Barriers to entry are fundamental to understanding the competitive dynamics of an industry. However, several common misconceptions surround the idea. This article aims to debunk five of the most prevalent misconceptions about barriers to entry, particularly as businesses get more digital.

Misconception 1: Barriers to Entry are Synonymous with Competitive Advantages

One of the most common mistakes is conflating barriers to entry with competitive advantages. While both contribute to a company’s overall strength and defensibility (i.e., its moat), they operate on different levels and target different competitive threats.

Barriers to entry primarily guard against new entrants seeking to establish themselves in an industry. They represent the initial hurdles a newcomer must overcome before even really competing with established players. These barriers can be the high capital expenditure required to build a nationwide logistics network like JD Logistics. Or the regulatory approvals needed to operate a mobile network.

Competitive advantages, on the other hand, dictate a company’s strength against existing rivals. These are the factors that allow an established player to outperform competitors already operating within the industry. This might involve superior brand recognition like Coca-Cola, a more efficient supply chain like Amazon, or the network effects of an operating system (like Apple).

–

Here’s how I view them.

The distinction is crucial:

- A company can have strong barriers to entry without possessing significant competitive advantages. The utilities sector often exemplifies this scenario. Setting up a power plant in a new region requires substantial investment and regulatory approvals, creating a high barrier to entry. However, once operational, power companies usually compete in a relatively commoditized market with limited differentiation.

- Conversely, a company might face low barriers to entry but enjoy strong competitive advantages. The cola industry illustrates this dynamic. While entering the market is relatively easy, competing against giants like Coca-Cola and Pepsi over time is incredibly challenging. The incumbents have extensive distribution networks, brand loyalty, and marketing prowess and scale. Richard Branson’s attempt with Virgin Cola demonstrated this point vividly, highlighting that market entry doesn’t guarantee success.

Misconception 2: Digitalization Has Eroded Barriers to Entry as a Durable Moat

While it’s true that digitalization can significantly lowered entry barriers in many industries, the notion that it universally weakens them is misleading. In reality, digitalization has destroyed lots of traditional barriers fall while also creating new ones.

Examples of traditional barriers weakened by digital:

- Big asset purchases upfront require lots of capital expenditures. Cloud computing services like AWS have reduced the need for massive upfront investments in IT infrastructure, allowing startups to enter digital markets with minimal capital expenditure. Airbnb and Uber entered the hotel and taxi business without having to buy any hotels or taxis.

- Physical retail networks, which went from assets to liabilities. Ecommerce platforms have challenged the dominance of brick-and-mortar stores, allowing smaller players to reach customers directly, without investing in extensive retail networks. And in many cases, these retail networks (such as Blockbuster) became liabilities.

- Controlled distribution channels. Digital marketplaces like Amazon and Alibaba have democratized access to distribution, enabling smaller merchants to reach a broader audience without relying on traditional gatekeepers.

However, digitalization has also created new types of barriers. Some examples:

- Data advantages. Companies with access to vast proprietary datasets can have real barriers. Insurance companies with legacy databases are better at assessing risk going forward. Client lists and relationships at companies like McKinsey & Co took decades to build are hard to replicate.

- User-generated content. Platforms reliant on user-generated content, such as Wikipedia, YouTube, and TripAdvisor, benefit from their vast libraries of content created over time. Replicating this content volume and quality represents a significant hurdle for newcomers.

- Specialized talent: As digital businesses become more sophisticated, the demand for specialized skills in areas like AI, data science, and software engineering intensifies1517. Attracting and retaining top talent becomes a crucial barrier to entry, particularly for companies venturing into cutting-edge technologies.

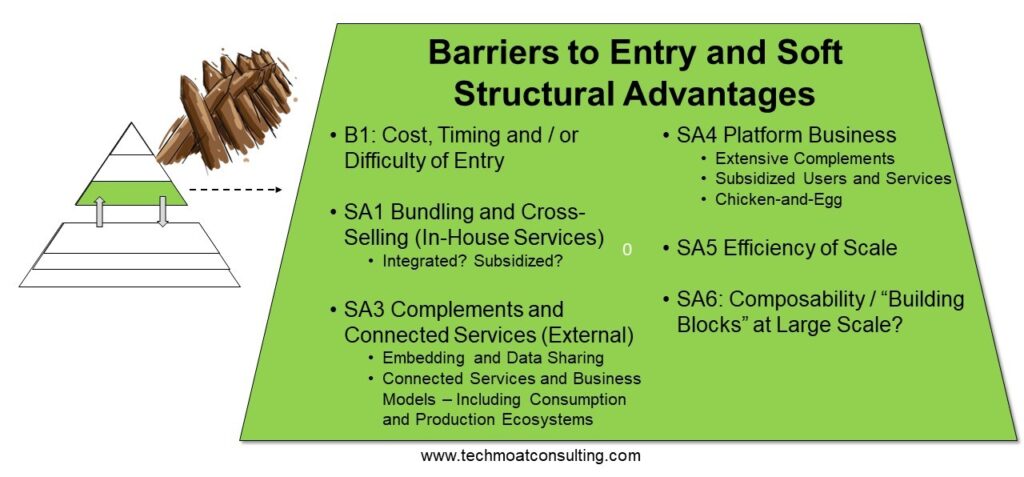

Here is my master list.

Misconception 3: Barriers to Entry Mean Profits

While barriers to entry can provide a degree of protection from new entrants, they do not guarantee long-term success or guarantee profits.

- Incumbents can become complacent: Companies operating in seemingly protected markets may become complacent, neglecting innovation. They can fail to adapt to changing customer needs and technological advancements. This complacency creates opportunities for agile newcomers.

- New technologies can jump barriers: The emergence of disruptive technologies can often circumvent or render existing barriers obsolete. This actually happens quite frequently. For example, the rise of e-commerce bypassed the need for expansive physical retail networks.

- Most barriers can be overcome with sufficient resources: Most seemingly insurmountable barriers can be overcome with if a business is willing to spend enough money. If Amazon really wants to be in your business, they can probably spend enough to jump in.

- Barriers don’t mean good unit economics. You can have a significant moat in a fundamentally bad business. Uber is an example of a business that has a moat but has struggled to profitability.

Misconception 4: Digital Businesses Have Low Barriers to Entry

The perception that digital businesses operate in low-barrier environments stems from the ease of launching websites, apps, and online stores. While digital tools have lowered the initial cost of entry in many cases, you can still have substantial barriers. Such as:

- Digital-physical hybrids: Companies that combine digital platforms with substantial physical operations (think JD Logistics and Coupang) can have great barriers. Replicating these integrated digital-physical systems requires substantial capital, operational expertise, and time, creating a formidable challenge for new entrants.

- Regulated industries: Regulatory frameworks can create substantial barriers even in digital markets. Obtaining licenses and approvals to operate in sectors like finance and healthcare can be time-consuming and expensive, limiting new entrants. Especially start-ups.

Misconception 5: Barriers Are Mostly Tangible Assets

Traditional assessments of barriers to entry often prioritized tangible assets like factories, infrastructure, and distribution networks. However, in the digital age, intangible assets like brand reputation, customer loyalty, user communities, and intellectual property play an increasingly significant role.

A comprehensive evaluation of barriers to entry must encompass both tangible and intangible assets, especially in industries where digital technologies and customer experiences play a crucial role. You basically want to do a reproduction valuation of the balance sheet.

***

That’s it. I hope this was helpful.

Cheers, jeff

———

Related articles:

- Buffett’s Airline Stocks and an Intro to Economies of Scale in Fixed Costs (Tech Strategy – Daily Article)

- The Big Strategy Concepts for Web 3 (1 of 3) (Tech Strategy – Daily Article)

- Why I Really Like Amazon’s Strategy, Despite the Crap Consumer Experience (US-Asia Tech Strategy – Daily Article)

From the Concept Library, concepts for this article are:

- Barriers to Entry

From the Company Library, companies for this article are:

- n/a

———–

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.