Given the political shake-up in China tech, I’ve been shifting my focus to smaller companies that:

- Are not of a size that puts them on the radar for anti-trust regulation.

- Will benefit from government constraints on the giants.

So I’ve recently written about NetEase, the #2 player in gaming in China.

But I think ecommerce is really the best place to look. I recently wrote about grocery delivery company Dingdong, but it has the typical issues with last mile costs.

Really, what I am looking for another Shopee circa 2017, a small ecommerce company that is unprofitable but about to turn on its operating leverage. Or a specialty ecommerce company, which usually means the following scenario.

- A small ecommerce company emerges and gets some traction with a clever product. Or in an interesting niche. This happens regularly in Asia.

- The company shows growth but is a smaller market opportunity. And maybe is still operating profit negative.

- The ecommerce giants are looming potential threats.

So is the company going win? Is it going to get crushed? Do you invest?

I’m trying to come up with a reliable framework for this scenario. I wrote about Oriental Trading Company as an example of a winning strategy for this type of specialty ecommerce (see Company Library).

Here are my 5 questions (thus far) for assessing the viability of a specialty ecommerce company.

- Is the company sufficiently differentiated in the user experience?

- Can the company compete and/or differentiate in logistics or infrastructure without ongoing spending?

- Does the company have a strong competitive advantage in a circumscribed market?

- Is there a clear path to significant operational cash flow?

- Has the company avoided markets and situations that are attractive or strategic for the major ecommerce companies?

Here’s how I think about this as a strategy question.

Based on these questions, I think you can get a reasonable assessment of the viability of a specialty ecommerce company.

- Is it going to be viable financially?

- Can it build up sufficient defenses?

- Is it going to attract lots of serious competitors?

- Can it grow fast enough to actually compete with the majors and survive

- Does it need to sell?

Which brings me to Etsy, an American specialty marketplace for handmade, vintage and other unique items.

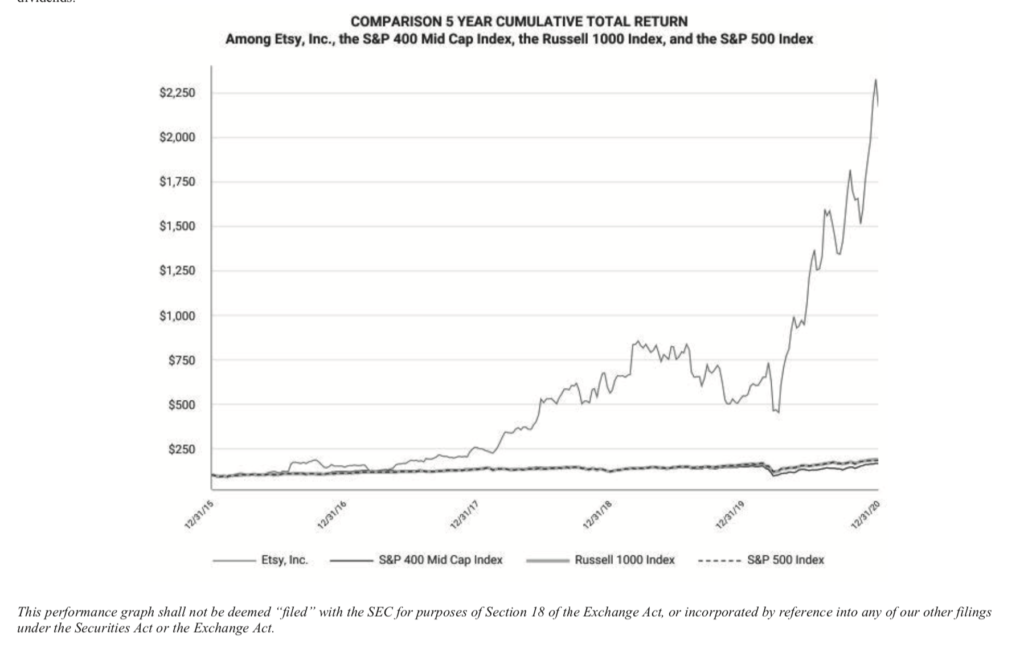

First, take a look at their stock price in 2020-2021. It really did well in the pandemic. The company has since spent 2021 bouncing around a market capitalization of $26B.

An Intro to Etsy

Etsy is a simple marketplace platform for products, with two user groups (consumers and merchants). And it’s mostly in the US, although it has expanded to 6 other geographies (UK, France, Germany, Canada, Australia, India).

Etsy’s revenue growth in 2020 is what really got people’s attention:

- 2020: $1.3B

- 2019: $0.59B

- 2018: $0.44B

Its financials are what you would expect to see in a small marketplace platform with increasing operating leverage:

- Revenue: $1.3B

- Gross Profits: $1.26B (72%)

- Up from 66% in 2019

- Marketing: 28%

- Product Development: 10%

- Down from 15% in 2019

- G&A: 9%

- Operating Profit Pre-Tax: $0.42B (24%)

- Up from 10% in 2019

Plus, it is asset light with strongly negative working capital.

- Net PP&E of $0.112B in 2020

- WC of around -$0.118B in 2020

The only thing I don’t like about the financials is the $1.06B of convertible debt on the balance sheet.

Ok. So what makes this marketplace platform different?

Why is it likely viable as a specialty ecommerce play against the giants?

Short answer: It’s the merchants and the unique collection of items they create and curate – and offer on the platform. They key words for Etsy are “personalized”, “vintage”, “hand-made” and “unique”. It’s a collection of products that are “hard to find elsewhere”.

The merchants on Etsy are “creative artisans and entrepreneurs”, which mostly means solo individuals working at home. They are creating various unique items. Or they are hunting through antique stores and other locations to find unique items. For those in the West, these are the same people who sell at flea markets. Or who make things for local craft fairs.

The categories are:

- Home and living items (#1)

- Jewelry and accessories (#2)

- Clothing

- Wedding and party evens

- Toys and entertainment

- Art and collectibles

- Vintage items (i.e., from certain time periods)

If you want handmade jeans, jewelry from the 1920’s or replicas of the latest SpaceX rocket, you go to Etsy.

Shoppers on Etsy are looking for inspiration. They want a unique style for themselves. In clothing. In their homes. They are looking for a special gift. Or something for a special occasion.

In fact, I recently ordered a replica of the new SpaceX starship. Etsy was literally the only place I could find this. It is being handmade by a guy in the UK.

When I log in to Etsy, the items it currently shows me are:

- Japanese currency from the 1920’s.

- Postcards from around the world from the 1880’s.

- A picture frame that goes on the front door around the peephole. It’s a copy of the one in the tv show Friends.

- A t-shirt about physicist James Maxwell.

- A coffee coaster in the shape of the SpaceX drop ship.

- A handmade samurai sword identical to the one used in the videogame Ghosts of Tsushima. If you want to see that, it’s here.

And that is what makes Etsy different. I don’t think I would see a single one of those things on most other ecommerce sites. The statistic the company mentions over and over is 88% of consumers say they find items on Etsy that they can’t find anywhere else. They big difference is Etsy’s 85M listed items, most of which are unique. They are created. Or curated. And they can be personalized for the customer.

That’s the basics of Etsy. Let me see if my 5 questions hold up.

Question 1: Is the company sufficiently differentiated in the user experience?

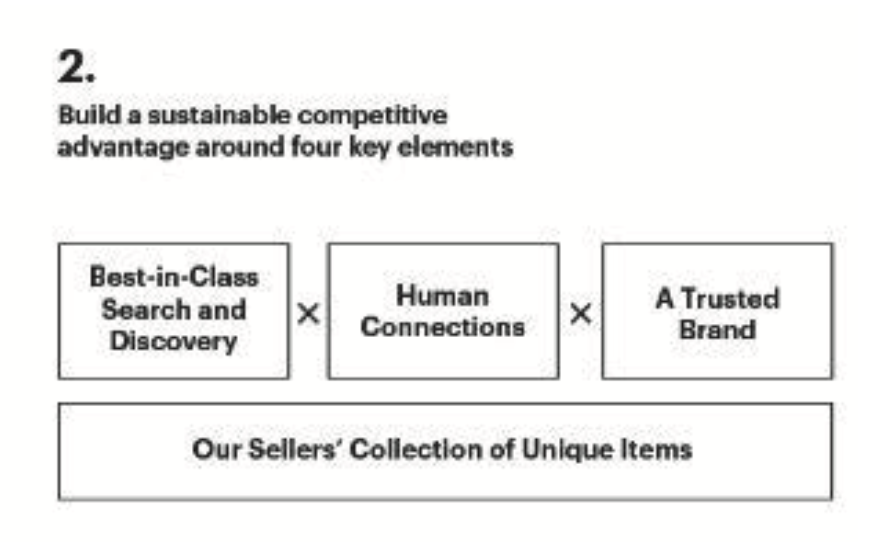

Yes, by virtue of their large offering of unique items. And the company actually explains its differentiation quite well in its filings. They call it a sustainable competitive advantage (it isn’t).

They rightly point to the collection of unique items. But they also point to how this combines with other unique features.

“Search and discovery” is actually important. These are not mass-produced items with SKUs that fall nicely into product categories. These are individually curated or created items. You can’t just label them like stereos and the search engine will find them. Etsy had to create a unique search and discovery function for their unique items. It also has an interesting ability to predict the right pricing for such items.

The “human connection” is also important. Buying a handmade purse from a seller at a craft fair is about the person as well as the item. It is important that they made it themselves. It matters who they are. Etsy is good at emphasizing the human connection between its buyers and sellers. You can email back and forth. You can ask for customization. Sellers are now making video introductions for their products and pages. This human connection shows up in a much higher conversion rate to sales. And in higher pricing premiums.

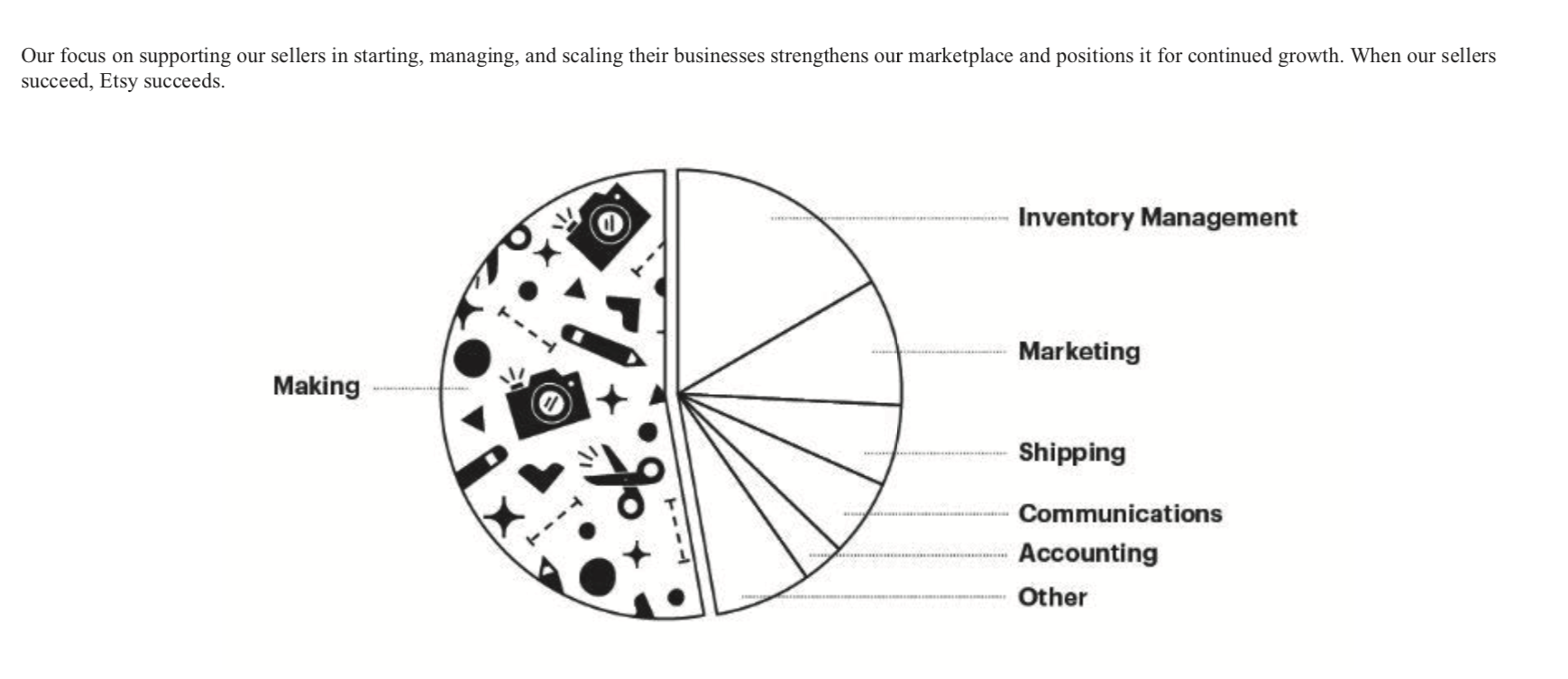

These are additional differentiating factors on the consumer-side. But there are also differentiators on the creator / curator / merchant side of the marketplace. These merchants / creators have very different interests and needs than your typical sellers on Amazon or Taobao. They range from hobbyists to professional merchants.

And their biggest problem is time. They are making these items by hand, unlike mass produced items. So Etsy gives them tools to free up their time from the business aspects, which consumes 50% of their time.

Etsy also provides shipping tools. And it provides them with marketing support. This is actually quite clever. Instead of charging merchants upfront for marketing (like every other marketplace), Etsy pays to market their items on other sites and then recoups that money out of their sales percentage payment.

It’s also worth pointing out that these merchants have few large places to sell their items. They can go to local craft fairs. They can go to local consignment and vintage stores. 55% are selling multi-channel but the scale of Etsy’s marketplace is really important. Access to 81M buyers of crafts is unique.

Finally, these are creators. This is not just a business for them. It is also personal. They want to create, like YouTubers and authors. So the character of the platform has to be like TikTok and YouTube, not just like Amazon. According to Etsy:

- 81% of sellers are women.

- 69% say their shop is a business.

- 97% run the shop from home.

- Only 30% pursue this is their sole occupation.

2) Can the company compete and/or differentiate in logistics or infrastructure without ongoing spending?

Yes. This is not an ongoing arms race with Amazon in warehouse building and logistics spending. Or in creating a fleet of delivery riders, like Dingdong.

Etsy has 1,414 employees. And it doesn’t have major logistics, infrastructure or other capex spending.

3) Does the company have a strong competitive advantage in a circumscribed market?

Yes. There are a couple of competitive advantages:

–Network effect is clearly the big one. It’s a classic marketplace. Clearly, Etsy offers more crafts and unique items than most other platforms in the USA. They are trying to replicate this in other major markets. And they are pushing cross-border sales. That’s all good.

But they should have gone global long ago – and far more aggressively. Crafts, hobbyists and curators exist in all the major economies.

–Switching costs are another option. Etsy’s ability to integrate operationally with merchants is interesting, given the small size of most merchants. Etsy is dealing with individuals who are 91% operating from their homes. That means very limited operational ability. They need help with shipping. They definitely need help with advertising. Etsy is doing interesting things here.

4) Is there a clear path to significant operational cash flow?

Yes, already proven. Their overall take rate is about 20-24% of the purchase price. They do quite well.

5) Has the company avoided markets and situations that are attractive or strategic for the major ecommerce companies?

I think so. Etsy is still in the $1-2B revenue range, mostly from the USA. It’s not a big enough market to attract the attention of the giants. Especially as they move to smaller markets (Germany, France) using the same IT system and global buyer and supplier network.

Ok. That’s good. I think it passes my 5 questions.

But what are the weaknesses?

What I Don’t Like About Etsy

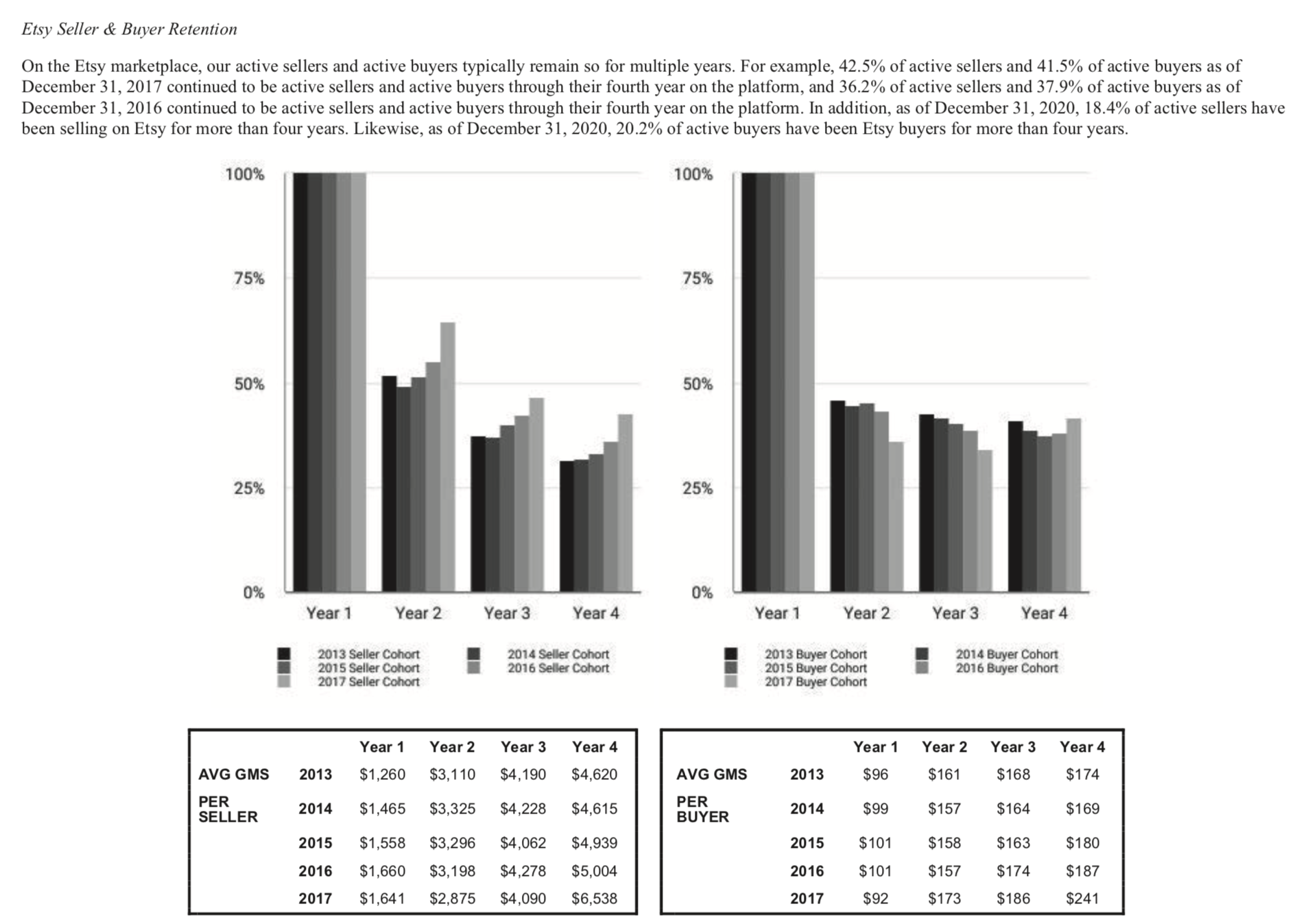

The big problem is the low frequency of usage by consumers.

That’s #1, #2 and # on my list of problems. People just don’t buy crafts that often. They don’t have special events that often. Etsy talks about this and is trying to create “habitual users”. They also talk a lot about reactivating lapsed users.

So far, the cohorts look fine over time. But frequency is the big weakness.

So Etsy talks about the need to create habitual buyers. To deepen engagement. To create a stronger brand. To reactivate dormant buyers.

But just trying to get people to visit, shop and buy more is a limited strategy. They should have gone after frequency and engagement by expanding into content or other activities a long time ago.

The second problem is slow innovation in the user experience.

Alibaba is very good at innovating in the user experience (both buyers and sellers). They view this as a strategic imperative. In the brutal China market, improving the user experience is how they increase value and keep ahead of the competition. We don’t see much of this at Etsy.

- Adding personal merchant videos was a good idea. It reinforces the human connection aspect. But they should have done this years ago.

- Where is the content? They should have been combining commerce with content a long-time ago. Have they not seen TikTok?

- Where is the movement into categories with higher frequency?

The third problem is too much dependence on search engines.

This is the bane of all low frequency products and services. They have too little engagement with their users. So they are far more dependent on search engines. Search is the default location where most consumers begin their journey.

***

Ok. That’s it for today.

I think Etsy is a solid example of a specialty ecommerce strategy. I’m putting this on the list of examples with Oriental Trading Company.

Thanks for reading, jeff

———-

Related articles:

- 4 Strategy Lessons from the Spectacular Rise of Sea / Shopee / Garena (Asia Tech Strategy – Daily Update)

- Dingdong and 5 Questions for Assessing Specialty Ecommerce Companies (2 of 2) (Asia Tech Strategy – Daily Lesson / Update)

- Podcast 90 (Can Dingdong Win in Groceries and Specialty Ecommerce?)

From the Concept Library, concepts for this article are:

- Network Effects

- Marketplace Platforms

- Specialty Ecommerce

From the Company Library, companies for this article are:

- Etsy

- Oriental Trading Company

Photo by Annie Spratt on Unsplash

Graphic by AI

——–