In the past months, I’ve been looking at companies are on the enterprise and cloud side. As opposed to the B2C side, which is where China / Asia tends to be very advanced. As part of this, I recently did a podcast about the fight for “dominant design” in cloud.

But when we talk about “cloud”, we are really talking about a mix of:

- IoT devices and edge computing

- Smartphones and ancillary devices

- Connectivity, mostly 5G

- Cloud and AI

We are really talking about the next overall architecture for computing and connectivity. It’s sweeping. And it’s a lot of chaos right now.

However, on top this new emerging architecture is a lot of action in enterprise software and services. From Microsoft Teams and Salesforce.com to Zoom and Slack and many others. There is a sea of enterprise SaaS companies selling specific services. And trying to parlay that into a platform or larger ecosystem business model.

This tends to get mixed in with the bigger cloud architecture idea just mentioned. These enterprise software and services all run on the cloud, as opposed to being on premise like in the past. And they always call themselves “cloud platforms” and “cloud ecosystems”. We keep hearing these enterprise service companies pitching themselves as “IoT cloud”, “data ecosystems”, “experience management ecosystems” and so on.

It’s confusing.

The cloud architecture evolution is hard to predict. But I think we can make some solid predictions in enterprise software and services. Especially when it comes to competitive strengths and business models (my area). Although life is a lot simpler in B2C and apps on smartphones.

I generally think about three concepts when trying to understand the business models of enterprise services.

- Digital Operating Basics.

- Ecosystems vs. Platforms.

- Hierarchies of Control.

These are all in the Concept Library. But first, let me introduce a new company that is making a play in this space, specifically in enterprise Internet of Things (IoT).

An Introduction to Tuya

Tuya is a Hangzhou-based company that offers an IoT platform-as-as-service (PaaS) to brands and original equipment manufacturers (OEMs). They sell this service to several thousand corporate customers, including Schneider Electric and Philips.

For their brand customers, they enable them to take a product like a toothbrush or humidifier and turn it into a smart device. They add the IoT hardware (semiconductors, Bluetooth, etc.) and software such that it is a connected device. And they provide the network and platform so both the users and the brand can connect with the device. And, given that most manufactured products come out of China / Asia, it is not surprising that a Chinese company has emerged early in IoT PaaS.

Tuya describes itself as:

- “pioneering the IoT cloud platform”.

- “enabling everything to be smart”

- “an IoT developer ecosystem”

Tuya uses the following graphic in its 10-K. Read the text at the top. It’s pretty good.

The text is pretty good. The graphic is not great.

- Ignore the Industry SaaS and Value-Added Services They are much, much smaller products for the company. The key product is the IoT PaaS.

- The bottom of the graphic is also good. The system can run on AWS, Azure and Tencent Cloud, so it is somewhat cloud agnostic.

- Ignore the rest of the graphic. I’ll give you a better explanation of its business model later.

Overall, Tuya is offering a reasonably compelling service that solves a growing problem for brands and OEMs. It enables these companies to turn their products into smart devices. And many brands and OEMs have a strategic imperative to do this.

For its core use case, Tuya’s customers are:

- Brands which work with Tuya to design, develop and market their own devices.

- OEMs which directly place orders with Tuya to deploy their devices.

The value proposition to these corporate customers is:

- Smart device development capabilities. Using Tuya is far easier than building IoT enabled devices in-house. Most OEMs and brands have no real software expertise.

- Scalability. This is always one of the big benefits of software-as-a-service. You can start small and use just what you need. But it is also globally scalable. The devices will work everywhere. And this is important for global brands.

- A reduction in total cost and complexity. Like most software-as-a-service, it enables the use of a centralized and existing IT infrastructure at large scale. This is just cheaper. Plus it eliminates the need to build. It also gets the company ongoing access to the latest technology updates, which are never ending.

- Interoperability with multiple clouds and protocols. This is where the ecosystem question comes up. This IoT platform and standard connects and is interoperability with lots of other enterprise services and functions.

- Reduced time to market. Companies can launch such smart products within weeks. This is important in their fight for market share.

- Reduced uncertainty and risk. This is just a much safer approach for software development, as opposed to doing this in-house or using a smaller vendor.

- Connected products can create deeper customer engagement. This is another reason why moving into smart, IoT devices is a strategic imperative for many companies. It creates an ongoing software-based connection with their customers.

The other user group for Tuya is the developers of smart devices and software. The benefits to them are:

- End-to-end, low-code or no-code development infrastructure. Developers can create products for the Tuya system without having to do much coding. They can use the existing tools and modules. This reduces the threshold for development. Developers can quickly design, develop, and launch scalable software-enabled smart devices.

- Neutral and compatible infrastructure. The Tuya platform works in lots of environments. The cloud and communication protocols are agnostic. They also have a comprehensive set of APIs and partnerships.

- Lots of data analytics. The platform has lots of insights based on aggregated data from lots of devices (both device number and type).

That is Tuya’s core use case. It is fairly compelling. And you can see why lots of brands and OEMs would turn to such a company.

The company is still small but claims lots of usage:

- 117M deployments of IoT devices.

- Products using their software cover 252,000 SKUs and 1,100 product categories.

- +5,000 customers.

- These are mostly OEMs and brands using the IoT PaaS product.

- 188 customers are “premium IoT customers”, meaning each of these customers generates >$100,000 in revenue per year.

- Tuya also sells SaaS products to industry operators and system integrators. These are in industry verticals like smart home, smart business, healthcare, education, and agriculture. But this is a much smaller part of their business.

- +262,000 IoT device and software developers. With 22,500 cloud-based apps.

So Tuya is an early mover and a global leader for IoT PaaS. The company is increasing in scale, clients and data.

Final point.

Tuya uses a consumption-based revenue model, which is not surprising. The main product is IoT PaaS and is sold as an all-in-one product (i.e., no a la carte). Fees are based on the number of deployed devices, with no minimum orders.

Additionally, the company has launched a membership program, which gets clients a discount and is prepaid. About 65% of PaaS deployments are within the membership program. This is great for the working capital.

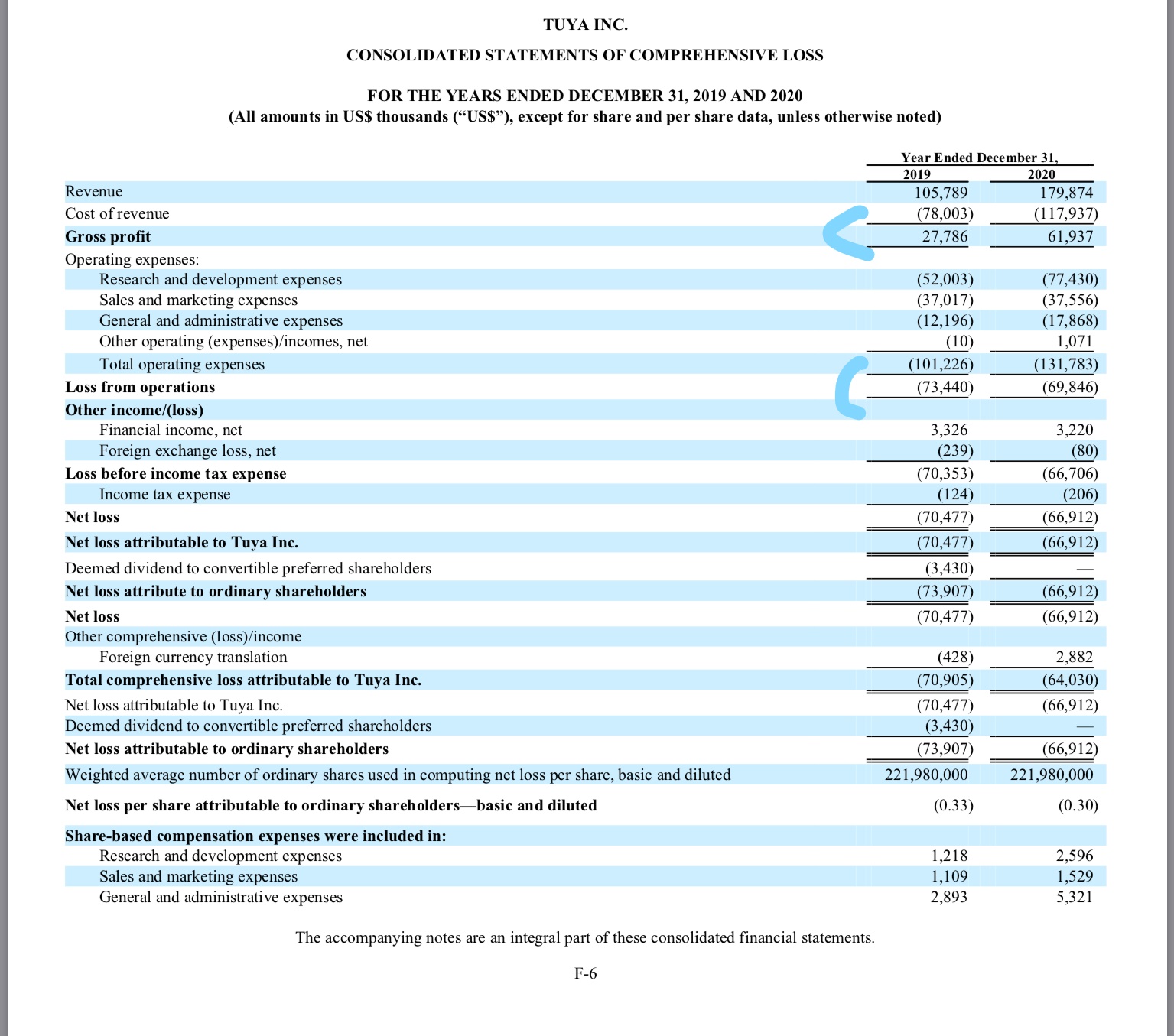

As for the financials, it’s a small company with rapid growth. But the growth profit is relatively small at around 26%. And the operating profits are very negative.

The financials don’t show a lot of cohort analysis. But they claim to have 181% dollar-based net expansion rate in PaaS.

***

Overall, this all appears solid as a service in the early stages of growth. But will this get Tuya an ecosystem? Will this become a formidable platform business model? Or will this just be one of many options for a typical company?

Can Tuya Become a Powerful Platform Business Model?

You can make a long list of factors that will impact competition in this space. The good news is that most brands and OEMs have no ability to compete in this area long-term here. And the smaller competitors to Tuya will also be struggling. But there are a lot of major players. And the list of competitive factors is long – including:

- Ease of deployment of smart devices and applications. Also ease of use.

- Reliability and security.

- The need to continually increase performance standards. This includes introducing new features, launching new products and enhancing current products. Technologies and user preferences are going to continue to evolve.

- Smart devices will need to support multiple use cases. Not just one or two.

- The size and effectiveness of the sales and marketing team.

- Established relationships with customers, suppliers and industry partners.

- The need to decreasing prices over time. Because that always happens in hardware and software services.

- Inter-operability with other enterprise systems.

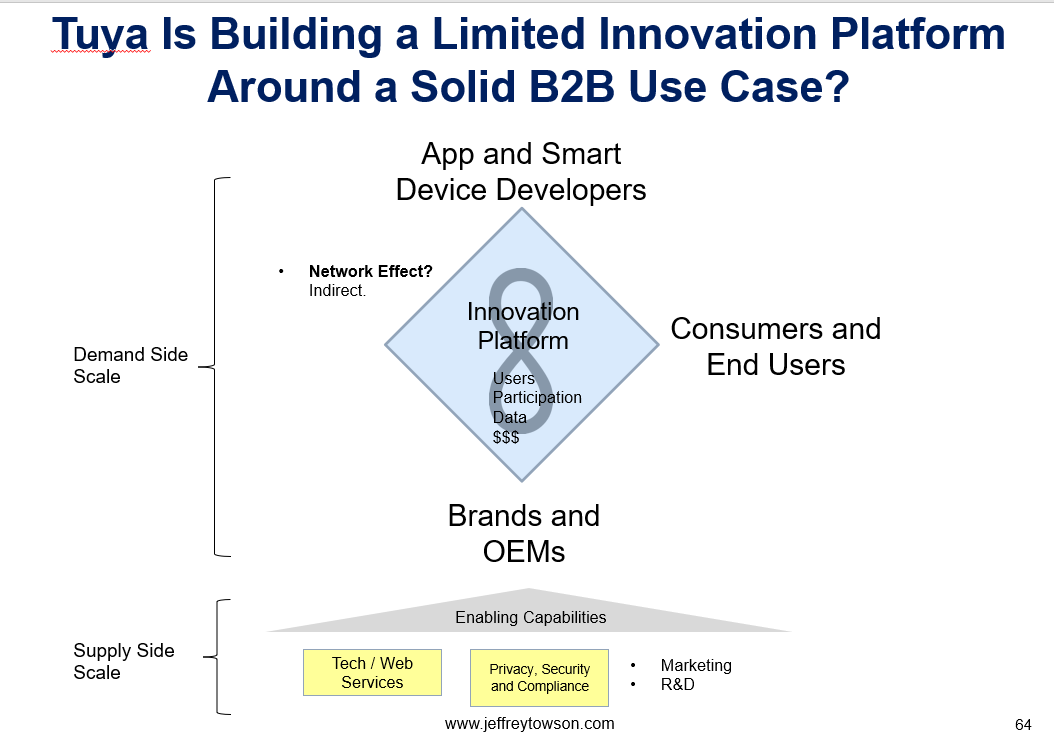

To create a platform business model, Tuya will need multiple user groups and lots and lots of interactions. Here are Tuya’s 2020 numbers for this.

We can see lots of developers and corporations. And the company claims it has network effects (I’m dubious).

So how do we take this apart?

First, Ignore the Big Story about an “IoT Era”.

All these enterprise companies tell big stories about how they are riding a major technology wave. And that is pretty true for the cloud. But most companies are not going to end up as the Android or the Microsoft operating system of the cloud or of enterprise. They are not going to be in control of a major portion of the new technology paradigm.

We hear big stories from Zoom, Slack, Dropbox, Salesforce, etc. Although we do hear a big story from Snowflake about its data ecosystem, and I am becoming a believer in that one (cautiously). But keep in mind, the major cloud providers are all moving into enterprise – including Huawei, AWS, Tencent Cloud and Azure.

Tuya’s big story is that we are now in an “IoT era”. And that the IoT era is the next iteration of the smartphone era. We are going from smart, connected phones to smart, connected everything. They use the word “ubiquitous” a lot.

The argument is that smart, connected products are going to be a big improvement in the user experience. All products and physical things will become software enabled IoT devices. And we are connecting these physical devices to a large, interconnected network. We are transforming how individuals interact with the physical world. And this will completely change how companies develop products.

That’s a big idea. And there is some truth to it. I do believe that many products will become smart, connected and software enabled IoT products. And that most all businesses will become digital businesses. But I’m not a big believer in smart underwear or milk cartons.

And I agree that such smart products are a problem for most businesses and developers. Most brands and OEMs don’t have the talent to create these devices. Certainly not quickly. And time to market matters. Plus, smart devices require continual updates in technology and features.

Does that make Tuya an ecosystem? A platform business model? Recall, my graphic of complementary platforms for Snowflake.

Doesn’t Tuya sort of look the same?

So…

Can Tuya Become a Powerful Platform Business Model?

I think the answer is “probably not”.

My conclusions (thus far) is:

- Ignore the big IoT era story. Don’t buy it.

- There is a compelling core use case.

- But the key questions are the degree of interoperability and connectedness – and the hierarchies of control.

I’ll explain that last point in the Part 2, where I go through the three key concepts.

- Digital Operating Basics.

- Ecosystems vs. Platforms.

- Hierarchies of Control.

Cheers, Jeff

—–—

Related articles:

- Tuya and Why Hierarchies of Control Matter in Enterprise (Pt 2 of 2).

- Snowflake, Tuya and the Fight for Dominant Design in Cloud (Asia Tech Strategy – Podcast 106)

- Part 2: Snowflake is Building 3 Complementary Platforms with 4 Network Effects (Pt 2 of 3) (Asia Tech Strategy – Daily Lesson / Update)

From the Concept Library, concepts for this article are:

- Enterprise B2B

- Ecosystems vs. Platforms

- Consumption Ecosystems

- Hierarchies of Control

From the Company Library, companies for this article are:

- Tuya

Photo by Sebastian Scholz (Nuki) on Unsplash

——–

I am a consultant and keynote speaker on how to accelerate growth with improving customer experiences (CX) and digital moats.

I am a partner at TechMoat Consulting, a consulting firm specialized in how to increase growth with improved customer experiences (CX), personalization and other types of customer value. Get in touch here.

I am also author of the Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.