This week’s podcast is about Barriers to Entry, which is one of my 6 levels of competition.

You can listen to this podcast here or at iTunes and Google Podcasts.

Here is my new book:

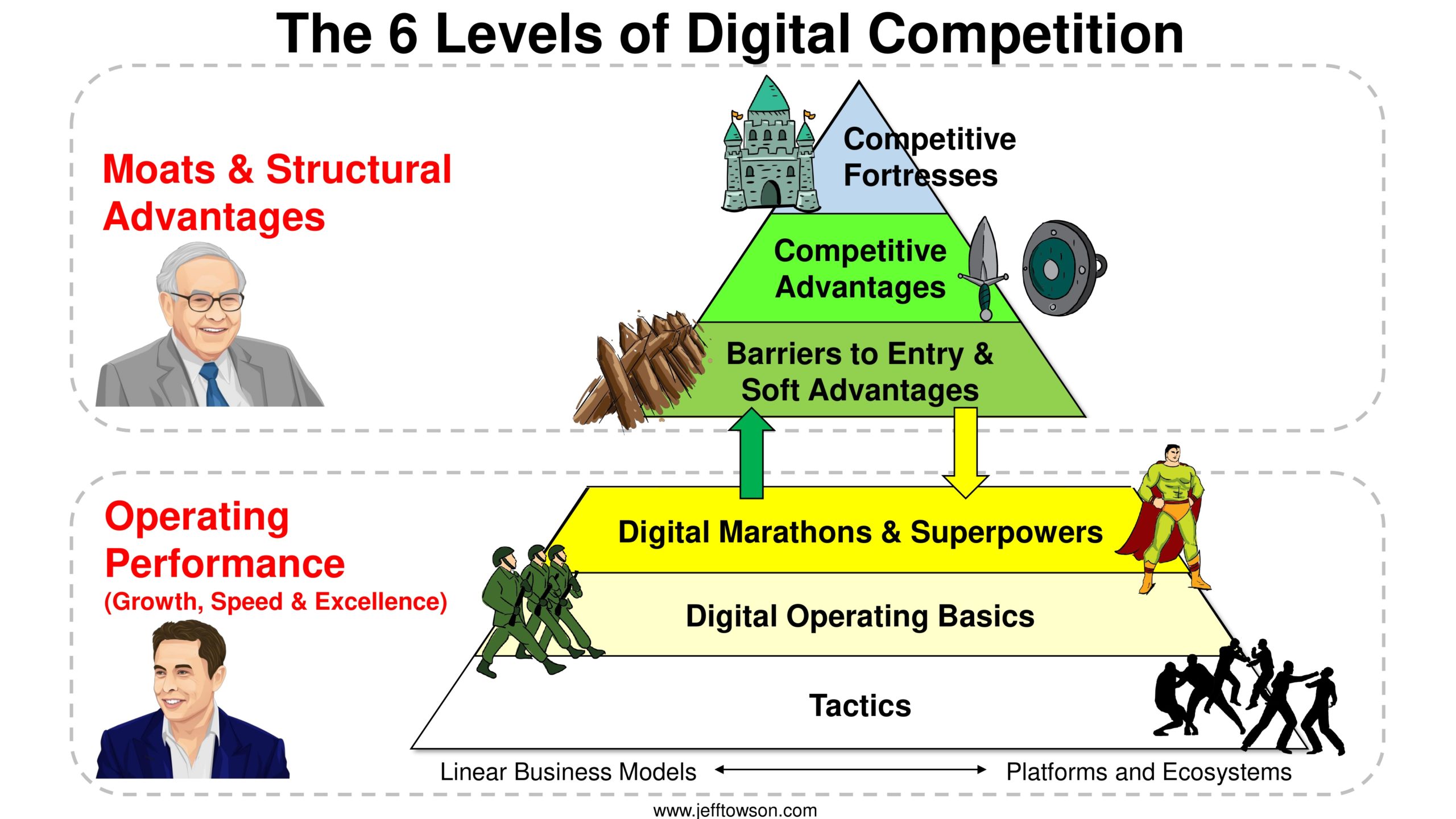

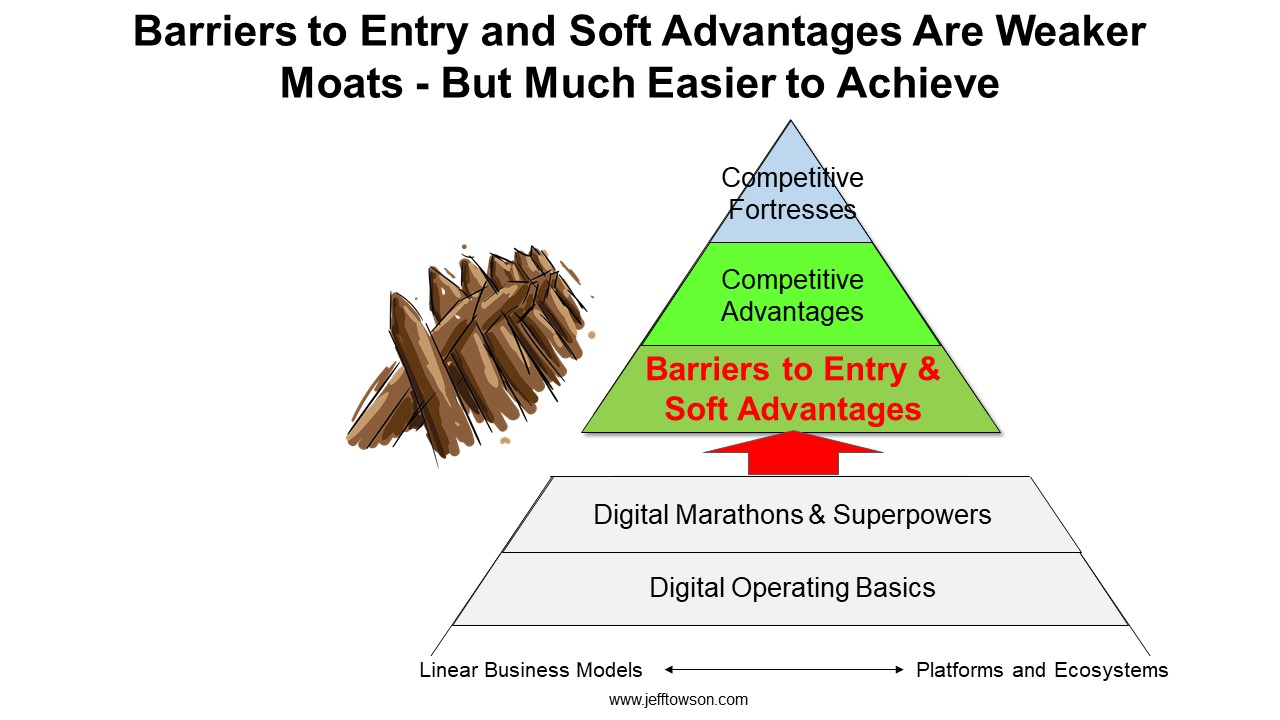

I break competition under digital change into 6 levels.

Most of my favorite businesses have key operating assets that can’t be easily built, bought, or transferred. This turns out to be an interesting list. Think about:

- Reputation, loyalty, and love.

- Personal customer relationships.

- Intellectual property, creative activities, and rare technical abilities.

- Certain technologies, scientific capabilities, and trade secrets.

- Certain physical assets.

- Physical and digital networks.

——

Related articles:

- SenseTime and an Introduction to AI Software Economics (1 of 3) (Asia Tech Strategy – Daily Article)

- 3 Lessons in China AI/ML from Artefact (Data Consultants and Digital Marketers)

- Adobe Inc. and the Power of Old School Software Economics (Asia Tech Strategy – Podcast 81)

From the Concept Library, concepts for this article are:

- 6 Levels of Competition

- Barriers to Entry

- Cost Timing and Difficulty of Entry?

From the Company Library, companies for this article are:

- n/a

———Transcription Below

:

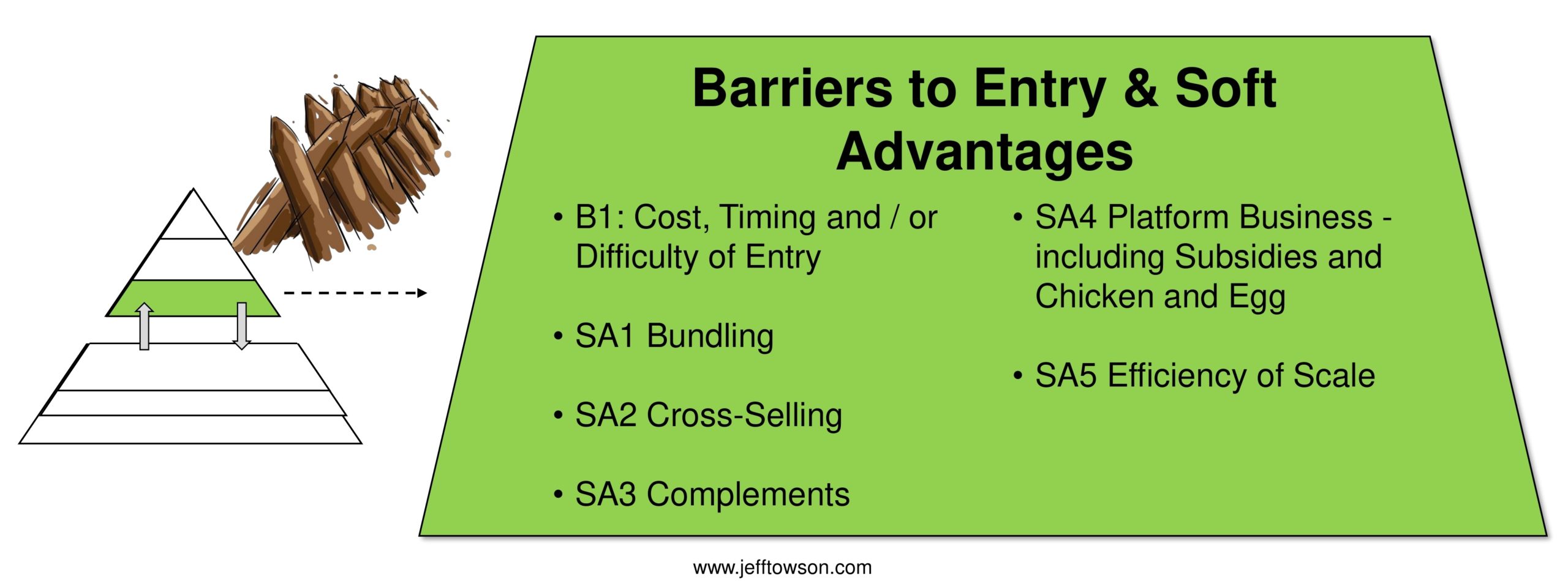

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy. And the topic for today, how digital is wreaking havoc on barriers to entry. So this is going to be more theory focused today. I don’t think this will go too long. This is really from my upcoming book. I published part one of Motes and Marathons in November. Part two is coming out in probably two weeks. And this is really one of the chapters there. I put some of this down in one of the emails to subscribers probably four or five months ago but I wanted to kind of go through it. I thought it’d be a fun topic for today. I’m actually doing this from Sri Lanka so I’m sitting in a hotel in Kandy which is kind of in the middle of the country up in the mountains. Very very nice but it’s a little, the Wi-Fi is not awesome. I got dogs barking nearby. I got my travel mic so. We’ll keep it a little bit lighter today. I’m a little too disjointed to go into a company in too much depth. So I thought I’d talk a little bit of theory today. Next stuff coming up, I’m gonna be sending out some stuff on New Bank in the next day or two. I had some really good discussions with some people about Stone versus New Bank, and this is Brazil, so it’s a little bit off topic, but it’s pretty much a copy of Ant coming out of China, so I thought there was some relevance there. So I’ll be sending that out in the next. day or two to subscribers. For those of you who aren’t subscribers, feel free to go over to jeffthousand.com, sign up there for a 30-day trial. Other housekeeping stuff, yeah, the book’s coming out, part one is available. There was a couple graphics issues, those have all been fixed. So if you have any issues, let me know, but everything has been fixed and everything’s been updated. If you still have any issues, let me know. It looks like that is all taken care of. And standard disclaimer at the end, nothing in this podcast or in my writing or website is investment advice. The numbers and information from me and any guests may be incorrect. The views and opinions may no longer be relevant or accurate. Overall, investing is risky. This is not investment advice. Do your own research. And with that, let’s get into the topic. Now as always, there’s a couple key concepts. So today, two concepts, which are six levels of competition. and barriers to entry and they relate obviously you can go over to the concept library but I mean basically all of my books are laying out six levels of competition and within that barriers to entry is number three on the out of the six so that’s kind of the two concepts for today. If you look in the show notes you’ll see the six levels this is kind of my standard graphic that I’m using over and over but basically I break competitive. strength into six levels. Three of those are about barriers, structural aspects. And then the other three levels are about operating performance. So you can make lots of analogies there. You can say, look, it’s sometimes it’s about the horse, which would be structure. Sometimes it’s about the jockey management, operating performance. I find operating performance to be a lot more complicated. You kind of have to know people, who’s a good manager, who’s not. There’s a lot in there. But when you move up to the next level of structural advantages, motes, you can kind of tell, look, you can have an idiot running that company and they’re still going to beat the other companies because the structure has so many advantages. So those top three levels, I call those structural advantages motes. Those are often referred to as competitive advantages. I’ve actually defined it a little differently. Within structural advantages, I have three levels, competitive fortress, competitive advantage, barriers to entry, because those are really three different things. And it was, you can see sort of the graphic there, but I really wanted to talk about that third level, which is barriers to entry. If you think about competitive advantages, the second level, That’s really your strength against rivals. It’s about strength against companies that are doing what you do. Maybe they’re larger than you. Maybe they’re same size. Maybe they’re smaller. So you have to sort of think about, look, you’re Coke, I’m Pepsi, how do we compete? That’s a similar sized rival versus what about a small soda company? Smaller rival. So that, you know, if you want to think about Michael Porter’s Five Forces, that would be one of his five forces would be your strength against rivals. That’s level two, competitive advantage. Now what I’m talking about today is barriers to entry. That’s how well you are defended against people jumping into your business. They’re not rivals, but they could enter. Maybe they’ll be big companies, maybe they’ll be small companies, maybe they’ll be new digital natives we’ve never seen before, but they’re jumping into your business. Maybe they’ll be… services within a larger company that has lots of other services. There’s lots of different types of new entrants. Okay, what is your defense against that? Well, that’s your barrier to entry. Now, there’s another thing we could talk about, which is substitutes. Usually, I think about your strength versus rivals, your strength versus new entrants, and then I think about substitutes, which is an alternative product. I’m not going to talk about those, but all three of those matter. because they are going to change the dynamics and the economics of a business. If you have a business like a restaurant and anyone can open on your street very easily, you have to behave differently. It’s hard to raise your prices, you always have to be reinvesting, it’s a different type of game. If you’re in a business where it’s very hard to enter, that’s going to change the dynamics. If you’re in a business, okay. Maybe you don’t have a barrier and maybe you don’t have a competitive advantage, but there’s no substitutes for your product. Like mobile phone, there’s no substitute for having a smartphone. There’s a lot of substitutes for cola. You can buy orange juice or water, but there’s no substitutes for having a smartphone. All three of those things are gonna shape how a company behaves, its pricing, its investment levels, its dynamics. So you kinda gotta get a read on all three. Now, when we start looking at barriers to entry, We can find, well we can find a couple combinations. We can find companies that have barriers, which means they’re hard to get into. It’s hard to break into that business like, I don’t know, power plants. But once you’re in the business, the incumbents don’t have any real competitive advantages. Another scenario would be, okay, it’s easy to get into Coca-Cola, but once you’re in there, They have tremendous strengths. So you can get in, but it’s a pretty brutal fight. And then there’s some businesses that have neither, and there’s some businesses that have both. Now my standard examples are, okay, no barrier to entry, but strong competitive advantages with existing incumbents. That’s Coke and Pepsi. It’s really easy to enter the cola business. Anyone can do it. I mean, you buy a syrup, you hire a marketing person. You put it in bottles and then you convince local stores in your neighborhood to stock it. It’s very easy to jump into the cola business. But then Coke and Pepsi crush you. No barriers, big competitive advantages. The example I point to is Richard Branson. He launched Virgin Cola in 1994. Went against Coke and Pepsi. Got some traction, big distribution deals. He’s pretty good at marketing. That’s what Virgin is good at. But Coke and Pepsi basically just ground him down year after year. He exited the business about a decade later Too hard You can get in you just can’t win. So no moats. I’m sorry no barriers to entry but big competitive advantages The power plant would be an opposite example. It’s actually pretty hard to get into the utilities Small town maybe a mountain town It’s got one power plant. If you’re gonna build a power plant, it’s pretty hard. You gotta spend a lot of money up front. You gotta tap into the grid. There’s regulatory approvals you have to get. There’s a big first step to opening a power plant in a small town. Let’s say not a small town. Let’s say a big town like Austin. There’s a big first step. But then when you get in there, you’re basically a commodity business. Nobody has any real strengths. in somewhere like Austin or Phoenix. Now in a mountain town, you can actually have some. So that’s the opposite, significant barrier to entry, but once you get in, no real advantage. And then my standard third example is some businesses have both, which would be a mobile network. AIS, True, China Mobile, Verizon. If you wanna sell mobile service, big barrier to entry. You gotta get the license in some countries. You have to buy the spectrum, that’s usually an auction. Then you’ve got to build base stations that cover the entire country, because nobody wants a smartphone that can only call some places. Doesn’t get reception, can you hear me now? You got to build the base stations, you got to buy the software, you got to build the whole system before you can charge $1 for service. Big, huge first step, barrier to entry. And then when you get in, you realize the incumbents. China Mobile, True, AIS, I don’t know, name whatever you want, Etisalat, they’ve all got huge advantages in terms of R&D spending, fixed cost spending for maintaining the network, continual network upgrades, 4G, 5G, soon it’ll be 6G. Huge competitive advantages. So it’s hard to get in, barrier to entry. Once you get in, big competitive advantages. tough business to break into, if you have one of those businesses, it can be a pretty good business. Okay, so we can look at those various scenarios and in my six levels of competition, the reason I map this out so specifically, six levels, is because when you start looking at digital businesses, what you realize is digital is changing different things in different levels. So this is why I’m kind of detailed about laying it out because then when I look at something digital that’s emerging, I can sort of pinpoint what it’s gonna affect and what it’s not gonna affect. And it turns out when you look at barriers to entry, digital is laying waste to so many things here. Now when we look at competitive advantages, that’s not actually true. Sometimes it matters. A lot of times digital has no impact. Digital is not impacting Coke and Pepsi. or Starbucks, not really. Barriers to entry are getting hit really hard. There’s a lot more going on there, that’s kind of the point of this podcast. Okay, so how do you assess a barrier to entry? I have detailed out a checklist for this, which is, I’ve actually put in two things here. I’ve put barrier to entry and I’ve put what I’ve called soft structural advantages of one, two, three. I put five of those. But really I’m just going to talk about barrier to entry. And my standard question is, what is the cost, difficulty, and timing for entry? And I’m talking about entry for a well-run, well-funded competitor. If a well-run and well-funded company was going to try and break into this business, let’s say, for entry and I look for those three factors. How much does it cost? How difficult is it regardless of how much money is spent? And how long would it take? Now second to that you would want to think about, okay that’s theory but can we see a track record here? How many companies have tried to enter? Are they succeeding? Are they failing? You know if it’s restaurants that’s pretty easy. You can see companies open and close all the time but you know how many companies have tried to take on You know, that’s a much better analysis, it’s just history. But okay, we also want to think about cost, difficulty, and timing. Now the cost one is actually pretty easy to figure out. You basically just do a reproduction valuation calculation. So, you know, for valuation you can look at the cash flow, discounted cash flow, or you can look at the asset values. And then people usually talk about a liquidation value or a reproduction value. Basically, you just look at the balance sheet, and you say, if I’m going to reproduce this business today, what are the key operating assets? Factories, past marketing spend, consumer awareness. So some of those things are gonna be tangible assets, but some of them are gonna be intangible assets. Some of them show up explicitly on the balance sheet, some of them don’t. Past research and development spending, things like that. But you basically have to figure out what are the key operating assets for this business and how much would it cost me to reproduce all of those because that’s what it would take if I was gonna jump into this business. How many factories would I need, things like that. And when you do that, you realize the tangible assets are pretty easy to figure out. We may need a bunch of land. We may need a bunch of factories. I can put a number on those. The intangible stuff like You know, the rights, Disney has a lot of intellectual property. Iron Man, Marvel, Star Wars. How much are those? Intellectual property is a little bit harder to figure out, cost-wise. But you can generally put a decent number on it. You don’t have to figure out the exact number, because we’re not doing evaluation. We’re just trying to figure out how big are we talking about here. Does this take $20 million to play this game, or can you get in? like a cola business pretty easy just starting at a neighborhood. So that’s one. You could just sort of take apart the cost. The second question I think is probably more interesting, which is what is the difficulty of reproducing those assets? You know, some things you can’t buy. If you say, look, we wanna get into this pharmaceutical business, we need to create a new high blood pressure drug. Well, you can spend the money, you’d have to spend the money, right? And you could put a number on that, but doesn’t mean you’re gonna succeed. You could spend a lot of money on clinical trials and it could fail. I mean, there’s a difficulty that’s not just spending money. A lot of creative endeavors are like this. Like you say, I wanna be a pop star, so let’s try and write a bunch of popular songs like the Beatles. Well, a lot of people have tried. It doesn’t seem to be about money. It seems to be about talent and creativity and expertise. That can be very hard to reproduce. Um… Some things are just like scarce land. If you say I wanna have a great hotel on Central Park West in Manhattan. Okay, I mean I guess you could write a big enough check, but people probably aren’t gonna sell. One, it would be crazy expensive. And then two, most people aren’t gonna sell. Some things you just can’t buy. Nice locations on Hong Kong Harbor, certain pieces of land, you just can’t get them. So some things aren’t available. If you wanna buy the Avengers, well guess what? Marvel isn’t selling at any price. not Marvel, Disney is not selling at any price, well, which is Marvel. So some things are just difficult. And then the last one would be timing. Okay, let’s say we do want to do this. How long would it take? If you look at reproducing Coke and Pepsi on a large scale, not one neighborhood, but let’s say a whole country like the US, you have to reproduce the awareness of those companies in people’s minds and the positive association they have with that. You can’t do that just by putting up billboards this year. It actually takes a long time. You know, you can’t just write big checks for marketing. It takes decades of people seeing the ads, drinking it when they were kids, having it after soccer practice when they were in high school. You know, that’s what builds up that sort of association in their mind. There’s no way to get there fast. Legacy brands are an interesting type of business because, you know, Heinz Ketchup, Snickers, Johnny Walker. These are brands that took decades to build, and if you just spend a lot, you can’t reproduce them. I mean, I know a lot of investors, that’s all they look for is legacy brands, because they take so long. So sometimes it’s just the timing. The famous Warren Buffett quote on this is, you can’t make a baby in one month by getting nine women pregnant. Certain things just take time. This is one of the things I like about companies like FedEx, or what I like about JD Logistics or Tsai Niao. And I’ve talked about this before. I like the digital side, but I like that the physical assets take years and years to build. Okay, but I find that to be a pretty decent question. What is the cost, difficulty, and timing of reproducing the key operating assets? Now, I’ll give you some recommendations. What do I like? When I look at barriers to entry, certain things I like. I like… reputation and loyalty and people that just love things. I love that people really love certain characters and they really like certain books and certain members of certain businesses are super loyal and the reputation has an outsized power. I like that stuff mainly because you can’t buy that. People love Tesla. Not everybody, but a subgroup of people love Tesla. Certain people love Harry Potter. Certain people love the Beatles. Certain members are super loyal. That type of foundation, that type of core user group, you really can’t buy it. And there’s no way to build that. It takes, one, it’s difficult, and two, it takes a long time. So I like that. I like personal customer relationships. I like when it’s not just selling something online. I like when it’s actually personal between the partners at McKinsey and the vice presidents at GE and Ford who they’ve been working with for 10 years. And it turns out they probably all have went to the same school and they probably all know each other. You know I like personal relationships between clients and service providers that takes time. That’s kind of interesting. I like intellectual property, creative stuff, rare technical abilities. Every 15 years some country rises up like Japan or China and then the big companies always say, I’m going to be the Disney of China. I’m going to be the Disney of Japan. That was Sony. Hollywood companies say this all the time, we’re going to be the next Disney. Nobody has ever been able to become Disney. Like 70 years there hasn’t been another Disney. Everyone’s tried. Because one, they have a lot of intellectual property. Snow White, Beauty and the Beast, going back to the 40s. They have creative activities that are really hard to replicate. It is hard to make animated movies with singing and music and that makes 10 year olds lose their mind. It’s actually really hard to do that. They can do it, but very few other companies can. I like that one. I like technological capabilities, trade secrets. I like certain types of physical assets like land, warehouses, beachfront property and white key key. I think that’s interesting. And then I like physical and digital networks. So it could be a digital network like TikTok, network effects, things like that. But it could also be a physical network by like putting FedEx stations all over the planet. So those are generally my four or five I looked at that. So physical and digital networks, certain types of physical assets, certain technologies, trade secrets, intellectual property, creative activities, personal customer relationships, and then just sort of outsized reputation, loyalty, and you know, love. I mean, certain. Companies and their products people just love them It’s it’s pretty great. So that’s kind of my short list on that I will put that in the show notes if you’re curious, but let me switch now to okay digital Why is digital laying waste to this whole idea of barriers to entry? And it’s not the whole idea, but it is super active here This is just where we see a lot of activity all the time Now I’ve given you quite a few talks on digital economics and why they’re just different. And one of the takeaways of those talks is, look, digital economics make competition just absolutely brutal. You know, it decimates pricing ability. When you shift from a physical product to something made of ones and zeros, you know, it can make, most software companies don’t make money. You know, most software products, the right price is zero. and it’s a commodity. Most of the apps on your phone, the people who made those don’t make a dollar. The thing I’m recording this podcast with is a company called Audacity. It’s a nice software you can record, you can edit, you can do some noise filtering and stuff. I’ve been using this software for two years. I’ve never paid them a dollar, right? That’s a tough business to be in. So think about just, you know, when you start to combine digital economics with barriers to entry, what happens? Now when you listen to people like Jack Ma talk about what they’re doing in creating digital tools, they will often say something like this. In building their platform business model, they will say something to the effect of, we create digital tools that let small companies do what only big companies could do before. So if you’re a small merchant on Taobao, You can’t sell halfway around the country historically. The only way you could have done that would be to open stores all over the country or to have a big distribution agreement or to do big marketing all over the country. That’s what big companies do. Small companies couldn’t do that. But you go on Taobao and suddenly you can do all that. You can reach everyone, you can market to them, you can ship to them. You basically are given tools by Alibaba that lets you do. what these big companies have done and you’ll hear versions of that all the time. What is YouTube? Well, we let anyone become a content creator. What is Facebook? Well, we let anyone post news and information which historically only big media companies could have done. They will talk about this using the word we democratize industries. True, you could call it that. completely decimating the barriers to entry for these businesses. And then they usually try and commoditize them as well, which makes the merchants fairly powerless on most platforms. But they do take down the barrier. Suddenly, anybody with a camera can turn that thing around and start making YouTube and TikTok videos. and you can get as much traction as the major media companies. Joe Rogan, who I like if you didn’t know, he sits in a basement, he smokes weed, and he talks on his podcast, and he gets what? 60 million listeners a week? He dwarfs all the major news companies. That’s kind of amazing. Shopify, what do they do? They give tools to any business, big or small. where you can basically have an online business. You can ship, you can bill, you can do it. You can do it through Shopify, or you can sign up for Taobao and Amazon, and they’ll give you the tools, but you gotta go through their marketplace. You know. Historically, like what retailers used to say is like, oh, it’s all about location, location, location. Well, not anymore. I mean, a lot of the things that they use to protect themselves, what we would calculate as barriers to entry are just getting wiped out. Anyone can be a taxicab driver. That’s DD and Uber. Anyone can be a media creator. Anyone can be a radio host. That’s podcasting. It’s pretty brutal. And if we had done a cost analysis of the barrier to entry for something like Blockbuster Video, we would have added up the cost of reproducing all of those stores they built. Well, digital, not only you don’t need those, they turned their biggest barrier into a liability. That’s often what digital does. It takes your biggest asset, your biggest barrier, and suddenly at the snap of a finger, it’s a liability. I’m trying to think of a cool name for that phenomenon. I haven’t really figured it out. Some other examples, you could think about Amazon Web Services. It used to be if you wanted to do anything on the internet, you know, as a startup or a new subsidiary, the first thing you had to do was spend a couple million dollars on servers. This is back in 2000, 2005. Well, I mean, Amazon Services has basically wiped that out. Now you can just… sign up for AWS and use whatever service of them you need, as much as you need or as little as you need. You want to be an author? It used to be you needed an agent, then you had to get a publishing deal, then you had to print your books, then they had to go into the bookstores. Now pretty much anyone with a web page or a sub stack or, you know, I don’t use a publisher for books anymore. I used to. I don’t do that at all anymore. Why would I? So, I mean, as you start to think about a lot of the digital playbook, especially for venture capital-fueled initiatives, it’s almost like their core strategy is just to take down barriers to entry. It’s like that’s what gets them the most excited. Let’s just wipe out these barriers and also make it cheaper. McKinsey has some good work on this. They use words like disaggregation. Which means when you have a large asset, like buying a bunch of servers for your business, you break that up into pieces and you let people use only what they need. You know, why do I need an entire office to start my business? Why don’t I just rent a desk at WeWork? So you could call part of this like disaggregation. They use the word dematerialization where you used to have physical products like a blockbuster chain store. and then suddenly you just ship the DVDs, which was early Netflix. So dematerialization, disaggregation, democratizing an industry, I put that all under, look, they’re just using digital tools and digital business models to take down barriers to entry. And that seems to be the case. So those four or five examples I gave you of like physical and digital networks, certain physical assets, creativity and love of products, loyalty. The reasons I like those is because I think they are largely immune to this sort of digital attack. And that’s kind of what I look for. Okay, last point and then I think I’ll call it a night here. Okay, so we’re wiping out. lots of barriers to enter. It’s pretty active. But digital is also creating entirely new types of barriers we haven’t seen before. So you could ask yourself questions like, alright, what would be the reproduction cost, difficulty, and timing for all that content on Wikipedia? One of the big barriers to entry, if you want to create an encyclopedia online, you’re going to have to reproduce all the content on Wikipedia. Well, I mean, they don’t even pay those people. Those are all volunteers. It’s a community. It’s sort of community-created content or user-generated content. What is the cost of user-generated content? What is the difficulty? How long would it take? Well, it looks like UGC, user generated content, and communities, those look like pretty compelling new types of barriers to entry. Let’s say you want to do semiconductor manufacturing, a foundry. So let’s say TSMC in Taiwan. Well, if you want to reproduce what they’re doing and break in, how do you get the people? There are very few people in this world that have deep expertise in semiconductors. That is a highly specialized, relatively small group of people. How are you going to get them? Now what we’ve seen in the last year and a half since the sort of US China entity list issue is there was a massive hiring spree out of mainland China pulling people from So you can try to get them, but I mean, it’s not like you hire five of those people and you’ve got it. You need a whole sort of Silicon Valley-like ecosystem to get going to build that. So the talent can be actually pretty difficult for cutting edge semiconductors. So how do you reproduce that? Is that a barrier? Might be. What is the difference between the loyalty of… customers. Like when we talk about loyalty as a sort of barrier, OK, Starbucks and Costco both have big membership programs. They’ve had them for a long time. People sign up. How do you compare that type of loyalty and membership to the loyalty of someone who has a lot of YouTube followers? Is that the same thing? Is it stronger because you’re giving people a discount? Is it more? content creators, they get followings. What is that worth? How hard is it to replicate that? Why did Spotify pay Joe Rogan like $100 million to come onto their platform exclusively? Which they did. So you start to see there’s interesting things going on. There’s a professor at NYU called Melissa Schilling who writes about how to manage tech companies. She has textbooks on it. Really good stuff. I mean, it’s worth reading, but these are real textbooks. She points to things of intangible assets you see in technology businesses, we don’t see other places, intellectual property, patents, copyrights. She does point to user generated content as well. If a bunch of influencers are writing about your company, which is what she in is doing. A lot of influencers are writing about Shein, making YouTube videos about them. That’s real powerful. Live streaming. How much of the value of a company like Expedia is in TripAdvisor and all those reviews people have been leaving forever. Wikipedia I mentioned Quora Juhu Google Maps all of those companies Waze all those companies are based on content created by users Some of its purchase, but a lot of its free organizational capital, these new business models, these new ERP systems. She had an interesting number where she says when a company buys an ERP system they spend three to five times as much on the installation and the training as they do on the system. So how do you think about that? And then human capital, because the digital world’s all about people, right? So that’s another one. Anyway, so barriers to entry under digital change start to look very different. A lot of the stuff we know is getting wiped out really fast. There’s a lot of new interesting stuff emerging. Yeah, I mean, there’s just a lot to think about there. It’s pretty fun. And I think that’s probably all I really wanted to cover. The two ideas for today, six levels of competition, barriers to entry. I’ll put the graphic in the show notes and also put sort of the four to five things I think about here or I look for. Yeah, I think that’s enough. I got dogs barking all over the place here. It’s kind of hard to concentrate. So I think that’s enough content for today. As for me, this is my third, fourth day in Sri Lanka. I’d never been here before. I actually… This was about getting a visa. My visa for Thailand was expiring, so I had to fly somewhere, which usually if you live in Thailand, you just jump to Cambodia or you jump to Laos. But everything’s closed border-wise, so I came to Sri Lanka because it was open, but then of course Thailand changed the rules on me again, so now I can’t get back into Thailand for a little bit. So anyways, my trip for a visa basically turned out to be a vacation. Because one, I can’t really get back and I shouldn’t get the visa right now. So I’m hanging out for a couple weeks. Really a nice place. I’m up in Kandy, which is in the center of the island, up in the highlands. Very green, lots of mountains, cool. Really it’s just a pretty place and people are so nice. Like I’d heard this before, but I was, you know, who knows? People always say stuff like that. Man, people are real friendly. I mean, they’re really on the street, in the store, like just super friendly all the time. It’s kind of, it reminds me of Thailand, to tell you the truth. Usually when people approach me on the street, if I’m traveling around the world, you know, my guard goes up, because statistically speaking, it’s probably someone selling something or scamming you or something. You know, and that does happen here. I mean, you have, You have to be a little careful. It even happens in Thailand if you go to certain places like the real tourist zones, you’ll see that occasionally. But it’s really rare and it’s kind of the same here. It’s pretty rare. 14 out of 15 people that come up to me on the street are really just being friendly. And I like that. That puts me in a good mood all day long. Of course, the barking dogs maybe counteract that a little bit, but anyways, it’s great. So I’m gonna be here for two weeks and then I’m… heading out to the US. I’m basically gonna go see some animals because I really like safaris. So this is like the elephant capital of the world. So I’m gonna go do that. Oh, actually I had an interesting meeting with Huawei here. I talked about what they were doing and what’s going on. And you know, it’s really interesting place. I didn’t know the financial crisis that was happening here. That’s pretty bad. You know, the tourism got shut down because of COVID, which is important for the island. But then also there’s a financial situation with the currency happening. Yeah, I mean, the Sri Lankan people are having a tough time. That’s my three-day old opinion, you know, as someone who knew nothing four days ago. But it strikes me that there’s a pretty difficult period. So anyways, that’s kind of what’s going on. But fascinating. Highly recommend it. If you can get out this way. Beautiful country. Really nice people. Anyways, that’s it for me. I’ll be here for a couple weeks and hopefully my microphone will get a little bit better and I’ll find a non-dog barking environment for the next one. But that’s it for me. I hope everyone is doing well and I will talk to you next week. Bye bye.

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.