This week’s podcast is my second on Ram Charan’s new book “Rethinking Competition Advantage“. I think it has a lot of great insights about the basics of digital operations.

You can listen to this podcast here or at iTunes and Google Podcasts.

Here is my summary of digital operating basics (Dr. Ram’s book combined with some of my own thinking):

- Scale and growth at small incremental cost.

- Target a real or imagined 10x or 100x market space. Disrupt an existing space or create a new one.

- Imagine an end-to-end experience in a customer’s life that could be greatly improved.

- Have the confidence that you can overcome whatever obstacles may encounter.

- Growth and scale without cost or constraints is one of the great advantages of digital.

- Continuous personalization and customer-facing innovation.

- An improving and personalized customer experience is key to continued value-add and growth.

- It enables new products and services and cross-selling more and more products and services to a larger and larger audience.

- A “market of one” is the ultimate personalization.

- A digital core for operations.

- Being a data-driven company is critical for speed, smart decision-making and incremental improvements and innovation.

- Algorithms and data are essential weapons. Combining and refining algorithms over time “can be a competitive advantage” But not always. It is mostly about continuously making changes and frequent incremental improvements. This combined with speed is tough for physical competitors to beat.

- Dynamic pricing – for markets and individual consumers.

- Ecosystem and connectedness.

- Companies need to be used to dealing with partners – and not stand-alone islands in a changing and evolution ecosystem. Every major player needs at least 10 partners for sharing data, meeting a range of consumer preferences, growing faster than it otherwise could and continually refreshing with technology and innovation.

- Connectedness is one of the strengths of digital. It is critical for adapting in complex and changing ecosystem. It also feeds data to the digital core.

- People, culture and work design create a social engine that enables innovation and execution – increasingly personalized for each customer.

- Decision-making is designed for innovation and speed. Think Teams, not organizational layers.

- Money-making at scale makes the company sustainable. It enables continuous innovation, including big bets where the ability to withstand losses is important.

- Companies need powerful moneymaking models that capture the benefits of digital scale. Target a big opportunity and increases cash gross margin by innovation and cost reductions over time.

- Use cash flow to improve innovation and technology. That can fund multiple experiments against consumer experience. Add that can revenue streams on top of the same digital core and customer base.

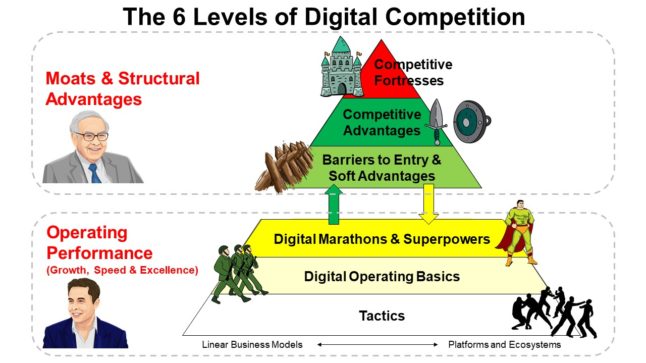

Here are my 6 Levels of Competition:

—–

Related articles:

- Lessons in Digital Operating Basics from Ram Charan. Part 1 of 2 on “Rethinking Competitive Advantage”. (Asia Tech Strategy – Podcast 98)

- Meituan vs. Ctrip vs. Alibaba: Who Will Win in China Services? (Jeff’s Asia Tech Class – Podcast 22)

From the Concept Library, concepts for this article are:

- Digital Operating Basics

From the Company Library, companies for this article are:

- n/a

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.

——Transcription Below

:

Welcome, welcome everybody. My name is Jeff Towson and this is Asia Tech Strategy. And the topic for today, Lessons in Digital Operating Basics Part Two. So this is the second part of a two-part series that I started last week on a book written by Dr. Ram Charan who wrote Rethinking Competitive Advantage, which is really about, he’s kind of a very well-known famous. management consultant slash advisor to Fortune 500 companies. And this book is sort of on his digital thinking. He mostly talks about competition and strategies. This is sort of the digital side, which is obviously my world. So in part one, I laid out basically four of sort of six ideas, six principles, six steps that I am calling the digital operating basics. That’s not what he calls it. That’s what I call it. He calls it competitive advantage. I don’t think it is. I think this is basic operating requirements for a digital age. And the companies that get there first look like they have an advantage, but these are actually sort of operating basics in a digital world. Anyways, today I’ll go through basically parts five and six, sort of wrap it all together, show you how it fits into all the concepts I’ve been dealing with. Now, for those of you who are subscribers, I sent you out kind of a lot this week. I sent you out something on… Kingsoft Cloud, which is a China cloud-based company, cloud services company, that’s kind of tied with Xiaomi and Kingsoft Group, which is, you know, they’re both Lei Jun, basically, that guy. So this is sort of the cloud business that supports that. Very good way to look at the cloud business of China, because unlike all the other cloud companies, Tencent, Alibaba, Baidu, this one is actually pulled out as a separate entity and you can see the numbers. So I sent you a bit on that. And tonight, or early tomorrow I’m gonna send you some stuff on Kenjun, which is a recruiting platform. It goes by the name BossJupin, but it’s basically a recruiting platform business model and pretty interesting. I think it’s a compelling model to think about when we go into platforms. You kind of, I suspect, know the ones that I like. This one’s interesting, so I’ll go through that. That’ll go out tonight or in the morning. Next up on the list is probably globally or shimaleo or maybe ozone which someone recommended It’s a Russian company. So it’s a little bit off topic, but you know, we’ll take a look at it Okay, for those of you who aren’t subscribers, you can sign up go over to Jeff Towson comm sign up there It’s a free 30-day trial. Try it out. See what you think one little I guess Notice on that in the last month. I’ve had two people contact me saying they have difficulty logging in I think we got it fixed pretty quick. If you ever have an issue like that, just shoot me an email. You can go onto the website, look at contact, email’s right there. It’s info at 1000group.tom. If you ever have an issue, it hasn’t happened much, but it’s happened a couple of times, so I’m keeping an eye on it. Let me know and we’ll get it fixed up right away. Okay, and let’s see, my standard disclaimer, nothing in this podcast or in my writing or the website is considered investment advice. The number’s an information for me and any guess may be wrong or incorrect. The views and opinions may be incorrect, no longer valid, no longer accurate. Overall, investing is risky. This is not investment advice. Do your own research. And with that, let’s get into the topic. Now the two concepts for today are digital operating basics. So you can go to the concept library. You’ll see that tab there. Click on it. I’ll start to put more and more stuff under that as we go. And in the show notes for today and for last week’s podcast, I’ve sort of written out what those digital operating basics are specifically. So as I’m going through this, you don’t have to write it down, just look in the show notes. And for those of you who are subscribers, the note going out on BOSJAPIN, we’re also going to talk about digital operating basics. So it’s all detailed there if you want to copy it. Anyways, that’s one of the concepts for today. The other is this, my sort of competition pyramid, which is the main graphic you see on the concept library. Someone started to refer to that as Towson’s Tower, which I kind of like, because I think the pyramid is kind of a weird name. I’m going to start using that. So yeah, we’re redoing it right now. We’re cleaning it up, making it a lot simpler, because there’s way too much text on it. More usable, easy to remember. So that’s what we’re doing right now. And that’ll be kind of the center point of the book, is explaining that tower. So anyways, that’s the other concept for today. The now named Towson’s Tower, which is my last name. Now, last week, what I went through was, okay, Ram Charan, very well-known guy, advises a lot of famous CEOs. He’s written a ton of books. Most of his books, they’re about competition, but they’re not really about competition. They’re much more about just sort of operating excellence. You know, how do you get your team to perform? How do you motivate your people? How do you train? the managers, how do you get the board to support? It’s a lot of those softer skills that really, that’s what management cares about, right? You know, they always wanna improve their performance, operate better, make their team more cohesive, things like that. You know, I tend to focus on the structural aspects. Well, doing advising on structural aspects isn’t a great business, because most people don’t change their structure of their business very often, but they’re always looking to increase their operating performance. So most of what he’s talking about when he’s talking digital ideas and most of what I’m laying out and sort of adapting from what he says in the book to what I think, it’s really under the category of sort of operating excellence. You know, I’ve referred to this many times in previous podcasts, like there’s the horse and the jockey. The business model’s the horse. Some horses are just faster than others, then there’s the jockey. Some people, some management teams are better than others. So you could call it structural, versus management, you could call it competitive advantage, structural advantage, moats, which is what I use, versus operating excellence. There’s always these two levels to performance that matter when you’re competing company A versus company B. Do they have a structural advantage? Do they have moats? Do they have competitive advantages? Or look, did they just operate better? They run faster, the management team’s better, it has a better culture, they’re more innovative, they’re more agile. You always have to win on both levels. And if you look at my tower, and I’m gonna put a copy of the new version in the show notes, you’ll see that I’ve basically broken it out into those two levels. The top of the pyramid, tower now, I’ve listed competitive fortress at the very top, competitive advantages, barriers to entry and soft advantages. Those are all structural advantages, i.e. motes. and it says right on the left on the top of the tower, motes. Then there’s a gap. And then below that, we have operating speed and excellence. Now, traditionally what people have always said is operating excellence. I’ve changed that a bit because I think speed has become so important in anything digital, that it’s not just about being better, it’s about being faster. It’s about being data-driven. All of that is sort of encapsulated in operating speed and excellence. And this is what a lot of management consultants talk about. They’ll talk about like McKinsey will talk about agility. That’s their term. BCG will use a bit other terminology. People talk about it, flexibility. They will talk about it, rate of learning, innovation, culture, people, all of that sort of gets wrapped up into this general term, operating speed and excellence. And it’s pretty fuzzy and I mostly don’t. go into that in detail because it’s not really my area. I look for everything above that. Where look, it’s just a faster horse. You know, I like it when one horse is a lot faster than the other. Now, that said, if you look at the bottom of my tower, I’ve broken operating speed and excellence into two levels. One of them is yellow, and then one of them is just blank, no color at the bottom. Everything in color, yellow, green, red, are areas where I think you can build real advantages. That’s where I think you can actually be better than another company, where you can pull ahead of the pack, where you can have a structural advantage. At the bottom, when it’s just sort of white, I’ve put digital operating basics, tactics, dynamic competition. I think that’s just normal back and forth of business. It’s important. You have to do it. You can’t win that game. You just have to play forever. So that’s kind of how I’ve broken it. If you look at the bottom of the tower, under operating speed and excellence, I have two levels. Smile and other marathons, and then below that digital operating basics, tactics and dynamic competition. I generally don’t talk about that bottom level because I think that’s just ongoing. You gotta do it every day. Your competitor offers promotions on Tuesday, you have to offer them on Wednesday. They added ATMs, you have to add ATMs. Back and forth, back and forth, dynamic competition. However, I pulled out certain activities that are under operating excellence that I call marathons, where if you are consistently better at certain activities, it’s like running a marathon, where yes, you’re all running the same marathon, but you run a little bit faster and you can start to pull away from the pack. And over time, you can pull away further and further and further. And you can see that in companies where it’s like, Look, they’re all competing, they’ve all got operating excellence and speed, but in a couple dimensions, a couple companies are just way ahead of everyone and it’s unclear that you can ever catch them. And I’ve listed five of those which I call SMILE, SM-I-L-E, SMILE Marathons, which are scale, machine learning, innovation, rate of learning, ecosystem orchestration and participation. Those are all dimensions of digital competition where I think if you run faster consistently, you can pull ahead. And at a certain point, it’s almost impossible to catch you. I would say Elon Musk has that at SpaceX in terms of innovation. He’s been innovating day by day in making rockets, inventing new hardware, new technologies. step by step over 20 years, he started to pull ahead and he’s so far ahead now, his competitors like Blue Origin look at him and they’re like, he just makes better rockets than us and he’s way ahead. I don’t know if we can ever catch up. He doesn’t necessarily have a structural advantages, but he’s been running a innovation marathon for 20 years in building rockets and he just slowly pulled ahead and pulled ahead and pulled that, uncatchable, probably. Now if he messes up, they could do it. Anyways, that’s kind of how within operating speed and excellence, I break it into those two levels. Certain aspects of digital competition, you can pull ahead if you commit yourself to a marathon like innovation in digital, like rate of learning in digital, like ecosystem orchestration in digital. Everything else below that, I put into this general bucket of digital operating basics, tactics. dynamic competition. It’s just a laundry list of stuff you all have to do. If you’re running restaurants, managing restaurants, you got to do a ton of stuff every day that’s just the operating basics. You got to clean the stores, you got to refresh the menu, you’ve got to refurbish every now and then, you’ve got to do marketing, you’ve got to manage the supply. Those are all just operating basics of running restaurants. Well in a digital world, there’s digital operating And I think what Ram Tran is talking about, most of what he talks about that he calls competitive advantage, I just call digital operating basics, but it’s a good list. So that’s kind of the point of today. Here’s a list of what I think are the operating basics in a digital world. Everyone’s gotta do them. If you have a digital aspect to your business. If you’re running restaurants, you don’t actually have to do so many of them. Okay, so that’s me sort of teeing this up. You can look at the graphics there and see how I’ve laid that out. So with that, I’ve laid out six digital operating basics. They’re in the show notes. This is about 70%, 60% Ram trans thinking. So I’ll summarize that, but it’s a little bit of mine too. Here’s the list. And they all kind of feed on each other. They’re all linked. So number one, scale and growth at small incremental costs. One of the benefits of being in a digital operating world and not a traditional operating world like opening restaurants. is you can grow much faster, much further, without any constraints, at a relatively small incremental cost. So number one, scale and growth at small incremental cost. If you are in any type of a digital operating business, you wanna be thinking scale and growth because it’s one of your biggest advantages. Opening stores takes decades. You can grow Netflix from one country to 50 countries in two to three years, right? So part of that, and this is Dr. Ram’s thinking, is like, he says these businesses wanna target or imagine a hundred times, 10 times, 100 times market space that you can transform or that doesn’t exist yet, and then you wanna grow to fill it. I mean, if you have the ability to grow really, really big, you wanna target a really big opportunity. Maybe it doesn’t exist, maybe it does and you’re transforming. And you kinda wanna have confidence that You don’t necessarily see the path, but you have confidence that whatever the obstacles are, you can overcome them. Which is Elon Musk land, right? He doesn’t know how he’s going to get to Mars, but he thinks he can figure it out. Now that’s kind of number one in this, which is basically go big, take advantage of growth. So growth is part of every digital operating playbook. It’s the basics. Number two, personalization and customer-facing innovation is key. And this is Dr. Ram’s, I, you know, focus that, look, one of the benefits of a digital world is you can really understand your customers for the first time in a way that you never could. Could be consumers, could be businesses, but you’re so data driven now that you wanna have a direct tie with your customers. One, because you can solve problems for them you could have never solved before, but two, you can also understand them. Most CPG companies like Nestle and Unilever and all this, they didn’t really ever know the consumers. They sold to markets. and stores and distributors. And then they did general marketing, but they didn’t actually sell directly to you and me. Well, for a company like that, now the key is to build a direct relationship with your end consumer, start to gather data from that, and then start to innovate against their consumer experience all the time. And it never ends. What do our consumers want? What else can we do? What pain points can remove? What part of the end-to-end experience can we solve and advance and make better? And that is sort of the ultimate deep well of value creation because it turns out in digital world you can continually do that forever. The iPhone gets better and better and better every year for 15 years. It doesn’t seem to end. So that’s kind of where you live and the ultimate personalization, that you want to evolve towards a market of one. Instead of being mass market, you are optimizing your product, your service, your experience, your customer communications to each individual person. And that is just a huge lever to pull in terms of value. So that’s number two. Now I actually, if you look at my tower, I have put market of one up as a soft advantage. I think that is beyond just operating basics. I think that is a real advantage when you are customizing everything person to person. I don’t think it’s a structural like moat, but I think it’s more powerful than just the basics. Okay, number three, you have a digital core for your operations. The essential weapons in your operations are algorithms and data. You are data-driven across the company. It’s not like we’re a real estate company at the core and we’re opening stores. No, at our core, we are software data and algorithms. And that enables us to innovate faster than others, to understand faster, to make decisions as a management team faster, because our central operations have been digitized. So we’re always combining and refining our algorithms. We’re always improving. We’re always making incremental tiny improvements to everything. If you do that rapidly, so operating speed and excellence, that is very hard for competitors to beat. And the best companies like Facebook and them, I mean, they run, I don’t know the exact number, something like 30,000 experiments every year on their customers. I mean, the experiments happen automatically, that they’re always just making little changes, changing the font, changing the color, trying out new features, all of that all the time. and constantly just improving, improving, improving. Now, obviously, to do customer innovation, to do increasing size, you need to be data-driven. So all these first three points feed on each other. Number four on the list, ecosystem and connectedness. Now, that’s not Dr. Ram’s language, that’s my language. You have to stop thinking like as one standalone company, we’re a factory. We make glasses, we roll them off the assembly line and we sell them. You have to think of the connections between your company and other companies. That’s one of the benefits of digital. It scales quickly, which I mentioned. It can be data driven, which I mentioned. It also lets you connect to other players easily in a way that is actually very difficult with people. But if you have a good digital core with lots of APIs and lots of connections, there’s tremendous benefits from that. You can start to gather data from everyone and that feeds your digital core. You can start to coordinate on innovation. You can start to coordinate on research. You can work with other companies to provide new customer solutions and services that one company could never provide. Right, so all of that ecosystem and connectedness ties into the digital core. It ties into continual innovation for customers. All of it sort of links together. Now, Dr. Ram, what he says is most made, when he says ecosystem, he means something different than me. He says every major player should have at least 10 partners that you connect to. And you share data, you meet a range of consumer preferences, you can grow faster than otherwise because it’s 10 of you working together. You’re continually refreshing your technology and innovation. That’s eight to 10 partners every company should have. Now, if you move into larger ecosystems, Facebook, Amazon, you have tons of APIs. You’re connected to thousands of parties, different. Okay. All right, so those are sort of the first four I talked about last week. I think you can see they all sort of fit together. They all support each other. I think that is all. for the most part a very very solid basic operating playbook. That’s, you know, I don’t think most, I think every company has to do all of those things. So this is like everyone in restaurants has to be good at real estate, they have to be good at supply chain, they have to be good at marketing. Those are just the operating basics of being in the restaurant business. Well in a digital world I think you have to do those digital operating basics well. Pretty much every company that has a software component, which is more and more companies. I don’t think any of those are advantages except for maybe market of one, ultimate personalization. Okay, and that brings us to number five. And this is an area I don’t really talk about and I don’t really feel I’m terribly good at. So I’m gonna just summarize Dr. Ram because I think this is most of what he does when he does consulting, which is number five, people, culture, and work design. need to form a social engine that naturally drives innovation, execution, personalization at a very rapid pace. So this is all about just people. How do you organize your people? How do you feed them data? How do you give them structure? How do you build a culture at the board level, at the senior management level, at the team level? You know, that’s agility, that’s management consulting, that’s… That’s just a different type of question than I ever deal with. And I generally avoid this because I don’t feel like I’m terribly awesome at it. But your decision making is designed for innovation and speed and continual improvements. So in his book, which I recommend you read, I’ll put the book in the show notes, I think this is his best thinking. I think his thinking here is incredibly well thought out and I think it reflects the fact that he’s been advising Fortune 500 companies for decades at the highest level. You can really tell that this is stuff he understands very, very well. So I’m just going to summarize his thinking. None of this is mine. He talks about like you have to organize not in a traditional hierarchy of silos. Well there’s the marketing department. There’s the R&D department. There’s the geography silo, that’s the Thailand operation, that’s the Vietnam operation, right? These geographic silos, these product silos, these functional silos, which is traditional management consulting. I used to do a lot of this, but I’m not an expert at it at all. That’s not, and usually they have multiple layers to the organization. Your hierarchy might have five or six or seven layers between the CEO and staff at a local restaurant. I mean, he’s kind of saying, look, most companies now that are digital first in their operations have no more than three layers. There’s Jeff Bezos, there’s layer one, there’s layer two, there’s layer three, that’s it. Now, the reason that never existed before in the world, and that’s what Amazon uses, is because you didn’t have the tools to make that work. You had to have reporting up and down the chain. You couldn’t let your junior staff just be making decisions. You had to have reporting. That was about moving information up and down. You had to have decision-making, being moved up and down for various things. Well, now if you have a digital core with common information, common data, total transparency, you can start to operate in a much more effective way with three layers. And the way he lays this out is it’s basically all about teams. You’re basically building teams, eight to 10 people. And you’re empowering these teams to take a project like launch this product, it’s WeChat, it’s a new idea, build a small team, eight to 10 people, go. As a team, you are totally responsible. From design, initial concept, to delivery, to execution, to making it work. You have all the information you need. because you have access to the digital core. And we are gonna shield you from all the other activities that a manager normally has to do. You know, you don’t have to do any of your normal duties. We strip that from you. You have one job, go, go, go, go fast. And you basically break the operations of a business into bite-sized missions. And then you give those to standalone teams and you don’t tell them how to do it, you tell them what to do. And then the how is their responsibility. Go figure it out. So it’s a combination of what McKinsey would call agile management, these agile teams. It’s a combination of that with very fast feedback from a digital core that gives you real time information on what’s working and what’s not. It’s the combination of those two things, teams, a digital core. and you just get these very rapid smart teams that are trying things and getting immediate data and reiterating and changing and go, go, go. And across these organizations, you have hundreds of metrics that everyone sees for what’s working and what’s not. So real time information becomes transparent across the organization. We make a decision on Tuesday, we see the results in the metrics on Wednesday. Bam, bam, bam. A lot of self correction. Very easy to launch new products quickly, get data, revise them, remove the risk. You know, it used to be to launch a product, you know, you have to study for six months, 18 months, market research, roll it out, all that. You know, if gaming companies are famous for this, gaming companies will make changes to their product, the video game, every week. They’re continually operating this way. And in terms of agile meets data, video games and software companies have traditionally been the fastest. Xiaomi, which I’m very impressed with their management team, when they launched the Xiaomi phones back in 2011, 12, they were making changes to the operating system every two to three days. You know, it was incredibly quickly. So here’s how Dr. Ram summarizes this, which I think his language is outstanding. He says companies like Amazon, or I think he talked about Fidelity Investments, they use three organizational levels, three organizational layers. with quote, high quality, high velocity decision making with continuous innovation, superb execution and a laser like focus on aligning the company with the customer experience. I mean, that’s really good, right? And it kind of touches on the things I just brought up. So I’ll read it again. Three organizational layers with high quality, high velocity decision making. plus continuous innovation, superb execution, and laser-like focus on aligning the company with the customer experience. Right? Anyways, he talks about like some examples about how companies have done this. Teams are typically 10 to 15 people. They tend to be co-located. You kind of put them all in the same physical location. They all see the information from each other. You get rid of command and control decisions. You get rid of reports going up and approvals coming down. You don’t want anything to take like six to eight weeks to see if it works, right? If it’s six to eight weeks to see if something works, you’re not playing the right game. That is not operating speed and excellence in a digital world. He actually makes one point, which I was sort of really impressed by. This will be kind of the last one. He says the key to all of the things, all of this stuff, digital planning, laser-like focus, blah, blah, blah, the biggest tool in all of this is, quote, simultaneous dialogue. The rest, the minimal organization levels, the integrated autonomous teams, transparency, it’s simultaneous dialogue by which information is shared between teams and within teams. And in that process of talking it over, where everyone is data driven, everyone’s looking at the same number, biases get checked. People who rely on their authority get put in their place. It’s the best idea. There is sort of a shared reality that emerges and is understood by everyone based on the simultaneous dialogue data. And that really becomes the culture. Then they can start to sort of triangulate around the best ideas. They can solve problems quickly. You get rapid iterations, refinements, break out, breakthrough problem solving. Anyways. I think his thinking is pretty impressive. Okay, I think that that’s enough. So that’s number five in digital operating basics. How does this relate to marathons? Because I’ve kind of said, look, this is just baseline stuff for operational speed and excellence. But at a certain point, if you run a marathon along certain competitive dimensions, you can really pull ahead. I think The things that I have mentioned, Smile Marathon, you can see they’re all in there to some degree. SMILE, the I stands for innovation. If you’re doing this sort of operating game well and you get better and better at innovation, you can start to pull ahead of your competitors in making rockets, right? If you get better at rate of learning, that’s the L, you could see how certain companies like Shein or Amazon are just learning about the ecosystem faster than anyone else. In any case, you can kind of see those SMILE bubble out of this people, culture, social, asset way of operating. And number six is money making at scale. All of this activity, all this innovation, it’s got to be tied to a business model that throws off cash flow. And given that one of the benefits is You know, we can grow very large, get very big. You want to have a system that starts to generate operating cash flow at scale. One, because it’s a big opportunity and two, because it makes all this sustainable. You got to have a cash machine at the center of this thing. Why is that valuable? Well, because what do we do with that money? Do we send it to shareholders? Well, maybe, but it also, that’s where we flood money back into things like innovation to improve the customer experience, right? That’s how we try new things like, look, we’re a gaming company, let’s jump into e-commerce. You know, if we have a sustainable cashflow at the center, we’re able to make big bets. at less risk and we’re allowed to flood money into them such that they have a higher likelihood of winning. So in any of this you need at least one powerful money making opportunity and that’s kind of why you wanna target a really big market opportunity with your high scalability digital capabilities. As you start to capture the large opportunity, if you’re successful. you’ll start to throw off more and more money because this is usually economies of scale. Usually your gross margin will start to increase and usually you’ll find more cost reductions over time. So, you know, that’s kind of what you want. Now the way Dr. Ram says this, here’s how he describes it. I don’t really buy how he describes it. I think I like the way I think about it more. He says, look, operating leverage is about prepaid expenses. You know, some expenses you pay as you go along. You know, you pay your labor as you go along. But other things like you build the software platform first, it’s a prepaid expense, and then the revenue comes later and you start to increase your operating leverage. Operating leverage, which I’ve covered before, what is the incremental increase in operation cashflow based on incremental revenue? So if my revenue goes up $5 from wherever it is, what happens to my profits? If my revenue goes up 10%, does my profit go up 10% or does it go up 12%? That’s operating level. It’s marginal increase in profits versus revenue. Anyways, that tends to happen in a lot of digital businesses. So he points out that like, look, gross margin tends to increase over time with these companies as they get bigger. Yes, that’s true. You often get negative working capital, which I always look for. Yes, that’s all true. You can use this cash to continually improve the customer experience, the personalization, which I’ve already kind of said that’s a big lever. Okay, fine, I don’t really buy that. I think it’s right, it’s not how I break it down. I think what he is mostly talking about is the unit economics of traditional software businesses like Adobe, which I’ve covered before. Right, well that’s where you tend to have these prepaid expenses. You tend to grow, you tend to get operating leverage which expands your margin at the gross margin level and at the operating profit level with scale. And then you also start to get economies of scale and so on. That’s fine, and I think that’s true, but I think a lot of what we’re seeing when we talk about cash engines at something like Garena, it’s not about the prepaid expenses, it’s about the business platform. And we start talking about AI-based business models, they have different economics as well. So I think there’s a lot more going on here with the unit economics than just that approach, which is a pretty traditional software picture. But I think the conclusion is right that look, you really need a cash machine at the beginning. Okay, so if you’re looking for the cash machine, if you’re looking for money making at scale, what do you look for? Well, for those of you who read my stuff, I think you know what I look for. I look for growth, I look for cash gross margins, and I look for operating spending versus operating profits. such that those three numbers, three to four numbers, are going to change over time with size, and they do. And that’s always what’s confusing. Like this company’s growing, but they’re still spending a lot on marketing, so they’re operating cash flow negative. But is that just a reflection of their spending for growth? Is it gonna turn positive? If so, when? I mean, that’s always the question we’re looking at. And sometimes that happens, which I think is gonna happen with Shopee. it never happens like DD and Uber. You know, I did a talk on Pinduo Duo, or was it a talk or an article, you know, are they ever gonna make profits? And someone pointed out rightly that in the first to second quarter of this year, they did actually show an operating profit, which is kind of interesting. Anyways, yeah, you wanna look at growth, cash gross margins, not percentage, but cash. and then the big operating spending over time, both for the core engine, right? Because we have a core engine we’re building, we’re going for scale against a big 10X or 100X opportunity. But if we’re being agile and innovative, we are also launching new products and services, usually against the same customer. and those can create entirely new revenue streams. So you wanna look at those numbers over time for the core engine, but you also wanna see the creation of multiple other revenue streams over time. And then suddenly you’re a company that has six or seven major revenue streams, all with these same economics playing out over time, which is pretty much what Alibaba intends that look like right now. Some of his thinking, why is this valuable? Cash gross margins. I mean, what does a gross margin show you it reflects pricing. It usually reflect reflects pricing ability your brand value It shows you your repeat usage It can change with mix of services. It can change with your ecosystem partners and who you’re connected to Jeff Bezos Steve Jobs. I think this is where they they lived was the gross margin number because if you get to scale and you get big, the gross margin explodes in value, right? If you’ve got a tiny gross margin and you get really big, stuff doesn’t work out. So that’s kind of why the first point in this list was you want to target a big potential volume, so that at a certain point, that is a possibility. and you try and increase your gross margin over time. By innovation, you try and reduce costs over time. Generally, the operating profits will take off at a certain point. You might use capital raises early on to really go for growth, knowing that your gross margins will explode at a certain point. You wanna sort of stack more and more initiatives, products, services that all have positive gross margins. Anyways. That’s kind of, I think that’s all good point. That’s interesting. The other one, CAC, customer acquisition costs. As you start to stack different products on each other, all serving the same customer base, you know, your customer acquisition costs are quite low. Alibaba is amazing at this. They’ve built their whole business off serving Chinese consumers. and then merchants to a lesser degree. And they keep offering them more and more services and they just keep stacking gross margins on them. And their customer acquisition costs are very, very low. So that’s kind of great. And hopefully these things have great opportunities. Some of them generally have S-curves and they really take off. Some are slow growers, some don’t grow huge, some grow medium. You kind of got to know what type of product service you’re dealing with, but. Let’s see, one more point. So last point, this is Dr. Rem. He talks about OPEX, which is like CAPEX. Like we all know what CAPEX is, right? You know, you have a bunch of tangible assets, factory equipment, whatever. And that doesn’t generally show up on the income statement. It shows up on the balance sheet. And then the part that shows up on the income statement is the depreciation. You know, it shows up as capex spending out of cash flow, goes onto the balance sheet, and then it shows up as depreciation on the income statement. And then you can separate that into two buckets, maintenance capex and maintenance, or I’m sorry, growth capex. So certain CAPEX is just to support what we’re doing. Usually it matches the depreciation. And then other CAPEX is about growth initiatives, which will have a different RONIC. Okay, I think everyone’s familiar with that, and that makes a lot of sense when you think about factories. So he talks about OPEX, which is the digital version of that, which I think is a good way to think about it. And that’s really how I’ve always thought about it. I just never called it OPEX. where he says, you know, most of the money you spend building your digital assets is not capitalized. It’s on the income statement as expenses. How much money do we spend on people? How much money do we spend on software? We record it very, very differently, but you really wanna record it the same way you record CAPEX, hence OPEX, which stands for operating expenditures. You know, you wanna pull it out of the income statement and show it as OPEX being spent out of free cashflow. and then it goes on the balance sheet, and then you amortize it on the income statement, and you also wanna split it into two buckets. What is my maintenance OPEX and what is my growth OPEX? So, C Limited had tremendous growth OPEX to launch Shopee, but it has ongoing maintenance OPEX for Garena. and you wanna look at those two expenditures differently. You wanna pull them all out of the operating statement, I’m sorry, the income statement if you can. Often it’s difficult, because it’s people, and it’s hard to know how they spend their time. But, I mean, that’s gonna play out in a major way, right away, because if you’re taking things out on the income statement as expenses and not OPEX, that’s gonna decrease your taxes. One is gonna decrease your operating profit. you may look like you’re not making any money and then it’s going to decrease your tax burden when in fact you might actually have very healthy operating profits they’re just being hidden by the fact that you’re expensing something that should be capitalized and we do that with factories all the time if you’re looking at starbucks and you want to get a sense of their operating profits you’ve got to capitalize their rent because those are really not leases. They’re capitalized leases. If you rent a store for 10, 15 years, it’s not a yearly monthly expense, it’s an asset you bought. You’re just paying for it over time. Right, so same thing. So it’s really gonna impact your sort of, if you’re looking for earnings, net earnings of Amazon, you’re gonna be totally off on what their true operating profits are. Anyways. I think that’s pretty much it. But you can see how that funds all the other initiatives. So that’s basically six digital operating basics. If you want a short list, here’s the short list. Go after a market space that’s really big and capture it by innovating continually for the customer. Number two. Put the digital core at the center of your operations. Number three, build an ecosystem that expands your capabilities and makes you stronger. Number four, figure out a money-making machine at the center of this to keep funding one, two, and three. That would be a simpler version of all of this. One last quote from Dr. Rem, quote, think of customer experience and transform it with technology that is customized and continually improved through data. And that will generate cash as it gets delivered at increasingly low incremental costs across multiple geographies. Unquote, the quote continues later, digital technology makes the incremental cost of delivery that end to end experience to consumers closer to zero. The business becomes a cash machine and that cash can be used to further increase the market. Anyways, I think that’s a great quote. Okay, so I put all six points in the show notes and they’re in the concept library under digital operating basics and they’re at the bottom of my tower. So I think that almost covers it. One last point. Okay, so bottom of my tower, half of the tower is about moats. structural advantages half of the tower is about operational speed and excellence what is the building block of operational speed and excellent i’ve kind of i’ve broken it into marathons digital operating basics tactics dynamic competition things like that what i’m really looking for i’m looking for companies that are data driven that the core operations are digital that they’re obsessive about the customer experience and always innovating and personalizing as much as they can. Their improvements across the entire organization are rapid, continued, very, very fast. They’re good at collaborating and partnering and they’re increasingly becoming connected. to ecosystems that are continually changing in themselves. That would be kind of my short list if I had to describe what I think of operational speed and excellence. And I think all of these at the end of the day are table stakes for the digital world. I don’t think these are advantages. I don’t think it’s enough. I think this is just table stakes to get in this game. If you want to be better at this and have an advantage, you’re gonna have to specialize in one or two digital marathons and pull the way over time on one to two dimensions. That’s kind of my take on all of this. So that’s probably it for today. And I’ll get back into companies next week. These two talks were pretty theory heavy. But yeah, the two concepts for today, digital operating basics, thousands tower. And the link to Dr. Ram’s book is in the show notes. You can go over in Amazon. I recommend you get it. I think some of his thinking is just so far ahead of almost everybody. You can really tell he’s been doing this for a long, long time at the highest level when he starts talking about organizing your board and organizing your management and your teams. That part really kind of impressed me to no end. Let’s see, as for me, I don’t know, it was another awesome Sunday in Thailand. I tell you, every day is a good day. Even when it rains and thunderstorms, it’s real nice. It just puts me in a good mood. I don’t know why. I hope it lasts. A lot of things in life don’t last forever. I used to feel the same way about New York for a long time and then at a certain point it didn’t. So hopefully that won’t happen, because that would suck. But yeah, it was just a great Sunday. I took the scooter out. I went down to Central World, the big shopping mall. Everybody’s out again, which is great. Real kind of nice day. And what else? Oh, I am… I took possession of my new condo a couple days ago. That’s always kind of a nice feeling, like when you go and you sign the last paper and then they hand you the keys, and then you sort of go and you walk in, you’re like, ah, it’s sort of the first time it’s your place. That’s always a little bit of a memorable thing. So that was great. And then of course it turns out there’s issues. It’s the top floor of this condo building, so it’s pretty high up there for this part of town. And of course, you know, brought in the engineer and they looked at it before and they said, yeah, there’s an issue with the leak in the roof that’s coming in one of the rooms. So that was a new thing I got to learn to deal with. Fortunately, that’s not my problem. It’s the condo association, the juristic office. The roof is their problem. So they came out and they’re working on it. So anyways, learn a little something new every week. But yeah, it’s pretty exciting. I’m gonna bring people out and do a little painting and make it look nice. And yeah, it’s great. I’m really happy with it. Here’s the weirdo part. Like I’ve lived in a lot of parts of the world and. You know, I was an Upper West Side guy in Manhattan for a long time. I was sort of right across from the Natural History Museum. It was great. I like my condo here better. And it’s, I mean, I like it better. I think it’s better. I think the view is better. I enjoy being there more. I like everything about it better. And it’s like one seventh of the price. Like, I’m not even exaggerating. It’s got to be one seventh or one eighth. You know, it’s, you think about value for money. And that’s pre-tax. Right? You live in Manhattan, which I did for many years. You know, that’s New York State City and federal income tax. So post tax, you know, it’s even I don’t even want to do the numbers. So, yeah, it’s it’s funny how that works out. But that’s sort of my little devious plan in life is to earn all my money in the West, have my cost structure for life based in a developing economy, which I basically pulled off. and then try and figure out how to access welfare state of Northern Europe, which I don’t know how I’m going to pull that part off. Like I got to marry a Norwegian girl or something, but that would be the ultimate thing. Like cost structure of Thailand, income out of the West, benefits from Norway. I haven’t figured out the last bit yet, but you never know. I might pull it off at some point. Anyways, that’s it for me. I hope everyone is doing well. I hope this stuff is helpful. If I can ever be of help, don’t hesitate to reach out. Yeah, and I will, next week is podcast 100. That’s crazy. Like it’s amazing how time goes by, isn’t it? Anyways, okay, that’s it everybody. Take care and I will talk to you next week. Bye bye.