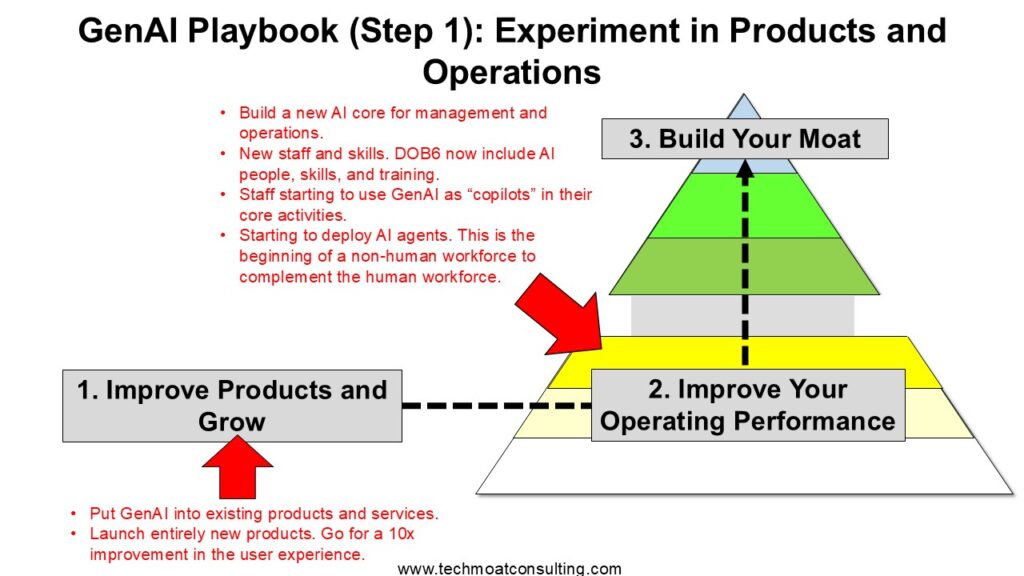

In Part 1, I laid out a basic first pass strategy for generative AI. And Step 1 was two points (in 3 slides).

I argued this is most of what was going on in generative AI in 2025. Lots of experimentation in products and internal operations. Both by challengers and incumbents. It’s pretty much table stakes.

However, not much of Step 1 of the GenAI Playbook is about building moats and other types of competitive strengths.

So, let’s start talking about building competitive strength and having more powerful business models with generative AI. How can you dominate with GenAI?

Which brings me to another graphic (and concept) you really need to understand.

The GenAI Knowledge Flywheel

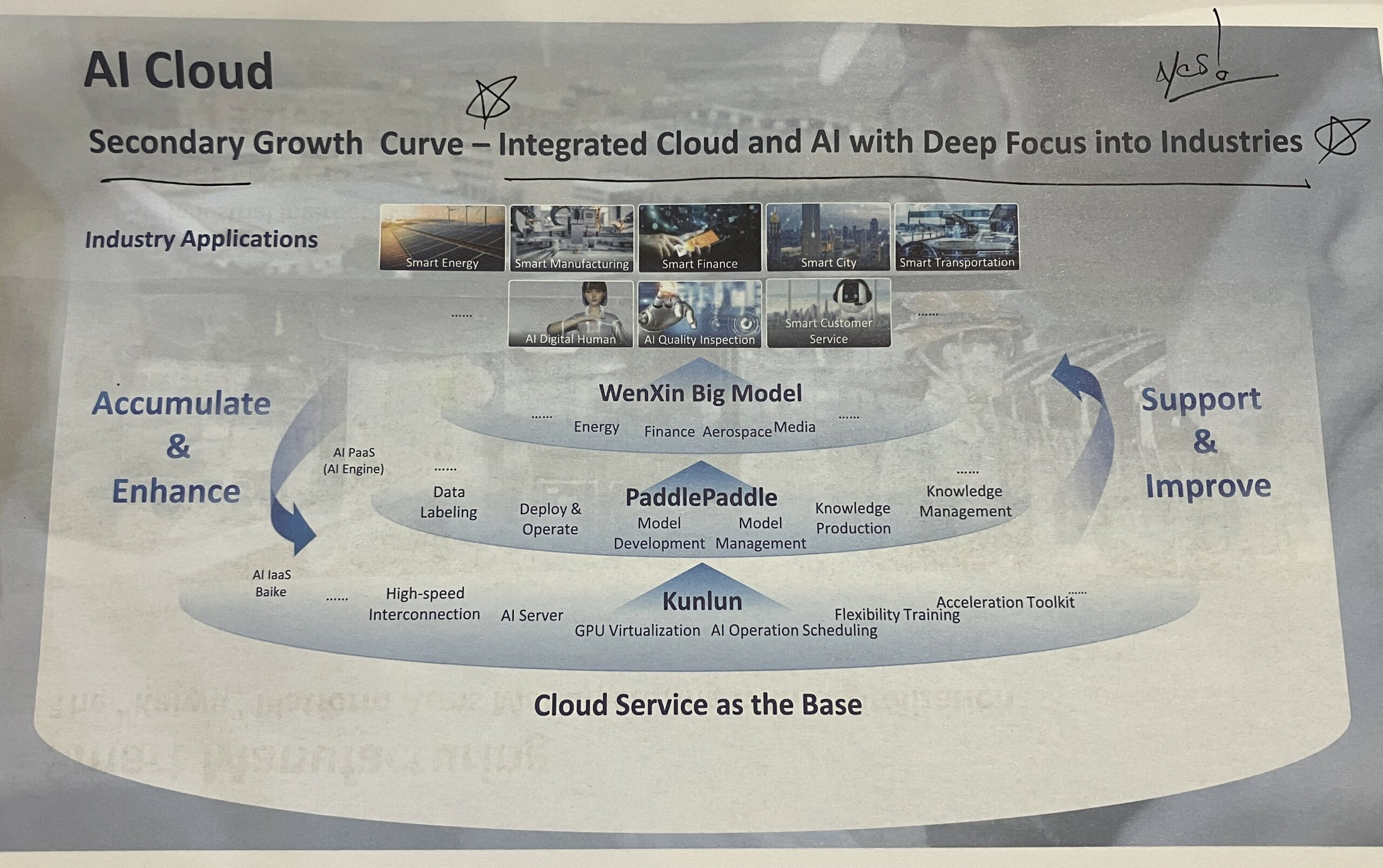

I’ve written a lot about Baidu AI Cloud, which has a very good AI strategy. And how they are aggressively building a flywheel in industry specific knowledge. Which looks like this.

You can see the four levels of their AI tech stack (discussed in Part 2).

- Industry focused applications.

- A suite of big foundation models (i.e., Wenxin / ERNIE)

- Deep learning platforms for developers (i.e., PaddlePaddle)

- Chips (i.e., Kunlun) and compute (i.e., servers). Based in the cloud.

And as mentioned, I would add another 2-3 layers to this tech stack.

- Databases and data architecture. You need massive amounts of data processed and shared in real-time. This is increasingly industry specific.

- L1 and L2 models. Huawei has a nice differentiation between big foundation models (L0) and the industry specific models (L1) built on top of them. And then applications (L2) above this.

Now look at the arrows on the left and right of the Baidu graphic. That is the industry-knowledge flywheel Baidu is talking about. The flywheel goes between:

- Model intelligence, performance, and efficiency

- Industry applications and usage.

The more users, use cases, apps, APIs, and data coming from industry usage, the more accurate and efficient the industry-specific models will become. And the more intelligent and efficient models should encourage more usage, apps, and use cases. And so on.

It’s a flywheel in industry-specific knowledge.

I wrote about this in:

And I noted how Baidu describes its advantages in AI cloud:

“The core advantages of ERNIE lie in its knowledge enhancement and industrial-level application.”

“Knowledge enhancement” and “industrial-level application” are the important terms. Those are the two KPIs of the flywheel.

Here’s more from Baidu. I added the bold.

“The (ERNIE) model learns from large-scale knowledge maps and massive unstructured data, resulting in more efficient learning with strong interpretability. It also aims to promote the intelligent upgrading of industries by constructing a foundation model system that is more suitable for specific scenario requirements. This includes providing tools and methods to support the entire process and creating an open ecosystem to stimulate innovation.”

That gives some more detail on what they mean by knowledge enhancement. They break that into knowledge maps and unstructured data.

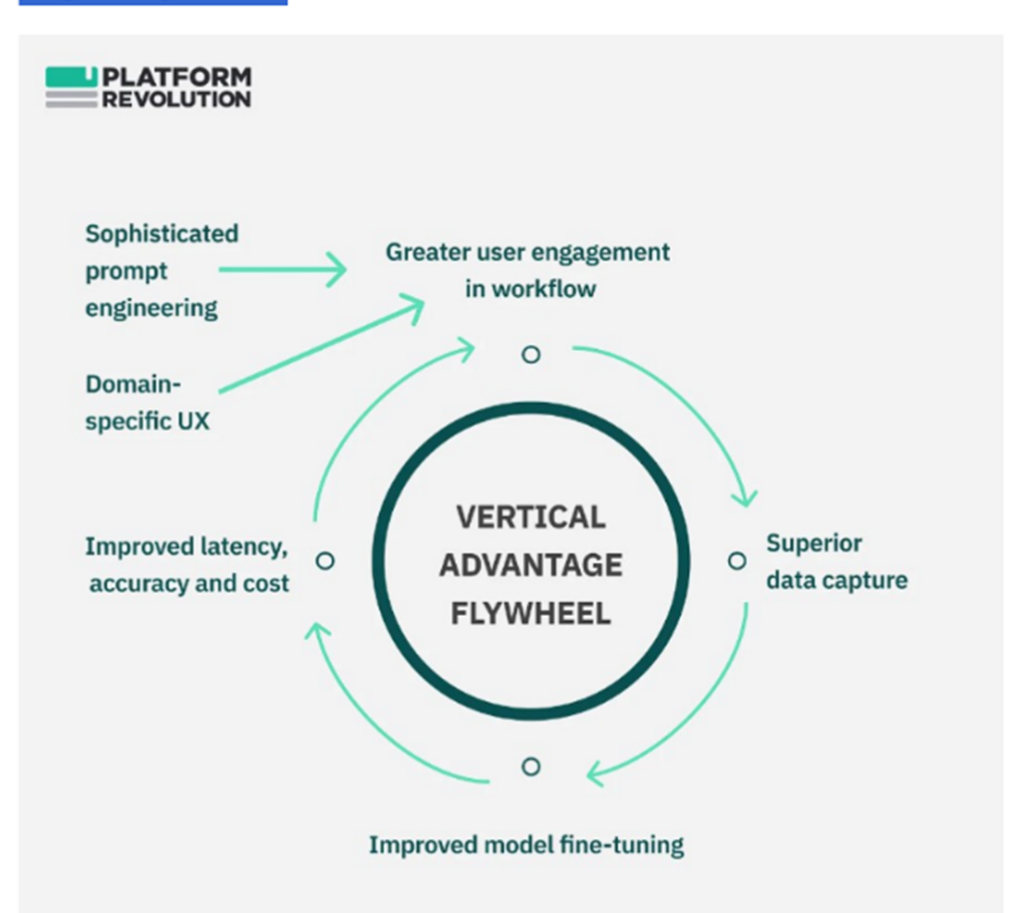

You can see a somewhat similar version of this flywheel by McKinsey & Co.

And also, by platform guru Sangeet Choudary.

Sangeet calls this a vertical flywheel, meaning you have to vertically integrate both apps and models. He describes this in an article on Substack. Definitely read his thinking on this. It’s very good.

From Sangeet’s article:

“Here’s the simple GenAI wrapper playbook for developing vertical advantage:

- Sophisticated prompt engineering + Well-crafted UX drives workflow engagement

- Workflow engagement drives rich data capture

- Data capture aids model fine-tuning

- A fine-tuned model drives greater workflow engagement”

That’s the flywheel. He goes on (I added the bold):

“Model fine-tuning helps build proprietary vertical advantage by:

- Improving model performance for that specific use case

- Reducing model size / costs and improving model economics

Smaller models, trained on domain-specific data deliver better performance on latency, accuracy, and cost than larger foundational models. This verticalization has its own reinforcing feedback effect. The more you develop vertical advantage, the more competitive you get on all parameters.”

Those are the same performance parameters Baidu talks about. You’re looking for a flywheel between industry-specific usage and the performance (quality and latency) and cost of the model.

Ok. Back to Baidu.

Baidu CEO Robin Li has great thinking about this. He has been very frank that most companies building foundation models are wasting time. He is focused on customer usage, which he calls “industrial-level application”. Which he is using to create “knowledge enhancement”.

As mentioned, knowledge enhancement follows from “large-scale knowledge maps and massive unstructured data, resulting in more efficient learning with strong interpretability.” Baidu’s plan is to combine industry-specific knowledge graphs with massive amounts of industry-specific unstructured data, coming from on-the-ground industrial use.

Basically, their cloud business plan is to build 4-5 flywheels in industry specific knowledge. Here’s how they present it.

The one I am most interested in is Kaiwu, their “Smart Manufacturing Platform”.

Kaiwu was launched in 2021 as an industrial internet platform powered by AI cloud. Given China’s massive operational footprint in manufacturing, it’s not surprising this is a focus. It’s a really big opportunity. And we should expect a China-based cloud company to win in this sector.

The Kaiwu proposal to customers has been about improving the quality and efficiency of factories. And accelerating their digital transformation.

Ok. Fine. That’s a standard cloud services value proposition.

But this has now been upgraded to focus on “intelligent transformation”.

And to lower the threshold for AI applications in the industrial space. This flywheel depends on adoption. So, lowering the threshold for adoption is a strategic priority for Baidu. And Baidu says they are now providing services for +180,000 industrial enterprises.

Here’s a one-pager for Kaiwu.

Last Question: Is This a Moat?

Usually, a flywheel is about improving and accelerating advances in operating activities. That is not a moat.

And what is the operating activity we are talking about here?

I’ve been using the terms knowledge and intelligence. But really, the key operating activity here is learning and adaptation. Being smart is of no value if it is not being applied.

And for those who have read my books, you know I talk a lot about rate of learning by humans and organizations as an operating activity and sometimes a competitive advantage. This is all basically a more complicated version of the same idea, which I will go into in Part 4.

That’s it for today.

Cheers, Jeff

- GenAI Playbook: When Rate of Learning by Humans Is an Operating Activity (4 of 12) (Tech Strategy)

- GenAI Playbook: Framework for Generative AI Moats and Strategy (1 of 12) (Tech Strategy)

- GenAI Playbook: You Really Need to Understand This AI Tech Stack Graphic (2 of 12) (Tech Strategy)

——-

Related articles:

- AutoGPT and Other Tech I Am Super Excited About (Tech Strategy – Podcast 162)

- AutoGPT: The Rise of Digital Agents and Non-Human Platforms & Business Models (Tech Strategy – Podcast 163)

- The Winners and Losers in ChatGPT (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- AI: Knowledge Flywheel

- GenAI and Agentic Strategy

- GenAI Playbook

From the Company Library, companies for this article are:

- Baidu AI Cloud

Photo by Sanket Mishra on Unsplash

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.