There is a lot of buzz around “new retail” coffee chain Luckin Coffee in China now.

- They are opening at a blistering rate – about 800 outlets since their launch earlier this year. That’s 2-3 locations per day (including weekends).

- They are focusing strongly on digital and delivery – a “new retail” version of retail coffee.

- They are generating lots of press, especially by directly challenging Starbucks. They are also suing Starbucks regarding competitive behavior.

- They are raising money rapidly. Their recent Series A round reportedly raised $200-300M at a +$1B price – making them China’s first coffee unicorn.

Altogether, the A team of China has finally turning its attention to retail coffee. They are executing fast and effectively. Make no mistake. This is a serious competitor playing to win. I went to visit a bunch of their outlets to check them out.

Why doesn’t Starbucks have a serious competitor in China?

A couple of years ago, I started to ask this question. Every other company in China (foreign and domestic) fights ferociously against a sea of competitors, against rapidly changing consumer behavior and against ton of investment capital. Nike and Adidas fight Li-Ning and Anta. Apple fights Xiaomi (and many others). Wal-Mart fights tons of players. Uber fought Didi. Google fought Baidu. Ebay fought Alibaba. And so on. China is a tough market and tough competition is the norm.

Yet Starbucks has sort of been cruising along, opening stores and growing steadily. They have some smaller competitors like Costa Coffee and UBC coffee. And there are lots tea places and take-out stands. Plus there is McCafe at McDonalds.

But none are what I would consider serious China competitors. Starbucks is strangely unbloodied in China.

Plus, Starbucks has also been pretty open about its growth and profits in China. They are opening 500 stores per year (about 3,300 now). And these are apparently some of their most profitable stores. This sort of commentary is loved by Wall Street analysts but it breaks the number one rule of China business. If you are doing really well, keep it quiet.

So I’ve been asking why they don’t seem to be fighting anyone. I never got a great answer. And my advice (which Starbucks doesn’t care about) has been: Open as many stores as possible right now. Don’t worry about profitability. Run as fast as you can. Because competitors will be coming.

My visit to Luckin Coffee

Luckin Coffee was founded in Nov 2017 by Jenny Qian Zhiya, former COO of UCAR. From quotes I have read, the goals of the company appear to be to beat Starbucks and to grow with increased coffee consumption in China. They are also mentioned as a “new retail’ version of retail coffee. New retail, coined by Alibaba, is pretty hot topic in China right now (note: Starbucks new partnership with Alibaba is also described this way). So there are sort of three big ideas about them floating around right now: beat Starbucks, grow with consumption, and “new retail” applied to coffee.

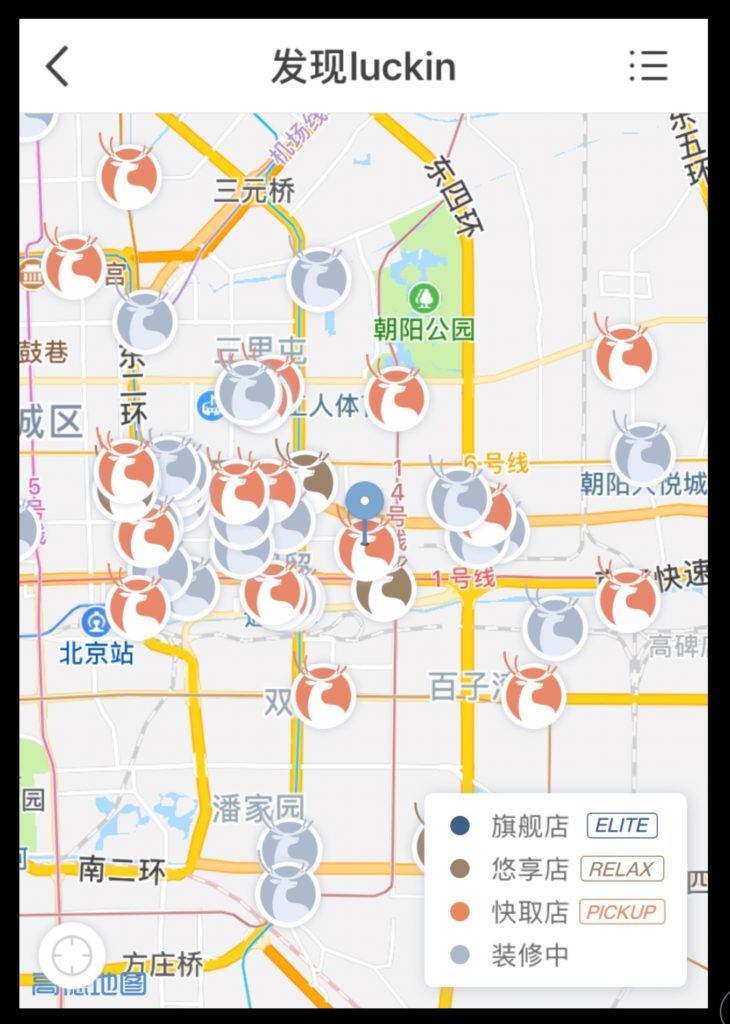

In my area of Peking University / Zhongguancun, I count about 7 Luckin locations. That is already more than the Starbucks in the area. And as I hunt around on their app, I can find tons of their outlets across Beijing. You can see in the below pic that they have pick-up, relax and pop-up stores all over the place.

The first thing I noticed was that their locations seem to be in central business districts and near (but not in) high traffic areas. That distinction could be important (see Part 2). They appear to be 1-2 streets away from the high traffic and high visibility locations that Starbucks tends to occupy. Maybe that is the strategy. Or maybe that is just what was available. But you have to give their real estate person credit, they are awesome at opening locations fast.

In Zhongguancun, I went to a sit-down (i.e., relax) site.

There were 2-3 delivery people waiting outside, with Luckin delivery pouches stacked and ready to go. That is pretty standard for retail food in China now.

Entering the outlet, I was immediately greeted by a nice young woman who asked me if I wanted some coffee – and then offered to show me how to order on my phone. Because Luckin doesn’t have cash registers and they don’t take cash or credit cards (at least at the outlets I have seen). You have to download their app and order there. And you pay either through Wechat / Alipay or their own wallet function.

So from the moment you enter, they are pushing hard to get on your smartphone. And they are trying to do as many orders as possible offsite from smartphones – which you can then pick-up or have delivered.

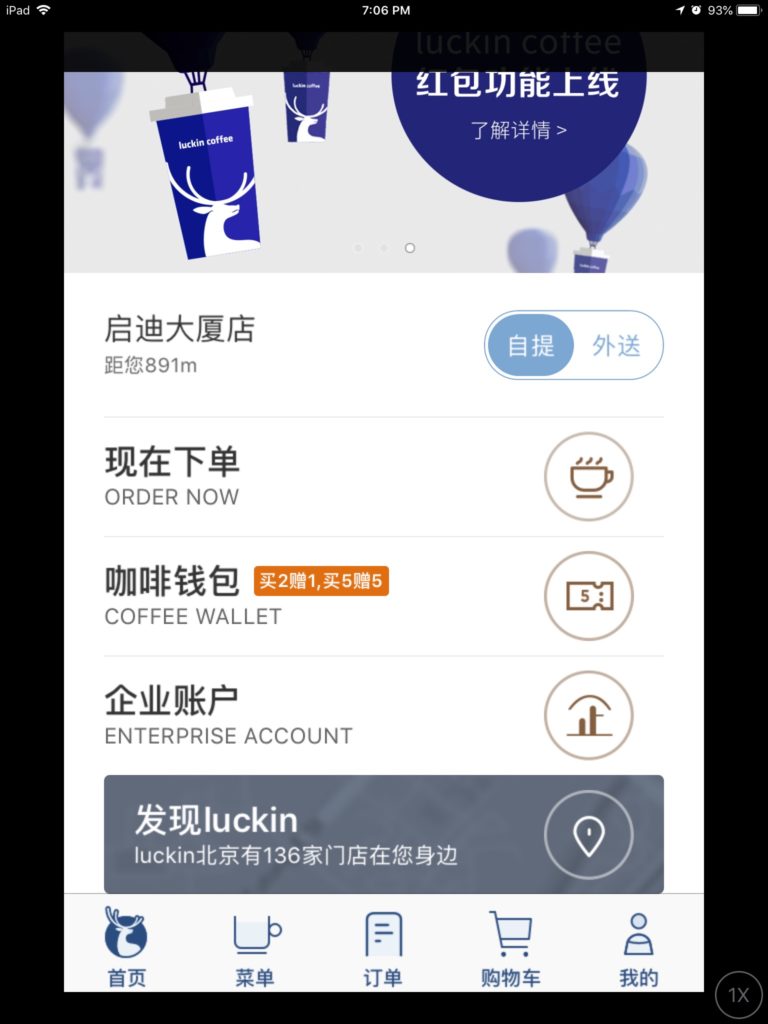

Here’s what the app looks like:

It finds your closest outlet and you place your order for pick-up or delivery. The menu of beverages (and some food) looks pretty similar to other coffee shops. But the coffee prices are about 10Rmb less than Starbucks (about 20%). As discussed in Part 2, I think that is pretty important. You’ll also note lots of promotions for buy 2 and get 1 free. Or buy 5 and get 5 free. That’s also really important (also discussed in Part 2).

You are encouraged to sit and relax. There are nice chairs. It is a pleasant place. There is free wifi and lots of power outlets.

So Luckin is definitely positioning many of their outlets as a 3rd location in life, just like Starbucks. These are places you can go to sit, talk with friends, relax and read. Although other outlets are mostly for pickup and delivery.

In this outlet, there was even a book kiosk where you can rent a book to read (again, only available by smartphone).

Overall, the several locations I visited were all really nice. And I do like the color and the logo.

So my first conclusion is this is a serious competitor. They are moving very fast and can execute well.

But can they beat Starbucks? Do they need to?

You can’t really beat Starbucks by going for the “high traffic and high visibility” locations. That is their strategy. It is an expensive fight and they are good at it. And you probably can’t beat them on marketing spend (they have economies of scale there too). So maybe you focus on changing the rules of retail coffee with digital? Or maybe you just try to expand the market to the vast the majority of Chinese who are not drinking much coffee yet? I think Luckin is doing both.

My take is their big weapon is digital + lower prices + tons of locations

And that could work.

In Part 2, I’ll give my opinion on whether and how they can actually beat Starbucks. And in Part 3, I’ll explain why they don’t really have to beat Starbucks to win big in China.

Thanks for reading, jeff

- How Luckin Coffee Can Beat Starbucks in China (Pt 2 of 3)

- Luckin Coffee Doesn’t Have to Beat Starbucks to Win Big in China (Pt 3 of 3)

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

Note: This content (articles, podcasts, website info) is not investment advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. Investing is risky. Do your own research.