I’ve been thinking a lot about my past visit to JD’s new E-Space in Chongqing. It was quite cool and I’ve been mulling over what is next in new retail. Supermarkets are clear OMO winners. Furniture stores and apparel stores are interesting. But I think department stores and shopping malls are really the next big frontier.

Here is my thinking about my trip and about what is happening in new retail in department stores and shopping malls.

Take-Away #1: Chongqing is Awesome

First, I just really like going to Chongqing. It’s a great place.

- Chongqing is a massive city. It’s China’s most populous municipality, but most people outside of China have never heard of it. It has about 30M people and is roughly the size of Austria.

- It’s one of the biggest city clusters in the geographic center of China. Like Chengdu, it has a commanding position in the economy of middle China.

- It’s sort of the gateway to Inland China, which is the 50% of China nobody talks about. When companies like Ford move their production facilities to Chongqing, it’s considered a big move West.

- Chongqing city has an interesting position on the Yangtze river. It’s downstream from the three gorges dam, one of China’s stunningly big water projects (China is a very dry country so the most ambitious government projects are usually in water). It’s also upstream from many of the factories that ship products down the Yangtze, through the Yangshan deep water port near Shanghai and out into the Pacific Ocean. When people talk about China being the factory of the world, a lot of that is stuff being shipped down the Yangtze.

- Finally, the geography of Chongqing is stunning. It’s a mess of hills, bridges, and the intersection of the Yangtze and Jialing rivers. The climate is sub-tropical so there is lots of rain and greenery. But it’s also mountainous. Skyscrapers stick out of the sides of green hills. Getting around town means lots of curvy roads, bridges and tunnels.

Anyways, I’m always happy to go to Chongqing. I thought it was an interesting choice for JD’s first e-space project.

Take-Away #2: E-Space 1.0 Was a “Destination Site” for Home Appliances, Consumer Electronics and Computers

Ella Kidron (JD media relations) and I went out to the north of Chongqing where the new E-Space is located. It’s a 50,000 sqm retail space and is located away from the crowded downtown areas. That’s interesting. It means the E-Space is more of a customer destination, a place customers have to be drawn to. That is a different strategy than going after a high traffic and high visibility location – like being in a downtown shopping center or walking street.

I initially thought the E-Space was going to be a third location in urban life. Somewhere you just go to as part of life in the city – as opposed to somewhere you travel to specifically for purchases. I got this wrong. It’s a destination site.

Version 1.0 of the department store was mostly about home appliances, consumer electronics and computers. There were some smaller spaces for make-up, coffee, drones, wine and others things – but it was mostly about three major categories. Whether that is the long-term plan or was just their first step is not clear to me. JD has historically been strongest in these three categories.

Take-Away #3: JD Is More Ambitious Than Alibaba in New Retail Department Stores

When I visited Alibaba’s first attempt at new retail department stores (i.e., Intime) in Hangzhou, I noted that they were mainly pulling three levers (see my previous article How Alibaba and Intime Are Pioneering a New Digital Lifestyle in China.) They had:

- Moved all the customers to an Intime mobile app. This creates an ongoing two-way relationship with consumers in the local area. Very important.

- Launched on-demand delivery. This effectively extended the radius of the store to 2-3 km around it.

- They were digitizing operations. They were using the various Alibaba services like Cainiao, Alibaba Cloud and Alipay. They were using data to better choose inventory. Most of this was about increasing efficiency (i.e., no more cashiers cause staff use mobile phones with payment)

Overall, I thought Intime 1.0 was mostly a digital upgrade to an existing department store. But it wasn’t a big change in the consumer experience within the store. It pretty much looked like a traditional department store.

However, JD’s E-Space is a bolder strategy. It is certainly pulling the same three levers as well.

- Everything is ordered through a mobile app, in this case a WeChat mini-program.

- Everything can be delivered within 24 hours locally.

- Operations are somewhat digitized. Prices in the store are sync’d with online prices. Communications and marketing and via smartphones. There are no cashiers.

But the store is also focused on dramatically improving the consumer and brand experiences. They are attempting to reinvent the experience – with a focus on “experiential” retail.

Take-Away #4: “Experiential” Retail Means Consumers Can Try Literally Anything

Walking around the store with the local retail head, the thing that really got my attention was that you can try anything. Yes, anything. You try all the blenders and microwaves. You can practice taking pictures with the new Canon DSLR cameras.

You can try out the Dyson vacuums on carpet and wood floors.

You can make coffee with the Nestle machines. You can even drive the Ninebot karts around the store. And not just in the Ninebot area. I started driving all over the store.

You can wash your clothes in the washing machines (they are connected to water. See below). I’m not sure who would do that really.

You can even fly the drones in the store. But only within the netted areas, which seems reasonable.

You can even fly the drones in the store. But only within the netted areas, which seems reasonable.

So when JD says this “experiential” retail, they are being literal. According to the retail head, you can try out absolutely everything in the store.

But:

- Does experiential retail dramatically improve the consumer experience in department stores?

- Does it dramatically improve the merchant / brand experience and capabilities?

Those are the key questions.

Digital Superpowers and When Experiential Retail Matters

I argue that digital tools can enable new use cases, products, services and sometimes business models. Often this is not a big deal (nobody needs a smart toaster). And most of the time, these are just tech upgrades (ATMs are good but didn’t make retail banks obsolete).

But every now and then, a digital tool can be a real game changer. Digital tools can sometimes create new use cases, products, services or business models that make existing offerings obsolete. It’s like you are fighting a competitor and they suddenly get a superpower. And I keep a list of 9 digital superpowers to watch out for. One of these, which is what I was looking for in the E-Space, is when the user experience dramatically improves.

Can experiential retail dramatically improve the experience such that more traditional department stores are in trouble and need to adapt quickly?

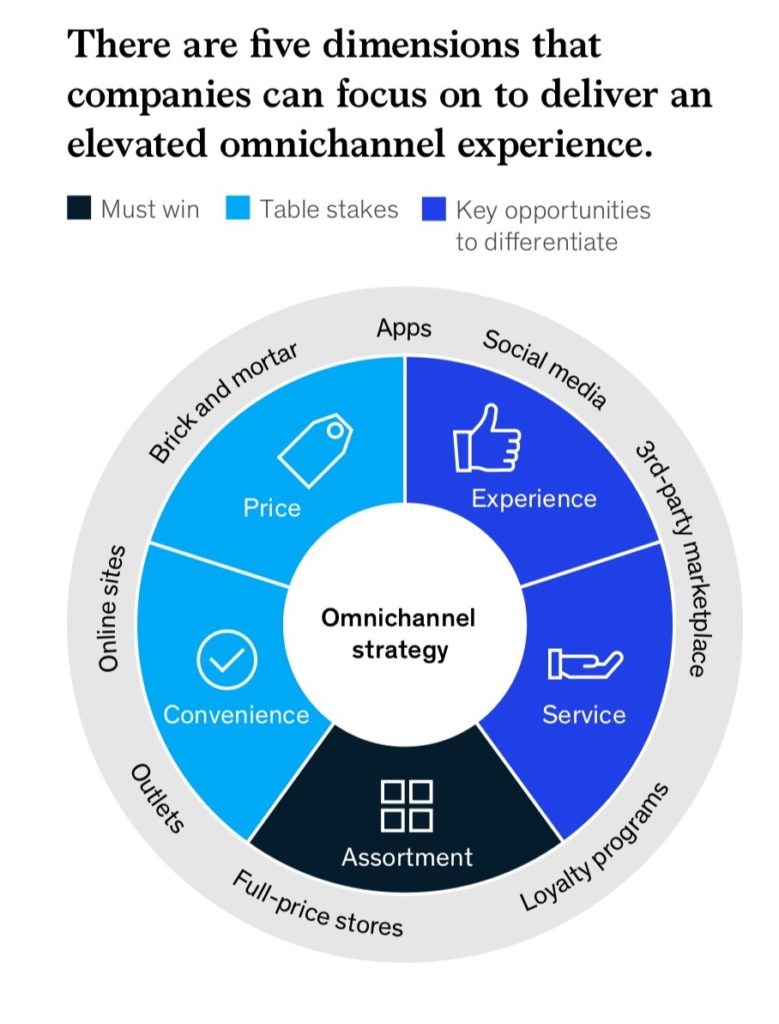

Here’s a graphic from McKinsey & Co that argues that experience is an important way to differentiate.

And JD is a platform business model. So consumers are not the only user group. You can also dramatically improve the experience for merchants and brands.

And JD is a platform business model. So consumers are not the only user group. You can also dramatically improve the experience for merchants and brands.

I left the E-Space with a list of 6 situations that could be really interesting in this regard. Which is what I will detail in Part 2.

Thanks for reading, Jeff

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.