This week’s podcast is about my interviews with Lazada CEO James Dong and CTO Howard Wang. Here are my 3 three take-aways.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

If you’re interested in talking digital strategy and transformation for your business, contact us at TechMoat Consulting.

————

Related articles:

- JD’s Emerging Competitive Advantages? (Jeff’s Asia Tech Class – Daily Lesson / Update)

- JD’s Is Making a Big Strategic Move into the Low-Cost Market (2 of 3) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Southeast Asia

- Ecommerce

From the Company Library, companies for this article are:

- Lazada

————transcription below

:

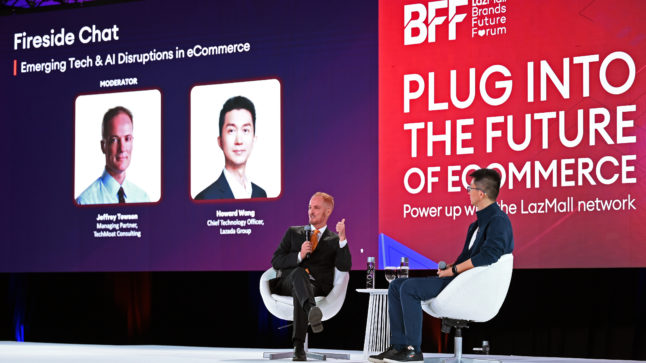

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast where we analyze the best digital businesses of the US, China and Asia. And the topic for today, three takeaways from my interview with Lazada CEO James Dong and also from my talk with CTO Howard Wong. Now a couple of weeks ago, I went down to Singapore. at the sort of Lazada annual event which is called Brands Future Forum, which is really their event for merchants and brands that come out and you know they have presentations, they talk about their strategy, they talk about their tools and you know things that are valuable to brands and merchants that are on Lazada and then they give some awards and stuff and you can kind of see what people do and it’s pretty fun. Any opportunity to go to Singapore and the Marina Sands is always f***ed up. fun as well and they also have exhibits and things. I actually find the exhibits to be helpful because they kind of tell you between that and the CEO and CTO talks, you really get a sense of what they’re focusing on and what the big priorities are. So anyways, within that, I sat down with James Dong at a cafe, talked to him for a while and I also interviewed Howard Wong, the CTO on stage at the forum, sort of as a quote unquote fireside chat. which was a lot of fun. Anyways, there is a couple articles going up on this shortly and we’ll sort of detail quite a bit, but I thought for this podcast just sort of talk about my three takeaways from both of those talks and where I think Lazada is right now, which is one, it’s a cool company, very important company, a lot going on, two, it’s a great window into Southeast Asian e-commerce. And like on my short list of stuff that I think is just awesome that I really want to be involved in is e-commerce in Southeast Asia. It’s in the top three or four. So it’s a good window into that. Anyways, that will be the topic for today. Let’s see any housekeeping type stuff. Not really. As I mentioned last time, we’re doing a bit of a video production service, basically to help people who are professionals, very busy, very smart who want to become influencer types, which means putting up videos. And we’re offering a little service on that, probably only to a handful of people. It’s not really a money-making venture. It’s more like a capability we’re just building out. So if you’re interested, you’re a professional lawyer, consultant, executive, and you want to sort of become more of a B2B influencer, give me a note. work on something with that. We’re doing that for probably five to ten people most. Anyways, that’s it for that. And standard disclaimer, nothing in this podcast or my writing or website is investment advice. The numbers and information for me and any guests may be incorrect. If you have any opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advice. Do your own research. And with that, let’s get into the topic. right now sitting over the river which is really fantastic. This was really my old neighborhood. I used to live in the Hongkou, well work in the Hongkou area which is sort of right across from Lujiazui. Fantastic view. I’ve been watching the barges go by all morning which is really pretty cool. I used to do that all the time. Anyways, I’m here for the Huawei Connect which is sort of their really massive event. more on the enterprise side. So I’m going to be putting out quite a lot of content on that in the next week or so. It’ll go out to subscribers first as always. But yeah, flying out in a couple hours here. So anyways, let’s talk about Lazada. I don’t really have any big concepts for today, so there’s nothing to sort of cite. I think we’ve talked about the Lazada business model quite a lot. You know, marketplace model, not a retailer really. Operating as a sort of marketplace. I think that the interesting aspect of this is probably two things that make it different than say China. Number one, it’s not one market. I mean it is six to seven markets which you know we call Southeast Asia, but they’re really very different. Languages different, regulations different, customs are different. Most of the staff when you’re talking about Lazada in the Philippines, you know 95 probably closer to 99 percent. of staff are Filipino. And when you’re in Singapore, it’s 95%. And when you’re in, I mean, it is, it’s kind of more multi-local than you would think. And then you say, well, a lot of the products are moving cross-border, so it’s one platform. Not really, most of it’s local. The majority is still local. In the future, it might be, and we would expect to see a lot of goods coming out of China to the rest of Southeast Asia, but it’s really kind of multi-local. And then obviously IT is centralized. So I think this whole idea of Southeast Asia as a region is a bit of a misnomer. You really wanna look at Vietnam versus the Philippines versus Singapore and so on. That’s kind of one difference. The other difference is the stage of development. I like China a lot because I think it’s on the frontier. I think it’s pioneering a lot of new stuff, new retail, smart logistics at scale. the integration of entertainment and video and commerce. I mean, it’s really the frontier of all of that, far ahead of anywhere else. When we look at Southeast Asia, we’re really looking, you know, maybe what China was in 2015. We’re talking a lot more about marketing, search advertising, monetization methods, you know, a lot of algorithm work. and stuff like that, which was a big deal back in China, you know, a while ago, but that’s where a lot of the action is. Most of the logistics stuff getting more interesting now. So, but kind of the two deep wells in terms of things to think about for Southeast Asian e-commerce are technology that gives tools to merchants and brands, monetization technology, and probably the beginnings of smart logistics. That’s kind of where we are. And so that’s something to think about. All right. Let’s sort of talk first about James. Interesting guy. Big surprise, really smart. For those who aren’t familiar, he took over as CEO of Lazada Group in June 2022, which is about a year plus ago. Prior to that he had run CEO of Vietnam and Thailand. CEO prior to that, which was Prior to that, he’d spent a couple years running Vietnam. Prior to that, he’d spent a couple years running Thailand. So, I mean, he’s got four plus years on the ground as a senior executive with P&L Responsibilities for Lazada. Now, prior to that, he was at Alibaba, and he had spent about three to four years there in the internet, well, what they called globalization strategy and corporate development. He was head of that. That was really the group 2015 to 2018 that moved Alibaba international on the consumer side. Now Alibaba has always been international on the merchant side because you’re tying the world supply chains into Chinese consumers. That was a big part of the platform. This is the other side of that, which is going international on the consumer side, which means bringing non-Chinese consumers onto the platform, which is strategically very difficult. And I remember talking with Michael Evans about this, must have been president of Alibaba five years ago. And he even he was very open. He’s like, we have no natural advantage in bringing non Chinese consumers onto the platform. You know, there’s it’s not like bringing merchants onto the platform, we can tie them to Chinese consumers. So it was a lot more opportunistic. And a lot of that was M&A and investment. And James was involved in that period when they made their major investment and basically acquired Lazada. when they invested in Tokopedia, when they acquired Daraaz, which is 2018. Tokopedia deal 2017 about a billion dollars, acquisition of Lazada 2016, acquisition of Daraaz, you’ll see Daraaz in places like Sri Lanka. That’s 2018. Well, James was involved in all of that. And specifically the post-merger integration aspects after that, how you tie this together, which was a major undertaking, tying together the tech, tying together the people, all of that. Big deal because a lot of these companies had been built with very different technology platforms and then you had to sort of integrate and standardize with Alibaba. Big deal. Prior to that he spent about six years at McKinsey in what has now been become their digital strategy group. Back then it was called something else, but it basically evolved into their digital strategy business. And then prior to that he was working in computer science. I mean, he’s got a long history in the region. I was very optimistic when he came on board, and for those of you who’ve been following me for a long time, I have been pretty critical of Alibaba becoming a multinational. because the governance and management, I mean, there were new CEOs like every year. It was like clockwork every 12 months, new CEO of Lazada something, Thailand or group. I mean, and that’s not an uncommon problem for a major company in one region going international and becoming a multinational, but the regions they’re moving into, in this case, Southeast Asia, are much smaller. You tend to get some challenges there where the foreign business can somewhat be an orphan sometimes in the business It’s hard to get committed long-term management because everyone knows the path to the top Career wise is in Hanjo There’s a lot of issues there, but a couple things happened that made me much more optimistic in the last year Number one James stepped in and I’m like, okay This guy’s the real deal as far as I can tell as an outsider Long-term commitment to the region, deep expertise in both Southeast Asian e-commerce and in Luzardo proper, I’m sorry, Alibaba proper. Very good. Second to that, they reorg to the business. In the last six months, they broke it into six business units. They call it one plus six plus N, one group plus six business units plus N, which is kind of a lot of smaller businesses, including fresh hippo is one of the smaller ones, which I thought was interesting. That reorganization is interesting if it does indeed bring these six major business units more accountability to their respective capital markets. That could be a fairly powerful move in terms of energizing operating performance, bringing transparency and accountability, getting better management at each of those levels. If you’re a top tier manager in a large organization, you don’t want to run the small business unit. You want to run the big business unit. You want to be in cloud. You don’t necessarily want to be, hey, move me from Hanjo to Sri Lanka. Well, by separating the business units, you solve in theory a lot of those problems. So I was pretty optimistic about that. Any of those two changes, I’m like, this all looks interesting. Let’s keep a close eye on Lazada for the next six to 12 months and see what happens. That’s kind of where I was on that. So anyways, I was pretty excited to talk to James, sat down with him in a cafe in Singapore, which is, that’s kind of where I spend a lot of my time. Okay, so that’s that tease up. I’ll talk about Howard in a minute, but let’s just talk about the business as opposed to the individual. This is ultimately not gonna be a James story. This is gonna be a Lazada Southeast Asia story. So in that, bucket, let’s talk about takeaways for Lazada Southeast Asia. Well, I guess it’s all Southeast Asia. Number one takeaway. They are, you know, their strategic priority. And I’ve asked this, this is my standard question for every company is, tell me the two or three major strategic priorities this year. Because they’re always doing like 100 initiatives, right? There’s stuff everywhere. But tell me where the big levers are, where you’re putting most of your focus. and money and time and resources, that tells you what they kind of think is gonna matter most over the next couple years. And that’s my standard question. And the answer I got, big surprise, was improving the customer experience is priority number one strategically, and it has been for a long time. Now, those of you who sort of follow my frameworks, I talk about this as digital operating basics number two. I have my sort of six digital operating basics. Every digital business has to do these. Number two is always continuous and never-ending improvements in the customer experience. That’s just the flywheel you build as a digital business. You start to gather data, you look into the data for insights, that then turns into rapid iteration and experimentation in the customer experience. That gets you more customers, gets you more data. It’s a flywheel. Now, I think that’s standard for most businesses that are digital first. Now they mentioned this, okay, that’s our strategic priority. Fine. Normally I would say, well, that’s just the basics. But I think given where Lazada is in its own development path, you know, they’re really not like, hey, we’re pioneering new physical digital integration in supermarkets. That’s something we’d hear from JD. No, they’re really focused on the fact of, look, we’ve got six different markets here in Southeast Asia. you know, number one priority is to continually improve the customer experience in each of those markets, which is really still emerging. And also with that, you could talk about tools and services for merchants and brands as well. So normally I would say this is a digital operating basic, but I think in the case of Lazada, this is probably the strategic priority given where they are in terms of their development. Anyway, so that’s kind of interesting. And… they have sort of buyer tool. Now, here’s kind of the trick with that. If you are JD and you’re talking about improving the customer experience, you have a lot of direct ability to do that. You can change the customer experience because you control it. But if you’re a pure marketplace like Lazada and Alibaba, you don’t have as much control over the consumer experiences as you like. The merchants and the brands do. So you have sort of indirect control. It’s like running a franchise. You know, you don’t run the restaurants yourself. You have franchisees. So the way you improve the customer experience is giving tools to the, basically to the sellers. You deal with the merchants and brands. You give them new tools and those new tools are what improve the customer experience, the buyer experience. So. Lazada in their exhibit at their present, you know, at their forum, they actually had some good exhibits about the main tools they’re giving to buyers right now, which I think gives you some insight into how they’re trying to improve the customer experience. And they basically listed four. These are not the only four, but these are the four they talked about most, which was, here’s what they said. They would say, these are the tools, the buyer tools for Lazmaul that help you acquire and engage buyers. and they had gift wrapping and personalization. So you can, you know, if you’re selling on Lazada, Lazmaal, you can have different packaging that’s very customized, which is important in something like Lazmaal, not as much in sort of Lazada proper, which is more C2C. They had try and buy. You know, you can get new buyers by letting buyers try samples. A virtual try on, where you can, you know, have makeup. put on your face on the screen, things like that, and then store membership programs. So those were kind of the four buyer tools they talk about. And for me, that’s, okay, that would be sort of prime real estate within improving the customer experience. And they basically talk about these, how those are impactful for new buyers, how those are impactful for return buyers, and how those are impactful for loyal buyers. I’ll put the slides in the show notes that basically they have set up within their exhibit. But you can put all of that under, look, we are still building out, you know, we are still rapidly improving the customer experience. We don’t see that many rapid improvements, let’s say in Amazon these days. I mean, in fact, I think the customer experience in Amazon kind of sucks. But where we are in Southeast Asia, you know, there’s still sort of the steep part of the curve for improving that. Now the other big tools within improving the customer experience is bringing more merchants and brands on board, right? There’s a big difference between having 100,000 brands and having 50,000. So that’s still happening right now. I did ask James a bit about that and he basically said the onboarding, I remember a couple years ago I was asking the head of, I was JD or Lazada Thailand, I forget which. What’s your biggest problem? And the answer was getting merchants on board. We don’t have enough merchants and brands on board. There’s a lot of education involved. That’s the bottleneck. James basically said, no, that phase is over. We’ve got, people are on board now. The merchants and brands are on board. Now it’s about improving the tools for them now that they’re on board. That’s my language, not James. Nothing here is a quote from him in any way, shape or form. This is all to my interpretation. Okay, so bringing merchants on brands, these tools, and that brings me to sort of takeaway number two. Within improving the customer experience, one of the biggest levers is fast and reliable delivery. Right? I mean, that is, that’s what Amazon discovered 12 years ago. It’s what JD and Alibaba have been leaning into in China in a major way. If you can improve the delivery, make it faster and reliable. Like reliable is a big part of this. Um, if they’re going to be there in 24 hours, it has to be there in 24 hours. That really does customers feel that they feel the experience is better. They feel the service is better when you dial that in reliably. So that was sort of takeaway number two. That’s smart. fast and reliable fulfillment is a big competitive advantage for Lazada on the way. Now one, because it impacts the customer experience. Two, this, I mean I’ve been saying this for years, like one of the strengths Lazada has in Southeast Asia is its strategic partnership, relationship with Alibaba proper. because Alibaba has been spending an unbelievable amount of money on smart logistics and IT capabilities for 20 years. Now, there is no one else in Southeast Asia, i.e. Shopee, that has that kind of depth of resources and expertise in the region because it takes you 20 years, well maybe not 20 years, it takes you a good at least 10 years to build that. I mean, you’re talking billions and billions of dollars spent every year to… build that sort of capability. And they can draw on that. And I did ask a little bit like how much is logistics different in Southeast Asia as opposed to say mainland China because mainland China is a territorial geography like Europe like the US Southeast Asia is not Southeast Asia is defined by two like weird things like number one. It’s a huge number of islands. So You know, Philippines, 7,000 islands, something like that. Only a couple thousand of them are inhabited. Indonesia, crazy. Singapore, Malaysia, I mean, it’s islands, so you’re talking boats and planes. So that makes it different. Second, you have a tremendous concentration of the population in each of these countries, Thailand, Vietnam, into highly dense capital cities. When you look at countries and you ask like, here’s a good question. What is the difference in population between the first city and the second city? Like how much of a drop down is there? Now, if you’re in the United States, New York is a big city, but so is Philadelphia. So is Washington, DC. So is Chicago. The step down from the number one city to the number two city is not huge. When you’re in Thailand, It is a massive step from Bangkok to number two Chiang Mai. And in fact, I think it is the single most concentrated city on the planet country-wise is Thailand. And you see that across Southeast Asia, there is a tremendous concentration of people in the capital cities, Manila, Saigon, Bangkok, Singapore. Well, Singapore is kind of a city, Jakarta. Um, and then the step down is huge. So. you get this concentration of people in these cities. And when you draw a big circle around Asia, you get basically half the world’s population, China to India, that’s half the planet. Southeast Asia, a couple hundred million people. Within those, so that’s a little strange. Within those cities, you get hyper density. And I’ve talked about this in the concept library a lot. Economies of scale based on geographic density, not based on fixed costs, not economies of scale based on purchasing power. There’s like four or five different types of economies of scale, but based on geographic density is a big deal for a company like Grab, which does on demand delivery with scooter dudes everywhere. It’s a huge part of Maytwan. It’s a big part of Gojek. That is when you read their annual reports and they talk about their strategy, they’re talking about economies of scale based on geographic density. Now that kind of makes Southeast Asia very interesting as a market. So when you look at the logistics of these markets, I thought you would see more planes and trains. I thought you would see much more of a picture of one massive warehouse or maybe two outside of let’s say Bangkok, which is what they have. And I thought it would be a different type. of logistics system developing than what we see in say China. I asked James about this, the short answer was no, not true. It is the same software and hardware that’s being developed in China, looks like what’s going to happen in this part of the world, that part of the world. So the fact that they can draw on that capability, I would put smart fulfillment, smart logistics as a potentially… major competitive advantage for Lazada. And it looks like they’re gonna be able to draw on Lazada, I’m sorry, on Alibaba proper in a fairly powerful way. So, okay, I’m keeping it close. So takeaway number two, keep an eye on the customer experience, how fast that is developing, what is the slope of the curve. Number two, keep an eye on smart logistics development across the region. And the fact that they can draw on Alibaba is huge. And they had some cool slides on this. They actually had a, there was a guy in the forum, the, in the exhibit area, who was basically talking about how Lazada is a one-stop multi-channel e-commerce logistics service. And they had all these brochures, and this is something they’re basically presenting to brands and merchants. You know, we can be your multi-channel logistics solution. We can customize contract logistics for you. We can do cross border logistics for you. I basically took the pamphlet and photographed the whole thing. I put it in the article online for those of you who are curious. Yeah, but they’re clearly leaning into this. I think this is gonna end up being a fairly compelling business unit in its own right. You know, when you see e-commerce evolve, let’s say in China or the US, Like they build their e-commerce business, then they build their cloud business, that’s AWS, that’s Alibaba Cloud, and then they build a logistics business, which is a B2B business. That’s Sineo, Amazon’s going into this huge. It looks like Lazada is gonna do the same thing. I’m not sure if they’re gonna ever build a cloud business, but it looks to me like they’re building a multi-channel logistics business, which is very cool. Okay, that’s point number two. Last point, third takeaway, which brings me to Howard. And that is this idea of basically AI and tech partnerships are gonna be a big focus for Lazada going forward. Now, Howard Wong, the CTO, I actually talked with him quite a bit because we did the sort of onstage interview, but I also chatted with him ahead of time and we sort of back and forth. Really cool dude, very impressive. I mean most everyone I’ve met at Lazada, I mean this is the A-Team, right? This is top tier tech talent at the executive level. I’m sure there’s a lot of great people below but I don’t know them obviously. Alright so a little bit of background on him, yeah impressive. He basically went to Tsinghua University as an undergrad, did computer science. For those of you who aren’t familiar, getting in… Qinghua is often called the MIT of China. It’s really Qinghua and Peking University, which are in Beijing, right down the street from each other. I taught at Peking University for quite a long time. They’re incredibly difficult to get into at the undergrad level. That’s where you, you know, everyone takes the gaokao. Everyone studies like a maniac for, you know, most of their childhood. And then if you’re really lucky, you can get into one of those. It’s… Think getting into MIT or Harvard, but 10 times as difficult. That’s what, so when you meet someone says, oh, I went to Tsinghua as an undergrad. It’s like, okay, you know, this person’s got some IQ points and an unbelievable work ethic. Then you also ask, well, what did you major in? Because back then, I’m not sure if it’s still the same, you don’t just apply and then choose your major. You have to apply for a major at that school. So when someone says I went into computer science, or physics at somewhere like Tsinghua, you’re like, okay, that’s really hard to get into. So anyways, that was my first impression. He said, oh, I went to computer science at Tsinghua. I’m like, okay, impressive. Then he went to the US a little bit, North Carolina, Chapel Hill, got a master’s in computer science, went to Yahoo, spent eight years in their engineering group, then over to Twitter. where he became a senior engineering manager that was 2013 to 2015. And then finally he ends up at Alibaba at 2015, in 2015. So before he even gets to Alibaba, he’s got 12 years at Yahoo and Twitter, which is really important if you’re thinking about what is the technology required for search-based advertising, which is what both of those companies do. He spends five years at Alibaba 2015 to 2020. rises to the head of engineering at alibaba.com. Now that’s really interesting. Alibaba.com is the B2B division of business unit that people don’t really talk about it. I’ve probably written more about alibaba.com than anybody. I’ve met with their old CEO, he’s now gone. Years ago, I visited them. If you look up alibaba.com, there’s a good chance my articles will come up. It was sort of… a cross border marketplace. The idea was we’re going to take all the small businesses of the world, the SMEs, in the Philippines, in China, in the US, and we’re going to let them do B2B purchasing the same way multinationals might source their goods out of China. We’re going to let SMEs do the same thing. So it basically lets SMEs do everything that a multinational could do. So two dudes sitting in a warehouse in Texas can source their goods from the Philippines. India, China, and then turn around and sell it to other businesses in Europe or whatever. Basically SMEs get digital tools that let them act like MNCs. That was actually my phrase. If you go to like the Alibaba.com they’ll talk about we let SMEs do stuff that only MNCs can do. I thought that up. I think they copied it from me. Anyways, so he goes there. Now what’s interesting about Alibaba.com is within the new business unit for international e-commerce at Alibaba, there’s Lazada, there’s Duras, there’s AliExpress, but there’s also Alibaba.com. So he was in that division that’s now been rolled in. Anyways, he comes over in May, 2020. He becomes Chief Technology Officer of Lazada. That’s really impressive. Again, that puts him in charge of about a thousand engineers. sitting across six countries. Interesting guy. Plus he’s a really fun guy. He’s a pretty cool guy. Anyways, so let’s talk. Okay, that brings me to sort of the third takeaway, which is, yeah, everyone’s sort of hot for AI, generative AI this year, with good reason, but, and that’s a lot of what they’re doing, but, you know, if I were to characterize what is Lazada focused on, as an outsider, my perspective, impression, mostly tech tools for merchants and brands. Bringing back to that earlier point, and I think Howard spoke to this very well in our interview, which was we are focused on technologies, infrastructure, and AI that helps brands and sellers improve the customer experience. This is always the problem with tech. It’s really fun and cool and you can go down all these rabbit holes, but it needs to be focused on improving the customer experience. That’s where the rubber hits the road. Now, the customer experience can be merchants, brands, and buyers. You know, you want it to have impact in those locations. And I thought he spoke to this. I mean, he kind of said it over and over and over, like we are looking for tech that improves the experience for consumers and is valuable to the sellers basically. Otherwise, you know, what’s the point? Now that’s my opinion, not his words. Okay. So within that, the number one tool, the number one area of technology is helping monetization, right? Which is that, you know, that’s his background at Twitter. That’s his background at Yahoo. It’s like, look, how can sellers basically use this to improve their business, which means. getting more users, getting more engagement from users. You know, that’s sponsored discovery. That’s a data management platform that increases your customer targeting, right? It’s giving all those tools to the sellers that let them get more customers and sell more to the customers they have and get better engagement to the customers. And I think, you know, his background is well suited to that. Second would be, okay, so number one, technology focused monetization. Number two, product solutions. And these are what I kind of mentioned already. How can you make the products you’re selling better? Well, that’s gift wrapping, that’s personalization, that’s try and buy, that’s virtual try on, that’s membership programs. All of those are gonna be under the bucket of product solutions. That if you’re a seller on there, you’re making your product. better, which is not just the actual goods you’re selling, but also how they’re delivered, how they are experienced by your customers. So within technology, monetization, and product solutions, I think are most of what they’re focused on. That’s probably top of the list. But then we get to generative AI tools. OK. Within that, we’re really talking about two things. Oh, let me point to two things. One of the examples he gave for product solutions was virtual try on. So, you know, you can stare at the screen and it’ll put makeup on you and you’ll see that the makeup looks better or not. Um, the other one was they have a skin test solution they’re doing, which is like, you know, it can start to look at your skin and tell you things. So those would all go under there. But when we got to AI, the, the example he gave was LaziChat. which is basically a chat bot. And you can talk to the merchants and brands and the Lazi chat. Well, one, you can talk with the company. So where, you know, I have a return, I have an issue, but then you can increasingly talk to the merchants and brands directly. And Lazi chat is basically the first chat bot in Southeast Asia. And how did they do this? Well, because they’re part of Alibaba. and there’s a partnership or at least a relationship with Microsoft and therefore OpenAI. So this was built on top of chat GPT. Now that kind of goes back to my earlier point, like these sort of deep wells of strategic advantage competitive advantage are for these companies are usually in logistics, smart logistics and in technology. That’s where you outspend your rivals because you’re bigger. Alibaba, you can draw on their spending as well. So this is an example of that. By virtue of this partnership, when you think about AI and when you think about IT spending and how we’re gonna beat our competitors, part of it is the scale question. We’re bigger than this other company, so therefore we can spend more and invest more. The other aspect is external partnerships are how you develop this stuff. Well, they have external partnerships with Microsoft, Alibaba that give them greater capabilities in this area. And LaziChat, I think, is an example of that. On my website, on the article for this, you will see videos they put up showing LaziChat, showing their sort of skin testing solution, things like that. So number one, I would say chatbot. Number two, generally, AI is gonna help them do, generative AI is gonna help. the merchants and brands do better creative content. That’s banner ads, that’s things like this. We’ve seen a lot of this at JD and Alibaba proper over the last three to four years. So it’s similar to that. Anyways, that would be takeaway number three, is they’re leaning into technology and specifically AI that is directly beneficial to merchants and brands. They’re doing it internally. where they have some scale advantage and they’re doing it by virtue of external partnership where they have a massive advantage in my opinion. Anyways that would be kind of the three takeaways from the talk. Number one keep an eye on the slope of the curve for customer improvements. How fast is it improving versus others is a big one. Number two smart fast and reliable logistics is going to be a source of big competitive advantage probably. And number three, technology and AI developed internally and by external partnership is probably the other big strategic capability to keep an eye on for this company. Those are sort of my three takeaways. It was pretty awesome. I really have a great time. There’s like on my short list of fun things to do in life, chatting with executives at tech companies is really in the top two. Like it’s fantastic. And you know the funny thing is it’s It’s often not the CEO. CEOs tend to be a little more controlled in what they talk about. It’s usually the CTO or the head of AI or the head of product this or product that, that are more deep in the daily weeds of this stuff that tends to be the most fun. But yeah, it’s all pretty awesome. Anyways. That is it for me for today. I’ve got a plane to catch out of Shanghai in about… my taxi’s coming in about 15 minutes so I timed that pretty well. Yeah, pretty fantastic. I hope this is helpful. I don’t really have any fun stuff to mention today. Usually I try and mention something. Just a couple comments on Shanghai. Man, things are moving. Like this Huawei connect forum… Thousands and thousands of people it is unbelievable how many people they’ve basically rented as Far as I can tell the entire Shanghai expo that the Shanghai expo Which is the conference center which used to be the Shanghai expo in 2010. It’s six floors two buildings They rented the whole thing as far as I can tell there must have been 40 to 50 to 60 conference rooms packed with events running all day. Chairwoman Sabrina Meng gave a keynote. I will talk about that in the next day or so. I’ll send something out to subscribers first, and then I’ll probably talk about it, about what they’re doing. But as I’m sitting here, like, and then you’re, I’m in Lujiazui, which is kind of the Wall Street area of Shanghai. You take a, you know, it’s 15 minutes down to the Expo. It is just hopping. I mean, As far as I can tell, half of all the cars in Shanghai are now electric cars. There are Teslas everywhere, there are BYD everywhere, there’s XPeng, there’s AI. I mean, there are one, half these brands I’ve never heard of because there’s like 300 EV companies launched in China in the last couple of years. Tons of them everywhere. Things are just packed. And as I’m sitting here in the conference, you know, furiously taking notes, which is my way. Peter Zion, he just posted another video about how China’s collapsing. Like, he just posted, I’m literally losing my mind sitting there. And it’s hard to sort of hate tweet because you got to go through a VPN. And I’m like, it is so stupid, I don’t even know where to start. Like, there is so much going on, there’s so much energy and ambition and companies and technology being built. It’s really stunning. I mean, you can feel it immediately. And then, so I’m going through this like, I’m balancing this hyper energetic, oh my God, this is awesome. And then I open up Twitter or YouTube and it sees China’s collapsing. I’m like, God, this drives me crazy. Anyways, that was kind of my experience in the last day. But my advice would be, try to spend time on the ground here. Try to spend time. You know, we do these tech tours, which we’re doing another one in November. If you’re interested, send me a note. And half of the value of that sometimes I think is just getting people in the rooms with companies and everyone leaves and then we all go and we go to like, you know, we go to beer halls and stuff after we meet with companies and everyone we bring in from Europe is like, this is unbelievable. Like this is unreal. Like one, how many engineers are there here? Like and the energy level and the ambition and everyone’s building new tech. This whole idea that China copies, idiotic. This is frontier level innovation. Anyways, that’s kind of been my feeling for the last day. So super excited. And then I’m sort of getting angry, which I guess is my personality. Anyways, that’s it for me. I’m gonna catch a taxi to the airport. Hope this is helpful. A lot of stuff coming from about Huawei. The reason I talk about Huawei a lot is because they are really building the next wave of digital infrastructure for Asia and for a lot of Africa. They don’t talk about that as much. They are very, when we’re walking around here this week, there are people from Africa, there are people from Brazil, there are people from Southeast Asia, on the ground here who are doing all of this. And they’re using pretty much Huawei to build their stuff. Anyways, I’ll talk about that as well. Anyways, that’s it for me. I hope this is helpful and I will talk to you next week. Bye bye.

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.