Newly public Grab has recently had an investors day (September 2022), with lots of presentations by CEO Anthony Tan, COO Alex Hungate and others. It was quite good and had a surprising amount of detail. I went through the slides and found what I think are the important take-aways. In this and the next article I will be summarizing the important take-aways.

Earlier this year, I wrote two articles about Grab outlining its strategy. And its operating cash flow problem.

My summary was:

“There is a tremendous amount to like about Grab’s business. It has 2-3 platform business models that have strong-to-dominant positions in SE Asia:

- Mobility (ride-hailing, taxi, scooters, etc.)

- Food delivery

- Payment and financial services (in process)

The problem is Grab doesn’t have a cash engine. The company is losing money. It likely has lost money every year of its existence. So, there is also a big strategy question facing the company. Which is:

- Can Grab turn its impressive business model and market strength into operational cash flow? And if so, when?”

Here is how I assessed the company:

- “Grab has established itself as an “everyday everything” app in SE Asia.

- Grab is a very well-known brand across SE Asia.

- The focus on high frequency, daily services is smart. It’s a good target for digital platforms.

- Grab is very strong in its two main categories – mobility and food delivery.

- Grab claims to have 50% of the delivery market in SE Asia. They cite the #2 player as being at only 20% of market share.

- Grab claims to have 70% of the mobility market of SE Asia. They cite the #2 player is being at only 15%.

- The situation in their financial services / payment business is less clear. This whole business is being turned upside down right now. And regulations country-by-country are a problem. But Grab does say that 40% of GrabPay payments took place outside of its app, which is interesting.

- Overall, Grab is building 2-3 platform business models. That is fantastic.

- The user groups are consumers and merchants (not drivers).

- Mobility is a marketplace platform for a local, commodity service. That is much weaker than most marketplaces. Generally, you want differentiated products / services and to be regional or global.

- Food delivery is a marketplace platform for local, differentiated services. Ideally with a limited operational component. Enabling food reservations is more profitable than enabling food delivery.

- With increasing usage and scale, Grab is well positioned to build lots of demand and supply side advantages.

- These are complementary platforms that can support each other.

- Grab says 55% of its consumers use more than one service. And this has been increasing.

- Grab says 66% of GrabFood drivers were also working as mobility drivers.

- Finally, Grab is well-positioned for continued innovations and improvements in the user experience.

- They have lots of users and data. They can continue to innovate and improve the user experience, which is their best defense long-term. They can continually stay ahead of rivals in the value their bring to consumers, merchants, and drivers.

- The company is also well positioned to attack growth adjacencies.”

Reading the investor presentations by CEO Anthony Tan and the others, I think most of my description is accurate. And honestly, I think mine explanation of their business model is bit better.

***

But there were two areas that really jumped out in their current plans.

- Geographic density and other tech-driven cost efficiencies

- Growth tactics and strategic moves

These two together are most of their plan for getting to operating profits.

I’ll talk about the second one (growth tactics and strategic moves) in the next article. In this one, I’ll talk about their focus on geographic density and other tech-driven cost efficiencies.

Geographic Density and Other Tech-Driven Cost Efficiencies Are a Big Priority

I recently wrote about how Meituan finally became profitable.

And similar to Meituan, economies of scale based on geographic density (CA13) are a big part of how Grab plans to get to profitability. That’s not the entire playbook by any means. Growing revenue and cross-selling is critical. But they are also going after multiple “tech-driven cost efficiencies:”. And I think their key one is geographic density.

Here is my standard definition for CA13: Geographic and Distribution Density.

“Geographic density is a competitive advantage that results from having greater customers, volume, nodes, and/or routes within a geographic area than a competitor. For distribution businesses, this can result in:

- Lower costs

- Greater coverage

- Faster distribution times.

Superior geographic and distribution density can be an advantage of the larger players. It’s a scale advantage.”

Sean Goh of Grab management gave an interesting presentation on mobility and delivery. It had some great detail about how they are capturing cost savings in delivery. Their phrase is “improving partner-driver productivity” but it’s the same thing.

From their September 2022 presentation:

The part of the left is not important. This is basically just saying their drivers do both food delivery and mobility services. Fine.

And on the lower right, you can see a focus on increasing driver loyalty. Really, this is about increasing satisfaction and decreasing churn, which is expensive. Onboarding takes time and money. And in theory, you can also get better performance by upskilling and retaining the best drivers.

But the key is improving driver productivity (shown on the upper right). This is really about geographic density and other tech-driven cost efficiencies in delivery. They presented a good breakdown of the actual steps involved.

Think about the time and cost for each activity within a typical food delivery order.

- Riders must go to lots of different restaurants. This is usually within a 7-10 kilometer radius from their location when receiving the order. They can be close or far from the specific restaurant. And they can be going to lots of different places to pick up.

- At the restaurant, they usually wait while food is being prepared. Or the restaurant is waiting for them.

- They eventually pick up one or more orders from that specific restaurant.

- They then go to deliver the order(s) to one or more homes, which can be anywhere within a fairly large radius.

- They sometimes must wait for the customers at the point of delivery. Especially if they are getting paid in cash.

- They then accept another order and go off to another restaurant,

And that is the simple version. Drivers can also pick up orders at other restaurants as they are in the process of delivering already picked up orders.

Now, think about how these activities change with:

- Increasing customer density in an area. Doesn’t that make the trips shorter? Cheaper?

- Increasing restaurant density in an area. Doesn’t that also decrease time and cost? And increase the options for consumers?

- Increasing order volume in an area. How does this change the batch volume for a driver on a trip? Are they carrying 1, 2 or more orders? How does that change the optimal delivery route?

In the simplest version, greater geographic density or orders means the drivers are now closer to their next restaurant when they receive an order. The spatial distances decrease with increasing orders, restaurants, customers, and driver density.

But the routes the riders take are not fixed. Riders can change the streets they take to decrease the time to both reach the restaurant and then the customer. And as riders are increasingly combining different orders (batch size), they can then optimize their routes for that particular order combination.

Overall, what we should see with increasing geographic density and other tech-driven cost efficiencies is:

- Decreasing average delivery times.

- Decreasing average delivery costs.

- Increasing geographic coverage for both customers and restaurants.

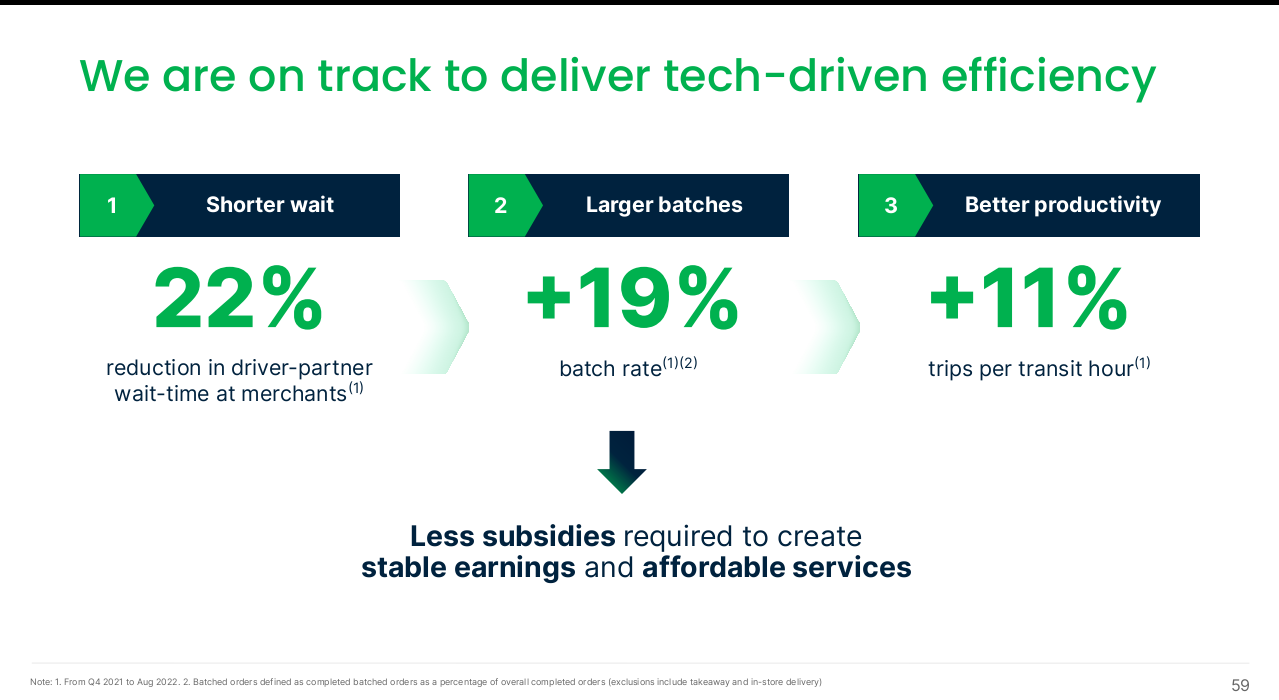

For Grab, they are specifically targeting three metrics for driver productivity with increasing scale.

That is really interesting. Note how this is quite similar to Meituan’s plan to get to operating profits in 2018 (from the annual report, added bold is mine):

“Our delivery rider cost per order further declined attributable to the continuous expansion of our delivery network, improvement of order density and enhancement of our AI-powered intelligent dispatch system. Our gross margin for food delivery in the first half of 2018 expanded to 12.2% from 9.6% in the same period of 2017.”

Note the company’s focus on increasing order density. And on using AI within the distribution operations. This is basically the same thing as Grab (driver productivity), but with different language.

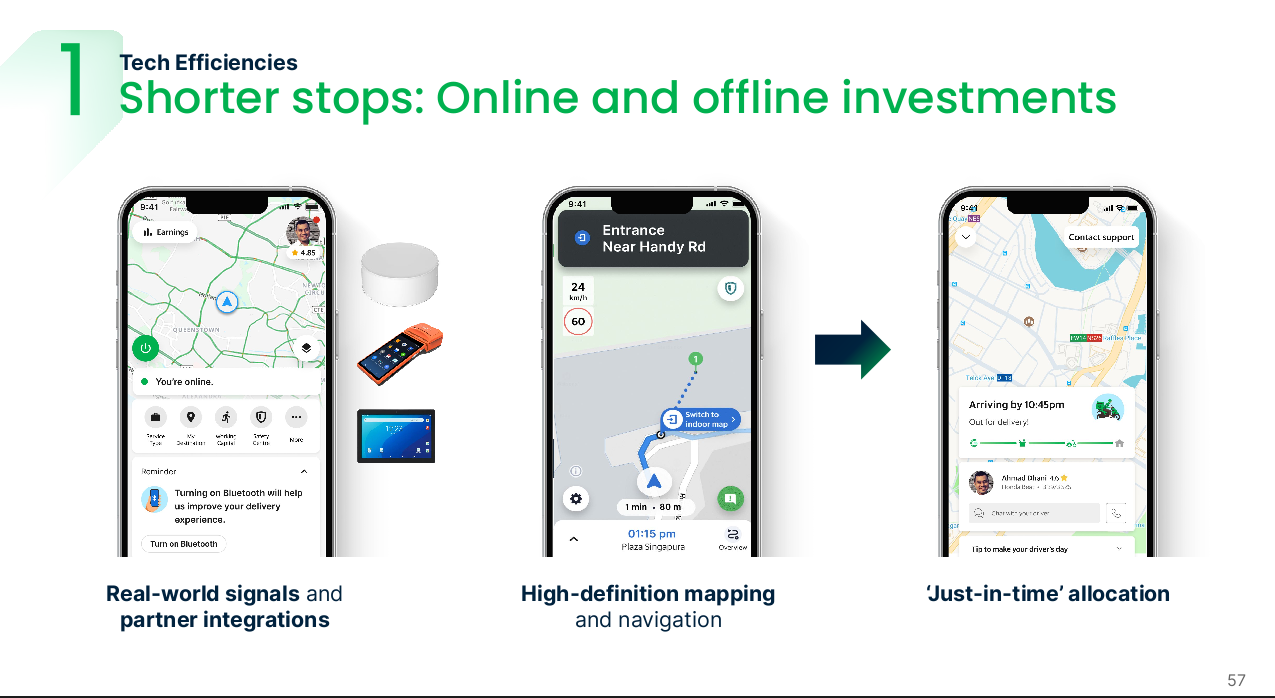

For shorter stops, Grab is pointing to better mapping and geo capabilities.

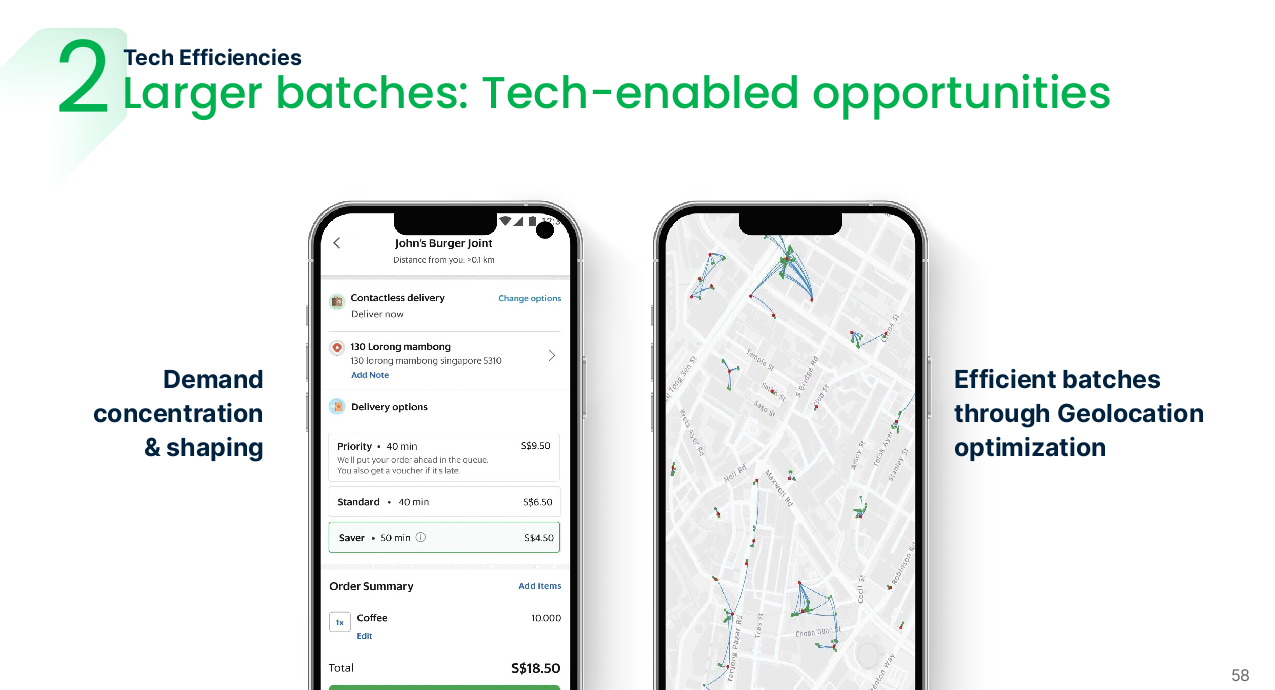

For larger batches, Grab is focused on “demand concentration and shaping”. I think this is basically just AI.

And they actually publish some of the key metrics, which is really interesting.

Overall, that’s some really clear thinking and detail on how they are going after delivery efficiencies. And, as mentioned, this is going to be key for getting to operating profits.

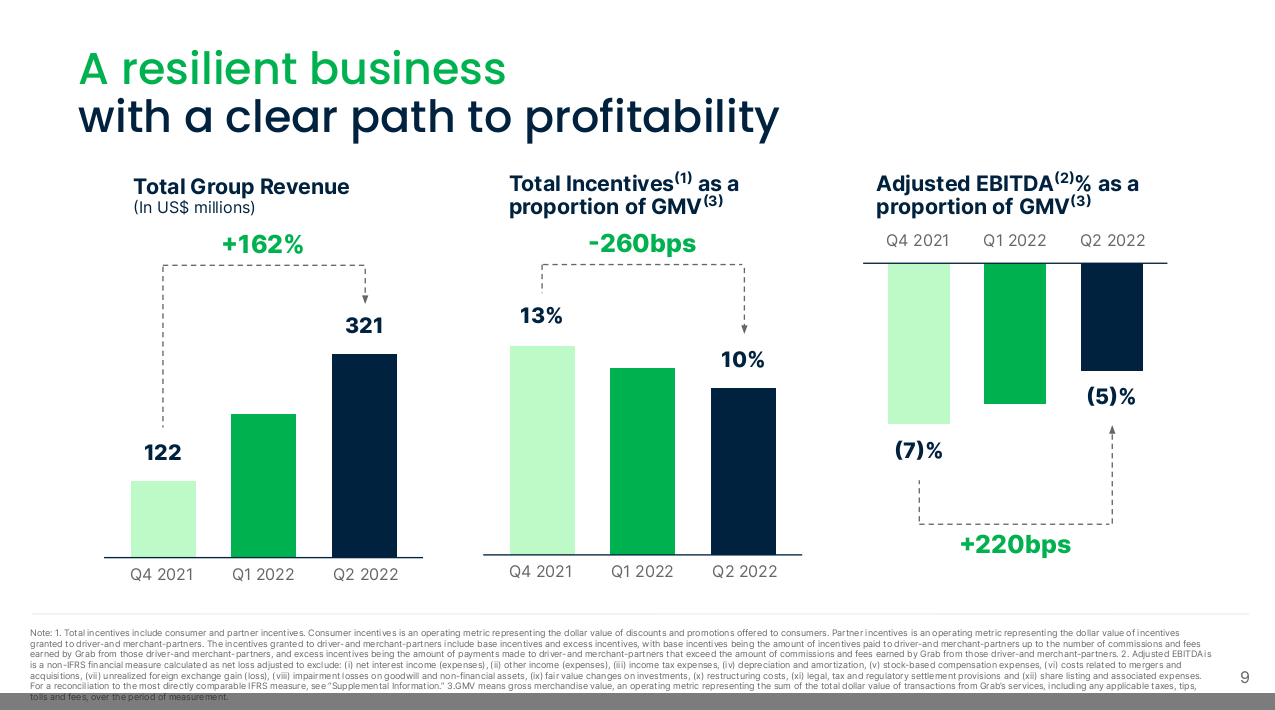

Here is the key slide from their presentation.

The operating profits plan appears to be:

- Increase revenue. I’ll detail that in the next part. It’s pretty cool.

- Increased efficiency, especially in delivery.

- Reduced incentives.

That’s it for this part. In the next part, I’ll detail their growth tactics.

Cheers, Jeff

———–

Related articles:

- Will Southeast Asian Grab Become Meituan or Didi? (Asia Tech Strategy – Podcast 121)

- Grab’s Big Strategy and Cash Flow Question (1 of 3) (Asia Tech Strategy – Daily Article)

- Grab and Why Operating Cash Flow is Part of the Digital Operating Basics (2 of 3) (Tech Strategy – Daily Article)

- Grab Has 5 Compelling Growth Initiatives (4 of 4) (Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Economies of Scale: Geographic and Distribution Density

- SE Asia

From the Company Library, companies for this article are:

- Grab Holdings

Photo by Grab Media Resources

———-