Southeast Asia unicorn Grab is now public via a SPAC merger with Altimeter Growth Corp. The company trades on the Nasdaq under the ticker symbol “GRAB”.

This is a really interesting company. There is a tremendous amount to like about its business. It has 2-3 platform business models that have strong-to-dominant positions in SE Asia:

- Mobility (ride-hailing, taxi, scooters, etc.)

- Food delivery

- Payment and financial services

But Grab doesn’t have a cash engine. The company is losing money. It likely has lost money every year of its existence. So, there is also a big strategy question facing the company. Which is:

- Can Grab turn its impressive business model and market strength into operational cash flow? And if so, when?

This is right in my strike zone. And it’s the kind of question that can lead to a really good investment. Is this going company going to turn into a cash machine in the next 1-2 years?

First, some background.

An Introduction to Grab Holdings

Grab was founded as MyTeksi in Malaysia in 2012. By Tan Hooi Ling and Anthony Tan. Anthony is one of three brothers in a family that operates Tan Chong Motors, the authorized distributor for Nissan cars in Malaysia.

The story goes that Anthony had noticed the difficulty of getting a convenient and trusted taxi ride in Malaysia. So he had looked at the taxi-hailing model. He worked on this as a project while at Harvard Business School. And his business plan for that project won second place at the Business Plan Contest at HBS.

In 2012, he quit his position as head of marketing Tan Chong Motors in Kuala Lumpur. And he launched MyTeksi with Tan Hooi Ling, an HBS classmate and consultant at McKinsey & Company.

They pitched the taxi-hailing service to taxi companies in Malaysia and most all declined. The fifth taxi company he spoke to, with only 30 taxis running, decided to try the app.

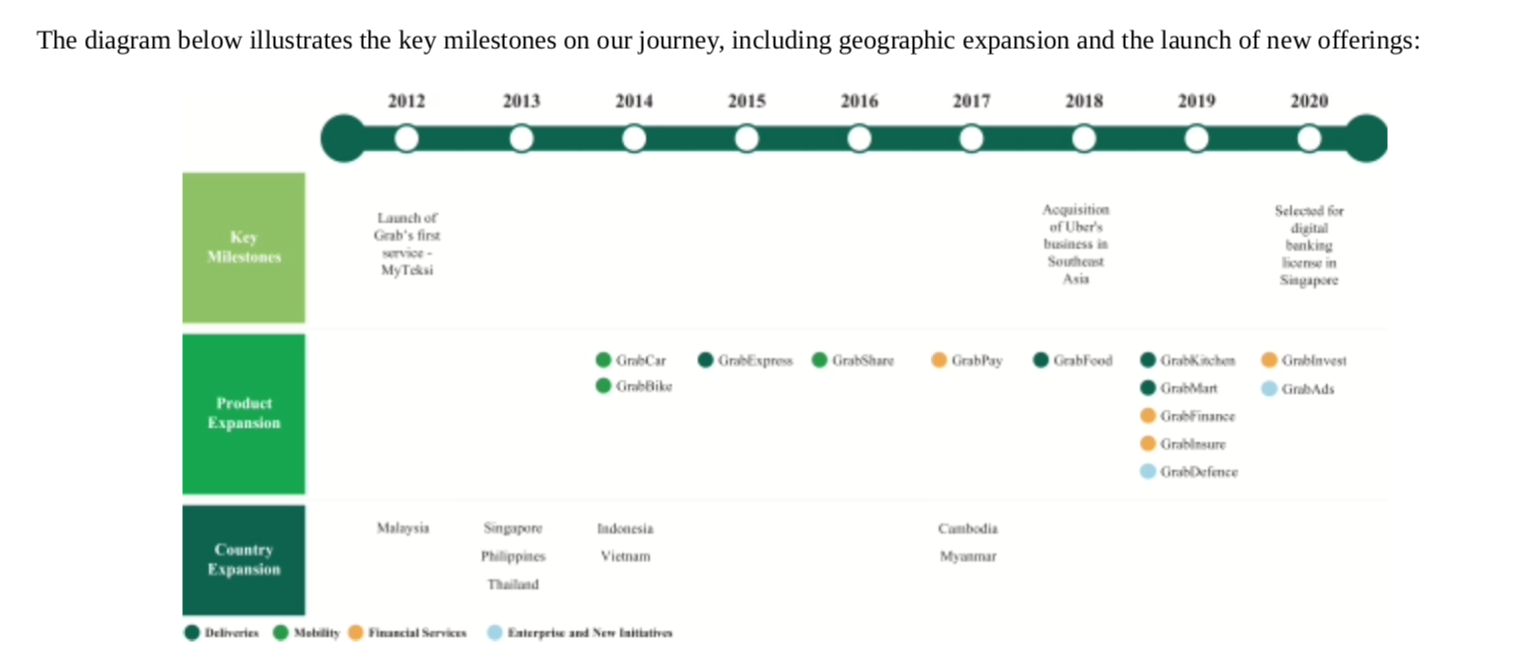

From there, the company began a rapid and relentless expansion across SE Asia. And like Uber, they were also relentless in capital raising. From their filings (sorry, a little fuzzy):

Some factoids:

- The headquarters was moved to Singapore and operations expanded to include Singapore, Japan, Cambodia, Indonesia, Malaysia, Myanmar, Philippines, Thailand and Vietnam.

- MyTeksi was renamed GrabTaxi. And later Grab.

- They launched an etaxi fleet with BYD electric vehicles in Singapore in 2014.

- They added GrabCar in 2014, which meant drivers using personal vehicles instead of licensed partners.

- They launched GrabBike (motorcycles) in 2014 in Vietnam.

- In 2018, Grab bought out the Southeast Asia business of its major competitor, Uber. Uber held a 23.2% stake in Grab as of December 31, 2018.

- The company was valued at $14 billion in March 2019. And had raised more than $9 billion, according to Crunchbase.

However, Grab’s aggressive expansion and spending has largely stayed within its three core businesses:

- Mobility (ride-hailing, taxi, scooters, etc.)

- Food delivery

- Payment and financial services

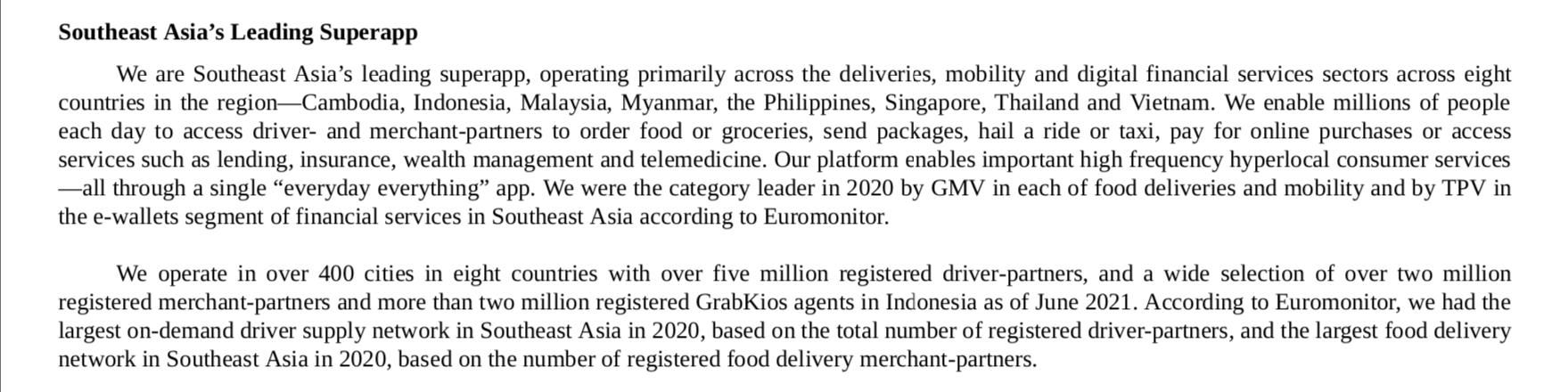

Here is a pretty solid summary of the company from its filing.

Grab says it is focused on “high frequency, hyperlocal consumer services – all through a single “everyday everything” app.” That is a pretty good summary. And mobility and food delivery are usually the most frequently used local services.

Grab also claims to be the category leader by GMV in both food deliveries and mobility in SE Asia. And the category leader in e-wallets by TPV.

Note: Grab also describes itself as a “super app” and a “platform”. I’ll go into that later.

Here are the numbers that matter:

- 25M MTUs (monthly transacting users)

- These are the active consumers across 8 countries and 300 cities.

- 5M registered drivers

- Grab says 46% of drivers were not working prior to joining Grab. Interesting.

- 2M merchants

- These are mostly small restaurants, multinational franchises, convenience stores, and grocery stores.

- Grab says orders for merchants are typically online and offline and within a 7.5 km of each store.

- Grab says 47% of merchants use Grab’s promotion tools.

Here are the financials. Look at the top right numbers. It’s pretty bad.

Ok. Let’s get into the strategy question.

The “Grab Ecosystem Flywheel”

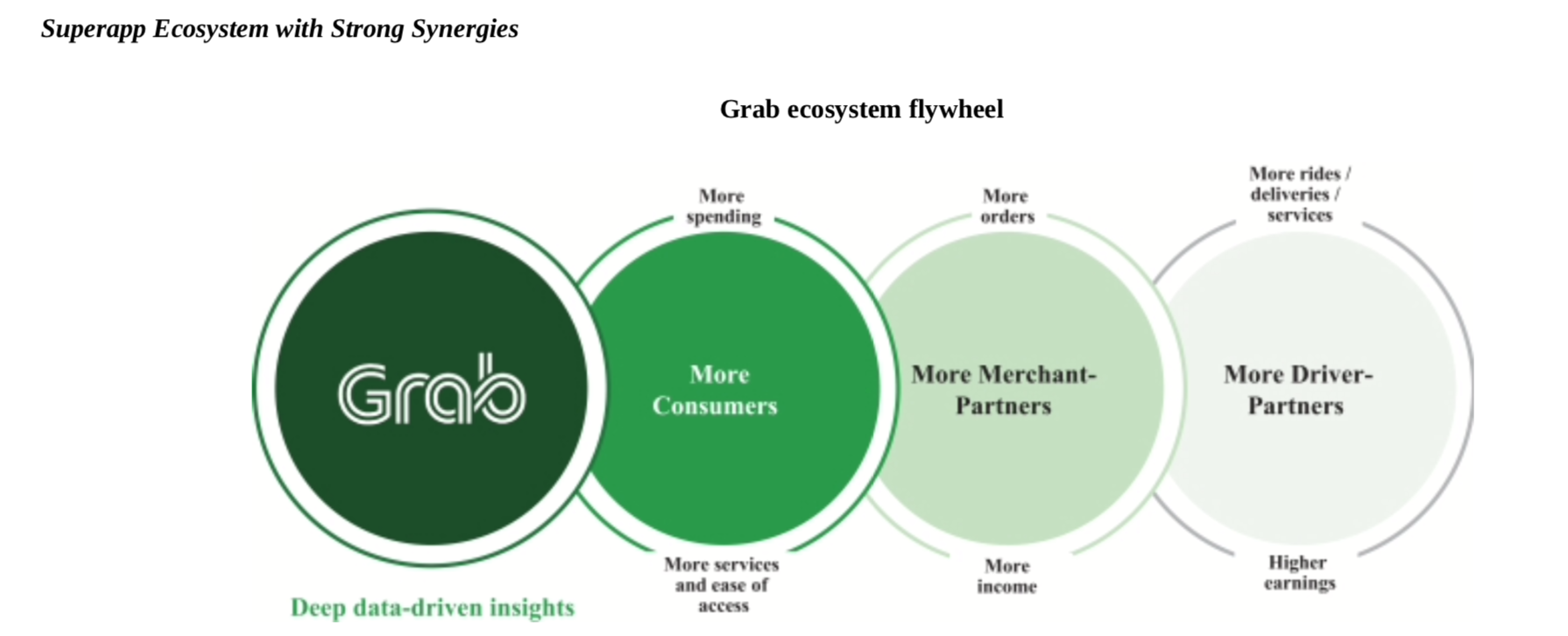

Grab describes its business model as an “ecosystem flywheel”.

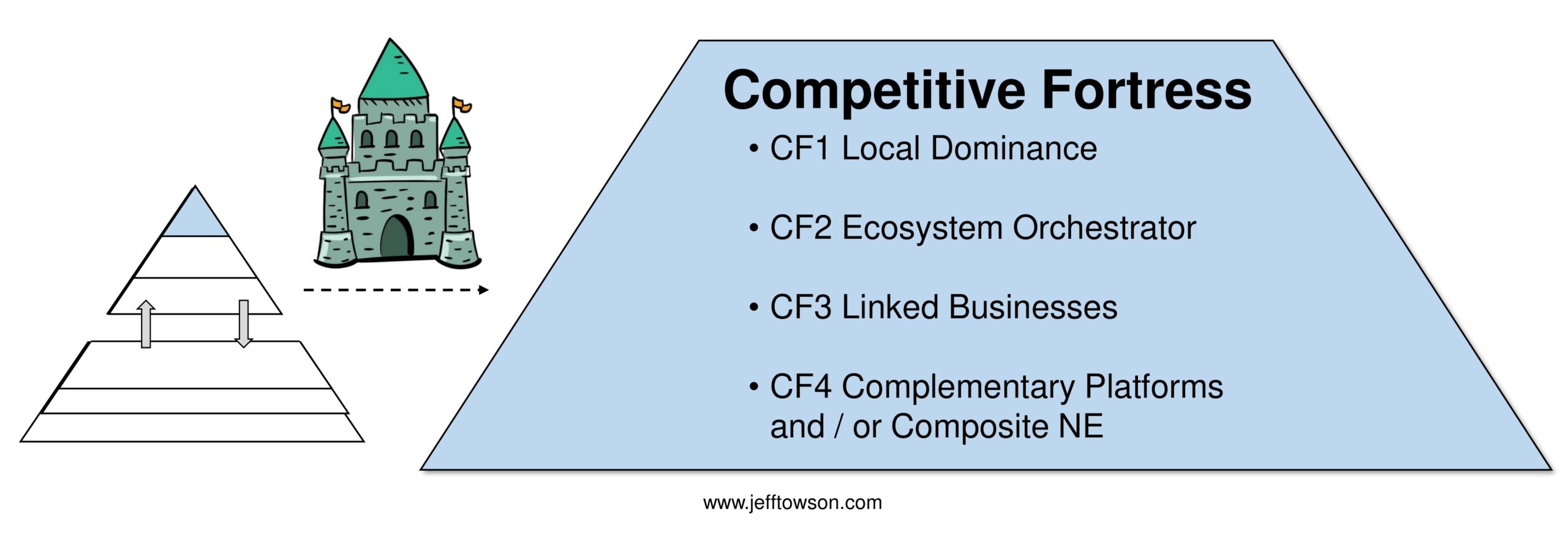

That graphic is not bad. I think my frameworks are better and will lay out the company that way shortly. I think it is 2-3 complementary platform business models.

But you can see the important points in their description.

- The more services provided, the more valuable the app is to consumers.

- This will lead to more consumers joining and more individual consumer usage. And then to more individual and aggregate spending over time.

- The more consumers and spending, the more valuable the app is to merchants and drivers.

- This results in more selection, more rides available, faster deliveries and cheaper stuff. Which is more valuable to consumers.

- All this generates more data, which should result in greater innovation and operational efficiencies over time.

Grab calls this an ecosystem flywheel. I call this is 2-3 complementary platforms with multiple network effects. And we can see increasing users and usage on Grab. And the yearly consumer cohorts have been increasing their spending.

Overall, There Is a Lot to Like About Grab’s Business Model and Operating Performance

This is a really attractive company in a lot of ways.

- Grab has established itself as an “everyday everything” app in SE Asia.

- Grab is a very well-known brand across SE Asia.

- The focus is on high frequency, daily services is smart. That is a good target for digital platforms.

- Grab is very strong in its two main categories – mobility and food delivery.

- Grab claims to have 50% of the delivery market in SE Asia. They cite the #2 player as being at 20% of market share.

- Grab claims to have 70% of the mobility market of SE Asia. They cite the #2 player is being at 15%.

- The situation in their financial services / payment business is less clear. This whole business is being turned upside down right now. And regulations country-by-country are a problem. But Grab does say that 40% of GrabPay payments took place outside of its app, which is interesting.

- Grab is building 2-3 platform business models. That is fantastic.

- The three user groups are consumers, drivers, and merchants.

- Mobility is a marketplace platform for a local, commodity service. That is much weaker than most marketplaces. Generally, you want differentiated products / services and to be regional or global.

- Food delivery is a marketplace platform for local, differentiated services. Ideally with a limited operational component. Enabling food reservations is much better than enabling food delivery.

- Payment platforms have been a great business in the past. But this is in flux right now.

- With usage and scale, there can achieve lots of demand and supply side advantages.

- These are complementary platforms that can support each other.

- Grab says 55% of its consumers use more than one service. And this has been increasing.

- Grab says 66% of GrabFood drivers were also working as mobility drivers.

- The services for each user group (consumers, drivers, merchants) are localized and diversified by both geography and politics.

- Localization in a region is a great defense against international tech companies. Localization country-by-country is Southeast Asia can also be a strength. But it can also leave you open to local champions who are more customized.

- Grab is more politically diversified, which is nice.

- Grab is very well-positioned for continued innovations and improvements in the user experience.

- They have lots of users and data. They can continue to innovate and improve the user experience, which is their best defense long-term. They can continually stay ahead of rivals in the value their bring to consumers, merchants and drivers.

- The company is also well positioned to attack growth adjacencies.

- The company is also well-positioned to build further competitive advantages with its demand and supply-side scale.

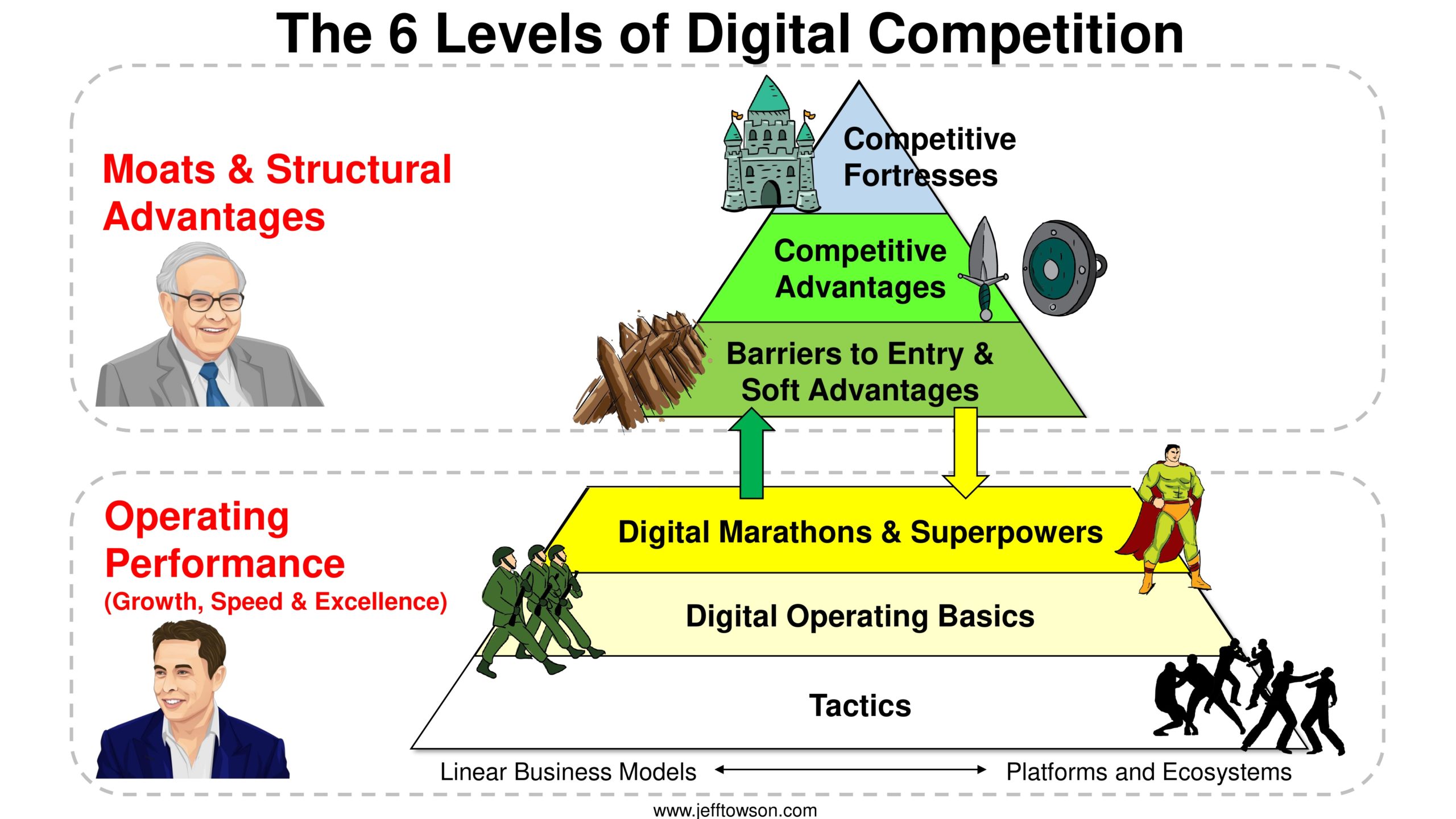

Overall, I put Grab at the top of my pyramid. Grab was a first mover in SE Asia services and has built 2-3 complementary platforms for the region.

Grab’s Problem is Not Competitive Strength or Growth. It is Unit Economics.

As mentioned in my book Moats and Marathons – Part 1, investors and managers typically look at three dimensions of digital businesses.

- Market size and growth. How big is the company and investment opportunity now and in the future?

- Competitive strength. What is the market share and/or ROIC versus current and potential competitors? Both now and going forward?

- Unit economics. What are the economic profits? This depends on the previous two dimensions, external factors, management performance, the specific industry, and other factors.

When combined, these three dimensions can sometimes tell you the economic value created by the company now and in the future. And that’s what most investors and managers want.

But you don’t always get all three. From my book:

“…in this book, I am mostly isolating the competitive strength dimension. What is the competitive strength of a digital business and how is this being changed by new technologies? Competitive strength is linked to and influenced by the other two dimensions. But I am trying to isolate it as much as possible.

Why?

Because building competitive strength and surviving longer-term is the primary strategic objective for a digital business. Growth and profitability are secondary priorities. They are nice. But they are luxuries. Survival is job #1. That means building and maintaining competitive advantages. It means continually improving operating performance. That is, building moats. “

That is how I see Grab. They are vey strong in terms of competitive strength and potential growth. And that accomplishes their first strategic objective, which is staying in the game.

Here’s my take:

“Building Moats and Surviving Longer-Term Is the #1 Strategic Priority for Digital Businesses”

After that, the goal is to get to growth and attractive unit economics. Which is the question for Grab. And what I will try to answer in Part 2.

***

Many of you are probably recognizing there is a decent sized flaw in this argument. I presented a framework that separates the creation of economic profits into growth, competitive strength, and unit economics. But there is lots of data going back decades that shows that growth strongly correlates strongly with competitive strength and longer-term survival. You often can’t separate growth from competitive strength.

There is a reason why growth has long been the default strategy for businesses. It obviously is key for creating economic value. But it is also critical for creating competitive advantages, such as superior scale. Growth is a big part of both economic value and longer-term survival. And it turns out this is even more true in digital businesses because of digital economics.

That’s a topic for the books.

Ok. That’s it for Part 1. In Part 2, I’ll go into what I think is going to happen to Grab’s operating profits.

jeff

——–

Related articles:

- Grab and Why Operating Cash Flow is Part of the Digital Operating Basics (2 of 4) (Tech Strategy – Daily Article)

- Lessons from Grab in Geographic Density and Other Tech Enabled Cost Efficiencies (3 of 4)(Tech Strategy – Daily Article)

- Will Southeast Asian Grab Become Meituan or Didi? (Asia Tech Strategy – Podcast 121)

- Growth, ROIC / RONIC and Growth + Sales in Digital Valuation (Asia Tech Strategy – Podcast 102)

From the Concept Library, concepts for this article are:

- Complementary Platforms

- Marketplace Platform for Services

- SE Asia

From the Company Library, companies for this article are:

- Grab Holdings

Photo by Grab Media Resources

——–

I am a consultant and keynote speaker on how to accelerate growth with improving customer experiences (CX) and digital moats.

I am a partner at TechMoat Consulting, a consulting firm specialized in how to increase growth with improved customer experiences (CX), personalization and other types of customer value. Get in touch here.

I am also author of the Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.