This week’s podcast is more on the well-known 7 Powers framework by Hamilton Helmer. I go through three of his 7 powers.

You can listen to this podcast here or at iTunes, Google Podcasts and Himalaya.

His fundamental equation of value is:

Value = M0*g*s*m = market scale * power

- M0 is Market at time zero. g is growth. This is about targeting big and growing market opportunities.

- S is long-term persistent market share. How much of it you have

- M is long term persistent margins. (operational margins after cost of capital)

- You can also do potential value = market scale * power.

His break-down of economies of scale is:

- Fixed costs

- Distribution network density

- Learning Economies (don’t agree)

- Purchasing Economies

- Volume / area relationships (cool but I never use this)

His break-down of switching costs is:

- Financial switching costs

- Procedural switching costs

- Relational switching costs

I also cited the 4 terrains from BCG:

Related podcasts and articles are:

From the Concept Library, concepts for this article are:

- Competitive Advantage: Economies of Scale

- Competitive Advantage: Surplus Margin Leader

- Competitive Advantage: Switching Costs

- Counter-Positioning

From the Company Library, companies for this article are:

- None

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

——Transcription below

:

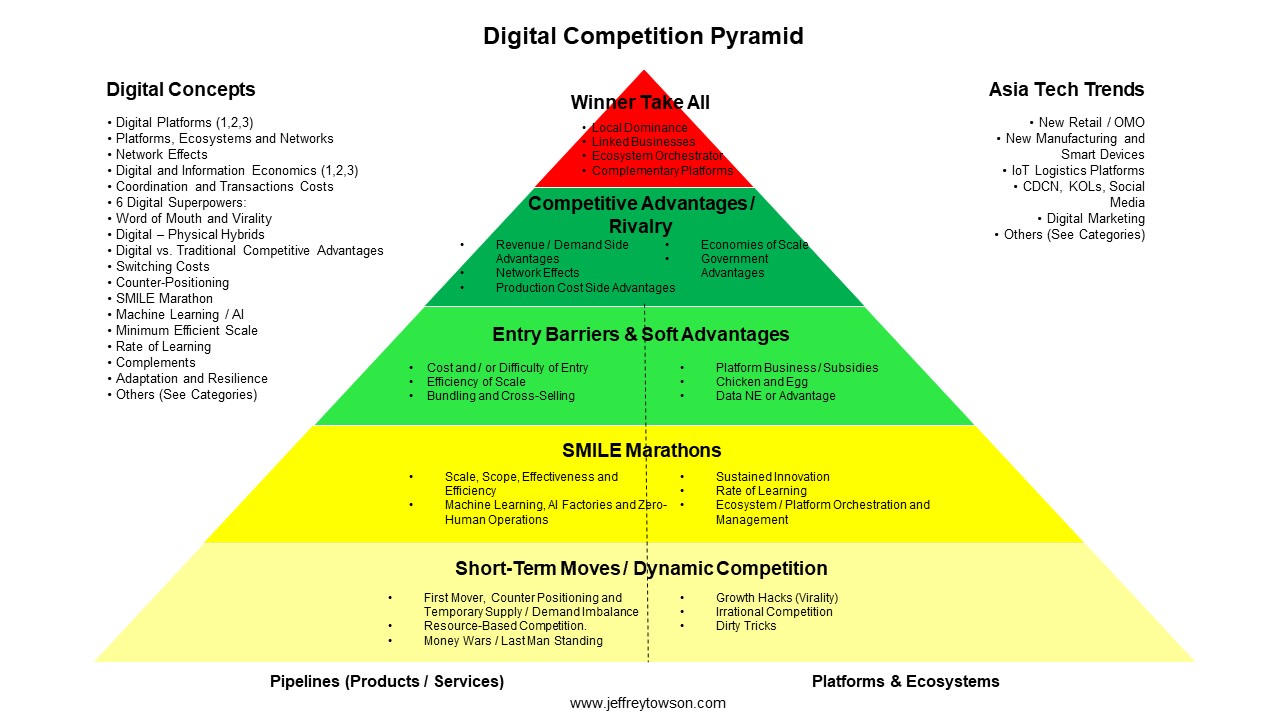

Welcome, welcome everybody. My name is Jeff Towson and this is Tech Strategy. And the topic for today, economies of scale and switching costs according to Seven Powers by Hamilton Helmer. Now, I spoke about this a couple weeks ago during podcast 62, which was titled, Four Problems with Seven Powers. Seven Powers is a very well known book in Silicon Valley. Netflix, companies like Vanguard. It’s sort of a real time compass to the development of these, what we would call shaping companies, internet companies that have the ability to sort of shape the landscape and the industry structure. And a lot of equity and tech investors follow these companies. And Hamilton Helmer wrote a book, which a lot of investors and CEOs tend to follow. in terms of how to think about it. And he basically points to seven powers that you want to develop any of these as you can. And if one fades, you try and build another one. And I want to go into two of them today. Well, actually three of them, but the main ones I want to talk about are economies of scale and switching costs, both of which I’ve talked about before in this class quite a few times. So I want to go into some of the details there and give you more his take. which is a little different than mine, but this is probably the area of the book that we most agree on and that there’s the most overlap. Now, first, let me, as always, put in my standard qualifier that nothing in this podcast or in my writing or notes or websites is investment advice. Informations and opinions from me or any guests may not be accurate. The numbers and information may be wrong. The views expressed. may be incorrect or may no longer be relevant or acumen. Overall, investment is risking. This is not investment advice. Do your own research. Okay, for those of you who are subscribers, I’m actually sending out an email, probably right when I’m done with this podcast, about SoftBank in Asia. And I think this one hopefully will be interesting to you because I’ve been thinking about SoftBank for a long time. And I’ve long struggled with it as an investment strategy. And I think I’ve sort of got a good take on it. So I’m going to send that out. And hopefully that will be usable. And I think SoftBank is such a big story in Asia technology that I’ve been kind of dodging around it, because it took me a while to sort of get my bearing on it. So I’m going to send that out shortly. So hopefully that is helpful. I think it’s pretty good, which is why I’m mentioning it. And for those of you who are not subscribers, feel free to join. You can go over to jeffthousand.com, sign up there. There’s a free 30 day trial. And that would pretty much get you the emails and most of the library, the concept library, the company library, and pretty much all my best thinking is now going just to subscribers. The podcast, I enjoy this a lot, but I’m shifting all my sort of actionable investment advice into that area. Okay, let me get into the subject. Now in podcast 62, the four problems with seven powers, I pointed to a couple sort of concepts there, competitive advantage, smile marathon. I’m not really gonna go through all those again. I wanted to just sort of, I’ll give you the quick 30 second summary of his argument and my problems with it. And then I’ll get into economies of scale and switching costs, which is what I think is more valuable. His argument by and large, I’m paraphrasing of course, is that there is what he calls a fundamental equation for value capture. A company creates value, value here would be value to shareholders, the owners of the company, which in theory could be banks and debt holders, but we’re talking about shareholders because he’s an equity investor by and large. And the value, he has an equation, which is, I’ll put it in the show notes, but I’ve put it in the previous one too, which is basically M times G times S times N. Don’t worry about that. It’s basically the… the market scale times your power in that market. So the market scale, which would be M times G, which is what is the market at time zero, which would be today, multiplied by the growth of that market. So how big of a market are we going after? Is this a little niche market? Is it a global market? So that’s the first part of his equation. Look, how big of an opportunity is this? Second part of the equation, which he calls power. is really two ideas. He calls it S times N. Don’t worry about the actual equation, but S would be, it’s your market share that is persistent and long-term multiplied by your operational margins within that market. So for the first part of the equation is, look, how big is this market now? And how big is it gonna be? Is it small but growing fast? Is it huge but not growing? You know. What kind of opportunity? That’s the market scale multiplied by your power in that market, which is, look, how much of it do you have, your market share, multiplied by what is the economic value you can extract, which is operational margins after cost of capital. Okay, now I tend to break that up into three factors. He’s using two factors, market scale and power. Power is his own term, it’s not really an economic term. I generally break it into three factors, which is, Is it a big and or growing market? So we agree on the first term, market scale. The second term, which he calls power, I break into competitive barrier and unit economics. Meaning, my standard area that I’m always talking about perpetually is this intersection of competitive advantage and digital. Do you have a competitive barrier? Okay. Now, you can have a competitive barrier. It doesn’t mean you’re gonna make money. It just means you have market dominance. You can have market dominance in a bad industry. Whether if you have market dominance and attractive unit economics, then you’re gonna start to get what he calls power. Yes, you’re dominant in a market that generates cashflow. I think that’s a sub case. I think there’s a lot of situations where you can have a big and growing market. You can have… competitive barrier dominance and the unit economics can be unattractive. So you don’t necessarily create value. And I generally focus on that question of competitive barriers, competitive dominance. Because I think for most people who are not investors and they’re not VCs and they’re not entrepreneurs, you are kind of stuck with the industry you’re in. If you’re an auto person and the unit economics are not great, There’s nothing you can do about it, but you’re not gonna change career or anything. So you just try and achieve competitive dominance, even though you might not have unit economics, or you might not have what he would describe as power. And I think that’s most businesses. I think most businesses, the most you, you can’t control the market. You can’t usually control the unit economics, but you can control is this factor I always talk about, which is competitive barriers and dynamics. You can have a good strategy for the world you find yourself in. Okay, that’s the difference. That’s a little bit of theory, but I think it’s kind of fun. And that was kind of my main point on that. I also spoke to this idea of before you even want to think about can you achieve power in this market, there’s this question of what economic—what terrain are you standing on? And I used the BCG 2×2. for the four different types of terrain or landscape or environment you find yourself in. And his strategy of seven powers doesn’t work in two of those and probably doesn’t even work in three. I summarize this again in last week’s podcast, but basically the idea is this is Boston Consulting Group is you put a two by two matrix in you, you look at is the industry malleable versus non malleable? Can you shape it as a company? You know, if you’re an oil company, you really can’t change anything. You know, if you’re an airline, you can’t change anything about the external environment you operate in. If there’s a pandemic, your flights are gone. There’s nothing you can do. If there’s weather, there’s nothing you can do. If oil prices go up, there’s nothing you can do. You are kind of at the mercy of an environment you can’t shape. It’s non-malleable. Other industries like media, well, you can actually shape the industry. And companies like TikTok and YouTube are really changing those businesses. Dimension would be predictability versus non-predictability. Some industries are very predictable. You can figure out Coca-Cola. You can’t really shape that business, but you can predict how many people are gonna drink soda in five years. Unpredictable, non-predictable would be fashion. You know, fast fashion, Zara, H&M. You can’t really predict what people are gonna wear. You just try and adapt as fast as you can. And based on that, you get four types of strategies that fit those four different terrains out of that two-by-two matrix. I’m not going to go through them again, but they’re classical strategy, adapting, shaping, and visionary. What he is mostly talking about, this seven powers thing, would go in the shaping category. This is an industry that’s not very predictable, but you can shape it. That’s Netflix. They did change the industry, early Netflix. That’s a lot of internet startups are doing that. That’s mostly what is, but if you take his strategy and apply it to other sectors like classical strategy or adapting Zara fast fashion, it doesn’t work that well. So I think he’s talking about a sub case. That’s my over. I think it’s very good for what it is, but I think it’s a very relatively small subset of companies and situations that this strategy applies to. It just happens to be one that people who study equities for technology, that’s a lot of what they look at. So it’s pretty useful. Okay, that is a bit of a hand-waving type summary of the last two weeks, but in the show notes, I’m gonna put the equation, and I’m gonna put the BCG two by two, which I’ve put before. So it’s really worth looking at those and thinking about them. I think these are important ideas. Okay, let’s get into the main two ideas for today. Now the first is economies of scale. And this is one of his seven powers. So I’m gonna go through three of his seven powers today. I’ll probably touch on the others later, but I think these are the two most broadly useful are economies of scale and switching costs. Now economies of scale, I’ve been talking about forever. And I will often say economies of scale and economies of scope, which are a little bit different. And the basic idea is, if I am bigger than my competitor, I have some degree of cost advantage, which means I can do things cheaper for some reason. And the example I’ve been giving a lot, like I talked about this a lot with Huawei, that Huawei is so big that they have economies of scale as a competitive advantage versus Ericsson and Nokia, mostly in the area of manufacturing and research and development, because these are largely fixed costs. Huawei spends approximately $18 billion last year on R&D, which is a fixed more or less percentage of their revenue. And because they’re bigger, their fixed percentage at 18% is bigger than a smaller competitor whose percentage may also be 18%. So, you know, this is going way back to the old days of factories and such, where if I have a factory and you have a factory, if my factory produces three times as many widgets, three times as much revenue, and we’re both spending, let’s say 20% on our manufacturing costs, which is running the factory, staffing it up, all of that, I’m gonna be cheaper on a per unit basis. Right? So the cost is fixed, you divide it by the number of units, and that gets you the thing. So people call this sort of a declining unit cost with increasing business size. A company like Netflix has this now. They didn’t before. before when they were just shipping DVDs and stuff, they didn’t have a lot of fixed costs beyond sort of IT and things. But when they started building their own content, creating their own content in-house, doing internal development, that is pretty much their biggest fixed cost on their income statement. And it’s actually the biggest fixed cost for a Youku, Tudou, iQiyi, Tencent video, these sort of music or video. streaming-ish platforms are spending a lot of money internally on development of their own content and it’s turned out to be something that’s very hard for their smaller competitors to match. It tends to be a nice barrier. Okay, now people tend to look at the fixed costs on the income statement and they say okay Coca-Cola spends five eight percent of their revenue on marketing, that’s their fixed costs, therefore that is an economies of scale advantage versus a smaller competitor like Dr. Pepper or something like that, who is also spending five to 8%, it’s just a lot less money. Now there’s kind of two ideas. First, let me qualify. The example I gave you is all about sort of fixed costs. And that is the most common version of these. And it can be fixed cost on the income statement, but you should also think about like maintenance capex. If you’re looking at a telecommunications network like AIS, China mobile. Yes, they have a big fixed cost in R&D, but they also have a maintenance cost regarding their massive telecommunications network. That’s not growth capex. It’s not, you know, building something new. You probably want to think about that as an ongoing fixed cost as well and put that in there. And a lot of the stuff that’s done in software is not necessarily categorized correctly as R&D versus operating expenses. Software doesn’t really fit in the balance sheet terribly well, so there’s some subtleties to this. You can also think about something like a mobile network, like let’s say China Mobile. You know you’re gonna have to upgrade your network every three, five, eight years. It’s expected, so that growth capex, when you go from 3G to 4G to 5G. You can pretty much factor that in as a fixed cost as well, even though you’d consider that growth capex. But it is so normal to the business that I think you put that in there. So it doesn’t just have to be the income statement, your fixed costs. It can also be maintenance capex and it can also be growth capex. Okay, that’s the most common bucket is fixed costs as an example of scale economies. But I think very rightly he points out. one, two, three, four other types of scale economies. Now I agree with basically three of these and not the other one, but I think the definitions are good and I’m gonna put these in the notes. So the second one is distribution network density, distribution network density. I have generally referred to this as economies of scale in logistics. A company like FedEx has really good economies of scale as an advantage. So does DHL, so does FS Express. That’s why you see two or three of these companies, these express delivery companies per region or globally. They have some very powerful competitive advantages. I call that economies of scale on logistics, he calls it distribution network density, which is, and I think his definition is probably better than mine. He says, as the density, i.e. the number of consumers within a geographic area. As the density increases, like the number of homes that are buying food to get delivered on Gojek or Grab, as that increases, the cost per delivery generally decreases because you find new, more economical routes to deliver. Instead of having one, let’s say, Grab rider, go from this restaurant to the home, as you get more and more customers in a certain geographic area, you can start to do clever things like, well, we’re gonna have that rider go to this restaurant and pick up two packages and we’re gonna have him or her go across town, but they’re gonna hit both of those deliveries at the same time and then they’re gonna be very well placed to pick up in that location. There’s a lot of complexities you can do there. And it works okay in food delivery. It works a lot better in things like Jingdong, Cai Niao, package delivery. because you can load up somebody’s cart for delivery, usually like a company like JD in China, the delivery people will come back to their local distribution point between two and three times a day. So they’ll go and they’ll go deliver for two to three hours and then they’ll come back, they’ll load up, they’ll go out and they’ll come back and they’ll load up about three trips per day. You can choose the packages each delivery person should have and give them very complicated routes, not just to deliver, but to pick up. And AI is very good at squeezing new efficiencies and economies out of increased density. Now, Meituan actually is an awesome example of this phenomenon because two years ago, I got it totally wrong. Meituan had just gone public. Their unit economics, mostly doing food delivery and some other things, their unit economics were negative. They were losing money. Alibaba said, we’re going to crush you, more or less. And I didn’t see how they could win. And within six to 12 months, they moved to profitability. And they kind of did two things. Number one is they focused on hotels, which is a much more profitable business. Food delivery is not profitable, but they got it out of negative profits. They got it to break even and a little better. And then they made their money in hotels. In the food delivery, they started to really take advantages of the fact that they had superior density within their distribution network. And they did all these clever things with their software deciding every rider should carry what packages and take what routes and all of that. and they just became cheaper. It’s a great example. Trucking companies, there’s a US company called Convoy, I think it’s called Convoy, that is delivering packages in, basically they’re a B2B sort of marketplace platform that pairs people who wanna ship stuff with independent truckers who own their own trucks and they go between cities. And they’re extracting a lot of interesting efficiencies as they get density city to city and between cities. very interesting. If you look at things like airlines, pipelines, rail lines, that’s we see a little bit of that these are more like network effects, but they’re actually a little bit different because it’s what we’d call a radial network, a typical trucking line or a typical airline hub and spoke model. All the planes fly to one hub and then they load up and fly to another place. So we sort of see hub and spoke models as opposed to everyone connects with everyone. And the network effects, which I’m not going to go into, in that case we’d consider those a radial network versus a sort of ubiquitous complex network. Anyways, don’t worry about that. The basic idea is distribution network density. That’s a pretty good one to think about. He has three more here. Learning economies. Now, I don’t consider this an economy of scale. Here’s his definition of a learning economy. a learning economy of scale. If the learning of an organization, an enterprise, a factory leads to more reduced costs or improved deliverables, and that correlates positively with production levels, then you get a scale advantage. So he’s looking for a correlation between your level of production, your scale, and improved delivery and cost based on your staff is smarter. And this is, I’ve mentioned this before. but I called it rate of learning. And I consider it a separate competitive advantage. I don’t consider it economies of scale. And I actually put it in my smile marathon too, because I think the case he is talking about is sort of what we’d call phase one learning, which is Henry Ford, every time he doubles cumulative production in one of his factories for the Model T, his cost per car was dropping about 20, 25%. And I had a talk on this before. I think that’s phase one, rate of learning. Phase two is more like Steve Jobs, where he’s not getting cheaper, but he’s going iPad to iPhone to IE, whatever. There’s different types of learning that are much broader than I’m just doing things cheaper. So I don’t consider that in economies of scale. I consider that to just a subtype of rate of learning. Number one, two, three, this is number four. Four of five types of economies of scale. Number four, purchasing economies. I call this supplier cost as an advantage. This is Walmart. Walmart has big market share. So when they go and they buy stuff, a lot of it from China, they’re able to negotiate lower costs and they get better terms. And that’s their biggest advantage. The biggest advantage Walmart has is purchasing economies. And JD as a retailer and Amazon as a retailer, not as a marketplace. Keep in mind those companies are both things. They’re a marketplace platform and they operate as a retailer that buys and sells on its own. Usually their biggest strength as retailers is the same thing, that JD is very good at negotiating rates. I think that’s true. I think Pinduo Duo is based on this to a large degree. I think health, one of the companies I really like, which I never talk about, are health insurance companies. Most insurance companies don’t have very good competitive advantages. It tends to hinge on the ability of the CEO. Very similar to stock pickers. Stock picking companies don’t have a lot of advantages. It usually depends on how good is the person making the choice. It’s management ability is the dominant factor. Insurance companies, it’s mostly the same thing. Not always, but mostly. The exception is healthcare. Health insurance, if you’re selling someone a full… sort of health insurance policy, you then go and you negotiate hospitals and doctors. And if you are very big in a city, like Oxford Health in New York City was a famous case of this, they can negotiate very good rates from hospitals and doctors in New York because they had such good market share in New York. So that was actually, you can get some good economies of scale in purchasing for healthcare insurance, which makes it a pretty good business, by the way. I think that’s true. And the last one, which is something actually Charlie Munger, he’s been talking about this forever. Volume area relationships. Volume slash area. When you have the production, like let’s say you have a huge, I don’t know, canister of milk. Like one of these canisters, not the right word. Like these massive milk vats that dairy farms have. the volume area relationship of the milk vat, that massive thing, actually has an economies of scale aspect in the sense that as you build the vat bigger, the area that you have to flatten the steel, the area of the vat, the area that makes up the walls of the vat increases. But as you increase the walls of the vat, the volume that the vat holds increases much faster. the volume increases faster than the area. And there’s several businesses like this. They’re actually kind of interesting. Warehouses are like this. When you buy a warehouse, if one company has a bigger warehouse than the other, it can hold a lot more, but they didn’t actually have to spend proportionally that much more to do that because you build bigger walls, you build a bigger ceiling. and the volume enclosed increases faster than that area. So it’s kind of like a physical structure thing. That’s not a huge deal. I mean, it’s almost like geometry. It’s not a huge deal in digital, although it helps you in trucks and it helps you in warehouses. It tends to help you in things like pipelines. So I don’t usually talk about that one, but it’s actually kind of an interesting example of economies of scale. As you get bigger than the other person, in terms of volume, your cost… per square meter of building, whatever you’re building is actually lower. Anyways, kind of fun. So for those of you who are subscribers, this is all going under the ideas of economies of scale, which is you can, anytime you wanna learn more about this, just go to the concept library. You can just go down the list, look at competitive advantage economies of scale. And all my stuff’s under that. Okay, now there’s some subtleties here that are worth pointing out. Hamilton, he tends to talk about—the way he sort of—I think there’s two different ideas here. I think there’s competitive advantage, and then I think there’s unit economics. And as I keep saying over and over, you can dominate an industry. It doesn’t mean you’re going to make money. Now, he’s combined those two. Now he kind of later splits them out by—he says, OK, when you do look at—and he calls it a power. When you do look at a power like economies of scale— according to him, I think it’s just a competitive advantage. He says there’s two sides. Does it have a benefit and does it have a barrier? That’s his word. Does it have a benefit or does it have a, the benefit would be like, hey, you’ve got this power and it produces higher cash flow. Or two, you’ve got a barrier and it doesn’t necessarily provide cash flow, but it prevents your competitors. I think from jumping into your business, I think he’s just separating those things back out into competitive advantage and. attractive unit economics. And this is actually kind of worth thinking about. Like, let’s say you have a competitive advantage. Let’s say I have a factory and I can make widgets. I know I keep using widgets as a terrible example. Let’s say I have a brewery and I can make beer, for some reason I can make beer 30 to 40% cheaper than a smaller brewery. Actually, that’s not how breweries really work. I shouldn’t use a fake example. Okay, let’s go back to widgets. I have a factory and because my factory’s twice as big as my competitor, I can make things cheaper significantly because of this volume effect economies of scale. Okay, what do I do with that advantage? And I can do a couple things. Number one, I can sell my product at the same price as my, in theory, I’m cheaper than my competitor. I can make these things for let’s say a dollar. they can only make them for $1.50. Okay, now let’s say they can make them for $1.50 and they sell them for two. I can then put my widgets on the market at $2 as well, and I’m turning my competitive advantage into a profit-making opportunity. Okay, I could even do it at like $1.9. And mostly I could be under them in price and so that would be helpful. And I could also make a profit. That would be me trying to turn my competitive advantage into economic benefit. I could also go the other extreme and I could say, look, I’m not gonna use this to make money. I’m gonna use this to protect my dominance, my market share. So. If I can make these things for a dollar and my competitor can make them for 1.5, I’m gonna sell them for 1.1. Because I know they can never get to that price. Doesn’t mean I’m not gonna make any money, but I’m gonna lock this market down. So I can use my advantage in either of those two ways. Or what most people do is they use both. Okay, I’m gonna price my thing at 1.4. I’m gonna make some profit, but I’m gonna stay under what my competitor can do. Now, truth is, I’m not gonna have that much of a benefit. But you can use it in both ways. And, you know, generally, companies like JD, JD has some very powerful competitive advantages right now. They are overwhelmingly using that to get growth and to get market share and not to profit. I call this JD’s profitless growth strategy. They’re taking their low cost structure and they’re passing all of those savings onto consumers. and they’re using that to expand their market share. And they’re not worried about profits. It’s profitless growth as a strategy. It’s a pretty good strategy. Now, Hamilton, he has a pretty good little phrase he uses for this. He calls it surplus margin leader. And this is one of the other ideas for today. Surplus margin leader. This is where we say, okay, if my competitor, I’m not going to have that much of advantage. Let’s say I can make widgets for $1.3. My competitor can make them from 1.5. A surplus margin leader would be where I put my prices at a level such that my competitor makes zero profit. So in this case, I would price at 1.5. Based on that, what would be my profit? That’s my surplus margin leader. If I price at the exact same… level that my competitor would make zero profits, how much profits do I make in that scenario? And that’s a good number to know. It’s like, okay, I’ve got an economy of scale advantage. What does that mean? How do I put a number on that for this company? Well, my competitor can only sell at 1.5. My cost structure is 1.3. So I’m making 20, basically 20 cents per unit. That’s the measurement of my economy of scale advantage, which he calls surplus market leader. Sorry, surplus margin leader. I like that he does this, he tries to put numbers around them. And there’s an equation here about how he does it, and that’s fine. But yeah, okay, so if someone says, I have an economies of scale advantage, you say, fine, how big is it? Put a number on it. It’s good to know, okay, now what are you going to do with that number? You’re going to turn it into profit, you’re going to turn it into a barrier, how do you want to use it? So that’s one of the two ideas for today. For those of you who are subscribers, the main ideas here are economies of scale and surplus margin leader. These are going under learning goal seven, which is basics of economies of scale. That’s in level three. And the sub points under economies of scale, these are in the show notes again, it was basically fixed costs, distribution, network density, learning economies don’t agree with that one, purchasing economies, that one’s okay, volume area relationships, interesting, fun to think about. I rarely ever use it. Okay, let’s go on to the other idea for today, which is switching costs. Now, switching costs are actually kind of my favorite competitive advantage. I put economies of scale as a cost advantage, right? Now you can turn it into profits by pricing the same, but it really stems from the cost side of the equation. As I’ve said before, there’s two types of cost advantages. There’s ones that are sort of based on scale, which is relative to your competitor. It’s one-to-one. You can have economies of scale versus one competitor, but not another. So you have to look at each individual competitor. And generally speaking, it’s kind of, it’s a, not winner take all, but it’s sort of one company has it and the other can’t. So if I have economies of scale versus a smaller competitor, that competitor by definition can’t have it to me, either I’ve got it or they’ve got it. But we can’t both have it. Switching costs are not that way. Switching costs actually, kind of everyone can have this one. I can have switching costs with customers, my competitor can have switching costs with customers, we can all get this one. So it’s a little bit different. I like this one a lot, because I think in the digital world, there’s a lot of interesting, one, the digital world tends to be more interactive, it tends to be more connected. So those connections tend to lock things in. It’s very, you know, all your software connects with your other software, the data is shared, it’s very hard to swap out this program for that program, you gotta migrate the data, that’s a pain. It’s just a more connected world. So I tend to like switching costs in that regard. And also switching costs tends to be nice for things that are complicated, that are difficult, that take training. There’s a lot more hurdles to saying, well, I mean, if I want to switch from one table to another table, it’s pretty easy. OK, I throw that one out. I put a new one in. Switching software is difficult. So I like things that are complex and connected, and you can get good switching costs. When we talk about these platform business models with multiple user groups, if you’re a platform business model like Lazada, you’re gonna go for economies of scale and logistics. And that’s gonna apply to everything. But you have a marketplace platform business model. So we have multiple user groups. We have the merchants and we have maybe the consumers and we maybe have content creators. Those are three different user groups. I can get switching costs for each of them. or maybe just one of them. So I can build this one in on the demand side and because this is a revenue side advantage, this is a customer user side advantage as opposed to a cost side advantage. I can build this in like a company like Didi, I don’t really like the way, I don’t like its position relative to consumers. I don’t like, because I don’t think people care about who they get a ride from. I think it’s a commodity service for them, they don’t care. there’s not a lot to do on the consumer side, but on the driver side, you can actually build in some really interesting switching costs with your drivers. I think that’s the interesting side of the platform, and it’s mostly switching costs. Okay. Now, Hamilton talks about this, again, he’s calling this a power, which means he’s combining good unit economics with a competitive advantage. Again, I don’t think that’s right. I think you can have switching costs, which Uber does, kind of on the driver’s side a little bit, and you can still have bad economics. I think these are separate issues, but I’m kind of repeating myself on that one. Okay, now he describes this, the switching cost would be the value loss expected by the customer for switching from one comparable product to another. So if they decide to switch from one to the other, what is the cost that they incur? And that cost, in theory, should be the amount that you can price above your competitor and they’ll still stay. and he puts down one, two, three types. First one is financial switching costs. That’s literally just the cost. Like if you buy an ERP system for your company, you have to pay Oracle and Microsoft and all of this, and it used to have to be, you had to buy all the servers. This is not as big a problem as anymore because of web services. And then you’ve got to implement it, and that’s just a flat out upfront cost. So if I switch to another one, I’ve got to pay that cost again. That’s a straight up cost. A lot of durable goods have this. Smart devices like printers. If I have a printer, and a big one for the office, and I want to switch to another company from HP to Xerox or whatever because I have to keep buying printer ink and stuff and it’s annoying, there’s an upfront cost. I got to literally buy another printer. So a lot of the time these durable goods that have ongoing revenue streams like because they’re smart or they have supplies or compliments. There’s just a straight up upfront cost. That’s a financial switching cost. That’s kind of a nice one. Second one, procedural switching costs. I don’t really like this word that much. I think this is a catch all. That when you’re familiar with the product, you tend to stay. If your organization is used to using Slack, if there’s daily routines and workflow. that have been built into this. If there’s a degree of operational integration, that this is our email system and we have a lot of past emails here and we tied that into our archives and if we switch it, we’d have to migrate it out. This is kind of a catch all for workflow, operational integration and retraining, familiarity of your staff. He also puts in this idea of risk and uncertainty that if, yeah, I have my accountant and… My accountant’s good and if I switch to another accountant, it is probably fine but there’s some risk they’ll screw it up and I don’t know, maybe they don’t know. Risk and uncertainty is sort of a cost as well. I think those are actually multiple ideas here. I would have put this as more operational switching costs. I would have put this as risk and uncertainty perception. I would have put this as training costs. human capital issues. I mean I think there’s a lot within what he’s calling procedural switching costs, especially in the digital world. And The last one he talks about is relational switching costs, which is sort of personal. This is breaking emotional bonds. This is the fact that, look, you’re a CEO, you’re a vice president, you have a long working relationship with McKinsey and BCG and the partners there are your friends. Maybe you went to business school together, you know your investment banker, you’ve known each other forever, and you work with them. And if you switch, you’re gonna, you know, this is not a small thing. I’m talking B2B. You could also talk B2C. You know maybe your local grocer. You know the person that cleans your house. You know the person that’s the nanny to your children. There’s an emotional aspect there. If you fire your nanny and hire someone else, you’re gonna feel bad about that. So that’s kind of a thing, and I think that’s just sort of a personal thing. It can be between sales people and companies that buy stuff. It can be positive mutual feelings. can be ease of communication, it can be familiarity, can be affection for the person, affection for the product. Sometimes the product becomes part of your identity. You identify, I like the Nike Running Club, even though I’m not that much of a member. You can become sort of, these things can get put into your identity a little bit. I don’t wanna leave my community. One of the things I have talked about in the past is retention and… strategy for retention as opposed to strategy for customer acquisition. And one of the biggest levers you can do if you’re going to do marketing focused retention, I’m sorry, retention focused marketing is build a community. It’s probably your smartest lever that you have a community around your product or your whatever your service and people will don’t want to leave the community. So there’s a lot going on in here. His three categories, financial switching costs, procedural switching costs, relational switching costs. I don’t think that’s awesome. I think it’s okay. It’s not the same list I used, but I wanted to give you his… Now, some sub points on this, which I think are quite good. As I mentioned, this is a non-exclusive competitive advantage. I can have it. My competitor can have it. He would call it a power. I call it a competitive advantage. A lot of people can have it. It tends to show up in retention rates. It’s not how many customers you get, it’s how many you keep, it’s your churn rate. And probably the most important thing to think about this is switching costs are all about repeat purchases. If you don’t have repeat purchases, you don’t have switching costs. So you can actually draw this bright red line between the first purchase and the subsequent purchases. And how people compete in both of those arenas. Let’s say if you’re an ERP company, this is going back 20 years, if you’re Microsoft and you’re competing with Oracle or whatever to put in an ERP system in a large company, I don’t know, pick one, GE, there is tremendous competition for the first sale because you know whoever wins that first sale is going to effectively have a monopoly. on all the next sales, which are the, okay, now you’ve got the system in there. Do you want to buy an upgrade? Now you’ve got to pay your monthly service. Everything you sell from then you have a monopoly. So the competition is very different for the first and the subsequent sales. And if you don’t have subsequent sales, then there’s no switching costs. The point he makes, which I think is outstanding is you have to look at the price. of that first sale versus the ultimate value. Because what happens a lot of times is people say, we’re gonna go for this customer, we’re gonna build in big switching costs. And then they pay so much to get that first sale by dropping their price that any economic benefit they may have gotten from that monopoly position going forward has already been priced in. So in that case, what you’re really doing is you’re getting a barrier. I’m dropping my price, I’m getting that first sale, I’m getting my ERP system installed in this company, and that’s gonna give me a barrier because I’m gonna have a monopoly on that client going forward. However, I’m not gonna get any economic benefit because I already gave that away in the first sale. Now what he wants, because he’s looking at this case where you have both a barrier and a benefit, attractive unit economics and the barrier. He wants a scenario where you go into a company and you get that first or you could go to a customer and you get that first sale usually early in a market before all the subsequent value is priced in. So you capture all the long term economic benefit. You don’t give that away on day one. So his quote is most. You want a situation where most of the value. is in locking up the customers before the pricing in the market starts to include these long-term switching costs. That’s really important. I’m going to say it again. You want, he would describe this power as a situation where quote, this is not an exact quote, but pretty much most of the value is in locking up the customers before pricing in the market starts to include the long-term switching costs. You get no benefit in the long-term value of this customer if it’s already totally priced into the service. You also get no benefit if there are no additional sales to the same customer. It’s that binary sales process. And generally, it’s not gonna be like ERP where you lock up the first sale and then you have a monopoly. It’s more like you’re gonna get someone to, I don’t know, subscribing to your drop shipment. process and then they’re going to keep doing it. You can’t, it’s not a monopoly, but you are locked in there. You have some degree of switching costs. One of the things that happens, which is really cool, is switching costs tend to relate to compliments. That a lot of times you will get something to buy some, buy like they’re going to buy your printer and they install your printer in their office. That’s this financial cost. It’s a durable good. You’re actually not making money by selling them more printers, you’re making your money, your recurring revenue is coming from selling them compliments like paper and ink and things like that. So you can actually separate this idea of what is the aspect of our relationship that is locking in, that is building the switching costs, versus what is the aspect that is getting me economic benefit. You can separate those two things. And I think platform business models are very good at this. I think this is what Metuan is doing. I think Metuan gets you to sign up for food delivery because it’s a high frequency. habit forming process where you do tend to get locked into it to a certain degree and you get a lot of activity and then they make their money on hotels. We see a lot of this sort of pairing of behavior. Nike, which I keep talking about it because I like their strategy so much, you know they offer the running club, the Nike fitness club, which are apps you can download. They’re awesome. And you sign up for there and you become part of a community and the switching cost is in the community. but it’s almost free. And then they make their money on the fact that they’re gonna sell you shoes from time to time. They’ve separated the compliment from the thing that’s building in the switching cost. So it’s really kind of a fun space for digital. I think switching costs are kind of the most exciting, one of the most exciting areas for digital. And just like in surplus margin leader, you wanna try and put a number around this. Okay, you say you have a switching cost, maybe you’re a… You’re a regular company, you’ve got a switching cost with your membership program at Target. You wanna try and put a number around that, just like we did for economies of scale. We can describe it qualitatively, but it’d be good to have a number. And you can actually put like, okay, literally how much more can I charge before these customers switch? It is in fact a cost. And you can generally get your brain around that pretty good. The switching costs for ERP systems are huge. The switching costs for most things, you know, especially on the consumer side, it’s very hard to lock in consumers. A lot of the most powerful switching costs are B2B. It’s very, because there’s a lot of close operational integration between companies and their suppliers and, you know, semiconductor companies work closely in design when they make chips with other companies. There’s a lot there that’s really, you know, you’re almost becoming one organization at a certain point. Consumers, it’s hard to do that because you kind of annoy them and they tend to leave. Membership programs are pretty good. Loyalty programs are pretty good. But you can’t really gouge them very much. People are going to leave. They don’t like it. So 10 to 20%, something like that. And if you’re a CPG company or I know you’re selling some service to consumers, you know, if you can add 10% to your top line, your pricing, such that your revenue is 10% higher. Generally the operating margins on these things are 10% maybe. So you’re effectively doubling your operating margin even by having just a 10% switching cost ability. So it can be fairly powerful as an economic move. OK, let’s go on to the third and final idea. And I just want to touch on this because I think this is an idea that is, this is counter positioning. And he is really associated with this idea. When you hear counter positioning, people will always say, oh, Hamilton-Helmer, because this is one of his seven powers. And yeah, I think it’s worth knowing about this one. It’s really easy. It’s not nearly as in-depth as everything I just talked about. So I’ll just touch on it briefly, because it’s pretty cool. Now you’ll hear Silicon Valley people talk about counter positioning all the time. And this is when you come up with a new business model that is definitely superior to the existing model. So I would call this an attacker advantage. When I think about competitive advantages, I think about attacker versus incumbent. And you have different playbooks, whether you’re defending or attacking. This would be kind of an attacker advantage. You come up with a superior business model. Maybe you’re cheaper. Maybe you can charge higher prices. Maybe your service is just better. This could be Netflix. Like Netflix is like, hey, we’re gonna do streaming and it’s better, or we’re gonna do. let’s say we’ll do streaming a video and it’s better than going to the video store to rent a movie, which it is by every measure. A better example would be when digital cameras came up and Kodak was still making chemistry-based photography where you buy the film and then you get it developed and all that. I mean, that was clearly a better product and it was cheaper and it was easier and it’s just better on every measurement. And what you would expect to have happen is this new entrant. comes in and for some reason, the incumbent doesn’t respond, even though it’s clearly better. And then the attacker starts to grow their market share. They usually aren’t going for margins at this point, but a newcomer with sort of a new superior business model enters and for some reason, the incumbent doesn’t respond or copy them and. The reason they don’t do this according to Hamilton is because of quote, anticipated damage to their existing business. Kodak knows if they start selling digital photography, it’s gonna wipe out their chemistry business. And they just don’t, or they do but they’re slow, or they avoid it, and they wait. And so, counter positioning is when you come in with a strategy, with a business model, with a product or service that puts the incumbent in a bind. where if they don’t do what you’re doing, let me phrase that better, if they try and copy what you’re doing, they end up hurting themselves. If Blockbuster said, we’re gonna start shipping DVDs, they would have hurt their retail business. And that’s where their cash flow is coming in, that’s where their jobs are. So. That’s kind of the and it doesn’t last forever. Eventually what happens is the incumbent, the incumbent basically lives in denial for a while because you’ve mentally tied them up. If they copy what you’re doing, they hurt themselves. So it’s an idea of quote, an anticipated damage to their existing business. They tend to be slow. And then eventually they do respond, but it’s usually too late. So Hamilton says basically watch for three conditions that would denote a situation of counter positioning happening. Number one, you see a superior approach. Usually it’s related to technology or a business model that gets you lower cost, improved features. It’s just better. This new approach has a high degree of substitutability with the existing incumbent. It’s very easy for the existing customers to switch. So people buying regular cameras and film could switch to digital cameras very easily. Number three, the incumbent has very little prospect for achieving power in this new business. It’s not that the incumbent doesn’t see it, and yeah, they know they’re gonna get damaged to their existing business, they also don’t think they’re gonna win in the new one. You know, Kodak, to a large degree, was right. It’s like, look. We don’t know how to make digital cameras. We don’t know semiconductors. We don’t know any of that. Everyone who works at Kodak does chemistry. We don’t have any software people here. So they kind of think, his third condition, incumbent has little prospect for power in the new business. Either the new industry economics offer few opportunities for power. Hey, it’s a commodity business. We’re going from our premium profitable business into a commodity. or the incumbent has little ability to capture it anyways. Kodak can’t do semiconductors, they can. And so they just kind of sit and wait and Kodak sat and wait and cameras took them over one by one, Blockbuster sat and watched Netflix for a long time and eventually they do respond and it’s usually too late or they can’t do it or the business doesn’t have that much profit anyways. So he calls all of that counter positioning. I call that more of a short term advantage or a soft advantage. If you look at my strategy pyramid I’ve put that under light green which is yes I think it’s an advantage but I think it’s a short term thing. It lasts for a while and then you got to have something else because if you have a good business model you’re going to have a it’s like being first mover. If you have a new idea or a new business model you’re going to get a short term advantage and you’re going to have room to run but eventually people are going to copy what you’re doing. It’s not a long term thing. People, you know, Netflix did very well with this against Blockbuster for a handful of years. But now they, you know, they have a new business model, Amazon, Disney, they are competing with the same business model. So now their source of power is no longer counter positioning. Now their source of power, their competitive advantage would be considered economies of scale and content. So I consider it a short term effect. It’s a good one, like first mover, but I don’t put it under the category of competitive advantage for that reason. And you can see it in my pyramid there. Now, probably the last aspect of this is, I gave you the rational argument that, you know, these managers at Kodak and such, you know, they’re behaving rationally, logically. Hey, we can’t win in that business. If we go and do what they’re doing, we’re gonna hurt our existing business. Or even if we can do what they’re doing, maybe we know semiconductors. This is turning into a low-profit commodity business. You know? It’s kind of a dead end anyways. We don’t want to win there. So that’s all the rational good management argument. There’s a lot of personal stuff. There’s a lot of self-interest stuff. There’s a lot of psychology on top of that. One of my standard checklist questions is I look at things economically. I just sort of gave you the economic argument. And then I look at all the major players just from the psychology. What is their self-interest? Because a lot of times, the management of companies… they’re not behaving economically or rationally. They’re behaving out of self-interest a lot of times. So, you know, maybe the Kodak people just sort of have cognitive bias that they’re a slave to history. This is what we’ve always done. This is what we know. Maybe it’s sort of what we call agency effects. Look, if I do this, I’m gonna lose my job. I’m gonna put us out of business. And while that may be great for shareholders, I’m a middle-aged dude who’s been in this business for 20 years. I can’t retrain. You know, and they’re just like, I’m gonna try and keep my job security as much as I can. Maybe this particular business unit that runs all the blockbuster stores, you know, maybe that person’s got a lot of clout in the organization and he’s like, or he or she’s like, I don’t know, don’t wreck my business. So there can be a lot of internal bureaucracy, there can be psychology, there can be denial, there can be a lot going on outside of the rational aspects. So that’s counter positioning and that’s a pretty good one. So those are the three, four, two, day. I’ll probably go through the other three or four and next week or the week after. And that is the content for today. I think this stuff is all pretty cool. I mean, I really like thinking about this stuff. I think there’s a lot of subtleties here. I’ve been saying for well over a year now that you wanna write this stuff down. You wanna use checklists because even though we talk about things like switching costs and platform business models and all of that. When you start to dig into each of these ideas, and these are all in my concept library, so go to the homepage, concept library, I’ve even given you my pyramid, even within each of those ideas, which I think are very important, there’s a ton of subtlety, and there’s a ton of details, and when you start digging into switching cause and all that, you realize there’s a lot there, and it does vary company by company. So that’s why I do checklists, that’s why I keep a journal, because that’s far beyond what I can keep in my brain. If I’m thinking about switching costs in a retail company like Target, it is very different than how I’m thinking about switching costs on a subscription model or within B2B software sales or Slack or any of this. That’s why I keep encouraging you to write this stuff down as much as you can. Okay, just to recap, main ideas for today, economies of scale, surplus margin leader, switching costs, counter positioning. And those go under learning goal six, which is the basics of Huawei and economies of scale and learning goal 15, which is DD and switching cost. But that’s for those of you moving up the steps, just go to the concept page and you can click any of them and it’ll take you to the articles on that. As for me, I’m getting a little stir crazy. I really felt like we were coming to the end of the whole. COVID thing and this was the home, the final stretch. And man, it doesn’t feel like that anymore. That’s, things are, have heightened here in Bangkok. It’s not gotten to full lockdown, but they definitely took it up a couple notches. Now it seems to be somewhat stable. You know, gyms are closed again, things like that. Not as many places to go. Shopping malls are still open. But you know, the idea of I was supposed to be back in China. couple weeks ago and you know that’s keeps getting… it’s starting to wear on me in a way that it wasn’t. My sort of good friend and business partner, he’s a doctor in the US and I talk to him all the time and you know he’s treating patients all the time and he just says it’s packed. He’s in sort of New Mexico, places like that. He says it’s absolutely packed. The hospitals are packed. The incubators are all being used. The ER is packed. I sort of told my parents who are pretty elderly, you need to lock yourselves indoors because something is happening. This surge, something’s going on and I don’t think we know what it is yet. It may turn out to be nothing. It may just turn out to be who knows, but there’s a chance that something’s going on. So they’re up, which helped. Thankfully they’ve moved up the coast of California in a little isolated cabin. They’re just relaxing on vacation. That makes me quite happy because it’s like. They’re literally not near anybody. So I figure that’s pretty good. But yeah, it’s starting to wear on me. And I don’t know. Maybe it’s just how I’m feeling today. I did finish Ghost of Tsushima, which is the, um, the sucker punch game where you get to be a samurai and you get to run around in this sort of open world environment and it’s the greatest video game I’ve ever played. It is such a pleasure. Like it’s, it’s stunningly. I hate to say beautiful, it’s beautiful as a game. It’s the snow and the hillsides and you’re running. And it’s just, I’ve never seen a video game like this before. And I’m getting pretty good at throwing things and fighting with swords and doing, you know, my level of skill as a samurai in a video game is shocking for a man my age. So that was, I guess, my big accomplishment for the last couple of days is I killed the Mongol ruler and freed Japan. I felt pretty good about that. Anyways, if you like video games and you haven’t played it, you have to play it. It’s my favorite video game ever. It’s amazing. So, anyways, that’s my recommendation. Other than that, that’s it. I hope this is helpful. I hope you’re sort of getting into this subject. For those of you who are subscribers, I’ll be sending out the SoftBank sort of strategy assessment later tonight. And that’s it. I will talk to you next week. Everyone, stay safe and thank you for listening. Bye bye.