I have been thinking about JD’s logistics operations for like 4 years. I visited a couple of their warehouses. I toured their robotics laboratory. And I am always looking for their cool logistics videos (see here or below).

But it’s hard to see the whole system. Most logistics is behind the scenes. But JD Logistics has just filed for a Hong Kong IPO. And it’s a fantastic read. I spent two days and tons of coffee going through all +500 pages. I ended up with 42 pages of notes. In this article, I’m going to give you my summary of their system.

***

JD’s goal is an integrated logistics and fulfillment network for China. They talk a lot about integrated vs. single service logistics. And how their integrated end-to-end bundled services are a better solution for lots of industry verticals. But I think this is really about the dream of a smart, automated logistics network at scale. They want to become an operating system for moving physical objects in China. More on this below.

Today what they have is a mostly physical logistics network, with 6 components.

- Warehouse network. JD operates +800 warehouses plus 1,400 cloud warehouses (third parties own and operate these but JD provides the software, brand and connection to the core network).

- Line-haul transportation network. This is their fleet of +7,500 trucks and vehicles. Plus +200 sorting centers. This is the system for actually moving things around.

- Last-mile delivery network. This is +7,200 delivery stations and +190,000 delivery people. All in-house although they do access other capacity as needed.

- Bulky item logistics network. This is 86 warehouses and 102 sorting centers for bulky and heavy items (typically furniture and home appliances).

- Cold chain logistics network. 87 warehouses and +2,000 vehicles for fresh produce and other perishable items.

- Cross-border logistics network.

They describe this as 6 synergistic networks. But it is really one network. And it is not unlike what you would have seen 10 years (just bigger). Logistics has long been a mostly physical network. Closer to railroads than telephone systems. The logistics nodes are tons of warehouses and delivery stations. The linkages are tons of trucks, planes and delivery people. And most everything is done by people (almost 250,000 at JD). They have built a very large, labor-intensive physical network.

However…

They are pioneering hardware and software to make this network digitized, connected and increasingly smart and automated. Their software and data technology today are:

- Warehouse Management System (WMS). For tracking people and inventory in and out of the warehouse network. This is real-time visibility.

- Transportation Management System (TMS). For tracking orders and available transport. For deciding optimized routes. For real-time tracking and tracing for goods and vehicles.

- Order Management System (OMS). This is quite important. This is for splitting and merging orders that come in from the various channels. Then modifying them in route, if necessary.

Ideally, a digitized and connected network should enable total visibility of an integrated supply chain. That will have a big impact on decision-making, whether done by people or AI. But they are getting a ton of real time data that will feed into everything from sales forecasting and merchandise distribution planning to supply chain optimization.

The hardware component is also significant. Which makes them different than a lot of the tech companies I talk about. This includes automated inventory handling systems. Such as the storage system, robot picking and packaging and (maybe) unmanned delivery. JD has been moving steadily forward with their Autonomous Mobile Robots (AMR), Automated Guided Vehicles (AGV), sorting robots and self-driving vehicles.

What JD is doing is very ambitious. Bordering on audacious. But what could do you do with such a capability?

From Capability to Service to Operating System

The weakness of competitive advantage as an idea is that it is a snapshot. It is a moment in time of one company versus another. But it does not tell you about the creation of resources and assets over time, especially those that enable the advantage. Resource-based competition is another way of viewing strategy. It looks at how one capability evolves over time. And enables the creation of others. How resources and assets grow is important. And is often path dependent. You’ll note in my competitive pyramid (below) that I have put the creation of resources and capabilities as the bridge from operating activities to completive advantage.

JD is still building their capability, which is a smart, automated logistics network at scale. But I think it has the potential to be used for 3 important things one day (listed below). Today, we are just seeing the first two.

First, the network is a unique capability that parent JD can use as a retailer and a marketplace.

Their network already creates big benefits to consumers (convenience, speed, low price) and merchants on their platform. And this network will be key to JD’s ongoing efforts to improve the user experience over time.

This capability will also be difficult, if not impossible, for their non-Alibaba competitors to replicate. It both enhances their services and creates a barrier to competition.

And as this capability becomes increasingly smart and automated, those big investments in technology should keep paying off. Things should keep improving in performance and cost. That’s the beauty of technology (versus human labor). It advances dramatically over time.

Note: This is all basically the same playbook as Coupang and Amazon.

Second, the network is a service business.

Most of the IPO filing talks about how JD Logistics competes against other logistics (and Saas services) for business customers. Their main point of differentiation is that their logistics and fulfilment network is “integrated” end-to-end. I don’t find this terminology helpful. Usually people talk integrated vs. modular as an architecture. What JD Logistics is really doing is bundling lots of services into industry-specific solutions. Today, JD is JD Logistics’ biggest customer at about 50% of revenue (down from 70% a few years ago).

Third, this network may become its own operating system or ecosystem.

I been writing about this third point for quite a while. And it has been a staple of my talks for the past 2 years. My argument is that once you have a digitized, standardized and connected logistics network (with a couple of service businesses running on it), you might be able to turn it into an operating system. And JD (and Cainiao) have been talking about doing exactly that.

Digitization, standardization and connection is the first step. This is like when railroads all started making the tracks the same size. Or when local telephone companies all started making their phone systems connect. Once that happens, everything can start to connect and work together. So think of all the trucks, robots, packages, IoT sensors, cameras and warehouses in a national logistics system. Now imagine they are all being digitized and standardized. And are able to start to interact and connect in real-time nationwide. This is what is starting to happen right now. That is how JD Logistics is extending its Warehouse Management System to +1,400 external warehouses. The software and other tools are letting those external warehouses with their core network of +800 warehouses. This is their Cloud Warehouse program. Now imagine when this happens with trucks, robots, packages, cameras and everything else.

The next step is to open up the data and APIs to businesses and developers. You want user groups to start creating apps and software that run on the now open network. This is like the App Store on your Android or iOS smartphone. Imagine something similar for their logistics network. It’s not clear to me what kind of apps might run on this network. But its capabilities keep increasing so it’s pretty exciting.

The third step is intelligence and automation. That’s when you add AI, robotics, 5G and cloud computing. What happens when the logistics network just described is automated and run by AI? I don’t really know. But that’s why I titled this article the “dream of smart, automated logistics at scale”

A smart, standardized, automated and open logistics network would make JD Logistics look more like an ecosystem than a company. With lots of hardware manufacturers, software engineers, shippers, receivers and app developers involved.

Ok. Let me take it out of the clouds into something more tangible.

Take a Look at These 3 Cool Charts

What value does JD Logistics offer to businesses today? What is the main value proposition?

Like most B2B businesses, it’s pretty simple. It’s:

- Improved operating efficiencies. The service can (in theory):

- Remove redundant distribution layers.

- Improve agility in the supply chain.

- Increase inventory turnover.

- Optimize inventory management.

- Improved customer experience. It can increase delivery speed but can also improve the accuracy of delivery. And for sectors like apparel, it can increase the ease of returns.

- Better forecasting and intelligent decision-making.

They are focusing on more complicated industry sectors where their suite of logistics services provides a better solution. The ones they mention are fresh produce, FMCG, apparel, automotive, home furniture and appliances and the 3Cs. And they have really good descriptions and charts for these. Kudos to whoever made the three below charts. These are great.

FMCG Solutions

Fast moving consumer goods (FMCG) is usually food and beverage, personal care, beauty and packaged goods. This is about doing logistics for high volume, low cost items with high turnover. And that require omnichannel distribution. Here is their solution for that situation:

I encourage you to look at chart in detail. It’s outstanding.

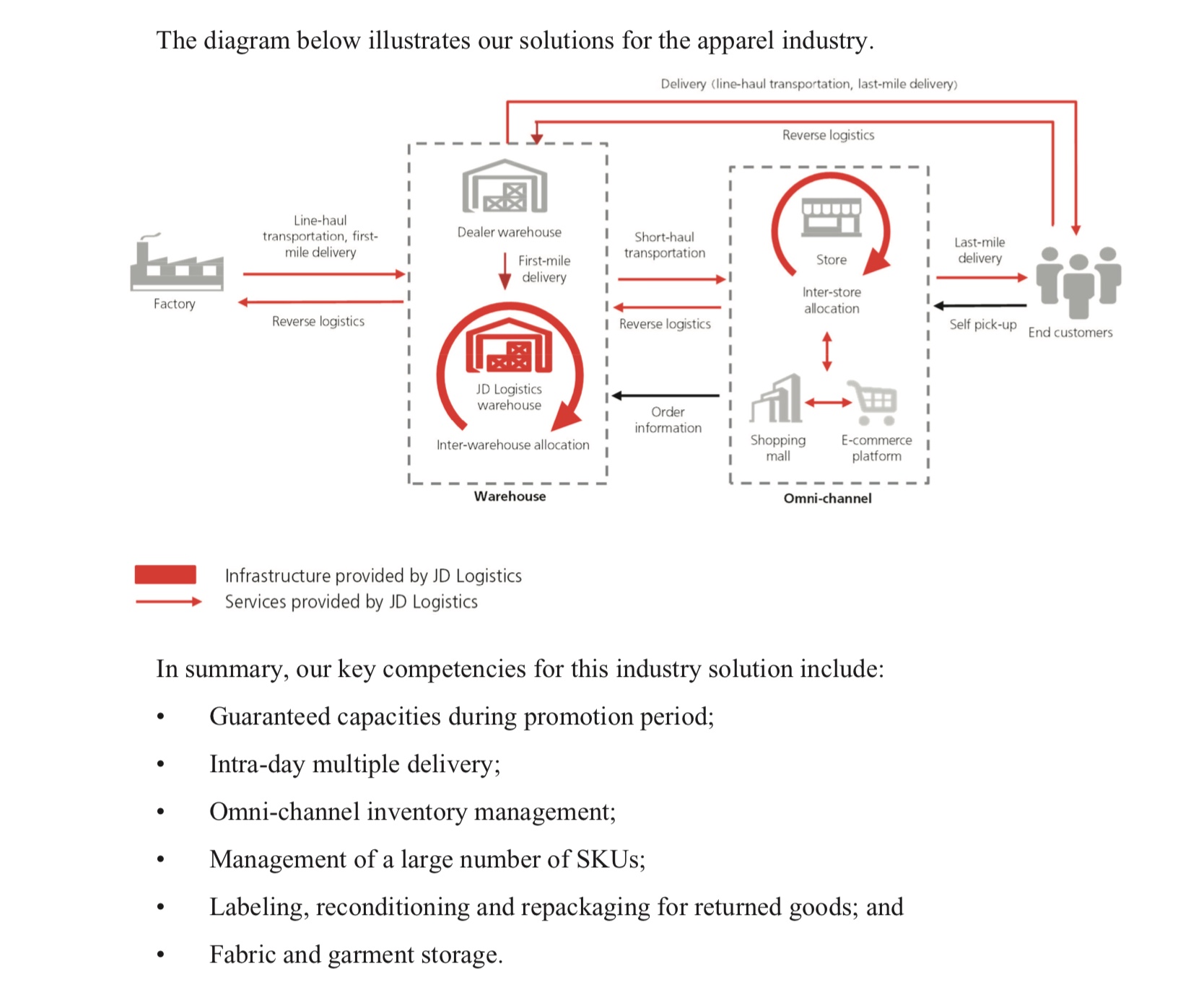

Apparel Solutions

Apparel requires logistics capabilities that can deal with lots of SKUs in small amounts. And can deal with seasonal fluctuations and promotions. There are also frequent returns and exchanges. So the logistics system needs to be flexible and fast-changing. And it is increasingly integrated with the customer IT systems.

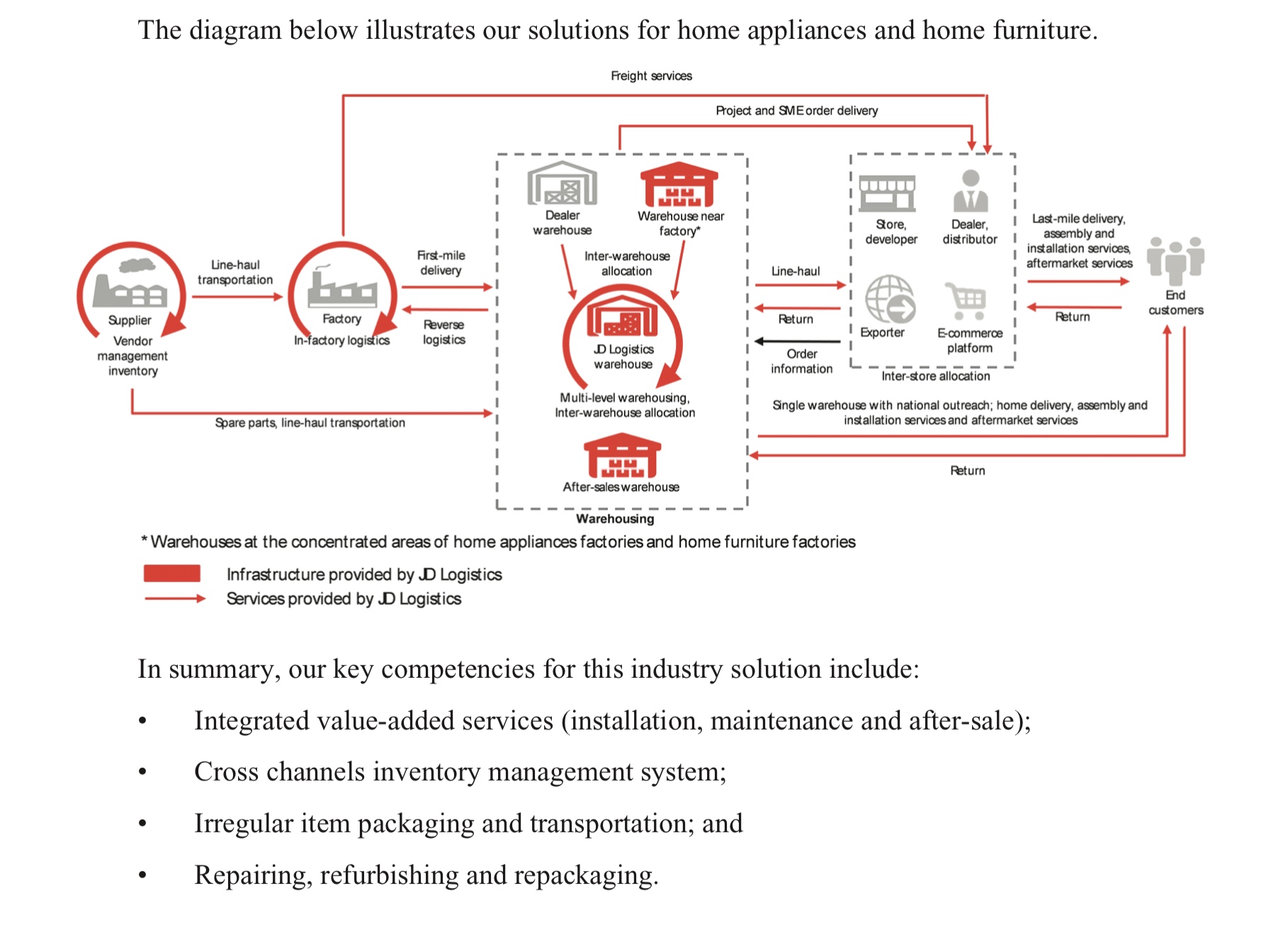

Home Appliance and Home Furniture Solutions

This is about moving things that are heavy and/ or large and odd sizes. Plus, the manufacturers for these items tend to be in a few locations in China. Customers also want installation, repair and refurbishment services.

That’s it for today. I’ll send out more about JD Logistics shortly. It’s a really important company as logistics and infrastructure tends to be the leading indicator for digital China / Asia. Financials are a lagging indicator. Infrastructure is the leading indicator.

Cheers, jeff

————-

Related podcasts and articles are:

From the Concept Library, concepts for this article are:

- N/A

From the Company Library, companies for this article are:

- JD Logistics

- JD

————

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.