This week’s podcast is about my visit to ByteDance, which is just a fascinating company. Lots of good lessons that I will be writing about. But here are the three things I think I was not appreciating or understanding.

Two clarifications:

- This was a visit to a ByteDance office. Which is a different group than TikTok.

- The ecommerce GMV numbers cited are from external reports – and not ByteDance or TikTok. And these numbers are likely probably guesses and only somewhat accurate.

You can listen to this podcast here, which has the slides and graphics mentioned. Also available at iTunes and Google Podcasts.

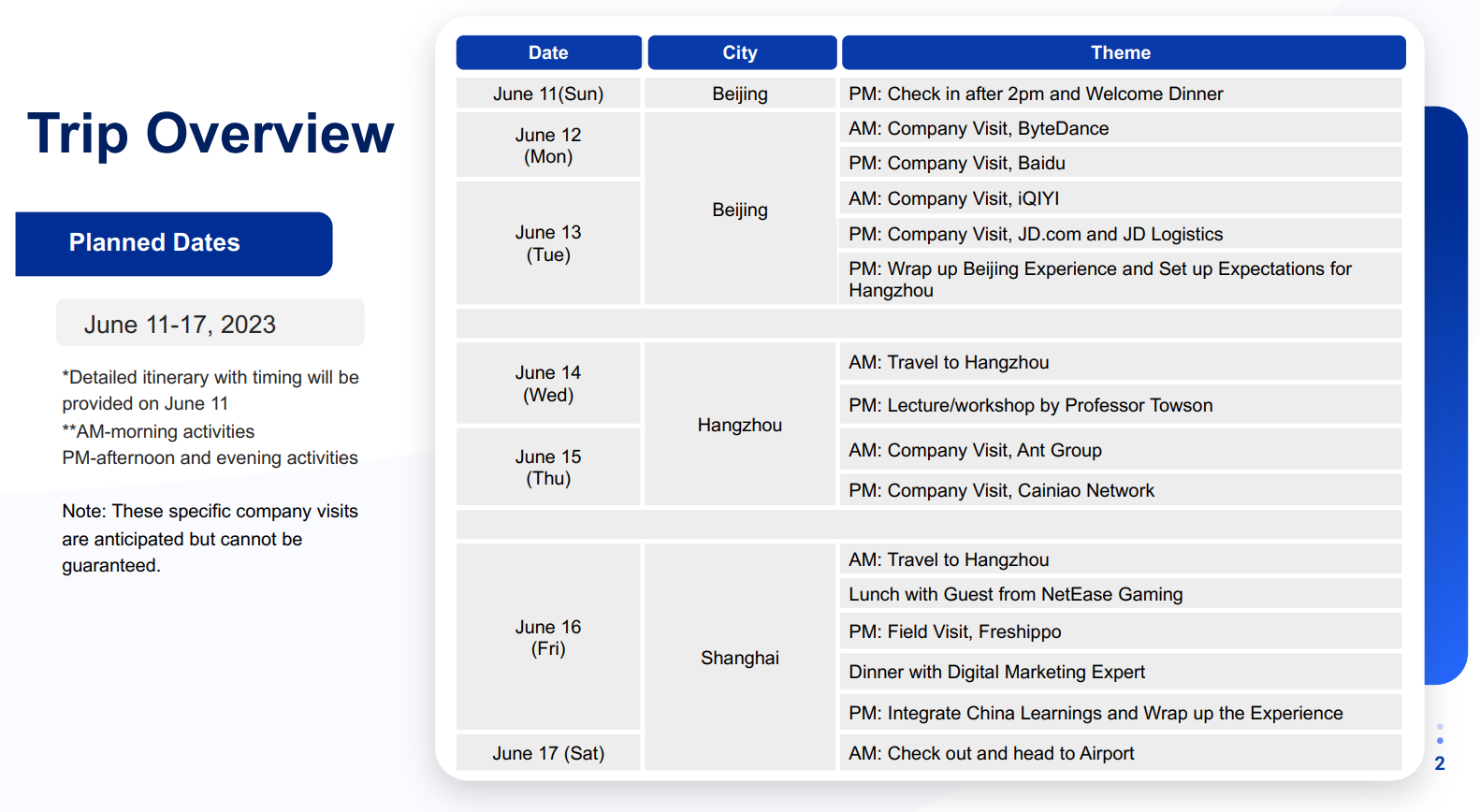

If you’re interested in talking digital strategy and transformation for your business, contact us at TechMoat Consulting. Here is the itinerary for the China tech tour.

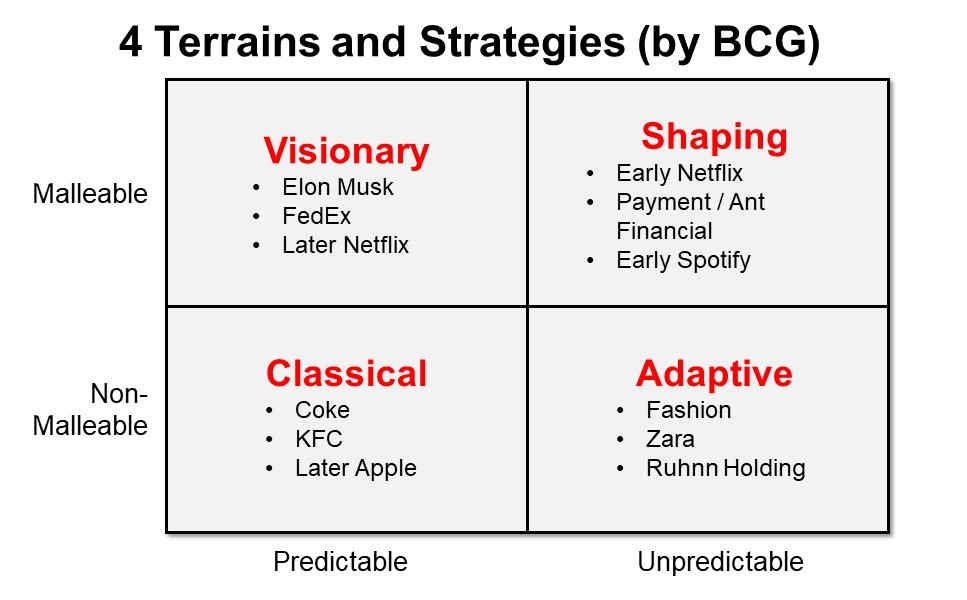

Here is the BCG 4 terrains and strategies mentioned.

———

Related articles:

- Can ByteDance Breach Alibaba’s Infrastructure Moat and Become An Ecommerce Giant? (Tech Strategy – Podcast 82)

- Alibaba Takes Over Sun Art Retail. Is It Going to Take Off? Or Is It Infrastructure? (pt 1 of 2) (Asia Tech Strategy – Daily Update)

- Could Sun Art Grow +30% Under Alibaba? (pt 2 of 2) (Asia Tech Strategy – Daily Update)

From the Concept Library, concepts for this article are:

- Externalization of Capabilities

- 4 Terrains and Strategies

From the Company Library, companies for this article are:

- ByteDance

——-Transcription Below

Welcome, welcome everybody. My name is Jeff Towson and this is the Tech Strategy Podcast where we analyze the best digital businesses of the US, China and Asia. And the topic for today, three strategy lessons from my visit to ByteDance and TikTok basically. And I mean, if you’re gonna make a short list of the quote best digital businesses of the US, China and Asia, you’ve got to put ByteDance on that list. I mean, it is, you know, the 10 years this company has really been out there. And really the five years since it did what no China B2C mobile app has ever done really, is it went from China to the international markets and it didn’t avoid the major markets that are having entrenched players like the US, somewhat Europe, it went right at them. It didn’t go to Southeast Asia first. Well, I mean, it kind of did. But I mean, its primary sort of international focus was the US. We hadn’t seen that before. Companies had tried. WeChat had kind of tried. Alibaba definitely tried. But generally, they don’t do that. And, you know, they went head to head with Facebook and Snap and Instagram. And they beat them. I mean, this is ongoing. But phase one, you have to say, look, round one, they won round one. You know, they launched into the US, became a major source of news, entertainment, media, and they beat them. That was pretty amazing. And so anyways, as part of the China Tech Tour, which was last week, we went out to Beijing, Hangzhou, Shanghai, visited, you know, how many? One, two, three, four, five, six, really seven to eight companies we talked to in various forms. But You know, Monday morning, our first trip was out to a bite dance, which is kind of in the northwestern side of Beijing. Really spectacular. And so what I’m going to talk about today is what I learned. And let me qualify that because it’s kind of important. The discussions that happened, the photos of the videos, that’s all basically private, cannot be shared. And, you know, that was sort of the discussion between me and ByteDance, which is fine. And I will publish over the next three weeks, probably almost four weeks, a series of probably 10 to 12 sort of in-depth pieces on these companies. And that requires a little bit of back and forth and approval, is it okay to use this photo, things like that. So that’s all gonna happen in the future. What I’m doing today is sort of talking about the stuff that I personally learned that I think I was getting wrong. And therefore, none of this is an opinion from ByteDance or TikTok or anyone involved. None of this information is from them. Everything is still off the record in terms of discussions and all of that. So this is basically just what I learned personally, as opposed to anything anyone said during the visit. So let me clarify that. Now, going forward, I will do more detailed stuff that is okay to say publicly, but I’m not going to get to that today. That was kind of a big disclaimer, which is important. Anyway, so that’s what I’m going to talk about. Those of you who are subscribers, all of this is going to you. Some of it will be public, a lot of it won’t. Anyways, that’s coming your way in the next couple weeks. And what I’m talking about today, I’ve already sent you an email earlier today with a lot more thinking on this, in terms of three lessons. Okay, that disclaimer out of the way. Let me get into the topic here. Any other things? Oh, I got to do my standard thing. Nothing in this podcast or in my writing or is investment advice. The numbers and information for me and any guests may be incorrect. The views and opinions expressed may no longer be relevant or accurate. Overall, investing is risky. This is not investment, legal or tax advice. Do your own research. And with that, let’s get into the content. Now, as always, we start out with sort of the key concepts and we really do have two important ones today. Today, I think it’s gonna be pretty good because we’re doing kind of what I really like to do, which is 50% is gonna be on sort of the details of an important company, check, and the other 50% will be on fairly useful concepts and frameworks that I think about often. So we’re gonna actually got a good balance today, not too much theory. not too much in the weeds on companies. So 50-50, so the two concepts for today, which are in the concept library as always. Number one is what I’ve called sort of four terrains and strategies, and this is BCG thinking. There’s a nice two by two matrix for this, which I’ll put in the show notes. I think about this all the time, which is, there was a good book, it was also BCG Boston Consulting Group, this is their framework. They wrote a good book several years ago called Your Strategy Needs a Strategy or something like that. Basically saying for different terrains, investment, I’m sorry, business landscapes, different business types, you’re going to have completely different strategies. And you see, you got to kind of answer this question before you get into, OK, what is our strategy? Well, what game are we playing here? And. They’ve listed out a bunch of these, but they have a two by two matrix that basically outlines four different business terrains. Like what terrain are you standing on? And based on that, you’re gonna probably have one of four strategy types. It’s a pretty good framework, I think about this a lot. And I’ll go into it when we get into ByteDance, because I think they are a very specific terrain and strategy type. But to give you the short version. The two by two matrix on the Y axis, you have malleable versus non-malleable, which means you as a company can change your terrain and the environment you live in. Now, if you’re making semiconductors, you can change the terrain. If you introduce AI chips, that changes the terrain you’re on. So we’d call that malleable. If you’re Coca-Cola, you probably can’t change… much of how people drink soda. It’s got a can, it’s got some flavor, there’s distribution. That is largely non-malleable. So that’s the y-axis. The x-axis would be predictable versus unpredictable. Predictable would again be Coca-Cola. How people drink soda, how much they drink every day, liquid, what they like, it doesn’t change that much. It’s fairly predictable. It does change a bit But it’s pretty slow. That’s why Coca-Cola’s been around for 100 years. People are still drinking it. Unpredictable would be like fashion. It’s hard to know what people are gonna be wearing fashion-wise in a lot of areas next year. Are UGG boots gonna take off? Is it gonna be bright clothing? Are people gonna be wearing hats? Now certain types of fashion like socks, okay, that’s more predictable, but other type changes pretty quick. So… And you could say a lot of media is in this category. People are watching superhero movies now. They might be watching something else next year. Maybe it was rap music, now it’s country music, and so on. But you can basically put those two dimensions that get you a two by two matrix. In the four quadrants, you get four types of terrain and therefore four types of strategy. You can get classical strategy. That’s non-malleable, highly predictable. That’s Coca-Cola. That’s KFC. Look, you can’t really change this. It’s pretty predictable. You’re Coca-Cola, you’re Dr. Pepper, you’re bottled water, you’re Starbucks. If you’re in that quadrant, predictable, non-malleable, you are doing classical strategy. And usually classical is strategy. That’s kind of Michael Porter 101. What’s your strategy? to go for economies of scale, to go for customer share of the mind. A lot of Warren Buffett stuff sits in this category. That sort of classical strategy, which is number one strategy is get big. Find an attractive space in the value chain and then get as big as possible against that position. So it’s like classical strategy is like 50% positioning, choose your area and then 50% scale. Pretty decent summary of that. And that’s been a lot of strategy for the last 200 years. If we move from predictable to unpredictable, but still non-malleable, okay, that’s Zara. That’s fashion. Look, we are still choosing our space. Let’s say we’re a fashion retailer, Zara, H&M. But what people are gonna be buying in six months is very unpredictable. Now, if that’s your world, and we can’t change that very much, it’s non-malleable. Okay, if that’s your situation, then we call that adaptive. You’re on an adaptive terrain, you need to have an adaptive strategy. And basically the number one skill you want is to study what’s going on minute by minute in your market and then adapt as quickly as possible. You can’t really change it very much, the most you can do is adapt. So if everyone starts buying Ugg boots next month, we start making Ugg boots and that’s fast fashion. or she in we could call that ultra fast fashion. So if we’re in that quadrant, unpredictable, non malleable, we’re gonna go for an adaptive strategy. Go to the next quadrant, which would be predictable and malleable. Okay, that would be something like FedEx. Elon Musk kind of lives in this strategy, which is… Okay, we can shape the environment and it is actually kind of predictable in the longer term. Now when FedEx was founded, and sorry we call this visionary strategy, that’s FedEx, that’s Elon Musk. That’s when like look, when FedEx was launched, it was in a fairly predictable business, which is we’re going to ship packages all over the United States. And it largely came about because FedEx created this in the world. They launched their planes in like 1978. They did their first packages between a handful of cities. Um, and they, they kind of created this, they shaped the world. They had a vision and it was largely predictable. This is Elon Musk. He’s convinced we can get to Mars over 20 years. And so in his mind, it is predictable, but he’s having to. bring this into the world over 20 years. That’s visionary, malleable, predictable. The last quadrant we would call shaping, which is, okay, it’s malleable, like Elon Musk going to Mars. We’re going to bring this into the world, but it’s not really that predictable. So there’s high uncertainty. There’s a lot of technological disruption. You know, that could be the early days of Netflix, that could be Ant Financial. A lot of like Alibaba is this. Like they’re creating the world, but it’s not that much under their control. It kind of is, but not so much. So we would call that shaping. Anyways, those four quadrants, I think about this all the time. I find that very helpful. And I’ll explain how bite dance, I think, I’ll give you the so what. I think they are overwhelmingly. Let’s say I think they are 50% adaptive strategy. They are always sort of responding to unpredictable behavior of what gets people’s attention and what doesn’t, which keeps changing. And then I think to some degree they are shaping the future as well. But you know they are in the attention business first and foremost. They don’t know what videos people are going to watch next month. So they’ve built businesses that can adapt to that very quickly. They also don’t know what types of mobile apps are going to be used. So they have built a business model that lets them launch lots of mobile apps all the time and adapt. That’s how they found Short Video. So I think they’re kind of 70% adaptive, but maybe 30% shaping. But if you ask them, do you know what the attention business is gonna look like in 10 to 20 years, like Elon Musk does for Rockets, they probably have no idea. How could you? So I put them sort of 70% adaptive, 30% shaping. In contrast, I think Baidu, which has been making very big bets. in AI for 10 years. They’ve been building semiconductors, they’ve been building large language models, this chat GPT, they’ve been doing that for five, four years. You know, they are much more like a visionary structure. They invested long term in tech the same way Nvidia does, the same way TSMC does. They have to make these large bets on the future, like Elon Musk does. Okay, a little bit different. Anyways, that’s kind of a lot of theory to start That’s an important idea for today. So think about those sort of four quadrants. And the other concept for today, which will be much quicker, is the idea of the externalization of internal capabilities. Virtually every tech company, whether it’s e-commerce or ByteDance or whatever, in order to do their core business, short video, marketplace model, they build capabilities internally, usually in IT. They can be in R&D, they can be in logistics, and then at some point they externalize those capabilities and sell them as a service, which gets them greater scale and can sometimes get them a second business. Okay, ByteDance is doing the same thing. We’ve seen that before, I’ll talk about that more. Anyways, those are the two concepts for today. Bit of theory, but I’m not gonna do too much more theory than that. So let’s talk about ByteDance. Okay, so China Tech Tour. We had a pretty busy week. I’ll put the actual schedule that we did. I’ll put it in the show notes. It’s pretty awesome like I’m kind of pretty proud of this because you know, it was just I’ll read it to you here as long as I got it in front of me I mean it was just a who’s who it was Monday morning bite dance Monday afternoon Bye, dude, Tuesday morning. Hi Chi. I’ll talk about them in the future. They’re actually a pretty important company Tuesday afternoon JD.com JD logistics, you know, train to high speed train to Hanjo, which is a lot more reliable than flying, by the way. You know, next morning, Ant Group, Tsai Niao, then it’s lunch with some folks from NetEase, then it was fresh hippo, the supermarkets, then it was consumer marketing. I mean, it was just a bam bam. It was kind of exhausted by the end of the week, like my brain was full. I know, I’ll put the itinerary in there. We’re going to do this. Not the same one exactly, but we’ll do another one in the fall, probably September. Probably not exactly the same companies, but you know, I think it’s almost a one of a kind thing. I don’t know any other group that does this. I mean, people do tours to China, Southeast Asia all the time, business tours for executives. So for individuals, or you do it for a company specifically. I don’t think anyone has our tech tour matched. I think we’re number, in my opinion, I think we’re number one. But you can tell me if I’m wrong. Okay, so that was the tour. We get up Monday morning, you know, coffee of course first. It turns out coffee is a big part of these tours. It’s like three to four stops every day for coffee. Because we had some Europeans and Europeans drink a lot of coffee. I don’t drink that much coffee, but yeah, that turned out to be a constant thing. Get in the bus, you know, we were staying out in sort of San Lutun area, for those of you who are familiar. It’s kind of my part of town. Years ago, I used to hang out there a lot. There was Worker Stadium, San Le Tun, Bookworm, for those of you who remember. So the Lang Machao area, really fun part of Beijing. And then you get on the bus, you got to go across town. You go out to the Northwest. That’s where one of the bike dams, their main facility was. But they got facilities everywhere. Not a big surprise there. Super fun. We head out to there. We go to the exhibition center. I don’t know if people know this. Most of the China tech companies have exhibition halls, which are these big sort of places where they take visitors and they sort of show what they do and they put lots of information on the walls with screens. Anyways, over time, these things have gotten better and better. They’re almost like museums now. They can be truly spectacular. Anyways, ByteDance has a new exhibition. I think they just opened it. It was pretty awesome. It was like in my book, it was probably the second or the best one by far, Aunt Financial, has an unbelievable exhibition. It’s like a museum, it’s absolutely beautiful. I’ll talk about that on another podcast, but let’s say number two or number three, probably Alibaba and ByteDance have fantastic exhibition halls. You learn a lot, plus they’re really cool. Anyways, you go there, they have this spectacular presentation. You kind of get a good sense of what management thinks is important and how management thinks of itself, which is really important. That’s kind of the reason I like visiting these companies so much. Like my two primary sources of information are company visits and annual reports, because you get to hear how management thinks about the company themselves in their own language. You learn a lot from that as opposed to reports and stuff. Anyways, go to the Exhibition Hall is pretty great. I got to sat down with some management, communications department, things like that. Sometimes you sit down with the Investors Relations Department, which is great, but that’s a totally different process. Anyways, had a good old time. Let me just sort of jump to the so what. So, you know, spend lots and lots of questions, lots of back and forth, really great. I take tons of notes. Out of that sort of three lessons. that are just sort of what I personally learned that I think I was getting wrong. Or maybe that I had underestimated or maybe I wasn’t looking at the business in the right way. So three lessons, we’ll get into that. Okay, number one, and this is for all the bite dance, but obviously, especially TikTok because that’s their biggest product right now, mobile app right now. I have underestimated. how different e-commerce is when you go from e-commerce based on consumer intent versus e-commerce based on user interest. Now what does that mean? I’ve been giving a talk for like a year and a half now about how there is kind of a merger of three different things happening and China kind of got there first, which is a merger of e-commerce Entertainment and attention and social media. These used to be sort of three different businesses. Social media, okay, that’s, and we could put communication systems in there like WhatsApp, but let’s say Facebook, WhatsApp, WeChat, those are all basically social media foundation. Communication, interactivity, that sort of thing. Then we could move to entertainment. attention like YouTube, Netflix, TikTok really has sat there. They’ve never really been a social media company. They’ve been a content company and entertainment company and WeChat has always had Tencent has always had sort of one foot in each of those. They do something like WeChat, QQ, but they also do gaming and other forms of attention Tencent video music things like that. And then the third bucket would be e-commerce, which is like Alibaba, JD, traditionally. Well, all of those things are kind of merging together into one user experience. And this has been happening over time with China way out front. Like, I don’t know why Facebook doesn’t do this stuff. It drives me crazy. But we’ve seen it there first, but I think I underestimated how different it is depending on where you start. Now, if you’re Alibaba. You have Taobao, you have Tmall, their core e-commerce business. Now they also have some degree of entertainment. They have Youku, Tudou, which is like number three in terms of video. It’s kind of a mix between YouTube and Netflix. That’s kind of a number three in China. iQIYI is number one, Tencent videos usually number two. They’ve had these two, and then the Alibaba pictures as well. So they’ve had one foot in e-commerce and one foot in entertainment for a long time. and they’ve talked about this for five, seven years. They are now moving more and more into something like short video and live streaming. So you see them moving more and more into the attention business, into the e-commerce business, I’m sorry, entertainment business, and then merging those things together. More than they’ve done in the past. Okay, fine. That is very different of a process than TikTok going into TikTok shop. And this has been happening in China for a couple of years, and it’s going to happen to TikTok outside of China. It’s already starting to happen. But, you know, TikTok had your attention, your views, the videos, and they’ve been moving more and more into e-commerce. And the numbers in China are pretty spectacular. According to the TikTok shock report, in 2022, in China, TikTok had over $200 billion of GMV. Now that’s huge. I mean, that I mean, okay, Alibaba is up at one trillion and the other companies are 600 billion, but they’re growing very rapidly. Outside of China, which will follow, they’re probably 20 to 30 billion. I think management has said they want to they want to reach 30 billion dollars of GMV for TikTok outside of China. And this is from e-commerce, not from advertising, which is an entire cash machine. In addition to this, so they’ve got two major cash machines coming. One’s in place, the second is already on the way. Okay, so if these things are sort of coming together, I think I underestimated how different they are. That when you do e-commerce as Alibaba, you have from day one, from the moment the consumer clicks on the app, you have consumer intent. They are coming to this site to buy something. It’s like going to Walmart. Nobody goes to Walmart to have fun. You are going in the door with consumer intent. You probably have a list in your pocket. Okay. When you go on to TikTok to watch videos, you are going based on interest, not consumer intent. That’s more like going to watch a movie. Now, when you try and do e-commerce on top of consumer intent, it’s different. You know, if they’re trying to sell you everything at every step of the movie theater, it takes away from the experience. You’re looking for something else. And so that really does limit, or at least shape how they can do e-commerce based on let’s say short video. Really, I mean the e-commerce is not really happening on short video, it’s all happening on live stream. And these things go together. But it’s a different type of e-commerce, it’s not sort of broad. like it is with going into Walmart, going onto Alibaba. So I think I simplified that too much. I think how e-commerce is going to emerge out of TikTok is gonna be different based on consumer intent versus interest. And on addition to that, most of their e-commerce, and this is true of Quaishow and all of them, is coming out of live streaming, not short video. Well, the problem there is… Short video is pretty much popular everywhere in the world. Everywhere you go, people like short video. That’s not true for live streaming. It is very different. When you try live streaming in places like the UK, it doesn’t seem to work. And a lot of the EU live streaming doesn’t take. But when you do it in South Korea and Thailand, it takes off. So the consumer level of adoption is very different once you go from short video to live streaming, and that’s where the e-commerce sits. So I’m gonna sort of take apart that question more going forward, but yeah, that sort of was lesson number one for me. I underestimated the complexity and the differences there. Okay, lesson number two, and I’ve sort of already talked about this, that what bite dance is doing is adaptive and to some degree shaping strategy. at a very, very large scale that I don’t think we’ve ever seen before. So this is sort of the other concept for today, which is, you know, if we are talking about classical strategy, Coca-Cola, okay, fine. That’s find your location, the good part of the value chain that’s profitable, that offers you competitive defenses and get to scale. If you move into adaptive strategy, which is more like fast fashion, H&M, you know, your core strategy on that terrain has to be find out whatever people are doing this week and just adapt to it faster than everybody else adaptive strategy. Okay, that is where TikTok bite dance is very good. You know, they’ve every love every one of their products seems to be based on rapid adaptation of what gets people’s attention today versus yesterday. and individually. And by the way, in entertainment, in video, what you want to watch on TikTok personally changes every hour. You may be watching something for a while, then you get bored of it, and then you move on to something else and something else. So they are very good at tracking that with their machine learning and adapting on a person-by-person level, which is why TikTok is so addictive. But at the same time, their company is very, very good at testing hundreds of mobile apps. all the time. And then, you know, with the idea that look, short video may not be popular in five years. I think it will be. I think it’s like Coca-Cola. People love it. But it might be VR. It might be AR. It might be music. It might be, you know, how technology changes entertainment very, very quickly. So I think they’re playing this adaptive strategy game on two levels. at the individual video by video level, and then at the mobile app type of entertainment level. And two years ago, they bought Pico, P-I-C-O, which was the second largest maker of VR headsets. They bought them. So they’re clearly positioning themselves for new technology changes. So let’s say 70% of what they’re doing is adaptive strategy and 30% is shaping strategy. I don’t think we’ve ever seen a company do this at such a global scale. Now we could say YouTube is doing the same, but they don’t roll out 200 different apps every six months, which ByteDance does. They’re called the attention factory or the mobile app factory. I don’t think we’ve ever seen a company that iterates at this speed at the app level. In 200 countries with billions of users, I mean this is kind of a new thing. That sort of was my lesson number two, which is adaptive versus shaping strategy at a large, large scale and ByteDance, which I really didn’t appreciate before was they really do operate as a very flat organization that’s multinational. There’s teams in the U.S., there’s teams in Brazil, there’s teams in Mexico, and they can all create apps and they do. They create apps all the time that get uploaded and put in the app store and you can download them. You don’t know their bite dance probably. They’re always testing for what works. Which is why like in the US, they’ve had multiple hits now. They did TikTok, everyone knows that one. They have CapCut, which is a video editing mobile app, which is fantastic by the way. That hit number one in the US. They’ve got Lemon8. now which is rolling out in the US, kind of doing okay. I mean, they’ve been hitting this one after the next. So I’ve been thinking about that as lesson number two. I underestimated how flat they are organizationally and what that means for sort of large scale global innovation as an adaptive strategy. It was, I’m gonna write a lot about that and how they, and I’ve already sort of asked them, can I talk to someone? involved in this because I want to figure out how they do that in terms of HR, product development, product release, things like that. So that is lesson number two. And last lesson is kind of related which is I think they are very good at externalizing their internal capabilities and that has opened up for them some pretty compelling what we would call growth adjacencies. And when we know their core engine, TikTok, Toe Tiao to a lesser degree, CapCut, which is their all in one video editing software, which is by the way, awesome. If you haven’t tried it, it’s fantastic. I mean, you can, there’s filters and they have a lot of these baked into TikTok as well, but this is more robust. You know the filters you can use, you can de-age yourself, you can add videos, you can add text, you can do sound effects. The one that freaks me out a little bit is the filter, this is in TikTok, not CapCut, oh I think it’s there too, where you can make yourself look more attractive. It like, it cleans up your appearance and it improves your hair and your jaw line. It basically makes you look like a model, but still like yourself. It’s really kind of like, if you ever wanted to know what you would really look like being really good looking, this is what you can see it. It’s kind of freaked out a little bit. Anyways, this process, I mean, CapCut basically came out of the internal capabilities they were building for content creators. If you’re uploading videos on TikTok, they had all this sort of good capability. Well, they turned that into a second app and that’s CapCut. Now I’ve heard, and I’m not sure if this is true, I’m gonna look into it, that Alex Jew, was involved in that. And this is one of the co-founders of MusiCali, which was acquired and became TikTok for bite dance. I think it might be him, but I’m not totally sure. I’m gonna try and find that out. Anyways, this same process of taking your internal capabilities, externalizing them, turning them into a service for the market, and all the tech companies do this. It gets you two potential great things. Number one, worst case scenario, you get a lot more scale. in this capability that gets you economies of scale versus your rivals, because they’re all building, let’s say their internal logistics or their internal web services. You might be bigger than them as a rival, but when you open it up to a service for the market you get much, much bigger. So there’s a scale advantage there that gets kind of supercharged. The second is you might turn it into a new source of revenue. In some cases, you can turn it into a powerful business model. That’s how you get Ant Financial. That’s how you get AWS. That’s how you get Alibaba Cloud. Sometimes it’s not clear if logistics is going to turn into this. JD Logistics and Sineo are both externalized capabilities. JD Logistics has really externalized it and is offering it as a service that is growing pretty rapidly right now. Sineo has never really done that. you know, 90 plus percent of all the merchandise moving through TzaiNiao is still internal. It’s from their own e-commerce services. So that’s something that’s interesting to watch for Alibaba, JD Logistics and Amazon. They’re all focused on logistics that way. Okay. What ByteDance is doing here, what they’ve already done, is, I mean, if you think about… what they’re good at, everything I just said about how they’re good at adaptive strategy, how they can roll out mobile apps very, very quickly. They’re built to do this. They have tech tools that their internal people can use to investigate, to test, to deploy, and then to scale up mobile apps very, very quickly. In kind of a light fashion, like you don’t have to build these massive databases. I mean, the process for creating a new app. which they use internally to be so adaptive. Well, they’ve offered this to the marketplace now and that’s, they have a cool name for it, it’s called Volcano Engine, which is pretty awesome. I don’t know if that’s their internal or external version. I think they have a couple versions, they have different names for their domestic version versus their external version. I think, I think the… internal, I think it’s called Byte Plus maybe. Anyways, they got one based in Singapore, they got one domestic. Volcano 8 Engine is domestic. They’ve offered this as a service to developers and to businesses. Hey, do you want to roll out a new app quickly like we do? And it’s basically a cloud service. It’s a cloud service that’s sort of very light and very nimble and has all of their outstanding expertise and algorithms and data. So if you want to ramp up your own app very easily, which developers and businesses want to. So it’s B2B. That’s Volcano Engine, which is an externalization of everything I just talked about for adaptive strategy. And I know they’re rolling this out internationally, but I don’t think they’ve done it too much yet. Anyways, I’m going to have to look that up to make sure I’m not telling you incorrect. So they’ve done that once. That’s a B2B potential growth engine. it could get them into the cloud business, which would be spectacular because the cloud business is fantastic. The other one they’ve done for this, which is not as clearly a big growth engine as Volcano Engine is the Lark Suite, L-A-R-K Lark Suite. That was basically their internal tools that they used for collaboration and communication. So they… They basically released this externally in 2019 as an enterprise tool. And a lot of companies have done this WeChat work. Same thing, DingTalk, same thing, Slack, same thing. Pretty much everything Microsoft Teams does, same thing. These are all enterprise collaboration and communication tools. Microsoft lives there. In China, it’s… You know, it’s not quite as developed. The big players have been like Ding Talk, which is Alibaba. WeChat work was moving into this space. Anyways, they all got a big boost during COVID because everyone had to go home. So all of these companies really got a big jump and it was Lark Suite was, was ByteDance’s version of that. So there’s at least two of these B2B services that are interesting. I think Volcano Engine is more interesting because if it’s successful it moves you into cloud. But LARP Suite is also pretty interesting. So there’s two of them there. Both of them I would call sort of compelling growth adjacencies. And we’ll see what happens. Anyways, those are kind of my three lessons for byte dance, which are sort of high level That e-commerce based on interest versus consumer intent is much more different than I had appreciated. That if you’re going to do adaptive and some shaping strategy at a very large scale, that poses very interesting organizational issues. How do you be agile in a flat decentralized organization, which ByteDance definitely is, that’s global? and still do that? I think that’s really interesting is sort of an organizational question. And then the third one is this international, I’m sorry, this externalization of internal capabilities is giving them some fairly compelling growth trajectories within B2B enterprise and cloud. It was those were, when I was sort of thinking after we met and sort of making my notes, those were the three things that got sort of big circles and stars in my notepad. which I always carry. Anyways, that is it for content for today and the two concepts. Think about these four terrains, which is a BCG model. You can read that book, Your Strategy Needs a Strategy. It’s pretty good. It’s pretty much what I just said, though. And then this other idea of externalization of capabilities is a pretty good thing to keep your eye keep an eye on because most companies do pull this lever where they try to because if you’re going to try and go after another source of growth and revenue, This directly builds on your own capabilities so you have an advantage. And if you can find a big growth adjacency that’s attractive as a market and you have this internal capability that gives you an advantage, that’s a very good strategy, which is why everyone goes for that one. Anyways, that is it for the content for today. For those of you who are subscribers, I’m gonna be sending you a ton of stuff. I mean, it’s crazy how much writing I have to do in the next three weeks. That’ll be coming in the next probably three weeks. I’ll keep hitting you Any other stuff that’s kind of it for me for today. I’m heading back to Shanghai in a couple days There’s the mobile world conference in Shanghai, which is super fun. I love this stuff So gonna be spending a couple days in Pudong Which is really kind of it’s funny like, you know, I used to live in Shanghai for a long time And I really loved it there, like in terms of cities I love to live in, like it’s New York, Bangkok and Shanghai are my top three. And I had an office on the river and I used to, you know, hang out on sort of, I was in Jing’an for a while, which is sort of pushy. I ended up moving more to Pudong over time, which is a little more quiet. Just for that sort of just lifestyle and aging, probably the chaos of downtown got to be a much, I eventually had to move to Beijing. Because all the digital stuff, not all of it, most of it’s there. So week after week you fly back and forth from Shanghai to Beijing. Eventually you have to accept it. Alright, I’m going to move to Beijing. And that flight in particular, Shanghai to Beijing, it was always delayed. It was like the most delayed flight on the planet. I’m not making that up. It was statistically number one. So I ended up taking trains most of the time because one, they’re really fun. The high-speed trains are great and they’re never late. So you can actually plan your day. If I have a ticket for the 8 a.m. train, I know I can do meetings at three. If you’re doing flights, you can’t really do that because they’re always delayed. So you kind of lose a day. Anyways, I ended up moving to Beijing, but I’ve always sort of loved it. So I’m eager to get back. I’ll probably do some videos and stuff from there. It’s gonna be fun. And that will be my week. I think that’s it for today. Anyways, I hope this is helpful. If you’re interested in doing any of this stuff, we’re gonna do a tech tour in the fall. Send me a note. We can talk about it either individually or for companies, which is kind of fun to do custom tours. Anyways, that is it for me. I hope everyone is doing well, and I will talk to you next week from Shanghai, I think. Bye-bye.

I am a consultant and keynote speaker on how to increase digital growth and strengthen digital AI moats.

I am the founder of TechMoat Consulting, a consulting firm specialized in how to increase digital growth and strengthen digital AI moats. Get in touch here.

I write about digital growth and digital AI strategy. With 3 best selling books and +2.9M followers on LinkedIn. You can read my writing at the free email below.

Or read my Moats and Marathons book series, a framework for building and measuring competitive advantages in digital businesses.

This content (articles, podcasts, website info) is not investment, legal or tax advice. The information and opinions from me and any guests may be incorrect. The numbers and information may be wrong. The views expressed may no longer be relevant or accurate. This is not investment advice. Investing is risky. Do your own research.