I have long considered digital platforms the super predators of the business world.

They are like that Indominus Rex dinosaur in the movie Jurassic World. The one that is part T-Rex and part velociraptor. And when it breaks free (which always happens in those movies), it runs around eating everything on the island. Because it is the super predator and nothing can stop it.

Digital platforms have been like this over the past 10-15 years. They were new business models that emerged in the business world and very few companies could compete with them. If Amazon, Facebook or Google want to eat your business, most of the time you can’t really stop them.

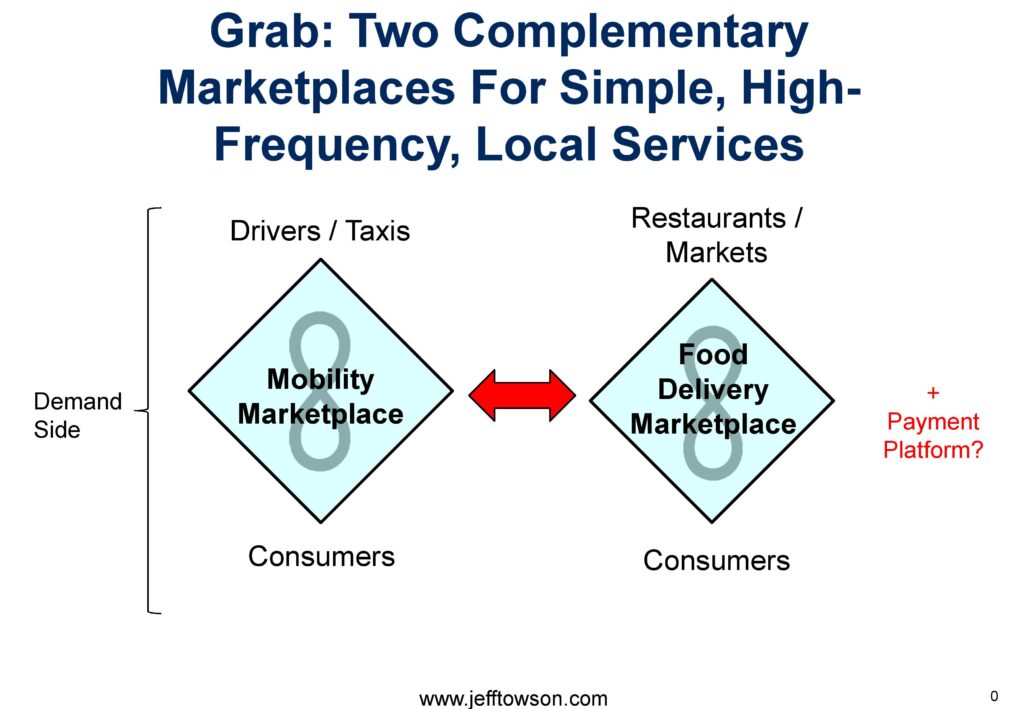

And, every now and then, a business builds not one but multiple digital platforms. And these platforms complement and reinforce each other. For example, Grab has two primary marketplace platforms.

Complementary platforms are like 3-4 dinosaurs hunting as a pack. It’s pretty awesome.

And that is pretty much what Alibaba is. It has always been in the platform building business.

Today Alibaba has multiple complementary platforms: Taobao, Tmall, Youku-Tudou, Lazada, AliExpress, Alipay, and some others. And they reinforce each other. They create service offerings that are very difficult for competitors to match.

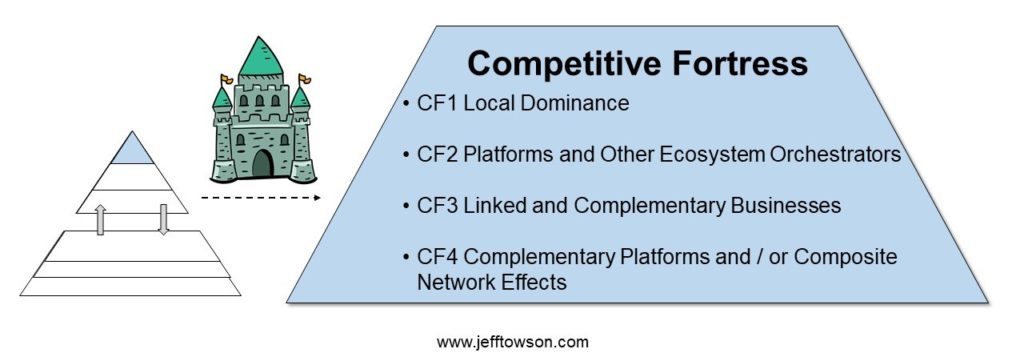

Recall, I have called complementary platforms and linked businesses competitive fortresses. They are the top level of my 6 levels. One platform is great. Several is much better.

And even if services don’t create complementary platforms, they can still be linked businesses. Unrelated businesses can still share customers (lowering acquisition costs), technology and capital. A good example of this is Baidu’s relationship with investee iQiyi. They have a master agreement that covers AI, web services, online advertising, internet traffic, data / content and smart devices.

More on this in a second. But first a quick review.

The Basics of Alibaba’s Complementary Platforms

I have argued there are 5 steps for building marketplace platforms (like Alibaba):

- Build Basic Demand-Side Scale Around 1-2 Core Interactions. You’ve got to get to big scale for these platforms to work.

- Keep Building Demand-Side Scale. Keep adding New Users and Use Cases.

- Build Supply-Side Scale. This is usually in IT spending and logistics.

- Externalize Some Capabilities to the Market. This creates a new revenue stream and additional scale.

- Compete in an Innovation Marathon with Unfair Advantages. More on this below.

I wrote this the evolution of Alibaba in detail here.

Why Alibaba Can Innovate So Fast. And So Successfully

The last point on the above list is about innovation. And this is something not usually recognized about Alibaba. They rapidly create new services and other value add for their customers. And they can do this customer-facing innovate very rapidly and with a lot of unfair advantages.

In fact, Alibaba often refers to this as their core strategy. To rapidly innovate and always be adding value to their customers.

So how do they do this?

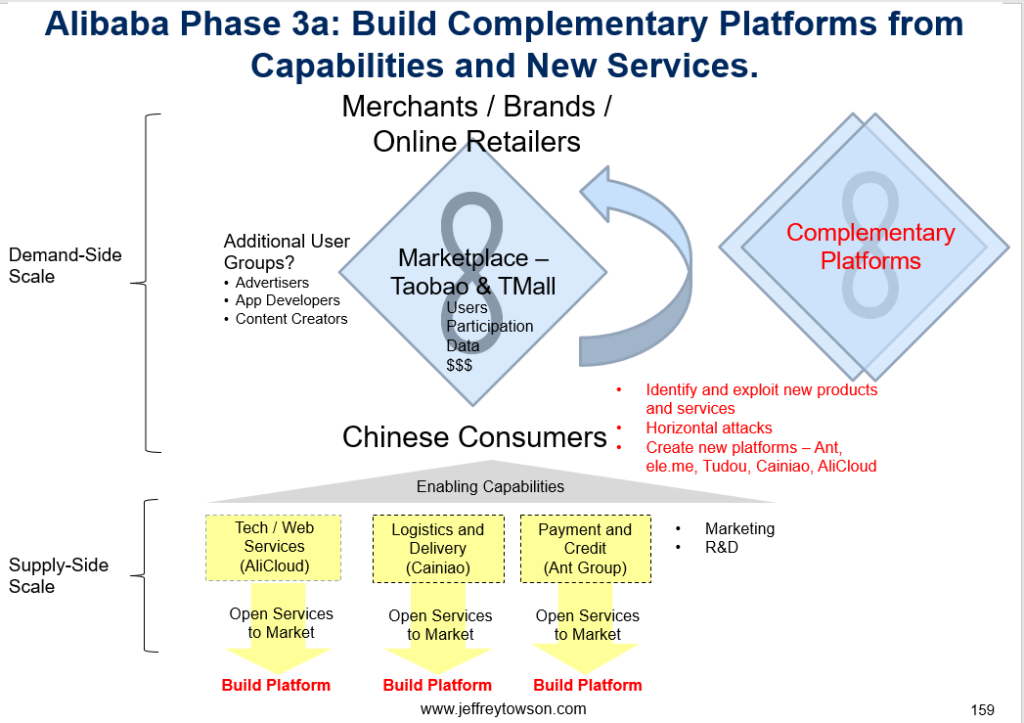

The answer is they use their platforms (especially their complementary platforms) as an advantage in innovation. It looks like this:

Note the arrow and text in red in the middle.

- On a big platform, you have tons of user interactions and data.

- They mine this and run experiments to identify and exploit new products, services and features. They have a much higher success rate than other companies.

- They then launch these to their captive user base. They can cross-sell and subsidize. They have a much faster adoption rate than other companies.

- These new products, services and features add value to their customers. And sometimes they create new revenue streams. And sometimes, these new services can become platforms themselves.

This is how Alibaba achieves such a high rate of innovation. It really is an unfair advantage to have such a system. It works both with consumers and with merchants/brands.

Also, notice the red text on the bottom.

- They can also take their core capabilities (marketing, logistics, IT) and sell them to the market as a service.

- These are an easy form of innovation. To either their current customers or to new customer bases.

- These can become free services. Or paid services. And sometimes they can also become platforms themselves. Think AWS, Cainiao Logistics, and Alipay.

Now imagine all of this rapid and advantaged innovation that is happening in a business with several complementary platforms.

That’s basically how I see Alibaba. Yes, it is a dinosaur pack that can crush most businesses. But it can also innovate at a stunning rate. In lots of different dimensions. This is how Alibaba went from Taobao and Tmall to adding things like hotels, digital media, credit and other services.

Keep it Simple: Innovate Rapidly and Build a Moat

Using my standard frameworks, Alibaba is running an innovation marathon (like Elon Musk) but they also have big competitive advantages (like Warren Buffett).

Rate of customer facing innovation plus moats is pretty much my “go to” strategy now.

That’s actually my Extreme Personalization Playbook. It’s just a simplified version of it.

Note that the bottom three levels are about adding value to the customer (personalization, better interactions and new services). That’s innovation.

While the top level is about building a moat.

In fact, I got a lot of this strategy from studying Alibaba.

Think about the 3-4 digital platforms Alibaba has built over time:

- Tmall / Taobao – a marketplace platform that connects consumers with merchants and brands (for products and increasingly services).

- Ant Financial – a payment and financial services platform that started by connect merchants / brands and consumers. But is now adding banks, insurers and lots of financial services providers.

- Youku / Tudou – an audience-builder (or innovation) platform that connects content creators with viewers (and increasingly with brands)

- Cainiao – which is mostly a support service today. But is starting to increasingly looking like a logistics network in its own right.

Alibaba is basically in the business of building digital platforms. And think of the benefits the company gets when these platforms work together.

- They can subsidize financially. Amazon does this by using profits from AWS to support its e-commerce business.

- They can coordinate on marketing.

- They can cross-sell and dramatically lower their customer acquisition costs.

- They can bundle products and services. We discussed this in the section on bundling. Alibaba is increasingly offering memberships that get you special prices on all their services.

- They can combine data.

- They can create entirely new types of interactions between various user groups.

- They can avoid the chicken-and-egg problem for a new platform because they usually already have one user group for a new platform (usually consumers).

And there is probably a ton of other stuff they are doing that I don’t know about.

Now, imagine trying to compete with this as just an e-commerce company with a marketplace platform? It’s brutal.

Final Point: AI Services Are Changing All This

Up until 2022, that was pretty much how I viewed digital strategy.

But then GenAI landed and now things are changing.

First, customer facing innovation is getting rapidly accelerated with new GenAI tools. Every business is getting amazing new capabilities. If innovation is running a marathon, GenAI is about getting a motorcycle.

But it is also changing how you build moats.

I’ve just argued that digital platforms are the most powerful business model. But now the dinosaur pack is getting challenged by entirely new business models based on GenAI Services. For example:

- Grab (shown above) is two marketplace platforms that support each other. But now robotaxis (an AI service) are offering similar services and they don’t need humans to drive the cars. In fact, they don’t need a marketplace at all.

- Google Search was long the most powerful platform business model. Which paired nicely with YouTube, another platform. But now ChatGPT and other AI services have emerged that are replacing search. And these aren’t platforms either.

Most platform business models are about helping humans (and their businesses) connect and interact with each other. You concentrate buyers and sellers in one convenient location.

But AI agents don’t need marketplaces. They don’t need you to concentrate supply or make it convenient. They can search the entire web to find what you want.

So GenAI is changing both innovation and moats. And I’m going to have to think up a new animal analogy for them. Lion vs tiger? Indominus Rex versus King Kong?

That’s it for today. Thanks for reading.

– Jeff

——-

Related articles:

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

- Why Netflix and Amazon Prime Don’t Have Long-Term Power. (2 of 2) (US-Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Complementary Platforms

- Innovation Marathon

- Build a platform superpower

- Bundling Unbundling

From the Company Library, companies for this article are:

- Alibaba

——-