This week’s podcast is about how web 3.0 is creating three types of marketplaces:

- Digital platforms (web 2.0), such as a Taobao

- Platform-protocol hybrids, such as Coinbase

- Protocol networks, such as Uniswap

You can listen to this podcast here or at iTunes and Google Podcasts.

Here is my new book:

—–-

Related articles:

- How to Think About Web 3.0 Business Models (1 of 2) (Asia Tech Strategy – Daily Article)

- Platform-Protocol Hybrids and Why DeFi is the Center of Web 3.0 (2 of 2) (Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Marketplace Platforms

- Protocol Networks

- Platform-Protocol Hybrids (PPH)

- Blockchain

From the Company Library, companies for this article are:

- Coinbase

- Uniswap

———Transcription Below

:

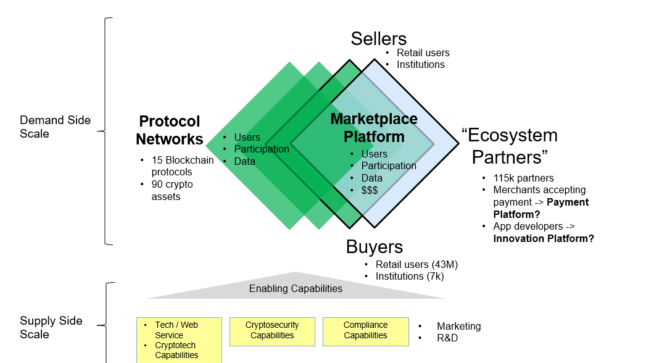

Welcome, welcome everybody. My name is Jeff Towson and this is Asia Tech Strategy. And the topic for today, why Uniswap’s protocol is a threat to Coinbase’s marketplace. And this is going to kind of pull together, I don’t know, quite a few emails and a couple podcasts over the last couple months about sort of Web 3.0, which was, you know, I started talking about sort of protocol networks. Then combine that with platforms, which got us platform protocol hybrids. And this is kind of be, I guess, the last piece of that puzzle, which is just how these things are different. So I’m going to basically give you three different versions of a marketplace. A traditional marketplace, let’s say like an Alibaba Taobao, a platform protocol hybrid, which is Coinbase, and then a pure protocol, which is Uniswap. But they’re all basically marketplaces and how they are very, very different. So this is hopefully going to be helpful to pull all this together. Let’s see, other stuff for subscribers. I’m going to kind of pivot back to China Asia because I’ve been talking a little bit about Brazil because I was out here and sort of did a down the rabbit hole with Web 3.0. I think I’m pretty much done with that. I’m going to start focusing more on Chinese Asia companies again. So. If you have any suggestions for companies to look at, please send them my way. I have a list, but anything you think is worth doing, please forward it out to me. That would be much appreciated, but that’ll be, I guess, starting in the next day or so. Okay, and for those of you who aren’t subscribers, you can go over to JeffTowsend.com, sign up there, free 30-day trial, see what you think. Standard disclaimer, nothing in this podcast or in my writing or on the website is investment advice. The numbers and information from me and any guests may be incorrect. The views and opinions expressed may not only be relevant or accurate. Overall, investing is risky. This is not investment advice. Do your own research. And with that, let’s get into the topic. Now the two concepts for today. are gonna be protocol networks and platform protocol hybrids, which is a bad term. I gotta think of a shorter term from that. PPH, PPH is platform protocol hybrids. I’m not sure that’s any better. But it’s basically a contrast to platform business models, that’s why. On one extreme we have pure protocols, on the other extreme we have traditional platform business models. And this is sort of… when you split those in half and you get one of each together, Platform Protocol, hybrid PPH. Not awesome, but anyways, I’ll go through these sort of step by step. But I’ve talked about both of these before. I’m just going to try and bring it sort of full circle at this point. Now, I mean, for quite a long time now, I’ve been talking about marketplace platforms, five different platform business models. marketplaces, payment, coordination and standardization platforms, innovation audience builders, learning platforms. Those have been my main five. And all of those would be squarely within the Web 2.0 idea which is, yes, these are business models that are based on networks that are in the business of enabling interactions and there’s four common interaction types, hence four, five platform business models. There are others but those are just five common ones. And that’s how I characterize them by the type of interaction they enable, whether it’s coordination, a marketplace transaction, or payment, or whatnot. Now, Web 3.0, decentralized platforms, decentralized web, whatever you want to call it, is aimed squarely at disrupting these platforms. I mean, that’s really what it’s going after as much as anything, hence the name decentralized. Let’s. get rid of a centralized authority, whether it’s a company or a government, that has control of the interactions and is probably abusing them at this point and is definitely taking most of the value. When you post stuff on, you put up a book on Alibaba or something, they’re gonna take 20, 30%, let’s say Didi or Uber, they’re gonna take 30% of the value. That’s not awesome. Same with the Apple Play Store, Apple Store, but it’s a heck of a lot better than YouTube or Facebook where they effectively take 100%. When you post information on YouTube or Twitter or let’s say Facebook, you’re creating the content, they’re showing it, they’re putting ads next to it, and they’re taking 100% of the ads for the most part. So that’s like the old standard Jeff Bezos line was, your margin is my opportunity. He would target products with high gross margin. Well the Web 3.0 mantra is, your take rate is my opportunity. That’s kind of what they’re going after. We can see this can be very powerful. Off the bat, Bitcoin is a direct assault disruption on payment platforms. Forget sending money through MoneyGram. Forget sending wire transfers, which in that case, your bank would be the intermediary, the enabler of the interaction. PayPal, I mean, it is trying to disrupt all of that by allowing people to send payments person to person with no intermediary whatsoever. Now, it turns out Bitcoin is not actually very good for doing payments. It takes a lot of energy. It’s slow. It has a very low volume, which is ironic because the original white paper was about payments. It turns out it’s a really good thing to speculate with and it turns out it’s a really good thing to store value with, but payments, not so much. There’s other things, but same idea. And so we see a lot of this in DeFi, but pretty much across any major web 2.0 platform you can think of, someone’s working on a web 3.0 version to take it down. So people talk about decentralized social networks. Those are aimed at Twitter and Facebook. They’re talking about decentralized video sharing platforms. That’s aimed at YouTube. There’s a decentralized Uber, obviously, against Uber. I mean, across the board. Now, most of those haven’t quite worked out for various reasons, but the ones in decentralized finance really start getting some traction, which brings us to the idea of marketplaces. OK, marketplace. These can be complicated, or these can be simple. They can be marketplaces for products. They can be marketplaces for services. I’ve talked about these a lot. They can be global. They can be regional. They can be local. There’s lots of types of marketplaces, but currency exchanges are arguably global, which is important, and very, very simple. These are not providing advanced cardiac services. These are not hiring people on Upwork to design book covers. This is very, very simple. I have two Bitcoin. You have Ethereum. Let’s swap them at a certain exchange rate. So currency marketplaces, very, very simple type of marketplace. But what it does have is it has a global reach, which can be important. OK, so we’ve never really talked about those as digital marketplaces, platform business models. that we’ve particularly cared about. I mean, they’re out there. You can all change money. You can go to your bank. You can go down to the little kiosk that’s at the boarding or exit of an airport. I mean, it’s just never been that interesting. And then Coinbase comes along and they basically say, we’re gonna build a global, well, I mean, it’s mostly US, but in theory, it’s global marketplace for exchanging various types of cryptocurrencies and… and this is why they became so successful, we’re gonna help you bring on fiat currency and then change it into cryptocurrency. So they’re sort of regarded as the on-ramp into the crypto world. And that’s, I think, largely true. They say this a lot and I think it’s actually very true. This is how most people end up getting into crypto is they put in their debit or their credit card on Coinbase, they start buying some Bitcoin. And then you start trading. Maybe you trade some Bitcoin for dollars, maybe stable coins, maybe some of these funky coins. They got 90 plus cryptocurrencies scattered across 15 protocols that they interface with, and they enable the exchange. So that would be what we would call a platform protocol hybrid, as opposed to a pure platform business model like a Taobao. or like if there’s payment, would be PayPal. Now what’s the difference? A traditional, let’s say, Web 2.0 platform business model, you can separate it into two things. You can separate it into the platform business model and the network that is the asset it is built upon. And that network can be physical, roads, things like that. It can be people, companies interacting with each other. Or it can be protocols, which is something we’ve never really talked about much, but they were kind of a big deal in the 70s. A protocol is just a software or a technological interface that lets one computer or electronic device connect with another one. So email, how emails are sent back and forth, that’s a protocol. You can send them to various domains in different computers and whatever. how the internet was formed. Well, they created protocols between anyone that ran these sort of software. And suddenly, all the computers, which all had data, could connect, hence the internet. So we haven’t really talked about these very much, and at least I haven’t, because this tends to be sort of deeper in the tech stack. But generally speaking, we don’t talk about that too much with Web 2.0 companies. Because we’re almost always talking about a network that is connecting people and companies together. We’re sending money to each other, we’re sharing files, we’re sharing videos, we’re doing transactions. The network is maybe social, maybe it’s social plus business, but that’s the nodes and the linkages between companies and people and things. Then the platforms are built on top of that. Okay. And I’ve never really separated those out because what was the point? We knew that if you uploaded videos to YouTube… YouTube would put them on their own servers, and then you would sign into YouTube, and that would be the person registering on YouTube or the content creator, and all of those interactions and nodes and content was all within the YouTube servers. The network that this business model is based on is within their servers in-house. Now, platform protocol hybrids were basically separating those things out. Now the database is no longer within YouTube’s vaults. The database is now public and it’s on the blockchain. So hence, you can still build a platform business model on top of that. And you can help people find videos and watch videos and aggregate demand and try and sell ads. You can still do everything YouTube does, but now all those videos and the people are pretty much on the public blockchain and anyone can do it. So hence, it’s a platform protocol hybrid. And companies are doing this. And that’s pretty much what Coinbase is. It’s a PPH. They have a nice interface that makes it like a platform business model. And then instead of having all that data in their own servers, they interface with 15 different blockchain protocols, which are public. And anyone can search them. And it’s a pretty. interesting business model. Now, why is that different than say a traditional platform like I just said? Well, I mean there’s a couple things that are different. The ones I’ve pointed to are it pretty much wipes out the barriers to entry for a lot of these companies if it’s successful. Now if you’re going to compete with these sort of traditional Web 2.0, you’re going You have to have a good service. I mean, just being decentralized is not enough to win. You have to have a comparable service, and that can involve a lot of things. Could be involve the user interface. It could be services you’ve put on top of the connections. It could be a lot of things. But generally speaking, if all of the videos of YouTube were suddenly in a public blockchain, and anyone could build an app, a DAP, a decentralized app. that sits on that and could draw all the same videos into their app and compete, that really does lower the barriers to entry fairly significantly. So I’ve kind of said that’s one of the biggest differences between 2.0 and 3.0 is the barriers to entry go way down in some cases. So for something like Coinbase, they definitely are pulling off the public protocols, the And that’s how they’re enabling the exchange of various currencies, one for another. That would be sort of the protocol side of the business, the public database. But they’re also adding services on top of that. So their platform business model that sits on top of that is not just a simple interface. They’ve actually built some pretty decent services on top of that. One of the services they offer is a custodial wallet, which is basically like your savings account. So you go on to Coinbase, you have to get registered, they have to sort of check you because not everyone can use it. So it’s not a permissionless service. They do have to actually approve you. So, you know, it’s not decentralized in that sense. If the government sends Coinbase a note and says, take all these truckers off your service, they have to comply, or at least they can comply. because there is a centralized control where you sign up. It’s not totally permissionless. The other company I’ll talk about, Uniswap, that is not the case. It is totally decentralized. There is no platform business model on top of the protocol. So therefore, there is no permission. Anyone can sign up, and there’s no one to tell to take it down because nobody has control. But for Coinbase, we see the protocol, we see the platform business model on top of it. One of the services they provide is a custodial wallet. So you put in your debit card, credit card, you get approval to participate, you transfer some money and they put it in a wallet, which is on the blockchain. So you get a public key and a private key and that’s where your money is. But the difference is you don’t hold the keys. Coinbase holds the keys, that’s hence custodial. They are custodians of the wallet. So technically it’s theirs. Now, so if the government tells them to freeze the wallet of Jeff, they could do it. Now, the benefit of that is if I lose my keys, I can call them up on their customer service and say, hey, I lost my password. At least there’s somebody to call, like, you know, sort of call in your bank if you lose your credit card. And that’s actually pretty good. If you’re functioning as the on-ramp to the crypto world, that’s a nice safe half step. to get in there. That’s a nice, rather than going fully decentralized, which is a little more complicated and risky. So that’s a service. The fact that you can add fiat currency through your debit or credit cards because they have basically arrangements with all the banks and the traditional finance world, that’s a service. They have lots of compliance capabilities where they are… Basically everything they’re doing and everything you try and do, they will make sure it’s in compliance with the various laws and regulations so that you’re not doing anything illegal. That’s pretty important for institutional customers. And then of course they have lots and lots of security, which is one of the things banks do is they protect your money. A decentralized system, a non-custodial wallet, which I’ll talk about with Uniswap. That’s basically like putting money under your mattress. It’s yours and there’s nobody else involved, but it’s under your mattress. Coinbase, something like this, that’s more like going down the street and putting it in the bank. The primary thing they’re doing is security. And you know, you go down there and you feel pretty good. So they do a lot of crypto security, which is actually kind of complicated. So I mean, that’s not a bad way to think about a traditional marketplace. Web 2.0 versus a PPH, platform protocol hybrid, Web 3.0, I think most of the businesses we’re talking about in this, hey, we’re gonna disrupt you, I think most of them are gonna be in one of those two scenarios. I don’t think you can do YouTube without significant services at the platform level. I don’t think you can do a Facebook. I don’t think you can do a marketplace for products and services that are complicated. I think for all of those, you’re going to end up with a platform protocol hybrid where yes you’re pulling it off the public blockchain where the data is, but you’re adding a lot of services on top of that. You’ve got a centralized authority that’s in between those two things, the public blockchain and the centralized services. That gets you the complete solution that is actually competitive with YouTube. Okay. Now, I’ve kind of said all that before. which kind of brings me to the topic of Uniswap. Now, Uniswap is a really cool, really interesting sort of one of the early big movers out of the Ethereum world. So, for those of you who aren’t familiar with this stuff, Ethereum, if Bitcoin is crypto money, It’s money that lives on computers. It’s money that’s technology only. It’s a distributed ledger that enables a currency to exist. Well, Ethereum is a distributed ledger, a distributed computer that creates sort of a global computer that everyone can build programs to run on. So one’s global money that’s public. The other is a global computer. that’s public and in both cases they’re permissionless. It’s just a protocol software that has been put into lots and lots of computers. They can all connect, hence protocol network, and anyone can build on these things. Just like anyone can trade, you know, if you can get online and just buy yourself some Bitcoin and trade it, there’s nobody that you ask permission from. If you have a browser you can do it. Well this is the same but instead of a global money, it’s a global computer, now that’s much more complicated as an idea. I mean, it’s a much bigger idea. I mean, it’s pretty awesome, actually. And the fact that a 19-year-old did this is pretty stunning. Vitalik is, that guy’s really, really interesting. But it’s also more complicated, and it gets you into smart contracts and DAOs and tokens and all that stuff. People have tried stuff. Can we make programs that only exist as protocols? Like Bitcoin. There is no centralized authority. It’s not a platform protocol hybrid. It’s a pure protocol network. It’s just software that exists on computers. And you don’t need any permission to participate. And if someone wants to kick you off, there’s no way to do it because nobody controls it. There’s nobody at the steering wheel on this thing. It’s just running. Now, that’s not 100% true, but mostly true. You can have foundations because you do actually need to make changes to these protocols over time because if you create the code and release it and it gets put on computers but nobody has any ability to change anything, the likelihood is you’re going to need to change some stuff. It’s going to need to evolve. You’re going to run out of speed. You’re going to run out of volume. So these things do have to have some degree. of changeability. And so there are, there’s no centralized authority, but often there’s a foundation or people who own tokens can vote and if you get 51% you can make changes to the protocol. So there is a mechanism to change, but it is very decentralized. It ain’t 100%, but it’s pretty good. And so Ethereum has a foundation. Most of these protocols run on tokens and if you get 51% you all vote and you can change and make things happen. But there’s no way to force it. Well, I mean you could force Ethereum but in many cases there’s no one the government or anyone else would come to and say you must do this because you’d have to basically order 51% of all the token holders to act and they just wouldn’t do it and plus you might not know who they are. So It’s not 100% but it’s much more decentralized. Okay, so within the Ethereum grand vision, which is really amazing, Uniswap was one of the first DApps, decentralized apps to really succeed. And so this is kind of the old guard of Ethereum and by old guard, I mean like 2018. Like those are the old apps. And it was one of the first really big ones. So what is Uniswap? It’s a marketplace. It’s a marketplace just like Coinbase and just like the Web 2.0 platforms I’ve talked about. So everything today is about marketplaces, but I’m giving you three different types of approaches to them. The 2.0 marketplace, which I’ve talked about a lot, the platform protocol hybrid, Coinbase, that’s a marketplace. Well, Uniswap is a pure protocol marketplace. The story behind this is pretty cool, and those of you who are subscribers, I sent you a note about this this week. But I mean, it’s a guy named Hayden Adams, who is a mechanical engineer, or he was a mechanical engineer. Out of college, gets a job, Siemens as a mechanical engineer. He gets laid off in middle of 2017. And that was his first job, and he was 24. And he writes about everyone’s blogging everything in the Ethereum world. So he emails a friend, a guy named Carl Flourish, who happened to be working at the Ethereum Foundation. And he actually published his email exchange, which said basically Hayden says, hey, I got laid off. Carl says, congratulations, this is the best thing that could have happened to you. Mechanical engineering is a dying field. Ethereum is the future and you’re still early. Your new destiny is to write smart contracts! Hayden, don’t I need to like know how to code? Question mark. Carl, not really, coding is easy. Nobody understands how to write smart contracts yet anyways. Ethereum, proof of stake, trustless computation, et cetera. So. Hayden spends a couple months teaching himself how to code. And the key with the Ethereum blockchain, I mean why is Ethereum such an interesting blockchain as opposed to Bitcoin? Because you can write smart contracts. You can basically say, here’s a token, here’s a coin, in this case it’s the ETH coin. I’m going to trade it to Bob or I’m going to sell it or I’m going to put it up there where anyone can buy it. But it’s not like Bitcoin where it’s just one fixed thing. You can program it to do things. So I’m gonna create a token, let’s say an NFT. I’ve actually tried putting up some NFTs in the last couple of weeks, non-fungible tokens of my own sort of writing and podcasts and some of my graphics. I may put them up to sell them. But okay, so let’s say I take one of my podcasts, which I did, and I uploaded it. onto the Polygon network and I created an NFT. So it’s up there, I haven’t put it up for sale, but you could buy one of my podcasts and own it. Now other people can listen to it, but you would be the only person that owns it. So it’s like having the original of a painting, but other people can see prints, but only one person has ownership. And that person could sell it one day if they think, if they want to. Okay, so I sort of put that into the. you know the contract but I also put the contract in if they sell it I get like three to five percent of the sale price. So I could sell it today put it up there it would be somebody’s if they sold it next year because they thought the value was up and they made money part of that money would automatically come back to me because I’ve put a smart contract in the NFT and you can create all sorts of smart contracts I could put in that Anyone who buys one of my graphics or podcasts, let’s say I created a club somewhere in Bangkok, anyone who has one of those gets free access to my club for the next five years. I could code it, I could code membership into the NFT, so whoever buys it gets membership. Access, additional content, anything you can code you can do, so you can put smart contracts in these things. So that’s kind of a big, big idea. Anyways. So Hayden teaches himself to code for a couple months, and he focuses on smart contracts on the Ethereum blockchain. And he decides he’s going to build a quote, automated market maker. Now that is just pretty much exactly what I’ve been saying. He’s going to build a marketplace that’s purely protocol. There’s no platform business model. There’s no centralized authority. It’s going to work just on the protocol network itself. Okay, they call it an automated market maker. I would just call it a marketplace on the protocol with the protocol network or whatever, but same thing. In contrast to what I just kind of said for Coinbase and what I said for a traditional marketplace. Okay, so this is in theory a marketplace for exchanging currency that operates on a protocol that runs on Ethereum. And anyone can log in with their wallet. and trade currency. And that’s it. Now this would be a non-custodial wallet in the sense that I can log in on my browser. If you want a non-custodial wallet, use MetaMask or Brave browser is now got a wallet in that. But these are all, basically it’s all in the browser for the most part, well at least for it is for me. So I can go on Uniswap, which I have, and I can just start transferring money. however I want. You know, I have ETH, I want Bitcoin. Oh, actually it doesn’t work with Bitcoin. It has to be on the Ethereum blockchain, but yeah, it’s real easy and there’s no signing up process like there was for Coinbase. There’s no, I need to get permission from Coinbase before I can start. Now there’s also no rails with fiat currency, so you can’t use your credit or debit card either. There’s no custodial wallet. I mean, there’s none of these services we saw with Coinbase because there’s nobody there. It’s just software and computers. But the fees are effectively zero in terms of the exchange fee. There’s some gas fees for operating on Ethereum, whatever you do. But because there’s no intermediary and there’s no business there, it’s basically free. And it works really well. And now the mechanics are a little bit complicated in this. I mean, if I want to change, I don’t know, let’s say Ethereum for USDC, which is stable coins tied to the US dollar. Okay, I need somebody, I’m going to put in the Ethereum, I want someone to give me USDC. Okay. There needs to be some level of liquidity there such that the trade can be executed. So there’s people who want to buy currency like myself. and then there’s people on the other side of the trade. So that’s two parties that have to be involved. But then there also has to be liquidity providers. And these are other people who agree to put their money, their coins, on the blockchain, under Uniswap, sort of like putting money in a bank account, and they leave their money there and they get an interest rate. and that liquidity is what is used so that everyone else can do trade. So there’s actually three parties. There’s two sides of the trade and then there’s the liquidity providers. But I could have just as easily done that. I could have just put some money into as a liquidity provider and started to make 3%, 4%, 5% on the money just by leaving it there. So the mechanics are a little more complicated, but yeah, it’s pretty cool. and it got quite a lot of traction and As of the time I’m sort of looking at it, it’s the fourth largest cryptocurrency exchange in the world. It was written by a 24-year-old with no coding experience, but it’s just the idea that I’m going to make a marketplace, a cryptocurrency exchange, that only exists on the protocol network and doesn’t have any centralized authority. So, I mean, that’s pretty… Here’s how Hayden describes it. He calls it a Uniswap protocol. Uniswap is a protocol which automates transactions between cryptocurrency tokens on the Ethereum blockchain through the use of smart contracts. Basically, you can exchange all these. And all of these things, cryptocurrencies, tokens, these things are all basically digital assets that only exist on blockchains anyway. So it’s just changing numbers on a computer screen. It only runs on the blockchain networks. It’s open source software, so everybody can see it. If there’s a problem, this is important for transparency and trust. There’s no intermediary or centralized authority that has any control really, although the Ethereum Foundation probably kind of does. You don’t have to have any registration. There’s no permission required. There’s no real way to kick anybody off this if you don’t like it, whether you’re a user or a liquidity provider. And if you do want to make changes to the protocol, well that happens by votes, by people who own the governance token, which is UNI. And that really requires 50% of all the holders of those coins. So there is a way to change the protocol, which makes sense, but it requires sort of a democratic vote of quite a large number of people. And according to Hayden, this is all sort of in terms, this all syncs up. with Ethereum’s values. And the Ethereum values are to be censorship resistant, nobody can stop it, to be decentralized, nobody controls it, to be permissionless, anyone can use it, and to be secure where anyone can verify execution because it’s open source. And he has made some points that like, those are the principles of Ethereum, but. A lot of the dApps that are running on Ethereum don’t really match those too much, but you could argue that Uniswap really does. It’s kind of a pure breed in terms of a protocol network only. Okay, so let me try and sort of wrap this up. I’m basically looking at this idea of a marketplace. We know what marketplaces are. They’ve been some of the most powerful business models we’ve seen. Everything from shopping malls to bazaars to digital platforms to the Taobao’s to the shoppies. I mean this has been a big part of the story. Well now we’re seeing at least two more types of marketplaces emerge in terms of their business model. We’re seeing the platform protocol hybrid which is sort of halfway between Web 2.0 and 3.0 or it’s sort of a combination of them. Coinbase very good example of that. Gone public. financials of this company, very successful, and definitely a major threat to a lot of sort of traditional currency exchange type businesses. And we should expect to see a similar thing in payment platforms. So companies like Moneygram, Mastercard, Visa, which also were very powerful business models for a long time. You know, I would expect. this sort of platform protocol hybrid to be a big problem for them because what these business models do, these blockchain-based business models, as mentioned, they lower the barriers to entry significantly. Okay, so that’s kind of part of it, but then we move to the next version, which is a pure protocol network as a marketplace. And Uniswap is another good example. And came out of nowhere, rocketed upwards. and is really an interesting competing model. So, okay, my job here is to try and figure out who’s gonna win. That’s why I always look at the six levels of competition. I’m trying to figure out who’s gonna win. And I’ve kind of pointed out the differences between 2.0 and the PPH model, but okay. What is it that Uniswap has that’s compelling? Now, I think we can point to Uniswap and see lots and lots of weaknesses. A pure protocol has far less ability to innovate. It is very much a very, very simplistic solution. So if you’re trying to compete with a real complete evolving solution that customers want, like let’s say a YouTube or a marketplace like Taobao, there’s a lot going on there. It’s very hard to compete with that with just a simple protocol that only does one thing. and you have very little ability to innovate because you operate by a democracy or foundation. So I don’t expect these protocol networks to be terribly competitive against a lot of the platform business models from marketplaces that we see, like a Taobao, like a Shopee, where it’s entertainment, it’s commerce, it’s all this together. Okay, but when we move to DeFi, decentralized finance, which are really simple transactions, Yeah, it looks like it’s getting some real traction in just exchanging currency or sending payments, very basic standardized stuff. These pure protocol networks like Uniswap could be very, very powerful. Now I have sent out, this is not my thinking, I heard this somewhere, but I’m not totally sure where. I kind of… sent out an email the other day to the subscriber saying, look, I think there’s at least three competitive weapons that happen when you have tokens. You know, you build these platforms, tokens, coins, crypto coins, right? You can use tokens in three particularly effective ways. And we see most all of the Web 3.0 companies using this as a line of attack against the incumbent Web 2.0s, whether it’s YouTube or Facebook or whatever. Number one, tokens are a really good way to raise money. You can start a company and say this is going to be a new protocol and we’re going to issue tokens and anyone who wants the tokens that the thing runs on, in this case it would be the uni tokens, which are the governance tokens for Uniswap. But there’s all types of tokens you can put in these things. You can have access tokens, you can have personal tokens, you can have social tokens, you can have utility tokens. You can do all of this stuff and people can give you money and that’s your fundraising. So now maybe they get these tokens because they wanna capture the rising value of this service. So in that case, it’s like owning stock. Or maybe they want. to have these tokens because it gets them access or it gets them utility. So if I were to sell NFTs of some of my sort of writing, I could probably propose that in multiple ways. I could say, hey, you know, if you’re a fan of my work, this is a way to own part of it. You know, you own it. Like if Michael Porter, I’m a big fan of Michael Porter. If he had, you know, put out there, you can buy my early drafts of my articles that led to my book, I would probably have bought one of those because I’m a big fan and I think that would be pretty cool. And I’m like, well, that’s kind of neat. So in that case, it’s almost like a collectible. Like hey, I kind of identify with it. I kind of like it. You can make it like merch, but you could also pitch it as like an investment. Like, you know, I think this young guy, Michael Porter, might be really successful one day. I want to own these things because I think it might be worth a lot. turns out would have been good if you had owned a bunch of his early articles, they would be worth a tremendous amount of money. So it can be an investment, it can be a collectible, it can be identify with an artist, it can be a lot of things by which people would put money into an enterprise. And that’s kind of what these tokens do. They’re very good vehicles for fundraising. Now in the worst case scenario, you see these like ICO, these initial coin offerings. which was a big fiasco a couple years ago. Every company, all these companies were issuing coins and going public as ICOs. It was a bunch of fraudsters and bad behavior and whatever. But it’s, you know, if you’re a startup and you’re trying to compete with a Facebook or whatever, you know, you might take some friend and family money, you might get some VCs, you might have 10 or 20 investors. If you do it with a Web 3.0 company, you can get tens of thousands of investors immediately just by offering coins globally. So anyways, we see a lot of these companies doing this and raising money very, very quickly and moving very, very quickly. So number one, tokens on blockchains, you can issue those in various ways with various functions. That can be a very effective way to raise a lot of money very quickly. I think we see that a lot. Okay, advantage number two, weapon number two. You can use these tokens to drive growth. Now, the easiest way would be like, hey, sign up for my new competitor to YouTube today, sign up for my Brave browser, and we will give you some of the tokens on our platform today. You know, and that’s kind of like what PayPal did back in the days when PayPal was first launched. Everyone who signed up for a PayPal account got like $50 or something like that. You know you can do that, okay? That’s not an awesome one. That’s just kind of marketing What is more powerful is you go to the other user groups like content creators and You say all you content creators on YouTube if you have more than a hundred thousand followers on YouTube Come over to the Jeff web 3.0 version of YouTube and you’ll all get 50 tokens and basically I’m going to make them owners. So yeah, you’re doing all this work for YouTube and they give you almost nothing. Wouldn’t you like to contribute your work to a platform that you own? And that’s this idea of decentralization. One decentralization, the idea of nobody should be in charge and be able to censor people, which is happening everywhere. But also like, look, all you YouTube people and TikTok people and writers and bloggers and content creators, you’ve spent all this time and energy and you’re getting like almost none of the value you have created. YouTube is taking all of it. Facebook is taking 100% of it. You’re not getting anything. Wouldn’t you like to build on a platform where the more you build, the more you’re an owner? And the more traffic you generate with your videos and whatever, the more you make. So you can issue these coins to sort of drive growth from various user groups, and that’s very, very powerful. And this is a great way to get around the chicken and the egg problem. If you’re going to create a marketplace, you’ve got to get around the chicken and the egg, buyers and sellers, viewers and content creators. Well, one way to get around that problem is to give tokens to all the buyers or sellers or content creators. It’s a great way to hack that problem. That’s a pretty compelling thing and we see them doing this. Third big tool, weapon. You know, most protocols, like let’s say the liquidity providers on Uniswap, they’re kind of employees or they’re kind of work… For the Uniswap protocol to work, you need to have liquidity providers put some coins in. Well, you pay them. Well, what do you pay them with? You can pay them with coins that you issue or in this case, they give them some interest. But you know, you can pay people this way. So you can say, we’re going to have a new game. We need lots and lots of developers and in the game, when you play in the game, you’re going to get coins that are, you know, Jeff coins from the Jeff game. Well, any developers that work on this, we will pay you in coins. So you can sort of get, you can view that as ownership of the game, you can view that as, I don’t know, something you can use in the game. You might view it as like an equity stake. So then the developers get very, well, they could get very excited. I’m going to spend a lot of time and I’m going to help take this company from zero to one by doing their coding and I’m going to get ownership of it. It’s almost like I’m a VC. It’s like you’re an early developer and you’re being paid with stock. So there’s a lot of people there and this scales up. You can have lots of different roles you can define. It can be developers, it can be coders, it can be liquidity providers, it can be validators, it can be miners, it can be curators. It can be lots and lots of stuff. Now, no Web 2.0 company can add 1,000 developers in a week, but a Web 3.0 issuing tokens, they can ramp up 1,000 developers in a week because this is global and they’re everywhere. So it can be a very powerful model. And let me, I’ve talked about Audius before, which is a Web 3.0 sort of competitor to SoundCloud. Artists put up their songs and then people listen to their songs, right? Two user groups. So it’s like YouTube, but for music. Like Spotify a bit, but without all the licensing stuff. OK. So I mentioned Audius before, but. Couple guys have been writing about them, Andrew, Hagio, and Julian Wright. They describe how do you build a platform business model on a protocol for listening to music. Content creators and listeners. Well, here’s how they describe it. Artists upload their tracks to the blockchain. They get tokens in return for this and depending on how much engagement they get, they get from their tracks, the more popular ones, obviously, they get more tokens. The fans listen, that’s the other side. They can earn tokens by curating the playlists. So they can have a role, too. There’s a group called Node Operators, which is another user group. They host the content on computers, because all this has to sit somewhere. So you have to put it on someone’s computer. Well, that’s called node operators. They host the content, and they index it to make it searchable. They get paid in tokens. Developers can build on the service, which is all open source. They get tokens by building API integrations. And then there’s a foundation that oversees everything. So I mean, you can see them sort of doing all of the three moves. right? They’re raising money, they’re using tokens for user-led growth, and then they’re also basically using this as a type of employment. So all three. Those are kind of the three big tools, I think, when we look at a company that’s a Uniswap-like pure protocol network versus the other two models. So it’s an interesting mix of strengths and weaknesses across these three different types, but they’re all marketplaces at the end of the day. So I mean, this is all getting really, really interesting. And it’s still early days, but we’ll kind of see how this all plays out. OK, and I think that’s enough content for today. Yeah, the two key concepts for today, protocol networks and platform protocol hybrids. As for me, it’s officially two months on the road, two months since I left Thailand. Lots and lots of hotels. I’m getting a little tired, which is unusual for me because I used to live, I don’t know, 300 days a year on the road for a long, long time. But during COVID, I was kind of grounded. I’ve kind of lost my endurance. So it’s been actually pretty crazy. I’m in Sao Paulo right now. And I mean, it has just been jam packed. It’s, I think I’m averaging six to seven speeches and talks and whatever per week. Usually it’s like one to two per day. It’s really been kind of jam-packed, which is, it’s great, but I’m a little tired, and I’m looking forward to having a little bit of a downtime, which I think I will next week. I’m going up to Brasilia, so that’ll be a little bit of a break. It’s great, but I’ve been meeting with lots and lots of companies, fascinating stuff going on sort of in the tech space, or let’s say digitization space of Brazil. So yeah, pretty exciting stuff. Next on the list will be out to Serbia, Eastern Europe, I think Germany. So that’ll be probably my spring. So yeah, I’m kind of back on the road. But if anyone out there wants to meet or companies out there that are worth looking at, please send me a note. But I should be bouncing around that part of the world for a couple of months. And I think that’s going to be the schedule. It’ll be a couple months in Latin America, a couple months in Asia, a couple months in Europe and then repeat. So that’s kind of, I’m excited about it and just a little tired today. Anyways, that’s it for me. I hope everyone is doing well and I will talk to you next week. Bye bye.

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.