I’ve covered three topics that relate to digital valuation:

Plus I did an aside on Seth Klarman and his counter-strategy to growth investing.

I thought I would wrap up the topic of digital valuation (for now). It’s been kind of a lot of theory.

So here are 9 simple rules for digital valuation.

Rule 1: Get the Big Numbers Right.

This includes:

- The normalized cash flows on the core operating assets.

- The explicit cash flows in 3-4 years.

- The cost of equity and/or capital of the operating assets.

- The expected growth rate in operating cash flow and operating assets.

- Optionality on big new products and services.

Buffett’s valuation approach appears to be mostly about “Owners’ Earnings” +5 years in the future. That means figuring out who will be the winner in 5-10 years. It means:

- Making projections 5-10 years into the future. This is discounted cash flow.

- Bird in hand worth two in the bush. Key is to know how many birds will appear in the bush and when.

- Discounting at the 10 year Treasury note – or 10%

- Doing similar analysis for stock or a bond. Both are types of coupons.

I think most of his valuation is being confident about a handful of big numbers (about +5 years in the future).

Rule 2: Separate the Operating Engine – and Stick with an Enterprise Valuation. Not Equity Valuation. Also, Not Levered.

Rule 3: Keep Consistent.

Don’t confuse the Cost of Equity with the Cost of Capital. If you are discounting cash flows to equity, use Cost of Equity. If you are discounting cash flows to the enterprise, use Cost of Capital.

Don’t mix currencies. Use the same for projects and discount rate (risk free rate).

Don’t mix real and nominal cash flows.

- If you are projecting real cash flows, use the real cost of capital.

- If you are projecting nominal cash flows, use the nominal cost of capital.

- If inflation is low (<10%), stick with nominal cash flows since taxes are based upon nominal income.

- If inflation is high (>10%), switch to real cash flows.

Rule 4: Focus on Small Things and Use Multiple Models.

Focus on small phenomena that can be understood. Target individual companies. Or customer demographics.

Then come at them with multiple models. The more models the better. Each will capture part of the phenomenon.

- Some models will be quantitative (DCF, asset value, liquidation, etc.).

- Some models will be qualitative (consumer behavior, psychology, economics, etc.).

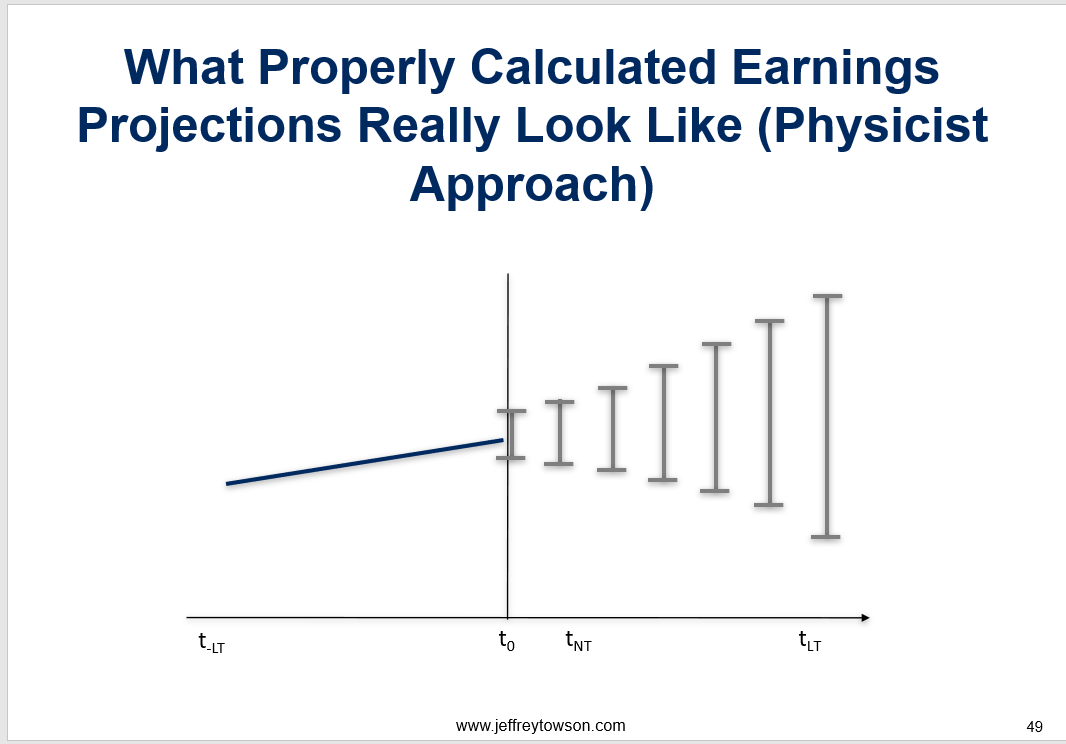

Rule 5: Never Do Modeling Without Uncertainties.

- Science is measuring and modeling phenomenon in the real world – outside of our own opinions and limited perceptions.

- Valuation is modeling (both quantitative and qualitative) plus measurement. It is science, and is mostly like basic physics.

- It is not an art and a science.

- It is not accounting.

- Modeling plus measurement always requires two numbers: an estimate or measurement + the uncertainty in that number. If you don’t know both numbers, you don’t know anything.

Keep in mind, uncertainties can come from definitions, measurement and calculations. And uncertainties compound. Here’s an example:

Rule 6: You Cannot Project Cash Flows Accurately for More Than 2-3 Years.

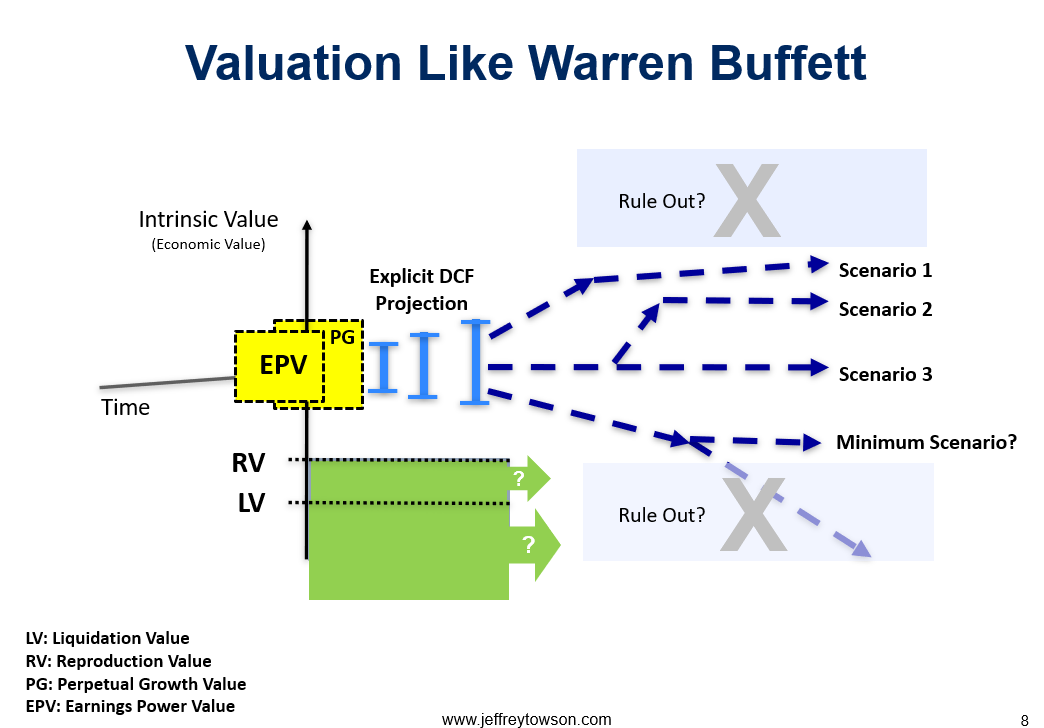

Rule 7: Build Scenarios Within a Bounded Future You Are Confident About.

Rule 8: It is 10X Easier To Prove What Something Isn’t. Versus Proving What It Is.

I cannot emphasize enough how much easier valuation is when you focus on what something cannot be. That is actually fairly easy to prove. I know I will not be 100 pounds in 5 years. Proving what something will be is much, much harder.

Rule 8a: It is 10X Easier To Prove Whether Something Will Happen. Versus When It Will Happen.

Rule 9: Consider a 2-3 Stage Growth Model.

This is from Prof. Damodaran. He appears to do lots of future projections in stages (I prefer scenario building). For stages:

- Use a Stable Growth Model if a company is:

- Large and growing at a rate close to or less than the growth rate of the economy – or

- Constrained by regulations from growing at rate faster than the economy – or

- Has the characteristics of a stable firm (average risk & reinvestment rates)

- Use a 2-Stage Growth Model if a company is:

- Is large and growing at a moderate rate (≤overall growth rate +10%) – or

- Has a single product & barriers to entry with a finite life (e.g. patents)

- Use a 3-Stage or n-stage Model if a company is:

- Is small and growing at a very high rate (>overall growth rate +10%) – or

- Has significant barriers to entry into the business – or

- Has firm characteristics that are very different from the norm

***

Ok. Enough valuation stuff. Back to companies.

Cheers from Phuket, jeff

-—–

Related articles:

- An Intro to Discount Rates and Cost of Capital for Digital Valuation (Asia Tech Strategy – Daily Lesson / Update)

- Why DCF Sucks for Digital Valuation. (Asia Tech Strategy – Podcast 101)

- An Intro to Digital Valuation (Asia Tech Strategy – Daily Lesson / Update)

- Growth, ROIC / RONIC and Growth + Sales in Digital Valuation (Asia Tech Strategy – Podcast 102)

From the Concept Library, concepts for this article are:

- Valuation: Digital

From the Company Library, companies for this article are:

- n/a

Photo by mostafa meraji on Unsplash

——-

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.