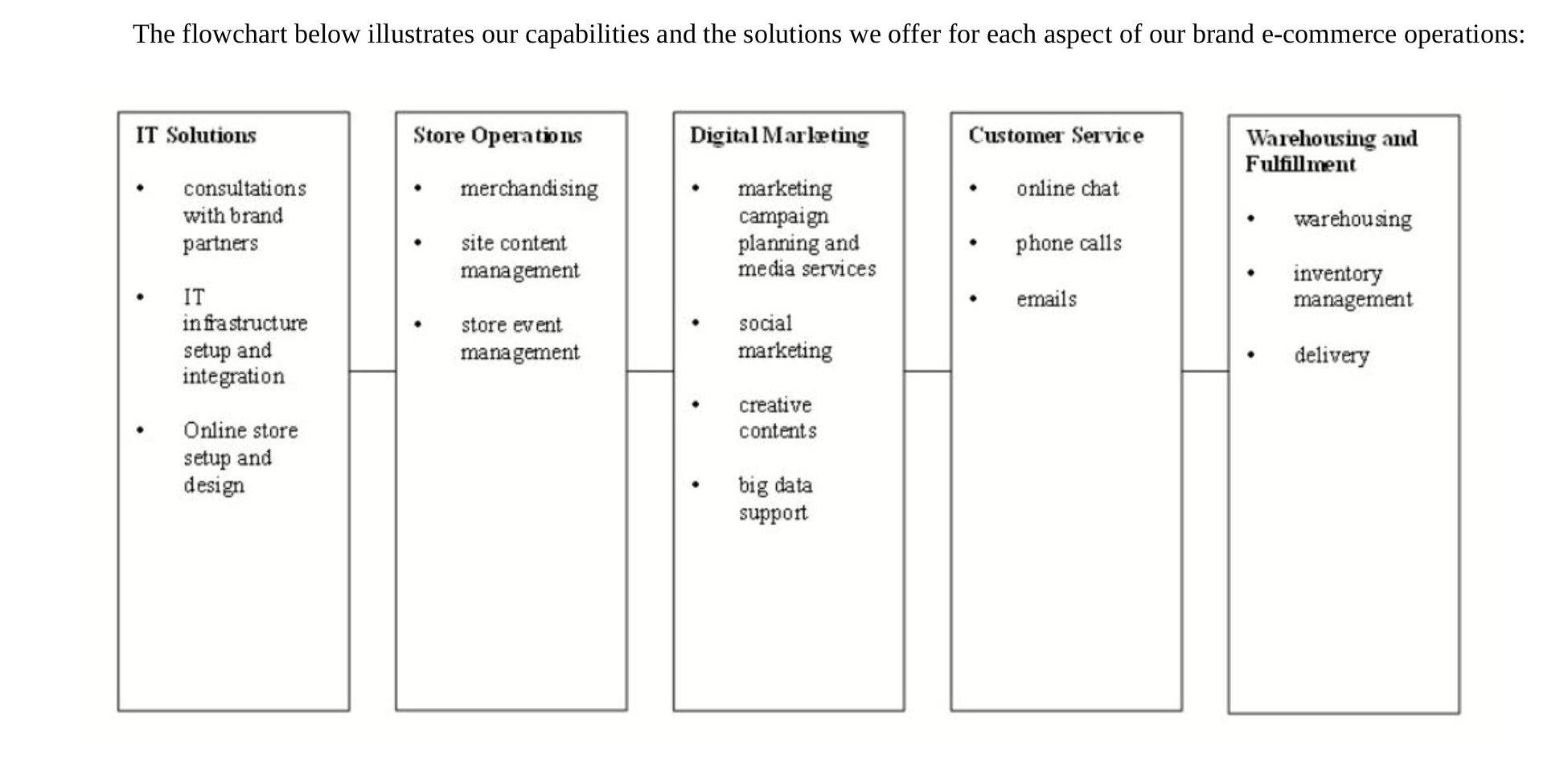

“We are the leading brand E-commerce solutions provider in China, our integrated capabilities encompass all aspects of the E-commerce value chain covering IT solutions, store operations, digital marketing, customer services, warehousing and fulfillment…”

This is a company that does IT services for brands, specifically end-to-end integrated services for ecommerce. Unlike Shopify, which provides highly scalable, self-service ecommerce tools to SMEs, Baozun offers a complete, end-to-end integrated set of ecommerce solutions for large brands. Notice how this is emphasized in the above statement (“integrated capabilities encompass all aspects of the ecommerce value chain…”).

They have +200 clients and are growing at about 20% per year in clients. Their clients include “15 out of the top 50 most valuable global brands according to BrandZ Top 100 Most Valuable Global Brands.” Their famous clients that they frequently cite are Nike and Starbucks.

In practice, they offer five types of services.

They are operating in a really interesting space for client services. The larger brands (especially the foreign ones) are struggling to adapt to the constant changes and increasingly complexity of ecommerce in China. The game is changing so fast it makes it difficult to know which new digital capabilities to deploy. Which are critical? Which are optional? And which do you build in-house versus contract?

As the landscape and client needs keep changing, Baozun has also been evolving in the services they offer. They have evolved from helping brands get set up on TMall / JD to direct sales capabilities to fulfilment / logistics to digital marketing to O2O and so on.

And the larger brands are also facing the challenge of coordinating effectively with the major ecommerce and social media platforms. But not becoming too dependent on them. So you see Baozun cited as an “award winning” partner of TMall, JD and others. And they are one of the top 5 clients of SF Express. But they are also helping clients go direct and around these platforms.

Baozun mentions this unusual intermediary role in their description:

“We help brand execute their E-commerce strategies in China by selling their goods directly to customers online or by providing services to assist with their E-commerce operations. Our business ranges from China’s largest online shopping platforms – Tmall and JD.com, as well as social mobile shopping malls, to brands’ official stores and off-line smart stores. Rooted in the evolving digital business, driven by technology, we dig into each area of supply chains, make customized solutions for brands, and build a communication bridge with customers.”

They use 2-3 business models for their services:

- Distribution model.

- This is where they buy the goods from clients and sell them themselves. So they are a channel and distributor for brands.

- This business has the economics of a typical retailer or distributor. With lots of inventory on the balance sheet.

- Consignment and service fee models.

- This is IT services sales to clients. This business has been growing. And it has typical business services economics. Better profitability and much less inventory on the balance sheet (good) but lots of accounts receivable as they wait for their clients to pay (typically 4-6 months. Bad).

Note: Baozun was listed on NASDAQ in 2015.

My 5 Take-Aways for Baozun

I think most of you know my standard approach. I look at the customer view and then the competitor view. That’s where the rubber hits the road. Which product does the customer end up choosing and why? And how many comparable options were available from competitors at that moment?

And, cutting to the chase, I really like the customer view for Baozun. But the competitor view makes me nervous.

Take-Away 1: Baozun Is Well-Positioned Against a Large, Evolving and Ongoing B2B Problem

Prior to Covid, I gave talk at the Adidas headquarters in Shanghai. It was part of their digital day and the company was talking about the never-ending changes in Chinese ecommerce. Think of the challenges a brand like Adidas faces in China.

- Ecommerce and retail are always advancing rapidly. First, retail went online. Then to omni-channel. Then to O2O. Now it’s online-merge-offline, with lots of experimentation in physical stores. Ecommerce also combined with entertainment. Then there was social media and the rise of KOLs. Now it’s KOCs. The game just keeps changing.

- New brands can and do emerge very quickly. Perfect Diary was only founded in 2016 but it quickly became the leading ecommerce make-up brand. That was a big surprise for established brands like L’Oreal. Perfect Diary did this mostly by leveraging innovations in digital marketing and influencers.

- The ecommerce giants (Alibaba, JD, Pinduoduo, Mini-Programs) keep expanding into brand and merchant services. They keep offering more and more digital tools for merchants. And they keep expanding their presence in the market. Are your customers still your consumers? Or are you more and more in the serving Alibaba business?

So how can a leading brand like Adidas keep up with all this? How can they stay on top of the constantly emerging capabilities and tools?

Enter Baozun. This whole situation just creates a natural role for an IT services partner specialized in Chinese ecommerce. They can provide advisory and also IT tools and services. This is not unlike a specialized, faster version of IBM and Accenture. It’s just a great business opportunity on the customer side. It’s big money. It is evolving (good for advisory). And it never ends.

Another random example.

I was walking around the Alibaba headquarters late at night on Singles Day 2019. And for the sales event, they have entire floors of rooms set aside for brand teams. I randomly poked my head into the room labeled Coca-Cola and chatted up the team working through the night. The head of China ecommerce for Coca-Cola was there and they were tracking performance and running promotions in real-time.

Where else do you see brands doing something like that?

Holidays and shopping festivals are a big deal in Chinese ecommerce. So that is yet another capability brands have to master. You’ll note that events and campaign planning are listed on Baozun’s services.

A last point on this.

I routinely tell companies you need to engage as much as possible with the major ecommerce and social media platforms (especially in China). But you don’t want to be too dependent on them. You also need direct channels and relationships with your customers. You can see this same idea in Baozun’s description.

“We help brands execute their E-commerce strategies in China by selling their goods directly to customers online or by providing services to assist with their E-commerce operations. Our business ranges from China’s largest online shopping platforms – Tmall and JD.com, as well as social mobile shopping malls, to brands’ official stores and off-line smart stores. Rooted in the evolving digital business, driven by technology, we dig into each area of supply chains, make customized solutions for brands, and build a communication bridge with customers.”

“With e-commerce in China growing rapidly in scale, more global brands view e-commerce as a critical part of their China expansion strategy. However, as the industry also grows in complexity, brands rely on it as their trusted partner to provide local knowledge and industry expertise in executing and integrating e-commerce strategies. This helps its brand partners avoid significant investment and risk associated with establishing and maintaining their own local infrastructure and developing their own capabilities.”

Basically, I like all of this as a business opportunity. It is a big, evolving and never-ending problem to be addressed. It’s a great space to build an advisory and IT services business.

But the competitor view is where I have concerns.

Take-Away 2: The Emergence of Smart and Integrated Logistics / Fulfilment Is a Problem

Historically, Baozun has had a big presence in logistics and fulfilment. From Finpedia:

“Baozun is recognized by SF Express, one of the largest Chinese express delivery companies, as one of its top five customers in China. Baozun is able to achieve next-day delivery in over 100 cities across China.”

“As of December 31, 2016, the company operates seven warehouses…In September 2016, its wholly-owned warehousing and logistics solutions subsidiary, Baotong E-Logistics, became a partner of Cainiao, a leading logistics data platform operator affiliated with Alibaba Group, which enabled it to provide best-in-class services to a wider variety of merchants through Cainiao’s logistics data platform.”

So a significant part of their end-to-end ecommerce services has been logistics. That means dealing with Cainiao, JD, SF Express and lots of other single-service logistics providers.

But I recently wrote about how JD Logistics (JDL) was offering integrated logistics and fulfilment services.

JDL is actively creating an integrated logistics service that is rich in data. And positions them to move into other business and ecommerce services, which they are planning on doing. And Cainiao is doing the same thing.

That is a problem for Baozun. Fulfilment is a capital intensive business. And it’s an area brands are more comfortable outsourcing. Baozun can continue to work with JDL and Cainiao in logistics. And they can go more direct with companies like SF Express and others. But I think they are not that competitive in logistics / fulfilment services long-term.

Take-Away 3: Digital Marketing Is Also Becoming Increasingly Specialized. That’s A Bigger Problem.

Companies and services firms are building great and highly specialized capabilities in digital marketing, social media, influencer marketing and customer relationship management. They are developing sophisticated 360 degree views of customer behavior and two-way, real-time communication.

This has very little to do with coding Warehouse Management Systems. Or building online stores. So I’m not optimistic that an integrated, end-to-end ecommerce solutions company like Baozun is going to do well against specialized in CRM and digital marketing firms. Not unlike how Salesforce specialized and carved that part out from Oracle and Microsoft long ago.

Take-Away 4: It’s Likely About Ecommerce IT and ERP-Type Services.

Here’s what it looks like to me in terms of competition.

As ecommerce becomes more complicated and mature (i.e., slower growing), we should see increasingly specialization. I think Baozun will have to choose a space. And ERP / IT Systems and Ops is their likely position.

Take-Away 5: This Is All About Operational Execution and Building in Switching Costs

Ok. So it’s a good space. But the competitive picture is murky and changing.

The immediate goal for Baozun is to lock-in customers. To build in switching costs as much as possible. And they are in a good position to do that. They were an early mover. And these types of IT systems are very costly to remove and replace.

So those are the metrics I am paying the most attention to. How many clients? How much do they churn? Does their spending go up year after year per client?

From their filings, it looks ok. An increasing number of clients year after year. And increasing spending per client per year. But the accounts receivable are concerning. And you really can’t know what is in those contracts.

I only see two long-term competitive advantages for Baozun:

- Proprietary IT systems for ERP-like services. But their R&D spending is only about 5%.

- Switching costs. With a large client base locked in.

Outside of that, they are in a SMILE Marathon. Execute, execute, execute.

***

My Summary of Baozun

- They have targeted a great B2B client need. It’s large, complicated, evolving and long-term.

- There is lots of competition from lots of areas. From ecommerce platforms. From self-service, low-cost tools. From specialized players in digital marketing and fulfilment. And from similar IT service providers.

- The priority is to lock-in customers ASAP.

***

That’s it. Here is a digital concept that I think is relevant to this company.

Digital Concept: Necessary vs. Critical vs. Strategic B2B Costs

In the concept library, you will see “Necessary vs. Critical vs. Strategic B2B Costs” as one of my digital concepts. I like to think of these three dimensions when selling to a business customer.

I put most business costs in the category of Necessary Costs. This is when a restaurant buys food supplies. Or when an office buys tables. Or you pay an accountant to close the books. It’s a very rational decision about a necessary purchase for the business. Usually, it’s about quality vs. price. And generally, customers are trying to drive these costs down as much as possible (given an acceptable level of quality).

It’s not a great space to be selling in.

You can have different power dynamics in necessary B2B costs. Sometimes there are tons of suppliers of a basic commodity (a tough business). Sometimes there are just a few differentiated producers. When Baozun says it has 1-3 year contracts with clients, that is a good sign. When they say they have 4-6 month payment terms, that is bad.

Baozun looks to me mostly as a necessary cost. That’s the most common category. But it’s generally a tough business.

Critical Costs are much better. This is where Warren Buffett tends to invest in B2B companies. An example would be buying into the 1-2 companies that provide the airframes to Boeing and Airbus. In these cases, it is not a rational trade-off between price and quality of one product. Three is consideration of the larger risks involved. If Boeing switches to a 20% cheaper version an airframe and then two planes crash, that’s a huge event. They probably have to ground all the planes. Bankruptcy is possible. Plus, a bunch of people died. Customers are much less price aggressive when buying critical parts and services for their business.

Some other examples:

- If you switch to a cheaper system for processing international settlements, you could have much higher fraud risks.

- If you go for a cheaper sealant on your roof, you could have water leak in and cause significant damage.

- If you go for a cheaper brake management system for long-haul trucks, you could have greater safety risks.

My favorite B2B businesses are for critical products and services that are a very small percentage of the overall cost of the project. Businesses happily overpay for these small cost, critical items. Why take the risk for a small cost savings? Note: two of the above examples are companies Buffett invested in.

I mentioned Baozun is a little like IBM. Which is true. But if you look at IBM, you can see they have shifted over time to IT services for the “critical workflows” of businesses. In fact, in their filings, you will see the word critical all over the place.

The last category is Strategic Costs. This is where a business views the expenditure as something that makes them money or strengthens their position against competitors. That’s marketing and R&D. Businesses are trying to do these more effectively. But they are not trying to decrease these expenses year-after-year. In fact, they are usually trying to maximize them expenditures versus competitors. The team at 3G Capital often talks about being ruthless in cutting spending in their necessary costs so they can increase spending in their strategic costs.

Anyways, I find assessing B2B companies based on these three factors to be pretty helpful.

That’s it for today. Cheers, jeff

——

Related podcasts and articles are:

From the Concept Library, concepts for this article are:

- Switching Costs

- B2B Customer View: Necessary vs. Critical vs. Strategic

From the Company Library, companies for this article are:

- Baozun

Photo by Mathew Schwartz on Unsplash

——-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.