This week’s podcast is about JD Central in Thailand. I had an interesting visit and interviewed the CEO. And it raises a bigger point of whether China’s ecommerce giants can or will go international?

You can listen to this podcast here or at iTunes, Google Podcasts and Himalaya.

The McKinsey & Co article I mentioned is here.

Related podcasts and articles are:

- My Interview with JD Central Thailand CEO Vincent Yang (1 of 2) (Asia Tech Strategy – Daily Update)

- JD Central Plays the Long Game in Thailand and SE Asian Ecommerce (2 of 2)(Asia Tech Strategy – Daily Update)

- Hold On To Your Hat. Alibaba.com is Building a Massive New E-Commerce Platform (Pt 1 of 2)

From the Concept Library, concepts for this article are:

- N/A

From the Company Library, companies for this article are:

- JD

- JD Central Thailand

- Alibaba

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

——Transcription below

:

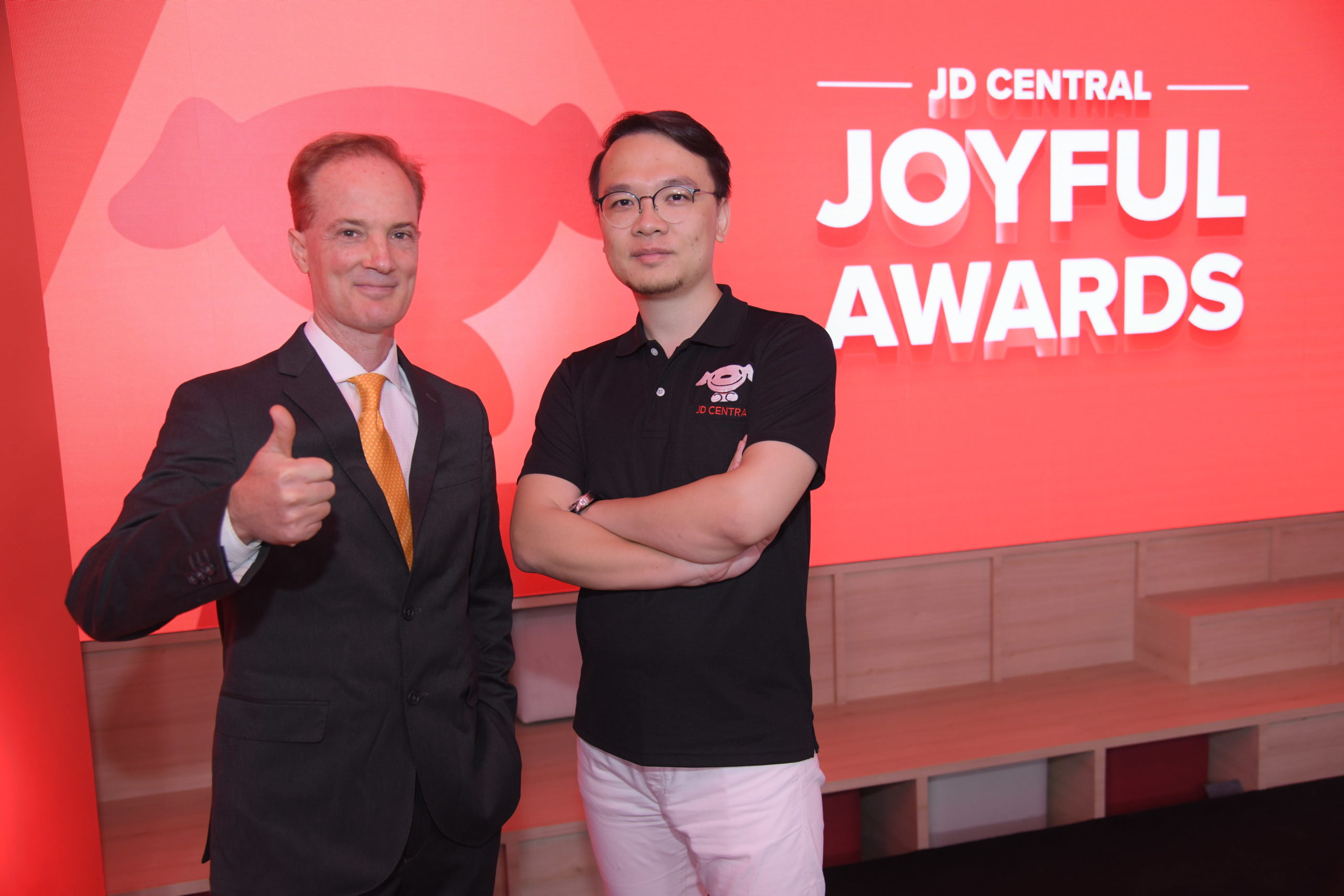

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy. And the question for today, can JD Alibaba and New Retail go international? A couple of days ago, I sat down with the CEO of JD Central here in Thailand. That’s sort of the joint venture between JD out of China and Central Retail, which is just the massive retailer here in. in Thailand and a little bit outside in other parts of Southeast Asia and some other places. I’ll talk about that. I’ve been writing about that. A couple articles went out about that in the last couple days. But I mean, that’s kind of a local Southeast Asia question. I think there’s a bigger question, which is this idea of, you know, we do have something very interesting coming out of China within e-commerce. And These are very, very big companies. The money is very, very big. And I would argue they are significantly more advanced in e-commerce and in retail in general than we’re seeing pretty much anywhere else. So can it go international? Can it, you know, Walmart is international. Amazon is international. What about JD? What about Alibaba? Now, I think we’re definitely seeing that in Southeast Asia. largely considered a strategic priority for a lot of those companies. Outside of that, it tends to be pretty opportunistic, or it just tends to come down to whoever the management happens to be and how they think about these things. But I think they are sort of coming to the international question with a fairly compelling set of advantages versus other players around the world. I mean, they’re ahead. They’re significantly ahead. So why aren’t they gonna kind of go global with some degree of vigor? And that could really change the valuation. I mean, we saw it with TikTok. How do you value bike dance without calculating in the non-China value of TikTok? I mean, it’s massive. We’ve seen it with some degree, Didi, and financial was a very significant global effort for years and years. It was not talked about, but it was arguably one of the most global of the digital companies out of China. until the whole political storm erupted and then that kind of, I don’t know if it stopped or if they just became quiet about it, but we didn’t hear about it much for the last year. Well, you know, e-commerce is not terribly political. There’s no reason why a major retailer out of China couldn’t be very successful in other parts of the world. It’s not a very political sector, generally speaking, so it avoids a lot of the problems that certainly Huawei has, although they are still overwhelmingly, well, not overwhelmingly. They’ve always been sort of an international company in terms of their revenue. But let’s say Ant Financial, which is definitely more on the political radar than it was two years ago. But why couldn’t e-commerce do that? Anyways, that’ll be the question. And my standard disclaimer as always, that nothing in this podcast or in my writing or on my website is investment advice. The information and opinions from me or any guests may be incorrect. The numbers and information presented may be wrong. The views expressed may be incorrect or may no longer be relevant or accurate. Overall, investing is risky. So if none of this is investment advice, do your own research. And for those of you who aren’t subscribers, you can feel free to go over to jefftowson.com. You can sign up there. There’s a 30-day free trial. And join in. OK, let’s get into the subject. Now I think if we sort of put this into physical versus online e-commerce versus sort of new retail, I think we see different pictures when we look at it from an international lens. If we’re just talking about retail, okay, everyone knows what international retail looks like. There’s a long, long history of it. It’s you know, traditional physical retail is a lot about goods and services and people. I mean, it’s really a people and goods items. You move boxes around. They go to the inventory, they go to customs, they go on ships, they cross, they land, you put them in the shelves. It’s people and it’s sort of packages moving back and forth. We kind of know what that looks like. There’s customs and trade deals. And typically in a well-developed market, we’ll see a handful of large local. domestic or let’s say regional players, depending how big the company is or the country is. So we might see the major retailers of a country like Thailand, like Central, we know what they are. And then we’d also see the presence of multinationals to some degree. We might see a Walmart, we might see a Tesco, and often they work together and they join ventures and stuff like that. But it’s usually a mixture of sort of local champions and then multinationals depending. And it’s… You know, I like retail. I think everyone knows this by now. I like retail. I like the differentiation you see. I like that retail can be so different. And there’s so many dimensions of the experience to build upon. It can be fun, it can be hanging out, it can be exploring, it can be discovering. It can just be checking off whatever list of getting stuff you have to get on the way home. There’s a lot there that you can do. So there’s a lot of differentiation and then digital can make all that a lot more interesting. So, I mean, you just see these nice pictures of multinationals succeeding. You see Walmart rocking and rolling in Mexico. We see the major players of say Saudi Arabia, which I used to work with some of them, the all-who-care group. I used to deal with them quite a bit. But I mean, if we were giving advice on this, we’d probably point to a couple of things. It’s like, look, if you’re gonna go international, from China to Southeast Asia, from Southeast Asia to Mexico, from the US to wherever. Generally, you kind of got to get there early as a general rule, either, hey, it’s a developing economy, nothing is there yet, or it’s still very primitive, which is still the case in a lot of the world, or you get there early with a new type of retail. You know, and there’s these interesting evolution of retail with. shopping malls and big box stores and small retail. So you can get there with the next generation, something like that. Or you just do sort of opportunistic stuff, which usually means M&A. Someone jumps in and buys something. It’s usually like that. And so I think we get a good picture of that. And if we were to look at that, we get a sense for how retail, physical retail has expanded across Southeast Asia. Okay, fine. Now we get more into my area. We start talking about, all right, what about… platforms. What about digital platforms, specifically marketplace platforms, one of my five types of platforms? Now, how would they go international? And that question is a lot more interesting. One thing we absolutely clearly see is domestic fortresses, competitive fortresses. Coupang, South Korea, which I wrote about last week, their numbers are great. That thing is a digital marketplace. I mean, they do retail as well, but let’s say it’s mostly a marketplace in its future. You know, with all the logistics, the on-demand delivery, that thing is a competitive fortress. And that fortress only extends to the borders of South Korea, all of their strength. None of those things exist outside of South Korea. It’s very focused. And we could say the same thing about JD. And I basically describe Coupang as a mini JD circa 2015. JD is a competitive fortress within China. So we get that picture, Amazon, same picture. So clearly these marketplace models, it’s still not winner take all. It’s not like a WeChat or something. There is still a sort of diversity of players differentiation, but the strength they have is pretty impressive once you go from traditional physical retail to a marketplace business model. Now, when you look at them, when they do try to go international, typically what you see is they’re going international. I’m talking about China now, but I think you could apply this beyond China. They’re using one of three sort of advantages. Number one, they are taking their domestic consumer base. So let’s say Alibaba, Chinese consumers. And they’re sort of building connections between them and international, i.e. non-China-based merchants. So massive numbers of merchants all around the world, Mexico, Europe, Paris, London, whatever, every time there’s a single state, tons of them are participating. So you can go international on the merchant side very easily because you have the Chinese consumer. And in theory, something like Coupang could do that as well, but I mean, it helps if you’re a massive consumer base. So that’s one angle, one advantage, and you pretty much see all the domestic China digital players using that in some form. They’re either, you know, they’re connecting those international merchants to their home consumers or to a much, much lesser degree. They are trying to connect Chinese manufacturers to the world’s consumers. And I mean, let’s keep in mind, China is the world’s manufacturing base. You know, if you wanna do a little more advanced manufacturing, okay, then it’s an Asia story. you bring in Japan, you bring in South Korea and some other places, but China’s massive, right? So you see AliExpress doing that where they are going into Italy, Spain, apparently Poland. I keep hearing that they’re getting good traction in Poland, Russia, and they are connecting those consumers with the Chinese manufacturing base. Not bad. I mean, these aren’t huge numbers. The Russia thing is actually pretty interesting. You know, there’s a major, obviously, domestic e-commerce player in Russia, but the cross-border aspect of China-Russia, which is huge, which is not huge, it’s huge geographically. You know, that’s a joint venture between Alibaba. So that actually is kind of interesting, it’s taking off. And you do see that play a bit. It’s interesting to watch. I’ve been keeping an eye on it and talking to Alibaba about, you know, what’s really happening with AliExpress. That’s their B2C business in this regard. They’re B2B business, which I’ll talk about in a minute, alibaba.com, that’s different. Okay, that’s kind of interesting. And I think that story of connecting Chinese manufacturers to foreign consumers gets a lot more interesting when you start talking about Southeast Asia, because you’re talking about a lot of small companies. I’m sorry, a lot of small countries, Indonesia, Philippines, Singapore. Okay. In the future, it would be surprising if those consumers when they were digitized online were not sort of leveraging in manufactured goods beyond their own borders, which are quite small. So I think the supply chains, that whole merchant side across Southeast Asia is gonna become much more connected. And I think China is gonna be the major player there one day. And I’m kind of keeping an eye on that as I go. And then third thing I guess would be tourists. Chinese tourists are big. 100, I don’t know the numbers off the top of my head, it keeps changing, 140 million pre-COVID. I think it was 135, 140 million. Keeps going up and then everyone gets interested in them because they typically spend more per capita per tourist than any other group on the planet. So there’s a lot of them, they spend a lot of more. That has a lot to do with avoiding luxury taxes actually. That’s not as obvious as you think it is, but that’s there. So when they fly around, these e-commerce platforms tend to follow them. Cross border payment tends to be a big part of that. And when you start looking in Asia, when suddenly pre-COVID Chinese consumers are 30, 40, 50% of all tourists in Asia. Okay, that makes a lot of sense. Okay, so you’ve got three plus angles a domestic e-commerce player could build upon. Most all the companies are doing this. It’s okay, it’s not awesome. The big problem they have is really they have no natural advantages from going from a Chinese-based marketplace to capturing foreign consumers in any significant way. I don’t want to quote the wrong person. I believe it was Michael Jensen, the president of Alibaba, who said that. But don’t hold me to that. There’s just no natural advantage. That’s their biggest strategic gap. There’s no easy way from what they are to having a large number of Brazilian consumers on their platform. It’s a gap. They’ll have to make a jump somehow. And so what they’re doing is opportunistic. Get there early, invest in a local champion, which they do, and then maybe just do M&A. If you were to see a major e-commerce site out of, well, let’s say not Russia, Ukraine, parts of Latin America, Mercado Libre out of Argentina. It would not surprise me on any given day to hear an announcement, Alibaba bought them. Wouldn’t surprise me in the slightest. So their M&A team, which is awesome, by the way, that team’s like, they do deals so fast, it’s crazy. It wouldn’t surprise me, and that’s how they ended up with Lazada in Southeast Asia, minority investment, then they stepped it up and took it over and brought it in. the JV with Russia. That’s also, I mean, Amazon kind of did the same thing early on getting into Japan. So we see that. And that’s, I think, what we’re looking at. So I’ve given you two buckets of thinking. Traditional physical retail, how do they go international? I think everyone knows that. And I’m not the expert on that anyways. How do marketplaces go international? Okay. Sort of laid that out. There’s a sub case within that, which is worth pointing out, which is Alibaba.com. which is their B2B business, which nobody ever talks about anymore, even though it was their first business, and it’s pretty cool. I’ve written a couple things about this. I’ll put the links in the notes about pre-COVID. I thought they had one of the most daring strategies I’d ever seen. I’m not sure how well it’s gonna work, if it’s gonna happen, but the scale of the vision was amazing. And that was basically, we’re gonna connect small businesses starting with the US with Chinese manufacturers, so that basically a team of five to 10 small people sitting, not small people, small business sitting in an office in Texas, can have all the sourcing capabilities of a multinational. They can do virtual tours of Chinese manufacturing plants, find the items, sign the deal, be given credit, have it all handled through customs delivered into their offices, and then use that as part of their sourcing. And then they could turn around and sell the other way. And in theory, you could connect all the world’s SMEs and let them behave more or less like multinationals, all buying and selling to each other in a way that only very large companies can do now. And they worked this idea and they focused on the US early and then sort of COVID hit and the US got a lot more political with regards to China. So I’m not sure the state of that. I’ll put the link in, but the idea is pretty stunning as a Go international type of marketplace. Okay, and that basically brings me to our question. On the horizon, we see two big things, and I’m wondering if this changes that Go international approach I just described. The first thing we see is new retail. I’ve talked a lot about this, OMO. online merge offline, taking all the digital, all the physical assets, all the digital assets, integrating them into one seamless data-driven consumer experience that is far richer and far more engaging than a standalone shopping mall, a standalone Walmart, or just an app on your phone. The combination there could be, I think, sort of an amazing experiential type of retail. And I think that’s where it’s going. So if that happens, China is clearly far ahead in this process. They’re way ahead in supermarkets. They’re looking good in department stores. Shopping malls are looking very, very interesting. They’re doing furniture stores. They’re doing fashion. They’re doing luxury. I mean, they’ve been working on this for four to five years now, and I don’t see anything comparable coming out of anywhere else. Amazon Go, really? The Whole Foods tie up with Amazon, really? I mean, it’s just, it’s not interesting. So this is a China thing. Now, what would it mean to take an Alibaba or a JD or any of these sort of new retail players that are really coming out of China to take them international? Does that change the calculus? Well, if you’re gonna ship goods around, that’s cross-border e-commerce, or, you know, open up lots of stores around. We know the process for how you do that has a lot to do with trade deals and moving bodies and people across borders. Now part of that is the same because we’ll have this supply chain. But a lot of new retail, you know, the strength is not in the building the structures or shipping things in boxes. A lot of the strength is in the data technology. It’s in the algorithms. And there aren’t really customs or tariffs in place for that. I was on a, it must have been CGTN, I was on a TV show a month or so ago, and they were all asking me about what about trade, what about this, you know, in Asia it’s being balkanized. And I said, look, you know, that’s all the stuff you see. You see the boxes and you see the trade deals. Asia is integrating at a very rapid pace. It’s just integrating in ways that don’t show up on our typical screens. It’s integrating with data. the sharing of technology, the sharing of algorithms that are passed back and forth, brain power, expertise, it’s all moving back and forth and capital is moving back and forth really at a massive rate. So Asia is integrating on the digital side regardless of what government people think. It’s totally happening. Okay, if new retail starts to go to Southeast Asia from China to somewhere else, is it that hard to start sharing the algorithms? turnkey solutions where you provide hardware and software and you put them into stores? Is it really that hard? That’s the front piece. What about the back piece, the smart logistics play, which I did a podcast on JD Logistics and this potentially new type of ecosystem they’re building that integrates objects and trucks and warehouses and robots and data and connections and computer vision and AI, and it’s all run by the cloud where it’s increasingly smart and automated and you know that’s a new thing. Well when they get that perfected it wouldn’t be that hard to expand that. So there are certain parts of new retail that look like they could go international very very quickly in the way that software normally goes international. Software goes international like it’s nothing. It is not a big deal for Facebook to open up in a new country. It’s just not. as opposed to opening a lot of shopping malls. So that’s an interesting idea. You have the tech and data part, you have the smart logistics, and JD Logistics and Sineo are building their networks all the time. You’ll hear announcement every couple weeks, so-and-so did a trade deal for some new port in Singapore or Amsterdam, and they have them all the time. You know, six new carrier planes are going to be doing direct flights from Sao Paulo to Shanghai every week for, you see them stitching together this sort of smart logistics network far beyond the borders of China. And then the third piece would be new manufacturing. Okay, we’ve got smart digitized consumers. Well, let’s not say smart, but let’s say digitized consumers. We have new retail, OMO, that’s serving the consumers. Then one step up. We have this. smart logistics, IOT, ecosystem, whatever you want to call it. And then one step up from that, we have new manufacturing, industrial internet, digitizing these factories so that they’re tied in real time to the logistics, to the retail, to the consumer. And the whole thing is one data-driven real time loop. That’s what’s coming next. We’re a couple of years into it, probably three to four years away from it. It’s going to be really cool. Okay. Does that change the idea? of what a international e-commerce company out of China would be if they can bring that to the table, which that stuff’s also in China. So I think there’s this whole idea of this thing could go international in ways we haven’t seen before. That’s kind of my so what. That’s factor number one. Factor number two, as mentioned, it’s the regionalization, the integration of Asia. You can look at it. various sorts of flows, capital flows, human capital, data, information, goods, trade, all of these things, media, all these things sort of flow back and forth. I mean, Asia is being stitched together fairly quickly. McKinsey has a good breakdown for this. They describe sort of Japan and South Korea as developed Asia, sort of more advanced higher GDP. GDP per capita and such. Then they have China as its own category to itself. They have sort of developing Asia, which is mostly Southeast Asia. And then they have frontier Asia, which is places like Myanmar and really sort of out there. And they kind of look across these four regions, we can see various flows moving back and forth. We see a lot of capital and brain power coming from China and developed Asia into Southeast Asia and frontier Asia right now. But we see a lot of goods coming out of Southeast Asia and frontier Asia going into developed Asia. So you can sort of map these flows out across those four areas. It’s a pretty good way to think about it. I’ll put that paper in the show notes. It’s called The Future of Asians. I think it’s a pretty good way to think about it. Okay, does that change this idea of can JD, Alibaba, and New Retail go international? And My answer, I’ll give you my short answer, I think the answer is yes and yes. I think this is wide open in terms of the strategic opportunities and I think it’s gonna come down to four factors, which is gonna be my so what for today. I think it’s gonna come down to management need, advantages and timing. The strategy looks like it will open up over time. It’s gonna take time, but it looks like it’s opening up. But. Those sort of four factors, management need, advantages and timing. I think that’s what’s going to matter. And that’s kind of what I look for. That’s my little shortlist. Now I used to work on a lot of cross border stuff out of the Middle East because, you know, a lot of, if not most businesses in the Middle East, Middle East GCC, not, not broader Middle East GCC, it’s pretty small place. There’s not that many people, handful of cities. So most. most of being a business person there is doing deals with Europe, the UK and the US, not so much Asia, China. That was an idea for a while, never really happened very much, somewhat, but not so much. So you’re always working on cross border deals. And as a general rule, cross border deals, international expansions are very difficult. They usually fail. People avoid them because they’re hard, different culture, different language, it means moving your life. Now, it really, they don’t succeed that often, generally speaking. Like if you ever look at the cross-border M&A numbers versus regular M&A, cross-border M&A, the failure rate’s much, much higher. So it tends to be about the jockey and not the horse. The biggest single factor is just sort of the management team. How good are they? The example I gave, I sent out a note to the subscribers the other day about this. And I said, you know, One of the funnier quirks of recent China digital history is Mobike went international. They were China, they were doing well with the bike sharing thing. And then they started expanding. I was here when they sort of did their opening deal in Thailand, which was an event at Central World with the CEO of AIS, which was kind of fun. They opened in Birmingham, they opened in Milan, they cut a deal in Mexico. I was actually at the opening of Mexico too. We did a video where we all rode the mobikes around Mexico City, which was kind of fun. Mexico City is awesome, by the way. It’s like my favorite place in North America, pretty much. Well, like New York City and Mexico City. Anyways, and then they sort of went into some other countries and, you know, that was never really their strategy. I mean, it wasn’t the CEO and they weren’t saying, oh, let’s go international in a major way. It was more like hired two people, one of whom I knew well, Chris Martin, a really cool guy, and these two people just took off and did it, and they were crazy. They were flying like, I’ve emailed Chris, what are you doing? He’s like, I’m in Japan today. I’m going to South Korea tomorrow, then I’m going to Australia. I mean, they were just a whirlwind. And they just kind of made it happen. Now, was it an awesome idea at the end of the day to bike sharing global? probably helped their valuation a little bit, but nah, I mean, they were just really good at it. So, you know, oftentimes it’s just the jockey and not the horse. And certain companies are good at that. And the Amazon and Walmart teams seem to be really moving against in India quite well. Companies that tend to do well are usually from, well, so point number one is like, has a lot to do with management. It’s just the people, it just is not just not just you have to do it, you have to get support from home. You know, it’s easy to waste a lot of time flying around the world and then you go back to the management team at your home quarters and they just don’t feel comfortable. Yeah, OK, they’re not daring enough. They don’t want to do it. So that tends to be a lot of wasted time. Second one is just need. I think this problem is this is probably more important. Certain companies have to go global. It’s not an option. If you’re a Singapore based digital company, you are going international. Well, if you’re a Singapore based pretty much anything company, you’re going international. Why? Because the market’s too small. Hong Kong, too small. You have to learn. Dubai, Dubai is very good at international. Why? Because there’s not enough domestically to do. So business people there from day one are very savvy about. the rest of the world and what’s going on. I used to give quizzes, when I would go around I’d give talks, I would give a standard quiz about like who is Carlos Slim, what is the Dubai Tower, just to see people’s level of awareness of international business. And my standard question was who gets the questions right and then who gets the most questions wrong. I did this all over the place, like Hong Kong, Dubai, London, South Carolina, New York, San Francisco. Japan, everywhere. And the basic answer is the people in Dubai and Singapore knew everything. Every question I get them about some random business in Mexico, they knew about it. The Americans and the Chinese did the worst. They were totally clueless about business outside of their own home markets. Why? Because they didn’t have to be. There’s more than enough to do domestically. So. Southeast Asia I think is very very interesting in this regard because if you’re operating in Southeast Asia you are probably going international. You probably have to. And just to prove my point there have been some interesting moves by Shopee in the last couple weeks going into Mexico. Isn’t that interesting? Is there another digital player out of Southeast Asia that’s in Latin America? There probably is. I can’t think of one off the top of my head. When we’ve seen some of the China giants go, their DD has a presence in, you know, basically Brazil and Mexico. Mobike, they ended up selling that to, I think Groupon, Latin America ended up buying Mobike from that part of the world. We do see some Tencent has bought into some digital banks in Brazil. We do see some moves. Latin America seems to be relatively high on the target list of Chinese digital giants, but Shopee, really? That’s clever, but if you think about it, from the day they opened, they have had to cross borders, Philippines, Indonesia, Singapore. So it’s not surprising that they’re bouncing around the globe. They’re kind of mentally already there, and this is the need aspect. They have to. Generally, my thing I look for is, is a company going to go international? The number one question I ask is, do they have to? If they don’t have to, it tends not to happen. So number one, management team. Number two, need. Number three, advantages. It helps if you have an advantage. It makes you feel more comfortable. It gives you a lever to play. Otherwise, you’re just probably being opportunistic. I don’t think Shopee has any particular advantages in Mexico. I think they have some good advantages across Southeast Asia. And then most important, number four, timing. It’s all, you know, you gotta go at the right moment. You gotta go when the technology, you gotta go when the market’s still undeveloped, when you’re the first doing that. You don’t wanna get in there late, everything gets more difficult. Or you wanna go when the technology is at a, sort of a paradigm changing moment, and you can jump in with something new. But you don’t want to jump in when there’s two or three established players and just do the exact same thing they’re doing. I mean, that’s no good. So timing is probably the biggest one. So that’s what I always look for is management need, advantages, and timing. Okay, and with that, I guess I’ll talk a little bit about my visit over to JD Central, which is an example of, okay, JD’s one of their two sort of significant go international initiatives in Southeast Asia, one in Thailand, one in Indonesia. And that you know they haven’t been nearly as international as say Alibaba, but they could. And it’s clearly on their radar and you know we’ll see what happens with these two. But I think it was a very interesting visit and I thought their strategy was very compelling. I thought their strategy in Thailand has been very compelling for a long time. Anyway so I buzzed over to G Tower on my little scooter which is a terrible idea like I gotta stop riding a scooter in Bangkok it’s like super not safe but it’s so much fun because it’s you know it’s hot outside and you zip on the scooter it’s really fun it’s a terrible idea I gotta stop doing that but it was over to g tower and you know it’s I keep going to g tower every time I do something sort of digital in Thailand and do a visit it’s always g tower that’s where hua hua is based really big office there and they have a whole sort of exhibition center where they show all their technology. So we took some Chulalongkorn undergraduates there to sort of meet with their CTO, which was really kind of a nice trip. The undergraduates, you know, these are very young folks, but they’re doing their sort of bachelor’s in innovation. And as is customary at Chulalongkorn, which is sort of the famous university here in Bangkok, So they all come in their white shirts and their skirts and slacks. It makes a really good impression on the executives when these students all come with their uniforms and they pull out their notepads and they’ve prepared their questions. It’s turned out to be a really enjoyable thing. It’s really pleasant. Everyone seems to just get a kick out of these young’uns. And they had good questions because they’ve been researching for a while to ask questions. So we took them up to Huawei. Well, so they met with Alia Lazada, which is also in the same building. And then sure enough, they said, come on over JD Central. Well, they’re in the same building. So there it was again. And what’s interesting is, okay, JD Central. The strategy, which I’d sort of been thinking about for a while, was to joint venture. So joint venture with Central Group, but Dam has corrected me, thank you, that I’m saying that wrong. Central is complicated. I can’t figure out where everything, it’s a massive conglomerate here in Thailand. They’ve got retail, they’ve got real estate development, they’re all over the place. It’s private, but the retail groups, I’m just gonna say central. When I say central, I’m talking about central retail. You know, it’s absolutely massive. 33 shopping centers under four brands, Central World, Central Plaza, Central Everything, Central Pooquette, which is awesome, by the way. They have department store groups. So they have Robinson department store, CRC Sports, lots of big department stores. They have sort of a… Hardline Group, which is home and electronics, like Powerbuy, Thai Watsadoo. Thai Watsadoo is like do it yourself, you go get drills and stuff. Awesome. Hotel and Resorts, 40 Hotels and Resorts. That one tends to be a bit more international, Thailand, Vietnam, Indonesia, Maldives, Sri Lanka. The Food Retail Group, which I go to like every day, the Topps Markets, the Superstores. Family Mart all of that and then they have restaurant groups KFC’s Auntie Anne’s Coldstone Creamery, which is fantastic, but it’s got to be terrible for you Anyways, they’re just a massive retail operation in this part of the world and so when JD came to do something in Thailand They partnered with them and they created JD Central and That’s really just from a strategy point of view. I mean, JD wants to enter Thailand. And he’s going to enter Thailand. top two or three markets in terms of Southeast Asia. Everyone likes Indonesia, because it’s the biggest one, but then it’s usually people talk about Thailand or Malaysia in terms of wealth, GDP per capita. If they’re talking about most rapid growth, most people start talking about Vietnam. But generally it’s one of those two. What do they bring to the table? Well, they bring a lot of software, amazing digital expertise, an ability to build online marketplaces, and they bring a lot of sort of what we call cross-border e-commerce abilities. They have this massive logistics platform they’ve been building into all the Chinese manufacturers. They could just plug an e-commerce site in Thailand into that supply chain. Okay, that’s pretty compelling in terms of an advantage. And then as well, there’s a lot of Chinese tourists here, eight, nine, 10 million per year, not this year, obviously. So that’s what they bring to the table. But what does Central bring to the table? Well, the massive retail footprint. all the physical assets and then they have one of if not the largest membership programs in this country. I mean it’s absolutely massive everyone signs up I’ll get a number for you here. I believe it’s 23 million members right 21 million members so those are consumers in this loyalty membership program so that’s massive. So you put those two companies It looks a lot like OMO retail. It looks like a leapfrogging ahead to what retail is gonna look like in three to five years. We already see this in China to some degree, but the e-commerce players of China, Alibaba, they’ve had to acquire physical assets to move down this path. They bought, Alibaba bought a bunch of department stores, they’re opening these supermarkets, they bought a hyper-mart. Well, in this one move, you’ve got all the pieces for new retail, OMO, in one JV. That’s really interesting. You now compare that to, say, Lazada or Shopee, which are, by every measure, doing much better in Thailand and Southeast Asia as an e-commerce play, an online play, an online marketplace, and they’re doing the standard playbook. Marketplace, let’s build out some warehouses, let’s do a lot of delivery. They are far ahead. JD is quite quiet here in Thailand actually. So you think, oh, they’re sort of sitting out e-commerce 1.0, but it looks to me like they’re incredibly well positioned for e-commerce 2.0 and 3.0. Think about when Lazada tries to start to build the physical assets in Southeast Asia, how long that will take to acquire them or build them. Well, JD Central’s already there. Anyway, so I always thought that was very compelling. that it looks like they’ve already got the assets for OMO. It looks like they’ve already got a massive consumer base with the membership program, and it looks like they have the cross border infrastructure in place. So strategically, hey, that’s pretty cool. But the company has been very, very quiet. And this was, I believe, their first media event since they opened in Thailand in 2017. So I was really curious, like, what are you really doing? How come I don’t hear from you? Because… On paper, this looks like a really good strategy. So anyways, I went to the office and they gave a presentation, Vincent Yang, the CEO, who is from China. He’s been there from day one. In fact, he was on the team in 2015 at JD that began to look at international options. And there was a study done and they came up with Indonesia and Thailand as their sort of primary targets. He was part of the deal, put it together and then he was deployed from China to run this. He’s been there. ever since. So I was curious what they were doing. And, you know, they made a presentation and they just hired a chief marketing officer from Gojek, interestingly enough, of one of the sort of co-founders of Gojek Thailand. I don’t think Gojek proper, just Gojek Thailand. Brought him over in the last couple months to take over as CMO of JD Central. Then they had their first media event shortly after. I think that’s not a coincidence. and the woman I spoke with had just been hired over by, I believe, Unilever, from Unilever. So they’re making some moves on the media front right now after several years of being pretty quiet. Anyways, presentation, I’m not gonna go through it. It was some basic numbers. The takeaway was not a lot of numbers really, which I would not expect. I mean, everyone knows they’re kind of a small, they’re sort of a distant third in this market. This was their first media event. I expected them to be a little bit sparse on the numbers. I would have been. So I thought that was understandable. The number that got my attention was e-commerce penetration in Thailand, 8% of all retail. Compare that to 25, 27, 30 and above in China, depending what sector you’re talking about. There’s a recent study came out that said, oh, 50% of retail in China is online. 50 plus percent. I won’t say who did it. But people are quoting it totally not true. If you see that number, don’t pay attention to it. Anyway, so they’re sort of building, they’re saying we’re getting good growth. But really what they talked about was merchant solutions. I mean, it was really like they skipped over sort of consumer engagement, consumer spending, all of that pretty quickly. And they spent most of their time talking about the merchant side. all the suite of services they’re providing to businesses mostly in Thailand to a much less degree in say China selling into Thailand but retail solutions, marketing solutions, basic business solutions and then of course fulfillment solutions. Four categories of solutions all which go under their general mantra of quality price and services are North Star, And they actually provided some decent data on all of that, which I thought was really interesting. And then they talked about sort of their university, online training for merchants. There’s a calendar, step-by-step learning. There’s community, they’re doing quizzes. You know, what really jumped out at me as they were presenting was, they appeared, the bottleneck, the limiting factor appears to be. I think it looks to me like it’s on the merchant side. That that’s what’s slowing things down, that merchants, brands in Thailand in particular, but probably cross-border to a lesser degree, are just not digitally savvy. They don’t have the capabilities yet. They’re just at the beginning or the early stages of the learning curve. And JD is focusing on getting them up to speed and helping them learn about how to market online, how to build a retail store online. how to start gathering data that way, how to start reaching your customers, how to build in fulfillment, all of that. That was my sort of working thesis. And I basically, I sat down with Vincent after the thing and I basically asked him, I said, you know, it sounds to me like that’s overwhelming what the limiting factor is and not to speak for him, but he basically said, yeah, that’s where they’re focusing. And I’ll put a link in the show notes to my write-up of this where I’ve put up some of their slides. Now Vincent was an interesting guy. Let me talk about him. I mean, I just got through arguing that international expansion depends on management. Management needs, advantages and timing. Okay. On the timing scale, they were clearly a bit late to Thailand. I mean, Lazada had been on the ground here for quite some time. Shopee actually got here around the same time, 2016, 2017, but they just seemed to be really fast at everything. So okay, a bit late, but not ridiculously late. Do they have advantages? Yeah, I mean, I basically just, by virtue of the joint venture, they entered Thailand with some really significant advantages, their strategy looks awesome. Timing, a little late. Did they need to go to Thailand? No. And that could be a problem. That could be a problem. If you don’t need to do something, Okay, maybe you get your slow, or maybe once you do commit to it, which they already have, maybe headquarters isn’t willing to really open the floodgates and support it. Is it a primary consideration for the management back in Beijing? It’s obviously a consideration. Is it a primary one, such that they would spend a ridiculous amount of money? Unclear. That comes down to personality. It could, I don’t know. And then management, okay, so hence talking with Vincent. Interesting dude, he came out of Guangxi, which is really fantastic. This is sort of southwestern China, which is really my favorite part. Well, my favorite part is Shenzhen and Beijing because it’s like, there’s tech companies on every corner, so I can just go to town. But outside of that, I like to buzz down to Guangxi. Guilin, Yangshuo, fantastic place, blue skies, it’s really beautiful, a lot of fun down there. Anyways he grew up there and then he went to Jiangxi Agriculture University. I believe he majored in computer science, he said software, I’m assuming that was computer science. So anyways, pretty interesting background. And then upon graduation, 2007. He joined JD. So this is like his first job, post college. And he was there very much in the early days of JD. I mean, keep in mind JD was a physical retailer in Beijing. And then they moved online for the first time during SARS 2003 ish. And eventually closed all their physical stores, which is a pretty bold strategic move. But Richard Leo makes bold strategic moves. You don’t want to compete against that guy. He is very formidable as a competitor. So they start moving online 2007, 2008, they’re growing pretty quick. And they also make a major decision, which is we’re gonna do all of our logistics in-house because of the poor consumer experience people are having with third party logistics and fulfillment firms, express delivery, things like that. He makes that decision, which was a massive commitment of expenditure. And even today, of their 200 plus thousand employees, the vast majority are people on scooters and trikes and in warehouses and things like that. So they really, that was a major move. Anyways, but back then, the early days, this was sort of early B2C China. And JD was at that point, not a marketplace. They were operating like a retailer. Buy the inventory, it’s on their books, put it in the warehouses, have your increasingly your own delivery people. And they were basically an online retailer and it was called 360Buy. Interestingly, well, for me it’s interesting. My old boss, Saudi Prince Alwaleed, he was one of the significant investors in 360Buy back when it was called that. And the argument, I wasn’t involved in that, but my belief, the argument was, look, China e-commerce is gonna be massive. This is the number two, number three player in that market. That’s a good idea. And it turns out it was a really good idea because he’s an awesome investor. Anyway, so these are the early days and that’s kind of Vincent, according to him, worked in merchandising, selecting goods, filling out what you’re selling, managing to some degree the inventory, projecting demand, which has obviously gotten a lot easier now that we have a more data-driven system, and consumer electronics, which was sort of the… the core of JD for a long time. They’ve moved beyond that now into appliances and other things, but really, I mean, that was a big part of their beginning. Okay, and during the sort of 2010 to 2015, that was the golden years of China e-commerce. That was Chinese consumers starting to get smartphones in 2008, nine, 10, Apple, Samsung. Samsung was actually the first smartphone that really got popular there. Like it was super popular. Everyone had a Samsung. I remember I was like, oh my God, these are awesome. And then the iPhone came after that. And that was even, oh my God, the iPhone is awesome. Everyone started buying iPhones. And then Xiaomi came a couple of years after and everyone jumped there. So it’s the way it is. But 2010, 2015, that’s when Chinese consumers really started to arrive in the world as a major economic force. Prior to that, it wasn’t that big of a… a deal beyond China. Then everyone started to notice, oh my God, this is huge. And this is the number one market for this and the number one market for this. And the growth rates off the charts had a lot to do with smartphones and digital. And there was JD on the mother of all secular trends. And they just rode that to the top and they were a a really formidable competitor. Price wars. You know, they took on Guomai and Suning and Price Wars all the time. They’re just a really difficult competitor and they fought their way to the top and when all the dust settled, it was Alibaba and it was JD. That was really impressive. And Vincent was part of that. That’s why I thought it was so interesting to talk to him because I’ve been thinking about that time period for a long time. I’ve written a lot about it in the past. But you know, you fast forward from 2007 to 2008 to today and suddenly, JD has 800 warehouses, 1400 cloud warehouses, they’re in all 1800 of China’s sort of districts and counties. I mean, China is a massive geography and their logistics and fulfillment network covers virtually all of it. It took a decade to build that. That’s where they are today. And he was right there at the same time they were doing this massive operational build, which is amazing. They were growing at a tremendous rate. which had a lot of strain on the system. And at the same time, they were in these really ruthless competition and price wars with people. So I mean, unbelievable management during that period. That’s my point. Okay, 2015, they start to think international according to Vincent, they study Indonesia, Thailand, they do the joint venture, Vincent’s on the ground. 2017. And I basically had five takeaways from our conversation. So I’ll just sort of summarize. I had a nice talk with the guy. He’s a real pleasant, pleasant guy. It was really interesting. As I kind of said, takeaway number one, which I’ve already said, look, it appears to be they’re mostly focused on merchant services and really helping brands, retailers and merchants in Thailand digitally transform. I mean, that’s really, I’ve heard they said this phrase quite a lot, digital transformation, digital transformation. There’s just a lot of that that needs to be done. He mentioned that 90% of the supply was coming from Thai merchants as opposed to Chinese or other. So, okay. So they aren’t at O1O yet. They aren’t even at O2O yet. They’re really in the, we’ve got to help digital transformation on the merchant side of Thailand. That means helping these brands and merchants open their retail stores. providing them with logistics and fulfillment, helping them with after sales, helping them with customer service, begin them to help doing digital marketing. You know, a lot of merchants and brands have never had any contact with their customers. I mean, they just, they deal with distributors and retailers. Well, now you’ve got to engage with your own customers. You know, just sort of build out, transform and digitize their operations. And JD Central staff in Thailand, 600 plus people. He mentioned they have other part-time and contract, but it looks like 600 core staff, of which I asked him how many are from Chinese, he said about 30, so that’s, you know, 5%. Nine warehouses in Thailand today, no cloud warehouses. So, you know, much, much smaller. It looks a lot more like Coupang in South Korea than obviously. the mothership in China and they’re doing delivery mostly not in house, I believe, which is a contrast to China, but different when they were building out in China 15 years ago, there wasn’t a well-developed express delivery service. Well, I mean, Thailand has a lot of that. So anyways, okay, taking it away. Number two, JD Central is sitting out the Lazada-Shoppe money war. I mean, Lazada and Shoppe are doing what competing platforms that are backed by, I don’t know, venture capitalists in particular tend to do is they’re in a money war, right? They’re spending lots of money, they’re fighting for scale, they’re all trying to get to critical volume so that they can claim network effects. They don’t wanna get on the downside of another person’s network effect where suddenly your competitor’s 30, 40% bigger than you, and then their service is superior. network effect is a specific competitive advantage versus another competitor. It’s like economies of scale. It’s just on the demand side. So demand economies of scale versus cost economies of scale. Okay, they are sitting that one out. They don’t have signs all over town. I’m not getting little messages online all the time. Most people are not, not say most, a lot of people aren’t familiar with them. I often will ask my class or students, how many of you use JD and maybe 10% raise their hands, something like that. So they’re just sort of like this relatively quiet third player in the market. And are they doing that on, is that a strategic decision? We’re gonna sit this thing out or is it just like? senior management in Beijing looked at the numbers and said, look, we’re not gonna spend that much. For whatever reason, that’s out of our budget for this initiative, figure it out. So it could be a strategic decision, we’re gonna sit this one out because we have a strategy. It could be just like, no, we’re not gonna do it, it’s not worth it to us. Sometimes that’s really what’s going on. I don’t know. I tend to think that’s not it. I tend to think they’ve made a strategic call because… Now these are the masters of competition. The JD senior management are unbelievably good at competition. They are not newbies. They’ve been doing this for a long, long time. They’ve taken on major players offline and online for a long time. So it appears to me they are actually playing the long game here. They’re gonna sort of stay quiet. build out their capabilities, which they’re still doing, building out their infrastructure, building out logistics, and then at some point maybe start to engage and hit the gas, but not yet. I think that’s absolutely what they’re doing. So, and the fact that they’ve also been media silent for three years kind of supports that. If they did sort of want to be more active, but didn’t have the budget to do it, I would have seen some level of media and marketing, but we don’t see any. So it looks more like a strategic call. And you know, if you’re owned by a company, two major companies, Central World or Central Retail and JD in China, you’re not really exposed to the same risks. They could cruise along at a small market share for a long time and do just fine. OK, takeaway number three. It looks like they’re going to differentiate by quality and cross border in the near term. Now, big surprise. differentiation by quality. That’s what JD does. That’s been their mantra from the day Richard opened his first little store in Zhongguancun in Beijing. So big surprise. I think the cross border aspect is also gonna play out. I think they’re gonna be well positioned to help Chinese merchants connect with Thai consumers in a way that the smaller ones never could. The larger companies probably could. They’ve got an ability to cross border, but the smaller brands and merchants couldn’t do it without a company like JD. central to help them and then maybe help the Thai companies also go and start selling to consumers in other places possibly. So definitely quality and cross border logistics and merchant services look like that’s going to be their primary point of differentiation. And that’s not that’s a good strategy. I mean that’s exactly how JD is differentiated from Alibaba in China. Okay number four. I didn’t think that their international ambitions were totally, were very well really clear at all. I mean, it doesn’t appear to me that JD has an international sort of plan. Okay, they studied it, they did two deals, but that was several years ago. We haven’t seen anything since. Well, not much. So I mean, it’s not clear to me that they really want to go international beyond a certain degree in Southeast Asia. Now they are building out. their supply chain, that’s pretty active. But yeah, I would say their international ambitions at least to an outsider, not clear. And last one, which gets me back to my first point. If their advantage or point of differentiation in the short term is gonna be, in the near term, is gonna be quality and cross border, their most compelling strategy for the joint venture in the long term, is going to be OMO. It’s going to be dramatically improving the consumer experience. That to me looks like the big lever they can pull one day where they start to integrate their physical assets with their online assets and offer sort of that complete consumer experience that is so much better than buying on your phone or just walking around a not smart department store that it’s just dramatic transformation of the consumer or user experience. I think that’s the big lever I’m waiting to see if they pull and Vincent mentioned a little bit about how they are sort of looking across central and JD at all the consumer touch points and trying to sort of get a more complete picture of every place that the consumer touches any of these assets online or offline and start to look at it that way. So that’s definitely a steps towards that sort of. holistic consumer experience that if you’re good at OMO, you can really move the needle. Alibaba’s done it, JD is doing it in China. So that to me is kind of the biggest strategic move I’d be watching. Are they gonna pull that lever? How aggressively? Doesn’t look like they’re doing it this year, maybe not the next year or two, but that could be pretty impressive. Okay, so that’s kind of summary of my trip, which brings us back to the initial point. Can JD, Alibaba and New Retail go international? And I basically said from a strategic point, I think the new retail aspect and the regionalization, the integration of Asia is gonna make that possible as a strategy that’s pretty compelling, but then it will depend on management, need, advantages and timing. And… You know, don’t underestimate how much this is ultimately about management. Not just their capabilities, but do they want to do it? Are they ambitious? Does this, you know, they’ve always wanted to do this. They’re just super ambitious and they can pull this off. Some people can do that. Some people can’t. Some people don’t want to do it. And, um, yeah, it’s unclear. We know Alibaba does, right? We’ve got a clear answer. They’ve gone international at every opportunity. Fine. We know they want it. Um, Their strategy thus far has not been awesome, but I think when this new retail and Asia integration thing starts to more and more emerge, that could be more compelling. JD, unclear. They clearly did a good strategy in Thailand and Indonesia, but we’ll see. Anyways, that’s the question for today. As for me, I had a pretty great weekend. I’m a little late on the podcast this week because I was traveling around Thailand. So I just, I didn’t really want to do the podcast from a hotel room. So I kind of waited and pushed it a day. But I went up to Ken Chenaburi, which is a couple hours outside of Bangkok to the Northwest. It’s, you know, it’s the place where the bridge on the river Kwai is from the movie and the tourists go there. It’s about the Thai Burma railway and all the stuff that happened there during World War II. So it’s got a historic aspect, sort of tragic aspect. And then in addition, it’s a really pretty place. So it’s kind of a mix. It’s a little strange actually, because it is tragic. I mean, the numbers are crazy how many people died building that railway. But then at the same time, it’s kind of like a party town. Like, you know, there’s bars. And so literally on the, there’s the bridge, the bridge on the River Kwai, which you can walk across. And literally right next to the bridge, 25 feet. 30 feet down on the shore, there’s a big place to drink. Like it’s a, it’s kind of a dirt field with tons of little bar booths set up and tables and there’s beer bottles everywhere. And then floating right off into the river is a place where the band plays. And it’s literally called like the Prisoners of War Club. I’ll put a picture in the show notes. So it’s like this tragic thing, but then they’ve also turned it into a kind of a party scene. which is a weird juxtaposition. But it was pretty awesome. I mean, beautiful part of the country. It’s a bit hot and dry right now, but it’s national parks and all that. And I had a great couple days. I just stayed on this bungalow. I’m always tempted to stay in bungalows. They’re made of bamboo, so they look cool. And this one was literally over the water, so sort of over the water, but I’m not gonna do that anymore. The whole bungalow thing, give me a modern hotel. like with AC and you know, I think I’m past the stage of staying in bungalows in my life. Anyway, I had this bungalow and so you’re sort of sitting in the bungalow and it’s nice and you walk out on the deck and it’s all connected by little sort of scaffolding where you walk over the water. So I step out in the morning and first thing is right under my bungalow there is just a huge Asian water monitor. You know these big lizards that are you know second only to Komodo dragons. It was right there. It’s swimming under my. bungalow thing was huge, which I think is pretty cool because they’re not dangerous to people as far as I know. And as you go to the lobby, the lobby is filled with puppies. Apparently the owner, because everything is shut down, right? The hotels are all shut down. They apparently were consolidating, closed a hotel and moved in there or something like that. So as I’m sitting there typing away, there’s like four puppies. And I’m like, this is like the greatest cafe ever. You sit, you type. There’s iced coffee, which I like. There’s water monitors swimming around. And then there’s puppies running all night. This is like, this is a really cool Saturday by most standards. So anyways, it was kind of a fun experience. And I drove back a little early after I kind of saw everything and I was sort of eager to get back. But yeah, I had a great couple of days. It’s really fun to be a tourist in Thailand with the borders closed. Well, I shouldn’t say fun. That’s a little… insensitive. It’s really interesting because most of the sites are quite quiet. And there are tourists, but they’re all Thai. I mean, Thai families, friends, and you know, boyfriends, girlfriends traveling around. There’s no foreign tourists. So, you know, this must have been what it used to be like before all the craziness. And so, yeah, it’s kind of a nice way the beaches are. not totally empty but kind of empty. The tour sites aren’t overrun with people. It’s a it’s kind of a fun way to bounce around the country. So I’ve been slowly doing that. Anyways, I was kind of eager to get back and but it was a fun little trip. I encourage you if you ever get here it’s worth taking a bus up to Kenchenaburi. It’s only a couple hours from Bangkok. Although driving out of Bangkok turned out to be a nightmare. I hadn’t done that before. That took a long time. Anyways, that’s it for me. I hope everyone is doing well. I hope you’re staying safe and that this was helpful and I will talk to you next week. Bye bye.