Traditionally, revenue and demand-side advantages are described as “customer captivity”. It shows up as a company that gets higher pricing and/or more repeat purchases from customers – compared to other products or services of comparable quality. Next time you are in an airport terminal waiting for a flight, check the prices of literally anything. Once you pass security, you are a captive customer.

For example:

- Some consumers will just pay a lot more for Nike sneakers than for other brands of similar quality. The competitive advantage shows up as premium pricing.

- Some consumers will keep buying Coca-Cola over and over, even when similar beverages are available. The advantage shows up as higher frequency and/or engagement.

And as revenue equals price times the number of units sold, this results in larger revenue than a comparable competitor. A higher relative revenue over the a similar invested capital means a higher ROIC.

However, I have argued that competitive strength and defensibility does not always mean attractive economics. That is a sub-case. A competitive advantage or moat does not always mean an economic benefit.

I once heard Dilbert creator Scott Adams say that he only invests in companies that are loved or hated. That’s a surprisingly good summary of customer captivity and demand-side advantages.

- When a company is really loved, you hear terms like “irreplaceable”, “must have”, “fanboys”, “super-fans” and “evangelists”. Tesla is an example. So is Apple. So are beach homes in Waikiki. Loved companies often have premiums or lots of repeat business.

- What a company is truly hated, you hear terms like “no choice” and “have to buy”. Think about most US cable companies. Or companies buying advertising on Facebook. Customers have no choice and have to pay whatever they charge, which makes them resentful. Note: this also requires there be no acceptable substitutes.

Both extreme love and hate are examples of customer captivity.

A Checklist for Revenue and / or Demand-Side Competitive Advantages

Here are some standard questions for checking for a revenue and/or demand-side advantage:

- Can this company charge a premium versus competitors with similar products / services?

- How much? What percent?

- Usually this shows up in higher prices, higher gross profits and/or unused pricing power.

- Can this company charge a premium versus competitors with lower quality or less differentiated products / services?

- How much? What percent?

- Usually this shows up in higher prices, higher gross profits and/or unused pricing power.

- What percent of sales is repeat business? Is there a backlog? Are there long-term contracts? All of these indicate repeat business.

- How sustainable or stable is demand? Is it reliable for 0-3 years? 3-5? 5-10?

I look for 5 types of competitive advantages on the revenue and demand side:

- CA1: Share of the Consumer Mind (SCM), Share of the User Mind (SUM) and Purchase vs. Engagement Capture. This category contains lots of sub-types such as buying habits, branding and emotional attachment. And it is not just for consumers and B2B customers but also for other user groups on platforms.

- CA2: Switching Costs and Customer / User Lock-In.

- CA3: Searching Costs. Think surgeons, management consultants and complicated services.

- CA4: Limited Sellers and a Long-Term Supply-Demand Imbalance. Note, this does not include short-term supply-demand imbalances like first mover and counter-positioning. Those are under Tactics.

- CA5: Network Effects.

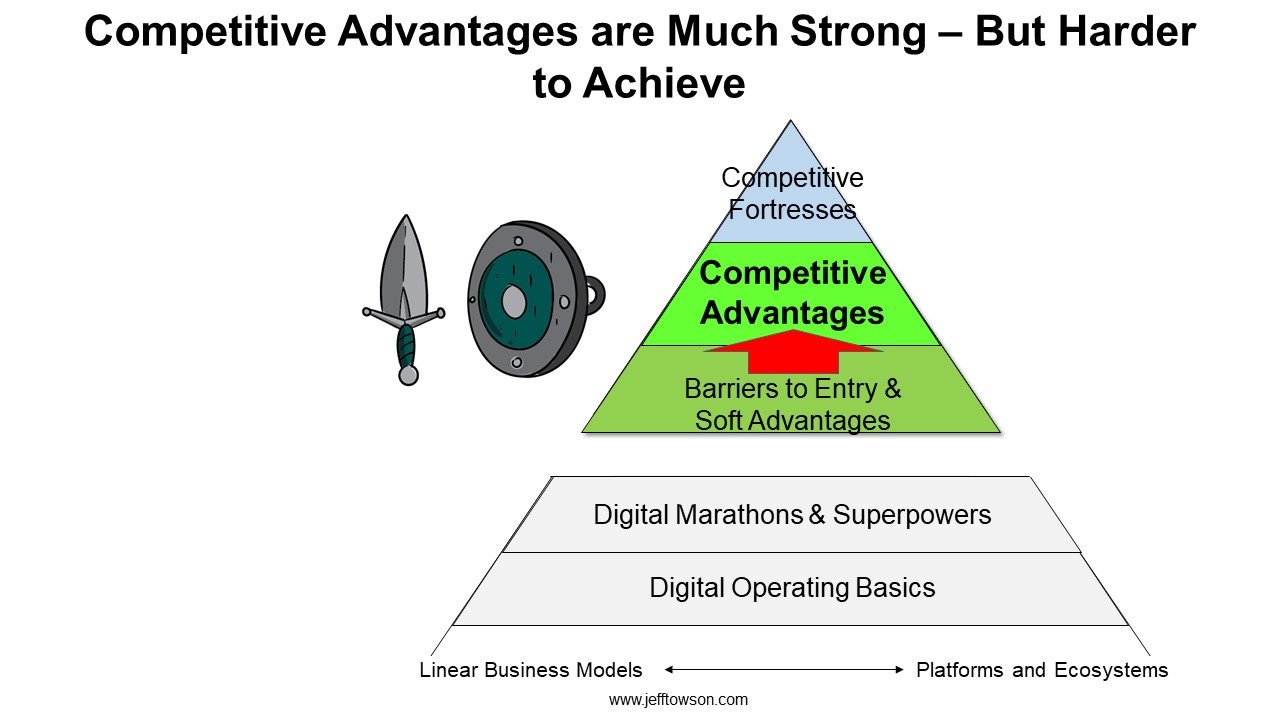

You can see these listed on the left side of Level 2: Competitive Advantage.

Going From Customer Captivity to User Captivity

The above introduction was pretty a standard explanation of customer capture in physical products and services. It is why people pay more for cans of Coke and hire the same accountant year-after-year.

But revenue and demand-side advantages is an area that is being dramatically changed by digital and digital platforms. Sweepingly so. You’ll notice I have been using the phrase revenue and demand-side advantages. Because we need to broaden our definition of customer capture to include more than just transactions by customers.

Think about the following questions:

- What does demand-side power mean when the relationship with a customer is more than just a transaction? Nike is building active communities of running enthusiasts in China. And these community members also occasionally buy shoes. The relationship is more than just quantity and pricing in transactions. In digital, demand and customer captivity can include user retention, engagement and community building.

- What does “customer captivity” mean when consumers are connected and increasingly acting like networks? Are you trying to make these sub-networks of customers captive now?

- In a connected world with platform business models and ecosystems, what about user groups that are not customers? What about content creators? Merchants and suppliers? Developers? What about captivity for these users?

- What about when the end users, buyers and referring agents are different groups within the same customer experience? Does captivity come from employees within firms using Slack or from IT departments doing long-term contracts with Slack?

So yes, Coca-Cola can charge a premium for a can of soda and get tons of frequent, repeat purchases. They have an addictive product, a legacy brand and customer habits built up by decades of mass marketing and ubiquitous distribution.

But in a connected world, “customer captivity” is increasingly becoming “user captivity”. There are important user groups beyond just customers. And you need to expand revenue-side power to demand-side power, where it encompasses more than just transactions.

Revenue and demand-side advantage is increasingly coming from the ability to engage consumer networks and to create and retain engagement with different user groups. Customer captivity is increasingly about capturing a broader definition of demand, not just revenue.

All five take a long time to go through, but I’ll detail the first one CA1 here.

CA1: Share of the Consumer Mind (SCM), Share of the User Mind (SUM) and Purchase vs. Engagement Capture.

“Share of the consumer mind” is an old Warren Buffett-term. This is the strange situation where a company has somehow occupied a part of the minds of its consumers. Consumers can have strong feelings about the company. Its products can be part of their daily routine. It can become part of their life. It’s like the brands owns an important piece of real estate, which is a part of their minds.

In this bucket (CA1), you will find a lot of consumer product (CPG) companies. Think Coca-Cola, Heinz and Marlboro. A lot of the investors I study (Thomas Russo, Warren Buffett, Charlie Munger) buy and hold these types of companies, trying to capture the economic (not accounting) goodwill this phenomenon can create over time.

Why is this so interesting?

Because there is nothing terribly special about so many of these companies in terms of their products or services. Coke is just water and syrup. Marlboro cigarettes are just tobacco and paper. Heinz ketchup is just tomatoes, and I don’t know what else. Yet, they somehow have strong demand-side advantages and create and/or preserve economic value over decades.

The power is clearly not in the product. And it is not in the “brand”. It is in the capture of the consumer mind. That’s the real intangible value that is surprisingly difficult to create and replicate. This capture can be by emotional impact. It can be by the creation of habits. It can be by chemical addiction. There are lots of take-over strategies for the human brain.

That is why this phenomenon is so important in digital. Because software is exceptionally good at influencing and sometimes outright hacking the human brain. It is scarily good at this.

Think about playing a video game and completely zoning out for 2-3 hours. Think about how often you check email or messages every hour. Or how angry Twitter can make you. Or how in just a few years TikTok got people across the globe to spend an average of 90 minutes per day starting at its 30-second videos. Share of the consumer mind as a competitive advantage is becoming more and more sophisticated and subtle as things go digital and data-driven.

Evil Moats: Tech-Created Habits and the Hijacking of Consumer Minds

Most of what I have just said about Share of the Consumer Mind (SCM), I could also say about heroin. It has a powerful chemical addiction. It has tremendous repeat business. Does anyone think heroin addicts are not “captured customers”?

Tobacco has a particularly powerful of a demand-side competitive advantage, mostly from nicotine. You can see it in the financials, even with all the taxes. It is not as addictive as heroin of course, but it has a far more powerful habit. The average cigarette smoker takes a break and smokes a cigarette 20 times every day. So you get both chemical addiction and habit formation. Cigarettes may well be the most powerful, legal consumer product ever created.

But both heroin and cigarettes have profoundly negative effects on individuals and society. So, there is a question at the center of creating demand-side moats: Is the self-interest of the company in the best interest of the customer?

I ask myself this often when looking at companies.

In the case of Coca-Cola, the answer is mostly yes. Sugar is bad for your teeth. But overall, it’s a nice product that tastes pretty good. So the company’s self-interest is pretty well-aligned with the customer’s best interests.

In the case of tobacco, the answer is clearly no. The self-interests of the tobacco companies are directly against the best interests of consumers. They want more consumers to smoke. And they want them to smoke more and more every day. That is the corporate self-interest. I used to have a fairly free market mindset about cigarettes. Educate consumers and let them decide. But don’t ban the product. But working in the hospital, I saw one patient after the next die from smoking. All of them wishing they had never started smoking. After watching patients die one after the next, my mindset became “just ban cigarettes.”

So yes, you can create powerful demand-side competitive advantages. These are always in the company’s self-interest but sometimes against a consumer’s best interest. I call these evil moats. And there are a lot of them happening in digital right now. Here are some types.

- Technology-created habits.

- Dopamine addiction.

- Exploitation of mental weaknesses and psychological short-cuts.

- Gamification taking advantage of gambling behavior.

- Surveillance capitalism.

- Misinformation, disinformation and conspiracy theories.

- Mass behavior manipulation.

- Societal fragmentation and increasing tribal and partisan warfare.

Virtually every digital company is doing #1, #2 and #3. Every mobile app is doing #1 when it asks you to enable notifications. Notifications are critical triggers for habit formation. Gaming is doing #3 every time it shows you a near win and you immediately want to play again. Facebook is doing #5 by harvesting surplus data, selling ads and steadily eroding all aspects of personal privacy.

We think we are using our smartphones to augment our knowledge and abilities. The truth is that smartphones are shaping (and sometimes controlling) our minds far more than the other way around. Every newsfeed you scan was chosen by a company and its systems. Every question you type into Google gives you a small set of answer chosen by someone else. When you are staring at a screen, someone else is controlling the information going into your mind. Perhaps they are being helpful? Perhaps they are prioritizing their own self-interests? Perhaps they have malicious intent? Maybe it is just a mindless algorithm that is not thinking at all?

More and more, I think we have gone from free digital services to surveillance capitalism and to mass manipulation. I tend to think about this more and more when looking at “customer capture” and “share of the consumer mind”.

***

Ok, that was a bit of a rant. Cheers from Rio, jeff

——

Related articles:

- How to Think About Web 3.0 Business Models (1 of 2) (Asia Tech Strategy – Daily Article)

- Platform-Protocol Hybrids and Why DeFi is the Center of Web 3.0 (2 of 2) (Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- CA1: Share of Consumer Mind, Share of User Mind

From the Company Library, companies for this article are:

- n/a

Photo by Antoine J. on Unsplash

———

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.