China is the world’s biggest beer market.

This is a frequently cited fact. So is the fact that Snow (drunk mostly in China) is now the world’s most popular beer by volume. In fact, three of the world’s top 10 beers are now Chinese (Snow, Tsingtao, and Yanjing).

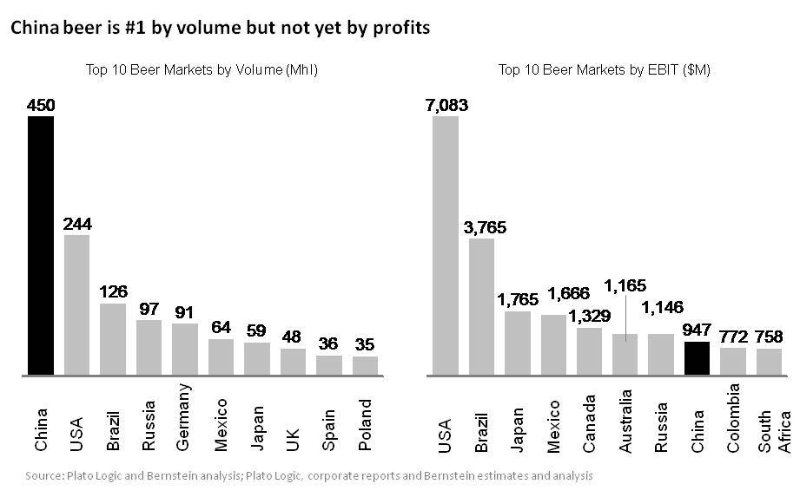

All very impressive. But it is worth remembering that while China is the #1 by beer volume, it is still fairly low in profits. Note the below chart (from a year or so ago, so not totally current)

Note: China’s 1.4B consumers have been generating about the same beer profits as Columbia or South Africa.

Note: China’s 1.4B consumers have been generating about the same beer profits as Columbia or South Africa.

Given the huge volume, the obvious reason for the small profits is low pricing. Low pricing in Chinese economy beer is a result of the intense current competition. But it is also a legacy of the days when the government owned and ran breweries.

It was actually Chairman Mao and the party that made beer both ubiquitous and cheap in China. They opened state-owned breweries in virtually every city and made it affordable for everyone. The big China beer SOEs have been rolling up these smaller SOEs for the past twenty years. One consequence of this history is that Chinese consumers are very used to the idea that beer should be really cheap.

Talk to any executive about beer in China today and they will quickly bring up “premiumization”. The goal is to get Chinese consumers to upgrade to premium beers – which offer better profits. And this is happening. But big profits in Chinese beer have been a dream for a long time.

Cheers from Beijing, jeff

——–

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.

Photo by Wil Stewart on Unsplash