A Summary of this Article:

- The article explores the competitive defensibility of app businesses and foundation model providers in generative AI, emphasizing the need to consider evolving competitive defenses beyond traditional moats.

- Generative AI has a particularly significant impact by setting a new standard for operating performance for most all businesses. This includes driving increased productivity and transforming business operations.

- While incumbents with strong moats and effective adoption have an advantage, most generative AI applications are likely to become free commodities. Success for AI apps lies in innovative services or disruptive cost models.

***

In Part 1, I summarized two arguments about how foundation generative AI models probably will not have moats. Those arguments (by some Google staff and a16z) were mostly about the two leading proprietary large language models (Google LaMBDA and OpenAI GPT). And both arguments point to the impact of open-source alternatives. Open source has already had an impact on image generation (Stable Diffusion vs. DALL-E).

My conclusion was that it was not really the right question. The key question is:

- What will be the long-term competitive defensibility of app businesses and for foundation model providers in generative AI?

Look for the Evolution of Competitive Defenses, Not Just Moats.

We are trying to predict who is going to win. And that means we need to look at competitive defensibility beyond just moats.

You can build competitive defensibility in lots of ways. Some defenses can be short term. Some can be long term. And we really do see different types of defensibilities at different points in the lifecycle of a business and/or technology. If you’re looking for economies of scale in the early stages of a technology, you’re going to be disappointed. Those almost always come later.

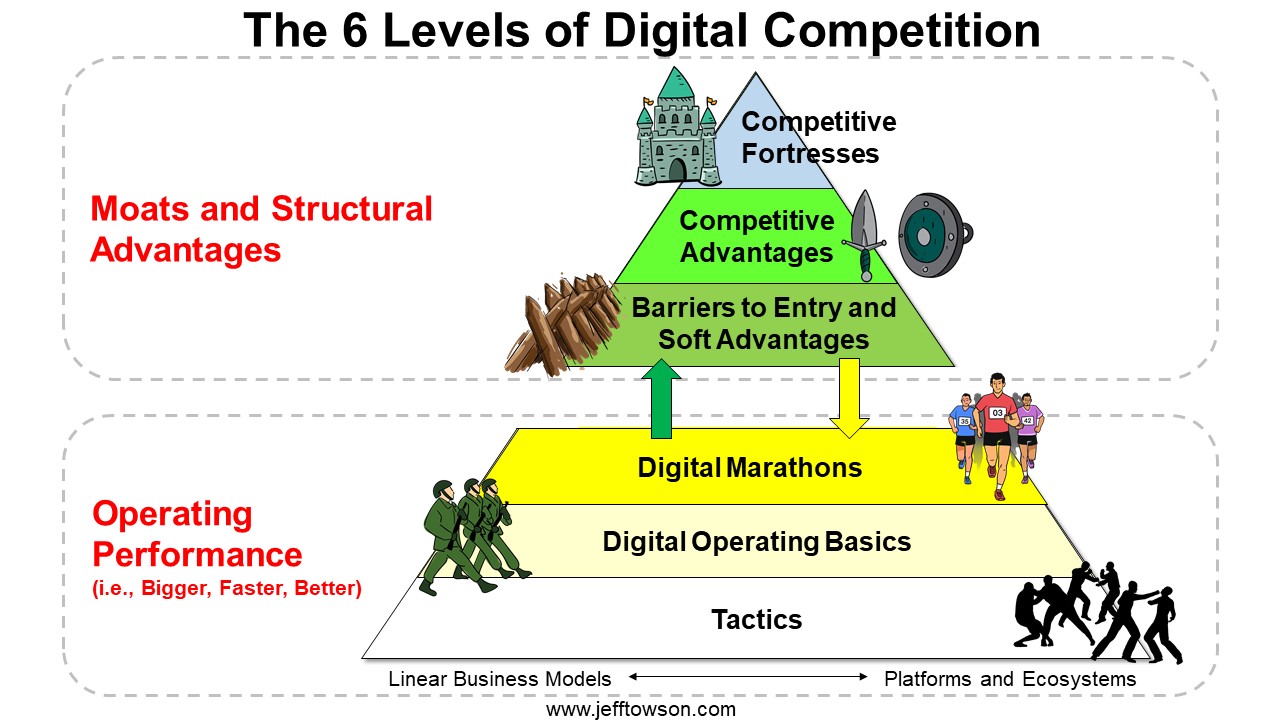

In my books, I have defined competitive strategy as having 6 levels.

We rarely see moats in the early stages of a new business (which is where generative AI is right now). The pattern usually looks like this.

- In the earliest days of a new business or product, we are looking mostly at first and early mover advantages.

- As the business models solidify, we are looking more at effective building and execution of the digital operating basics.

- Then we are looking for digital marathons. We look to see which companies are pulling ahead of others in key operating activities.

- These operating activities result in the building of capabilities, resources, and assets (CRAs).

- These CRAs are what create barriers to entry and moats over time.

So, for generative AI at this stage, what I am looking for is not moats right. I am mostly looking for:

- First mover and digital operating basics

- Digital marathons

- Developing CRAs – and maybe barriers to entry

- Likely future competitive advantages within proven business models

And that is for the app companies and the foundation models.

Keep in Mind: Technology Doesn’t Have Moats. Business Models Have Moats.

75% what is happening in generative AI right now is the development of a new technology stack. There are also businesses being built, but most of this is about the rapid development of something new. Until this is more done (and the dust settles), we’re limited in predictability.

If you look at my standard graphics, I always put the business model on the right and the technologies on the left in red.

That is how I view all of this. I am looking for how new technologies, tools and business models are impacting a business at different levels. But the emergence of generative AI as a technology is really its own phenomena. So, a lot of what is going on has nothing to do with moats and business models.

And technologies almost never have moats. Only business models.

There are some rare cases where proprietary or patented technology can be a competitive advantage in itself. Especially when it is a specialized technology that includes software and hardware. SenseTime in China is probably an example of this. They are building AI models, software, cameras, and data centers that are all specialized for computer vision. But event this is more about economies of scale in R&D and tech spending that proprietary technology.

And I do list proprietary technology as a type of competitive advantage. But these are actually pretty rare.

Most technology gets dispersed. Everyone gets it access to it. Lots of it becomes a commodity over time. And the value it creates is usually passed on to customers. It is rare for a firm to extract value for itself from technology for very long. And this is especially true for software.

For generative AI, this raises the question of data sets as a scarce resource. I’m not sure about this and generally look at overall operating performance, not just data sets. People frequently point to data network effects and data becoming a scarce resource. I don’t really see these very often. Data, like technology, is rarely a competitive advantage in itself.

In most cases, competitive strength comes from operating performance and structural advantages (i.e., business models). Not from technology, algorithms, software, or data.

***

Ok. Let me get to my conclusions about generative AI apps. I have 4 of them.

Conclusion 1: The Biggest Impact of Generative AI Is Creating a New Standard for Operating Performance.

Operating performance is improving dramatically. Everyone is getting far more productive. Think, code writers, lawyers, and marketing agents. And you can replace a lot of people with software. Think copy editors and graphic designers. This making so many things so much cheaper.

Plus, you can do things never before possible. And the emergence of digital agents (AutoGPT) means the nature of business and operations are both fundamentally changing. We are starting to see businesses composed of digital agents instead of humans.

So, forget competitive defenses for a moment. You need to jump into generative AI as much as possible just to keep operating performance at the new standard.

Conclusion 2: The Clear Winners Will Be Incumbents with Big Moats that Adopt Quickly. And Who Are Not Being Disrupted.

This is the simplest situation to understand. Let’s just dodge the question of competitive defensibility of generative AI companies. We’ll look at businesses that already have powerful moats AND that are adopting gen AI in an effective way. This is right out of Philip Fisher thinking:

So, forget OpenAI and all these novel new apps. Just focus on Adobe, Microsoft, Epic Games and others. They have powerful business models with big moats. And their gen AI products and features will create a lot of value. Whether they will try to keep that value themselves or pass it on to their customers is a good question. It will also be in interesting to see how much their do in-house versus tech and service suppliers. And how much open source versus proprietary tech they use.

One caveat here. Businesses that are adopting but also being disrupted are less predictable. So that’s Google. And, to some degree, Adobe.

Conclusion 3: Most of the New AI Apps Will End Up as Free Commodities.

Recall, the generative AI tech stack mentioned by a16z (from Part 1).

We want to break this into three types of businesses: infrastructure vendors, application companies and model providers. The authors’ conclusions about these three groups were:

- “Infrastructure vendors are likely the biggest winners in this market so far, capturing the majority of dollars flowing through the stack.”

- Application companies are growing topline revenues very quickly but often struggle with retention, product differentiation, and gross margins.”

- “Most model providers, though responsible for the very existence of this market, haven’t yet achieved large commercial scale.”

It’s pretty clear that most of the cool generative AI applications are going to become commodities. Image generation is already being offered by lots of companies. Basic functions like language translation and grammar checks are the same. Recall, my previous list of competitive defenses:

- First mover and digital operating basics

- Digital marathons

- Developing CRAs – and maybe barriers to entry

- Likely future competitive advantages within proven business models

We are looking for apps that can start digital marathons where they remain consistently ahead of other companies. That requires a service that has a long runway for development. In things like spellcheck, you can’t really keep ahead of others in terms of performance. The capability flatlines and becomes a commodity.

So, most of these apps are not going to be able to go from 1 to 2.

From Andreessen Horowitz:

“Generative AI products take a number of different forms: desktop apps, mobile apps, Figma/Photoshop plugins, Chrome extensions, even Discord bots. It’s easy to integrate AI products where users already work, since the UI is generally just a text box. Which of these will become standalone companies — and which will be absorbed by incumbents, like Microsoft or Google, already incorporating AI into their product lines?”

Keep in mind, most of these new apps are just using the foundation models of OpenAI and Google. So many can be easily copied in their capabilities. From Andreesen:

“Many apps are also relatively undifferentiated, since they rely on similar underlying AI models and haven’t discovered obvious network effects, or data/workflows, that are hard for competitors to duplicate…, it’s not yet obvious that selling end-user apps is the only, or even the best, path to building a sustainable generative AI business. “

Conclusion 4: A Few AI Apps Will Win by Doing Innovative Services or Cost Disruption.

The most predictable path for a new AI app is just to replicate a proven business at 1/10th the cost. Pick a proven business with ongoing development requirements (like legal services or HR) and just do it at a much cheaper price with generative AI. We should see several companies do well. But again, you want to look for a digital marathon that enables the disruptor to stay ahead of competitors in terms of performance.

We can also look for apps that are completely new and innovative services. ideally with a proven business models and significant operational cash flow. That’s what TikTok did. They came up with something new (short video). They adopted a proven business model (a copy of Instagram), and they had significant operational cash flow almost immediately. That’s what we’re looking for.

That’s it for Part 2. In the final part, I’ll put predictions for the big foundation models.

Cheers, Jeff

——-

Related articles:

- AutoGPT and Other Tech I Am Super Excited About (Tech Strategy – Podcast 162)

- AutoGPT: The Rise of Digital Agents and Non-Human Platforms & Business Models (Tech Strategy – Podcast 163)

- The Winners and Losers in ChatGPT (Tech Strategy – Daily Article)

- Why ChatGPT and Generative AI Are a Mortal Threat to Disney, Netflix and Most Hollywood Studios (Tech Strategy – Podcast 150)

From the Concept Library, concepts for this article are:

- GPT and Generative AI

From the Company Library, companies for this article are:

- OpenAI / GPT / DALL-E

- Google / Bard

Photo by Sanket Mishra on Unsplash

———

I write, speak and consult about how to win (and not lose) in digital strategy and transformation.

I am the founder of TechMoat Consulting, a boutique consulting firm that helps retailers, brands, and technology companies exploit digital change to grow faster, innovate better and build digital moats. Get in touch here.

My book series Moats and Marathons is one-of-a-kind framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.