Ping An is the quiet digital giant of China. It began as an insurance company. Then it added a wealth management company. Then it added a bank. And now it is focusing on healthcare.

And, along the way, it became a full tech company. It’s right up there with Alibaba, ByteDance and the others. I don’t really cover it though because it’s just too complicated.

But I did want to talk about the platform Ping An has been building in healthcare. It’s a really sweeping idea. And they have been grinding away at it for many years. It has two steps:

- To digitally connect the Chinese healthcare system. The consumers, patients, doctors, clinics, hospitals, pharmacies, etc. All of it. They want to be the nervous system. And have all the data and insights.

- Then they will add financing and insurance to this now digitized and data-driven system. China has no real private insurance today. Largely because there isn’t enough information to underwrite and price private insurance. There also aren’t the systems to processing claims.

Given China’s big population and its $1T in healthcare spending, this is a big and sweeping play. But most of the digital health businesses of China have not succeeded. Even the big names like Alibaba Health and JD health have been struggling along. It’s a difficult space. And this is much more ambitious than the rest.

Ping An Good Doctor’s Big, Big Dream

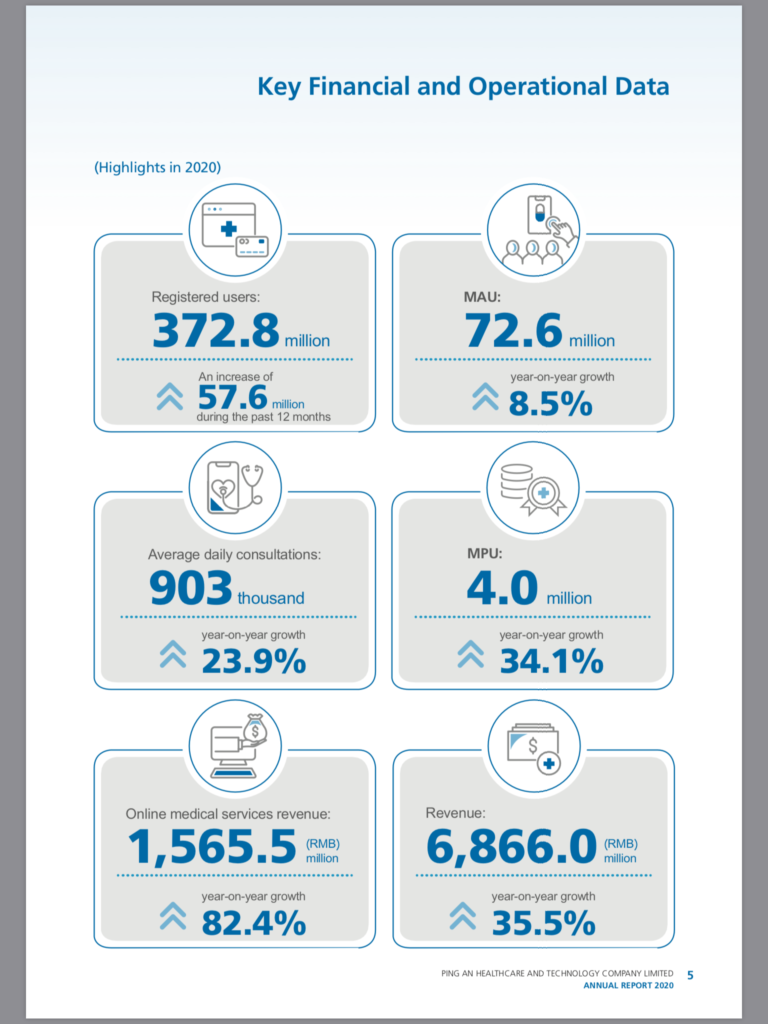

Take a look at their Mission Statement and 2020 numbers.

So lots of users (MAU) and engagement (consultations). And they describe their business as a “communications” and as a “bridge” between patients and doctor. Basically, they are talking about interactions. So this is a platform play. Here’s how I describe their big dream.

This is not a marketplace. It’s not about doing transactions. And it’s not an audience-builder or innovation play. This is clearly a coordination platform, not unlike Microsoft Teams, Slack and Zoom. They are enabling different users to interact with each and coordinate more complicated activity virtually. So it’s a coordination platform, which consumers patients and doctors / clinics / hospitals as the main user groups.

However, there are lots of potential interactions.

- Some can be fairly simple, like online consultations to renew prescriptions. Or doing basic online triage (“come into the hospital”, “stay at home and see if you feel better in the morning”.).

- But they want to move to more complicated interactions like monitoring patients at home after surgery. Or doing case management, including consultations, for chronic disease like diabetes and high blood pressure.

- Ultimately, they want to get to complicated and advanced care. Like handling acute situations (e.g., chest pain at 4am). Or complicated ongoing care that is mix of online and offline interactions.

But building a platform on this core interaction didn’t really work. Mostly government hospitals and clinics had little incentive to participate.

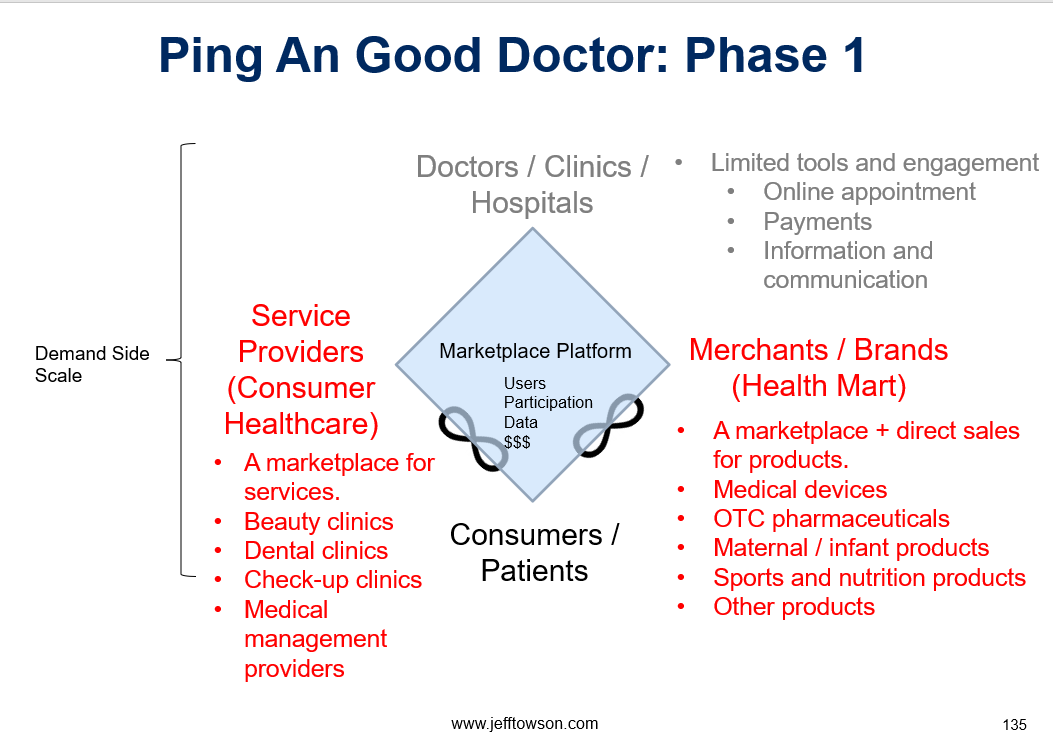

Phase 1: Good Doctor Goes for Consumer Engagement with 2 Marketplace Platforms

The above big dream didn’t really happen quickly. Good Doctor provided digital tools to hospitals like online appointments and mobile payment. And they provided information and forums to consumers. But it was hard to get the core interaction going. So Good Doctor focused on building consumers and their engagement with two marketplace platforms.

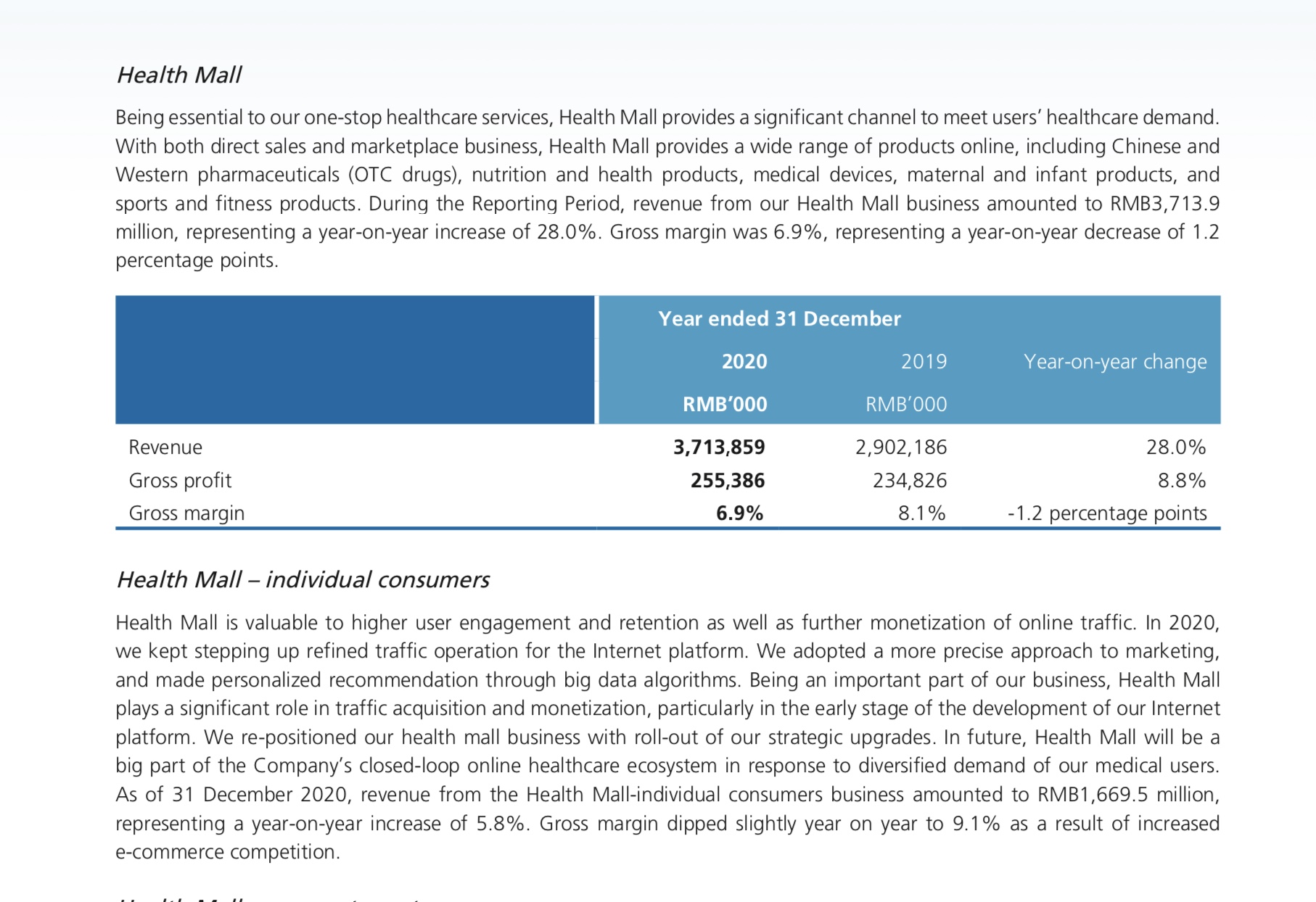

They launched Health Mart, which connected consumers / patients with lots of merchants and brands. You can see this on the right of the graphic. They did direct sales and a marketplace platform. And they covered lots of health related products – such as medical devices, nutrition products, maternal products and over the counter (i.e., non-prescription) pharmaceuticals. That got them lots of users and engagement. It also put them in competition with Alibaba Health and JD Health. Here is their description of this business.

Note the comment in the last paragraph. They say Health Mall “is valuable to higher user engagement and retention…”.

Good Doctor also launched a marketplace for local services called Consumer Healthcare. You can see this on the left of the graphic. This connects consumers with local clinics, beauty treatment providers, dental clinics and other consumer healthcare services. This sounds like their core healthcare business – but this is a marketplace. They are not coordinating the care (i.e., coordination platform). They are just arranging transactions (I think). Here is their description.

It’s an interesting approach. They added two marketplace platforms and are growing consumer number and engagement. While their core coordination platform sort of struggles along.

Phase 2: Good Doctor Builds Its Own Online Medical Capabilities

Good Doctor is probably best known for its attempt to build a medical AI that can do online consultations. Usually in coordination with doctors and nurses. And the company hired thousands of doctors in-house. As shown in the above graphic, Good Doctor was doing over 900,000 daily online consultations in 2020.

This is their big tech push. This is why having a massive company like Ping An behind this is so important. It takes a lot of money and a long time to build online medical capabilities capable of handling patients and cases. And you can see media pieces on this all the time. They are doing online consults. They are deploying capsules capable of doing interviews and dispensing drugs. They look like phone booths with vending machines attached.

Here’s how I view it.

Note the capability being built in yellow. Also note, how the coordination platform is getting increasing interactions between doctors and patients. And the company cites 4 levels of doctors:

- AI

- In-house medical doctors

- External doctors

- External specialists

So it’s like a combination of a marketplace and direct sales. Their coordination platform is both external and in-house.

Also, note how they actively refer their insurance customers (both individual and corporate) to the platform.

You can see all this in their description of their business. It’s a bit confusing but you can see the coordination platform and the two marketplaces all mentioned.

Here’s how the financials look by product.

But this raises one last big move.

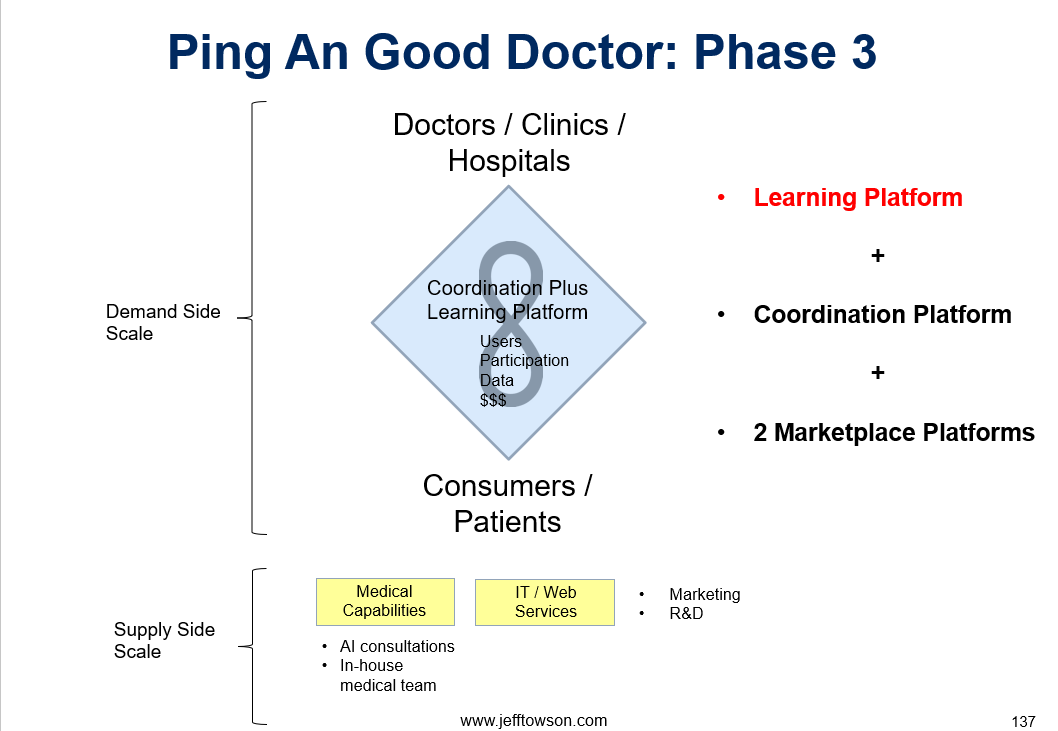

Phase 3: Good Doctor Is Building a Learning Platform

Learning platforms are the most fuzzy of my 5 platform types. These are companies like Google and Zhihu, where the primary interactions make the service smarter and smarter. And that is clearly happening with the medical AI at the center of Good Doctor. As they do more consultations the AI is getting better and better. And they are using their scale to invest more and more in this technology. Just like Google in search.

We add this all together and this is how I view Good Doctor.

That’s about where I am on this one. That is the digital ecosystem that connects the healthcare system. And if it succeeds, they can they add financing and insurance on it.

It’s a big, daring business model. And Ping An might be one of the few companies that can pull it off. We’ll see.

Cheers, Jeff

——–

Related articles:

- How to Think About Web 3.0 Business Models (1 of 2) (Asia Tech Strategy – Daily Article)

- Platform-Protocol Hybrids and Why DeFi is the Center of Web 3.0 (2 of 2) (Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Learning Platform

- Healthcare

- AI

From the Company Library, companies for this article are:

- Ping An Good Doctor

Photo by National Cancer Institute on Unsplash

——–