I’ve written a lot about Ant Financial because I think it is a cool example of a zero-human operation. It’s has been built from as an AI factory where all the core processes are done by AI and software. It is my standard example of the SMILE Marathon for AI/Machine Learning.

But Ant also has some other interesting aspects:

- It is tied with Alibaba and its ecommerce platforms. So it’s a complementary platform (i.e., a competitive fortress at the top of my 6 levels).

- It financially benefits from the rising wealth and credit use of Chinese consumers. It is sitting on a big long-term trend.

- It is going from payment to credit to insurance to other wealth management products. It is part of a larger financial services platform strategy.

There is just a lot going on in terms of strategy.

But Ant is not the first digital platform strategy for lending services in China. We have already seen the dramatic rise and fall of P2P lending platforms, which resulted in a big government clean up. And as the dust settles from the collapse of that industry, Yiren Digital, one of the leading companies, is one of the few survivors. It’s a company I keep an eye on.

The Rise and Purge of P2P Lending Companies in China

Yiren Digital was founded in 2012 and is based in Beijing. It’s a subsidiary of CreditEase Holdings, a much larger wealth management and lending company. The controlled company Yiren Digital is a platform connecting individual investors/lenders with individual borrowers. This is commonly referred to as P2P lending but it is really a marketplace platform for lending (i.e., credit services).

The crazy surge in p2p lending companies in China began with the arrival of smartphones (2010 onward). Private lending was already widespread in the shadow banking world. This just digitized the process. This p2p lending surge peaked in 2015 when around 6,000 companies were lending around 4 trillion RMB per year. Overall, it was an unregulated sector with lots of small fly-by-night companies, lots of Ponzi schemes and generally a rampant “get rich quick” mentality. And per Warren Buffett, any business based on “you give me money today and I promise to do something for you later” is particularly prone to bad behavior.

P2P lending was actually the digitization of the very large shadow banking system of China (i.e., lending outside of traditional banks). For consumers and SMEs in China, there has long been a large and unmet demand for credit. The major state-owned banks were mostly lending to other large SOEs. So an alternative system emerged with families and others lending to individuals and SMEs. It was called shadow banking, but it wasn’t that nefarious. By 2010, about half of all credit in China was happening in shadow banking. The government eventually designated shadow banking as one of the major systemic risks to the country. With the arrival of smartphones, this system basically went digital, which meant being much larger and more convenient. When a company makes ordering food convenient, that is a win-win. But making borrowing money super convenient is not a great idea.

For P2P lending, the end came in 2015. Online lender Ezubo lost $7.82 billion belonging to some 900,000 investors. Regulators said the company was running a giant Ponzi scheme, And business behavior with a social cost (such as families losing money) always generates a big government response in China. The government stepped in and basically shut down most of the p2p lending sector. Just like it did for online gambling and Bitcoin exchanges. P2P lenders were forced to partner with traditional banks. Assets were seized. Hundreds of individuals were investigated. Lots of people fled overseas.

By 2019, only 243 p2p lenders of the original 6,000 were still operating. The purge was basically over and the remaining industry has been consolidating to a few trusted and well-capitalized businesses. This is the standard approach by which the government deals with areas it perceives as creating financial and/or social risks.

In retrospect, was the delay of the Ant Financial IPO really that surprising? After the P2P fiasco, the government clearly did not want a big technology company processing loans at scale without any capital requirements or skin in the game.

Yirendai and CreditEase’s OMO Marketplace Platform for Lending

Yirendai (or Yiren Digital) is one of the survivors of the purge. It is controlled by CreditEase, which is a wealth management company with offices around China. Their main competitor is arguably Lufax, a financial services marketplace associated with Ping An Group. Both of these digital lenders are listed in the USA and worth following.

Their business model is a marketplace platform that enables transactions between two user groups: individual investors and individual borrowers. From 2012-2018, the platform facilitated $16.4B in loans between 1.5M borrows and 1.6M investors. The platform has a third user group with is wealth management companies selling additional products to these groups. But this is minor.

So the key activities are matching and closing transactions for loans. The company describes the benefits of its model as:

- Flexibility

- Cost-efficiency (i.e., cheap)

- Time-saving (i.e., fast)

- Very clear fees. All loans have fixed interest rates.

- All online. 60% of transactions happen on mobile.

- A quality risk management system for credit decisions and fraud detection.

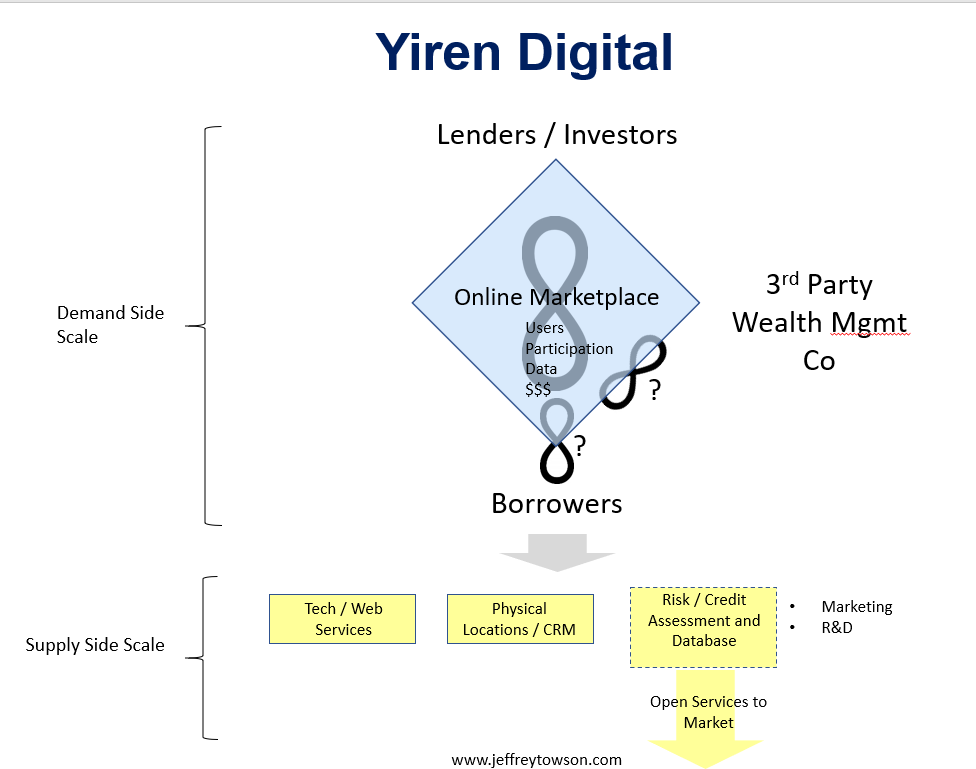

Here’s my diagram for the company.

So, for those who have been reading my stuff, you can see a pretty simple marketplace platform. What is somewhat unique here are the capabilities that enable the transactions. Note the physical locations for customer relationship management. This is important for ensuring trust on the platform. People worry about their money and there needs to be somewhere they can and talk to someone. It is a digital-physical hybrid.

Also, notice the risk and credit assessment capability. It is interesting to imagine how that might evolve.

The view for borrowers:

In a platform business model, you have to win with each user group individually. So I like to look at the service from each user group’s point of view. For borrowers:

- There is a standard loan product. The average loan is $14,000, which is unsecured with fixed monthly payments. The term is typically 12-48 months.

- There is also a fast track loan product done via mobile. The average loan is $9,000.

- Borrowers can only have one loan at a time.

The company specifically targets “creditworthy individuals” who are underserved or unserved. So they are looking for borrowers who are already prime borrowers. Or who have credit cards with stable credit performance. Or who have salary incomes. This is not about opening up a new market for credit (like Ant). This is about doing more in the existing market of qualified borrowers. And doing it cheaper and faster. They make decisions based on a generated Yiren credit score, which is based on submitted, internal and external data.

The tie with CreditEase is important for referrals and processing. CreditEase has +250 physical locations and about 30% of the borrowers come through these facilities. The local staff help them apply for the loans online and get a 5-6% referral fee.

The view for lenders / investors:

This is the side of the platform I find more interesting. Investments start at 100 RMB. And they offer lenders / investors 3-4 types of tools.

- Automated investing tools. The lender / investor deploys money for a set time period. The platform then auto-invests and reinvests. Filings state that the average investor gets 10% after fees.

- Self-directed investing tools. With this tool, the lender selects from the marketplace. Filings say the average return is about 9% for a 12 month loan.

- A secondary loan market. Lenders can sell and exit their loan prior to maturity through a secondary market within Yirendai, for a fee.

That is really interesting. Especially the automated investing tools. Lenders pay an ongoing monthly fee to use the service, which is taken out of their interest payments (10% ?). They also pay a one-time transfer fees to sell their loan on the secondary loan market.

As mentioned, there are also wealth management products. Third parties (another user group) can promote and sell products on the platform. So this is another marketplace platform in development (in theory).

There Is a Lot to Like About This Marketplace for Lending

Platforms are in the business of reducing Coasean coordination / transaction costs. This enables transactions and interactions to happen that otherwise would not. So to be successful, a platform needs a coordination problem to solve. And it needs to be widespread so the platform can get to scale. Small platforms don’t really work. Finally, it needs to be a problem with some complexity, but not one that is too difficult. Lack of trust, which is what Yirendai, is one of the best targets.

Airbnb was about solving the trust problem. How could I trust someone enough to stay in their home? How could I trust someone to stay in my home? Trust and security are a lot about what Yirendai is doing, which you can put under the heading of risk. How risky is it to loan money to a random person in China? How can I find the right person (searching costs)? How can I find the right risk vs. return (matching costs)? How can I trust that I will get paid (collections)? That risk / credit assessment capability I mentioned is really important.

The Yiren platform solves this by offering:

- A fast loan application process. It’s easy to both apply and lend. The staff and physical locations of CreditEase help with this. It is also easier to trust when you can go down to an office and talk to someone.

- Credit assessment. Credit scores are relatively new to China. Yiren’s credit assessment includes historical info, behavioral info, the credit database of CreditEase, info from the People’s Bank of China, social media history, online shopping history, credit card data, and fraud databases. They also do anti-fraud checks.

- Approval, listing and funding services. It is usually 24 hours from application to receiving the cash.

- Servicing and collection services. CreditEase does collections for any loan that is more than 15 days delinquent.

And both user groups pay the platform.

- 60% of their revenue is from borrowers as loan facilitation services.

- 29% is from account management services for lenders.

Overall, there is just a lot to like about this business model.

- It’s a very big market for both borrowers and lenders. With a big tailwind.

- It is a platform business model that is highly fragmented.

- It scales.

- It solves a difficult problem. Trust, matching and risk.

- It dramatically improves the user experience for both borrowers and lenders.

- It has an online-merge-offline (OMO) component for applications and collections. That is hard for purely digital competitors to replicate. Digital-physical hybrids tend to be more protected.

- It is perceived as free money by both borrowers and lenders. This is powerful.

However,,,

Yiren and Credit Marketplaces Have Lots of Issues

In terms of a platform:

- It is ultimately a commodity business. There is not a lot of differentiation on the supply side (at this point). There are not a lot of dimensions to compete upon beyond price.

- It has a weak network effect for both users. Like Uber (another commodity service), you don’t value an endless supply of options for loans or borrowers. A sufficient number of options is enough. Each additional lender does not create additional value for borrowers beyond a point.

- It is an infrequent activity for borrowers. And they are limited to one loan at a time. However, this is compensated for by lenders just letting their money ride when set to autoinvest.

But the biggest problem is the idea of credit marketplaces in general. The whole idea might be politically unacceptable, for good reason.

To borrowers, the company is pitching convenience and speed. They say they are helping borrowers but convenience is really about increasing usage. And enabling impulse purchases. It also makes fraud easier because it’s so fast. Mobile payment and credit cards also pitch convenience, because they know people will spend more. Making credit fast and convenient is a bad idea. Borrowing should be slow and deliberate. And rare.

There is also the free money effect and hidden fees.

For the borrower, this feels like free money. You just sign-up and they send you cash. Wow. That’s great.

For the lender, it is somewhat the same. You just put in money that is sitting idle and you get paid.

Anytime you offer consumers something free or give merchants a way to make money with no effort, you are going to get a lot of usage. I generally like to see this in businesses. It really lowers the bar to participation. Google Search being free is great. Restaurants selling slack capacity via Grab orders is also great. But enabling lots of borrowing and lending is not necessarily great.

Especially when something perceived as free is monetized by hidden fees. One of the reasons I don’t like consumer finance is because it takes advantage of human psychology. We are not good at assessing costs when they are small payments over long periods of time. Small leaks can sink big boats. So lots of consumer finance is based on taking out small fees over time, which end up being very expensive for the consumer. Additionally, there is the time value of money. Finally, in most loans and credit cards, these small fees are usually hidden and taken out automatically.

I admit this is a powerful approach. You offering stuff that appears free but actually has lots of small fees over time. But I don’t like it very much for in credit. And I really don’t like it when it is sold by sales agents with an incentive to push loans (i.e., paid by commission).

The Two Big Questions for Investors Are About Regulation and Management

Government regulation is obviously a big issue for investors in this company. But the dust has settled and it clearer now. Most P2P lenders have been closed. And Yiren Digital has not.

The other big question is the potential for bad behavior by management and sales staff. We are left with a handful of higher quality P2P lending companies in China (like Lufax and Yiren). But even with these companies, there is the question of what happens when business decreases? Say in a normal credit downturn? Or when there is increasing competition from ecommerce or traditional banks?

Insurance companies are famous for lowering their underwriting standards in these situations. They want to keep their commissions and business volumes. So they underwrite lower quality projects and keep the fees coming in. This is why Warren Buffett often invests in insurance companies largely based on the management. For a lending platform highly dependent on volume (all platforms are depending on activity to function), the are incentives for management and sales agents to make lower quality loans during slow times. What will this management team do when the volume goes down? Will they start making a lot of loans with lower standards?

***

That’s it for today. I think marketplaces for lending are interesting businesses that are still evolving. We have a clear model for this within ecommerce (i.e., Ant Group). And we have a clear OMO model (i.e., Yiren Digital) to study. There is also Nubank in Brazil. Overall, it’s a good business model to watch.

Cheers, jeff

——-

From the Concept Library, concepts for this article are:

- Platforms: Marketplaces

From the Company Library, companies for this article are:

- Yiren Digital

- Ant Group

Photo by Mitchell Luo on Unsplash

——-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.

Wanlapa Rerkkriangkrai

February 8, 2021 at 4:06amWhat abour LX (lexin fintech holdings)? They also run platform lending business.