This week’s podcast is about Walgreens and Ping An Good Doctor. Both are using digital tools to create entirely new business models in healthcare. And both look like they have real strengths, if successful. I also mention CVS health.

You can listen to this podcast here or at iTunes and Google Podcasts.

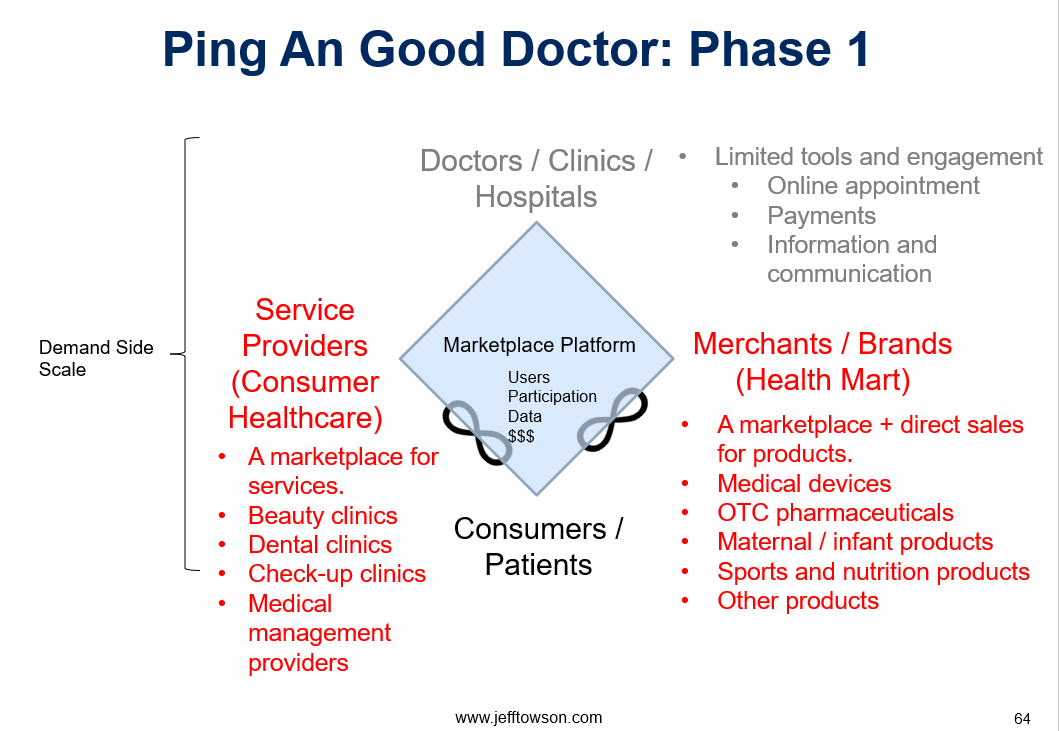

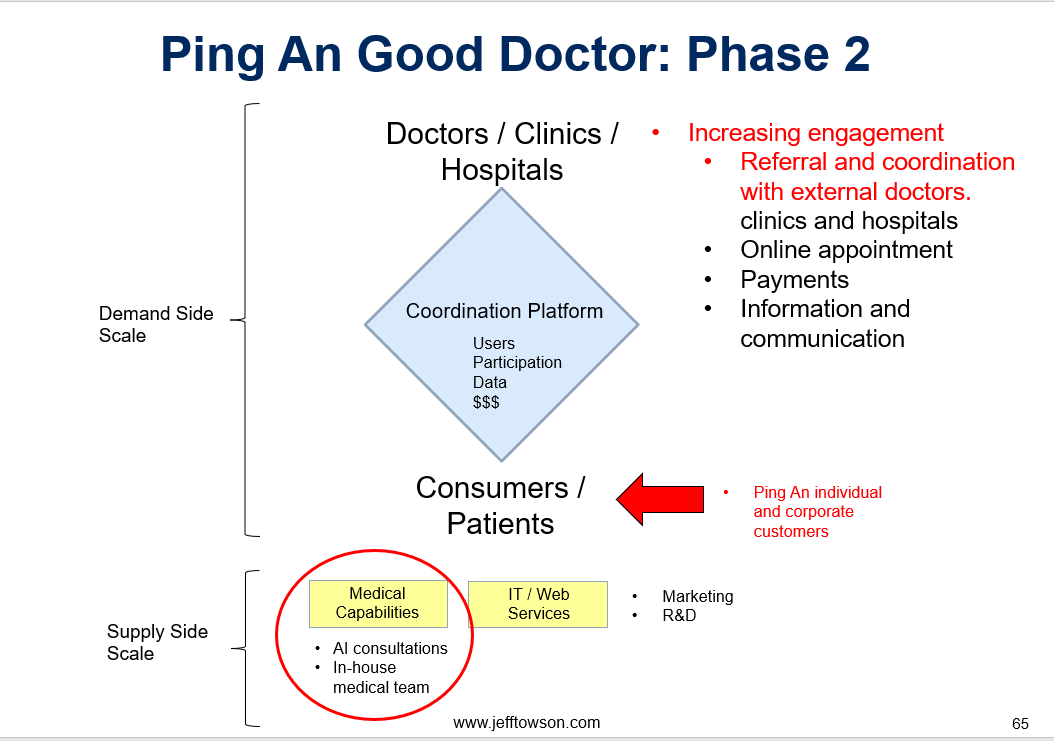

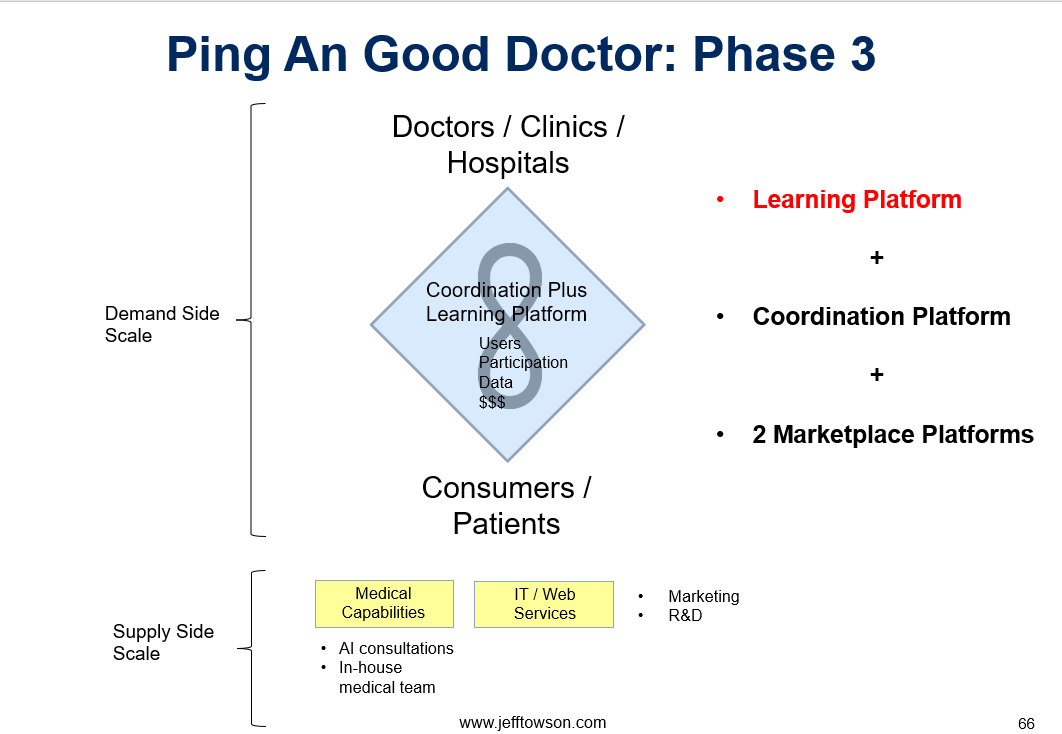

Here are the Ping An Good Doctor graphics.

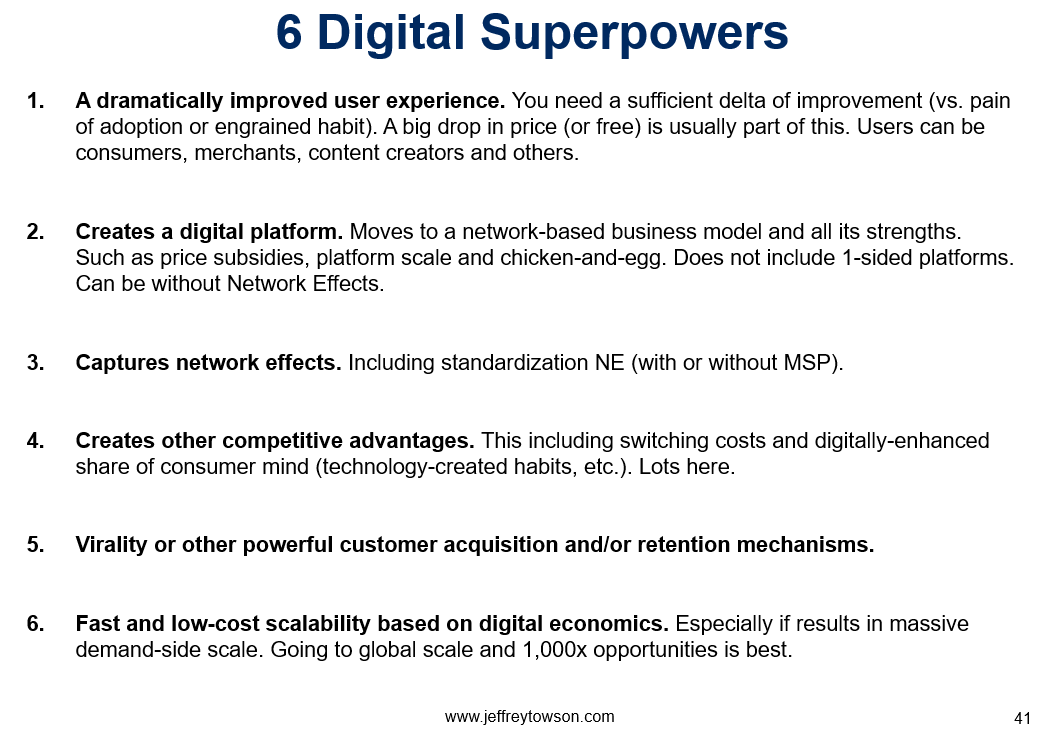

Here are the 6 digital superpowers.

—––

Related articles:

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

- 3 Big Questions for GoTo (Gojek + Tokopedia) Going Forward (2 of 2)(Winning Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Economies of Scale

- 6 Digital Superpowers

- AI as a Capability

- Learning Paltforms

From the Company Library, companies for this article are:

- Walgreens

- Ping An Good Doctor

Photo by Marques Thomas on Unsplash

——-transcription Below

:

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast where we dissect the strategies of the best digital companies of the US, China and Asia. And the topic for today, New Digital Business Models by Walgreens, Amazon and Ping An Good Doctor. Now those are all healthcare plays basically. And all of them sort of have jumped out, I think, as not just using digital to transform, to operationally upgrade. but really to come up with new business models. And they’re very different. So we have at least three compelling new business models, strong in their own ways. And I’ll sort of take you through what they’re doing and then I’ll basically make a prediction which one I think is the most compelling and the one worth watching, which I will tell you at the end. Let’s see, other stuff. Book number four of Motes and Marathons is coming out in probably two weeks. It’s just being finished up right now. Parts one, two, and three are available on Amazon. The only one that’s not there is the paperback of part three, which for some reason couldn’t be there, but it’s over at Barnes and Noble, but otherwise everything’s at amazon.com. Let’s see subscribers. I’ve been sending out kind of a lot of new theory that I haven’t talked about before in particular the experience effect Is gonna be a big deal rate of learning is a big deal I’m gonna get a lot more into economies of scope and scale Which is a lot more complicated than everyone thinks it is I’ll get into that a bit in the next week for those of you who aren’t subscribers You can go over to Jeff Towson comm sign up their free 30-day trial. There’s some buggy thing going on with PayPal If you’ve been doing that and you’ve had problems, I’m sorry about that. I’m trying to figure out what that is. I may end up disabling that just using Stripe, which works fine. Anyways, that’s that standard disclaimer. Nothing in this podcast or in my writing or on the website is investment advice. The numbers and information from me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment advice. Do your own research. And with that, let’s get into the topic. Now as always, there’s sort of key lessons for today, key concepts, and I really need to go through three today. First one, just economies of scale, which talked about a lot. I’ll detail this more out in the next book. There’s actually four to five different types of economies of scale and economies of scope, which are different. But generally speaking, and this is one of the ideas for today. Economies of scale are a lot about sort of power on the supply side. You have massive factories and therefore you can make things cheaper, but it’s a supply side phenomenon as opposed to a demand side phenomenon, which is like network effects, share of the consumer mind. And if you look at my graphic for competitive advantage, which has 15 types listed. I’ll put the slide in the notes. Everything on the left is a demand side advantage and everything on the right is a supply side advantage. And then there’s government, which is a bit of an outlier or at least doesn’t fit. Okay, but economies of scale. I want to think about how you get power on the supply side, which has been so much of the retail and healthcare story forever. And these companies I’m gonna talk about, which are finance, healthcare and retail related. That’s a lot of where their historical power has been. And one of the things digital is doing is shifting it to the demand side. And you can see them all pivoting that direction. However, when you start to look at the demand side of healthcare, it’s very different because it’s the consumer, the patient, the payer, the contractor. I mean, the person who buys the product may well be an employer, which is very different than the person who uses the product, which might be going to the pharmacy to get your prescription. So it’s more complicated on the demand side. But definitely supply side, that’s kind of idea number one, economies of scale. Second one is my little cheat sheet, which I call digital superpowers, which is just six little factors, phenomenon, you can look for as a cheat sheet to figure out what business model has more power to it. We’ll talk about that, I’ve talked about that for years. And then the third one is artificial intelligence, AI, which can show up. as a capability, which I’m gonna talk about, but it can also show up as a learning platform, which is a, you know, I’ve listed five types of platform business models. I never really talk about the learning one, although I’ve written about it. It’s more complicated. I’m not sure I understand it yet, but basically we’ll talk about one of these companies that is using AI to build out basically a learning platform. So those are the three ideas for today, digital superpowers, economies of scale, and AI as a capability and maybe a learning platform. Those are all under the concept library. You can find them there. Now, the first company to talk about is Walgreens. And this really came up because I had some students who were working on digital strategy and digital transformation. This is at SAS in business school. And one team wrote a really good paper about Walgreens and CVS I hadn’t thought about them in a while. I mean, I used to do a lot of healthcare stuff in the US. And I mean, I’ve interviewed like CVS and Walgreens in the past, their executives. This was a long time ago. But you know, it’s a business model I’m familiar with. And it was really fascinated by what they were doing digital wise, because it was, you know, this is swinging for the fence. This is a leading company and they’re going for it all in digital. And I often ask students or executives when we’re doing sort of a digital transformation exercise, are you going for the win or are you going for just surviving? And often going for, look, what’s the digital stuff we need to do so that we are okay? We’re not gonna win at all. We’re not gonna dominate by some massive ecosystem orchestrator. You know, are you going for surviving or are you going for the win? And often the right thing to do is to, for most companies is just You know, just do what you need to do to stay in the game and not get disrupted and wiped out. Now some certain companies can go for the win and Walgreens is going for the win. Okay, for those of you who aren’t familiar, this is Walgreens Boots Alliance. You know, it used to be Walgreens in the US, then they started growing and they merged up in 2014. But I mean, it’s a massive retail pharmacy and this is a very strong company. Historically, they’ve had significant competitive advantages. I mean, you go anywhere in the US, you’re gonna see two or three different pharmacies in the city, you’re gonna see CVS, you’re gonna see Walgreens. And they’re gonna be on every, not every street corner, but maybe every third to fourth street corner there’s gonna be one. You know, they’re going for sort of a saturation strategy. Actually, that was their word. I talked to them, must be 20 years ago. I talked with one of their vice presidents and he said, oh, we’re going for saturation strategy. And I said, you know, it kind of feels like a carpet bombing strategy, which he thought was pretty cool from a young consultant who had cold called him and got him on the phone. Anyways, leader in retail pharmacy, 170 years. And you know, everyone, you’re familiar with these companies, you know, they start with the pharmacy services, which they always place in the back of the store. Around that they add beauty products, some related healthcare products, and then they’ve expanded into somewhat of a convenience store. And it was Walgreens has been rolling this up for decades. Duane Reed Boots, Walgreens. And then to some degree, they have extended into their own private label brands, not uncommon. And to some degree, they’ve extended up into the wholesaler distribution piece. Amerisource, Bergen, which is also, I mean, all of these companies I’ve just mentioned, if you do sort of my standard competitive advantage checklist, not related to digital, they’ve all got them. I mean, I was looking at these pharmaceutical distributors eight years ago, because there’s only three of them, and they’ve all got these massive margins. And anyways, so all of these companies had a lot of traditional retail distribution power competitive advantages. And they’ve gotten bigger and bigger over the years and their margins are quite nice. And you know, Walgreens is in nine countries, 13,000 stores, 315,000 employees, Europe, US, Asia, a little bit in Latin America, interesting presence in Brazil. Okay, cool. And they’ve been doing sort of standard, let’s go digital omni-channel, let’s build out an app. let’s start to let people order on their app and pick up on the store, let’s have a membership program. You know, that’s kind of basic digital operations without a significant change in their business model. Okay, October, 2021, they announced a new healthcare strategy where they really wanna be a leader, not just in products, retail, and related pharmacy services. but also in clinical care services. So they wanna kind of expand what they’re offering to consumers. I mean, they’re not selling to hospitals directly, although that’s where the prescriptions often come from. I mean, they’re really expanding on their consumer facing position from products to pharmacies and now increasingly to healthcare services. Now that’s kind of interesting, big move, big strategy. And the mechanism by which they’ve done that is mostly to create a marketplace. We will sell you the products and services. They operate overwhelmingly like a retailer, not a marketplace for products. But we will create a marketplace for services where when you come in, we will connect you with lower level clinical care. You know, not a heart doctor, not a cardiologist, but you know, things for like physical therapy, nutrition, you know, sort of lower level. healthcare services and they’ll act as a marketplace. So very interesting strategy. And you have to admit that a lot of this comes from Amazon because Amazon, which is obviously a dominant retailer online, they’ve been moving into Amazon Pharmacy. So they can see the big boy coming. So they’ve sort of positioned, we’re going after services as well. Anyways, interesting space. They also did sort of a share purchase agreement with Amerisource Bergen, which is the distributor. So that moves them sort of vertically. upscale, very interesting play. And across this, you can kind of get this bigger idea. Okay, you’re a retailer, you’re selling products, you have a tremendous operational footprint, you’re adding a marketplace for services, your Omnichannel, okay, app in the store, and it. You start to get this idea that they are trying to offer a very wide range of health care products and services and to sort of be the local neighborhood health destination. And that is really how people see pharmacies. They’re always annoys doctors that when they sort of pull people, who do you trust most in the health care system? Doctors come up like third, but pharmacists come up. Number one, pharmacists are always the most trusted health care professional. because that’s the person you can go talk to when you have a problem and it’s 2 a.m. and your head hurts and you walk into the pharmacy and the pharmacist will be there and you tell them what your problem is or her problem is and they’ll help you. So you can see them sort of moving towards this idea of we’re gonna be the neighborhood health destination for everything. And that’s interesting. And then other things they’ve been doing is they added MyWallgreens, which is basically they took their loyalty membership program and they turned it into a broader digital offering where you can have a MyWallgreens app has everything in there. And some of the, one of the interesting stats that caught my mind, okay, 13,000 operating stores in the US, 78% of Americans live within a five mile radius of a Walgreens. or boots, the same chain. That’s really interesting. It starts to sound a lot like new retail out of China. It starts to sound a lot like Alibaba’s supermarkets. You know, their supermarkets, big operational footprint, they have their online app, but they’re really playing up the idea that we have one of our supermarkets, hypermarkets, within three to four kilometers of everyone’s house. You know, it’s that local aspect, which is a contrasting position to say a Walgreens. Everyone doesn’t have a Walgreens next to them or a hypermarket. Now the closest store to your home is usually your supermarket and your pharmacy. Everyone’s got one of them. Okay, so they have the operational footprint. They have 85,000 staff, pharmacists, technicians, practitioners, 85,000 health-related professionals, 300,000 plus staff overall. And then when you look at their revenue, okay, 75, 76% of all their revenue comes from pharmacy, which is sale of prescription drugs, not over the counter, and not all the retail stuff. And then the other retail stuff, the retail products, 24, 25%. So that’s a very interesting sort of picture, revenue-wise, operating-wise. The depth of healthcare professionals they already have in-house is really compelling. So this idea of we’re gonna be the neighborhood new retail version of a health destination, that’s a really interesting digital strategy. So we can dig a little bit more into that. And they start to refer to themselves as quote, an integrated healthcare pharmacy and retail leader. I mean, historically they were the pharmacy, then clearly they’ve expanded into retail plus pharmacy. Now they’re going for that healthcare piece. And they’ve been doing all the digital operating basics. I’m not really gonna go through that. It’s not that interesting. But what they’ve started to add in top of that is they have a partnership with a company called Blue Yonder, which is a couple years old now. Basically, exclusive services. 30 minute pickup, ship from store, drop shipping. You know, the whole sort of digital playbook, which I would characterize as the digital operating basics. Fine, you know, they will call this Omni Channel. I think this is much closer to Alibaba’s new retail play than what you would consider traditional Omni Channel. OK, November 2021, they acquire Village MD, which is basically a move into primary care. Village MT that brings in the doctors, they basically can open about a thousand primary care clinics at their stores over the next three, four, five years, something like that. And you can see them putting in that services piece and then My Walgreens turns into their balanced rewards program. Fine. You look at the revenue from their health care services, it’s pretty negligible right now, a couple percentage points. Okay, out of all of this, lot going on, this is why having a framework helps, what matters? Three things jump out at me as that’s really cool. Like number one, without question, they’re going for a platform business model for services. Anytime I see a traditional linear business model, like a retail store, go to linear plus platform. That’s really interesting because platform business models are really powerful. There’s no way around it. Even without getting network effects, which they usually go for that too. Just the spectrum of products you can offer as a marketplace versus a traditional company is so sweeping that it usually wins on the consumer side. Netflix is an interesting case right now. Because Netflix is struggling a little bit, Netflix is a traditional linear business model we buy and license content, we do some of it ourselves, and then we sell it as a bundle, a digital bundle. Against YouTube, which is a marketplace that uses other people’s content, I mean, YouTube is just rocking and rolling. You can see it sort of playing out over the years that the ability to offer this endless sea of product versus something you develop in-house. It’s pretty devastating most of the time. So when they say we’re gonna have our unique operational footprint, which they have, we have our successful stores, which they do most basically on it, mostly based on economies of scale. And then on top of that, we’re gonna add a marketplace for services. That’s really, really powerful in theory. Then on top of that, that’s just the platform, the consumer offering. On top of that, you can start to say, could they get a network effect as well? Because that’s what platforms do. Yeah, maybe, maybe. Well, both of those are big moves. So I think that’s interesting. The other thing that got my attention is they’re starting to reach out to suppliers and advertisers. So this is platform, right? You have one consumer group, one user group, who they’ve always served, the consumer. Now they’re expanding. Now in theory, they’ve worked with insurance companies and whatever, but you know, due to the pharmacy scripts. But moving out to suppliers and advertisers as other user groups, that’s a platform play. One of the reasons platform is so powerful, yes, it gets you a better offering, a better consumer offering, but it also just gives you more dimensions to play with. Suddenly you’ve got three user groups you can deal with, advertisers, suppliers, and consumers. You can start to subsidize, you can maybe charge the advertisers and then give it to the consumers for free. You can subsidize, usually people charge the suppliers and then they subsidize the consumers. You know, you could do a lot of plays, you have more dimensions, more flexibility. That’s usually why platforms with three users beat a platform with two. and four beats of three and five beats of four. Not always, but it tends to play out that way. So anyways, I thought this was a really sort of cool business. A lot of creativity, a lot of cool moves. The three that jump out of there for me, the new retail idea, the Alibaba type structure, where not just Omni-channel. We are the neighborhood destination that can do on-demand delivery, that has an app, that’s the ultimate healthcare resource in your neighborhood. Obviously the platform business model and then maybe the network effects. So there’s sort of three big things happening with their business model at least. Now keep that in mind and I’m gonna switch over to CVS Health. If you look at the large retailers of the United States, number one and number two is Walmart and Amazon, fine. Then you move down and they’re huge. I mean, $400, $500 billion worth of sales per year. Then you drop down a lot to Costco, Home Depot, Kroger’s. I mean, okay, then suddenly you’re at $120, $130, $140 billion in sales. Those are the giants. Now, right below them, we see Walgreens and CVS. 110, 105, and then below that, we start to see supermarkets. 70 million, 70 billion, 80 billion. And that’s kind of the big animals on the Savannah in this case. Okay, but CVS, Walgreens, those are unique in their positioning. Now CVS, which is CVS Health now, is very, it’s a very interesting animal. I mean, I’ve been doing healthcare for a long time and you always have sort of the providers. which includes retail, pharmacy, but usually you’re talking about hospitals and doctors. Those are the people providing the care and the products with obviously pharmacy being much more sort of retail focused. And then you have the payers, the insurance companies, the big companies, the government, you know, the payers and the providers, and that’s how most healthcare practices are set up. On a fairly regular basis, about every five to eight years, someone gets it into their head, probably a consultant or a banker, let’s vertically integrate. and maybe the hospital starts buying their own insurance company, or the insurance company moves downstream and starts buying clinics. And it never works. I mean, there’s a couple exceptions, Kaiser and a couple, but generally speaking, they end up all unwinding them a couple years later. And then it starts again and they try it again. It’s been going on for like three decades. Now within that pattern, along the way, CVS Health did basically do that, where they’re, you know, they have a retail footprint, about 10,000 retail locations, so smaller than Walgreens, but pretty much identical products, pharmacies, most of what they do. And then in addition to that, you know, they have a pharmacy, they basically have health insurance products, which is CVS Health. So pharmacy benefit manager, which is actually a pretty cool kind of business, and they consider themselves a diversified health solutions. company. So they’ve basically gone from pharmacy and retail up into the insurance piece. Now overall 10,000 locations they have about 110 million members that go to them but they also do these health insurance products that serve about 35 million people which is a pretty good size for a pharmaceutical pharmacy benefit manager of PBM. And then they have about a thousand walk-in medical clinics. It’s a heck of, I mean, why do you go into the insurance piece? Because it makes it really easy to reimburse yourself on, if you’re gonna open clinics, suddenly you’re basically living off insurance contracts. Well, it helps if you have your own sort of insurance business and you can direct them in. And that came through an acquisition they did with Aetna back in 2018. But we’ve seen this play before. I used to do a lot of consulting for PBMs in the US. Express Scripts out of St. Louis. And yeah, okay, it’s interesting. But now think about that as a platform or as a digital business. That’s a very different picture than Amazon Pharmacy. And it’s a different picture than what I just described for Walgreens. I mean, where are they going to go with that? Are they going to become a services marketplace like Walgreens? And a lot of that services stuff they’re doing, that’s all sort of cash pay, it’s not all insurance. Are they gonna go into more advanced care? Now, if you’re gonna go into more advanced care, you basically need doctors and hospitals. So they’re doing PBM type stuff, which is mostly reimbursing for pharmaceuticals. But you can expand into simpler care, simple consultations, primary care, triage, nurse practitioners. which is what they’re doing, which is also kind of what Walgreens are doing. So you can see they’re all moving into healthcare services, but not beyond a certain point in complexity. Now they are quite a ways behind Walgreens and sort of their digital activities. They’re doing the digital operating basics at this point, but it’s not clear if they’re going to make a big strategic move. In 2021, they announced a five-year partnership with Microsoft to basically accelerate their digital. personalized healthcare capabilities. That’s the prescription process, giving frontline workers tools that let them augment their abilities, delivery, pick up all that sort of stuff. So they don’t have as clear of a business model they’ve outlined for where they’re going, but they’re in an interesting position. And what they look like in terms of their position is they look like Ping An Good Doctor, which is kind of the other big company I want to talk about. They look a little bit like that, which is interesting. Now, Good Doctor is probably the most high-profile digital health project out of China. I mean, I’ve been talking about this one kind of a lot for the last year, especially around like Latin America, because it’s a really interesting business model, what they’re doing. It’s arguably the most ambitious digital health project I know anywhere in the world. I’ll sort of explain why that is. Okay, for those of you who aren’t familiar, Ping An, I covered Ping An in my One Hour China book as one of the really cool companies based out of Shenzhen. If you ever go to Shenzhen, you look on the skyline, there’s one massive tower, that’s the Ping An Tower. Really outstanding management. One of the first insurance companies, they became the largest private insurer in China. There’s public insurers as well, government, state-owned, but private, it was always Ping-On, very well run. They moved from there into a bank, Ping-On Bank, which, you know, there weren’t really private banking licenses in China for a long time. There are now, they’ve released them, but for a long time, it was just the big state-owned banks, Bank of China, ICBC, China Construction Bank. by some very clever merging and acquiring, Ping An got a bank license, it was pretty clever. So they became a major bank, and then they became a wealth management company, a trust company, various wealth managed products. They became the largest one of those in China. So that’s three massive businesses they built. And what all three of those businesses have in common is they’re all information businesses at the end of the day. I mean, it’s all contracts, car insurance, life insurance, corporate accounts, banks, it’s all information and data. And they really are the tech giant of China that nobody talks about. You know, it’s Alibaba, Tencent, and really Ping An. And that is how they talk about themselves, is they’re a tech and information company, and that’s what lets them jump between these various businesses. Now, of those three big pillars, The fourth pillar, as of five years ago, is healthcare. I mean, they focused on this as that’s our next big move. And they’re very well set up to go into that because they offer a lot of insurance already. They have tons and tons of corporate clients. Now, the trick with that is healthcare in China is pretty… I don’t want to say stagnant, let’s say underdeveloped, where overwhelmingly care has always been state-owned insurance plus cash, and people go to state-owned hospitals. It’s government supply. And there hasn’t been really private supply, i.e. private hospitals, things like that. Now there are… If you look at the numbers, they’ll say 50% of all China hospitals are private, 50% of them are public. Not true. If you look at bed count, 90 plus percent of all hospital beds are government. Because you can’t really build a secondary care hospital with lots of beds for advanced care, which is where you make your money, unless there’s private insurance to pay for it. People can’t pay out of pocket. So most of what they call private hospitals in China are actually big clinics. And they do simpler services that people can pay with cash. And that’s kind of been the missing piece in all of this is you won’t see a robust private supply hospital, secondary care, tertiary care, until you get private insurance. And the government has sort of been stepping towards that slowly but gradually. And… It’s not because they don’t want to, it’s because it’s very difficult. If you’re gonna do private insurance, as opposed to we have government facilities, people come in, here’s the rules. Private insurance requires data. You have to price the insurance contracts. You have to say, you know, we will sell your company or we will sell you as an individual, here’s your insurance contract. And then when that person goes into the hospital, the insurance has to create a claim. has to submit it to the insurance company and get billed. Well, you need the data, you need the claims data, and you need medical coding standards, or they call CPD codes and things like that. Well, none of that exists. Well, it’s being developed now, but there hasn’t really been the data infrastructure to allow a reimbursement-based healthcare system to emerge. So the types of insurance we have seen in China, private, They’ve basically been life insurance policy riders where if you get diagnosis X, you get a lump payment of this much cash. But they’re not managing the care. When you go into the hospital and there’s a lot of back and forth between the hospital and the insurance company and there’s claims going back and forth and readjustment and approvals, there’s none of that. And those that have tried to offer private insurance, they had no ability to price it. And then there was a ton of scams and things like that. So the whole system is sort of stuck there and people are waiting for the private insurance beast to come together. Okay, enter Ping An. That’s really what they’re going after. They wanna create the data digital infrastructure that ties everything together in China healthcare. And then once they have all that data digital infrastructure, the connections, the standards. then they want to offer insurance on top of that because they have the data. So it’s a sort of a digital ecosystem play that will tee up a financing play. Now if they pull that off, that is absolutely sweeping. I mean that is stitching together what could be, at least by body count, one of the largest healthcare systems in the world, and they would own all the connectivity. I mean, it’s a really sweeping vision. And people have tried this before in healthcare, never pulled it off. Because it’s very difficult to get all these parties to interact. If you’re building a platform business model, which is what this is, it’s one thing to get all the taxi cab drivers and all the consumers to get the apps on their phone and do it. It’s a whole noth… I mean, it’s a very simple transaction. It’s a very fragmented market. It’s a very different thing to get advanced hospitals. and all the complicated care connected that way. It’s very, very difficult. Nobody’s really been able to do it anywhere. And that’s why insurance companies have millions of coders and they spend all their time adjusting claims and doing all that stuff. Okay, so what is Ping An doing? And I’ll put the slides in the show notes of the platform business models that they’re trying to build. They’re basically trying to back their way into it. you know, if you go to the hospitals, which are mostly government, and you go to the doctors and you go to the clinics, which are somewhat private, mostly government, and you say, sign up for our system, they are basically saying no, not interested, thank you very much. So it’s very hard to get that piece of the platform. So what Ping An is doing is they went to the consumers, who all have smartphones in their pocket, because this is China, and they basically offered them two marketplace business models, a marketplace for products and a marketplace for services. They call the marketplace for products their Health Mart, and they call the marketplace for services, which they call consumer healthcare. So on the first one, they’re connecting consumers with a typical retail plus marketplace model. where you can get your pharmaceuticals, you can get your maternal and infant products, you can get your nutrition products, you can get medical devices, say you need a back brace, you need a wheelchair. It’s a health market. Now that one, in theory, should be a big win. The challenge they have there is the prescription, the pharmacy market is very well controlled, and it mostly sits with the hospitals and certain clinics. So they haven’t gotten a pharmacy license yet. Everyone’s waiting to, so they’re selling over the counter pharmaceuticals like vitamins, but not the stuff you need a script for. Those still have to be processed by the hospitals or certain pharmacies, but everyone expects that piece to go someday soon. And JD and Alibaba are waiting for the same thing. Okay, but at least you have a health mart and you start to get a marketplace that connects lots of merchants and brands who sell products with consumers slash patients. So they’ve got that. And that gets them engagement on the consumer side. It gets them users. It gets them data. Marketplace platform. The second platform they’re building is the consumer healthcare one. It’s where they connect the consumers and patients with service providers. Now, so again, marketplace for services, but these are consumer services like beauty clinics, dental clinics, checkup clinics, medical management, diabetes management. but not serious clinical care. Now that should sound kind of similar to Walgreens. Isn’t that what Walgreens is doing? Don’t they have their retail piece, which they’re doing in-house? They sell everything I just mentioned in the health mart, but they do it themselves. They have the operational footprint, and then they’re building the marketplace for services, which is exactly what Ping An has done. They call this Ping An Good Doctor. So that’s kind of phase number one, which they’ve been working on for several years. And I’ll put the slides, I’ll put graphics of this in the show notes so you can see what the model looks like. But really the big money is to connect the consumers and patients with the doctors, clinics and hospitals. That’s the big win. And you know, they’ve got a lot of consumers now, that’s good. But they can’t get a lot of engagement from the major hospitals who don’t have that much interest in doing this. So what Ping An has been doing… is building an AI capability that lets them do, they basically built a new capability to support this, which we’ll call medical capabilities. You can see the graphic. They’re building an AI and they’re building, they have an in-house medical team, such that if you’re a consumer or a patient, you can use the Ping On Good Doctor app. You can go to the Health Mart, buy your products. You can go to the consumer services part and. you know, make a beauty treatment or a massage or whatever. Or you can do a consultation for whatever your medical issue may be. I have a headache, I need my prescription refilled, my stomach hurts, it’s 2 a.m. And that consultation will be handled by one of four levels. If it’s a simple consultation, the AI will try to answer your question without connecting to anybody. And for basic triage, That’s fine. Like, should I go into the hospital today, my stomach hurts? And the AI tells you, no, you’re fine. Go to the clinic in the morning. Triage. It could be basic consultations like, I need my blood pressure medication refilled. I’ve had this for 10 years. Okay, the AI can do that. The next level up of complexity might be something like they have their own in-house medical team that works for Ping An. These are primary care doctors and some nurses, and they can answer. simpler questions. Next level up, they might refer you to a clinic which is not theirs. So then you’re doing the marketplace model. Next level up, they might refer you to a hospital. So they’re sort of inching their way up in terms of managing interactions between patients, consumers, and healthcare providers, which are a mix of advanced hospitals, basic hospitals, clinics. their in-house doctors and an AI capability. So we can call that not a marketplace. I’ve already described to you two marketplace platform business models. This is a coordination model. This is a coordination platform. This is more like Zoom getting everyone who needs to be in on the call together on the call. It’s coordinating various users and capabilities around a more complicated project. That’s really what they’re doing. with these consultations. Now, how are they doing? It’s pretty impressive. Ping on Good Doctor is doing consultations, treatments, products, and services. They have 300, almost 400 million total users. On a daily basis, they get about 900,000 inquiries. So they’ve got a massive number of people coming in for consultations, buying products, buying services, getting triage, whatever. They have 20,000 domestic medical experts connected in some form. Now, percentage of consultations that are happening online through this, about 3%. So it’s mostly about connecting the person. They might do triage with the AI. They might do the consultation with the AI. online purely, or they might do a telemedicine thing with one of their in-house, but you know 90 plus percent they are referring you and making appointments. And on their system now 150,000 pharmacies are signed up, 50,000 clinics, 3,700 hospitals, 2,000 what they call medical exam centers, which is a China thing. Now something should jump out of this like their goal is not to provide the care. Their goal is to be the digital nervous system that connects all the parties. And you can see they’re almost there. And once you start connecting all that and you have the data, that gives them the ability to offer financing. Suddenly they can start to offer things like we can offer you insurance. Let’s say they have a big corporate account because they have tons of corporate insurance customers, major company. They say, we can handle your pharmacy piece or we can handle certain types of care because we have enough data on that that we can not only price an insurance contract we can sell but we can also manage the interactions because we’ll make sure you go through our system so it won’t get away from us. So you can see there if they pull this off they’re very close to being able to go from we are the digital connectivity of the system and all the data to we’re the major insurance company. Now Ping On Proper, not good doctor, they’re major, they have 200 million customers in China, they have 4 million corporate clients. So they’re in a tremendous situation to start cross selling their healthcare services now. It’s a really compelling model. Now let me, I’ll summarize it for you because there’s a learning. Oh, let me tell you one more thing they’re doing. They have these, they look like phone booths where… They can put them in shopping malls, they can put them in business parks, and you go into the phone booth, and you know, the video screen, and you can do your consultation, not on your phone staring at your screen, but you go in there and there’s a screen, and there might be a blood pressure device, and you can walk in there, and either the AI will see you, or they will connect you with the doctor. But in the phone booth, which is private, you know, there’s a door and all that, they have all these things they can test. So that’s kind of interesting for the online consultation or the telemedicine bit. But then on the back of the phone booth, it’s not really a phone booth, but on the back of the phone booth is a vending machine. It’s slapped on the side. And that can dispense drugs and other things. So you can go in there, talk to the doctor, do the AI consult, they take your blood pressure, they give you a prescription, and then it comes out the vending machine on the back. And they’re deploying these. I think they’ve started to put them outside of China too, like in Indonesia, they’re doing something. I think with Gojek. Anyways, so there’s a whole lot going on there, but here’s the summary. They’re building two marketplace platforms, one for products, one for services. They’re building a coordination platform, a CCS, that enables you to sort of do various levels of medical care. And within that, they have built, which is the last learning idea for today, the key concept for today. They are building an AI capability that lets that happen. So to enable the coordination platform, they’ve had to build a new medical capability that can do these AI consultations or referrals. I think that’s another type of platform business model as well, and this is where I’m not sure. I think on top of this, when you’ve got this functioning and all the data is moving, I think you’re getting a learning platform. I think you’re getting, starting to see something that looks like Google or Snowflake, where the data is going ahead and the AI consultation is getting smarter and smarter and smarter. So I think there’s at least three platform business models here and there’s maybe a Google-like learning platform emerging. And that’s kind of the key lesson for today, the key concepts for today. Economies of scale. That’s how Walgreens and CVS built their business. They’re big on the supply side that gave them a lot of power. Those companies are now moving to the demand side. They’re adding platforms. AI as a capability is enabling Ping An to do these sort of interactions with doctors, AI and all that. I think it’s also starting to create a learning platform, which you can look on the concept library for learning platform. So I think that is probably happening, which is why this is really interesting. In those, those are the two, two of the main concepts for today. Economies of scale, AI is a capability and AI is a learning platform. Now last point, and I’ll let you go. Um, okay. How do you distinguish all of this? What, what matters? You know, there’s a lot going on with these three companies and Amazon pharmacy as well. How do you tell who’s going to win? Okay, you go to my cheat sheet, that’s the third concept for today, go to my six digital superpowers. You can see that if you look at the digital superpowers, traditional Walgreens, traditional CVS, their power was on the supply side, it was economies of scale. If you look at what Walgreens is doing now, number one on the list, does it dramatically transform the user experience? That’s number one on my superpowers. I think Walgreens is doing that. I think their idea of a neighborhood health destination with products and services and a new retail type model, I think that is a dramatic improvement in the user experience for consumers. I do. I think it checks that box. Number two on my digital superpowers, does it enable a platform business model to emerge? I think Walgreens checks that box as well. They’re going from a product to a platform. Number three, does it enable a network effect? Again, I think Waltherine checks that box. Walgreens to me checks one, two, and three of my six digital superpowers. So I put that on, and I don’t see that at CVS, not yet. So that’s my quick and dirty way of sort of making a prediction. I think the Walgreens model could be very, very powerful relative to the others if they pull it off. Now, if we look at Ping on Good Doctor, Does it dramatically transform the user experience? Yes, clearly. Does it have a platform? It has three, maybe four. Does it have a network effect? It has like three to four. Number four is does it create other competitive advantages? Maybe not. It’s mostly a demand side play. Number five, does it enable cheap, I’m sorry, number five is, is it viral? Not really. Number six, last one, does it enable large, large scale at low price, low cost? For Walgreens, no, you have to build more stores. But for what Ping An is doing, yeah, it has Google-like scalability. So for me, Ping An, good doctor, hits four of my six, Walgreens hits three, CVS, looks like a traditional retailer to me, mostly at this point, that’s digitizing a bit. Anyways, that’s how I sort of jumped to the answer on this. It’s not the answer. Let’s call it a first pass prediction. And that’s how I would do it. Now I’ll put the slides for Ping on in the notes because it really is an important model and it’s hard to understand it if I’m just sort of describing it. If you see the actual blue diamonds, you’ll get it. Very, very cool. And I think that is enough content for today. As for me, it’s been a week in Istanbul. and this place is really growing on me. It is, when I first got here, it was kind of crazy and hectic and it wasn’t really kind of my place, but man, I’ve been out sort of on the bus for us, take the ferry back and forth every day in the morning, it’s great. The neighborhoods, I mean, there’s stuff everywhere. I mean, this is like, I’ve never seen so many restaurants and cafes in my whole life, and I’m a restaurant and cafe and guy. I mean, it’s crazy, every street is just packed. There’s people out and… sort of went to Bebek, which is the nice area, walked along the river. I guess you shouldn’t call it the river. People don’t like that. Apparently if you call the Bosporus a river, people really don’t like it. The other thing I guess makes people angry is if you refer to Greek yogurt as Greek yogurt, which apparently it’s not, apparently it’s Turkish. People call it Greek, but it’s not Greek. That apparently makes people kind of angry as well, I’ve discovered. Anyways, it’s been pretty great. I’m here for about another week or so, and then I’m probably heading south down to Africa and working my way over to Brazil. So it’s great. It’s, yeah, it’s really pleasant. I mean, it has a lot to do with just it’s summer. Everything’s nice in summer, right? It’s clear out, you’re on the water, the ships are going by. I says maybe in December, it’s not so great. Plus there’s like everyone’s out in cafes and anyways, no, highly recommend it. I’m gonna buzz down to the coast in a couple of days. down in the Antalya area and sort of look around the Mediterranean side of Turkey for a couple days and then I’ll probably fly to Kenya after that. Okay, that is it for me. I hope everyone is doing well and I will talk to you next week. Bye bye.

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.