If we look at Microsoft’s business lines, we can see 7-8 significant businesses. It’s a big company. But I think it’s mostly about 4 particularly dominant businesses. They are:

- Azure, which is part of a global cloud oligopoly (AWS, Azure, Google Cloud).

- Windows, which has long been a global operating system monopoly.

- Office, which is also close to a global monopoly its is area.

- LinkedIn, which is pretty much a professional social network monopoly.

And there is quite a bit of other stuff. Such as GitHub, Xbox / gaming, Skype and so on. Additionally, Microsoft has several important new products, including Microsoft Dynamics 365 and Power Platform.

This is Microsoft’s graphic for how it all fits together.

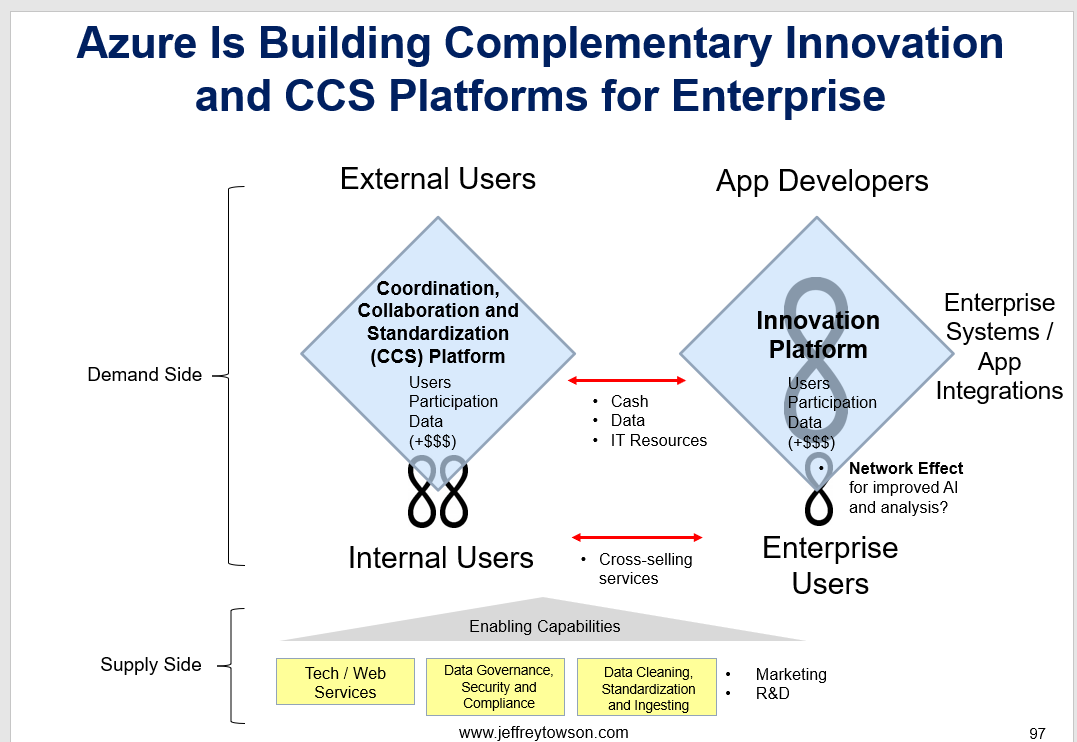

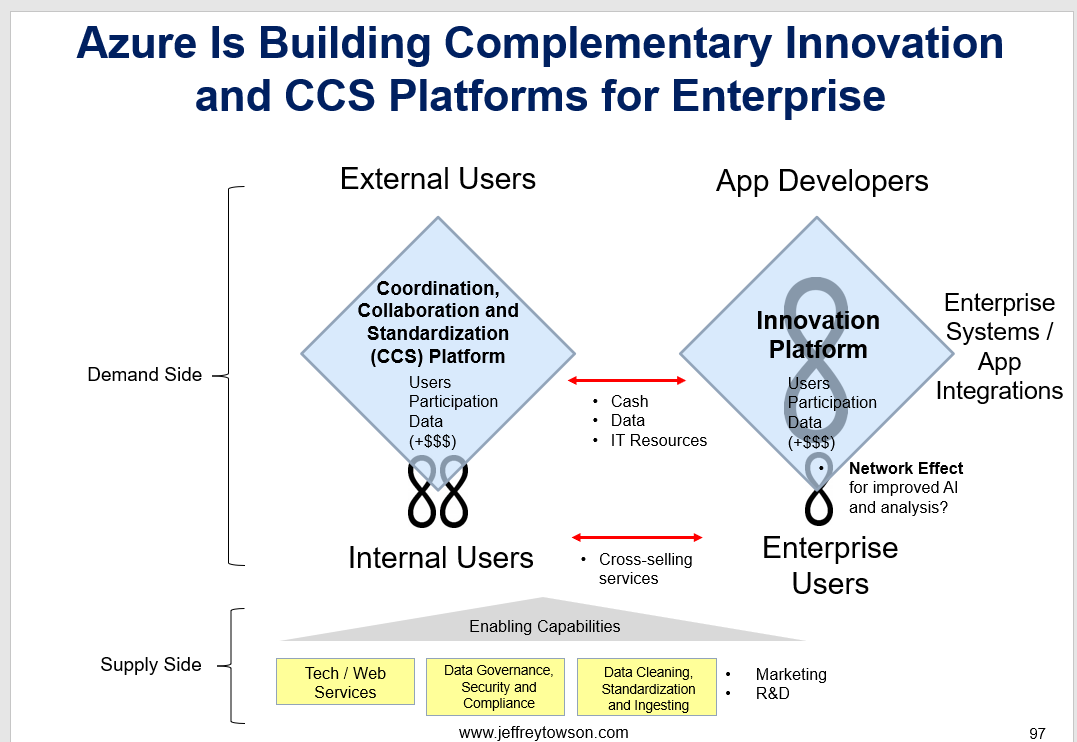

But in Part 1, I argued that Microsoft is basically building 2 platforms plus cloud infrastructure. I think this is a better explanation for most of what is happening at the comapny. They are building Azure Cloud infrastructure (which is expensive) and they have two complementary platform business models – which are:

- An innovation platform. These are their operating systems which connect developers and computer users – on personal computers but mostly within enterprises.

- A coordination, collaboration, and standardization (CCS) platform. These enable collaboration within and between users at enterprises.

So my graphic for Microsoft looks like this:

You can see the two platforms, which support each other. You can see network effects. There are common user groups. There is lots of cross-selling and bundling. And supporting these two platforms are enabling capabilities, which increasingly include security and compliance. If this doesn’t’ make sense, please look at Part 1,

Ok, that’s my basic take.

So how does this relate to CEO Satya Nadella’s recent comment:

“Microsoft 365, Dynamics 365, and the Power Platform, on top of what we’re doing with Azure, is the core of what we are doing as a company.”

He cites three products (Microsoft 365, Dynamics 365, Power Platform) as key to what Microsoft is doing with cloud and going forward. How do these products relate to the “two platforms plus cloud infrastructure” framework I just outlined?

It’s actually simple.

I think these products are about Microsoft upgrading and increasingly integrating their two big platforms. In fact, I think are three major upgrades happening (which I will detail below). Once you see that, I think you will find most of their activity (especially M&A) make a lot of sense.

Upgrade #1: GitHub and the Power Platform Are Powerful Upgrades to the Innovation Platform

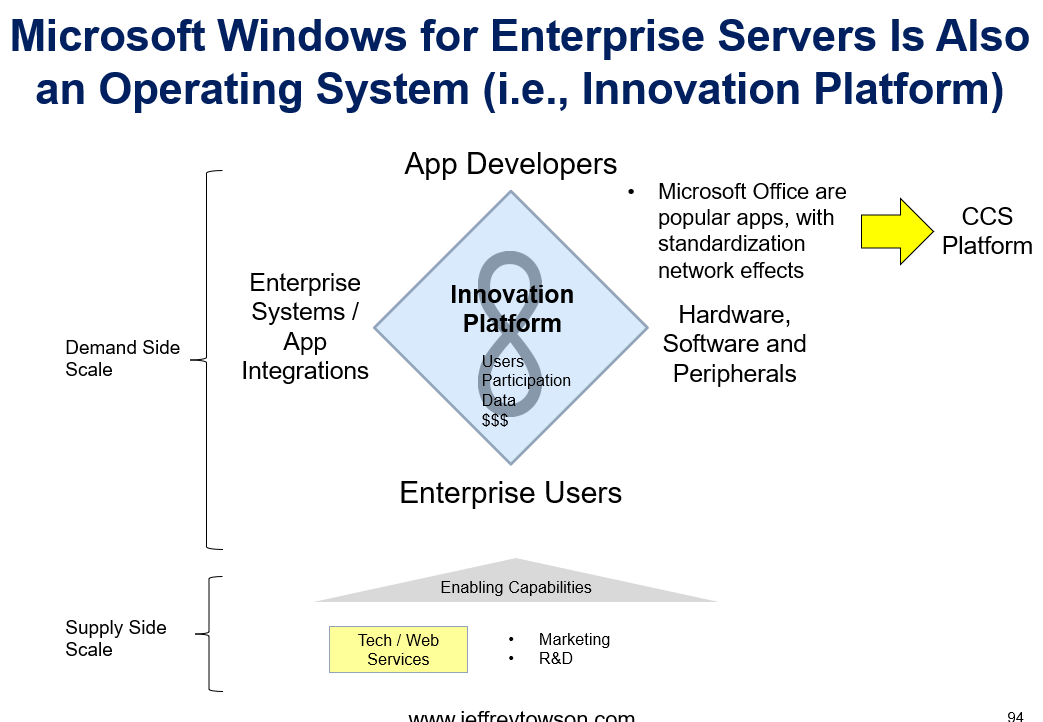

Take a look at the Part 1 graphics I used to show Windows as an innovation platform (for personal computers and for enterprise).

You can see the two user groups: app developers and computer users. This was for personal computers and then for servers at companies. You can see the network effects. You can see additional integrations with both hardware and peripherals as well as with other enterprise systems. This is basically the innovation platform they are moving to Azure cloud to become its operating system.

Now think about how Microsoft’s acquisition of GitHub increases the number of developers on this innovation platform. In 2022, GitHub had over 83 million developers. It is used by companies globally to host and develop open source software development projects. GitHub can be seen as a huge increase in the number of professional developers associated with Microsoft. Note: GitHub developers have created vast libraries with some +200 million repositories. It’s a quantum increase in the developers on this platform. And it was an awesome move if the goal is to build a global innovation platform running on the cloud.

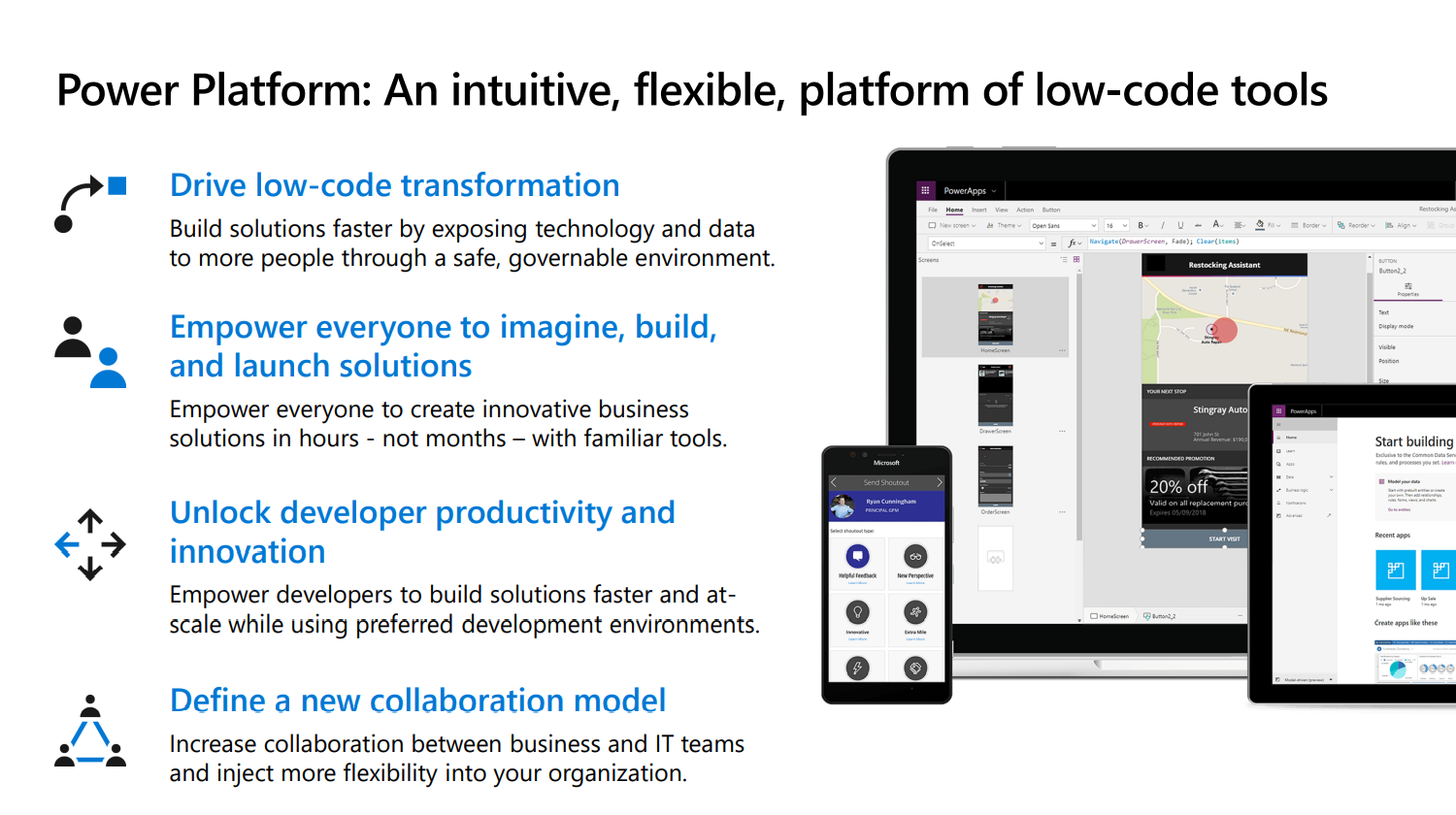

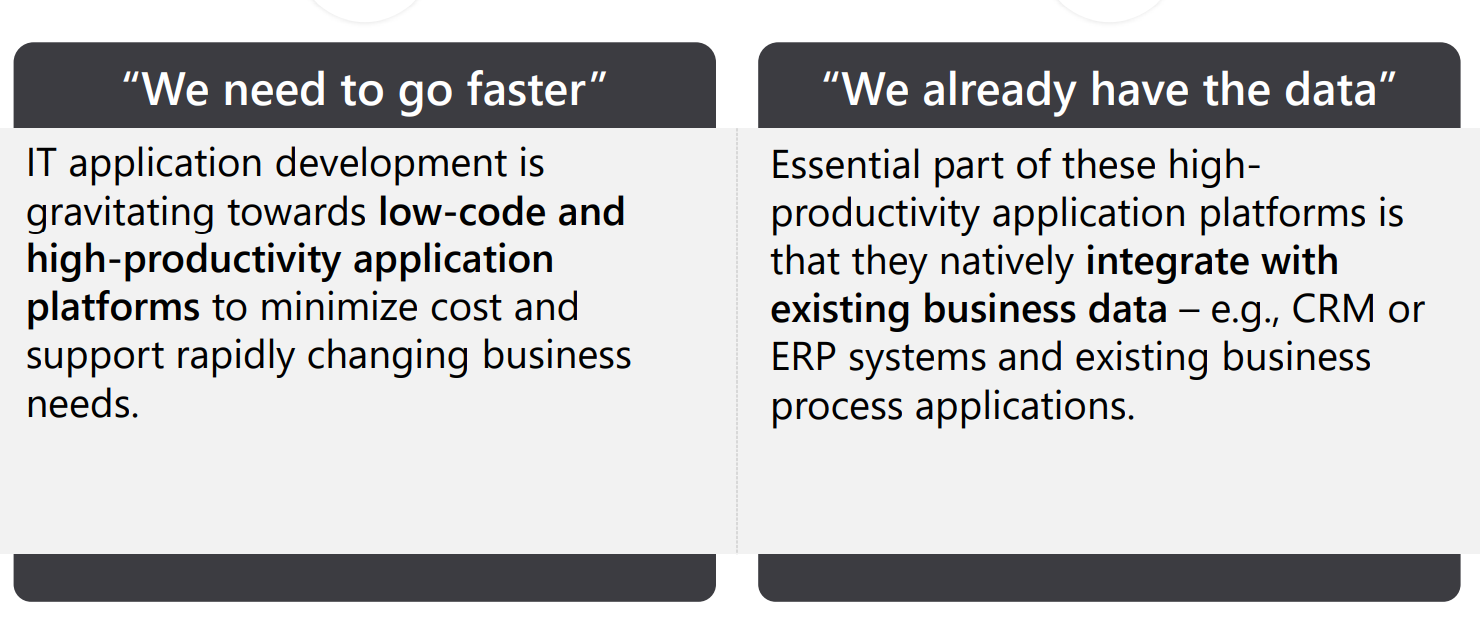

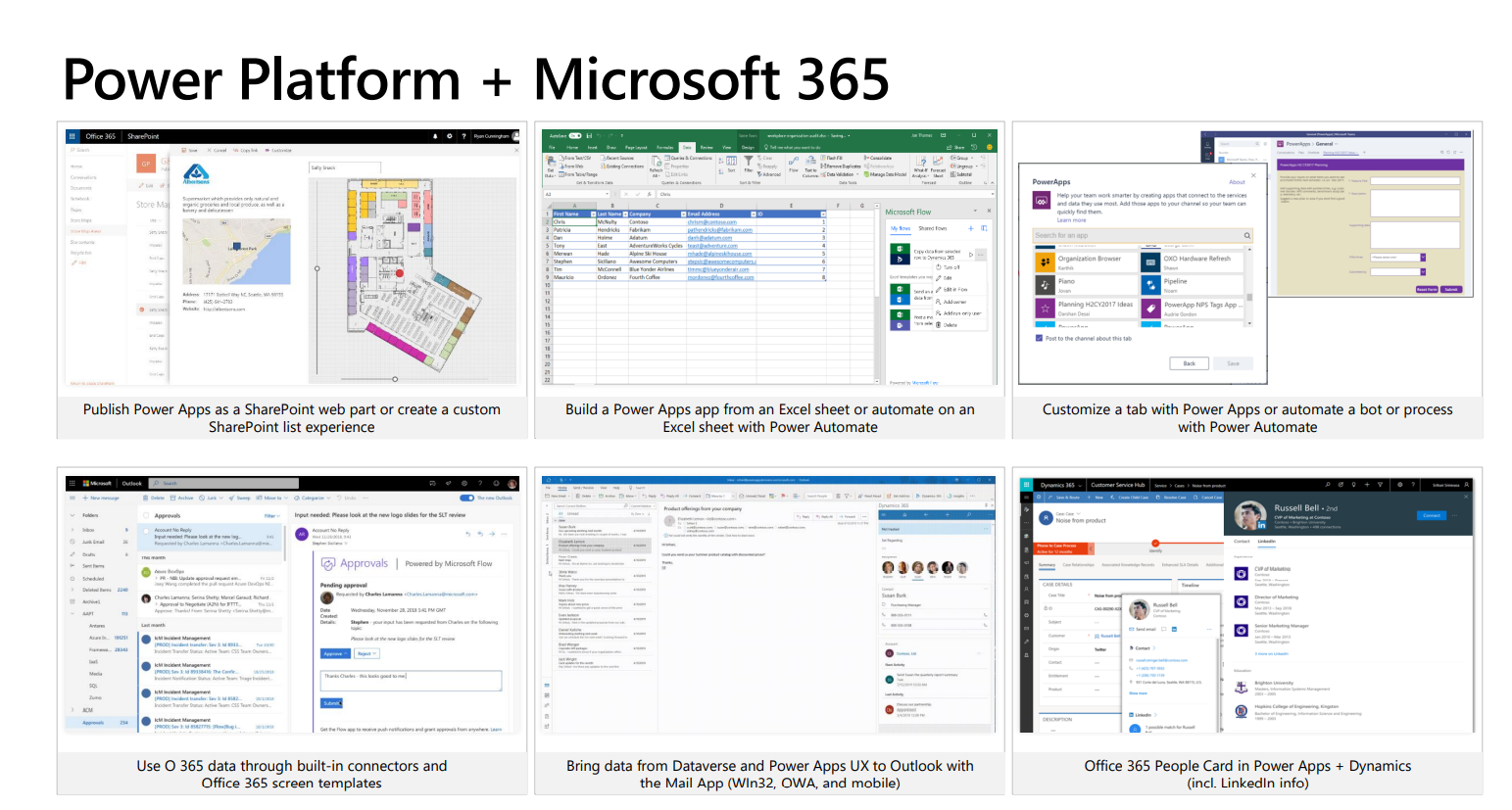

But it wasn’t as daring as the launch of Power Platform. Microsoft’s Power Platform is a family of products for low code and no code developers. It’s a product suite that includes:

- Power Apps, which is graphical software for writing low-code custom business applications.

- Power BI, which is software for visualizing data with different kinds of charts. It competes with tools like Tableau.

- Power Automate, which is a toolkit for implementing business workflow products

- Power Automate Desktop, which is robotic process automation (RPA) software for automating graphical user interfaces.

- Power Virtual Agents, which is software for writing chatbots

Power Platform is all about offering tools for low code and no code development. Basically, they are enabling everyone to become a developer, even if they don’t know how to code. They are doing the same thing to code development that TikTok did to video content creation. They are democratizing its creation and dramatically expanding its supply. You can view Power Platform as a huge addition to the number of developers on this platform business model.

One of the reason TikTok and YouTube are so powerful is because have a long tail of content types. You can basically watch videos about any small niche topic that you want. They have this long-tail of content because they have so many content creators (TikTok in particular). We should see the same phenomenon with Power Platform. By enabling low code and no code, there will be a dramatic increase in the number of long tail apps available to users (especially companies). Microsoft says Power Platform solves the problem of “there is no app for that”. It will also mean more robust network effects.

From Microsoft:

Microsoft says over 500,000 organizations are now using Power Platform every month. This includes both Fortune 500 companies and SMEs.

I view GitHub plus Power Platform as big upgrades to the innovation platform. They are increasing the number of professional developers and they are adding an entirely new class of amateur / low code developers to the platform. That will mean far more tools and apps available on the platform. It will dramatically increase the long tail of apps. And it will make a more robust network effect. Microsoft calls this “no limits”.

Note: Power Platform can be particularly helpful for businesses that already have lots of data, but can’t find the app they need. This is a pretty common scenario.

Ok. On to the next point.

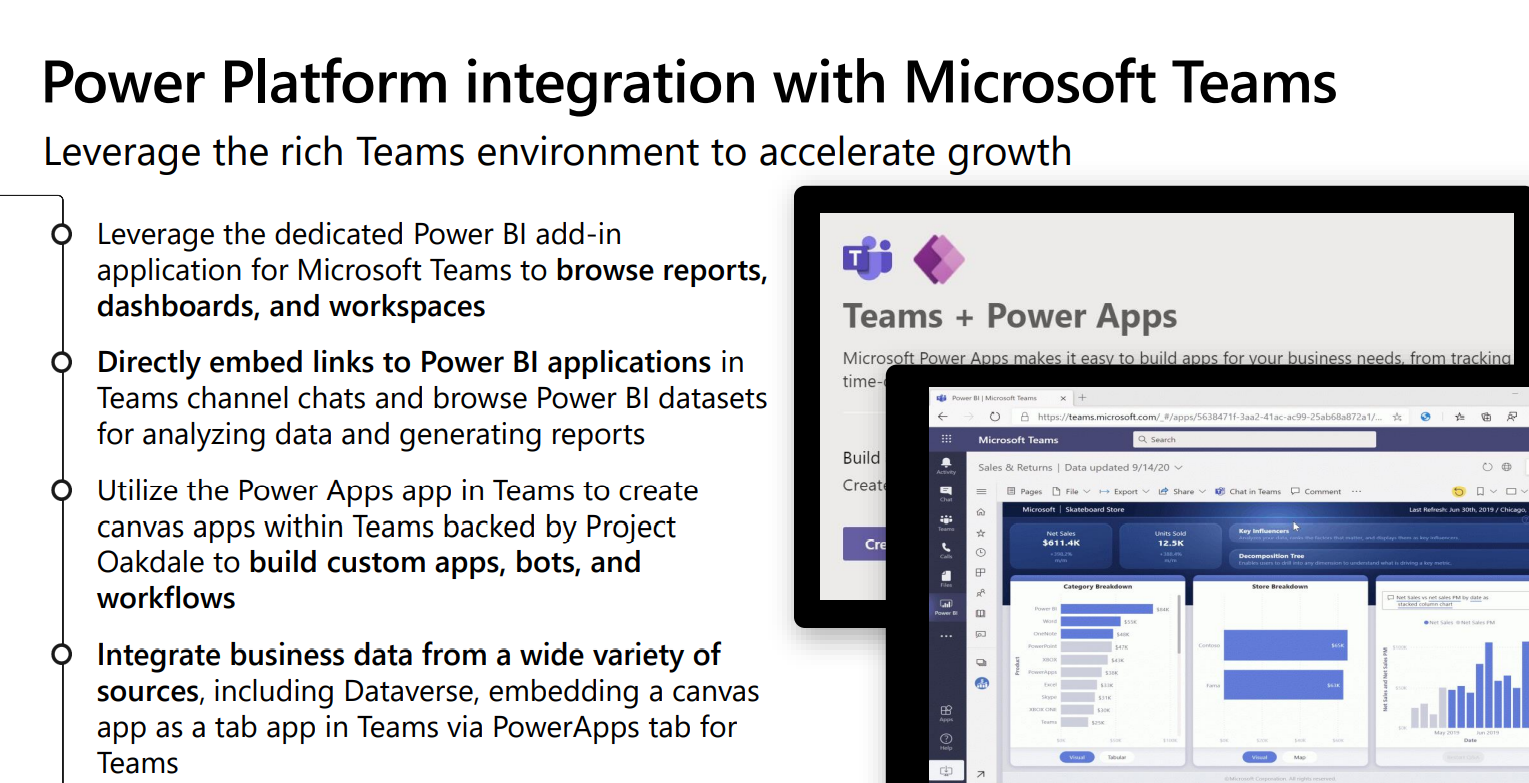

Upgrade #2: Microsoft 365 / Teams, and Dynamics 365 Are Upgrades to the CCS Platform

In Part 1, I used the following graphic to show Microsoft Office as a CCS platform (for enterprise).

Note the two users groups and the direct and indirect network effects. There are also additional integrations with the enterprise systems. And on the right, I have listed 4 common types of collaboration – Team Projects, Communication, Data Intelligence and Operational Integration.

In this case, the upgrade is from Microsoft Office to Microsoft 365 plus Teams. Over the past 5 years, we can see a dramatic increase in the productivity and collaboration tools offered. And in the types of collaboration that are possible. There is reason it is called Microsoft Teams. It helps people to work together and collaborate.

Compare the below list of tools below to traditional Microsoft Office.

I think we can also see a big expansion in the types of collaboration this platform enables.

- Productivity software has expanded to communications software.

- There are lots of tools to support team projects.

- This is a big focus on enabling data ecosystems and data management.

- It appears there are going to be more tools for work automation.

And this brings us to Dynamics 365, which is part of the suite of collaboration tools (especially ERP and CRM). Here are the summary slides.

To me, Microsoft 365, Microsoft Teams and Dynamics 365 look like a big upgrade to the collaboration platform discussed. They are all increasing the tools and types of collaborations possible.

Ok. Last point.

Updated #3: There is a Big Increase in the Integration of the Two Platforms.

Finally, look again at the Part 1 graphic I used to show the integration of the two platforms.

I highlighted some of the ways these complementary platforms strengthen each other. There are common user groups. There is cross-selling and bundling. There is data sharing and common IT resources. But really, there is a lot more than this.

Look at Microsoft’s own graphic for its business. There is a big focus on integrating the various services. They all strengthen each other.

Note their comments about:

- “Bridge processes, productivity and collaboration”

- “Integrated workspace for teamwork”

- “Share data and records seamlessly”

- “Boost collaboration selling and engagement”

In fact, they explicitly talk about how Microsoft 365, LinkedIn, Power Platform and all the rest are going to support each other.

And pay close attention to the sharing of data. This is a problem for Snowflake.

Ok. That is most of what I wanted to point out.

Microsoft was already a powerhouse of a business model. But the movement into cloud and the upgrading of these two platforms makes it even stronger. It’s really impressive.

That’s my breakdown.

Cheers, Jeff

——–

Related articles:

- Microsoft’s Azure Strategy Is “Two Platforms Plus Infrastructure” (1 of 2) (Tech Strategy – Daily Article)

- What is Elon Musk’s Plan to 10x Twitter? (2 of 2) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Innovation Platform

- Coordination (CCS) Platform

- Cloud Services

From the Company Library, companies for this article are:

- Microsoft: Azure

Photo by Ed Hardie on Unsplash

———-

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.