This week’s podcast is Part 2 of Capabilities, Resources and Assets (CRAs). They are a key part of strategy. And link operating performance with structural advantages. Here is Part 1.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

Here is the link to the TechMoat Consulting.

Key points:

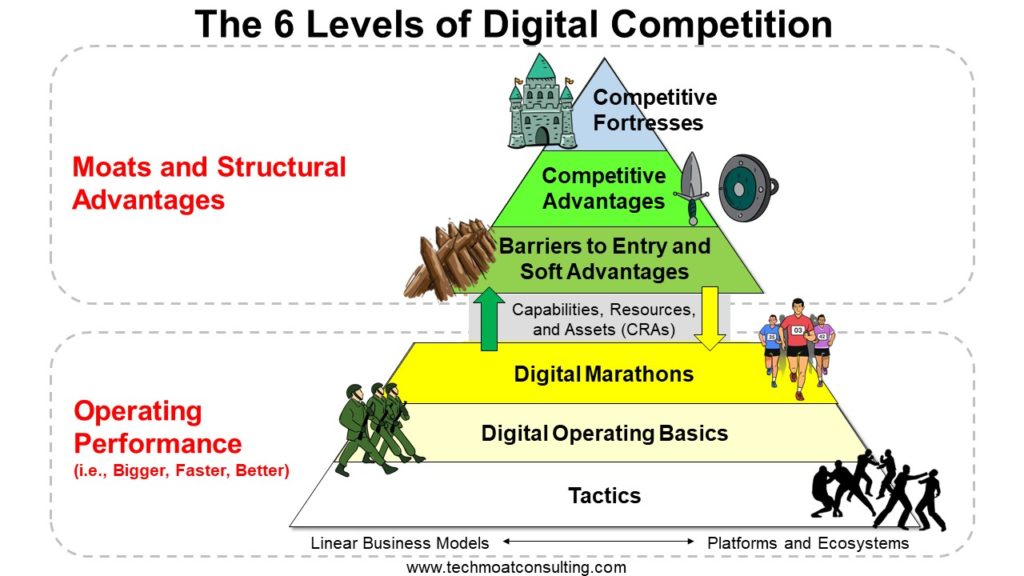

Point 1: Operating performance and structural advantage are separate parts of strategy and management.

Point 2: But they are also linked. By a select list of capabilities, resources, and assets (CRAs)

Point 3: Operating activities create and maintain CRAs, which can be tangible and intangible.

Point 4: Sometimes CRAs can manifest as competitive advantages and barriers to entry.

Point 5: CEOs need to identify moats. And then chart a path of critical CRAs to build and rebuild them.

McKinsey’s Framework for Intangible Assets

- Innovation / Creative Assets. This is any time, effort or money spent developing intellectual property. This includes content creation, such as entertainment and artistic originals. And it includes other types of content such as mapping and user generated content. But it can also include R&D in new product development, improved customer interfaces and improved user experiences (whether digital or physical). The term “innovation capital” is a good description of these types of intangible assets, which we see frequently in digital businesses.

- Digital and Analytics Assets. This is any time, effort or money spent developing, maintaining, and advancing digital assets and capabilities. This includes software, data warehouses, digital infrastructure, and other digital and data capabilities. This includes pretty much everything in the digital operating basics. It also includes CRM software, ecommerce interfaces, data analytics models and algorithms and so on. I like that they separated this as a category from intellectual property and content assets. The title “digital and analytics capital” is great.

- Human and Relational Assets. This has two sub-types. This is any time, effort or money spent on:

- Building individual or organizational skills through training within an organization. So, this is your talent strategy – which includes specialist skills and capabilities but also social and emotional skills. This also includes relations and interactions within organizations, such as organizational and managerial capabilities. You can put adaptability and resilience here.

- Building ecosystems and networks external the organization is also important. This is relationships and partnerships with suppliers, complements and data partners. This is where Digital Operating Basics 4 as well as Consumption Ecosystems would go.

- Brand Assets. This is any time, effort or money spent to maintain or increase brand equity. This is an important category, but the name is not great. Relationships with current and potential customers is an important intangible asset (often called brand equity). This can include capabilities that build and maintain these relationships – such as loyalty programs, promotions, and fan clubs. Customer service and churn and retention initiatives are also very important.

——–

Related articles:

- Digital Strategy Lesson: CRAs Are the Path From Operating Activities to Competitive Advantage (1 of 2) (Tech Strategy – Podcast 190)

- Lessons in Digital Operating Basics from Ram Charan. Part 1 of 2 on “Rethinking Competitive Advantage”. (Asia Tech Strategy – Podcast 98)

- Meituan vs. Ctrip vs. Alibaba: Who Will Win in China Services? (Jeff’s Asia Tech Class – Podcast 22)

From the Concept Library, concepts for this article are:

- Capabilities, Resources and Assets

- Intangible Assets

- Digital Operating Basics

- Digital Marathons

From the Company Library, companies for this article are:

- n/a

——–transcription below

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast from TechMoat Consulting. And the topic for today, why CRAs are the path from digital ops to competitive advantage? Now that’s a word, unintriguing title. This is basically part two of a podcast I did a while back. It was number 190, which was really digital strategy and it’s talking about how operating activities, digital operating activities, lead to certain assets being created and how these can manifest as competitive advantage. So really, kind of the heart of all those books I’ve written on the subject is basically this point. And I went through that in part one, just talking about regular businesses and I’ll rehash that quickly here. But today I want to talk about how it’s different for digital. So this one will be the completion of that one. Anyways, this is going to be a short digital strategy lecture. And it’s going to pull together pretty much all of my modes and marathons books into a pretty quick little talk here. So hopefully that will be helpful and that’s the topic for today. All right standard disclosure, nothing in this podcast or my writing or website is investment advice, the numbers and information from me and any guests may be incorrect. The views and opinions of the express may no longer be relevant or accurate. Overall, investing is risky. This is not investment legal or tax advice. Do your own research. And with that, let’s get into the topic. All right. Let’s start with quick tech news and, um, yeah, sort of some important stuff happened. For those of you who’ve been listening to me for a while, you know, I stay away from politics, but I do veer into it a little bit here and there when it comes into the idea of controlling information flows because these platform businesses have tremendous ability to control the flow of information, which has a lot of impacts in politics and other things. And the next version of this coming will be when these centralized platforms control digital currency, which will create another source of tremendous power in society, in a country, in an economy. And when there’s these big sources of power, big surprise, everyone wants to get their hand on the wheel and control it. So I do keep an eye on that. And we’ve seen a couple of these over the last couple months of people trying to get control of information flows. Politics, government, corporations, pretty much everybody. And I’m pretty much against that because I’m sort of a free speech person to the core. But there was another one this week, which was the EU Digital, actually there was two. First of all, there was a new bill in Scotland that pretty much gives politicians, bureaucrats, control of what can be said and what can’t be said. And we’ve sort of moved past the idea of its company A versus company V. We kind of know who’s in charge now in terms of these centralized positions of power for controlling information. So the corporate versus corporate fight is over. Now it’s usually governments and politicians passing laws that basically give them control. And outside of the US, well, the US has the First Amendment. So there’s pretty strict limits on this and it has to be done indirectly. And the courts have even struck that down. But in other countries, that’s not really the case. The courts can basically give them the ability, give themselves, I’m sorry, the politicians can give themselves the ability to determine what cannot be said and what can be said. And this will all be under the guise of misinformation or hate speech or something. But about 30 sections later, it pretty much turns into self interest. So Scotland did this. There’s a new law that gives them pretty much power to dictate what you can and can’t say what you can and can read and the penalties and fines are sweeping. So, yeah, you can kiss free speech gone in Scotland. It’s done. Now, they are not alone. For those paying attention to, let’s say, Brazil, The Brazilian Supreme Court has pretty much given itself the same power, kind of unilaterally. It’s really one dude on the Supreme Court that is banning people and censoring people at will. So Brazil pretty much gone. Scotland definitely gone. Canada’s following suit. And the big one is the EU Digital Services Act, which has already been passed, but it hasn’t really been implemented. And if you do not sensor control speech, eliminate speech, shadow ban, to what the regulators feel is appropriate, you can get hit with a fine up to 6% of your global revenue. Now you could pretty much call that the anti-Twitter legislation. It hasn’t been enacted in the sense of applied, but it’s been passed. And we’re kind of waiting for the shoe to drop when they hit Twitter with their first, you know, big fine. So anyways, if you’re a free speech advocate, which I absolutely am It’s pretty much bad news across the board and I think we’re gonna see a lot more of this. I just think You know There’s a lot of power here and people are going after it and they’re using whatever means They can to get it whether it’s corporate power or just legislation. And that’s, I don’t know, that’s where we are. So I pay pretty good attention to that. Within that, if you wanna learn more about sort of how it was done in the United States, which was a bit more indirect and now has been dialed back, there’s a guy named Mike Benz, who sort of follows the surveillance regime, the censorship regime using Glenn Greenwald’s language. He’s been on Twitter and he’s done some interviews. Mike Benz, B-E-N-Z, that interview blew my mind. I mean it really just made me look at the world completely differently. Anyways that’s where I kind of am on that. I’m, I accept that I might totally be wrong on this because this is veering away from strategy into more geopolitical national politics stuff where I’m an amateur at best. If you think I’m full of it, let me know. I’d appreciate actually the feedback on that. Okay, that’s four minutes of current events, quasi political stuff. Let’s get into digital strategy, which is my area. Okay. Now, podcast 190. I basically made the argument that I laid out five points and I’m going to reiterate those now. And I talked about them as applied to just not digital strategy, just strategy overall in non digital businesses. So I talked about Walmart, Aramco, Disney, Starbucks, Coca-Cola, companies like that. And I laid it out without talking about digital, because I want to kind of build today on top of that. But the five points I made, and I’ll read it or it them related to non digital businesses are point number one was operating performance and structural advantage are not really separate things. They are often described this way. You know, there’s the strength of the business are you a motorcycle are you an airplane that’s structural. And then there’s well, how good are you performing? That’s more a function of management and team and culture. And you can have a very powerful business model with weak management. Similarly, you can have unbelievably good management and culture operating performance in a fundamentally weak business. You know, and people talk about this, the horse versus the jockey. operating performance in a fundamentally weak business. And people talk about this, the horse versus the jockey. Is it better to have a fast horse but a mediocre jockey or a weak horse but a really awesome jockey? And most people usually say it’s the former. People talk about that value, investors all the time. And it was point number one is, look, these things are not really separate. They’re actually linked because it turns out I always sort of break that first point into Elon Musk versus Warren Buffett. Elon Musk is a good symbol for incredibly effective operating performance. And this gets to point two. Now, for those of you who’ve read my Moz and Marathon’s books, I always sort of break that first point into Elon Musk versus Warren Buffett. Elon Musk is a good symbol for incredibly effective operating performance. That dude and his teams can just execute like crazy. I would say the same thing about Xiaomi. I think Xiaomi is an outstanding operator. I think Microsoft is very good. Separate to, I would say Costco would be in the same category, right? But separate to that is structural advantage. That I use the symbol of Warren Buffett. Okay. So I’ve kind of made that analogy versus operating performance versus structural advantage with Warren Buffett versus Elon Musk. I’ll put the graphic in the show notes for that. Point two is, look, these things are really linked and the key linkage is CRAs, capabilities, resources and assets that you’re operating activities, Walmart, what do they do as an operating activity? Well they manage stores, they build stores, they open stores, that’s all operations. In the process of their weekly operating activities, which they’re very good at, they create assets over time, which are the stores, the logistics network, the supply chain, the marketing activities, the customer database, those assets fall out of the operating activity. So we could call those an asset, the CRA. If you were talking about something other than Walmart, let’s say we were so when we talk about Walmart, we usually talk about assets because they show up on the balance sheet, the stores, the factories, the supply chain. If we were talking about Sony, we would say, look, they’re operating activities or more about design, Operating activities are more about design, technology, innovation, and the CRA that falls out of that is not actually on the balance sheet. The CRA we would talk about is they have a very powerful capability in making microelectronics, in taking electronics and making them smaller. And that’s how they created like the Sony Walkman. You know, that was their, we wouldn’t talk about Sony in terms of the balance sheet, the assets, like Walmart, we’d talk about a core capability they have that is very unique, which is miniaturization of electronics. And that’s what cuts across all of the products that they rolled out for a long time. cuts across all of the products that they rolled out for a long time. And if you look up core capability, core competency as a structural advantage in various papers, you will see Sony as the company they point to. Now that would be the C in CRA. The other one you can talk about is a resource. If we talk about Sony Aramco, the big oil giant of Saudi Arabia, their key capabilities, the oil, we’d call that kind of a resource. So these things, CRA, they kind of blend together as look, this is kind of the key asset that you’re developing that falls out of your activities. And that’s really the linkage with operating activities, performance, with CRAs is that. And people write about this, they call it capability based advantage or capability based strategy, resource based strategies, a whole people have been writing about that for 30 years. That’s kind of point number two. And I’ll put the picture in the notes for that, which is between my my standard graphic of Elon Musk at the top, I’m at the bottom, and Warren Buffett at the top in the middle, there’s a little line in yellow that’s called CRAs. That’s the linkage between them. All right, point three is that most of the key operating activities that a company does. They’re really important. You have to do a lot of operating activities as a company. Hundreds of them. But the key ones, the select ones, are the ones that create and maintain your critical CRAs. Right? Those are the key. I mean, when we look at Walmart, they’re doing a lot of stuff in human resources. It’s important. They’re doing a lot of stuff in administration and legal. It’s important, but it’s the opening and managing of stores and logistics. That’s the key activity that builds and maintains their CRAs because assets degrade. Capabilities will degrade and decline and get amortized and depreciated. So that’s what you want to look at is the short list of activities that create and maintain your CRAs. Okay, point four. You can then go from CRAs to structural advantage to Warren Buffett land. Sometimes the CR’s you build manifest themselves as competitive advantages in various forms. It turns out that if you look at the key competitive advantages Walmart has like economies of scale in operations like purchasing power which is another type of economy of scale, which, you know, the customer membership database, those things are really CRAs that manifest as competitive advantages. So, resources and competitive advantage are really two sides to the same coin. So, within those CRAs, certain ones matter more. Those are kind of the four points now, the fifth point which we don’t really have to talk about is if you’re a CEO and you’re doing strategy, the key is to decide what winning looks like, building a competitive advantage over two, three, four, five years. Working back from that to say, these are the key CRAs that get me there and then working back further, these are the key CRAs that get me there, and then working back further, these are the key operating activities that get me those CRAs. That’s your critical path to winning. Identify the moat you’re building, how, you know, what CRAs does this depend on and what activities today get you those CRAs? That’s the critical path. Okay, that’s sort of a traditional business approach to strategy. Now, let’s talk about how it’s different for digital, because every example I gave you was pretty much about traditional business, which is much easier to visualize stores, factories. Maybe if we were talking about a company like Disney, the critical asset we would talk about is their intellectual property. They make movies, that’s their key activity. Out of that, sometimes falls critical intellectual property like we own Snow White. That resource will then manifest as a type of competitive advantage. So that would be the same story, but we’re not talking about a physical asset. We’re talking about an intangible asset intellectual property. Well, when you move into digital, those intangible assets that matter grow dramatically. So it’s kind of an extension. It’s a bigger version of what we would talk about with a version of Disney. And that’s what I’ll talk about next is, how does that story, how is it different for digital? Now for digital, there’s really three concepts that matter. And these are all in the concept library. Number one, the digital operating basics. I’ve talked about this a lot of times. Number two, digital marathons, hence my books, Moz and marathons. And number four, the four intangible assets of digital. Now I’ll list those in the show notes. You can go to the concept library. All of those I’ve talked about a lot. Those are kind of the three concepts that help you put all this together. All right, so let’s start back with point one. Operating performance and structural advantage are not really separate like everyone thinks they’re linked. That is more true for digital. It was easier to separate these two things when we were talking about like we have hundreds of factories and we have a good management team therefore the structural advantage is different than the operating performance. Well, more and more businesses about the human aspect and it’s getting harder and harder to sort of delineate between the structural advantage coming from something like a factory and the people. It’s people writing and coding and customers logging in every day. This line, it’s easier to see that they’re linked when you’re talking about a digital business than a traditional one. Point two, how are they linked? Again, they’re linked by the CRA’s, capabilities, resources, and assets. Some people say competency, your core competency, resource, and asset. I’m the one who uses CRA’s. I think I came up with that term. But again, the linkage is the same. It’s just that the CRAs are pretty different. You’re really talking about it different. When we’re talking about traditional businesses, most of the CRAs show up on the balance sheet. We can see the factory. We can see the stores. We can even see intangible assets like we have the intellectual property for Iron Man But once you move into digital business the the balance sheet doesn’t really help you at all if you ever I mean if you want to see something funny look at a pure digital business like reddit Etsy well, I mean Etsy kind of has well, they don’t do Logistics very much the balance sheet almost has nothing on it. I mean, it is just accounts receivable, accounts payable, maybe some debt, and then maybe you’ll see something under the category of other intangible assets, goodwill if they’ve been doing a bunch of M&A, but there’s really nothing. I don’t spend a lot of time looking at the balance sheets of digital companies. I look at the working capital a lot, but I don’t really look below the current liabilities and the current assets very much. It’s not listed there. You have to kind of tease it out of other parts of the 10K. So we are looking at digital CRAs, different CRAs, and that’s why the topic of this top is digital operating activities get you a sort of different path to CRAs. So point three again was operating activities create and maintain the important CRAs. Well, in this case, it’s digital operating activities create and maintain your CRA’s. Okay, what would those be? Well, that’s your digital operating basics. I’ve gone through this a ton of times, but I mean, I’ll read them quickly because it’s worth looking at them as key operating activities in any business that is now part digital or entirely digital, and how these activities result in certain CRAs being created over time. So the seven digital operating basics were number one, rapid growth at small incremental cost, and usually without constraints. Okay, that’s a growth one, not as useful in this discussion. Number two is much more never-ending personalization in customer improvements. That’s this feedback loop we talk about all the time. We get data from our customers, the engagement, what they’re doing. We use that data and other things to make lots of experiments to improve the user experience. We then change those and then we see the data resulting. There’s basically a flywheel that goes between rapid experimentation based on data and then as you implement those to improve the user experience we get more data. In theory if we are improving the experience more and more, we should get more users and more engagement and it’s a flywheel. Number three, the digital core for management operations. That’s your database, your data lake, your data warehouse, your data lake house, if you want to call it that. It’s all the analytics. It’s you build on top of that. It’s increasingly all the operations that have been digitized and are increasingly becoming autonomous. All of that core digital operating activity. Number four, connectedness and interoperability. This is when you start to integrate various parts of your businesses internally and increasingly externally where you’re hooking up with partners, with parts of your supply chain, with complementary activities, products, and services that your customers like. As you start to integrate various operations, that becomes very important. Usually, it starts with data sharing that increasingly becomes operations and research and development and other things. DOB5, DOB6 are about leadership and management, people, culture and teams. I mean, you talk about operating activities in any digital first business, let’s say Amazon. Everyone just talks about team building and empowering teams and getting your product managers to work more effectively with your go-to-market team. ByteDance is very, very good at this, which is why they can iterate so rapidly at the product level and they have one hit after another in terms of apps. And then DoB7 is cash-engine, we don’t have to pay attention. I mean, that’s your digital operating basics. As you start to think about building out a digital organization, those activities are the key activities, but they are going to create certain CRAs that matter over time. And what are the four intangible assets that matter? Well, I’ve written about these kind of at length. This is mostly not my thinking. This is a lot of McKinsey, which is, what are the four intangible assets that really matter in a digital organization? And if you read my recent book, The One Hour Motes in Marathon, which is the short summary, we talk a lot about the core intangible assets that really matter in a digital business. They all fall out of the digital operating basics and they are. And I think this is a great framework. This is pretty much if I was to redesign the balance sheet of a digital business and get all the accountants to accept it. These are the four categories I’d want to see on the balance sheet. Number one we call creative and innovative assets. So this is any sort of time, effort, or money the business has spent developing intellectual property. So this would be Ironman and this would be the IP for Snow White. Usually we’re talking about entertainment and artistic originals. But we would also talk about things like mapping and user generated content. So if we were talking about Disney, we’d talk about Snow White in this category. If we were talking about Reddit, we’d be talking about user generated content, which is really what Reddit is. It’s, you know, 100 subforms. If we were talking about Waymo or Google Maps, we’d be talking about the user-generated content that creates real-time mapping information like this road is busy right now, use another road. All of that would go under innovation and creative assets. Now you could all and that’s kind of information that’s going to feed directly back into improving the user experience. That would be bucket number one. Bucket number two for intangible assets, CRAs, would be digital and analytics assets. This would be any time, effort or money spent on developing, maintaining, and advancing assets like software, digital infrastructure, data warehouses, data capabilities. All of that is similar to the first one in that it’s intangible but it’s very different than sort of creative and user-generated assets. I mean this is all more like the infrastructure you would build so for something like Reddit this would be the architecture that creates and enables all the sub-forms that all the users use to chat about everything. The digital operating basics number three, the digital and management core, that’s what a lot of this is. If DOB2 is about innovation and creative assets, DOB3 is about the digital and analytics assets. So that, we could also talk about e-commerce interfaces, digital analytics models, CRM software, and all of that. Those two buckets are incredibly helpful when you’re looking at how a company is developing. Look at how fast these two intangible assets are developing and how sophisticated they are. It’s going to tell you a lot about the future of the company. All right, number three human and relational assets. This is any time effort or money spent on building the individual skills within an organization, the training, you know, how many AI experts do you have at your company? How much are you training your people? How much do your people work together effectively in teams? Now that is a huge asset within a company that we would put under the category of human or relational. One, it’s the human beings and then two, how well did they relate to each other and work together? Now, McKinsey actually breaks this into two buckets. One is internal. Your internal teams, your internal staff, your internal skills, how much are you training? But you can also look at the external component, how much are you working with other organizations? How much are you building ecosystems outside of your organization? Now that’s DOB4, this interconnectedness between different parts of your organization and within other organizations. So human and relational assets, I think, is a great bucket for a CRA. And the last one is brand assets. This will be any time, effort or money spent to increase your sort of brand equity. I don’t really like the name of this, but this is really when we’re talking about relationships with customers. How much are your customers engaged? Your current customers, your future customers, how many of them do you have? What about your loyalty programs? What about your promotions? Do you have fan clubs? Do your customers log in 10 times a day or once every month? They call that a brand asset. I would call that much more of sort of customer assets. If you look at Walmart today, I want to know how many people are on the membership rolls. That’s a huge asset that is largely intangible. But in digital businesses, that is number one on the list every time. How much do your customers engage? What is your retention rate? That sort of stuff. So I think those four buckets for intangible assets. And I’ll put this in the show notes. That is a tremendous way to think about the CRAs that really matter in a lot of digital businesses. And you can link that directly to the digital operating basics. Okay, last one and I’ll finish up. I’m trying to finish this in a half hour. Okay, that’s your CRAs. How does that manifest in some cases to a structural advantage, a mode, a competitive advantage? And here the story is kind of different. I have argued in seven books that digital activity, digital assets, get you two different types of advantages. You can get structural advantages, which we call modes, or you can get digital marathons. Hence, my books are all called modes and marathons. Marathons are an operating advantage. I’m not going to go into that, but there’s whole books written about the different types of digital marathons that create an operating advantage as opposed to a structural advantage. Now, if we talk about structural advantages, modes, there’s two types, there’s barriers to entry and there’s competitive advantages. It turns out digital businesses have a lot of interesting types of barriers to entry. Platform business models where you have to get two user groups to engage at the same time, buyers and sellers to get going in this business, the chicken and the egg problem. That’s a type of barrier to entry that we really mostly see in digital businesses. There’s a couple in the physical world, but they’re mostly digital creatures. Bundling, cross selling, what I call soft advantages. All of those are barriers to entry that we see mostly in digital businesses. So a lot of these CRAs can manifest that way. But the one people usually want to talk about is competitive advantages. We know what the competitive advantages are for something like Walmart, for something like Aramco, for something like Disney. But when we talk about digital competitive advantages, that would manifest from certain CRAs. There’s probably three we’re talking about most of the time, three to four. Number one, everyone likes to talk about network effects. Platform business models get networked. This is the big, big gun. Most of the major digital players have network effects. So Alibaba, Amazon, Google, Facebook, all of them. That’s the big one. We don’t see network effects in non-digital businesses very often and we certainly don’t see global network effects but we do in digital. Switching costs can be pretty interesting in digital businesses, particularly when we’re dealing with the enterprise side, Microsoft, Slack, anything that’s built in on the enterprise side of businesses, usually switching costs are more powerful. We don’t see a lot of switching costs on the customer side, on the consumer side. I mean, they tend to be soft because switching costs annoy consumers. That’s why, you know, Netflix lets you cancel at any time. But on the enterprise side, we can see pretty powerful switching costs. We do see various types of customer capture. Usually it’s more psychological in nature. Facebook is very good at sort of hacking your psychology and getting you addicted to stuff that is really not very good for you. So customer capture in digital, a lot of that is sort of soft and psychological. Can be pretty pernicious sometimes. And then economies of scale. Those are kind of the three to four big competitive advantages guns we see when we’re building a digital business or a business that is traditional, that is going digital. So, okay, so that would be sort of how I would view a really powerful business model with big structural advantages. I’d look for the competitive advantages. I’d look for the barriers to entry and I’d look for the digital marathons. That would be my step one. Step two, I would then link the picture, I think, of the future with certain CRAs, and I’ve given you four to think about, I would then translate that CRA picture to certain digital activities, operating activities, really just two or three, and that would be my critical path. That would be how I’d sit down with a client and say, this is how you win in two years. This is how life gets easier and easier for you over time as opposed to harder and harder. This is your critical path. Oh, and by the way, here’s what losing looks like. If you end up here in one to two years, life is going to get a lot harder. That would be sort of digital strategy 101. And there’s a lot of judgment in that because you have to sort of tell a CEO, “Look, I know you’re going to spend a lot of time, effort, and money on things that don’t look like they’re helping you today.” But in two to three years, it’s really going to play out. Making those longer term bets that often require a lot more money. It gets hard to make those bets as a CEO when you’re not seeing an immediate payoff in three to six months. You know, we are losing money a lot of money in this area. We’ve been losing money for a year, but we’re gonna stay the course because we understand what this gets us in two years. A really good example of that was Shopee. Shopee committed to winning in e-commerce as a gaming company, knowing that it wouldn’t play out for at least two to three years. But they committed and they spent a lot of money and they lost a lot of money for two to three years before what they were building started to manifest itself. And suddenly they had a very powerful business. It gets hard to do that as a CEO or management team if you don’t understand what you’re going to get at the end. And that’s kind of what I spend a lot of my consulting engagements. This is what we talk about. Look, this is what you’re gonna get in one to two years if you stay the path. And when a management team sees what they’re gonna get, they’re willing to do it. It’s sort of like, it’s like going to the gym. Look, this is gonna suck and it’s gonna be hard and it’s gonna be unpleasant, but this is what you’re gonna look like in one to the gym. Look, this is going to suck and it’s going to be hard and it’s going to be unpleasant. But this is what you’re going to look like in one to two years. And when people see what they get, they’re actually willing to tolerate a lot of pain because they understand the trade off. Okay, it’s going to hurt, but I’m going to get that. I got it. It’s worth it. Or it’s not worth it. But you know, the more we can paint a clear picture of what winning looks like in one to two years, the more the management team is on board. And that’s a lot of what I spend my time doing is conversations like this. And oftentimes management kind of knows what they’re getting, but they’re not a hundred percent sure and having an outsider coming and talk about it one it crystallizes it a little bit more it clarifies it a little bit more and it also it sort of gives them a second opinion okay we’re right just wanted to check we’re okay because it’s a big bet anyways that is it for today and I think I’m right on time. We’re at 34 minutes. I’m pretty close. Anyways, I hope that’s helpful. This has been a lot of I bounce back and forth between company deep dives and strategy. Today’s been a strategy lecture. If any of that was interesting and you want to know more, look at the show notes because I’m going to put the key slides that explain that. And if you want to know more, there’s seven books written about this. The one hour Moz and Marathon was designed to be a quick read about all of this. You can read it in an hour. So that’s an easy way to do it. And I’ll put a link in the show notes for that too. But that is it for me for today. I hope that is helpful. I don’t really have any fun stuff for today. I’ve been watching that Shogun TV show. It is almost done. It’s like, I think there’s one more episode that’s going to be released in a week. Man, it’s really good. It is just like my favorite TV show in a long, long time. Probably going to watch it again. It’s really thoughtful and interesting. If you like the James Claville Shogun book, this is really well done. So I’ve been enjoying that. As that one ends, the one I’ve started watching, I watch a lot of Korean TV. I don’t know why that is probably because Netflix keeps teeing it up in my queue, ’cause I live in Asia. There’s a show called “100,” where they take 100 athletes from around Korea and they have then compete in various physical competitions and it’s everything from gymnast to sumo wrestlers to fitness models to, it’s a really interesting group of a hundred people with different skills all competing in various things like who can run the longest on a treadmill or who can hang the longest from a pull-up bar and it’s really surprising who wins like mountain climbers can hang on forever like firefighters do really well on that like the firefighters can hang on ropes for hours. It’s crazy who wins. Anyways, that’s a pretty good show I’ve been watching that is a season number two. I watched season number four. So anyways, I think it’s called physical 100 or just 100. That’s pretty cool. Anyways, that is it for me. Hope everyone’s doing well and I will talk to you next week. Bye bye.

——

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.