Economies of scale is a foundational concept in business strategy. Particularly in the digital age where companies like Amazon and Netflix have achieved global dominance through their ability to leverage scale.

Much of the strategy thinking for the industrial age was about production scale advantages.

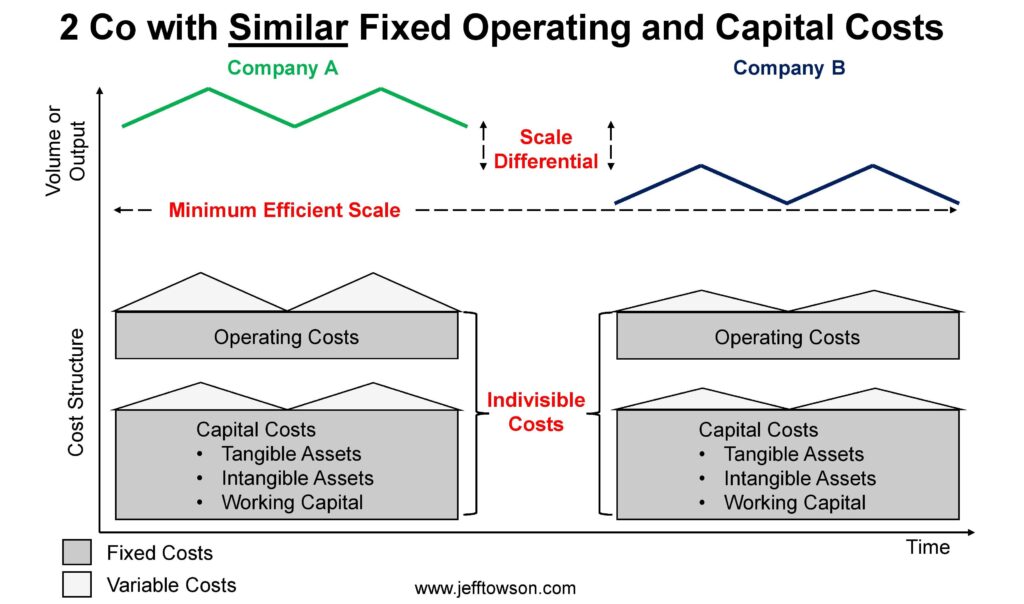

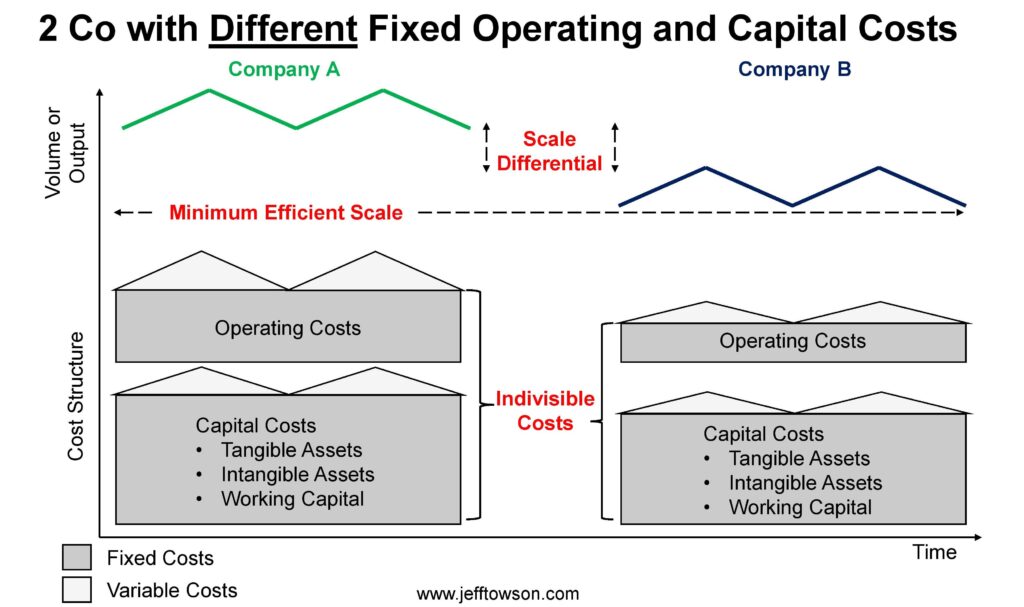

Good strategy is usually about capturing the advantages of superior scale while avoiding the disadvantages. Which looks like this:

However, there are several misconceptions about economies of scale that often lead to flawed analysis and bad strategic decisions.

–

Here are seven things people often get wrong about economies of scale (based on fixed costs).

1 – Focusing Only on the Income Statement

It’s common to simply look at a recent income statement for large, fixed cost items and divide them by volume or revenue. That gets you cost per unit, which you can compare with rivals.

While this provides a starting point, it overlooks the complexities of both fixed operating costs and ongoing capital costs. We also must consider:

Rolling Averages of Major Operating Costs: Instead of looking at a single month or year, consider the average operating costs for a given volume or output over a longer period. Ideally you want 1-2 business cycles. This helps account for variations in production and provides a more accurate picture of the fixed operating cost component.

Capital Costs: You want to separate this into growth versus maintenance capex. The ongoing capital costs required for maintenance should be added to the operating costs on the balance sheet. You also want to think about the initial capital cost of acquiring the assets (like a factory or a fleet of airplanes) and potential upgrades or expansions. It’s a judgement call on whether to include these.

But you want to look forward and backward in time, considering both historical and projected capital expenditures.

Tangible and Intangible Assets: Expand the analysis beyond just tangible assets like factories and equipment to include intangible operating assets like software, customer service infrastructure, and brand value. These intangible assets often represent a significant portion of fixed costs, especially in digital businesses.

2 – Ignoring the Importance of Throughput

Throughput, defined as output produced per unit of time, is a crucial element in understanding economies of scale. While volume is important, it doesn’t account for time. Throughput tells us how efficiently a company utilizes its assets and resources to generate output.

Think of a business like a pipeline: A larger pipeline might hold more volume, but its efficiency depends on how quickly it can move that volume from point A to point B. Similarly, a factory’s size matters less than its ability to produce a high volume of output per unit of time. Focusing solely on volume can lead to misinterpretations of a company’s true cost structure and competitive advantage.

Throughput matters in areas such as:

- Manufacturing: Output produced per hour, day, or week.

- For airlines, it’s cost per seat flown per mile and aircraft utilization (time in the air).

- E-commerce: Number of orders processed per day, delivery time.

3 – Not Understanding Minimum Efficient Scale, Indivisibility, and Scale Differentials

Three key concepts are often misunderstood or overlooked when analyzing economies of scale:

Minimum Efficient Scale (MES): This is the minimum level of production volume or throughput required to achieve a competitive cost structure for a market. This means there is a threshold level of production needed to participate. New entrants will often have to lose money until they can reach MES. It’s part of the market entry cost.

Indivisibility: This is the degree to which a company’s fixed cost structure cannot be easily reduced, even if production volume declines. High indivisibility amplifies the benefits of scale for larger companies and increases the challenges for smaller competitors to catch up.

Scale Differential: This is the difference in scale between a leading company and its rivals. A larger scale. The greater the scale differential, the greater their cost advantage (usually).

This is how I view it.

4 – Underestimating the Impact of Digital Disruption on Economies of Scale

While economies of scale (based on fixed costs) remain a powerful competitive advantage, digital disruption can disrupt traditional models built on this advantage.

Digital disruption is challenging traditional economies of scale in several ways:

Tangible-Intangible Asset Shift: Digital companies often rely more heavily on intangible assets like software, data, and algorithms, blurring the lines between fixed and variable costs. This can make it harder to assess economies of scale using traditional methods.

Connectivity and Distributed Production: Connectivity and the rise of platform business models enable smaller players to access resources and capabilities that were once only available to larger companies. This can level the playing field, reducing the advantages of scale for traditional businesses.

Disintermediation, Disaggregation, and Dematerialization (The 3 Ds): This is a McKinsey framework that argues that digital technologies are disrupting value chains by cutting out intermediaries, breaking down large assets into smaller, more accessible services, and shifting from physical to virtual products and processes. These three forces can erode the traditional scale advantages enjoyed by companies with large fixed costs in areas like retail, media, and IT infrastructure.

5 – Overlooking the Need for Demand-Side Advantages

A common mistake is assuming that supply-side economies of scale based on fixed costs are sufficient to create a sustainable competitive advantage. While scale on the cost and supply side is valuable, it’s often not enough without corresponding advantages on the demand side.

Consider a business that achieves significant cost savings through economies of scale but lacks strong customer loyalty or brand recognition (i.e., competitive advantages on the demand side). Competitors might be able to gradually chip away at their market share, eroding their scale differential and eventually neutralizing their cost advantage.

To build durable moats, companies need to combine economies of scale on the cost side with demand-side advantages such as:

Switching Costs: Making it costly or inconvenient for customers to switch to a competitor, whether through contracts, loyalty programs, or integrated ecosystems.

Network Effects: Creating a situation where the value of a product or service increases as more users join, making it increasingly attractive for new customers and difficult for competitors to gain traction.

Share of the Consumer Mind: Building strong brand affinity and emotional connections with customers that make them less price-sensitive and more resistant to switching.

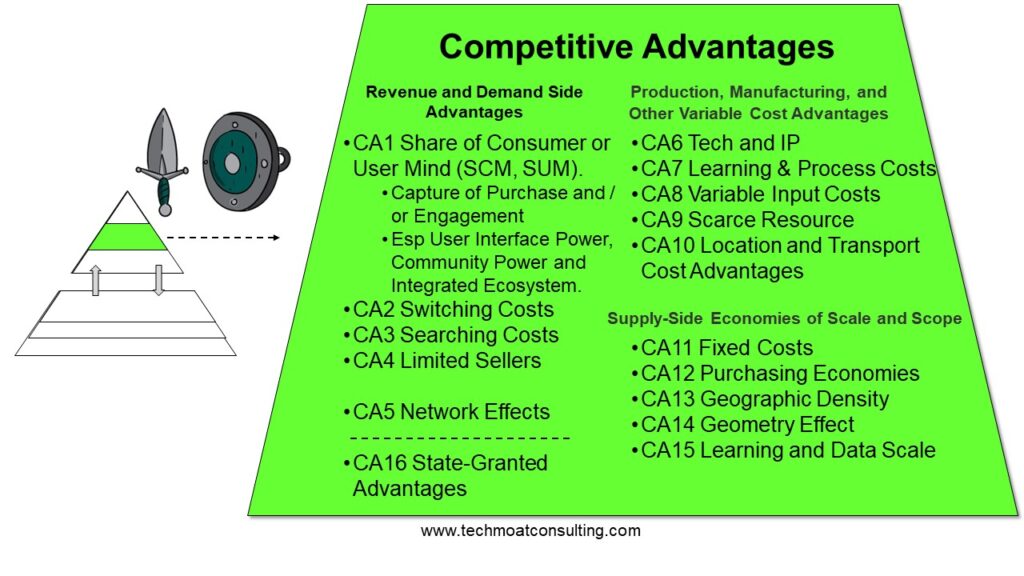

You can see this in my list of competitive advantages.

6 – Overlooking the Negative Impact of a Non-Circumscribed and / or High Growth Market

A company’s ability to benefit from economies of scale based on fixed costs is significantly impacted by the nature of the market it operates in. A sharply circumscribed market, where there are limitations on growth and limited room for new entrants, amplifies the advantages of scale for incumbents.

A circumscribed market can be due to:

Geography: A business can dominate a geographically isolated market, like a supermarket on an island or a hospital in a remote mountain town. Businesses with scale advantages in these markets are particularly dominant. There isn’t enough demand in the market for another player to enter and get to their scale.

Product Specialization: Companies operating in niche or specialty markets, such as Etsy with its focus on handmade and vintage goods, benefit from a circumscribed market where demand is concentrated in certain specialized niches. This limited market size means new players have no room to grow and erase the scale differential of the incumbent.

In contrast, a rapidly growing or expanding market can dilute the benefits of scale.

While growth creates opportunities, it can also allow competitors to enter a market. A growing market means more room for more players. And more room for them to catch up, reducing the leader’s scale differential and eroding their cost advantage.

7 – Failing to Recognize the Interplay Between Fixed and Variable Costs

The distinction between fixed and variable costs is rarely clear-cut. While some costs, like rent or salaries, are predominantly fixed, others, such as raw materials or energy, can fluctuate with production volume and market prices. Additionally, advancements in technology and shifts in business models can blur the lines between fixed and variable costs even further.

Digital companies, in particular, often exhibit a complex cost structure where fixed costs play a dominant role, but variable costs still have a significant impact. For instance, while the marginal cost of distributing digital content like music or software is often low, companies like Spotify and Adobe still incur substantial fixed costs related to:

- Platform Development and Maintenance

- Content Acquisition and Licensing

- Customer Support

Accurately assessing economies of scale requires a thorough understanding of how fixed and variable costs interact within a specific business model, recognizing that:

- Fixed Costs Are Rarely Truly Fixed: They often increase in a stepwise manner as production volume expands. Or requires upgrades.

- Variable Costs Can Impact Scale Advantages: Companies with a high proportion of variable costs may find it harder to achieve significant cost savings through scale, as their costs will rise more rapidly with increased production.

- Technology and Business Model Innovation Can Shift the Balance: Digital disruption can lead to the disaggregation of traditionally fixed costs, turning them into variable costs accessible through on-demand services, as seen with the rise of cloud computing.

***

That’s it. I hope this was helpful.

Cheers, jeff

———

Related articles:

- Buffett’s Airline Stocks and an Intro to Economies of Scale in Fixed Costs (Tech Strategy – Daily Article)

- The Big Strategy Concepts for Web 3 (1 of 3) (Tech Strategy – Daily Article)

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Economies of scale in fixed costs

From the Company Library, companies for this article are:

- n/a

———–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.