I recently got a call asking if I would like to come visit the Meituan-Dianping headquarters in Beijing – and I jumped at the chance.

I had been watching Meituan for a long time but I had never really had great information on the company. But with my visit and now with their recent filings for going public, I have finally able to dig into the company. And it’s just a really cool business. I think it raises lots of interesting questions like:

- How do you evolve from a “hot app” (i.e., food delivery) to a full platform business (i.e., a consumer services marketplace)?

- Will e-commerce for consumer products and services remain separate? Where will the industry boundaries fall?

- How does the increasing offline cost structure of “new retail” (such as delivery riders, warehouses, retail hubs, etc.) change the economics and competitive dynamics?

In this first article, I am laying out my three main take-aways from my visit to Meituan. In Part 2, I list things I think people are getting wrong about the company. And in Part 3, I lay out what I think is the biggest question for the company. Can it evolve from a popular O2O service (in-dining plus food delivery) to a full platform for online and offline services, something I am calling “new services” (a contrast to “new retail”).

***

Meituan headquarters is in the northeast of Beijing, about 30 minutes on the subway from downtown. It is in one of the new business districts that has sprung up outside of the fourth ring road. And when you get off the subway, it is like entering a different Beijing. It feels more like Silicon Valley and Santa Clara than the hustle of Tiananmen Square and Guomao.

There are wide tree-lined streets, modern office parks with Grade A buildings, fantastic shopping malls and retail, probably several 4-5 star hotels and just great infrastructure. So much of the interesting stuff happening in Beijing is now in the outskirts of town.

Note: If you go to the southeast of the city, near Yizhuang, you can find the same type of district. And you can find companies like JD.com with their massive new campus being built. To the northwest, near Peking University, you can find Microsoft, ofo and others in Zhongguancun. And if you go even further northeast, you will find a newer district that houses Didi-Chuxing and others.

Getting off the subway, I just followed the stream of people walking north along a still under-construction roadway that connects the subway, shopping centers and the office parks. And immediately, the different demographics were noticeable. Everyone was young and well-dressed. Everyone was staring at their smartphone, usually an iPhone or Samsung (maybe a Xiaomi). And like half the people were jumping on and off the sharing bikes.

Arriving at the office complex, I was a bit early so I went to look for coffee. I noticed there were lots of people carrying around blue coffee cups, which I hadn’t seen before. I followed them back to a coffee place called Luckin Coffee. I made a mental note to look into that now well-known company.

Heading back to Meituan, I went into their lobby, which is kind of a museum. They had their signature yellow uniforms and delivery pouches on display. They had also just purchased Mobike so there was one of those bikes too.

Interestingly, they also had drones and autonomous delivery vehicles they are prototyping.

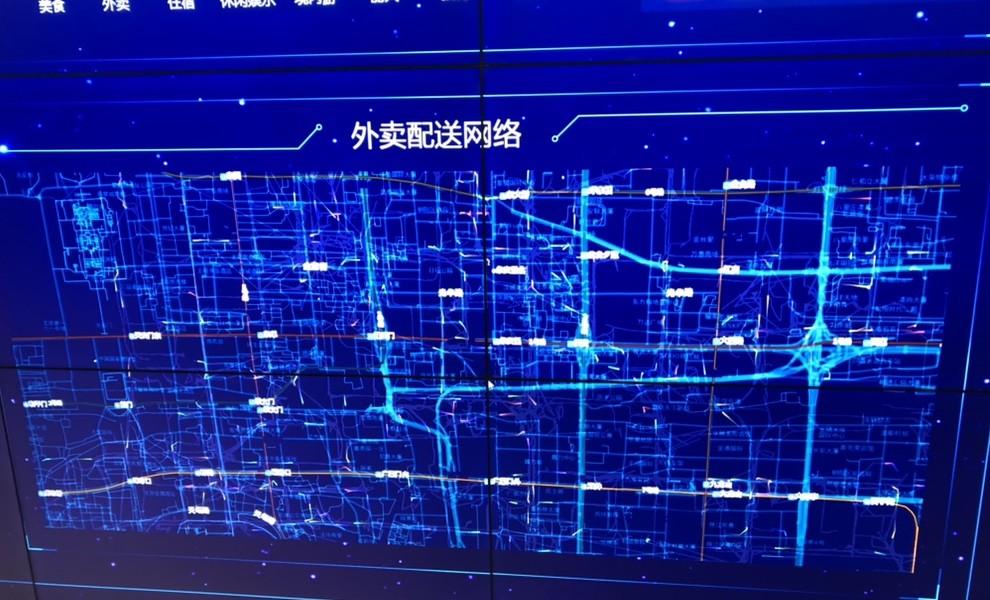

And they had lots of information on the walls. My favorite was a real-time display that showed all the delivery people moving around.

Over the next couple hours, I peppered people with questions. As everything with me is always off the record (I’m an academic, not a reporter), I’m not going to detail the actual conversations. I’m just going to jump to my three take-aways from the visit and their recently released financials.

Take-away #1: Meituan is very well-positioned in a very big market with some very big tailwinds.

So much of business is determined by what space you choose to play in. If you are dentist, you are probably a small business person with good margins and lots of repeat business – but with limited ability to scale. If you are selling pianos (i.e., Baldwin) or big motorcycles (i.e., Harley Davidson), you are selling my two of my favorite products. But you are limited to a small, niche market with infrequent purchases. And there’s little you can do to change this.

By luck or strategy (both?), Meituan has found itself dominating a fantastically attractive space.

- They are an e-commerce company in China – which means they are in the world’s largest e-commerce market. It’s just a big, big market and they have a scalable business model with high frequency purchases. That’s awesome.

- Plus Chinese consumers are continuing to upgrade their lifestyles. This market is going to get a lot bigger as spending increases. You can go back 5-7 years and Chinese e-commerce was quite small, a fraction of the world leading market it is today. So imagine what it will be 5-7 years from now? How about 15 years? Upgrading Chinese consumers are increasingly buying premium beer instead of economy brands. They are increasingly buying SUVs instead of compacts. And they are paying more for food and other services, which benefits Meituan as a service platform. This is a big tailwind in an already big market.

- Additionally, China’s service sector is currently getting a digital upgrade. Restaurants, beauty salons, delivery, travel, hospitality and other services are overwhelmingly local, fragmented and underdeveloped in China. They just happened to be at this stage of their development as these new digital tools arrived. Meituan, as a company that serves both consumers and service businesses, is very well positioned against the digital upgrading of the entire sector. Giving restaurants delivery capabilities was a good start. But helping these and other service companies build out their onine presence, find customers, do marketing, get onto ERP systems, access financing and payments and so on will be coming. The digitization of China’s service sector is another big tailwind that is just beginning.

Meituan is sitting in a great position. A big market that is benefiting from some big tailwinds.

Take-away #2: Meituan is building out its competitive barriers.

One of my standard questions for every business, is “could I break into this business? How difficult and/or expensive would it be to enter and/or win?”. Some businesses (like soda) are easy to enter but impossible to win long-term (Coca-Cola will grind you down). Other businesses are difficult or expensive to get into (i.e., hospitals) but then winnable after that initial phase.

And some rare businesses are difficult to get into and then difficult to win long-term. That’s WeChat and China Mobile (communications networks), Fedex and American Airlines (international delivery networks) and probably Meituan.

Think what it would take to break into this business. You have a chicken-and-egg problem where to get your first restaurants you need a big local customer base – but to get a customer you need a large choice of participating local restaurants. This is a situation common to many platform businesses. But in Meituan it is even more difficult because you also need the army of delivery riders from day one as well. You have to convince them to sign up even though you don’t have much volume yet. And then there are lesser barriers like having a brand, getting the IT working and so on. Unless you are like Alibaba, it’s a hard business to break into.

And let’s say you somehow manage to break in. You are then a small player against two dominant incumbents (ele.me and Meituan). They have greater volume in their platform so they have supply side economies of scale on you in IT spending, marketing and probably price subsidies (if they choose). They are going to be cheaper and faster in delivery – and with better tech, marketing and product development.

The combination of physical and online assets of “new retail” has some negative effects on the economics. But it also creates increasing barriers to new entrants.

Another increasing factor is the pairing of low margin services with high margin one. Food delivery actually has relatively low margins (you have to pay the delivery guy) when compared to a pure online transaction (like a restaurant reservation). But you can’t get the second business without also offering the first. Combined services were one is low margin (or loss making) and the other profitable can be hard to replicate.

Take-away #3: The ideal service mix for Meituan is a key question going forward. And it will determine their ultimate profitability.

Meituan is offering tons of services. And they keep jumping into new services like ride-sharing, bike-sharing, and international restaurant bookings. They are increasingly connecting small service businesses with their consumer base and becoming the “Alibaba of services”. Some of these services will end up being profitable and others not. Some will be strategic or operational requirements and others not.

Keep in mind, e-commerce for product sales grew for a decade before it moved into groceries (more complicated) and cross-border e-commerce. It is unclear how service e-commerce is going to grow and where other profits may be. Plus it is unclear whether products and services will remain mostly separate (Hema supermarkets offer both service and products) or whether it will come together in one massive B2C marketplace.

***

That’s if for Part 1. It was a fascinating visit. Flying around and visiting cool companies is really one of the best parts of my research and writing.

In Part 2, I will lay out things I think everyone is getting wrong about Meituan.

Thanks for reading. Cheers – jeff

- 4 Things People Are Getting Wrong About Meituan-Dianping, China’s Food Delivery Giant (Pt 2 of 4)

- Meituan vs. Alibaba vs. Didi vs. Ctrip: Why China’s Internet Giants Are Colliding In Local Services (Pt 3 of 4)

- Meituan vs. Alibaba vs. Ctrip Is About 3 Big Questions (Pt 4 of 4)

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.